· Accounting & Financial Analysis· Analyze quarter-to-quarter (Q.docx

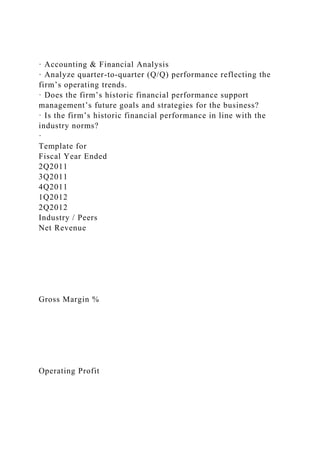

- 1. · Accounting & Financial Analysis · Analyze quarter-to-quarter (Q/Q) performance reflecting the firm’s operating trends. · Does the firm’s historic financial performance support management’s future goals and strategies for the business? · Is the firm’s historic financial performance in line with the industry norms? · Template for Fiscal Year Ended 2Q2011 3Q2011 4Q2011 1Q2012 2Q2012 Industry / Peers Net Revenue Gross Margin % Operating Profit

- 2. Net Earning Leverage Ratio Net Working Capital Liquidity Ratio Inventory turnover ratio

- 3. ROA, ROE Income Statement Analysis · Discuss revenue recognition policies. · Discuss changes in trends; unusual or extraordinary items · Quality of earning: potential red flags Balance Sheet Analysis · Major changes in assets/liabilities · Significant trends in liquidity, working capital and balance sheet ratios. · Identify off-balance sheet exposure and identify potential impacts. Cash Flow Statement Analysis · Amount of cash generated; · Source and uses of cash. · Availability of funds to finance capital expenditures, expansion of business activity, etc. 5). Pro Forma Financial Analysis (Cash Flow Statements) i). Three sets of financial projections are required (base or most likely case, worst case, best case). Results from all three cases are to be included in the forecast comparison spreadsheet. In each section the student should briefly summarize assumptions, the rationale behind the assumptions. ii). Valuation using price multiples (comparable companies); Provide reasons why you select certain ratios 9). Conclusion: proposed action (buy, sell, hold, spin-off) and its justification

- 4. Historical Data29/11/2012 23:42Error check = OK= Input on this sheet= CalculationName - ScenarioHistoricalCurrencyOther inputsNANANANANANANANANANA----------Historical Income StatementRevenuesPositiveOther Operating RevenuesPositiveCosts of Goods SoldNegativeSelling, Gen & Admin ExpensesNegativeDepreciation ExpenseNegativeOther Operating ExpenseNegativeReported EBITA0000000000Goodwill WritedownsNegativeAmortization of IntangiblesNegativeNon-Operating IncomePositiveInterest IncomePositiveInterest ExpenseNegativeRestructuring ChargesNegativeSpecial ItemsEarnings Before Taxes0000000000Income TaxesNegativeMinority InterestIncome Before Extraord. Items0000000000Extraord. Items (After Tax)Net Income0000000000Preference dividendsNegativeEarnings for common shareholders0000000000Common dividendsNegativeRetained profit0000000000Statement of changes in equityBeginning Equity000000000Retained profit000000000Foreign Exchange Rate ChangesIssue of New Shares/buy backGoodwill Written OffNegativeOther Adjustments to Equity000000000Ending Equity0000000000Historical Balance SheetOperating CashPositiveExcess marketable securitiesPositiveAccounts ReceivablePositiveInventoriesPositiveOther Current AssetsPositiveTotal Current Assets0000000000Net Property Plant and EquipPositiveGoodwillPositiveAcquired Intangible AssetsPositiveOther Operating AssetsPositiveInvestments & AdvancesPositiveDeferred tax AssetPositiveOther Non-op AssetsPositiveRetirement Related Assets (non- operating)PositiveTotal Assets0000000000Short Term DebtPositiveAccounts PayablePositiveTax PayablePositiveDividends PayablePositiveOther Current LiabilitiesPositiveTotal Current Liabilities0000000000Balancing DebtPositiveLong Term DebtPositiveDeferred Income TaxesPositiveOther operating liabilitiesPositiveRestructuring ProvisionsPositiveIncome

- 5. smoothing ProvisionsPositiveOn-going operating ProvisionsPositiveLong-term operating ProvisionsPositiveRetirement Related LiabilitiesPositiveMinority InterestPositivePreferred StockPositiveTotal Long Term Liabilities0000000000Total Common EquityPositiveTotal Liabs and Equity0000000000Balance sheet checkOK0000000000Off Balance Sheet ItemsNon-operating Component of Income Taxes%Note: Use + if non-op income was positive and taxes were paid, otherwise use - (negative)Non-opea Component of Incr in Def Tax LiabNote: Use + if increase in net deferred tax liabilityCapital ExpenditurePositiveInitial Cumulative Goodwill Written OffPositiveInitial Cumulative Intangibles Written OffPositiveMarket Value of Common EquityPositiveNon- operating component of pension expensePositiveWeighted Average Cost of Capital%Risk Free Rate (10 yr T-bond, avg yr.)%Operating LeasesPositiveInterest rate on Operating Leases %%Interest rate on Long-term operating Provision%Number of ordinary shares (average) (000)PositiveNumber of ordinary shares (year end) (000)PositiveAdditional number of shares if fully diluted(000)PositivePar value of preference shares (Currency)Positive &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company

- 6. Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P Forecast Drivers29/11/2012 23:42= Input on this sheet= Link to historical data= Calculation= Input on this sheetError check = OKName - ScenarioHistoricalDetailed ForecastKey driver forecast000000CurrencyRange nameOther inputsNANANANANANANANANANANANANANANANANA NANANANANANANANANA-------------------------- GeneralNameNameNameScenarioScenarioScenarioLatest year endYEdd/mm/yy or mm/dd/yyValuation dateVal_DateMust be after latest year endEnd of detailed forecast periodEnd_DFNAContinuing value yearCVY_DateNAEnter any year end from NA to NACurrencyCurrencyCurrencye.g. DM, US$UnitsUnits1e.g. 1,000Share price for comparison with valuationText:HighHighLowLowOperationsP&LOperating Revenue: % GrowthNANANANANANANANANAOperating revenuesRevPositive000000000000000Other Revenue: % GrowthNANANANANANANANANAOther

- 7. revenuesOORPositive000000000000000COGS: % RevenueNANANANANANANANANANACost of Goods SoldCOGSNegative000000000000000SGA: % RevenueNANANANANANANANANANASGASGANegative000 000000000000Other Op Exp: % RevenueNANANANANANANANANANAOther Operating ExpenseOOENegative000000000000000Working capitalOp Cash: % RevenueNANANANANANANANANANAOperating cashOpCashPositive000000000000000Inventories: % RevenueNANANANANANANANANANAInventoriesInvPositiv e000000000000000Acc Rec: % RevenuesNANANANANANANANANANAAccounts receivableTradDebtPositive000000000000000Acc. Pay: % RevenuesNANANANANANANANANANAAccounts payableTradCredPositive000000000000000OCA: % RevenuesNANANANANANANANANANAOther current assetsOCAPositive000000000000000OCL: % RevenuesNANANANANANANANANANAOther current liabilitiesOCLPositive000000000000000Total operating working capitalWC_Bal000000000000000WC increase/(decrease)WC_Delta00000000000000WC: % RevenuesNANANANANANANANANANANANANANANABal ance Sheet ItemsProperty Plant & EquipPPE NetPPE_NetPositive000000000000000Capital expenditure optionEnter 1,2 or 311: Net PPE as % revenuesNANANANANANANANANA2: % Operating revenuesNANANANANANANANANA3: Cash amount Currency000000000Capital expenditureCapexPositive00000000000000Depreciation: % Net PPE b/fNANANANANANANANANADepreciationDepnNegative000 000000000000Balancing itemNANANANANANANANANAOther historical fixed asset movtsFA_Hist0NANANANANANANANAGoodwillOpening000 00000000000Additions/(disposals)GW_Cash000000000Writedo wnsGW_AmortNegative0000000000ClosingGW_BalPositive000

- 8. 000000000000Initial goodwill written offGW_InitPositive0Acquired IntangiblesOpening00000000000000Additions/(disposals)Intang _Cash000000000AmortisationIntang_AmortNegative000000000 0ClosingIntang_BalPositive000000000000000Initial intangibles written offIntang_InitPositive0Other operating assetsOpening00000000000000Additions/(disposals)OOA_Cash 0NANANANANANANANAClosingOOA_BalPositive00000000 0000000Other operating liabilitiesOpening00000000000000Additions/(disposals)OOL_C ash0NANANANANANANANAClosingOOL_BalPositive000000 000000000Non-operating assetsOpening00000000000000Additions/(disposals)NOA_Cash 0NANANANANANANANAClosingNOA_BalPositive00000000 0000000Retirement Related AssetsOpening00000000000000Increase/(decrease)RetRelA_Cas h0NANANANANANANANAClosing balanceRetRelA_BalPositive000000000000000Retirement Related LiabilitiesIncrease/(decrease)RetRel_Cash000000000Closing balanceRetRel_BalPositive000000000000000Memo: % RevenuesNANANANANANANANANANANANANANANANon -operating componentRetRel_Nonop0000000000InvestmentsOpening00000 000000000Additions/(disposals)Inv_Cash0NANANANANANA NANAClosingInv_BalPositive000000000000000Off-Balance Sheet ItemsOperating leasesImplied principalOpLease_BalPositive0000000000Investment in operating leasesOpLease_Cash0NANANANANANANANA00000Interest rate0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%Implied interestOpLease_IntPositive00000000000000Adjustments to operating valueValuation basisBook valuePV (discounted at WACC)Excess Marketable SecuritiesEMS0Book0Financial InvestmentsFFA0Max(BV,PV)00Excess pension assetsPen_ExcessManual

- 9. calc30DebtMV_Debt0Book0Capitalized Operating LeasesMV_OpLease0Book0Retirement Related LiabilityMV_RetRel0Book0Preferred StockMV_Prefs0Book0Minority InterestMV_Min0Max(BV,PV)00Restructuring ProvisionMV_Restr0Max(BV,PV)00Long-term operating ProvisionMV_LTOp0Book0Value of Options OutstandingOptionsManual calcValue of Future Stock OptionsFuture_OptionsManual calcProvisions & Non-Op. P&LNon-operating P&L itemsNon-operating income % growthNANANANANANANANANANon-operating income/(expense)NOI000000000000000Special (pretax) income/(expense)SpecItem0000000000Extraordinary items/(expense)ExtraordItem0000000000Income smoothing ProvisionIncrease/(decrease)Prov_CashNegative000000000Clos ing balanceProv_BalPositive000000000000000Memo: % RevenuesNANANANANANANANANANANANANANANAOn- going operating ProvisionsIncrease/(decrease)OOP_Cash0NANANANANANAN ANAClosing balanceOOP_BalPositive000000000000000Restructuring ProvisionsOpening00000000000000P&L additionsRestr_ProfPositive0000000000Cash paymentsRestr_CashNegative000000000ClosingRestr_BalPositi ve000000000000000Long-term operating ProvisionsOpening00000000000000Implied InterestLOP_Int00000000000000Interest RateLOP_IntR0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%Exp ense00000000000000ClosingLOP_BalPositive0000000000Incre ase/(decrease)LOP_Cash0NANANANANANANANA00000Mino rity interestsOpening00000000000000P&L attributed (+ve)Min_ProfPositive0000000000Cash paymentsMin_CashNegative000000000ClosingMin_BalPositive 000000000000000Debt Finance & WACCInterest ratesExcess cashBalancing debtShort term debtLong term debt - 1Long term debt - 2Historical balancesExcess

- 10. cashCashPositive000000000000000Balancing debtODPositive000000000000000Short term debtSTD_BalPositive000000000000000Long term debt - 1000000000000000Long term debt - 2Use this if you want to subdivide LTD00000TotalLTD_BalPositive000000000000000Scheduled additions/(repayments)Short term debtSTD_Cash000000000Long term debt - 1Long term debt - 2TotalLTD_Cash00000000000000Interest calculationsExcess cashInt_IncPositive000000000000000Balancing debt00000Short term debt00000Long term debt - 100000Long term debt - 200000Total interest expenseInt_ExpNegative000000000000000Total interest expense (excl OD)Int_Exp_Excl_ODNegative00000WACCWACC0.0%0.0%0. 0%0.0%0.0%0.0%0.0%0.0%0.0%Note: to be calculated in separate modelEquity FinancePreferred stockOpening00000000000000New issues/redemptionPrefs_Cash00000000000000ClosingPrefs_Bal Positive000000000000000Dividend: Coupon % average balanceNANANANANANANANANADividendsPrefs_DivNegat ive000000000000000Par value per share0No. preferred shares (thousands)Prefs_No000000000000000Common equityOpeningEquity_Bal _BFPositive1000000000000000Net earnings for year00000000000000Dividends: % earningsNANANANANANANANANADividendsDiv_ComNegat ive000000000000000Translation effectsTranslation000000000New issues/(buy- backs)Equity_Cash000000000Goodwill write offGW_writeoffNegative000000000Other adjustmentsEquity_Adj000000000ClosingEquity_BalPositive00 0000000000000Number of common sharesCurrent no. shares (thousands)AverageShares_AvPositive000000000000000Movem ent in year0NANANANANANANANAYear endShares_YEPositive000000000000000Fully diluted no. shares (thousands)Additional

- 11. sharesPositive0000000000AverageShares_FD_AvPositive00000 0000000000Year endShares_FD_YEPositive000000000000000Dividends payable (B/S)Opening00000000000000Dividends declared00000000000000Dividends paidDiv_CashNegative000000000ClosingDiv_BalNegative0000 00000000000TaxCurrent taxEarnings before tax000000000000000Tax chargeTax_ChargeNegative000000000000000Tax creditor b/f00000000000000Current tax payable00000000000000Tax paidTax_PaidNegative000000000Tax creditor c/fTax_Cred_BalPositive000000000000000Tax creditor deltaTax_Cred_Delta00000000000000Tax ratesEffectiveNANANANANANANANANANANon-operating Component of Income TaxesNon Op Taxes- 0- 0- 0- 0- 0- 0- 0- 0- 0- 0- 0- 0- 0- 0Non-oper Comp of Incr Def Tax Liab- 0- 0- 0- 0- 0- 0- 0- 0- 0- 0- 0- 0- 0- 0Deferred taxAsset Increase/(decrease)DefTaxA_Delta000000000Deferred tax assetDefTaxA_BalPositive000000000000000Liability Increase/(decrease)DefTax_Delta000000000Deferred tax liabilityDefTax_BalPositive000000000000000Phase 2 & CV driversPhase 2 InputsRevenue growthNANANANARevenueRev_P20000000000000000Adjuste d EBITA marginNANANANANAAdjusted EBITAAdj_EBITA_P20000000000000000Cash tax rateCashTax_P2NANANANANANOPLATNOPLAT_P20000000 000000000Closing Net PPE as % RevenuesNANANANANANet PPE0000000000000000Other Invested Capital as % RevenuesNANANANANAOther Invested Capital0000000000000000Invested Capital (pre- Goodwill)Inv_CapP_P20000000000000000Cumulative Goodwill00000Invested CapitalInv_Cap_P20000000000000000Net InvestmentNet_Inv_P200000000000Continuing value inputsChoose ROIC optionEnter 1,2 or 311: Input value2: Last year of phase 2NA3: WACC0.0%ROIC usedROIC0.0%Growth

- 12. in NOPLATgConstants & datesDays in yearDIY365Months in yearMIY12OneOne1Units - labelUnit_label11000thousands1000000millions1000000000billi onsDatesNANANANANANANANANANANANANANANANA NANANANANANANANANANAYear(9)(8)(7)(6)(5)(4)(3)(2)(1 )012345678910111213141516CVY000000000000000000000000 00FY10Mid year adjustment factor (months)MYAF0 &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &C&F&RPage &P &L&BMcKinsey && Company Confidential&B&C&D&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&BMcKinsey && Company Confidential&B&C&D&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P

- 13. &C&F&RPage &P &C&F&RPage &P &C&F&RPage &P Results29/11/2012 23:42Error check = OKName - ScenarioOKHistoricalDetailed ForecastKey driver forecast000000CurrencyNANANANANANANANANANANAN ANANANANANANANANANANANANANANA------------------ --------Income StatementRevenues00000000000000000000000000Other Operating Revenues000000000000000Cost of Goods Sold000000000000000Selling, Gen & Admin Expenses000000000000000Depreciation Expense000000000000000Other Oper Expense000000000000000Reported EBITA000000000000000Goodwill Writeoffs000000000000000Amortization of Intangibles000000000000000Reported EBIT000000000000000Non-Oper Income000000000000000Interest Income000000000000000Interest Expense000000000000000Restructuring Charges000000000000000Special Items000000000000000Earnings Before Taxes000000000000000Income Taxes000000000000000Minority Interest000000000000000Income Before Extraordinary Items000000000000000Extraordinary Items (After Tax)000000000000000Net Income000000000000000Preference dividends000000000000000Earnings for common shareholders000000000000000Common dividends000000000000000Retained profit000000000000000Earnings per share (Currency)0.000.000.000.000.000.000.000.000.000.00NANANA NANAEarnings per share - fully diluted (Currency)0.000.000.000.000.000.000.000.000.000.00NANANA NANAStatement of changes in equityOpening

- 14. balance00000000000000Retained profit00000000000000Foreign Exchange Rate Changes00000000000000Issue of New Shares00000000000000Goodwill Written Off00000000000000Other Adjustments to Equity00000000000000Closing balance000000000000000Check: Changes in EquityOK00000000000000Balance SheetOperating Cash000000000000000Excess Marketable Securities000000000000000Accounts Receivable000000000000000Inventories000000000000000Other Current Assets000000000000000Total Current Assets000000000000000Net Property Plant and Equipment000000000000000Goodwill000000000000000Acquire d Intangible Assets000000000000000Other Operating Assets000000000000000Investments000000000000000Deferred tax asset000000000000000Other Non-operating Assets000000000000000Retirement Related Assets000000000000000Total Assets000000000000000Short term debt000000000000000Accounts Payable000000000000000Tax payable000000000000000Dividends payable000000000000000Other Current Liabilities000000000000000Total Current Liabilities000000000000000Balancing Debt000000000000000Long Term Debt000000000000000Deferred Income Taxes000000000000000Other Operating Liabilities000000000000000Restructuring Provisions000000000000000Income smoothing Provisions000000000000000On-going operating Provisions000000000000000Long-term operating Provisions000000000000000Retirement Related Liabilities000000000000000Minority Interest000000000000000Preferred Stock000000000000000Total Common Equity000000000000000Total Liabs and

- 15. Equity000000000000000Check: Assets = LiabilitesOK000000000000000Traditional Cash flowReported EBITA00000000000000Depreciation00000000000000EBITDA0 0000000000000Less investment in working capital00000000000000Foreign exchange translation effects00000000000000Operating cashflow00000000000000Less tax paid00000000000000Capital investmentsLess capex00000000000000Less investment00000000000000Less goodwill & intangibles acquired00000000000000On-going operating Provision00000000000000Less other operating assets/liabilities00000000000000Total capital investments00000000000000FinanceInterest Income00000000000000Interest Expense00000000000000Debt raised/repaid00000000000000Total finance payments00000000000000Plus non-operating income &expenseNon-Oper Income00000000000000Special items00000000000000Extraordinary items00000000000000Investment in non-operating assets00000000000000Retirement Related Assets00000000000000Total non-operating items00000000000000Less payments from reserves and to minoritiesRestructuring charges00000000000000Income smoothing Provision00000000000000Long-term operating Provision00000000000000Retirement Related Liabilities00000000000000Minority interest00000000000000Total payments to reserves/minorities00000000000000EquityLess pref dividends paid00000000000000Prefs issued/(redeemed)00000000000000Less dividends paid00000000000000Equity raised/repaid00000000000000Total equity cash payments00000000000000Net Cashflow00000000000000Cash/overdraftOpening balance00000000000000Increase/ (Decrease)00000000000000Closing balance000000000000000Check: Cash calc = Cash

- 16. balanceOK00000000000000Excess cashCash_Calc00000000000000Balancing debtCash_OD00000000000000NOPLATReported EBITA00000000000000Adj for Operating Leases00000000000000Adj for Non-operating component of pension expense00000000000000Add: Interest associated with Long-term operating Provision00000000000000Add: Increase in Income smoothing Provision00000000000000Adjusted EBITAEBITA_Adj0000000000000000000000000Taxes on EBITA00000000000000Change in Deferred Taxes Operating00000000000000NOPLATNOPLAT000000000000000 0000000000Taxes on EBITAProv for Inc Taxes00000000000000Non-operating Component of Income Taxes00000000000000Taxes on EBITA00000000000000Reconciliation to Net IncomeNet Income00000000000000Add: Increase in Deferred Taxes Operating00000000000000Add: Non-operating Component of Income Taxes00000000000000Add: Increase in Income smoothing Provision00000000000000Add: Amort of Intangible and GW Writeoffs00000000000000Add: Extraordinary Items00000000000000Add: Special Items00000000000000Add: Minority Interest00000000000000Adjusted Net Income00000000000000Add: Interest Expense00000000000000Add: Interest Exp. On Long-term operating Provision00000000000000Add: Interest Exp. on Op. Leases00000000000000Add: Interest Exp. on Non-operating component of pension expense00000000000000Add: Restructuring Charges00000000000000Less: Interest Income00000000000000Less: Non-operating Income00000000000000NOPLAT00000000000000Check: NOPLATOK00000000000000Invested CapitalOperating Working Capital000000000000000Net Property Plant and Equipment000000000000000Other Assets Net of Other Liabs000000000000000Less: On-going operating Provision000000000000000Value of Operating Leases000000000000000Op. Invested Capital

- 17. (excl.Goodwill)00000000000000000000000000Goodwill & Intangibles000000000000000Cumulative Written Off & Amortized0000000000000000Op. Invested Capital (incl.Goodwill)Inv_Cap00000000000000000000000000Excess Marketable Securities000000000000000Investments000000000000000Non- operating Assets000000000000000Retirement Related Assets000000000000000Total Investor Funds000000000000000Total Common Equity & Pref. Stock000000000000000Cum Goodwill Written Off & Amortized000000000000000Deferred Income Taxes000000000000000Dividends Payable000000000000000Income smoothing Provision000000000000000Adjusted Equity000000000000000Minority Interest000000000000000Restructuring Provisions000000000000000Long-term operating Provision000000000000000Retirement-Related Liabilities000000000000000Interest Bearing Debt000000000000000Value of Operating Leases000000000000000Total Investor Funds000000000000000Check: Investor FundsOK000000000000000Free Cash FlowNOPLAT0000000000000000000000000Depreciation00000 000000000Gross Cash Flow00000000000000Increase in Working Capital00000000000000Capital Expenditures00000000000000Incr in other operating assets/liabilities00000000000000Incr in Ongoing operating Provisions00000000000000Inv in Operating Leases00000000000000Gross Investment00000000000000Free Cash Flow Excl. Goodwill00000000000000Investment in Goodwill and Intangibles00000000000000Free Cash Flow Incl. GoodwillFCF0000000000000000000000000Interest Income00000000000000(Incr)/Decr Excess Mkt Sec00000000000000Foreign Exchange Translation00000000000000(Incr)/Decr Retirement Related

- 18. Assets00000000000000Non-operating Cash Flow00000000000000Restructuring Cash Flow00000000000000Non-operating Component of Income Taxes00000000000000Extraordinary items00000000000000Cash Flow Available to Investors00000000000000Financing FlowInterest Expense00000000000000Interest on Operating Leases00000000000000Interest on Nonoperating Component of Pension Expense00000000000000Interest on Long-term Operating Provision00000000000000Decr/(Incr) in Debt00000000000000Decr/(Incr) in Operating Leases00000000000000Decr/(Incr) in Retirement Rel. Liab00000000000000Decr/(Incr) in Long-term Operating Provision00000000000000Payments to Minorities00000000000000Common Dividends00000000000000Preferred Dividends00000000000000Decr/(Incr) in Preferred00000000000000Decr/(Incr) in Share Capital00000000000000Total Financing Flow00000000000000Check: Investors CF = Financing CFOK00000000000000Economic ProfitBefore GoodwillReturn on Invested Capital0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0. 0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0% 0.0%WACC0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0. 0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0% 0.0%0.0%Spread0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0. 0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0% 0.0%0.0%0.0%Invested Capital (Beg of Year)0000000000000000000000000Economic Profit (before Goodwill)0000000000000000000000000NOPLAT000000000000 0000000000000Capital Charge0000000000000000000000000Economic Profit (before Goodwill)0000000000000000000000000After GoodwillReturn on Invested Capital0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.

- 19. 0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0% 0.0%WACC0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0. 0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0% 0.0%0.0%Spread0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0. 0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0% 0.0%0.0%0.0%Invested Capital (Beg of Year)0000000000000000000000000Economic Profit (after Goodwill)0000000000000000000000000NOPLAT000000000000 0000000000000Capital Charge0000000000000000000000000Economic Profit (after Goodwill)EP0000000000000000000000000DCF Valuation CalculationsCV period0000000000000000FCF periodSumSum1111111111111111Free Cash Flow00000000000000000Discount Factor1.001.001.001.001.001.001.001.001.001.001.001.001.001. 001.001.001.00PV of FCF000000000000000000Continuing value00000000000000000PV of Continuing value000000000000000000Operating value0Economic profit00000000000000000Discount Factor1.001.001.001.001.001.001.001.001.001.001.001.001.001. 001.001.001.00PV of EP000000000000000000Continuing value00000000000000000PV of Continuing value000000000000000000Invested capital at start of forecast00Operating value0Check: EV=FCFOKMinoritiesProfits attributable to minorities00000Perpetuity based on final year detailed forecast00000Discount factor1.001.001.001.001.001.00Present Value000000Non- operating assetsNon-operating income00000Perpetuity based on final year detailed forecast00000Discount factor1.001.001.001.001.001.00Present Value000000Restructuring costsRestructuring costs paid00000Discount factor1.001.001.001.001.001.00Present Value000000RatiosAdjusted EBITA / RevenuesCost of Goods Sold / RevenuesNANANANANANANANANANANANANANANASG A costs /

- 20. RevenueNANANANANANANANANANANANANANANAEBI TDA / RevenueNANANANANANANANANANANANANANANADepr eciation / RevenuesNANANANANANANANANANANANANANANARep orted EBITA / RevenuesNANANANANANANANANANANANANANANAAdj ustments to EBITA / RevenuesNANANANANANANANANANANANANANAAdjuste d EBITA / RevenuesNANANANANANANANANANANANANANANANA NANANANANANANANANAReturn on Invested Capital (BY)Net PPE / Revenues0.0%NANANANANANANANANANANANANAWork ing Capital / Revenues0.0%NANANANANANANANANANANANANANet Other Assets / Revenues0.0%NANANANANANANANANANANANANARev. / Inv. Capital (pre- Goodwill)0.0NANANANANANANANANANANANANANANA NANANANANANANANANAPre-Tax ROIC0.0%NANANANANANANANANANANANANACash Tax Rate0.0%NANANANANANANANANANANANANA0.0%0.0% 0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%0.0%After-Tax ROIC (pre- Goodwill)0.0%NANANANANANANANANANANANANANAN ANANANANANANANANANARev. / Inv. Capital (incl. Goodwill)0.0NANANANANANANANANANANANANANANA NANANANANANANANANAAfter-Tax ROIC (incl. Goodwill)0.0%NANANANANANANANANANANANANANAN ANANANANANANANANANAReturn on Invested Cap (Avg)Net PPE / Revenues0.0%NANANANANANANANANANANANANAWork ing Capital / Revenues0.0%NANANANANANANANANANANANANANet Other Assets /

- 21. Revenues0.0%NANANANANANANANANANANANANARev. / Inv. Capital (pre- Goodwill)0.0NANANANANANANANANANANANANANANA NANANANANANANANANAPre-Tax ROIC0.0%NANANANANANANANANANANANANAAfter- Tax ROIC (pre- Goodwill)0.0%NANANANANANANANANANANANANANAN ANANANANANANANANANAAfter-Tax ROIC (incl. Goodwill)0.0%NANANANANANANANANANANANANANAN ANANANANANANANANANAAverage ROE0.0%NANANANANANANANANANANANANAGrowth RatesRevenue Growth Rate0.0%NANANANANANANANANANANANANANANANA NANANANANANANANAAdjusted EBITA Growth RateNANANANANANANANANANANANANANANANANAN ANANANANANANANANOPLAT Growth RateNANANANANANANANANANANANANANANANANAN ANANANANANANANAInvested Capital Growth Rate0.0%NANANANANANANANANANANANANANANANA NANANANANANANANANet Income Growth Rate0.0%NANANANANANANANANANANANANAInvestment Rates (excl. Goodwill)Gross Investment Rate0.0%NANANANANANANANANANANANANANet Investment / NOPLAT0.0%NANANANANANANANANANANANANANAN ANANANANANANANANANAFinancingEBIT/Interest PayableNANANANANANANANANANANANANANAAdjusted EBITA/Interest payableNANANANANANANANANANANANANANACash Coverage (Gross CF / Interest)N/ANANANANANANANANANANANANANADebt / Total Cap (Book)NANANANANANANANANANANANANANANADebt / Total Cap (Market)NANANANANANANANANANAValuation indicatorsMkt Val Op Inv Cap/ BV Op Inv CapNANANANANANANANANAMarket / Book (incl. Cum

- 22. Goodwill)NANANANANANANANANAMkt val Op Inv Cap / Adj EBITANANANANANANANANANAEnterprise value / EBITANANANANANANANANANANAPrice Earnings RatioNANANANANANANANANANA &C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &C&F&RPage &P &C&F&RPage &P &C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &R&F &A &C&F&RPage &P &C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &R&F &A &C&F&RPage &P &C&F&RPage &P &C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P Valuation Summary29/11/2012 23:42OKName - ScenarioCurrencyValue of Operations: DCF approachValue of Operations: Economic ProfitValue of EquityFree CashDiscountPVEconomicDiscountPVOperating Value0YearFlowFactorof FCFYearProfitFactorof EPExcess Mkt Securities0NA01.0000NA01.0000Financial Investments0NA01.0000NA01.0000Excess Pension

- 23. Assets0NA01.0000NA01.0000NA01.0000NA01.0000Enterprise Value0NA01.0000NA01.0000Debt0NA01.0000NA01.0000Capit alized Operating Leases0NA01.0000NA01.0000Retirement Related Liability0NA01.0000NA01.0000Preferred Stock0NA01.0000NA01.0000Minority Interest0NA01.0000NA01.0000Long-Term Operating Provision0NA01.0000NA01.0000Restructuring Provision0NA01.0000NA01.0000Future Stock Options0NA01.0000NA01.0000Stock options0NA01.0000NA01.0000Equity Value0NA01.0000NA01.0000Cont. Value01.0000Cont. Value01.0000No. shares (thousands)0Operating Value00Present Value of Economic Profit0Value per ShareNAInvested Capital (incl. goodwill)0Continuing value % Operating valueNA- HighNAOperating Value0-LowNAMid -Year Adjustment Factor1.000Mid -Year Adjustment Factor1.000Value Difference - HighNAOperating Value (Adjusted)0Operating Value (Adjusted)0Value Difference - LowNAComparison of key ratiosEvaluation of entry and exit multiplesAveragesFrom:NANANANATo:NANANANANANARe venue growth (CAG)NANANANAOperating Value00Adjusted EBITA growth (CAG)NANANANANOPLAT growth (CAG)NANANANAExcess Mkt Securities0Invested capital growth (CAG)NANANANAFinancial Investments0Adj. EBIT/RevenuesNANANANAEnterprise Value00Revenues/Invested Capital (pre- Goodwill)NANANANARevenue0NAROIC (after tax, pre- Goodwill)NANANANAAdjusted EBITA0NAROIC (after tax, including Goodwill)NANANANANOPLAT0NAAverage Economic Profit0000Enterprise / RevenueNANACash Tax RateNANA0.0%0.0%Enterprise / Adjusted EBITANANAWACCNA0.0%0.0%0.0%Enterprise / NOPLATNANA &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &C&F&RPage &P

- 24. &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P &L&"Times New Roman,Bold"McKinsey && Company Confidential&C&F&RPage &P