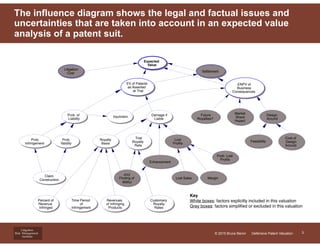

This document provides a valuation of seven recommended patents for defensive purposes against a potential plaintiff. It outlines the methodology, which includes quantifying the expected monetary value if found liable as well as the value of an injunction. Key factors like infringement probability, royalty rates, and revenues are accounted for in the calculations. The results show the expected value and net value-to-cost ratio for each patent. Additional considerations around the patents as a portfolio and further searching are also discussed.