Working committee

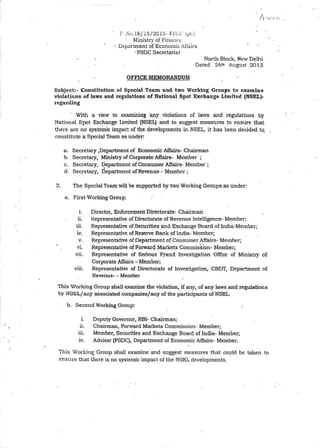

- 1. : f. Nu.18/ i5/2013- F::;r:,c (pl.) Ministry of Finance: Department of Economic Atiairs ·FSDC Secretariat }, '·•· C ~• J , ~ •• North Block, New Delhi Dated 26th August 2013 OFFICE MEMORANDUM Subject:- Constitution of Special Team and two Working Groups to examine violations of laws and regulations of National Spot Exchange Limited (NSEL}- regarding · With a view to examining ·any violations of laws and regulations by National Spot Exc~ange Limited (NSEL) and to suggest measures to ensure that there are no systemic i~P.act of the developments in NSEL, it has been decided to, constitute a SpecialTeam as under: a. Secretary ,Department of Economic Affairs- Chairman b. Secret~, Ministry of Corporate Affairs- ~ember ; c. Secretary, Department of Consumer Affairs- Member ; d. Secretary, Department ofRevenue - Member; 2. The Special Team will be supported by two Working Groups as under: a. First Working Group: i. Director, Enforcement Ditectorate- Chairman ii. H.epresen~tive of Directorate of Revenue Intelligence-·Member; iii. Representative ofSecurities and Exchange Board of India-Member; iv. Representative of-Reserve Bank oflndia- Member; v. Representative of Department of Consumer Affairs- Member; vi. Representative of Forwai<;t Markets Commission- Member; vii. Representative of Serious F:raud Investigation Office of Ministry of Corporate Affairs - Member; viii. Representative of Directorate of Investigation, CBDT, Department of Revern.1e- - Member This Working Group shall examine the violation, if any, of any laws and regulations by NSEL/any associated companies/any of the participants of NSEL. b. Second Working Group: i. Deputy Governor, RBI- Chairman; ii. Chairman, Forward Markets Commission- Member; 111. Member, Securities and Exchange Board of India- Member; iv. Adviser (FSDC), Department of Economic Affairs- Member. This Working Group shall examine and suggest measures that co1.:1ld be take·n to ensure that there is no systemic impact of the NSEL developments.

- 2. 3_ l3ot.:1 the Viorking Groups will comp!<:,e th, i1 tasi< withi:r1 t"<J ·.,.1:ks' ·time and subrr.it their report lo the Special team he~ded by Secretary (EA) for further consideration and finalization of the report for submission to Government: ' . 4 . To: This issues with the approval of the Finance Minister. ~~-(Ujjw"aJ Kumar) Under Secretary to Government of India Tel No. 23095744 1. Governor, Reserve Bank of India; 2. Secretary, Department of Economic Affairs, North·Block, New Delhi; 3. Secretary, Department of Revenue, North Block, New Delhi; 4. Secretary, Ministry of Corporate Affairs, Shastri Bhavan, New Delhi; 5. Secretary, Department of Consumer Affairs, Krishi Bhavan, New Delhi; 6. Chairman, Securities Exchange Board of India, Mumbai; 7. Chairman, Forward Market Commission. Mumbai; 8. Chairman, CBEC,-North Block, New Delhi. 9 . Chairman, CBDT, North Block, New Delhi. 10.Director, Enforcement Directorate, Loknayak Bhavan, Khan Market, New Delhi; 11.Deputy Governor, Reserve Bank of India, Mumbai; 12.Director, Serious Fraud Investigation Office, Paryavaran Bhawan·, CGO Complex, Lodhi Road, New Delhi; 13.Adviser, Financial Stability Development Council, Department of Economic Affairs, North Block, New Delhi Copy for informa~on to: l _ Director Oe1:1eral (DoC)' & Additional Secretary, Department of Economic Affairs 2. Additional Se~retary (Economic Affairs) 3. or: Shannila Mary Joseph K, Director, Prime Minister's Offke (w.r.t PMO I.D. No. 260/31/C/7:8/2013-ES-1 dated 14th August, 2013) 4. Shri V.S.Chauhan, Director (FMO) Iv»»~(Ujjwal Kumar)

- 3. F. No.18/ 15/2013- FSDC !pt.) Ministry of Finance Deptt of Economic Affairs · FSDC'Secretariat OFFICE MEMORANDUM North Block, New Delhi Dated 3oih_August 2013 Subject:- Constitution of ~peclal Team and two Working Grt?~i>~ :tq. ex~e violations of laws and regulations of Natfo'nal Spot Exchange Limited (NS~L)- ,e~arding ·· In continuation of FSDC Secretanat's· OM of even number dated 26th August, 2013, on the above m~ntion~d subje~t. it has l;>e~n dec;id~4 to. include Director (FIU.JND}, Financial Intelligence Unit - India, ~~ a me~ber of the first· ·workiqg group chaire~ by.DirectQr, EIµ'Qrce:m~nt Directorate_. 2. '-Chi~ is~ues ~~ the_app~oval ofthe ~ance Minis~er! 1. Governor, Reserve Bank of India . . . (U,ij~ Kum~) Under Secretaryto Goveinnient of In<_:iia .T~lNo. ~3095744 2. Secretary, Department of Economic Affair~. North Block, New Delhi; 3. Secretary, Department ofRevenu·e, North 'Block, New Delhi; ·4. Secretary, Ministry of Co~rate Affain, Shastri BhavW11 New Delhi; 5. Secretary, bepartment of Consumex: Aff~. ~ishi B'b~val'l; New De~; 6. Chairman, -s~curities ~change·Bo:;lrd of Indi~ Mumbai; · 7. Chairman, Forward Market Commissioli , Mumbai; 8. Chairman, CBEC,.North Blo~lc. New.0.el.hj. ·9. Chaimian,-CBDT.~North Block, New Delhi. 10.Directcir, ·Eo~o_rg:.ment E>irectotate, iokn~ak Bhavan, IQ-r~ M;u-ket, New Delhi; . . . : . : . . . . · . 11.Deputy Goverhor, Reserve Baiµ< oflhclia, Mumb~; 12.Director ·(FIU~lfID); Financial ~telligence 'J~it - India,· 6th 'Floor, Hotel Samrat, Kau:tily~ Marg, Chanakyaptiri,·New ~elhj . _. 13.Director; Setious Frau(! ~nv.estigaµon QfQce, Paryavaran .Btia'Yan, CGO Complex, Lodhi Roa~, N~w Delhi; . . . •. . 14.Adviser, Finaic;i.p Sta~ilty J?evelopll}ent qouncµ, Depart,me~t of Jkonoinic Affairs, North Block, Ney.r Delhi · .

- 4. CQpy for information to: . 1. Director General (DoC) & Additional Secretary, Department of Economic Affairs 2. Additional Se~retaiy {Economic Affairs) 3. Dr. Shcbmila Mary Joseph K, Director, Prime Minister's Office (w.r.t PMO 1.0. No. 260/31/C/28/2013-ES-I dated 14th August, 2013) 4. Shri V.S.Chauhan, Director (FMO} (Ujjwal Kumar)

- 5. i / . ;~ /, t·•.-"'ff"' >., 3 J. .FSDC Secretariat DEA, Ministry ofFinance -------·--------·--·--------- -~------------------------------------------------------------ RECORO OF OISCUSSION of the First Meeting of Special Team of Secretaries held on 3/9/13 on NSEL Issue 1. The first meeting of the Special Team of Secretaries on NSEL issue was held at 1500 Hrs. on 3rd September, 2013 ·in. New Delhi. The Secreta.ry (EA) chaired the meeting. The list of participants is atAnnex. The following deliberations took place in the m_eeting. 2. Shri Pankaj Agrawala, Secretary, Department of Consumer Affairs, describ~d in detail the background, origin, and issues involved with National Spot Exchange limited (NSEL). ·He observed that "Forward Contracts Regulation Act 1952 (FCRA) provides the contracts that are not settled within 1_1 days are forward contracts. It further provides that even during the 11 day period if the de_l➔very is dispensed with then the contract shall be forward contract and ' covered under the provisions of this Act. NSEL was granted exemption under section 27 of the FCRA to organize one day forward contracts and is therefore not an exchange regulated Forward Markets Commission (FMC). The initial performance of the exchange was rather poor and somewhere in 2010 it launched a. paired series of T+2 and T+25 contracts in contravention of the conditions of the exemption. This, it was alleged, was a sort of financing scheme which helps the participants pass on their income as business income and avail tax benefits. The complaints were examined and it was found that the operation of · the Exchange was in contravention to the provisions of the FCRA and the exemption granted to them. The Department of Consumer Affairs therefore directed the NSEL to stop T+25 contracts. The earlier complaints received with regard to NSEL operating as a NBFC were referred to Department of Fin·ancial .Services (DFS) on which no response was received. With regard to the latest developments at NSEL he observed that the first two settlements failed to meet the obligations, the latest ·reports of the SGS indicate t hat the warehouses of NSEL have no stocks and the present management is putting it on the earlier management for the crisis. The matter regarding NSEL therefore needs to be taken up by the investigative wings of the Government. A suggestion was also made by the Secretary (Consumer Affairs) . . that the concept that a Spot Exchange trades all the commodities from metal is flawed as it 1sr . meettng of Special Team of Secretaries Page 1

- 6. • I FSOC Secretariat DEA. Ministry of Finance --------- ----- ---------------- is impossible for one entity to under'stand the fundamentals of all the commodities and ' regulate them efficiently. Secretary Corpora~e Affairs observed that each Ministry having its own exchange would lead to mushrooming of the exchanges. 3. Shri Naved Masood, Secretary, Ministry of Corporate Affairs enquired about the mechanism to withdraw the exemption under section 27 Of .the FCRA Act. The issu·es involved in the present crisis as a Company, were also discussed. . . 4. Shri K.C. Chakrabarty Deputy Governor, Reserve Bank of India observed that the commodity markets need to develop gradually for the exchahges to perform the desired function. He further observed that RBI can take action only against entities regulated by it. ln case of NSEL, it is not regulated by RBI as an NBFC. He also highlighted that as the total amount of the payment crisis is only around Rs 5000 ~rores, there are ,:io systemic issues involved. However there may be a need to initiate actiof)/proceedings as per law if instances of money laundering are discovered. Further the ownership and management of a company needs to be separated for better governance of any company. 5. Shri Rajan Katoch, Directo·r, Enforcement Directorate, stated that formal meetirtg of the Group is scheduled for 4.9.13 and the group will get back with its report, whatever is possible, within the given time frame. 6. Secretary {Economic Affairs} urged that steps can be suggested to ensure that the developments in the Commodity marketmay not adversely affect the stock market. 7. lt was decided in the meeting that the two Working Groups would submit their report latest by 12 th o~ September 2013 and the next meeting of the Special Team may be held on 1J'hSeptember 2013-. 8. The meeting ended with thanks to the Chair. ) ( .· ~ 1 mee11ny of Special team of Secretaries Page 2

- 7. 'FSDC Secretariat DEA, Ministry ofFinance . . ---------------·····-··-····------ -------··---·---··-··--·······-----------···········-·•···--·---········ Annex LIST OF PARTICIPANTS j • 1 Dr. Arvind Mayaram, Secretary, DEA· IN CHAIR 2 Shri Sumit Bose, Secretary, Department of Revenue 3 Shri Naved Masood, Secretary,_Ministry of Corporate Affairs 4 Shri Panl<aj Agrawala, Secretary, Department of Consumer Affairs 5 Dr. K.C. Chal<rabarty, Deputy Governor, Reserve Bank of India 6 Dr. Rajan Katoch, Director, Enforcement Directorate 7 Dr C.S. Mohapatra, Adviser (FSDC) , 8. Shri Anupam M ishra, Director (SM &UTI) 9. Sh. Satyen Lama; Joint Director (FSDC) :S:i :!?-dll 1 nz1·719A?iJ nn:n:rm:» - C 1 meering at c:;µeciai Tt>ani of Sec;::,.,m~!. Pa9 °

- 8. • y •FSDC Sec_retariaf . . . .DEA, Ministry of Finance _..,........--------•-""'"'-·--·-··---...--....--..----------------·-------·-..--.---------·-·...-·--·---•·----------·--- ------ --·- .........--......,_..___.,_ RECORD OF DISCUSSION of the Secon,d Meeting of Special Team of Secretaries held on 18/09/13 on NSEL Issue 1. The second meeting of the· Special Team of Secretaries on NSEL issu·e was held at 1600 Hrs. on 18th September, 2013 in North Block, New Delhi. The Secretary (EA) chaired the meeting. The list of partici~ants is at Annex. 2. Secretary (EA) and the members of the Special Team considered the report of both the Working Groups. With regard to the Report of the first Working Group constituted to examine violation of laws and regulations by National Spot Exchange Limited (NSEL)/ any associated Companies/ any of the Participants the team felt that the r~port should specifically indicate the authorities that would be primarily responsible for taking actions against thes~ violations. 3. Secretary (EA) desired that Board Member of SEBI & Chairman of FMC ·. should attend the next meeting to be held on 20/09/2013 at 3:30 for providing inputs on the FCRA Act and the draft report may be placed before the team on .. 20/09/2013. 5. The meeting ended with thanks to the Chair.

- 9. ' ...--.-·~J; .:,,t• . x.:;1~.:ii!...~..:,.n.-.-;;!. •. l ~l .• , ~"""' FSOC Secretariat DEA. Ministry ofFinance ----------------·-··-····-··------ ---- - -- ··--------··--·-···---------··--·-··---·-- - LIST OF PARTICIPANTS 1 Dr. Arvind Mayaram, Secretary, DEA - IN CHAIR . 2 Shri Sumit Bose, Secretary, Department of Revenue 3 Shri Naved Masood, Secretary, Ministry of Corporate Affairs 4 Shri Pankaj Agrawala, .Secretary, Department of Consumer Affairs 5 Dr. Rajan Katoch, Director, Enforcement Directorate 6 Dr C.S. Mohapatra, Adviser (FSDC) 7 Shri Anupam Mishra, Director (SM) 8. Sh. Satyen Lama, Joint Director (FSDC) Page 2

- 10. .. Annex -IV RECORD' OF DISCUSSION . of the . ' Third Meeting of Special Team of Secretaries held on 20/09/13 on NSEL Issue 1. The third meeting of th.e Special Team 0f Secretaries on NSEL issue was held at 3:30 P.M. on 20th September, 2013 in North Block. New I . Delhi. The Secretary (EA) chaired the meeting. The list of participants is at Annex. The following deliberations took place in the meeting. 2. Secretary (EA) and the members of the Special Team considered the report of both the Working Groups. With regard to the Report of the first Working Group constituted to examine violation of laws and regulations by National Spot Exchange Limited (NSEL)/ any associated Companies/ any of the Participants the Special.team was provided with additional inputs from the Chairman of the first Working Group regarding the authorities that would be primarily· responsible for taking actions against these violations. The Special team also consulted Chairman of second working Group, Chairman· FMC and representative of SEBI regarding violations of Forwards Contracts (Regulation) Act, 1952 by NSEL. 3. Secretary (EA) along with the special team finalized the report and it was decided that Chairman will be submitting the same to the Government. 4. The meeting ended with thanks to the Chair.

- 11. LIST OF PARTICIPANTS -- 1 Or. Arvind Mayaram·. Secretary, DEA - In Chair 2 Shri Sumit Bose, Secretary, Department of Revenue 3 Shri Naved Masood; Secretary, Ministry of Corporate Affairs 4 Or. K.C. Chakrabarty, Deputy Governor. Reserve Bank of India . 5 Dr. Rajan Katoch, Director, Enforcement pi~ectorate 6 Shri Ramesh Abhishek, Chairman. FMC 7 Shri S V Murali Dhar Rao, Executiye Director, SEBI 8 Dr C.S. Mahapatra, Adviser (FSDC) 9 Shri Anupam Mishra. Director (SM·& CD) 10 . Sh. Satyen Lama, Joint Director (FSDC)

- 12. Annex-V Report <?f th~ Working Group to examine Viol~tion .of Laws and Regulations by National Spot Exchange Limited {NSEL)/ any Associat~d Companies/any ofthe Participants . . Ministry of Finance, Department of Economic Affairs vide Office Memorandum issued under F. No. 18/15/2013 (pt.) dated 26th August 2013 and 30th August 2013 constituted a Working Group under the Chairmanship. of.Director, Enforcement Directorate to "examine the violation, if any, of any laws and regulations by NSEL/any associated companies/any of the participants of NSEL." Copies of th~ OM are Annexures 1A & 18 to this Report. The Wo'rking Group held two meetings, on °4th September and 10th September 2013, and received written inputs on the subject from the organizations represented therein. First Meeting ofthe Working Group 2. The first meeting of the Working Group presided over by Dr. Rajan Katoch, Enforcement D.irector was held on 4th September 2013 in the office of Enforcement Directorate, Khan Market, New Delhi which was attended by the following: SI. Organisation Name of the Person Designation No. 1. Reseni~ Bank of India Shri N.S. Vishvanathan Principal thief General Manager 2. Directorate of Revenue Shri H.R.Garg Additional Director· lntelligen~e 3. Security and Exchange Shri SV Murli Dhar Rao Executive Director Board of India 4. Department of Consumer Shri G.N.~ingh Director Affairs 5. Forward Market i) Shri Ramesh Abhishek Chairman Commission ii) Shri Nagendraa Parakh Member iii) Shri Sanjay Punglia Director 6. Serious Fraud Shri Nilimesh Baruah Director Investigation Office 7. CBDT (Investigation) Ms. M.V.Bhanumati Director of Income Tax (lnvestigation)-11 8 FIU-IND Shri Amitav Additional Director Ms. Deepika Mittal Additional Director Besides aforementioned members, Shri Balesh Kumar, Special Director, Enforcement Director~te an9_S_hri Gurinder Singh Chawla, Deputy Director, Enforcem_ent Dir~~torate were also present. '

- 13. 3. ~ While v.·c,lcoming the particip;;r,t·;, the Chairman inforirn.d-the members about the terms and teference ofthe Working Group viz. examination of the violation, 1f any, of any laws and regulations by. . NSEL/any assqciated companies/any of the p~r,tjcipants of NSE°L antl impressed upon the necessity 'of submitting the Report of the Working Group to _the Sp~cial Team constituted by the Ministry of Finance by 12th September 2013. The Enforcement Director then invited Chairman of the Forward Market Commission (FMC) to brief the members _of the background and highlight key developments related to the issue. 4. Chairman, FMC stated that the term 'Spot Contract' has not been defined under any law. He informed that on 5th June, 2007 the Ministry of Consumer Affairs, Government of India, in exercise of powers conferr~d under Section 27 of the Forward Contracts (Regulations) Act, 1952 (FCRA) granted exemption to the National Spot Exchange Umlted•NSEL. Besides NSEL, ttie Government notified exemptions under Section 27 of the FCRA to NCDEX Spot Exchange Limited {notification dated 23rd July 2008)'.and National APMC {notification dated 11th August 2010). The Exemption Notification for NSEL exempted all forward contracts of one day duration for the sale and purchase of commodities from operation of the provisions of FCRA subject to following conditions: i} No short sale by members ofthe Exchange shall be allowed. ii) All outstanding positions ofthe trade atthe end ofthe day shall result in delivery. iii) The National Spot Exchange Limited shall organise spot trading subject to Regulation bythe Aut~orities reguli!ting spot trade in the areas where such tradingtake place. iv) All information or returns relating to the trade as and when asked for shall be provided to the Central Government or its designated agency. v) The Central Government reserves the right to impose additional conditions from time to time as it may deem necessary and· vi) In case of exigencies, the.exemption~will be drawn without assigning any reason in public interest. He stated that there was no regulating agency for monitoring the working ofthese exchanges. 5. Chairman, FMC further stated that prior to 2010, the volume of trade in these exchanges was very small and it was from 2010 onwards that the vot'ume of trade in these exchanges grew. The Ministry of Consumer Affairs issued a notification dated 6th February 2012, whereby FMC ;,.,as made the agency which could ask for information relating to the trade in these exchanges. Thereafter, FMC called trade data from these exchanges. Based on the analysis of the data provided by NSEL, it was noticed that there were contracts having settlement period exceeding 11 days In violation of FCRA and the condition of 'no short sale' by the members of NSEL was not being met. After protracted corresp':)ndence and discussions, the Ministry of Consumer Affairs vide letter dated 12th July 2013 directed NSEL to give undertaking that i) no further/fresh contracts shall be launched until further instructions and ii) all the existing contracts will be settled on due dates. NS~l however, vide letter dated 22nd July 2013 undertook to i) not launch any further/fresh contracts in new commodities and/ or not places till further instructions and ii) settle all contracts on their respective 'settlement due dates' as per contracts specification notified by the Exchange. NSEL, however, vide their circular dated 3P1 July 2~13 announced that i) trading in all contracts except e-series contracts stand suspended, ii) it has been decid~d to merge delivery and settlement of all pending contracts with immediate effect ' .

- 14. from today at.d to defer it for a period of 15 days a·nd ii) a revised settlement calendar will be· · announced for contracts du~ for settlement after su~h 15 days period. 6. Chairman, FMC further intimated thatt~e Ministry of Consumer Affairs vide notification dated 6th August 2013 imposed additional conditions on NSEL that i) no trading in existing e-series contracts a~d no further orfresh one dayforward ~ontrac.ts in any commodity shall be undertaken without prior. ·approval of the Central Government, and _ii) settlement of all outstanding one day forward contracts shall be done under the sup~rvision of FMC. He stated that NSEL had Settlement Guarantee Fund of Rs.~1.29 crore (non-cash component of Rs.48.69 cr~re and cash balance of Rs.12.60 crore.) NSEl also had Rs.30.64 crore in Settlement Escrow Account opened with Axis. Bank Ltd. He further stated that ~ . . there are concerns about the availability of stock in the warehouses . As per the status report submitted by SGS (a collateral management firm engaged by NSEL for surveying the warehouse stock), It is learnt that as against total value of_stock'of Rs.2,389.36 crore in 16 warehouses as reported by NSEL, physical verification has shown that the stock lying in these warehouses is only Rs."358 crore. He stated that the case to examine 'Flt and Proper' criterion is being pursued against the management and role of Indian Bullion MarketAssociation (IBMA).' He informed that NSEL has not been able to follow settlement schedules .and Cheques amounting to Rs.523.85 crores Issued by the members have bounced. He also informed that NSEL has filed complaint with Economic Offence Wing of Mumbai Police against S defaulting members. Out of 24 members 19 members have been declared 'defaulters'. He stated that FMC has a limited role of overseeing the settlements of all Ol!tstandlng one day contracts. . . 7. FMC also provided voluminous 'Note on Spot Exchanges' and 'Steps taken by FMC following the suspension of the contracts by NSEL for circulation among all members of the First Working Group. Copies ofthe two Volumes are Annex~res 2 Aand 2 Btothis Report. 8. Representative from t'1eMinistry of Consumer Affairs had no further comments to offer. 9. Representative from Reserve Bank of _India (RBI) stated that the· amount traded in this Exchange does not fall under the definition of Deposits under Section 45 (I) of RBI Act. He also stated that NSEL does not seem to be covered by the definition of NBFC. He informed that RBI can examine associates/subsidiaries-of NSEL as to their role into wealth management and how have they financed other players in NSEL. 10. Representative from SEBI Informed that af:ter the emergence of the case of NSEL, the Regulator had called ~he meeting of all Stock Exchanges and has com~ to a conclusion that there will be no spin-of effect of this.issue on the Stock markets. He also stated that the trading in NSEL does not come under the purview of collective investment schemes and as such no action can be taken by SEBI at this stage. 11- Representative from FIU 'stated that associations registered under FCRA are covered under the definition of intermediaries which are reporting entities for the purposes of cash transaction reports and suspicious transaction reports. He stated that the sources of money of the investors need to be examined as reportedly nearly 15% of the investment in the trading in the Exchange is supposedly to h_ave taken place through the proprietary accounts of the brokers. He also.suggested that s_ince th~r~ was ~imulation of actilities relating·to trading in forward contracts at NSEL it should be examined

- 15. whether ~uch unautho.rised a"ctivit1es could be covered i:,y the pe11al provisions of FCRA. 12. · Representative from CBDT stated that the Income Tax department has undertaken: suNey of NSEL-accredited warehouses and has found that either there was rio stock or the value of stock was less than w~at was stated. She also stated that they will be ascertaining flow of funds from the borrowers so as to examine that these are properly accounted for in their _books of accounts. They are also seeking details of investors to see how much money has been put in by the brokers through their proprietary accounts. She intimated that two of the PSUs have also lost money in the Exchange. 13. Director, SFIO stated that t_he action against NSEL, its Bo3rd of Directors and Auditor can be taken under various Sections of the Companies Act 1956 for violation of the provisions ofe5e~ions 211, 217, 397,398, 408 and 542 of the Companies Act. 14. Director, Enforcement Directorate mentioned that for the Directorate to take action it is necessary that the concerned law enforcement agency invokes a predicate offence that is scheduled under the· Prevention of Money Laundering Act. From the observations of the members, it appears that there is a possibility of scheduled offences having been committed: In this regard, the fMC was requested to examine the possibility of filing FIR with the Police, and also inform the Working Group of any FlRs/ complaints that they may be aware of which have been lodged by other concerned parties in the matter. Chairman thanked all the participants for sharing their views and requested them to send their comments on the matters discussed by 6th September 2013. It was also decided to hold second meeting of the Working Group on 10th September 2013 at 3.00 PM in the office of the Enforceme t1t Directorate. Inputs Received from Members ofthe Working Group 15. Written comments of the members of the First Working Group were received and have beer placed as Annexures 3-10 to this Report. Gist of comments received from the members are as follovvs: A Forward Market Commission (FMC) . 16. Forward Markets Commission (FMC) is a statutory authority set up under the Forvvar Contracts (Regulation) Act, 1952 for the promotion, development and regulation of commodi' derivatives market pertaining to forward contracts, the prohibition of options in goods and for ma1:te connected therewith. 17. The NSEL is neither a recognized nor a registered Association under Section 6 or 14 of FCF 1952. 18. Vide Notification dated 51h June, 2007, Department of Consumer Affairs, Ministry of Fo Consumer Affairs and Public Distribution, under power conferred upon it under Section 27 of the F. Act, 1952, have exempted one day forward contracts traded at NSEL from the operation of provisions of F.C(R)Act subject to certain conditions as stipulated as under: i) noshort sale by members of the fxchange shall be allowed; ii) all outstandin·g positions of the trade at the end of the day shall result in deliv~ry;

- 16. .'• iii) the National Spot Exchange Ltd. -:.hall ~rganize spot trading subject to reg~lation by the authorities regulating spot trade in the cireas where such trading takes place; iv) all information or returns .relating to the trade as and when asked for shall be provided to the Central Government or its designated agency; v) the Central Government reserves the right "to impose additional conditions from time to time as it may deem necessary; and vi) in case of exigencies, the exerciption will be withdrawn without assigning any reason in public interest. 19. Since the Ministry has exempted·one day forward contract traded-at NSEL from the operation- of the said Act by exercising their discretionary powers vested•in It u/s 27 of the FCRA, the tradl'ng and pther activities of NSEL were outside/ beyond the regulatorypowers of FMC and from the beginning itself, the Commission had no authority over the trading activities of NSEL. 20. Subsequently, vide Notification dated 6th February, 2012, the condition {iv) of the first Notification was modified by the Ministry by directing that in the said condition for the words "its designated agency" the words "Forward Markets Commission" shall be substituted thereby entitling the FMC to call for information or returns relating to NSEL's trading activities as and when desired. Ready delivery trades (spot transaction) in commodities are not within the purview of the F.C(R) Act. Therefore, the role of FMC with respect to NSEL was never that ~f a regulator unlike in the case of commodity futures exchanges which are recognized under Section 6of F.C(ij) Act. 21. As such, any failure on the part of NSEL in compliance of the directives ofthe FMC and/or non- submission of the information desired by FNIC, may be deemed to be violation of the conditions stipulated whit~ granting exemption under Section 27 ofthe F.C(R) Act to the tr~de in one day forward contracts, but may not a!llount to violation of any other provisions of FCRA_by virtue of the exemption granted to it vide the notificatiC!n discussed (supra). 22. Further, the non-availability of goods at warehouses accredited by NSEL and also the non-· payment of pay-in dues by buyers, dishonouring o.f cheques are subject matter of criminal nature' where an affected party needs to file a complaint/FIR to the police authorities.' As such the appropriate· body to lodge an FIR/complalnt would be the Investors affected or on their behalf collectively by Investor association, which may make NSEL, its Management/ Director, the borrower and their dire~ors as party for criminal breach of trust, cheating and defrauding by collusion. B Reserve Bank of India 23· Under Section 45-1 (bb) 'Deposit' includes receipt of money by way of deposit or loan or in any 0ther form. This is a very wide and inclusive definition. However, from the said definition, the receipt of money in some of the forms fisted therein is excluded. One of the excluded forms of receipt of money is advance against orders for goods, properties or services. Thus, the amount that represents consideration for goods is not included within the definition of deposit. Further, the essence of deposit is the·obligation to repay. In this case, NSEL has no obligation to re·pay in its own capacity. It repays the investor on behalf of the buyer as a Central Counter Party (CC~) only. As such, money

- 17. re_ceived by NSEL in these_transactions cannot be regarded as _deposit under section 4~-1(bb) of RBI. Act. . . 24. Under·section·45-l(c), business of financial institution includes financing ~hether by way of making loans, advances or otherwise of any activity other than its own. In the present case, NSEL does not finance th~ seller/miller. Merely because NSEL acts as a Central Cqunter ·Party to all these transactions, N~EL cannot be regarded as doing the activity of financing .the buyers. As such, provisions of Chapter 111B of RBI Act are not applicable to these kinds of activities. 25. Forward trading in commodities is specifically regulated by a Special law meant for regulating such activiti~s viz. FCRA. If NSELgot exemption from FCRA by making fals~ representations and if NSEL • is contravening the provisions of FCRA, it is a case for the authorities concerned to take action for contravention of the provisions -of FCRA. Any attempt to treat these transactions as camouflaging deposit acceptance activities by using instruments of commodity trading would be farfetched and difficult to prove in a court of law. It is felt that any such interpretation by RBI could be used by NSEL for trying to avoid the consequence of committing a breach of FCRA, which is not in the interests of the investors. C. Securities a.nd Exchange Board of India 26. The activities carried out by _NSEL are in the nature of normal routine trading activities of commodity brokers ofthe commodity spot exchanges i.e trading to profit from arbitrage. 27. These are one to-one transactions involving sale & purchase of derivatives and spot contracts on the exchanges. The sale / purchase activities are generally covered under the Contracts Act, 1872 and Sale of Goods Act,1930. SJch ~ale / purchase activity is not any pooling of money activity b~t is payment of money to the commodity brokers. Such transaction concludes on the sale or purchase of the ~ontract which is for a defined short period. 28. Further, the product involved in the present case is a specialised one , therefore it is covered under FCRA, 1952. This aspect was also clarified by the Govt notification dated Feb 6 , 2012 wherein FMC was notified as the concerned regulator. This matter is thus not an issue/ scheme under preview of SEBI CIS Regulations, 1999. . D. Ministry of Consumer Affairs · 29. Ministry stated that one of the conditions laid dowl'I while granting exemption had been that the spot exchanges shall organise spot trading subject to regulation by the authorities regulating spot trade in the areas where such trading takes place. States have enacted APMC Acts and Spot Exchanges had taken licences under APMC Acts of the respective governments. The APMC Act provides for a platform only in res~ect o_f agricult~ral commodities but the spot exchanges were also t~ading i~_non notified commodities like metals, etc. There was clearly no ·regulation to regulate such tr"ade i~ electronic spot exchanges. Based on the analysis received from FMC, the Department directed NSEL

- 18. on 27t1> April 2012 to ~xplain why the action should not be_initiated against them f~r violation of the conditions of the notification date~ 5t1> June 2007. However, the response from NSEL was not f~und satisfactory and with a view to protect the interest of investors, NSEL v,1_as aske~ on 121h July 2013 to give undertakings to the effect that: i) . Tllo further/fresh contracts shall be launched by the ~SEL until f1..1rther instruction from the concerned authority; and ii) All the existing contracts will be settled on the due dates." 30. While the undertakings were under examination, NSEL unilaterally announced on 31st July 2013 stoppage of trading in all cont~acts and decided to merge the delivery and settlement of f11 . pending contracts and defer it for a period of 15 days. In order to protect interest of the commodity market participants, the Depart~ent vide notification dated 6th August 2013 imposed additional conditions of i) no trading in' existing e-series contracts as well as no fresh or further one clay forward contracts without prior approval of the competent authority and ii) settlement of all outstanding one day fo~ard contr'acts shall be done under the ~upervision of FMC. 31. FMC submitted status report on 12111 August 2013 and shared certain concerns relating to the stock in the NSEL accredited warehouse, financial standing and ability to repay dues to NSEL by top buyers. FMC reached to the conclusion that multi agency investigation is needed to locate and recover/seize siphoned-off money and establish criminal liability arising out of cheating, forgery, criminal breach of trust, money-laundering and criminal conspiracy.' by _persons/entities responsible for warehouse goods, buyers and exchange officials and directors. The Department, on due consideration about multiple aspects of the matter endorses the views and recommendations of FMC. E. Financial Intelligence Unit•lndia 32. The Prevention of Money Laundering (Amendment) Act 2012, notified w.e.f 15th February 2013, has Included within the definition of "intermediary"· under .section 2(1)(n), on association recognized or registered under the Forward Contracts(Regulation} Act,19-52 {FCRA} or any member of such association. Under section 5 ofthe FCRA, 1952, an association concerned with the regulation and control of forward contracts is required to apply for recognition by the Central Government, which is authorized under section 6 to grant recognition. 18·commodity Exchanges at national and regional level are recognized by the Central Government. Besides, unde·r section 14A, an association concerned with the regulation and control of business relating to forward contracts Is required to register with the FMC before commencing such business. As per the list obtained from FMC there are 6242 associations or members of association that are registered under Sec 14A with FMC. By virtue of being an "intermediary" all 18 Commodity Exchanges recognized under section 6 and 6242 associations or members of association registered under section 14 A would fall under the definition of "Reported Entity", with obligations under section 12'and 12 A of the PMLA. 33· National Spot Exchange Limited (NSEL) is a joint venture of Financial Technologies (India) ltd. (FTIL) and National Agriculture Cooperative Marketing Federation of India (NAFED) established in May 2oo5. It is understood that the Ministry of Consumer Affairs through Gazette Notification on 5th June 2007 exempted under Section 27 of the FCRA, 1952 all forward contracts of one day duration for sale and purchase of commodities traded on .the Ns.EL subject to certain conditions specified in the notification. However, it is not cl~ar _from the .facts that have rome to light, if NSEL itself was

- 19. · e)(empted from the requirement of section 6 and 14A of FCRA. It _needs to be examined if NSH would r:iot fall within the definition of a "reporting entity') for the purpose of PMLA and Rules made there under. 34. From media reports and information available in public domain, it is learnt that Multi Commodity Exchange of India ltd. (MCX} is a. subsidiary of FTIL and is an independent commodity exchange recognized by the Central Government. NSEL holds 61% of shares of another entity called Indian Bullion Market Association (IBMA) 'which is a trading member of MCX and has mobilized large funds/ investments for trading on NSEL and has outstanding dues of Rs 1204.23 Cr. Similarly, N K Proteins Ltd which is one of the major defaulters is said to have been promoted by the son-in-law of .. . . . . . the NSEL Chairman. The company is a trading member of MCX. These entities appear to qualify as "reporting entities" and any violation of their obligation~under section 12 of PMLA could be enquired by FIU-IND. MCA 21 database is being searched to find ~t any other entity that may be associated with NSEL. In case the investigating agencies (Income Tax Department or SFIO) have knowledge of other entities which also are recognized or registered with FMC, the same may be shared with FIU-IN0 to enable further enquiry. 35. FIU-IND can assist the investigating agencies in the following: I} Search STR/CTR database for tracing accounts of defaulters, investors and brokers being investigated by the law enforcement agencies. ii) Raise an alert with the reporting entities (banks) to track the financial transactions of alleged perpetrators being investigated by the LEAs or FMCfrom_the point of view of filing STRs. iii} Seek information from foreign FIUs in case the investigating agencies have found that money has been transferred to a foreign jurisdiction. .F. . Serious Fraud Investigation Office 36. In 2010, NSEL started a composite trade in the nature of REPO AGREEMENT where the following 2 trades are.entered into atthe same time: (a) A spot transaction to purchase a commodity with a short settlement cycle such asT+2 (Ready delivery contract as defined in 2(i) of FCR Act 1952) (b) A forward transaction to sell the same commodity at a future date with a longer settlement cycle.ofT+25-45 days 37. These dual settlement periods were designed to provide investors with an opportunity to purchase the commodity in a shorter settlement cycle contract and sell it in the longer duration contract whereby the investor could lock in the price and take the benefit of the price differential. An annualized return of 14% was almost assured to all the investors by the brokers as well as by NSEL. This single act of introducing Composite Trading resulted in substantial increase in volume of trade as well as income of NSEL. The exchange logged an average monthly turnover of Rs 25,200 Crore since the beginning of 2012. Annual turnover surged from Rs 2,555 Crore in 2009_to Rs 2.68 lakh Crore in 2011, Rs 3.17 lakh Crore·in 2oi2 and Rs·l .6 lakh Crore in 2013.

- 20. 38 Key Findings ► The sudden stoppage of trades put into peril the pay-out of over Rs. 5,600 Crore and has prejudiced the interests of over 17,000 investors in relation to the settlement crisis at_NSEL.. ► The Risk Management·System of NSEL which is core to the functioning of a spot exchange needs to be -carefully ~valuated which has a bearing on the management of th'e stock exchange. This includes areas like: Warehouse management including veraci~y of Warehouse ·Receipts, management of physical stock, margin money from buyers and se!lers, Timely . .. settlements, Management of Settlement Guarantee Fund (SGF). Medi_a reports point towards absence of risk management system ► An analysis of the profile of the 24 defaulting members as available in the media reveals that 6 entities of the 24 defaulting members are companies established within the last 3 years (one company was incorporated in 2013). five of these companies have a paid.share capital of less than Rs. 1 Crore while another five companies have a paid share capital In the range of Rs. 1 Crore to Rs. 1.S Crore. Four of these companies with a share capital in the range of Rs. 1 Crore to Rs. 1.5 Crore, have combined outstanding dues of approximately Rs. 1420 Crore. ► Conflict of in~erest- Related Party Transactions ✓ As per media reports one of the largest borrowers (Approx. Rs. 969 Crore), N.K Proteins Ltd. is promoted by the son-in•law of the NSEL Chairman, Shankarlal Guru ✓- In 2012, auditing firm S.V. Ghatalia & Associates was replaced by the CA firm, Mukesh P. Shah & Co., where the partner Mukesh P. Shah is reported to be a dose relative of promoter Jignesh Shah ✓ Indian Bullion Market Association (IBMA) is held 61% by NSEL. IBMA is a clearing and tradihg member of NSEL ~nd as per media reports clears around 20% of tota) trades of NSEL. IBMAis also a trading member, dealing for direct Investors/clients. ► The quantum, nature and deployment of the Settlement Guarantee Fund (SGF) needs to be examined ► The Exchange was responsible for th~ insurance of the commodities kept at the warehouses and the insurance paid was a paltry figure of Rs.71 Lac on commodities worth Rs.6000 Crore reportedly in the warehouses ► As per media reports audit by Swiss firm SGS has revealed missing stocks amid fears of forged receipts. SGS, hired by the bourse at the behest of the commodity market regulator FMC has discovered that stocks in the 20-odd warehouses, it has inspected so far are less than 20% of the declared amount against which financing took place through NSEL. 39- Based on the above analysis and information available in the public domain, website of NSEL and FTIL, the under noted are the potential / likely regulatory violations ~nder the Companies Act 1956: SI.No. Sections of the Nature of Violations Companies Act 1956 1 . Sect.ion 397, 398 and Conducting the affairs of the company in a manner 408 prejudicial to public interest ' .

- 21. --- ----· 2 Section 54'2. under Carrying on the business of lhe company wilh intent I Schedule XI to defraud any person or for any fraudulent purpose . 3 Section 211 Failure to furnish "true and fair" view of the state of affairs of NSEL in its Balance Sheet for the financial year ending March 31, 2011, 2012,2013 4 . Section 217 Failure to furnish "true and fair" view of the state of affairs of NSEL in its Balance Sheet for the financial year ending March 31, 2011, ~012,2013 G Central Board of DirectTaxes.. I • 40. Income tax Department carried out surveys u/s. 133A of the Income Tax Act, 1961 on 22.08.2013 on 24 entities which together owe more than Rs.SSO0 crores to NSEL, The surveys have revealed that the godowns were either empty or the reported amount of the stocks were not available in the god6wns, except in one case where there was no discrepancy in stock. The account balances of most of these- entities do not match with the balances shown by NSEL. In ~ne case (Lotus Refineries Mumbai} the entity has·stated to the I.T. Authorities that contrary to the claims of NSEL, it had to receive Rs.252 crores from NSEL Preliminary enquiries indicate that some of the entities have recorded bogus purchases in their concerns. In some cases, fund flow has revealed that money received from NSEL was utilized for various purposes like investment in properties,. repayment of loans, allowances to other concerns, personal drawings, etc. Efforts are on to trace the destination of the amounts drawn from NSEL. 41. Income Tax Department is investigating the follow~ng issues: 1. How the amounts drawn from NSEL were utilised and whether the income earned thereon was offered totax? 2. Whether intere~/expenses incurred by th'e borrowers are eligible deduction in computing their. respective total i~come? 3. Whether the sources of investment by the Investors are properly explained? 4. Whether the income earned by the Investors has been offered to tax? S. Any other violations of the provision of direct taxes by either the borrowers or t h e Investors. 6. Whether NSEL h~s admitted all the receipts/incomes to tax? H Directorate of Revenue Intelligence 42. There is no apparent violation by NSEL or any associated company/any of the participants <>f NSEL directly under Customs Act 1963 or any other law enforced by the ORI, per se. However, S. h. Kailash Aggarwal, one of the two Directors of· M/s ARK Imports Pvt. Ltd. (who are amongst the 24 borrowers/defaulter) has come to adverse notice in the past on accounts of his violations of the Customs Act, 1963 in exports made.by him. Second Meeting ofthe Working Group

- 22. . . . . 43. To further discuss these inputs and finalize views. the Wo,king Group met on 10th September 2013 ~t 3.00 PM under the Chairm,e1nship .of Dr: Rajan Katoch, Enforcement Director. Following members were present in the meeting: SI. Organisation Name of the Person Designation No. 1. Reserve Bank of India Shri N.S. Vishvanathan Principal Chief General Manater 2. Directorate of Revenue Shri H.R.Garg Additional Director Intelligence· 3. Security and Exchange i) Shri Praveen Trivedi Joint legal Advisor Board of India ii) Shrl Prasad Jagadale Deputy Genera.I Manager 4. Department of Consumer Shri G.N.Singh Director Affairs 5. Forward Market i) Shri Nagendraa Par:akh Member Commission ii) Shri Sanjay Punglia Director 6. Serious Fraud Shri Nilimesh Baruah · Director Investigation Office . 7. CBDT (Investigation) Ms. M.V.Bhanumati Director of Income Tax (lnvestigation)-11 8 FIU-IND Shri P.K.Tiwari Director Besides aforementioned members, Shri Bale6h Kumar, Special Director, Shri S.W. Naqvi, Special Director and Shri Gurinder Singh Chawla, Deputy Oirec_tor from the Enforcement Directorate were also present. 44. Chairman welcomed the members and thanked them for their quick response in sendi~g the written comments. The comments sent by the members were read in the meeting and were endorsed , again by t he Members attending the meeting. Enforcement Director asked for certain clarifications from the me"'!bers ~ith regard to their written comments. It was explained by F!'-,1C that as per their views NSEL has violated two conditions of the Exemption Notification viz. short sales having occurred and having offered contracts exceeding settlement period of 11 days. Member from FMC stated that NSEL has not agreed to these observations of FMC and has conveyed that the sellers had confirmed ownership of the goods before the sell order was put through. As regards settlement period NSEL has contended that the Gazette notification did not specify the period with in which NSEL was required to complete delivery and payment. It was stated by FMC that the decision to withdraw exemption would • have to be taken by the Ministry. ,. 45. FM C also informed that NSEL has filed seven complaint against buyers with Economic Offence Wing (EOW). three complaints have been lodged with EOW by i) Dr. Kirit Somaiya, Ex-MP, ii) Sh. Vijayslngh Patwardhan, Ex-ruler of Sangli and iii)M/s Gateway Leasing Pvt Ltd, Mumbai. Further, two Plls have been filed in the Hon'ble High Court of Mumbai by Indian Council of lnvestor_s and Dr. Kirit Somaiya. FMC forwarded ~ide letter F.No.7/3A/2010-MKT-1/NSEL/Sett dated 6.09.2013 the copies of

- 23. .. ·P!Ls ;;nd complaints filed in this re6ard to·Enforcement Director. These papers 'are placed as Annexure• • 11. On a qu~ry FMC conv~yed th~t the M/s SGS has been appointed by NSEL for inspection of warehouses and an interim report has been received by FMC. Further, NSEL has·appointed'M/s Grant Thornton as Fore-nsk Auditor on behalf of FMC and they are likely to submit ~h_eir report wit~in 15 days. 46. The Representative from the Department of Consumer Affairs informed that the fMC has come under the charge of the Department of Economic Affairs, Ministry of Finance with effect from S September, 2013. A copy.of the Order is Annexure-12 to this Report. Till the time a decision is taken on withdrawal of Exemption Notification, NSEL will conti~u~ to have exemption under FCRA. 47. Likely violations of the provisions of the Warehousing (Development and Regulation) Act, 2007 were discussed. Represe!ltative from the Department of Consumer Affairs stated that the enforcement ofthe Act falls under jurisdiction of the Department of Food & Public Distribution. It was also informed that registration of warehouses under the Act is not mandatory, except where the warehouses issue negotiable warehouse receipts. This appeared to be the case here, and consequently there may be potential violations.. 48. Director, FIU stated that if NSEL has violated conditions of exemption and thereby has become liable to follow the provisions of FCRA then it will become a reporting entity under the provisior,s of Prevention of Money Laundering Act, 2002 ("PMLA"). In case NSEL falls within the·category of Reporting Entity, it will be subject to the obligations of reporting entities under section li and 12A of PMLA 2002_read with Rules 3 to 10 of the Prevention of Money Laundering (Maintenance of Records) Rules, 2005. In t'his regard the mail dated 10.9.2013 of FIU is placed as Annexur.e • 13 to this Report. 49. It was also stated that since NSEL is a company registered under the Companies Act, the role of directors of NSEL can also be examined for the violation of criterion relating to 'Fit and Proper persons'. In this regard Note from FMC is placed as Annexure-14 to this Report. 50. During discussions, members of the Working Group felt that based on the reported c1ctivitie: of the NSEL and its associates, there appeared to be potential violation of IPC provisions relating t1 cheating, forgery, criminal breach of Trust, money-laundering and c~iminal conspiracy by persons entities responsible for warehouse goods, buyers and exchange officials and directors. For sue · violations FIR would need to be filed under relevant Sections of Indian Penal Code by the appropriat agency in a manner that could facilitate a full investigation. Complaints filed by the private partiE including NSEL may not comprehensively cover the whole gamut of the violations and t~ contraventions. 51. The Income Tax Department has indicated the Sections of the Income Tax Act which ha· been possibly violated which is placed as Annexure - 15 to this Report.