Boosting Wind Power Opportunities and Addressing Threats

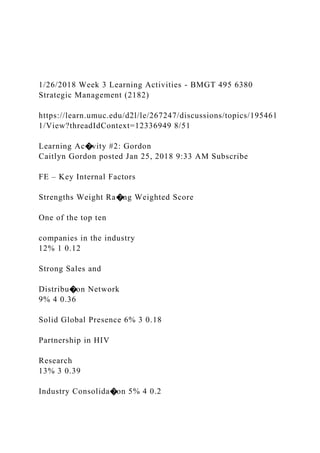

- 1. 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 8/51 Learning Ac�vity #2: Gordon Caitlyn Gordon posted Jan 25, 2018 9:33 AM Subscribe FE – Key Internal Factors Strengths Weight Ra�ng Weighted Score One of the top ten companies in the industry 12% 1 0.12 Strong Sales and Distribu�on Network 9% 4 0.36 Solid Global Presence 6% 3 0.18 Partnership in HIV Research 13% 3 0.39 Industry Consolida�on 5% 4 0.2

- 2. Weaknesses Loss of profit from various types of products not allowed in some of the coun�es. 8% 3 0.24 Brand Image controversies with drug addic�on 7% 2 0.14 https://learn.umuc.edu/d2l/le/267247/discussions/threads/12329 906/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 9/51 Insufficient number of vaccines available for certain virus/disease strands

- 3. 15% 1 0.15 Expira�on of products that have no been sold to the market yet. 10% 1 0.10 Economic slowdown in their main market (European) 13% 2 0.26 Totals 1.0 (Leave this cell blank) 2.14 1. Why did you choose those strengths and weaknesses? For the weaknesses in the table, they were chosen based on wha t GSK needs to improve on and keep up with its compe�tors. Dr ug addic�on has become a serious issue not only in the USA but around glob e. There is more and more stories being promoted about the horr ors of drug addic�on and pharmaceu�cal companies have to deal with thei

- 4. r name being thrown into the mix. Another area of concern is in sufficient vaccines available. in 2017, GSK had shortage of two vaccines, Hep B and Hep A. The shortage has actually rolled into the firs t half of 2018 (Palmer, 2017). Compe�tors are given the ability to move in o n that shortage and put their name out into the industry with the ir supplies for those vaccines. As for the strengths, GSK has global presence. The company is in a hundred and sixty countries. GSK has a large reach for thei r products and research. Consumers know GSK’s brand because of this large r each. The popularity of the brand has also fostered a partnershi p in HIV research with an American pharmaceu�cal company. This means GSK will have more supporters in their product and more money behi nd their research ("How are we redefining research in HIV?", n.d.). 1. What do the respec�ve weighted IFE scores mean for that or ganiza�on from a strategic planning viewpoint? IFE weighted scores have the same meaning as the EFE matrix. The humber between 100% and 0% is how important the factor is for that par�cular company. The ra�ngs for the IFE matrix are based o n a scale from 4‐1(Jurevicius, 2014). A ra�ng of a four would

- 5. mean that is major strength. GSK is increasing its reach or global presence at an al arming rate because of industry consolida�on. The pharmaceu �cal industry is very tough to keep up with and requires alarming amount of fun ds. Companies are falling to the side and giving mega‐companie s like GSK the room to spread their presence. The shortage of the Hep B vacci ne due to a produc�on issue really affected the company this ye ar. Millions of people across the globe were not about to receive this vaccine a nd the trust with its consumers for healthcare solu�ons fell. In 2018, GSK is star�ng this year at an extreme low and needs to improve the is sues with its produc�on and distributors to regain that trust wit h its buyers. This should be GSK first goal in its strategic planning. They ne ed to ensure this issue will not occur again or at the same size. 2. What are some strategic implica�ons by inferring based on th e total weighted scoresthat are derived from the IFE matrix resp ec�vely? 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 10/51

- 6. GSK received a below average score for IFE matrix. The averag e is 2.5. Fortunately or Unfortunately, depending how you want to look at it, the pharmaceu�cal companies do not really have to worry about tha t low score. The industry is becoming a monopoly very quickly. These companies have almost the sole power in pricing their products which means if the company is not making the amount of money it was projected to make, a simple raise in price would bring more prof its. An ar�cle wri�en last year, stated that pharmaceu�cal co mpanies are “high fixed low‐cost marginal industry” (Ginsburg, 2017). When it co mes to implemen�ng strategic goals, simply have to decide how much money to allocate to Rand D (research and development). Then promote t heir less‐produc�on cost drugs to the market to make huge profi ts. Resources How are we redefining research in HIV?. Gsk.com. Retrieved 25 January 2018, from h�ps://www.gsk.com/en‐gb/behind‐the‐scie nce/our‐ people/how‐are‐we‐redefining‐research‐in‐hiv/ Ginsburg, R. (2017). Pharmaceu�cal industry profits and resear ch and development. Brookings. Retrieved 25 January 2018, fro m

- 7. h�ps://www.brookings.edu/blog/up‐front/2017/11/17/pharmace u�cal‐industry‐profits‐and‐research‐and‐development/ Jurevicius, O. (2014). Why you need to know about IFE & EFE Matrices. Strategic Management Insight. Retrieved 25 January 2 018, from h�ps://www.strategicmanagemen�nsight.com/tools/ife‐efe‐matr ix.html Palmer, E. (2017). Merck and GlaxoSmithKline produc�on issu es lead to global shortage of hepa��s B vaccine | FiercePharma . Fiercepharma.com. Retrieved 25 January 2018, from h�ps://ww w.fiercepharma.com/manufacturing/merck‐and‐gsk‐produc�on‐i ssues‐lead‐to‐ hepa��s‐b‐vaccine‐shortage‐globally less 0 Unread 0 Replies 0 Views LA 1 Cassandra Caster posted Jan 24, 2018 1:47 PM Subscribe EFE – Key External Factors

- 8. Opportuni�es Weight Ra�ng Weighted Score https://www.gsk.com/en-gb/behind-the-science/our-people/how- are-we-redefining-research-in-hiv/ https://www.brookings.edu/blog/up- front/2017/11/17/pharmaceutical-industry-profits-and-research- and-development/ https://www.strategicmanagementinsight.com/tools/ife-efe- matrix.html https://www.fiercepharma.com/manufacturing/merck-and-gsk- production-issues-lead-to-hepatitis-b-vaccine-shortage-globally https://learn.umuc.edu/d2l/le/267247/discussions/threads/12320 653/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 11/51 1. Increased Awareness for Environment 0.20 3 0.60 2. Tax credits available 0.15 4 0.60 3.EPA limits on power plants 0.15 2 0.30 4. Poten�al market growth for farmers 0.05 1 0.05 5.Government’s willingness to turn to wind energy as a solu�on. 0.15 2 0.30

- 9. Threats 1. Shipping costs are increasing due to rising minimum wage. 0.10 2 0.20 2.Availability and amount of adver�sing for solar power. 0.15 1 0.15 3.Increased availability of informa�on on wind power could lead to more compe��on within the industry. 0.05 1 0.05 Totals for EFE 1.0 2.25 One of the biggest opportuni�es for the Wind Turbine industry is the increased awareness for the state of the environment. People are understanding that fossil fuels are l eading to climate change and are looking towards other methods of energy, such as solar and wind. This c reates a huge opportunity for the wind turbine business to increase sales and profits. Another opportuni ty is that tax credits and rebates are

- 10. offered on small wind turbine equipment and installa�on. This helps Bergey market to their customers to save money, not only by using wind energy, but to get the produ ct delivered and installed (Bergey, n.d.). Another opportunity for both Bergey and the wind turbine indus try is the EPA’s Clean Power Plan that imposes a limit on the amount of carbon dioxide pollu�on that power plants can emit in the United States (American Wind Energy Associa�on, n.d.). This opens up the p ossibility of wind companies partnering with larger associa�ons and power plants to generate energy in other ways. The next opportunity for Bergey, is the poten�al market growth that may be available for farmers. F armers are always looking for ways to cut their costs while providing a great, reliable product to their cust omers. Using wind energy could be one way to not only save money in the short term, but could be increasin gly reliable moving forward. The last opportunity that I would like to discuss is the government’s will ingness to turn to wind energy as a solu�on. Government agencies such as the FAA are already using wind tu rbines to help power remote loca�ons. If wind turbine companies can increase the number of government agencies that use their technology, it can

- 11. create more business customers, as well as individual customers . One of the biggest threats for the Wind Turbine industry is the i ncreasing shipping costs to due rising minimum wages across the country. Shipping for wind turbines i s already a daun�ng task, with large pieces of equipment that require special care and installa�on. As shipp ing costs increase, it could result in a higher cost to the customer, driving them away from wind power and s hi�ing to solar power. Another threat to the wind industry is the availability of solar power and the amount of adver�sing that is in place for solar power companies. In the past few years, the number of solar energy co mpanies have sky‐rocketed, and companies 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 12/51 are placing a ton of adver�sements that show how easy it is to i nstall solar. Another threat to the industry is the increased availability of wind‐powered opera�ng informa� on. This could lead to other companies

- 12. crea�ng addi�onal, more efficient machines and more compe� �on for Bergey. When using an EFE matrix, each strength and weakness is give n a weighted score based on a scale between 1 and 4. A 2.50 ra�ng means that a company is coping with its external environment, whereas 1 is not‐coping and 4 is excelling. (Capps, Glissmeyer, 2012). The o verall score for Bergey was a 2.25. This number means that Bergey is coping with its external environme nt, just not as efficiently as other companies. References American Wind Energy Associa�on. (n.d.). Wind energy ready as a solu�on to climate change. Retrieved from h�ps://www.awea.org/epa‐regula�ons Bergey. (n.d.). Bergey WindPower. Retrieved from h�p://berge y.com/ Capps, C., Glissmeyer, M. (2012). Extending the compe��ve p rofile matrix using internal factor evalua�on and external factor evalua�on matrix concepts. Journal of Appli ed Business Research. Vol.28, 5. less 4

- 13. Unread 4 Replies 7 Views Last post 9 hours ago by Sanh Tran LA 2 Cassandra Caster posted Jan 24, 2018 1:48 PM Subscribe IFE – Key Internal Factors Strengths Weight Ra�ng Weighted Score 1. “Wind School” 0.10 2 0.20 https://www.awea.org/epa-regulations http://bergey.com/ javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12320 659/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 13/51 2.Interna�onal Projects 0.15 3 0.45 3.Offer both grid‐�ed and off‐grid op�ons 0.15 4 0.60

- 14. 4. Longest Warranty in the industry 0.30 4 1.20 Weaknesses 1. Inability to purchase a turbine through Bergey. A cer�fied dealer needs to be contacted 0.10 2 0.20 2.Only manufacture small wind turbines. 0.10 2 0.20 3.Li�le Background informa�on provided on website 0.10 1 0.10 Totals 1.0 2.95 I used “Wind School” as one strength for Bergey. This is an onl ine por�on of their website that helps customers learn more about their product, retrieve wind maps, a nd training material on how to operate their wind turbines. This is a strength because it gives customers (and poten�al customers) a place to go for answers, advice, and exper�se on the product. Marke�ng to res iden�al and small business customers means that people want to spend less �me and save money. Their Win d School gives customers the opportunity to learn as much as they can (or want) in a short amount of �me. Another strength for Bergey are the

- 15. interna�onal projects that they par�cipate in. This helps to rais e awareness for their company, all over the world. This also helps to raise awareness on the availability of wind energy systems. The next strength, offering both grid‐�ed and off‐grid op�ons, is a strength for Be rgey in that it provides flexibility for customers. Bergey’s installers can �e the wind turbines into the service panel in customer’s homes. The off‐ grid systems provide remote power solu�ons that are currently used by the FAA in Alaska (Bergey, n.d.). The last strength that Bergey has is the warranty on their product. T he warranty that Bergey offers on their turbines is one of the longest in the industry (Bergey, n.d.). Thi s shows that Bergey is willing to stand by the products that they produce and expect customers to be happy wi th the product because it lasts. One of the weaknesses to purchasing a bergey unit, is that custo mers must find the Bergey company and then locate a cer�fied dealer to purchase a unit from. This creat es addi�onal research that a poten�al customer needs to complete, as they will research the Bergey co mpany, and the dealership company. Another weakness of Bergey, is that they only offer small wind turbine solu�ons. They specialize in turbines

- 16. for homes, farms and small businesses, however, they currently do not offer large scale wind turbine solu�ons. Not having this ability, limits Bergey in the types of companies that they can do business with. If they were able to create a larger turbine that can operate efficie ntly, they can expand their business to larger corpora�ons that may be interested in the technology. Th e final weakness to Bergey is the lack of availability on background informa�on. Prior to doing research, I had no idea what Bergey was, how it was formed, or where it was located. On their website, they have inf orma�on about the key contributors to the company, but not a lot of informa�on regarding the forma�on o f the company, any large contracts that they currently have (or were previously completed) or why the comp any was started. When using an IFE matrix, each strength and weakness is given a weighted score based on a scale between 1 and 4. A 2.50 ra�ng means that a company is coping with its i nternal environment, whereas 1 is not‐ coping and 4 is excelling. (Capps, Glissmeyer, 2012). The score that Bergey received was a 2.95, which means that they are successfully coping with its internal environ ment.

- 17. 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 14/51 References Bergey. (n.d.). Bergey WindPower. Retrieved from h�p://berge y.com/ Capps, C., Glissmeyer, M. (2012). Extending the compe��ve p rofile matrix using internal factor evalua�on and external factor evalua�on matrix concepts. Journal of Appli ed Business Research. Vol.28, 5. less 4 Unread 4 Replies 5 Views Last post 9 hours ago by Sanh Tran Learning Ac�vity #2 Danielle Hardy posted Jan 24, 2018 2:35 PM Subscribe Macure Pharma is a privately owned company that operates pri

- 18. marily in‐house. They have various distributors across the Denmark region, giving them availability and flexibility when it is necessary. The company is smaller as compared to their compe�tors, making th e decision making quicker and easier for process improvements or implementa�ons (Macure Pharma, n.d. ). IFE (Internal Factor Evalua�on) Matrix Strengths Weight Ra�ng Weighted Score Trusted by the public .20 3 .60 Network of distributors .20 3 .60 Interna�onal partnerships .10 1 .10 http://bergey.com/ javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12321 146/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 15/51 Weaknesses Weight Ra�ng Weighted Score

- 19. Not a large product por�olio .15 2 .30 Smaller compared to compe��on .20 1 .20 Limited research and development .15 2 .30 Totals for IFE 1.0 ‐ 2.10 A. Trusted by the public – customers are more likely to stay loyal to a company they trust, and knows delivers on their promises. Network of distributors – the company’s network of distributors is strategically geograph ical, making business more flexible and easier to operate. Interna�onal partnerships – If there are external factors that impact Denmark, or Europe in general, there are s�ll opportuni�es available globally. Small product por�olio/smaller company/limited research and d evelopment – Since the products provided are already limited, if compe�tors enter these markets, it will b e more difficult to maintain sales. This is also impacted by the size of the company, funds are already limited t owards research and development of new products.

- 20. B. Weigh�ng was distributed fairly, for the most part. The fact they are a small trusted company, creates a loyal customer base. Especially since there are various facili� es that can deliver products on �me, anywhere. These are their strongest assets. On the other hand, th eir greatest downfall is that they are smaller compared to compe��on and their internal aspects may not be able to weather external factor changes such as healthcare reform or a recession as well as their compe��on (Macure Pharma, n.d.). C. Strategically, the company has the ability to maintain sales a nd valuable rela�onships with their customers and distributors. It would behoove them to increase t he products that they over and get involved in more sectors of the pharmaceu�cal industry for sup port. References: Macure Pharma (n.d.). “About us.” Retrieved from h�p://www. macurepharma.com/about http://www.macurepharma.com/about 1/26/2018 Week 3 Learning Activities - BMGT 495 6380

- 21. Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 16/51 less 2 Unread 2 Replies 4 Views Last post 7 hours ago by Sanh Tran Learning Ac�vity #1 Danielle Hardy posted Jan 24, 2018 2:35 PM Subscribe Macure Pharma is a pharmaceu�cal company based out of Den mark. The strongest external factors that influence the company are technology and suppliers. Con�nuou s research and development efforts drive the expansion of the technology and informa�on that is availabl e to the industry. This technology impacts the innova�ons of medicine, and impact the ability of suppliers to provide the necessary medicines at compe��ve pricing (Macure Pharma, n.d). EFE (External Factor Evalua�on) Matrix

- 22. Opportuni�es Weight Ra�ng Weighted Score Development in a new niche market .10 2 .20 Increased efficiency of manufacturing .15 2 .30 Technological improvements .15 3 .45 Acquiring a supplier as a subsidiary .05 1 .05 Increasing awareness of promo�ng good health .05 2 .10 Threats Weight Ra�ng Weighted Score Changes in healthcare regula�ons .15 3 .45 Increase in taxes .05 2 .10 Availability of new pharmaceu�cals .10 2 .20 Changes in customer viewpoints/beliefs .05 1 .05 Global compe��on .15 2 .30 Totals for EFE 1.0 ‐ 2.20 A. Development in a new niche market – Many pharmaceu�cal companies in Europe specialize in

- 23. par�cular drugs, if they are able to acquire another niche drug, profits will likely increase (Macure javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12321 143/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 17/51 Pharma, nd.). Increased efficiency of manufacturing/Technological improvem ents – If the company is able to become more efficient and acquire new technologies, the cost of produc �on will decrease, increasing profits. Acquiring a supplier as a subsidiary – If Macure Pharma acquires one of their suppliers, then the profi ts will become theirs, and costs will decrease. Increasing awareness of good heath – If the public increases their awareness about the importance of good health, then profits for pharmaceu�cals will increase

- 24. Changes in healthcare regula�ons or taxa�on ‐ If regula�ons were to change, coverage will likely change, which could deter purchases of specific drugs just as taxes will increase costs. Availability of new pharmaceu�cals – New drugs will bring compe�tors into the market, which could possibly decrease sales. Changes in customers’ viewpoints – If the public’s opinion of pharmaceu�cal companies change for the worse, sales will decrease. Global compe��on – If foreign companies enter the European market, they could off er drugs at a cheaper price, driving down sales. B. Based on the weights I allocated to the factors above, Macure Pharma’s opportuni�es are heavily based on innova�ons in technology, new techniques, and proces s improvement. The greatest threats are a�ributed to changes in policies and the entrants of compe� tors from foreign countries. Their strategy should focus on maintaining innova�ve prac�ces in or der to decrease the threat of new entrants.

- 25. C. Macure Pharma has the ability to adapt to new technological changes, in order to stay compe��ve with exis�ng companies. This is something they have been doin g for years, and it is unlikely that this will change. Unfortunately, involvement in a new drug niche is not a tac�c they are familiar with, but it would give them a stronger share of the en�re pharmaceu�ca l market. Also, global compe��on is limited at this point in �me, so if foreign companies were to ent er, Macure Pharma would have to adapt to the best of their abili�es (Macure Pharma, n.d.). References: Macure Pharma (n.d.). “About us.” Retrieved from h�p://www. macurepharma.com/about http://www.macurepharma.com/about 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 18/51 less 2 Unread

- 26. 2 Replies 2 Views Last post 17 hours ago by Euriviades Beltre Week 3 Learning Ac�vity 2 ‐ BELTRE (Suzlon) Euriviades Beltre posted Jan 25, 2018 4:27 AM Subscribe IFE – Key External Factors (Suzlon Windmill) Strengths Weight Ra�ng Weighted Score Produc�on of new equipment 0.6 3 1.8 Customer service concerns 0.4 2 0.8 Social Responsibility 0.9 4 3.6 Consistent top line growth 0.12 4 0.48 Experienced Management 0.5 3 1.5 Weaknesses Concerns with workplace 0.9 2 1.8 High debt obliga�ons 0.6 5 3.0 Unfunded employee post‐re�rement benefits 0.3 2 0.6

- 27. Overdependence on the North American market 0.7 5 3.5 Technology Training 0.2 3 0.6 Totals for EFE 5.22 17.68 Suzlon Energy Ltd. Is having an integrated business model that they don’t have to go to other suppliers for raw products. They have very good ver�cal integra�on for supp or�ng their produc�on ac�vi�es. So, they don’t have to be dependent for supplies. They are having enoug h in‐house technology development javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12328 727/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 19/51 capabili�es as they have skilled employees so that they can desi gn their products of their own. They don’t have to go to outsider experts for designing the products. As Su zlon has a global presence, it produces the products which can be used globally. Though it is not that much technically developed as compared to other

- 28. global players, but its products can work at global level also. Su zlon as a market leader don’t have that much efficient opera�on management team. We can say this because t here are many complaints of customers regarding their opera�ng staffs who provide a�er sales service and it is also looking up to some extent in opera�ng the business. So proper implementa�on of strategies i s lacking. Reference: Suzlon. (n.d.). About Suzlon. Retrieved from h�p://www.suzlon .com/about/company less 0 Unread 0 Replies 2 Views Week 3 Learning Ac�vity 1 ‐ BELTRE (Suzlon) Euriviades Beltre posted Jan 25, 2018 3:49 AM Subscribe EFE – Key External Factors (Suzlon Windmill) Opportuni�es Weight Ra�ng Weighted Score

- 29. Expand market globally 0.9 3 2.7 Provide delivery 0.6 1 0.6 Product diversifica�on 0.8 2 1.6 Improve service quality 0.8 2 1.6 Product innova�on 0.8 3 2.4 Threats Many strong compe�tors 0.9 2 1.8 http://www.suzlon.com/about/company https://learn.umuc.edu/d2l/le/267247/discussions/threads/12328 652/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 20/51 Rising price in resource influence products cost 0.9 3 2.7 Rela�onship with suppliers 0.6 2 1.2 New entrants in the industry 0.5 3 1.5 Not engage with customers 0.6 2 1.2 Totals for EFE 7.4 23 17.3

- 30. Suzlon has enabled effec�ve integra�on of the departments wit h standardized audit methods, plans and schedules. To enhance responsiveness to management, a preven �ve ac�ons and report to all stakeholders about the scope for improvement on a con�nual basis has been adopted. The center is focused on developing the best blades and control systems in the industry, a nd integra�ng Suzlon’s aerodynamic, loads and new structures research across the company. Reference: Suzlon. (n.d.). About Suzlon. Retrieved from h�p://www.suzlon .com/about/company less 0 Unread 0 Replies 0 Views Week 3 ‐ LA 2 ‐ Jared Ubben Jared Ubben posted Jan 25, 2018 8:26 PM Subscribe Company: GE Wind Turbines Requirement 2: Discuss briefly some relevant corporate backgro

- 31. und informa�on about that company in regards to its internal environment. GE is a MNC that is recognized worldwide a leader manufacture r of appliances, technology, avia�on and energy providers. In 2009 it was named the largest company in t he world by Forbes Magazine. “GE has consistently been the dominant manufacturer of wind turbines in stalled in the United States since it purchased Enron’s wind business (formally Zond) in 2002. Betw een 2005 and 2015, GE's average annual share of installed capacity was 44%, or 2.7 GW per year”. (eia.g ov, 2016). http://www.suzlon.com/about/company https://learn.umuc.edu/d2l/le/267247/discussions/threads/12336 300/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 21/51 Requirement 3: Determine at least 3 internal factors as “strength s” and 3 other internal factors as “weaknesses”.

- 32. Strengths 1. In‐House Technologies 2. Global Recogni�on 3. Diversified Product Line Weaknesses 1. Can only be used in certain geographical areas 2. S�ll high demand for Fossil fuels 3. Dependence on suppliers of raw materials Requirement 4: Compile an Internal Factor Evalua�on (IFE) Ma trix (with specific internal factors, weights, scores, and weighted scores) as an analy�c tool for technically evalua�ng the focal company. IFE (Internal factor evalua�on) IFE – Key Internal Factors Strengths Weight Ra�ng Weighted Score In‐House Technologies 0.15 3 0.45 Global Recogni�on 0.25 4 1 Diversified Product Line 0.2 4 0.8

- 33. Weaknesses Can only be used in certain geographical areas 0.1 2 0.2 S�ll high demand for Fossil fuels 0.2 3 0.6 Dependence on suppliers of raw materials 0.1 2

- 34. 0.2 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 22/51 Totals 1.0 (Leave this cell blank) 3.25 Requirement 5: d. Why did you choose those strengths and weaknesses? (Please keep in mind you need to discuss at least 3 suppor�ng r easons for each of these respec�ve factors.) Strengths 1. In‐House Technologies ‐ Not having to outsource technology research and development can keep the technologies under one roof. By not allowing compe�tors to ha ve access to the technology the GE has, gives them a leg‐up on the compe��on. 2. Global Recogni�on ‐ The recogni�on the GE brand has enabl es it to stand out amongst compe�tors. It

- 35. allows them to have pricing power with their products, changing slightly more than compe�tors who may carry the same products, but can’t do so because of the brand re cogni�on. 3. Diversified Product Line ‐ GE is the only company to offer a n oceanic wind turbine. It carries a total of 9 turbines that can meet almost any clients needs. This sets them apart from other companies offering a smaller product line. Weaknesses 1. Can only be used in certain geographical areas ‐ Strong winds are not a condi�on that happens everywhere. To get the most use out of a turbine they must be pl aced in areas where high winds are normal. 2. S�ll high demand for Fossil fuels ‐ This cuts into the demand for their wind turbine products. Much of the world runs off burning fossil fuels and with he tax cuts fossil fu els are ge�ng from the government, it will be tough for renewable energies to keep their prices low while t heir being taxed more. 3. Dependence on suppliers of raw materials ‐ When a company is dependent on the raw materials they are subject to the bargaining power to shi� to the supplier. When th is happens, it leaves the door open to pay

- 36. more for their materials as the suppliers know it is necessary for GE to operate. e. What do the respec�ve weighted IFE scores mean for that org aniza�on from a strategic planning viewpoint? The diversity of products GE produces is what helps to keep the ir name as globally recognized as it is. According to the IFE, this is a high scoring strength and will he lp them in any product sector they enter. The strategic panning of GE should remain to diversify their product line. It sold also look to build rela�onships with their suppliers and the supply chain. This will help to keep prices of raw materials low and in the end, keep the prices of their products to customers low. f. What are some strategic implica�ons by inferring based on th e total weighted scores that are derived from the IFE matrix respec�vely? The strategy formula�on that can be used from the IFE is to foc us on the highest rated strengths and weaknesses. The score is at 3.25 which indicates the company is strong internally. That being said, it can focus more on the external func�ons in the industry.

- 37. References: 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 23/51 U.S. Energy Informa�on Administra�on ‐ EIA ‐ Independent St a�s�cs and Analysis. (2016, November 28). Retrieved January 25, 2018, from h�ps://www.eia.gov/todayine nergy/detail.php?id=28912 less 0 Unread 0 Replies 0 Views Week 3 ‐ LA1 ‐ Jared Ubben Jared Ubben posted Jan 25, 2018 8:24 PM Subscribe Company: GE Wind Turbines https://learn.umuc.edu/d2l/le/267247/discussions/threads/12336 274/View

- 38. javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 24/51 Requirement 3: Discuss briefly some relevant background infor ma�on about that company and its industry in regard to its external environment. GE Wind turbines operates in a growing industry that is being p ushed by the need to move away from fossil fuels. As more research comes forward about the damaging affe cts fossil fuels have on the environment, ci�es, governments and even individuals are wan�ng a cleaner alterna�ve. “As of the end of 2015, just three manufacturers— General Electric (GE), Vestas, and Siemens—accounted for 55 gigawa�s (GW), or 76%, of installed wind genera�ng ca pacity in the United States”. (eia.gov, 2016). With the minuscule number of compe�tors, GE is one of three c ompanies who are compe�ng against each other in the growing market. Requirement 4: Determine at least 5 external factors as “opportu ni�es”, and 5 other external factors as

- 39. “threats”. Opportuni�es 1. American market moving towards renewable energy 2. The “Go Green” movement 3. More infrastructure for renewable energies 4. More regula�on from EPA to produce cleaner emissions 5. More research and development in green technologies Threats 1. Discovery of more oil fields 2. Government tax regula�ons making it more difficult for turbi ne industry 3. High cost to enter market 4. Technology Risk 5. Objec�on to wind power Requirement 5: Compile an External Factor Evalua�on (EFE) Matrix (with specific internal factors, weights, scores, and weighted scores) as an analy�c tool for technically evalua�ng the focal company. EFE (External Factor Evalua�on) Matrix

- 40. EFE – Key External Factors Opportuni�es Weight Ra�ng Weighted Score market moving towards renewable energy 0.15 3 0.45 The “Go Green” movement 0.10 4 0.4 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 25/51 More infrastructure for renewable energies

- 41. 0.10 3 0.3 More regula�on from EPA to produce cleaner emissions 0.07 2 0.14 More research and development in green technologies 0.14 2 0.28 Threats Discovery of more oil

- 42. fields 0.11 2 0.22 Government tax regula�ons making it more difficult for turbine industry 0.15 3 0.45 High cost to enter market 0.08 1 0.08 Technology Risk 0.04 1 0.04 Objec�on to wind power 0.06 1 0.06

- 43. Totals for EFE 1.0 (Leave this cell blank) 2.42 Requirement 6: a. Why did you choose those opportuni�es and threats? (Please keep in mind you need to discuss at least 3 suppor�ng r easons for each of these respec�ve factors.) Opportuni�es 1. American market moving towards renewable energy ‐ I live i n Las Vegas and the due to the shortage of water, every hotel/casino has to provide a 3‐year water‐saving p lan. More ci�es are becoming green with solar, wind and hydro power. This has a huge affect on the fossi l fuel as well as the renewable energy market. 2. The “Go Green” movement ‐ People from every state are look ing to reduce their footprint and one way to do that is to use renewable energy. From re‐usable grocery bags to riding their bike to work, the Go Green movement is making an impact. 3. More infrastructure for renewable energies ‐ With renewable energies becoming more widely used, the technology and infrastructure side of things is growing.

- 44. 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 26/51 4. More regula�on from EPA to produce cleaner emissions ‐ Wi th the EPA pu�ng stricter regula�ons on the amount of emissions companies can produce, they are forced to look to alterna�ve forms of energy. By doing this, it helps the wind turbine industry as it is one of the a lterna�ves companies are looking towards. 5. More research and development in green technologies ‐ With more people going to school for green energies there is more resources available to companies than the re were 20 years ago. The more research that is being done is helping grow the technologies to perfect th e way the energy is harnessed. Threats 1. Discovery of more oil fields ‐ With more oil fields being disc overed, this can lead to more money being put towards oil and less going towards clean energy. 2. Government tax regula�ons making it more difficult for turbi ne industry ‐ By taxing the wind turbine

- 45. industry causes the companies to raise their prices to customers. 3. High cost to enter market ‐ This will affect any new entrants i n the market. The coast of the materials is high as well as crea�ng new technologies to be�er use them. 4. Technology Risk ‐ With the technology changing so fast, old turbines must be shut down or updated. This is a costly endeavor. 5. Objec�on to wind power ‐ Some people don’t want a giant wi nd turbine “in their backyard”. They must be approved by local governments before being approved for instal la�on. b. What do the respec�ve weighted EFE scores mean for that or ganiza�on from a strategic planning viewpoint? GE is seeing more opportuni�es than threats as the totals for th e poten�al opportuni�es outweigh the poten�al threats. To plan they should focus more on the opport uni�es as they are weighted heavier which means they have more impact on the organiza�on. Planning sho uld also be put on the threats to secure their posi�on in the market, but more focus and planning shoul d be out on the opportuni�es.

- 46. References: U.S. Energy Informa�on Administra�on ‐ EIA ‐ Independent St a�s�cs and Analysis. (2016, November 28). Retrieved January 25, 2018, from h�ps://www.eia.gov/todayine nergy/detail.php?id=28912 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 27/51 less 0 Unread 0 Replies 0 Views O� Learning Ac�vity 2 Jus�n O� posted Jan 24, 2018 2:40 AM Subscribe Maersk Lines is one of the oldest shipping companies in the wor ld with its incep�on in 1904. Since 1904, it

- 47. has also managed to become the world’s biggest shipping compa ny. Maersk has 630 vessels available to transport shipping containers and has a vessel pulling into port every 15 minutes. This has led to Maersk being by far the most recognizable and most seen brand in the c ontainer shipping industry. (Why Maersk Line, N.D.). With the above being said, Maersk also had opera �ng losses in the year 2017 along with the fact that they were competeing in a saturated market. Lastly in 2 017 Maersk was cyber a�acked which showed the Maersk is greatly affected by technology disrup�on s. IFE (Internal factor evalua�on) IFE – Key Internal Factors https://learn.umuc.edu/d2l/le/267247/discussions/threads/12317 047/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182)

- 48. https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 28/51 Strengths Weight Ra�ng Weighted Score Brand Iden�ty .2 4 .8 Highest Market Share .2 3 .6 Biggest number of ships .1 3 .3 Weaknesses Opera�ng cost Losses in 2017 .2 2 .4 Saturated Market .1 2 .2 Greatly affected by technology disrup�ons .2 2 .4 Totals 1.0 (Leave this cell blank) 2.7

- 49. Strengths: Brand Iden�ty: Maersk Line has built up a brand iden�ty that i s known around the world by even those not familiar with the container shipping industry. This brand iden�t y o�en makes them the first choices for customers wan�ng to ship their containers. I choose a 4 ra�ng f or Maersk because they have created a brand Iden�ty that is second to none within the industry (Invest or Rela�ons ,N.D.). 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 29/51 Highest Market Share: Maersk Line has the highest market shar e in the market currently, but recently changed their sights from maximizing increases in market share to maximizing profits. This change increased Maersk’s overall profits but caused a slight loss of market share

- 50. by the end of 2017. In the end Maersk s�ll holds a significant market share over its nearest compe�tor and that is why I rated it a 3 (Investor Rela�ons ,N.D.). Biggest number of ships: Maersk Line has many more ships then its nearest compe�tor. Maersk has been maximizing this advantage by building new more efficient and h igher capacity ships to add to their fleet, while removing old and inefficient one making Maersk’s fleet o f vessels the newest fleet in the industry. Maersk is also maximizing the use of those vessels by having on ly 4 currently not opera�ng. These reasons are why I rated Maersk a 3 (Investor Rela�ons ,N.D.). Weakness: Opera�ng cost Losses in 2017:Maersk sustained opera�ng cost loses in 2017 due to a major cyber a�ack and some subsidiaries pos�ng loses. With that being said, in 20 17 opera�ng losses were reported across the board in the shipping industry meaning Maersk was not at a disadvantage against its compe�tors. In the

- 51. end though pos�ng a opera�onal loss is a weakness and that is why I gave it a 2 (Investor Rela�ons ,N.D.). Saturated Market: Maersk in 2017 was compe�ng in a very satu rated market. This is evident by all container shipping companies in 2017 having some of their vessels not op era�ng due to a lack of containers to ship. Maersk was able to take advantage of this due to its market posi �on and bought one of its compe�tors out, but in the end being in a saturated market is a weakness and that is why it was rated a 2 (Investor Rela�ons ,N.D.). Greatly affected by technology disrup�ons: Due to recent dema nd by consumers to have the ability to track their containers in real �me along with requiring on �me delive ry of containers, the shipping container industry have become highly reliant on technology. This can bec ome a problem when there is a cyber a�ack that disrupts technology, such as the one Maersk experienced in summer 2017. This reliance on technology is a weakness that is experienced by the industry as a whole and that is why I ranked it a 2 (Investor Rela�ons ,N.D.).

- 52. The average company would have a overall weighted score of 2. 5. Any score below 2.5 would indicate the company is weak and any above 2.5 indicates the company is str ong. Maersk Line came in at a 2.7 which indicates the company is in a strong posi�on. References 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 30/51 David, F.R. (2005). Strategic management: Concepts and cases.( 10th ed.). Upper Saddle River, NJ: Pearson/Pren�ce Hall Investor Rela�ons. (n.d.). Retrieved January 24, 2018, from h� p://investor.maersk.com/ Why Maersk Line? (n.d.). Retrieved January 23, 2018, from h� ps://www.maerskline.com/about/why‐ maersk‐line

- 53. less 2 2 9 Last post 16 hours ago by 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 31/51 Unread Replies Views Euriviades Beltre O�‐ Learning Ac�vity 1 Jus�n O� posted Jan 24, 2018 2:40 AM Subscribe Maersk Lines is one of the oldest shipping companies in the wor ld with its incep�on in 1904. Since 1904, it has also managed to become the world’s biggest shipping compa ny. Maersk line serves 343 ports, 121 countries and has a ship pull into port every 15 min. This is pos sible thanks to Maersk’s fleet of 630 vessels (Why Maersk Line, N.D.). The container shipping industry thou gh is hugely affected by the world’s economy, government interven�on and rising cost of goods required. I am going to fill in the EFE matrix and then below the matrix explain the ra�onal for each item.

- 54. EFE (External Factor Evalua�on) Matrix EFE – Key External Factors Opportuni�es Weight Ra�ng Weighted Score Stricter emission laws implemented .15 4 .6 Reduc�on in amount of shipping containers that need shipped. .2 3 .6 Customers require increased capability to monitor containers in transit .05 3 .15 Lack of terminals able to service the bigger ships being built. .1 3 .3 Customers require shipping containers to be at des�na�on

- 55. on‐�me .05 2 .1 Threats Stricter trade regula�ons in the United States .1 1 .1 Increase in cost of fuel .05 3 .15 Cyber a�acks against company .15 2 .3 Bad weather condi�ons .05 3 .15 Fluctua�on in value of currencies .1 2 .2 javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12317 044/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 32/51 Totals for EFE 1.0 (Leave this cell blank)

- 56. 2.65 Opportuni�es: Stricter emission laws implemented: I choose this as an opportunity because if Maersk takes advanta ge of their posi�on in the market and start renova�ng ships or building new ships that are within the new e mission standards before it is required, then it puts Maersk ahead of its compe�tors who would unlikely be a ble to get their ships renovated in �me. I gave Maersk a 4 because they have been doing this buy building new efficient ships and renova�ng their old ones. Since 2016 Maersk has been able to reduce their co2 emis sions per container by 42%,which puts them ahead of schedule for their goal of 60% reduc�on by 2020 (Investor Rela�ons ,N.D.). Reduc�on in amount of shipping containers that need shipped.: I put this as an advantage for Maersk because the reduc�on in t he amount of shipping containers to ship

- 57. have hurt Maersk’s compe�tors and has allowed them to buy on e of their compe�tors. Due to Maersk’s sizes and its investment in other industries the reduc�on in cont ainers shipped hasn’t affected Maersk as much as the compe�tors and they actually increased their profit s. That is why I rated Maersk a 3 (Investor Rela�ons ,N.D.). Customers require increased capability to monitor containers in transit: Customers recently have been demanding from the shipping con tainer industry the ability to monitor their loads in transit. This task would be very difficult to do for most container shipping companies due to the extensive cost of the technology needed to do this. Thanks to th e size of Maersk, they have been able to implement this ability into most of the containers on their ships, especially refrigerator containers. Since the technology hasn’t been implemented into every container, I deci ded to give Maersk a 3 in this area (Investor Rela�ons ,N.D.). Lack of terminals able to service the bigger ships being built: Maersk along with many of the top shipping container transport

- 58. ers have been building larger and larger ships to maximize the amount of containers that can be transpor ted at once. The problem is many ports do not have the infrastructure to be able to accept these ships. I ma de this an advantage for Maersk because due to their size they are able to invest money into upgrading th e ports infrastructure and then they have 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 33/51 the advantage of exclusivity to some terminals of the port. This is why I gave Maersk a 3 in this area (Investor Rela�ons ,N.D.). Customers require shipping containers to be at des�na�on on‐ �me: Maersk due to its size should be able to expand its network and use technology to provide its customer with a higher on �me rate then its compe�tors. Sadly Maersk h as not been able to accomplish this and averages the same on �me rate as their compe�tors. That is wh y I gave Maersk a 2 (Investor Rela�ons

- 59. ,N.D.). Threats: Stricter trade regula�ons in the United States: A�er doing much research I was unable to find any standby pla ns or prepara�on of the possibility of taxes and regula�ons on items coming or leaving the United States. T his has the possibility of having a he affect on Maersk’s bo�om line because it will likely reduce the shipm ent going in or out of the United States. That is why I gave Maersk a 1 (Investor Rela�ons ,N.D.). Increase in cost of fuel: An increase in fuel cost has a significant effect on profits for M aersk due to the quan�ty of fuel used by Maersk on a daily basis. Maersk has done a good job of reducin g this threat by implemen�ng more fuel efficient ships to their fleet and by using real �me tracking of t he ships to allow adjustment in course throughout the journey to reduce fuel cost. That is why I gave Maersk a 3 in this area (Investor Rela�ons ,N.D.).

- 60. Cyber a�acks against company: Cyber a�acks are a real threat to the shipping industry as a who le and especially Maersk. Maersk was affected by a cyber a�ack in July and August of 2017 which los t the company between $250m and $300m. Since the cyber a�acks, Maersk has implemented new systems t o prevent it from happening again. In the end though Maersk s�ll is only on par with their compe�tors w hen it comes to protec�ng against cyber a�acks which is why I gave Maersk a 2 in this category (Invest or Rela�ons ,N.D.). Bad weather condi�ons Bad weather condi�ons can have a huge effect on profits in the cargo shipping industry. Maersk uses the same weather tracking ability as its compe�tors, but their real �me tracking systems allow them to watch the ships loca�on in real �me, therefore giving them the ability to help their ships avoid major storms. That is why I gave Maersk a 3 in this area (Investor Rela�ons ,N.D.) . Fluctua�on in value of currencies: Fluctua�ons in the value of currency is something that is a thre at to all interna�onal corpora�ons. In the

- 61. end all the companies can do is monitor the fluctua�ons of the currency to ensure that all the money is not lost due to a collapse of a currency. What Maersk does is the sa me as every other shipping container transporta�on company does and that is why I only gave them a 2. 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 34/51 Considering the fact that any combined weighted score above 2. 5 is consider to be in a strong posi�on, Maersk’s ra�ng of 2.65 means that they are both effec�vely tak ing advantage of their opportuni�es while also successfully minimizing their threats. References David, F.R. (2005). Strategic management: Concepts and cases.( 10th ed.). Upper Saddle River, NJ:

- 62. Pearson/Pren�ce Hall Investor Rela�ons. (n.d.). Retrieved January 24, 2018, from h� p://investor.maersk.com/ Why Maersk Line? (n.d.). Retrieved January 23, 2018, from h� ps://www.maerskline.com/about/why‐ maersk‐line 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 35/51 less 1 Unread 1 Replies 5 Views Last post yesterday at 12:23 PM by Sanh Tran Learning Ac�vity #2

- 63. Luis Vazquez posted Jan 25, 2018 5:33 PM Subscribe The company that I chose was AstraZenca. It is a mul�na�onal pharmaceu�cal and biopharmaceu�cal company. It was formed via merger and its major strength is its scien�fic research. Their mission is to make a meaningful difference to health through the research, developme nt and marke�ng of great medicines. We consider this to be at the core of our responsibility to our stakeh olders and society. Their code of conduct makes them stand apart from the crowd ("AstraZeneca", 2018). IFE‐ Key Internal Factors Strengths Weight Ra�ng Weighted Score good rela�on with customers and employees 30% 4 1.2 strong management team

- 64. 20% 3 0.6 Scien�fic leadership 30% 3 0.9 Weakness javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12334 119/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 36/51 Li�le diversifica�on 5% 1 0.05 Saturated market 5% 2 0.1 Technology disrup�ons10% 2 0.2 The strengths and weakness have been chosen because they are being quite cri�cal for the company. The company should need to be much more focused in it and work a ccordingly. Their code of conduct is one of their major strengths and it keeps their customer with them. The y are commi�ed to high ethical standards which makes them one of the best. Pharmaceu�cal industry is s aturated and they need to work hard to

- 65. make a difference. The crea�on of the new pipeline is an add o n but they need to be more diversified to retain customers. The weights of each factor do range from values of 10% which i s considered to be the low importance to the value of 30% which is the high importance. The range of the number shows that how much the factor is vital in order for the company to succeed in the long run. The sc ien�fic leadership has been given a weight of 30% which indicates that it is the most important factor to be considered. The technological disrup�on like the pipeline problem, on the other hand has been given a hi gh weightage because such problems needs to be looked a�er for the success of the company. The weighted score as being assigned to each factors stands out to be 3.05 which says that the strategies being implanted by the company is not so effec�ve in maintaini ng some of the strengths and in evading the weakness. Thus, in order to correct this problem, the company s hould focus on its strengths through which it can improve them and they need to focus more on how the we aknesses should be eradicated from the company.

- 66. Reference AstraZeneca. (2018). Retrieved 25 January 2018, from h�ps://w ww.astrazeneca.com/ Research and Markets: AstraZeneca ‐ 2013 SWOT Framework A nalysis. (2018). Retrieved 25 January 2018, from h�ps://www.businesswire.com/news/home/20130422006589/en/ Research‐Markets‐ AstraZeneca‐‐‐2013‐SWOT‐Framework https://www.businesswire.com/news/home/20130422006589/en/ Research-Markets- 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 37/51 less 0 Unread 0

- 67. Replies 0 Views WK 3 Learning Ac�vity 1 Luis Vazquez posted Jan 25, 2018 4:43 AM Subscribe The chosen company Astrazeneca plc is being considered to be one of the most leading companies of pharmaceu�cals. This company is being found to be emphasized mostly in supplying large number of medicines which is considered to be quite innova�ve and thus, differences among pa�ents is being created in some important parts of healthcare. But the medicines being provided by this company is really innova�ve and they create values for their employees, customer s and also for the communi�es. It belongs to the pharmaceu�cal industry which operates successfully in th at field ("AstraZeneca", 2018). In terms of the opportuni�es it need to be keep in mind that the company is quite aware with the risks being associated with them and they have been found to be quite busy with the acquisi�on forma�on. It can be expected by the shareholders also that the company will see some of the suitable bolt ons and along with it will use its firepower which in turn will help the compan

- 68. y to grow again. It is very much important for the company to expand more. Many of the drugs have been foun d even to have introduced in AstraZeneca and that has been done by Pearl Therapeu�cs. On the other hand, the biggest threat for the company is that the company is undergoing some risk because the strategy which they are following is not leading them to gro w. Instead they are failing again and again. Thus, the shares are being found to be re rated. It is very much s urprising however in the present day world to see that AstraZeneca is ending up having a share growth of a bout 30% lower rate. One of the important threats being imposed to the company is regarding the developm ent of some of the drugs. They are also needed to survive in compe��on with the other drugs emerging in the market ("Research and Markets: AstraZeneca ‐ 2013 SWOT Framework Analysis", 2018). EFE – Key External Factors Opportuni�es Weight Ra�ng Weighted Score The strong

- 69. presence of the company can be felt In the market which are emerging 0.11 3 0.33 https://learn.umuc.edu/d2l/le/267247/discussions/threads/12328 773/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 38/51

- 70. The demand for the biosimiler markets is growing rapidly and it has greater importance The global ageing popula�on also tends to increase Needs to be aware of the risk associated with the earning 0.09

- 72. 0.48 0.10 Threats 1.The drugs being produced by the company is being found to be facing a threat for copying drugs from the other brands 0.17 4 0.68 2.Guidelines provided for the drug development 0.03 1 0.06

- 73. 3.Facing much more compe��on with those of the other drugs evolving in the market 0.14 3 0.42 4.Not growing as required with that of the other markets in the present day world 0.12 2 0.24 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 39/51 Total 1.0 2.40 The opportuni�es and threats have been chosen because they ar e being quite cri�cal for the company. The company should need to be much more focused in it and work a ccordingly. If the company tries to recover

- 74. from the current problems they are facing then it can be expecte d that they will not fail to grow in the merging market. They will also be able to survive and compete with the other emerging firms in the market. The opportuni�es as being provided above are quite important f or the company to follow and they should also u�lize them in their ac�vity. The weights of each factor do range from values of 0.0 which is considered to be the low importance to the value of 1.0 which is the high importance. The range of the num ber shows that how much the factor is vital in order for the company to succeed in the long run. The global ageing popula�on has been given a weight of 0.24 which indicates that it is the most important factor to be considered. The copying of drugs on the other hand has been given a high weightage because that proces s needs to be stopped for the success of the company. The weighted score as being assigned to each factors stands out to be 2.40 which says that the strategies being implanted by the company is not so effec�ve in exploi�n g some of the opportuni�es and the threats being imposed. Thus, in order to correct this problem, the comp

- 75. any should focus on its strategies through which it can improve them and they need to focus more on how the advantages of the opportuni�es can be taken into account by them. References AstraZeneca. (2018). Retrieved 25 January 2018, from h�ps://w ww.astrazeneca.com/ Research and Markets: AstraZeneca ‐ 2013 SWOT Framework A nalysis. (2018). Retrieved 25 January 2018, from h�ps://www.businesswire.com/news/home/20130422006589/en/ Research‐Markets‐ AstraZeneca‐‐‐2013‐SWOT‐Framework https://www.businesswire.com/news/home/20130422006589/en/ Research-Markets- 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 40/51 less

- 76. 2 Unread 2 Replies 5 Views Last post 7 hours ago by Sanh Tran LA 2 ‐ Mark Szymanek Mark Szymanek posted Jan 23, 2018 3:14 PM Subscribe IFE (Internal factor evalua�on) IFE – Key Internal Factors Strengths Weight Ra�ng Weighted Score R & D .25 4 1 Cash Flow .30 4 1.2 Manufacturing .05 1 .05 Weaknesses Market Share .20 2 .4

- 77. Diversifica�on .10 3 .3 Name recogni�on .20 2 .4 javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12312 341/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 41/51 Totals 1.0 (Leave this cell blank) 3.35 Research and development are the basis of success for the major pharmaceu�cal companies. GSK spends 3.628 billion Bri�sh pounds on research and development in 20 16 (GSK, 2017). R & D is the backbone of successful pharma company and this is a great strength of GSK’ s to con�nue to innovate and bring new products to market. As one of the leaders in the industry it is no surprise that GSK had an income of 27.9 billion pounds and a profit of 2.6 billion pounds in 2016 (GSK, 2017). The cash flow could be used to move

- 78. into new markets or further R & D. GSK does most of its manuf acturing in house. While this is a good strength it is common in the pharmaceu�cal industry. Most com pe�tors have the same manufacturing base and it does not differen�ate GSK from its compe�tors. With the sale of its oncology por�olio GSK now focuses on Res piratory diseases, HIV/infec�ous diseases, Vaccines, Immuno‐inflamma�on, and only rare Oncology disea ses (GSK, 2017). This lack of diversifica�on in the pharmaceu�cal and vaccine industries could lead to a loss i n profit if one of the mul�ple compe�tors comes out with be�er alterna�ve to a GSK product. Name reco gni�on is an issue for GSK in the consumer healthcare market. Its most recognizable name brands include A qua Fresh and Tums. Its compe�tors’ products like Johnson & Johnson with Band‐Aid Brand, Tylenol , Clean & Clear facial wash and Neutrogena brand skin care have much be�er widespread appeal. GSK should con�nue to focus on R & D. It is the cornerstone of the industry and has lead to success in the companies past. Good R & D has lead to the sizable cash flow a vailable to GSK. That money can be used to

- 79. diversify its offerings and be�er market its products. Upping th e company’s name recogni�on and market share. References GSK. (2017, March 13). Annual Report 2016. Retrieved from h�ps://annualreport.gsk.com/assets/downloads/2_GSK. AR.strategic.report.V5.pdf https://annualreport.gsk.com/assets/downloads/2_GSK.AR.strate gic.report.V5.pdf 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 42/51 less 3 Unread 3 Replies

- 80. 7 Views Last post 9 hours ago by Sanh Tran LA 1 ‐ Mark Szymanek Mark Szymanek posted Jan 23, 2018 3:13 PM Subscribe GlaxoSmithKline is a Bri�sh company that was created out of t he merger of SmithKline Beecham and GlaxoWellcome in 2000 (GSK, n.d). The company competes in t he Pharmaceu�cals, Vaccines, and Consumer Healthcare industries (GSK, n.d.). The Pharmaceu�cal industry is crowded with not only large pharmaceu�cal companies like GSK and Merck, but also smalle r companies that sell generic drugs based off expiring patents of larger firms. EFE (External Factor Evalua�on) Matrix EFE – Key External Factors Opportuni�es Weight Ra�ng Weighted Score Emerging Markets .15 1 .15 Aging Popula�on .05 3 .15

- 81. Industry Collabora�on .05 2 .1 Technology .15 4 .6 Industry Mergers .10 2 .2 Threats Increased Compe��on .15 3 .45 javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12312 334/View javascript:void(0); 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 43/51 Govt. Regula�on .15 4 .6 Economic issues .10 3 .3 Social Change .05 1 .05 Price Pressures .05 2 .1 Totals for EFE 1.0 (Leave this cell blank) 2.7 Requirement 6:

- 82. Emerging markets are an increasing share of the worlds sales of pharmaceu�cals. Brazil, China, India, Indonesia, Mexico, Russia, and Turkey have 9.3% growth in sal es compared to less than 5% for France, Germany, Italy, and Canada (A�eh, & Tannoury, 2017). These markets have growing technical exper�se that can be u�lized by larger pharmaceu�cal companies to offshore lower level research func�ons, achieving cost savings. The aging popula�on of Europe and North America provides a new market to develop cures for later age‐ related diseases and condi�ons. Industry collabora�on and mer gers are a big part of the pharmaceu�cal industry. GSK recently sold its oncology por�olio to Novar�s i n exchange for Novar�s’s vaccine por�olio and merged their consumer healthcare divisions (GSK, 2017). St rengthening each company’s best assets and removing weaker elements. Increased compe��on comes from the growing list of companie s producing generic drugs. Government regula�on and price pressures are major hurdles for GSK to mai ntain profitability. Rising health care costs

- 83. have forced consumers and governments to look for ways to red uce costs. European countries have taken to regula�ng the price of drugs sold at a predetermined level (B rogan, Mossialos, & Walley, 2006). This is a real threat to research and development and GSK’s recouping th e cost of years of painstaking development of new pharmaceu�cal drugs. Economic issues include downtur ns in the economies of na�ons that purchase GSK products. Europe is s�ll recovering from the recent recessi on. Social change is the nega�ve publicity that has surrounded the Big Pharma companies. GSK and others have taken the brunt of the blame for the explosion of abuse of opioids meant for legi�mate purposes. GSK should focus on business outside of its main markets of Eu rope and America/Canada. There is plenty of room for growth, but compe��on will be high for Asian, Africa n, and South American markets. It should work with governments on legisla�on to ensure life saving drug s get to pa�ents at affordable prices, but also that years of research expenditures are recovered. GSK sho uld also focus on its public image. The company needs to do everything in its power to prevent abuses of its pharmaceu�cal drugs.

- 84. 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 44/51 References A�eh, Z & Tannoury, M. (2017). The Influence of Emerging M arkets on the Pharmaceu�cal Industry. Therapeu�c Research Volume 86, 2017, Pages 19‐22. DOI: h�ps://doi.org/10.1016/j.curtheres.2017.04.005. Retrieved from h�ps://www‐sciencedirect‐com.ezproxy.umuc.edu/science/ar�c le/pii/S0011393X16300984 Brogan, D, Mossialos, E, & Walley, T. (2006, Jul 1). Pharmaceu �cal Pricing in Europe: Weighing up the Op�ons. Interna�onal Social Security Review. Jul‐Sep2006, Vol. 59 Issue 3, p3‐25. 23p. DOI: 10.1111/j.1468‐246X.2006.00245.x. Retrieved from h�p://eds.a.ebscohost.com.ezproxy.umuc.edu/eds/pdfviewer/pdf viewer?vid=0&sid=fc383f69‐6a14‐44cc‐

- 85. bf57‐5856a90a0799%40sessionmgr4007 GSK. (n.d.). GSK today: 2000 – present. Retrieved from h�ps://www.gsk.com/en‐gb/about‐us/our‐history/gsk‐today‐200 0‐present/ GSK. (2017, March 13). Annual Report 2016. Retrieved from h�ps://annualreport.gsk.com/assets/downloads/2_GSK. AR.strategic.report.V5.pdf https://www-sciencedirect- com.ezproxy.umuc.edu/science/article/pii/S0011393X16300984 http://eds.a.ebscohost.com.ezproxy.umuc.edu/eds/pdfviewer/pdf viewer?vid=0&sid=fc383f69-6a14-44cc-bf57- 5856a90a0799%40sessionmgr4007 https://www.gsk.com/en-gb/about-us/our-history/gsk-today- 2000-present/ https://annualreport.gsk.com/assets/downloads/2_GSK.AR.strate gic.report.V5.pdf 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 45/51 less 3 Unread

- 86. 3 Replies 8 Views Last post yesterday at 1:20 PM by Mark Szymanek Week 3 Learning Ac�vity 2 Mercidieu Delva posted Jan 24, 2018 1:30 PM Subscribe BowTech, Inc. is a large, industry leader, that commands signifi cant market share in the archery industry. This industry houses many organiza�ons that offer an even grea ter number of products, but these products are not heavily differen�ated between the different organiza�o ns. Many organiza�ons have posi�oned their products into different price points, as a way of expanding their target markets. In addi�on, the number of hunters is rapidly diminishing, due to a dwindling hunter’s ment ality, stricter laws, and shrinking habitats. Where the industry has found its savior, is in compe��ve arche ry. Moving from a lifestyle to a sport, has spurred industry growth over the last decade. External Factor Evalua�on (EFE) Bowtech

- 87. Weights Ra�ng Weighted Score Opportuni�es 1. Increase market share 9% 4 0.36 2. Global sales expansion 8% 3 0.24 3. Business diversifica�on 15% 4 0.60 4. Global supply chain expansion 8% 3 0.24 5. Government exemp�ons for producing environmentally friendly bowtech 10% 3 0.30 Threats 1. Environmental Regula�ons 7% 2 0.14 2. House 12% 1 0.12 javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12320 491/View javascript:void(0);

- 88. 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 46/51 3. Products regula�ons 8% 2 0.16 4. Funding Produc�on 15% 1 0.15 5. Aggressive Compe��on 8% 3 0.24 Total Weighted Score 100% 2.55 Strengths: According to a lot of market researches being conducted, it is cl ear that the Cross Laminated Timber (CLT) Market is surging like never before. Since the �me of the intern et and smart devices, the major boom in the market is evident as every segment of the Cross Laminated Tim ber (CLT) market is growing at a rapid pace with the marke�ng expanding both in value and volume over th e last decade and is expected to con�nue this trend into the future decade as well. A major credit for this goes to the mass manufacturing of smart devices and handheld devices, a major innova�on coming in from North America and Asia Pacific regi

- 89. ons. China has a major role to play in the manufacturing sector while North America and Asia being the la rgest two markets for Cross Laminated Timber (CLT) market, followed by Europe. As technology evolv es more, the Cross Laminated Timber (CLT) market is expected to witness another high with the virtual reali ty world catching up and the market trend shi�s towards it. The reason behind my sugges�on for BowTech to pursue the di fferen�a�on strategy, is because it is known for its high‐quality products. By differen�a�ng its products, B owTech’s strong and reliable brand, will assure that consumers con�nue to purchase from the organiza�on. For example, if BowTech was to capitalize on the opportunity of purchasing a large plot of land for hun�ng, t his would be a unique service within the industry, that is valued by buyers; this uniqueness may then be r ewarded with a premium price (Porter’s Generic Compe��ve Strategies (ways of compe�ng), n.d., para . 3). Weakness: Back in January of 2015 Bowtech Archery was about to loss mu st of their clients because of a mechanical

- 90. issue with the bow that lead to the injury of people. As more co mpanies move into the bowhun�ng market, big‐name manufacturers are finding it harder to maintain their p osi�on at the front of the pack. This is due in part to computer‐aided design so�ware, which has helped lev el the playing field. Today, compound accuracy is typically limited to the shooter’s ability to release a n arrow without error. Manufacturers con�nue to produce bows that are increasingly capable of shoo �ng dime‐sized groups out to dizzying distances. And it shows: This test was the closest yet, with some bows outscoring others by frac�ons of a percentage point. While Bowtech is also posi�oned for a cost le adership approach as well, this would ul�mately devalue the brand, hur�ng its reputa�on while not a ctually increasing sales. Differen�a�on is ul�mately the best op�on for growing the Bowtech brand. a hig h level of legisla�on and over sight in the fishing industry. As popula�ons con�nue to grow the need to f eed them will con�nue to grow. This seems to be a sustainable strategy for the foreseeable future. REFERENCE Porter’s Generic Compe��ve Strategies (ways of compe�ng) ( n.d.). Retrieved from

- 91. h�p://www.ifm.eng.cam.ac.uk/research/dstools/porters‐generic‐ compe��ve‐strategies/ Bewtech. 2015, Bowtech Retrieved 2015 from h�p://northpacifi cseafoods.com/content/sec�on/14/59/ http://www.ifm.eng.cam.ac.uk/research/dstools/porters-generic- competitive-strategies/ http://northpacificseafoods.com/content/section/14/59/ 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 47/51 Bowtech 2015, Bowtech Retrieved 2015 from h�p://subscriber.hoovers.com.ezproxy.umuc.edu/H/industry360/ trendsAndOpportuni�es.html? industryId=1839 The Slayor Founda�on, 2014. Mastering Strategic Management, Retrieved 2017, from /learn.umuc.edu/d2l/le/content/224203/fullscreen/9369983/Vie w

- 92. http://subscriber.hoovers.com.ezproxy.umuc.edu/H/industry360/ trendsAndOpportunities.html?industryId=1839 1/26/2018 Week 3 Learning Activities - BMGT 495 6380 Strategic Management (2182) https://learn.umuc.edu/d2l/le/267247/discussions/topics/195461 1/View?threadIdContext=12336949 48/51 less 3 Unread 3 Replies 6 Views Last post 7 hours ago by Sanh Tran Week 3 Learning Ac�vity 1 Mercidieu Delva posted Jan 24, 2018 12:55 PM Subscribe Today's Northern Power Systems was started in 1974 Barre Ver mont , as North Wind Power Company. Its founders hitchhiked to Colorado, Minnesota, and North Dakota t o buy secondhand Jacobs wind plants.

- 93. They trucked the wind turbines to Vermont where they recondi�oned them for resale as the North Wind more 1 Unread 1 Replies 5 Views Last post 16 hours ago by Euriviades Beltre Week 3 LA 1 Patricia Quinones posted Jan 22, 2018 5:41 PM Subscribe Glaxo Smith Kline (GSK) is the third largest pharmaceu�cal co mpany in the world. The company employs over 100,000 employees across 150 countries (GSK, 2017) The company’s headquarters are located in London and the US corporate office is located in Pennsylvania Through Research and Development by more 2 Unread 2 Replies

- 94. 6 Views Last post Tue at 10:59 AM by Patricia Quinones Week 3 LA2 Patricia Quinones posted Jan 22, 2018 5:49 PM Subscribe As for the Internal Factor Evalua�ng, GSK has the opportuni�e s of brand name, Research and Development, Innova�on and Global presence behind their organiza�on. GS K has built a name for their company by providing Vaccines and medica�ons for chronic diseases The company con�nues to research new drugs in more 1 Unread 1 Replies 7 Views Last post Mon at 11:06 PM by Sanh Tran Ac�vity 2 Ronald Edhaya posted Jan 25, 2018 9:08 PM Subscribed

- 95. EDP Renewables North America has ac�ve management that is skilled and has experience in the energy industry. The firm is prolifera�ng expanding its opera�on to ne w markets building new customer clientele. The company operates over 20 onshore wind farms across nine states with a capacity genera�on of more 0 Unread 0 Replies 0 Views Ac�vity 1 Ronald Edhaya posted Jan 25, 2018 9:05 PM Subscribed javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12320 176/View javascript:void(0); javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12305 358/View javascript:void(0); javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12305 401/View javascript:void(0); javascript:void(0); https://learn.umuc.edu/d2l/le/267247/discussions/threads/12337