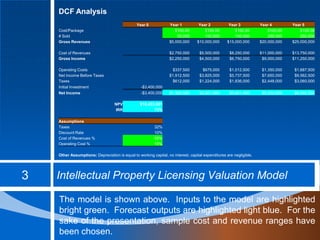

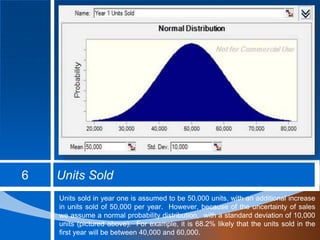

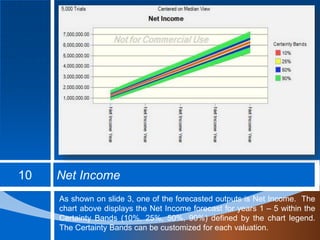

The document outlines an intellectual property licensing valuation model using Monte Carlo simulation to assess internal rate of return (IRR) and net present value (NPV) under uncertainty in cost and revenue linked to embryonic technology projects. It details inputs, sales price assumptions, units sold, cost of goods sold (COGS), and operating costs, providing a comprehensive framework for valuation and sensitivity analysis. The model generates random data for simulations, offering insights into profitability and required royalty payments with customizable certainty levels.