Financial Stocks Poised for Major Rally on Record Capital Levels

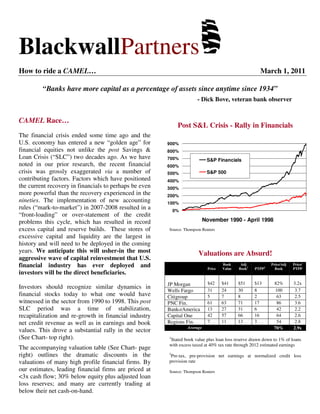

- 1. BlackwallPartners How to ride a CAMEL… March 1, 2011 “Banks have more capital as a percentage of assets since anytime since 1934” - Dick Bove, veteran bank observer CAMEL Race… The financial crisis ended some time ago and the U.S. economy has entered a new “golden age” for financial equities not unlike the post Savings & Loan Crisis (“SLC”) two decades ago. As we have noted in our prior research, the recent financial crisis was grossly exaggerated via a number of contributing factors. Factors which have positioned the current recovery in financials to perhaps be even more powerful than the recovery experienced in the nineties. The implementation of new accounting rules (“mark-to-market”) in 2007-2008 resulted in a “front-loading” or over-statement of the credit problems this cycle, which has resulted in record excess capital and reserve builds. These stores of excessive capital and liquidity are the largest in history and will need to be deployed in the coming years. We anticipate this will usher-in the most aggressive wave of capital reinvestment that U.S. financial industry has ever deployed and investors will be the direct beneficiaries. Investors should recognize similar dynamics in financial stocks today to what one would have witnessed in the sector from 1990 to 1998. This post SLC period was a time of stabilization, recapitalization and re-growth in financial industry net credit revenue as well as in earnings and book values. This drove a substantial rally in the sector (See Chart- top right). The accompanying valuation table (See Chart- page right) outlines the dramatic discounts in the valuations of many high profile financial firms. By our estimates, leading financial firms are priced at <3x cash flow; 30% below equity plus adjusted loan loss reserves; and many are currently trading at below their net cash-on-hand. Post S&L Crisis - Rally in Financials 0% 100% 200% 300% 400% 500% 600% 700% 800% 900% November 1990 - April 1998 S&P Financials S&P 500 Source: Thompson Reuters Valuations are Absurd! Price Book Value Adj Book1 PTPP2 Price/Adj Book Price/ PTPP JP Morgan $42 $41 $51 $13 82% 3.2x Wells Fargo 31 24 30 8 100 3.7 Citigroup 5 7 8 2 63 2.5 PNC Fin. 61 63 71 17 86 3.6 BankofAmerica 13 27 31 6 42 2.2 Capital One 42 57 66 16 64 2.6 Regions Fin. 7 11 13 3 54 2.8 Average 70% 2.9x 1 Stated book value plus loan loss reserve drawn down to 1% of loans with excess taxed at 40% tax rate through 2012 estimated earnings 2 Pre-tax, pre-provision net earnings at normalized credit loss provision rate Source: Thompson Reuters

- 2. 2 Anatomy of Under Ownership SEC filings by large funds indicate that portfolio managers are grossly under invested in U.S. financial stocks. In part, we believe this is attributable to the struggle and hesitancy that generalists have with the complexities of financial firm accounting. Naturally, a factor greatly exacerbated by the financial crisis and reflected in the ‘jaw-dropping’ valuations previously shown. Again, this mirrors what we saw coming out of the SLC. Extreme under weights in portfolios and subsequent low valuations now place financials at their lowest weighting in the S&P 500 in nearly forty years. The financial sector, excluding insurers, currently represents only 9% of the S&P 500, yet is responsible for more than 1/3 of the earnings or economic contribution to the S&P. It’s simply a blinding fundamental disconnect. This marked inefficiency also is evident in valuations where we calculate the typical larger U.S. bank trading at 3x free cash flow (“PTPP”), while the S&P 500 trades closer to 11x cash flow. This is despite the fact that non- financial firms are more heavily CapEx intensive and therefore arguably less “free.” The historic relative multiple of cash flow for financials relative to the broader market ranges from 60% to 80% versus today’s 27% [3x / 11x = 27%]. Therefore, both the absolute values across financials as well as their relative valuation signal an historic under valuation opportunity. A good example of current market disequilibrium can be found amongst the largest mutual funds. Our review of SEC filings indicate that a large (unnamed) Fidelity Investments fund is carrying twice the S&P 500’s weighting in industrial materials stocks; less than one-third the weight in technology; half the weight of consumer services; and half the already well below normal weight of financial services. This is astonishing empirically on several levels. For starters, the U.S. economy is approximately 85% services related as we are a services and information technology-driven economy; not an industrial/manufacturing driven one. There is nothing wrong with such a fund weighting per se. In fact, it’s the most common weighting (by sector) among funds where we canvassed their regulatory filings. Clearly, the aforementioned fund’s management team believes that they see more opportunity in the copiously heavy industrial and commodity-laden emerging markets than in any potential recovery in America. Undoubtedly, this is a sizable bet on a continued global disequilibrium. However, inferential statistics and the inevitable reversion to the mean greatly favor a more dominant domestic services sector recovery as it has for economic cycles over the past 40 years. So, the “mechanics” of a sustained advance in domestic financial and services economy stocks is in place, in part, because nobody owns them and Americans have forgotten what we do best. Under ownership and subsequent depressed multiples in the financials are despite tremendous improvement in credit (the main driver of earnings recovery) and earnings visibility. This is in addition to the industry sitting atop record levels of both liquidity and capital, the driver of earnings acceleration. Estimated Earnings Growth Sector 4Q10 2010 2011 Consumer Discretionary 13% 44% 15% Consumer Staples 2% 6% 11% Energy 25% 49% 14% Financials >200% 158% 37% Health Care 5% 10% 7% Industrials 10% 24% 18% REITs 7% 6% 1% Technology 13% 41% 10% Telecom 13% 0% 13% Utilities -3% 4% -1% S&P 5003 12% 28% 9% 3 Excludes financials Source: Thompson Reuters As we have referenced in recent musings, the table above illustrates that the financials have the strongest prospects for earnings growth over the next several years. In addition to growth, higher

- 3. 3 “visibility” will be present due to clear credit cost abatement. This makes the dramatic and ubiquitous under-weight of the financial sector via fund managers all the more curious to even the most casual market observer…disconnects often are. Credit abatement will drive initial out sized growth - While securitized loans across all credit types were mauled by M2M inaccuracies, banks with more traditional “portfolio” lending or “whole loan” accounting also were trampled inefficiently as the credit panic overshot reality. The accompanying chart courtesy of the Federal Reserve Bank of St. Louis illustrates the “real” peak in problem loans. And though potentially startling to some, this most recent credit cycle has produced non-performing loans peaking at 70% of the SLC. Thus, it was an unnecessary panic in 2007-2009. The resulting excessive build- up of capital and reserves now is a benefit to financial stock investors. Nonperforming Loans4 4 Federal Reserve Bank of St. Louis study of all U.S. commercial banks; Loans past due 90 days plus nonaccrual loans to total loans. Source: Federal Reserve Bank of St. Louis The following chart (top right) illustrates the excessive levels of capital and reserve builds generated as a function of the traditional capital and reserve over-builds that typically accompany any credit crisis. Common Tier 1 Capital (“CT1”) is Inordinately High for U.S. Banks 0% 2% 4% 6% 8% 10% 12% 14% 16% 18% AXP STT NTRS C KEY PNC STI USB RF WFC BAC JPM COF CT1 less Buybacks CT1 B3M5 = Basel III Minimum risk-based capital standard expected to be implemented by a global regulators roundtable known as the Basel Committee on Banking Supervision. Source: Company reports; Blackwall Partners LLC estimates US banks hold capital levels that materially exceed even the future expected higher minimums for “well capitalized” institutions (See above: B3M5 ). International bank regulators are debating these levels in the Basel III accords (not expected to be implemented until at least 2020 BTW). The perception by many is that U.S. banks are ill- prepped for B3M and this is patently false. Of course, we also recently saw a Rasmussen poll that suggested most Americans were unaware that the United States was the largest economy in the world, let alone three times the size of the second largest. So, it would appear there is plenty of room for folks that do fundamental research to find market dislocations. B3M5

- 4. 4 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10e 1Q11e 2Q11e 3Q11e 4Q11e 1Q12e Net Charge-Offs6 6 Morgan Stanley bank research coverage universe; average net-charge-offs to average loans Source: Morgan Stanley & Company We anticipate material improvement in credit in 2011 and near zero credit costs in 2012 (See- above). We fully expect to see banks and other financial firms continue to “release” excess loan loss reserves back into their earnings at an accelerated pace in 2011-2014. In addition to providing significant earnings re-acceleration, this makes substantial capital available for dividends, stock buy-backs and acquisitions, which will help drive-up valuation multiples. The combination of a strong rise in earnings coupled with multiple-expansion is the same recipe that drove the material outperformance for financials in the post SLC period. That being noted, how does Blackwall Partners analyze and value financial firms? What gives us the “edge” that drives our confidence that we not only are correct on the fundamentals, but can move-in early on opportunities? We ride a slightly different looking horse. How to ride a CAMEL Blackwall Partners relies more heavily on financial regulatory reporting or (RAAP) much more so than generally accepted accounting principles known as GAAP. RAAP reports provide to bank regulators more granular information, which we use for our proprietary safety and soundness rating system. This is integral in Blackwall’s selection process of traditional financial stocks. $0 $50 $100 $150 $200 $250 Pre-Tax, Pre-Provision Pre-Tax GAAP Bank Earnings “Power” v. GAAP Widest on Record (1980-Present) Mark-to-Market Accounting Overstatement of Losses Source: Keefe, Bruyette & Woods; Blackwall Partners LLC In prior writings, we have referenced the chart above as it speaks volumes relating to this most recent financial crisis. The chart tracks reported earnings (GAAP) versus RAAP’s pre-tax, pre- provision (“PTPP”) or “free cash flow” from 1980- 2010. The dramatic gap in recent years between the black and blue lines illustrates the reality of the “non-cash hole” that mark-to-market accounting (GAAP) blew through the earnings (and capital) of financial firms during the financial crisis. This also illustrates the inevitable earnings reacceleration that we not only can predict, but guarantee. It is RAAP after-all that the Federal Reserve used to “stress test” the banks in 2009 under the Supervisory Capital Assessment Program (“SCAP”). This is the very same test the Fed is performing right now to determine which banks can start returning excess capital to investors. The “test” criteria studies five core fundamental factors from which it gets its acronym – CAMEL C - Capital Adequacy A - Asset Quality M - Management E - Earnings L - Liquidity

- 5. 5 For partners and prospective investors to get a more thorough understanding of how Blackwall evaluates potential investments, we illustrate a few examples of the CAMEL process. Disclosure: Blackwall Partners LLC chose the institutions outlined here randomly to show a range between the controversial to the beloved and how our use of CAMEL is applied consistently therein. This is NOT necessarily a representation of the portfolio. The information is used exclusively for informational purposes only. Fifth-Third Bancorp (FITB) Capital Adequacy CT1 at 7.5% already exceeds the expected B3M minimum to rank as “well capitalized” of 7% and could be as much as 150bp above this level. Equally as important, FITB’s CT1 is steadily growing and will significantly exceed B3M long before any new standards are implemented 6.8 7.0 7.2 7.4 1Q10 2Q10 3Q10 4Q10 Common Tier 1 Capital (%) Source: FITB Corporate Reports 9.4% Tier 1 risk-based capital exceeds regulatory “well capitalized” by over 50%; 9.7% Tier 1 under B3M tops all regional bank peers Capital levels which are strong and rising are supplemented by high loan loss reserve levels near 4% which cover current non- performing loan levels by roughly 1.8x FITB repaid TARP in full to the U.S. Treasury in February 2011 and completed a successful follow-on equity offering Asset Quality Severe delinquent loans have fallen by 72% since 3Q09 and net-charge-offs have fallen below 2% in 4Q10 for the first time since before the financial crisis. Early-stage delinquencies have dropped below 1% for the first time since 2007. So, we have passed the peak in problem loans at FITB Early Stage Delinquency (%)7 0.5 1.0 1.5 2.0 3Q07 1Q08 3Q08 1Q09 3Q09 1Q10 3Q10 FITB Peers 7 Loans 30-89days past due Source: FITB Corporate Reports New nonaccrual loans have fallen by nearly 50% between 1Q09 and 4Q10. They have steadily declined for five consecutive quarters and 4Q10 additions represented just 0.6% of total loans The loan loss reserve (LLR) covers non- performing loans (NPLs) now by approximately 200% and PTPP (cash flow) covers NPLs by 1.6x. So, FITB has returned to cash flow growth since 1Q10-2Q10 and is comfortably absorbing remaining loan loss recognitions

- 6. 6 0 25 50 75 100 125 150 175 4Q09 1Q10 2Q10 3Q10 4Q10 PTPP/ NCOs (%) Source: FITB Corporate Reports Overall, NPLs have declined by 43% since 4Q09 1.5 2.0 2.5 3.0 3.5 4.0 4Q09 1Q10 2Q10 3Q10 4Q10 NPLs / Loans (%) Source: FITB Corporate Reports CT1 plus LLR at 12.3% is the second largest among FITB’s regional bank peer group Mortgage repurchase claims represent <1% of loans and the repo reserve of 63% greatly exceeds any risk, even if required to buy-in the loans (assumes all repo claims valid and home loan-to-value is 63%) Per regulatory bank exams; the total regulatory criticized assets (“substandard” or “doubtful”) are down 16% in 2010 and represent 6% of existing loans, however only 0.3% represent a “doubtful” regulatory classification. This suggests that bank examiners are just being overly persnickety, sighting few losses (“doubtful”) but higher levels of scrutiny (“substandard”); overall indicative of FITB having been “scrubbed” Management The historically stalwart FITB, which once coveted the highest valuation ratios among any of the major banks, stumbled in this recent credit mess The company has since re-tooled its risk appetite and accomplished a great deal in a relatively short time. All signs pointing toward a clear recovery are underway But, they are on notice from investors to keep moving in its current highly positive fundamental trajectory or we would anticipate that FITB would get acquired in the coming M&A cycle Earnings FITB has returned to profitability quite quickly with three consecutive quarters of reported profits (though free cash flow has been positive now for five quarters) The return on assets (ROA) reached 1.2% in 4Q10. This remains subdued due to excessive liquidity and remaining loan loss recognition The 4Q10 return on equity (ROE) was 10% or equally unacceptable if the stock should attain its once high valuation among its peers again Increasingly both the ROA and ROE will require significant redeployment of excess liquidity and capital into an economic recovery. The evidence would now suggest that both are highly likely; PTPP as a percentage of risk-weighted assets rose to 2.3% in 4Q10. This demonstrates the improving ROA and ROE to come or to be monetized by an acquirer

- 7. 7 Liquidity FITB is awash in liquidity The loan-to-deposit ratio has fallen to 94% meaning the bank is under “lent out”; 88% of FITB’s deposits are cheap “core” funding or non-time related; deposit growth is double digits while loan growth is just starting to turn up slightly FITB’s balance sheet now carries more net cash and cash equivalents than market value Conclusion – 1 2 3 2 1 / Overall 2 With improving fundamentals across all categories, we rank FITB with an overall CAMEL rating of 2. This clearly is not reflected in the stock’s current depressed valuations including but not limited to a mere 4x run-rate free cash flow (PTPP); 1x book value (which assumes no franchise value or “deposit premium”); and 7.8x our 2012 reported earnings estimate. At 1x book (<1x forward book value), FITB trades with no franchise value. For example, with approximately $90 billion in core deposits and applying a reasonable private market value premium of 15%; FITB is intrinsically worth as much as $29 per share or 109% above prevailing market...and this assumes no future growth. If FITB remains independent, we anticipate $2.50 in EPS by 2013 and a $38 stock price discounted in advance. Recent prevailing market for the shares is $13-$14 per share. Capital One Financial (COF) Capital Adequacy CT1 at 8.8% greatly exceeds the SCAP minimum and illustrates why COF was among the first banks to repay TARP in full in the spring of 2009. COF’s ability to generate excess capital internally has facilitated the maintenance of very high capital ratios throughout the crisis Strong Capital Generation Source: COF Corporate Reports CTI plus LLR is 13.2% or among the highest of any consumer-heavy bank, while COF’s ability to “cash flow” credit costs due to high yield assets differentiates the company from the ‘garden variety’ bank

- 8. 8 Asset Quality Credit improvement continues to ‘front-run’ broader economic indicators as net charge- offs (NCOs) have rapidly declined Domestic Credit Card (%) Source: COF Corporate Reports International Credit Card (%) Source: COF Corporate Reports Earliest stage delinquencies in the highest risk (unsecured) credit card portfolios also are declining rapidly, forecasting continued material lower credit costs for COF in the coming quarters/years despite perceived risks to persistent high unemployment Commercial Real Estate (%) 1.0 1.5 2.0 2.5 3.0 3.5 4.0 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 NPAs NCOs Source: COF Corporate Reports As a regional commercial bank, COF is also seeing steady improvement in commercial real estate credit Net Charge-Offs (%) Source: COF Corporate Reports COF also is experiencing low credit costs which have improved and are now stable in both mortgages and auto lending as well Management COF has among the most well respected management teams in the financial industry; the firm is a perennial member of FORTUNE’s best companies to work for CEO takes all of his compensation in stock and the senior management team also takes a substantial portion of their compensation in company stock

- 9. 9 Took a fledgling credit card business of a small Virginia bank (Signet) and created one of the world’s five largest credit card firms with global branding Earnings COF is among the most profitable banks in the world due, in large part, to being very adept at underwriting high yield credit (credit cards). The bank’s net interest margin has consistently been twice that of its regional banking peers Net Interest Margin (%) Source: COF Corporate Reports COF’s strong and consistent PTPP enables it to absorb credit storms with greater ease than traditional banks. Also, the bank is among the first to see earnings re-accelerate in an economic recovery as a result of its high, price inelastic earning asset yields Liquidity Like most of its peers, COF has more liquidity than would be normal given the economic environment we are exiting; COF’s cash and equivalents represent nearly 30% of the bank’s assets A consistent shift to lower costs and core funding also has positioned COF in a uniquely strong position coming out of this crisis; the loan-to-deposit ratio is 100% (unlevered) and COF’s blended cost of funding has fallen to as low as 1.5% in 4Q10 COF currently has more net cash and equivalents than market value Conclusion – 1 1 1 1 1 / Overall 1 Like a slot machine hitting all cherries, we rate COF an across the board CAMEL 1 with no regulatory fundamental weaknesses in our view. And COF is witnessing improved fundamentals across each of these categories. The disconnect between the fundamentals and the current valuation are stark with COF. In addition to trading below net cash-on-hand, COF currently trades hands at just 2.5x free cash flow (PTPP); <70% of book value (which assumes no franchise value or “deposit premium”); and 7.0x our 2012 reported earnings estimate, which we believe is quite conservative. A 15x P/E multiple on 2012-2013 earnings per share of $8 renders a target price of $120 or 2.5x prevailing market prices. Citigroup (C) Capital Adequacy CT1 is now the highest among ALL multi- national banks in the world at 11% or nearly 60% higher than the rumored Basel III minimum for “well capitalized” and 78% above the SCAP test level 1 3 5 7 9 11 2007 2008 2009 2010 CT1 (%) Source: Citigroup Corporate Reports

- 10. 10 CT1 plus its loan loss reserve (LLR) makes C the most heavily capitalized large bank in the world CT1 plus LLR (%) Source: Citigroup Corporate Reports Asset Quality C has started to “release” reserves as mark- downs on assets via M2M accounting rules in 2008-2009 proved to be far too large and resulted in a loan loss reserve over-build 1.5 2.5 3.5 4.5 5.5 6.5 7.5 2007 2008 2009 1Q10 2Q10 3Q10 4Q10 LLR (%) Source: Citigroup Corporate Reports Consequently, the managed loan loss provision is steadily declining, fueling C’s (surprising to some) profits recovery 5 10 15 2007 2008 2009 2010 Managed Credit Costs $B Source: Citigroup Corporate Reports C’s problem portfolio was in residential mortgages (of course) and a large part of the improving credit and falling credit costs story is the “run-off” in the levered mortgage portfolio North America EOP Mortgages $B Source: Citigroup Corporate Reports C now has repositioned itself into two companies – CitiFinancial, which looks like a levered bond hedge fund (which is in run- off), and the other entity which is the old core “Citibank”; both entities are seeing excessive reserve builds into peak credit losses, putting the former behind the company and the latter back into focus for global “core” banking growth

- 11. 11 Management This is likely the most controversial issue at present. We believe management has done a very good job of re-tooling itself and has the right talent to run the old new “Citibank” Equally critical, we are very impressed with additions to C’s board of directors which have taken place post-financial crisis which nearly crippled the franchise (and should have); for example, we like the addition of our old friend Jerry Grundhofer to the Citibank board; Jerry made us money at both Cincinnati’s Star Bank as well as thru his great success at putting together a top tier franchise in US Bancorp (USB) Should the current senior management not deliver on the promise of this franchise, we believe the right person to step-up already is in place. This gives us uber confidence in Citi’s leadership relative to the generally pessimistic investor perceptions Earnings A discussion of C isn’t complete without acknowledging its unmatched global presence, a strength of past management and a focus on the current leadership Global Banking by Region 0% 20% 40% 60% 80% 100% EEMA Latin America Asia North America Source: Citigroup Corporate Reports C’s earnings power across multiple geographies is incredible and cannot be easily replicated by any bank globally International Banking Growth 95 105 115 125 135 145 155 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 Loans Deposits Source: Citigroup Corporate Reports While C’s international bank continues to grow rapidly, its U.S. bank has turned the corner and thus the realization of a very substantial earnings turnaround is developing quickly as domestic credit expenses continue declining Revenue Stability $B Source: Citigroup Corporate Reports 5 10 15 2007 2008 2009 2010 Managed Credit Costs $B Source: Citigroup Corporate Reports

- 12. 12 -20 -10 0 10 2007 2008 2009 2010 Net Income $B Source: Citigroup Corporate Reports With C’s international bank continuing to grow; overall corporate revenue remains stable and strong. With credit costs falling C’s earnings power rises very quickly; the current run-rate cash flow (PTPP) exceeds analysts estimates for reported earnings this coming year by 150% Liquidity C too is awash in liquidity Loans-to-deposits at 72% reflect C being grossly under loaned. This signals a large opportunity in C for strong earning asset growth into an economic recovery C also has more net cash-on-hand than market value by almost two-fold Conclusion – 1 2 2 2 1 / Overall 2 With improving fundamentals across all categories, we rate C an overall CAMEL 2. So how this conclusion washes with C’s current depressed stock price is a question for psychologists perhaps. This is a stock trading at half its net cash- on-hand; a mere 2.5x run-rate free cash flow (PTPP); and half its book value (no franchise value for this global juggernaut?) We see this as a $12 stock inside of a few years. __________________________________________ JP Morgan (JPM) Capital Adequacy CT1 of 9.8% is well above the current regulatory minimum for “well capitalized” and JPM is already at the pro forma B3M CT1 “well capitalized” threshold years before its potential implementation The addition of a loss coverage ratio of 4.5% (of loans) creates an incredibly strong double digit “risk buffer” of nearly 15% JPM carries a global liquidity reserve of over $260 billion or >22% of total risk- weighted assets; amazing Therefore, JPM enjoys enormous capital and liquidity strength for a large, multi-national bank; internal CT1 capital generation is near 10% annually Asset Quality Loan loss reserve at a strong 190% of nonperforming loans already has started to come down as the level of problem loans has peaked and has begun to decline noticeably Huge Reserve Coverage $B Source: JP Morgan Corporate Reports Early-Stage delinquency also showing clear signs of “post peak” for this credit cycle and this bodes well for more of JPM’s excess LLR to be “released” back into reported capital (book value). We calculate JPM’s

- 13. 13 book value to be understated by a conservative $10 to $12 per share or 20%- 25% Early-Stage Delinquency $B Source: JP Morgan Corporate Reports Management Known as the “second Federal Reserve” during the financial crisis (aiding in the unwinding of rivals Bear Stearns, Lehman Bros. and Washington Mutual); we believe JPM’s management team has more than proven itself “Scarlet Letters” and “Half Bankers; Half Lawyers” are the persnickety words of a very high quality management team just frustrated with the government and investors; JPM’s management team has earned the right to shout loudly at both Earnings The acquisition of Washington Mutual alone adds huge earnings power to JPM as they acquired the beleaguered bank at “fire sale” prices including massive discounts on troubled assets JPM remained profitable throughout the crisis and throws-off the largest free cash flow (PTPP) among any multi-national bank. The current run-rate (PTPP) represents almost 30% of the market value of the stock which also is the book value; astonishing JPM recorded record revenue in 2010, up 15% from the prior year while expenses rose only 2%. This illustrates the profit scalability of this impressive multi-strategy financial franchise Reported earnings in core commercial banking rose nearly 100% in 2010 and the return on common equity (ROE) already is back to 16% with huge excess liquidity and capital which is yet to be redeployed into higher return investments Further earnings power is demonstrated in JPM’s “league table” position in investment banking - #1 in global investment banking fees; #1 in global debt and equity underwriting; and #1 in global loan syndication. Yet, despite leading the league, JPM’s average market share is under 10% in total investment banking globally, thus significant market share opportunity remains Liquidity With a liquidity reserve equal to >20% of risk-weighted assets and twice common equity capital, JPM is inordinately liquid JPM also holds net cash 1.5x that of its market value and the loan-to-deposit ratio is a materially under loaned out 66% JPM’s biggest problem is that it is too liquid, a classic “high class” problem to have Conclusion – 1 1 1 1 1 / Overall 1 With strong fundamentals and excess capacity across all categories from capital to credit to earnings power and liquidity, we rate JPM a CAMEL 1. How the stock of this impressive franchise trades hands at approximately 3x run-rate free cash flow (PTPP); below net cash-on-hand; and at book value is inexplicable.

- 14. 14 We expect investors will look back at these valuations and wonder why they didn’t take more advantage… To be conservative, we see at least $8 per share in EPS by 2013-2014. At 80% of the long-term market multiple (well deserved), we believe that this is a $120 stock inside of two years The untapped historic capital, liquidity and earnings power of the U.S. financial industry coupled with near all-time low absolute and relative valuations is excessive “dry powder” for the sector’s out- performance. When considering the recent macro events in the Middle East, we would anticipate that any tailing- off of these global headwinds would again be a “green light” for financials to move aggressively higher. It’s all there in the CAMELs. It’s just a matter of time. Regards, Michael P. Durante Managing Partner Blackwall Partners LLC