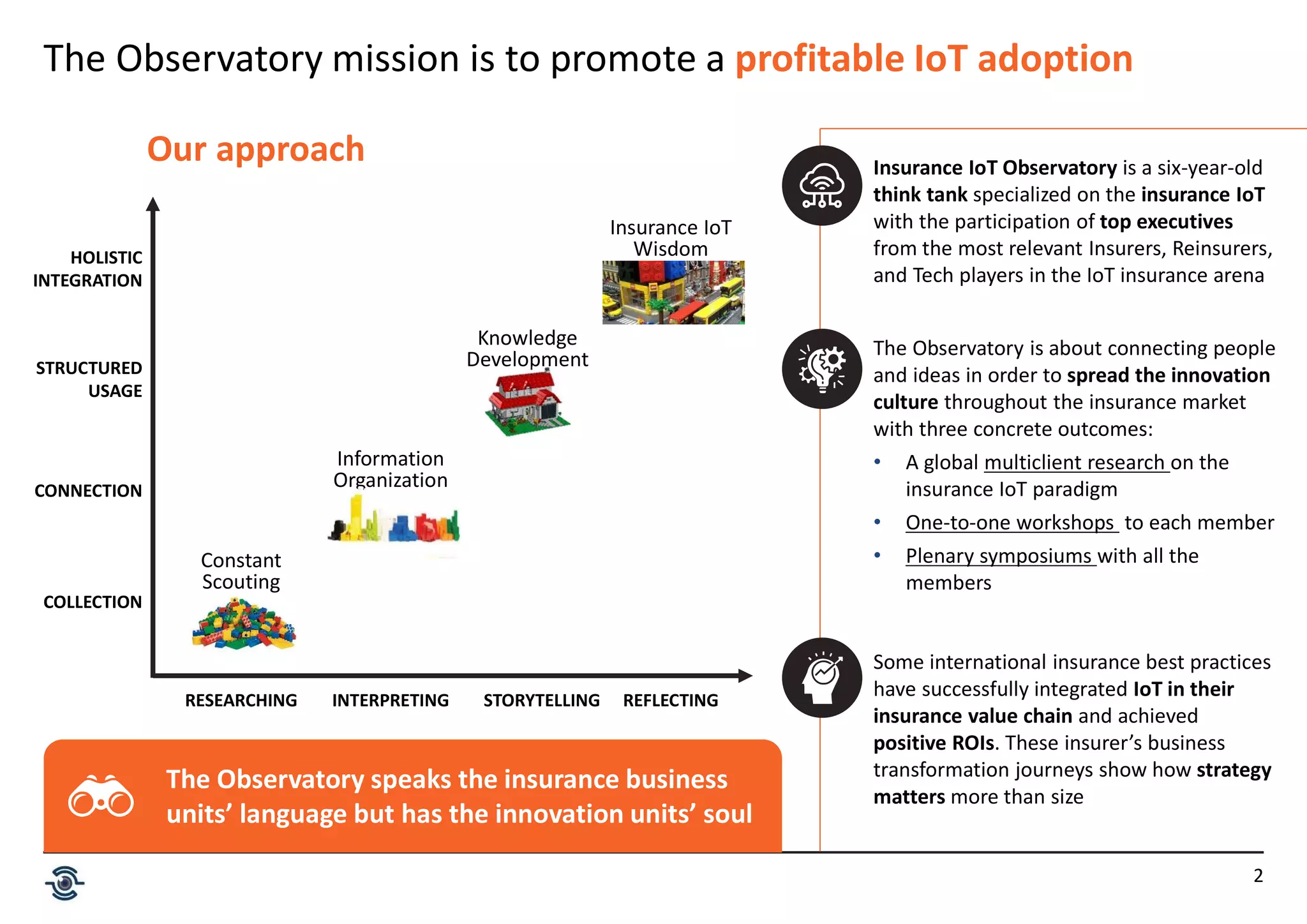

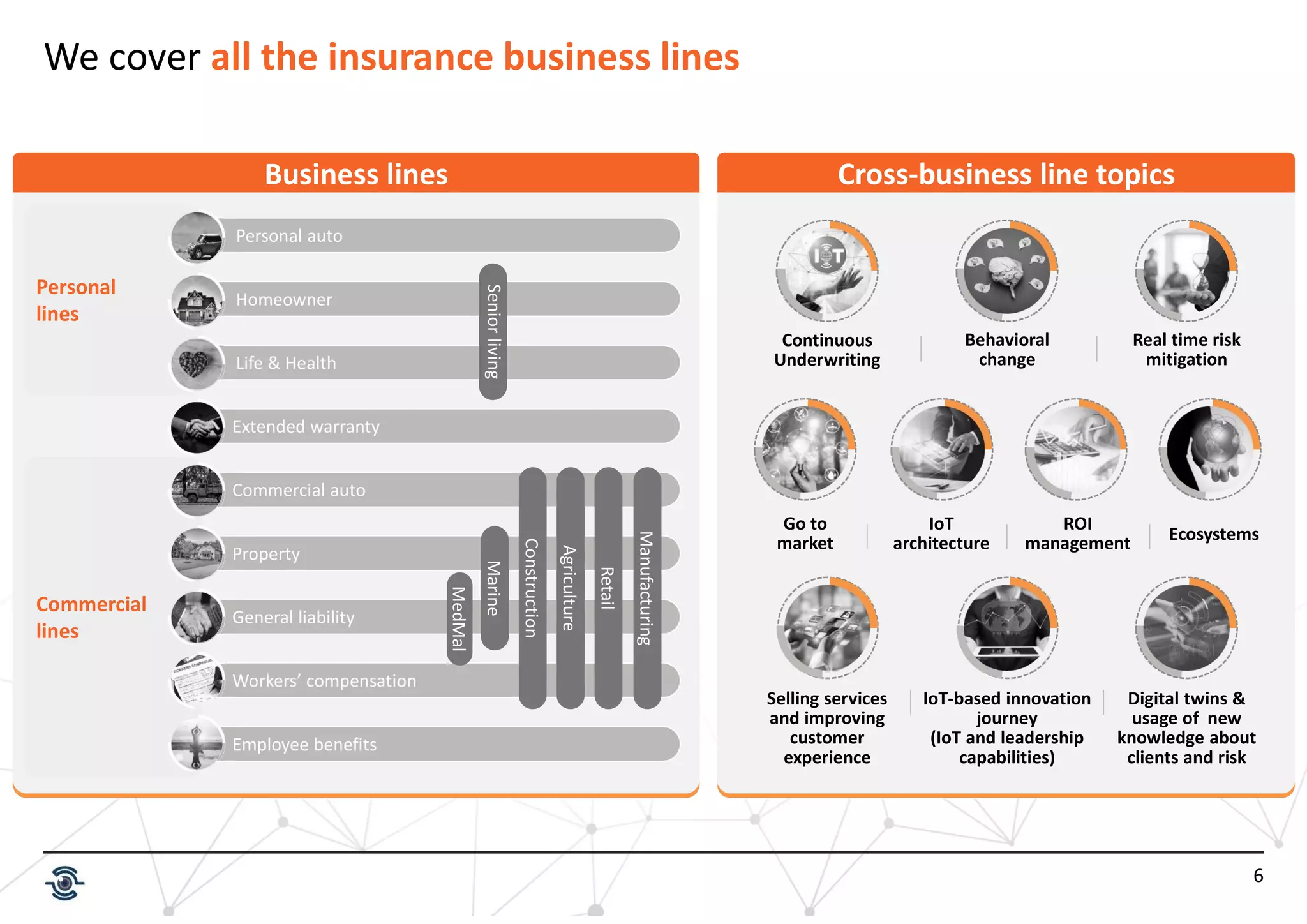

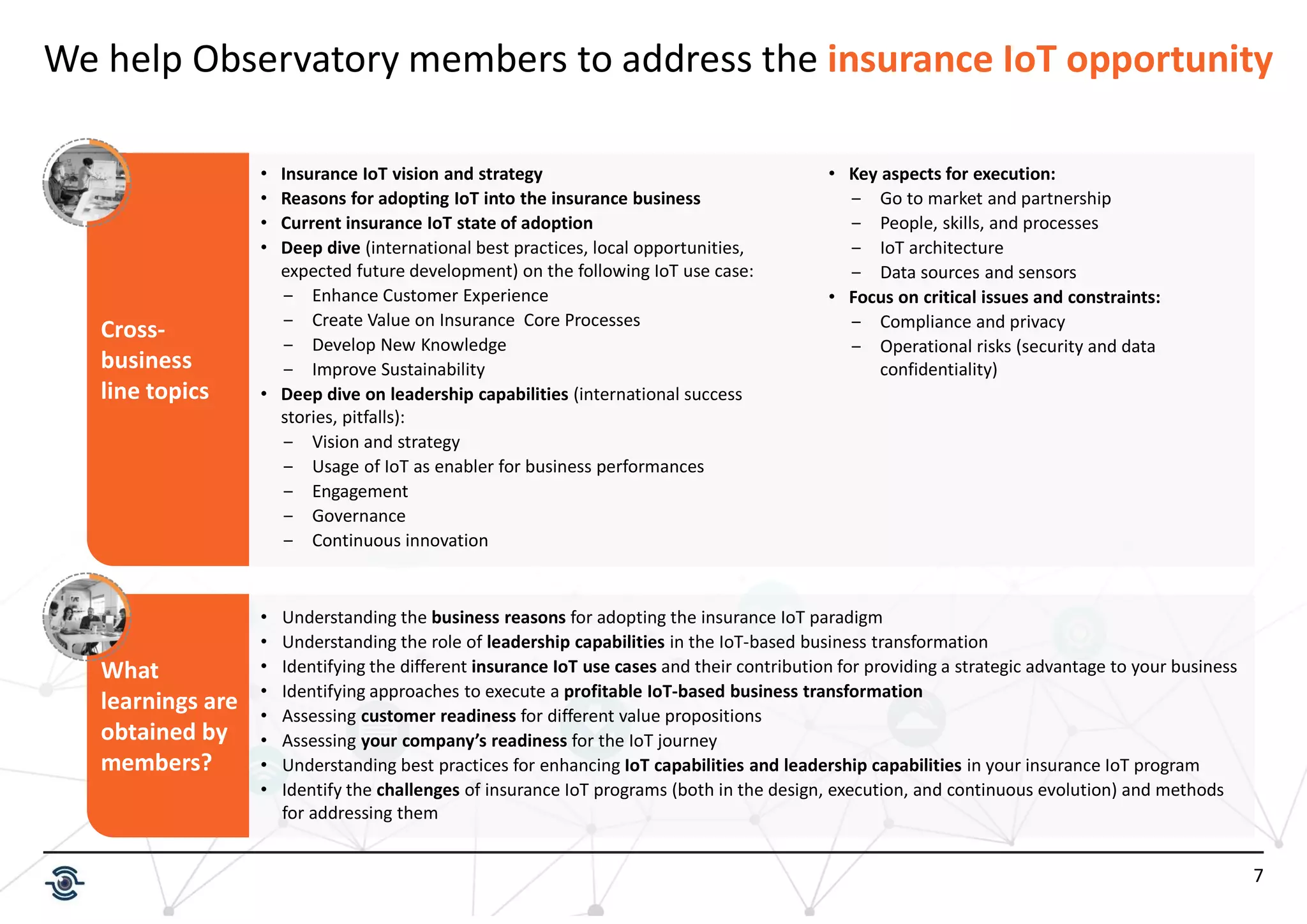

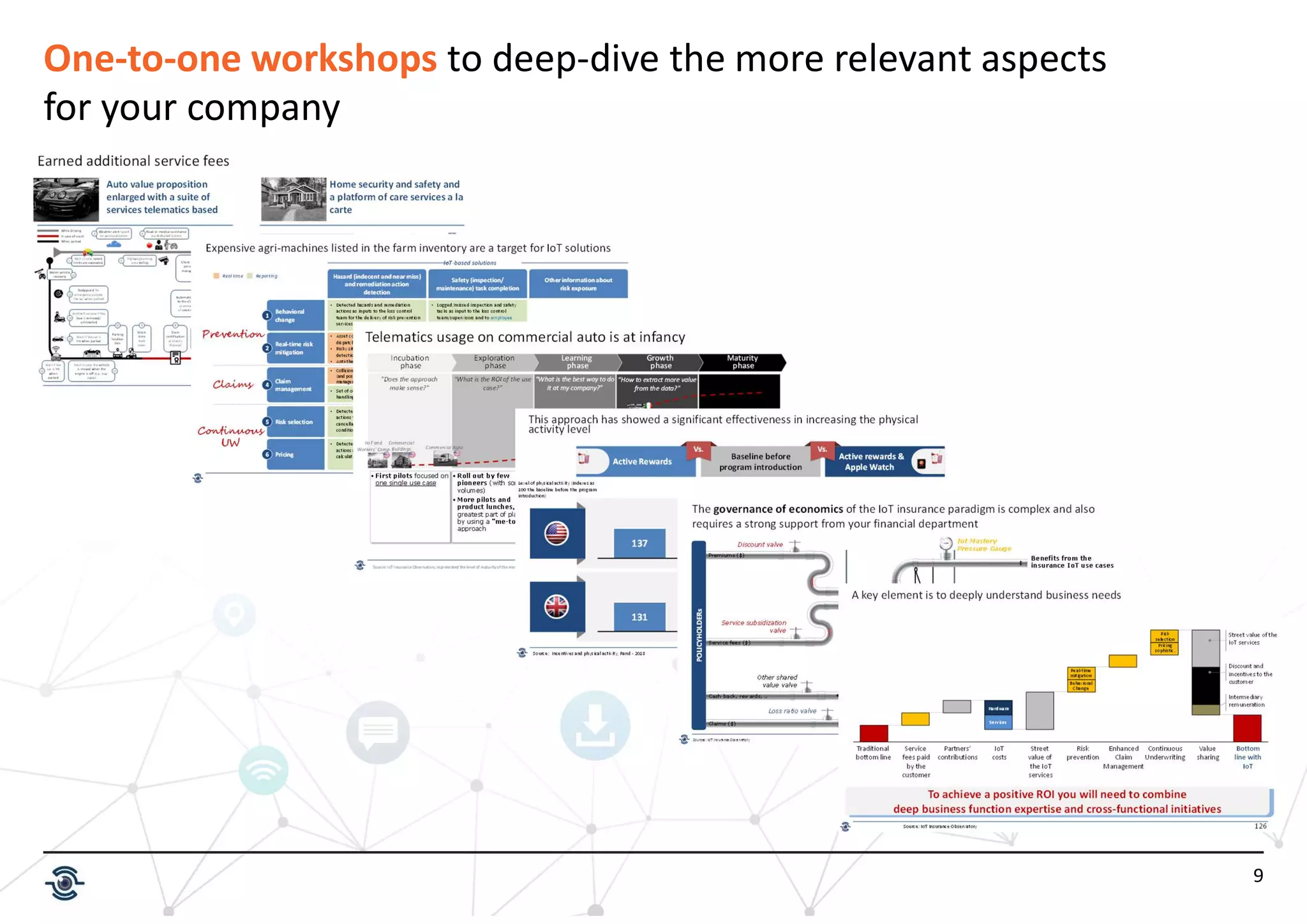

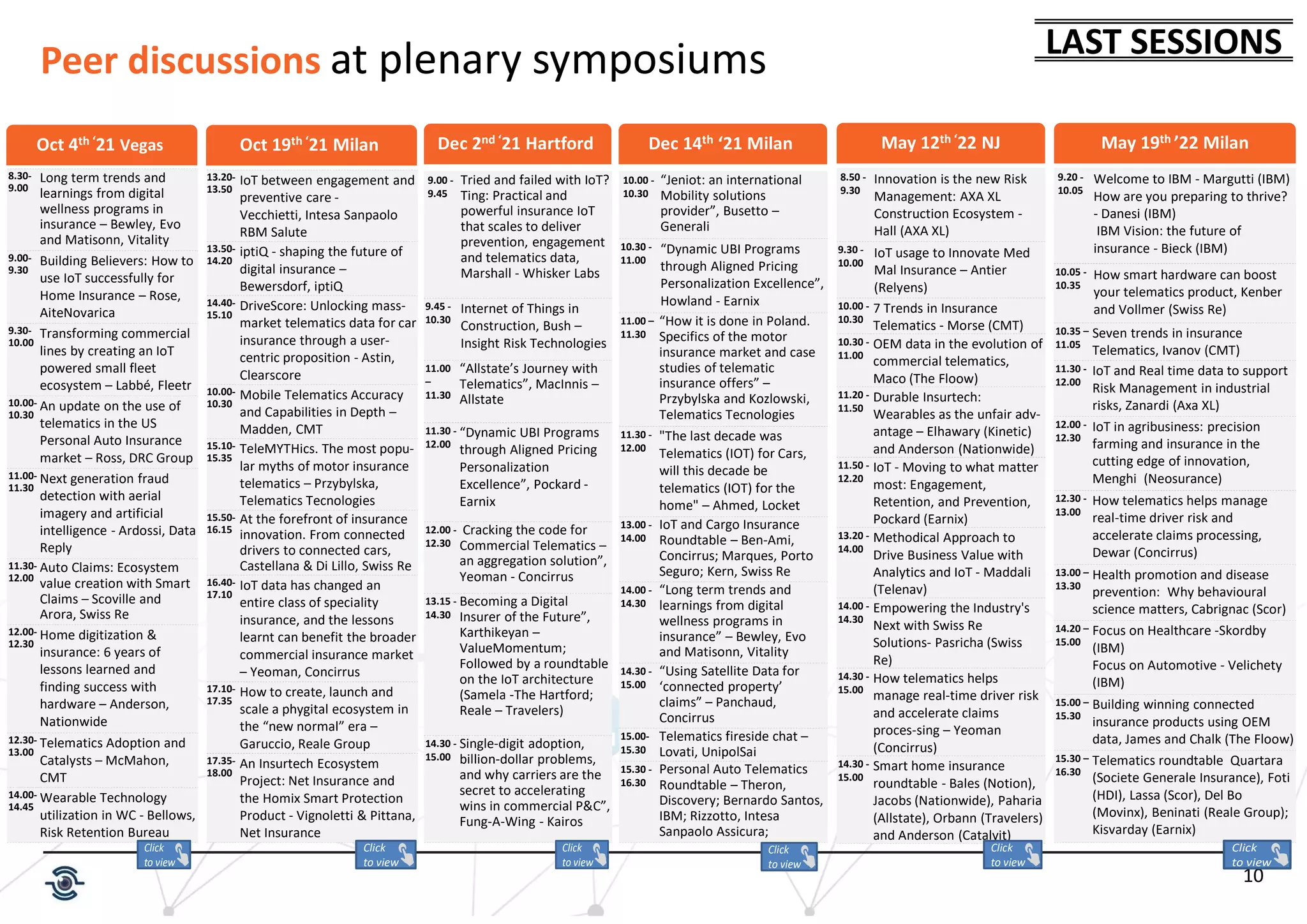

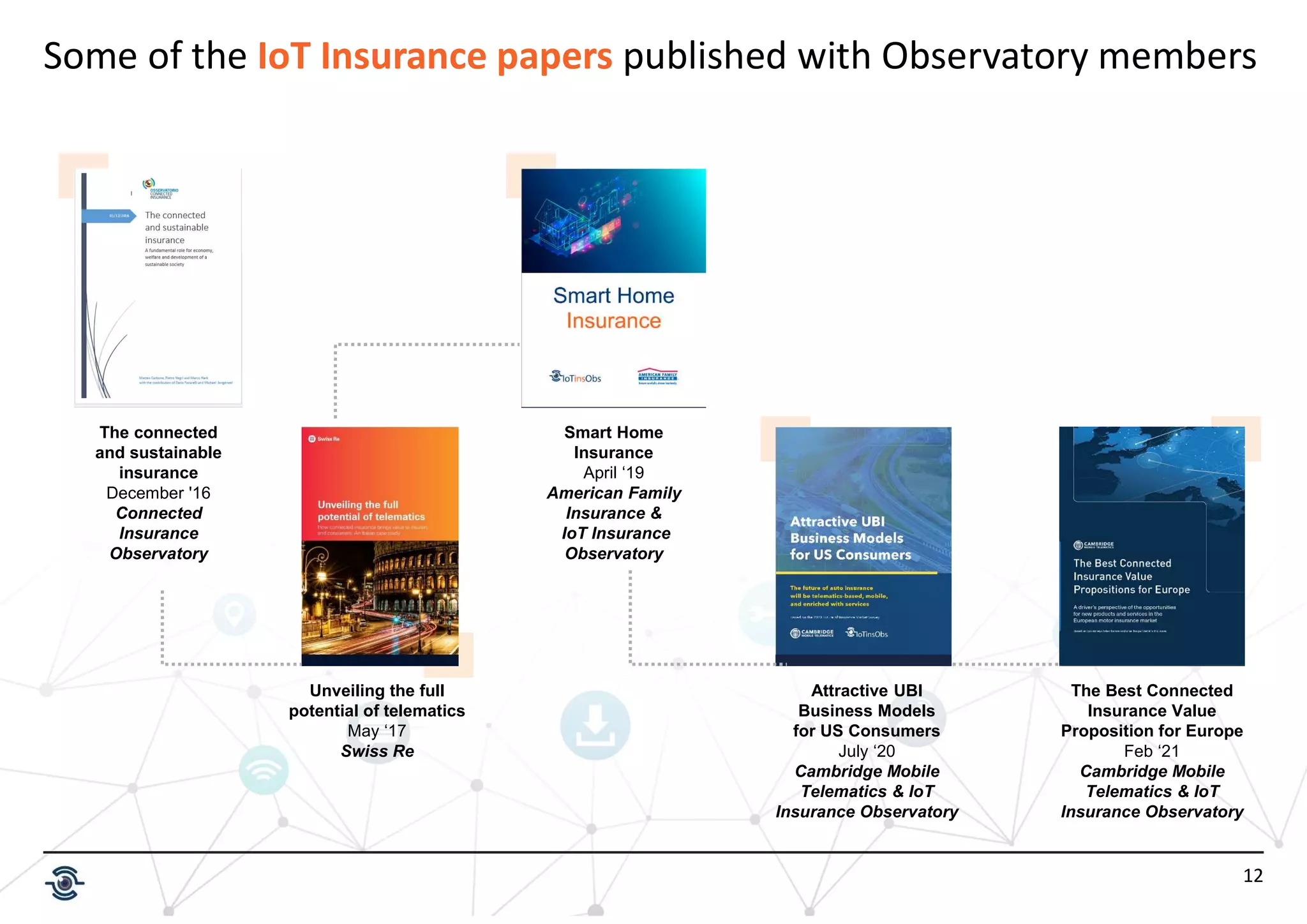

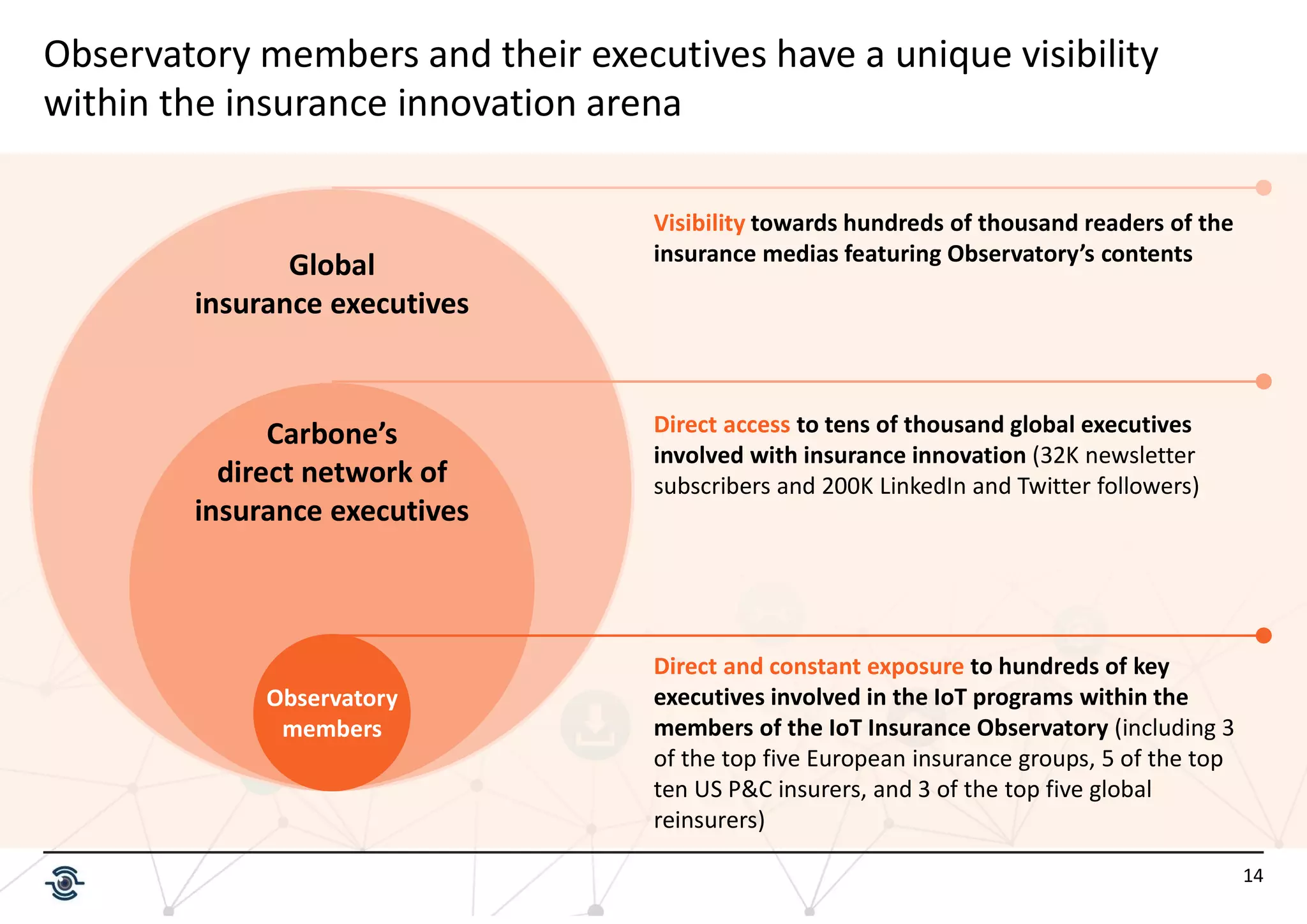

The IoT Insurance Observatory initiative is a collaborative think tank aimed at promoting profitable IoT adoption in the insurance industry, involving top executives from significant insurers and technology companies. The observatory offers workshops, research, and symposiums that address IoT integration and best practices across various insurance sectors, emphasizing the importance of strategy in achieving positive business outcomes. It facilitates knowledge sharing, provides insights on IoT's role in transforming insurance values, and supports members in addressing challenges and opportunities within the IoT insurance landscape.