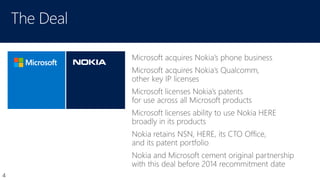

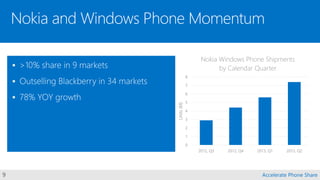

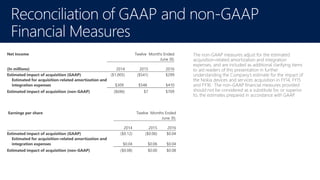

Microsoft announced its acquisition of Nokia on September 3, 2013, with expectations of significant benefits, including market share increases and operational efficiencies in the smart device sector. However, there are numerous risks associated with the deal, including regulatory approvals, integration challenges, and market response, which could impact the anticipated financial outcomes. The document provides projections related to operating income, revenue growth, and the overall strategic advantages Microsoft expects to gain from the acquisition.