Compliance Forms Under Important Labour Laws.pdf

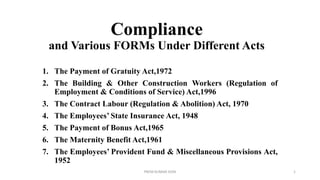

- 1. Compliance and Various FORMs Under Different Acts 1. The Payment of Gratuity Act,1972 2. The Building & Other Construction Workers (Regulation of Employment & Conditions of Service) Act,1996 3. The Contract Labour (Regulation & Abolition) Act, 1970 4. The Employees’ State Insurance Act, 1948 5. The Payment of Bonus Act,1965 6. The Maternity Benefit Act,1961 7. The Employees’ Provident Fund & Miscellaneous Provisions Act, 1952 PREM KUMAR SONI 1

- 2. The Payment of Gratuity Act,1972 Compliances 1. Form A - Notice of Opening 2. Form B - Notice of Change 3. Form C - Notice of Closure 4. Form F - Nomination 5. Form G - Fresh Nomination 6. Form H - Modification of Nomination 7. Form I - Application for gratuity by an employee 8. Form J - Application for gratuity by a nominee 9. Form K - Application for gratuity by a legal heir 10. Form L - Notice for payment of gratuity 11. Form M - Notice rejecting claim for payment of gratuity 12. Form N - Application for direction Before the Controlling Authority 13. Form T - Application for recovery of gratuity PREM KUMAR SONI 2

- 3. Applicability Every factory, mine, oilfield, plantation, port and railway company. Every shop or establishment with in the meaning of any law for the time being in force in relation to shops and establishments in a state, in which 10 or more persons are employed, or were employed, or any day of the preceding 12 months; Such other establishments or class of establishments, in which 10 or more employees are employed, on any day of the preceding 12 months, as the central government may, by notification, specify on this behalf. PREM KUMAR SONI 3

- 4. The Building & Other Construction Workers (Regulation of Employment & Conditions of Service) Act,1996 1. Form 5 - Register for Overtime 2. Form 6 - Register of Building Workers Employed by the Employer 3. Form 7 - Muster Roll 4. Form 8 - Register of Wages 5. Form 10 - Register for Deductions for Damage or Loss 6. Form 11 - Register of Fines 7. Form 12 - Register of Advances 8. Form 13 - Wage Book 9. Form 14 - Service Certificate 10. Form 15 - Annual Return PREM KUMAR SONI 4

- 5. Applicability • Applicable to the whole of India. • It applies to every establishment which employs, or had employed on any day of the preceding twelve months, 10 or more building workers in any building or other construction work. PREM KUMAR SONI 5

- 6. The Contract Labour (Regulation & Abolition) Act, 1970 1. Form I - Application for Registration of Establishments employing Contract Labour 2. Form V - Form of Certificate by Principal Employer to Contractor 3. Form XII - Register of Contractors 4. Form XIII - Register of workmen Employer by Contractor 5. Form XIV - Employment Card for Employee 6. Form XV - Service Certificate to Employee 7. Form XVI - Muster Roll 8. Form XVII - Register of Wages 9. Form XVIII - Register of Wages cum Muster Roll 10. Form XIX - Wage Slip 11. Form XX - Register of deductions for damage or loss 12. Form XXI - Register of Fines 13. Form XXII - Register of Advances 14. Form XXIII - Register of Overtime 15. Form XXIV - Return by Contractor to the Licensing Officer 16. Form XXV - Return by Principal Employer to the Registering Officer PREM KUMAR SONI 6

- 7. Applicability • It extends to the whole of India and applies to every establishment or every contractor who employs or employed 20 or more workers on any day of the preceding 12 months as contract Labour registration is compulsory to employ contract Labour PREM KUMAR SONI 7

- 8. The Employees’ State Insurance Act, 1948 Compliances 1. Form 01(A) - Form of Annual Information 2. Employer Registration 3. Employee Registration 4. Form 1 - Declaration Form 5. Form 2 - Addition/Deletion in Family Declaration 6. Form 3 - Return of Declaration Form 7. Form 6 - Register of Employees 8. Form 9 - Claim for Sickness/ Temporary Disablement Benefit/Maternity Benefit 9. Form 11 - Accident Book 10. Form 12 - Accident Report 11. Form14 - Claim for Permanent Disablement Benefit 11. Form 15 - Claim Dependent Benefit 12. Form16 - Claim for Periodical Payment of Dependent Benefits 13. Form 19 - Claim for Maternity Benefit and notice of work 14. Form 20 - Claim for Maternity Benefit by a Nominee 15. Form 22 - Funeral Expense Claim 16. Form 23 - Life Certificate for Permanent Disablement Benefit 17. Form 24 - Declaration & Certificate for Dependent's Benefit 18. Form 14 - Sickness or Temporary disablement or maternity benefit for sickness 19. Form 12A - claim for Maternity benefit for sickness 20. Form 21 - Maternity Benefit - Certificate of Expected Confinement 21. Form 13 - claim for Sickness or Temporary disablement or Maternity PREM KUMAR SONI 8

- 9. Applicability • All States in India except for Nagaland, Manipur, Sikkim, Arunachal Pradesh, and Mizoram. • Applicable to Delhi, Chandigarh, and Puducherry. • Applicable to non-seasonal factories employing 10 or more persons. • The scheme has been extended to shops, hotels, restaurants, cinemas (including preview theatres), road-motor transport undertakings, and newspaper establishments employing 20* or more persons. • The scheme has been extended to private medical and educational institutions employing 20* or more persons in certain States/UTs. • The existing wage limit for coverage under the Act is Rs. 21,000/- per month ( i.e.. 01.01.2017). PREM KUMAR SONI 9

- 10. The Payment of Bonus Act,1965 • An Act to provide for the payment of bonus to persons employed in certain establishments on the basis of profits, production, or productivity and for matters connected therewith. Compliances Form A - Computation of the Allocable Surplus Form B - Set-on and Set-off of Allocable Surplus Form C - Bonus Paid Statement Form D - Annual Return Bonus Paid to Employees PREM KUMAR SONI 10

- 11. Applicability • Every factory and every other establishment in India in which 20 or more persons are employed on any day during an accounting year. • Any person (other than an apprentice) employed on a salary or wage not exceeding Rs. 21,000/- p.m. in any industry to do any skilled or unskilled, manual, supervisory, managerial, administrative, technical, or clerical work for hire or reward whether the terms of employment be expressed or implied. PREM KUMAR SONI 11

- 12. The Payment of Wages Act • The Payment of Wages Act, 1936 and the rules framed thereunder are enacted wit the objective to regulate the payment of wages of certain classes of employed persons. Applicability • The Act extends to the whole of India. • The Act is applicable to the payment of wages to persons employed: • in any factory, • otherwise than in a factory upon any railway by a railway administration or, • either directly or through a sub-contractor, by a person fulfilling a contract with a railway administration, and • to persons employed in an industrial or other establishment specified in sub-clauses (a) to (g) of clause (ii) of section 2 of the Act. • The Act applies to wages payable to an employed person in respect of a wage period if such wages for that wage period do not exceed Rs.24,000/- per month or such other higher sum which, on the basis of figures of the Consumer Expenditure Survey published by the National Sample Survey Organization, the Central Government may, after every five years, by notification in the Official Gazette, specify. PREM KUMAR SONI 12

- 13. Professional Tax In India • A professional tax is a direct tax levied by the government on employees and professionals. The Professional Tax is a source of revenue for the state governments, which helps implement schemes for the welfare and development of the region. • The professional tax is a state tax, and the tax rates vary from state to state. • Just like the income tax, the professional tax is linked to the income slabs. It is deducted at the source by the employer. It is a nominal tax and never exceeds a few hundred rupees a month. The maximum amount of Professional Tax that any state can impose in India is ₹2500. Further, the total amount of Professional Tax paid during the year is allowed as a deduction under the Income Tax Act. PREM KUMAR SONI 13

- 14. States Where Professional Tax is not Applicable Andaman and Nicobar Islands Arunachal Pradesh Chandigarh Dadra and Nagar Haveli Daman and Diu Delhi Goa Haryana Himachal Pradesh Ladakh Lakshadweep Rajasthan Uttaranchal Uttar Pradesh PREM KUMAR SONI 14

- 15. Applicability • The professional tax applies to employees (wage earners) of almost all industries. It's also applicable to professionals like doctors, chartered accountants (CAs), consultants, traders, and other self-employed individuals. PREM KUMAR SONI 15

- 16. Who is exempted from professional tax? • There are exemptions provided for specific individuals to pay Professional Tax under the Professional Tax Rules. The following individuals are exempt from paying professional tax: • Parents of children with permanent disability or mental disability. • Members of the forces as defined in the Army Act 1950, the Air Force Act 1950, and the Navy Act 1957, including members of auxiliary forces or reservists serving in the state. • Badly workers in the textile industry. • An individual suffering from a permanent physical disability (including blindness). • Parents or guardians of individuals who have a mental disability. • Individuals above 65 years of age. PREM KUMAR SONI 16

- 17. The Maternity Benefit Act,1961 An Act to regulate the employment of women in certain establishment for certain period before and after child-birth and to provide for maternity benefit and certain other benefits. Compliances Abstract of the Maternity Benefit Act Notice Under Sec 6 of the Act Form of Receipt of Maternity Benefit Form A - Muster Roll Form G - Appeal to Competent Authority Form H - Complaint to Inspector Form I - Complaint to Inspector by Nominee Annual Return Form 19 - Maternity Benefit - Notice of Pregnancy Form 20 - Maternity Benefit - Certificate of Pregnancy Form 22 - Maternity Benefit - Claim for Benefit ANNUAL RETURN FORMS - L,M,N and O PREM KUMAR SONI 17

- 18. Applicability • Extends to the whole of India. • Applicable to mines, factories, plantations, shops and commercial establishments. • For a woman employed, whether directly or through any agency, for wages in any establishment. PREM KUMAR SONI 18

- 19. The Workmen's Compensation Act,1923 An act to provide for the payment by certain classes of employers to their workmen of compensation for injury by accident. In 2009, with an amendment in Workmen's Compensation Act, the act has been renamed as Employees Compensation Act. Compliances Form A - Deposit of compensation for fatal accident Form AA - Deposit of compensation for non-fatal accident to a woman or person under legal disability Form D - Deposit of compensation for non-fatal accidents, other than to a workman or person under legal disability Form EE - Report of fatal accidents Form F - Application for compensation by workmen Form G - Application for order to deposit compensation Form H - Application for communication Form K or L or M - Memorandum of agreement PREM KUMAR SONI 19

- 20. Applicability • It extends to the whole of India • Applicable to the specified classes of employers PREM KUMAR SONI 20

- 21. The Inter-State Migrant Workmen Act, 1979 An Act to regulate the employment of inter-State migrant workmen and to provide for their conditions of service and for matters connected therewith. Applicability This Act is applicable to the whole of India. PREM KUMAR SONI 21

- 22. The Employees’ Provident Fund & Miscellaneous Provisions Act, 1952 • An Act to provide for the institution of provident funds, pension fund, and deposit-linked insurance fund for employees. • One of the largest social security organizations in India in terms of the number of covered beneficiaries and the volume of financial transactions PREM KUMAR SONI 22

- 23. Compliances • Employer Registration • ECR - Electronic Challan Cum Return • Activate UAN (Universal Account Number) • Form 5A - Return of ownership • Form 11 - Declaration Form • Form 13 - Transfer Claim Form • Form 19 - Form to claim the dues by Member • Form 20 - Form to claim the dues by Nominee • Form 10D - Application for monthly pension PREM KUMAR SONI 23

- 24. Applicability It provides compulsory contributory fund for the future of an employee after his/her retirement or for his/her dependents in case of the employee's early death. It extends to the whole of India except the State of Jammu and Kashmir and is applicable to: • Every factory engaged in any industry specified in Schedule 1 in which 20 or more persons are employed. • Every other establishment employing 20 or more persons or class of such establishments that the Central Govt. may notify. • Any other establishment so notified by the Central Government even if employing less than 20 persons. • Every employee, including the one employed through a contractor (but excluding an apprentice engaged under the Apprentices Act or under the standing orders of the establishment and casual laborers), who is in receipt of wages up to Rs.15,000 p.m. shall be eligible for becoming a member of the fund. • The condition of three months continuous service or 60 days of actual work for membership of the scheme has been removed. PREM KUMAR SONI 24