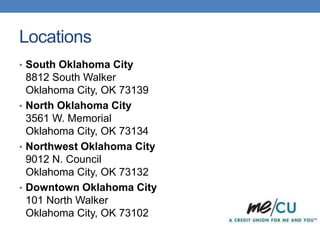

MeCU is a non-profit credit union serving over 12,000 members through four branches in Oklahoma City. It offers financial services like savings and checking accounts, loans for homes, vehicles and personal needs, and online banking. MeCU has been operating for over 79 years and aims to provide affordable services to its members.