Newsletter july 2016

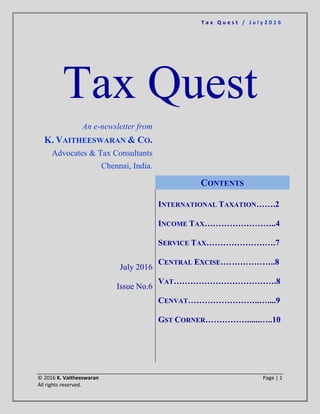

- 1. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 1 All rights reserved. Tax Quest An e-newsletter from K. VAITHEESWARAN & CO. Advocates & Tax Consultants Chennai, India. July 2016 Issue No.6 CONTENTS INTERNATIONAL TAXATION…….2 INCOME TAX……………………..4 SERVICE TAX…………………….7 CENTRAL EXCISE………………..8 VAT……………………………….8 CENVAT……………………..…....9 GST CORNER……………......…..10

- 2. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 2 All rights reserved. INTERNATIONAL TAXATION Section 206AA – Rule 37BC Central Board of Direct Taxes vide Notification No. 53/2016 dated 24.06.2016 has amended the Income Tax Rules, 1962 by inserting a new Rule 37BC through the IT (17th Amendment) Rules, 2016. (i) The Rule provides for a relaxation from deduction of tax at a higher rate under Section 206AA in the case of a non-resident not being a company or a foreign company not having PAN. (ii) Section 206AA shall not apply in respect of payments in the nature of interest, royalty, fees for technical services and payments for transfer of any capital asset if the deductee files the documents set out in Rule 37BC(2). Section 206AA Vs. DTAA In the case of Pritcol Ltd. (TS-332-ITAT-2016) the assessee-company had deducted TDS at beneficial rate of 10% on payments made to non-residents as per the relevant DTAA. The Chennai Tribunal held that Section 206AA of the Income Tax Act which provides for higher rate of deduction of tax at source for foreign payments in case where PAN is not available is not a charging section and hence, does not override Section 90(2) (application of provisions more beneficial to the assessee) of the Act. Foreign Tax Credit Rules, 2016 Central Board of Direct Taxes vide Notification No. 54/2016 dated 27.06.2016 has amended the Income Tax Rules, 1962 by inserting a new Rule 128 covering Foreign Tax Credit w.e.f. 01.04.2017. The key aspects are as under: (i) A resident assessee shall be allowed a credit for the amount of any foreign tax paid by him in a country or specified territory outside India, by way of deduction or otherwise, in the year in which the income corresponding to such tax has been offered to tax or assessed to tax in India, in the manner and to the extent as specified in this rule. (ii) Where such income is offered to tax in more than one year, credit of foreign tax shall be allowed across those years in the same proportion in which the income is offered to tax or assessed to tax in India. (iii) Foreign tax shall mean - (a) in respect of a country or specified territory outside India with which India has a DTAA, the tax covered under the said agreement; (b) in respect of any other country or specified territory outside India, the tax payable under the law in force in that country or specified territory in the nature of income-tax referred to in clause (iv) of the Explanation to section 91.

- 3. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 3 All rights reserved. (iv) The credit shall be available against the amount of tax, surcharge and cess payable under the Act but not in respect of any sum payable by way of interest, fee or penalty. (v) No credit shall be available in respect of any amount of disputed foreign tax or part thereof. (vi) The credit of such disputed tax shall be allowed for the year in which such income is offered to tax or assessed to tax in India if the assesse within 6 months from the end of the month in which the dispute is finally settled, furnishes evidence of settlement of dispute and an evidence to the effect that the liability for payment of such foreign tax has been discharged by him and furnishes an undertaking that no refund in respect of such amount has directly or indirectly been claimed or shall be claimed. (vii) The credit of foreign tax shall be the aggregate of the amounts of credit computed separately for each source of income arising from a particular country or specified territory outside India and shall be given effect to in the prescribed manner (viii) In a case where any tax is payable under the provisions of section 115JB or section 115JC, the credit of foreign tax shall be allowed against such tax in the same manner as is allowable against any tax payable under the provisions of the Act other than the provisions of the said sections (hereafter referred to as the “normal provisions”). (ix) Where the amount of foreign tax credit available against the tax payable under the provisions of section 115JB or section 115JC exceeds the amount of tax credit available against the normal provisions, then while computing the amount of credit under section 115JAA or section 115JD in respect of the taxes paid under section 115JB or section 115JC, as the case may be, such excess shall be ignored. (x) Credit of any foreign tax shall be allowed on furnishing the prescribed documents by the assesse. (xi) The statement in Form No.67 referred to in clause (x) shall be furnished on or before the due date specified for furnishing the return of income under Section 139(1) of the Act, in the manner specified for furnishing such return of income. (xii) Form No. 67 shall also be furnished in a case where the carry backward of loss of the current year results in refund of foreign tax for which credit has been claimed in any earlier previous year or years. It is interesting to note that the IT Rules have been amended w.e.f. 01.04.2017 whereas there are decisions even without these rules conferring foreign tax credit - Wipro Ltd. Vs. DCIT [TS-565- HC-2015-KAR].

- 4. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 4 All rights reserved. INCOME TAX Income Declaration Scheme, 2016 (i) Section 181 to Section 194 of the Finance Act, 2016 deal with Income Declaration Scheme and the objective is to provide an opportunity to persons who have not paid full taxes in the past to come forward and declare the undisclosed income and pay tax, surcharge and penalty totalling in all to 45% (tax at the rate of 30% on the value of such undeclared income + surcharge at the rate of 25% of such tax + penalty at the rate of 25% of such tax) of such undisclosed income declared. (ii) CBDT vide Notification No. 32/2016 dated 19.05.2016 has appointed the following dates for the implementation of various aspects of the declaration scheme: Particulars Due Date Declaration under Section 183(1) of the Act; On or before 30.09.2016 Payment of tax and surcharge under Section 184 and payment of penalty under Section 185 On or before 30.11.2016 Transfer by benamidar to the declarant On or before 30.09.2017 (iii) The following declarations are not eligible to be made under the Scheme: Where a notice under section 142 or section 143(2) or section 148 or section 153A or section 153C of the Income-tax Act has been issued in respect of such assessment year and the proceeding is pending before the Assessing Officer. A person will not be eligible under the Scheme if any notice referred above has been served upon the person on or before 31.05.2016. Where a search has been conducted under section 132 or requisition has been made under section 132A or a survey has been carried out under section 133A of the Income-tax Act in a previous year and the time for issuance of a notice under section 143(2) or section 153A or section 153C for the relevant assessment year has not expired. cases covered under the Black Money (Undisclosed Foreign Income & Assets) and Imposition of Tax Act, 2015. (iv) The Board had issued Circular No. 17/2016 dated 20.05.2016 and Circular No. 24/2016 dated 27.06.2016 has now been issued providing for further set of FAQs. The key elements in the second circular are: If only part payment is made by the due date, the entire declaration under the Scheme shall be invalid.

- 5. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 5 All rights reserved. In the case of amalgamation or conversion of Company into LLP, the declaration can be made by the amalgamated company or LLP in the year in which the amalgamation / conversion takes place. While valuation report is necessary, it is not mandatory to attach the same. However, the authorities may require the declarant to file the Valuation report before issue of acknowledgement in Form 2 for verifying the correctness. PAN has to be mandatorily furnished in the declaration. Where summons have been issued under Section 131(1A) or letter has been issued under Non-Filer Monitoring System or under Section 133(6) but no notice has been issued as specified under Section 196(e) of the Finance Act, 2016, Scheme is applicable. Tax Collection at Source (i) Section 206C of the Income Tax Act, 1961 deals with tax collected at source (TCS) and the scope was expanded by the Finance Act, 2016 w.e.f. 01.06.2016. The following table reflects the scope and ambit of TCS as amended: Section Person Liable to Collect Transaction Rate 206C(1D)(iii) Every person, being a seller Receipt of any amount in cash as consideration for sale of any other goods (other than bullion or jewellery) or providing any services; 1% where the consideration exceeds Rs. 2 lakhs; Section 206C(1F) Every person, being a seller Receipt of any amount as consideration for sale of a motor vehicle 1% where the consideration exceeds Rs. 10 lakhs; (ii) No tax shall be collected under Section 206C(1D) where tax has been deducted at source by the payer under Chapter XVII B. (iii) Section 206C(1E) provides that Section 206C(1D) shall not apply to such class of buyers who fulfill conditions prescribed. (iv) The CBDT has issued Circular No. 22/2016 dated 08.06.2016 and Circular No. 23/2016 dated 24.06.2016 and the key elements in the Circulars are given below: TCS is not applicable on sale of motor vehicles by manufacturers to dealers / distributors.

- 6. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 6 All rights reserved. TCS is applicable to each sale of motor vehicle and not to aggregate value of sales made during the year. TCS on sale of motor vehicle is applicable to even an individual seller provided he is liable to audit under Section 44AB. In so far as motor vehicles are concerned, TCS is applicable irrespective of the mode of payment. TCS not applicable where the cash receipt does not exceed Rs. 2 lakhs even if the sale consideration exceeds Rs. 2 lakhs (Illustration: Goods worth Rs.5 lakhs is sold for which consideration amounting to Rs. 4lakhs has been received in cheque and Rs. 1 lakh has been received in cash. As the cash receipt does not exceed Rs. 2 lakhs, no tax is required to be collected at source as per Section 206C(1D). TCS is applicable on cash component of the sales consideration and not on the whole of sales consideration. (Illustration: Goods worth Rs.5lakhs is sold for which consideration amounting to Rs.2lakhs has been received in cheque and Rs.3lakh has been received in cash. Tax is required to be collected under Section 206C(1D) only on cash receipt of Rs.3lakhs and not on the whole of sales consideration of Rs. 5lakhs) Whether Section 194J would apply to payments in kind? In the case of Red Chilies Entertainment Pvt. Ltd. (TS-336-ITAT-2016-Mumbai), the issue was whether gift of certain items to business associates including actors, would attract Section 194J? The Tribunal observed that the payments were not made in cash but in ‘kind’. Based on the decisions of the Karnataka High Court in case of Hindustan Lever where the term ‘any sum’ was interpreted as ‘only cash amount of money’, the Tribunal held that payments made by assessee in kind would not attract Section 194J. Note:- In the context of Section 195 which also uses the term ‘any sum’, the Supreme Court in the case of Kanchanganga Sea Foods (2010) 325 ITR 540 has recognized that payments in kind would also attract TDS under Section 195. Service Tax cannot form part of Gross Receipts The Delhi High Court in the case of CIT Vs. Mitchell Drilling International Pvt. Ltd. (TS-560- HC-2015) held that for the purposes of computing the ‘presumptive income’ of the assessee for the purposes of Section 44BB of the Act, the service tax collected by the Assessee on the amount paid to it for rendering services is not to be included in the gross receipts in terms of Section 44BB(2) read with Section 44BB(1). The service tax is not an amount paid or payable, or received or deemed to be received by the Assessee for the services rendered by it. The Assessee is only collecting the service tax for passing it on to the government.

- 7. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 7 All rights reserved. GAAR Rule 10U of the Income Tax Rules, 1962 have been amended vide Notification No. 49/2016 whereby it is provided that GAAR provisions shall not apply to any income from transfer of investments made before 01.04.2017. Similarly, the provisions would not apply to any arrangement, irrespective of the date on which it has been entered into, in respect of the tax benefit obtained from the arrangement on or after 01.04.2017. SERVICE TAX Krishi Kalyan Cess When views were expressed to the effect that KKC cannot apply for the period prior to 01.06.2016 and cannot apply on outstanding balances, alternate views were expressed based on Rule 5 of the POT Rules, 2011. The Government with a view to address the issue has issued Notification No. 35/2016 dated 23.06.2016 which provides that where invoice has been issued on or before 31.05.2016, KKC is exempted subject to the condition that the provision of service has been completed on or before 31.05.2016. Ocean Freight – Import – Sea Segment The similar issue in the context of ocean freight is also sought to be addressed through Notification No. 36/2016 dated 23.06.2016. Accordingly, there is an exemption for taxable services by way of transportation of goods by vessel, from outside India upto the custom station in India with respect to which the invoice for the service has been issued on or before 31.05.2016 and the import manifest / report has been delivered on or before 31.05.2016 and the service provider or recipient provides a custom certified copy of such import manifest / report. Service Tax Audit An attempt was made by the Parliament to rectify the impact on account of the decision in the case of Travelite by way of substitution of Rule 5A(2) of the Service Tax (Third Amendment) Rules, 2014 w.e.f. 05.12.2014. The amendment contemplated making available records to the officer authorized or the audit party deputed by Commissioner of CAG. However even this amendment has been struck down by the Delhi High Court vide its decision dated 03.06.2016 in the case of Mega Cabs Pvt. Ltd. Vs. Union of India. Bulk Discounts from Media to Advertising Agencies The Authority for Advance Rulings (AAR) in the case of AKQA Media (2016) 69 taxmann.com 390 has ruled that (i) when the applicant is appointed by the advertiser to provide services, incidental receipt of incentives and volume discounts from the media owner cannot be considered as a service; (ii) when the applicant buys and sells media inventory on its own account to the advertiser, incidental receipt of incentive / volume discount from media owner shall not be considered to be providing a service as defined under the Finance Act, 1994 to the media owner and shall not be liable to service tax.

- 8. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 8 All rights reserved. CENTRAL EXCISE Readymade Garments The Board vide Circular No.1031/19/2016 – TRU dated 14.06.2016 has clarified that excise duty would be levied on readymade garments and made up article of textile if: (a) Such garment or made up article of textile bears a brand name or sold under a brand name and; (b) Has a retail sale price of Rs.1000 or more. The Board has also clarified that duty will not be levied nearly because a readymade garment or made up not bearing a brand name is sold from an outlet bearing a brand name. The levy requires affixation of brand name on the readymade garment or made up. First Stage Dealer who is also an Importer The Board vide Circular No.1032/20/2016 dated 28.06.2016 has clarified that where the Assessee is an importer as well as a first stage dealer, he has the option of taking a single registration and filing a single quarterly return giving details of transactions as a first stage dealer and as an importer one after the other in the same table in the return. Jewellery The Board vide Circular No.1033/21/2016 dated 01.07.2016 has extended the time limit for excise registration by a jeweler upto 31.07.2016. The Circular also provides that jewelers may make the payment of excise duty for the month of March 2016, April 2016 and May 2016 along with payment of excise duty for the month of June 2016 upto the extended date of 31.07.2016. VALUE ADDED TAX Tamil Nadu VAT – Non Filing of Return by Selling Dealer – ITC The Madras High Court in the case of Computer Consultants Vs. AC (CT) vide order dated 02.06.2016 has held that when the purchaser has paid the tax to the seller credit is available. Where the seller has not paid the tax so collected, the liability has to be fastened on the selling dealer and not on the purchaser. Whether Sales Tax is applicable on sale of food and beverages in a club/association – Mutuality Principle – Issue goes to Larger Bench The Supreme Court in the case of The State of West Bengal and Others Vs. Calcutta Club Ltd. in (Civil Appeal No.4184 of 2009 dated 04.05.2016) has held that, the controversy that has arisen in the case regarding, whether the doctrine of mutuality applies in the case of application

- 9. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 9 All rights reserved. of sales tax, has to be authoritatively decided by a larger Bench in view of the law laid down in Cosmopolitan Club and Fateh Maidan Club. The Supreme Court held that none of the earlier judgments really laid down whether doctrine of mutuality would apply or not but proceed on the said principle relying on the earlier judgments. The following questions would now be decided by the Larger Bench: (i) Whether the doctrine of mutuality is still applicable to incorporated clubs or any club after the 46th amendment to Article 366 (29A) of the Constitution of India? (ii) Whether the judgment of this Court in Young Men’s Indian Association still holds the field even after the 46th amendment of the Constitution of India; and whether the decisions in Cosmopolitan Club and Fateh Maidan Club which remitted the matter applying the doctrine of mutuality after the constitutional amendment can be treated to be stating the correct principle of law? (iii) Whether the 46th amendment to the Constitution, by deeming fiction provides that provision of food and beverages by the incorporated clubs to its permanent members constitute sale thereby holding the same to be liable to sales tax? Alternative Remedy The Supreme Court in the case of Aircel Ltd. & Anr. Vs. The Commercial Tax Officer & Anr. (TS-255-SC-2016-VAT) has set aside the decision of the Madras High Court and allowed Aircel’s appeal on maintainability of its writ petition filed in the High Court. The Madras High Court declined to interfere in the writ petition citing availability of alternate remedy. The Supreme Court held that there are three questions of law raised in the writ petition as to whether Tamil Nadu has jurisdiction to levy VAT tax on telecommunication towers located outside the State; whether the transfer of the businesses claimed by the Petitioner as the whole of that business qualifies for exemption under explanation III to Section 2(41) of the Tamil Nadu Value Added Tax Act, 2006; and whether the assessing authority has jurisdiction to pass an assessment order with regard to such a composite transaction. The Supreme Court observed that the questions raised by the Appellant being pure questions of law the High Court should have decided these matters and directed the High Court to decide the writ petition within 6 months. CENVAT The Single Member of the Hyderabad Bench of CESTAT in the case of Alliance Global Services IT India Pvt. Ltd. Vs. CCE & ST (TS-240-CESTAT-2016-ST) while allowing refund under Rule 5 has held that (i) manpower recruitment or supply agency, (ii) cleaning services, (iii) renting of immovable property service, (iv) club or association, (v) commercial training or coaching service, (vi) courier services, (vii) customs house agents services are eligible. It has been further held that works contract services for making and fixing of door, windows, floor etc. are nothing but repair or renovation and would not fall within the exclusion segment of works contract post 01.04.2011.

- 10. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 10 All rights reserved. GST CORNER The Constitution Amendment Bill is pending before the Rajya Sabha and there is a lot of expectation that the bill may get cleared in the monsoon session. The Ministry of Finance has made available the model GST law in their website and it is upto the stakeholders to examine the model law and either accept or object to some of the provisions. In my view, while there is no dispute that GST would be a path breaking tax reform, a cursory reading of the model law indicates a host of issues. The draft law indicates certain tax consequences which do not exist in the current system and can have significant impact. Given below is a teaser of things to come if one were to go by the model law: (i) State wise registration. (ii) GST on advances for goods. (iii) Complex provisions with reference to place of supply for certain sectors. (iv) IGST on inter-state stock transfers. (v) No clarity on stock transfers within the State. (vi) Complex valuation mechanisms for stock transfer. (vii) TDS on e-commerce companies. (viii) Existing restrictions in Cenvat Credit to continue in GST. (ix) Subsidy forms part of value. (x) Discounts under various schemes post supply may not qualify for exclusion from value. (xi) GST on supplies made by one taxable person to another taxable person without consideration (FoC). (xii) Concept of price being the sole consideration retained. (xiii) Time of supply of goods shall be at the earliest of: Date of removal of goods Date of which goods are made available to recipient Date of invoice Date of receipt of payment with respect to the supply Date of receipt of goods as shown in the books of accounts by recipient. (xiv) No clarity on subsuming of various cess.

- 11. T a x Q u e s t / J u l y 2 0 1 6 © 2016 K. Vaitheeswaran Page | 11 All rights reserved. (xv) Transition credit mechanism. However, dealers having stock may not get the benefit. (xvi) Deemed exports to be notified. (xvii) Exports treated as zero rated supply. (xviii) IGST on import of goods or services into India. Disclaimer: - Tax Quest is only for the purpose of information and does not constitute or purport to be an advise or opinion in any manner. The information provided is not intended to create an attorney-client relationship and is not for advertising or soliciting. K.Vaitheeswaran & Co. do not intend in any manner to solicit work through this Newsletter. The Newsletter is only to share information based on recent decisions and regulatory changes. K.Vaitheeswaran & Co. is not responsible for any error or mistake or omission in this Newsletter or for any action taken or not taken based on the contents of the Newsletter. WE HAVE MOVED……………….. Our New Address: ‘VENKATAGIRI’ Flat No.8/3 and 8/4, Ground Floor, No.8 (Old No.9), Sivaprakasam Street, T. Nagar, Chennai – 600 017. Tel.: 044 + 2433 1029 / 2433 4048 Email: vaithilegal@gmail.com vaithilegal@yahoo.co.in www.vaithilegal.com