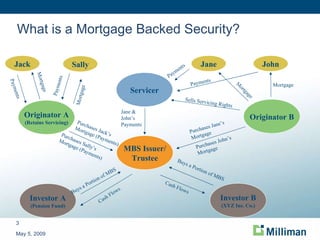

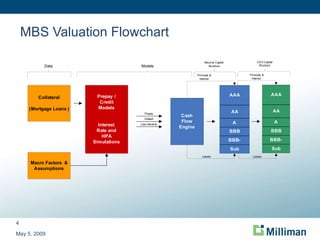

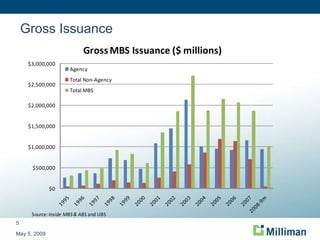

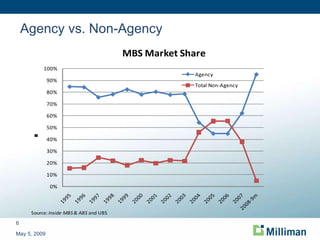

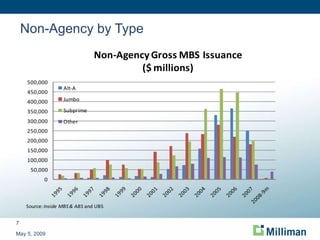

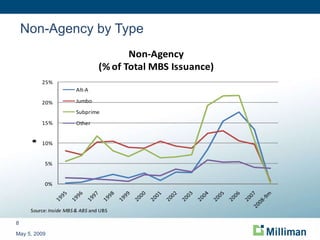

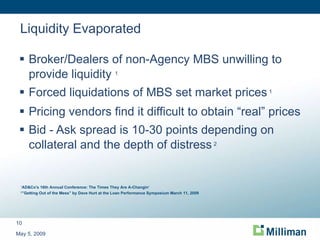

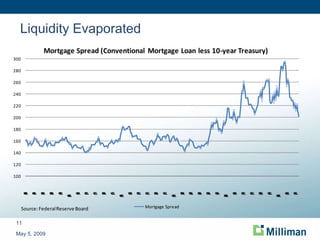

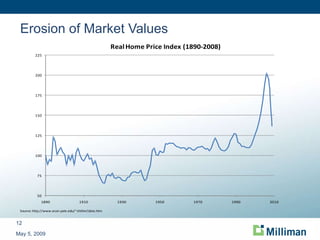

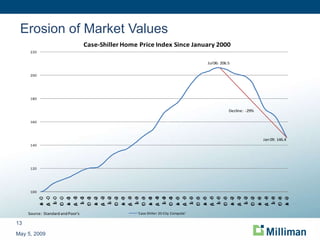

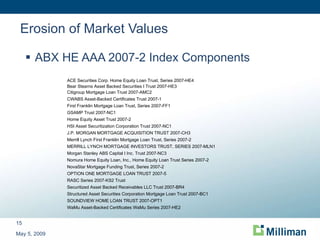

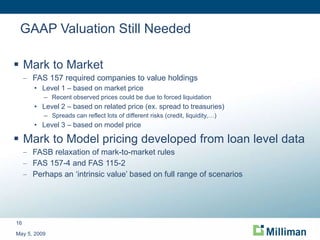

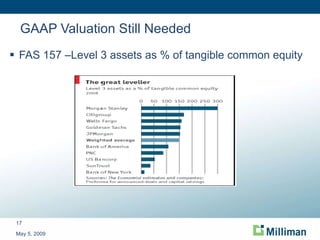

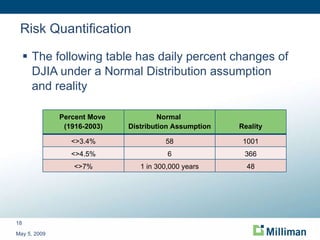

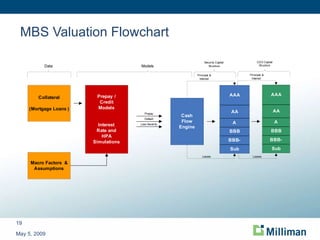

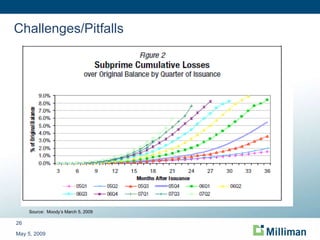

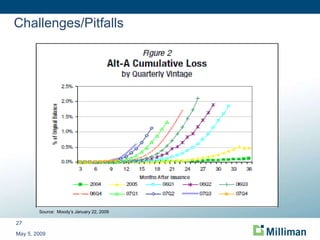

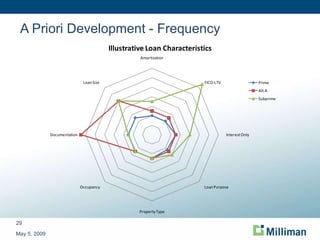

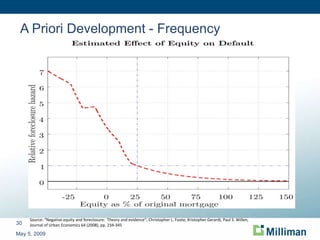

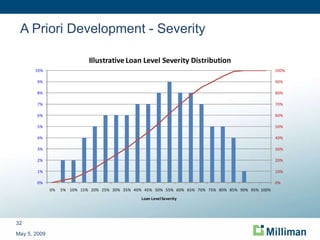

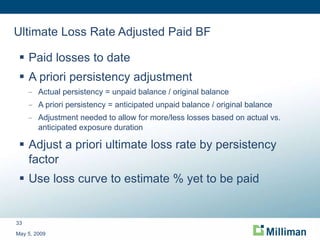

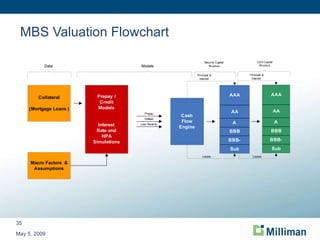

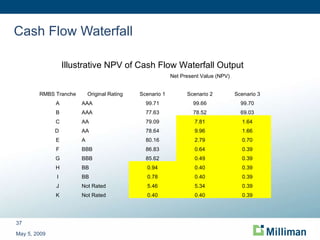

The document presents an actuarial approach to cash flow analysis for mortgage-backed securities (MBS), discussing the current market situation, valuation methods, and risk quantification. It highlights challenges faced regarding liquidity, valuation under GAAP regulations, and the effects of market volatility on MBS pricing. The analysis also includes insights into credit models and ultimate loss projections based on loan-level data.

![MORTGAGE BACKED SECURITIES AN ACTUARIAL APPROACH TO CASH FLOW ANALYSIS May 5, 2009 Questions? [email_address] [email_address]](https://image.slidesharecdn.com/casmeeting20090505final-12853382384607-phpapp02/85/Actuarial-Approach-to-MBS-Valuation-38-320.jpg)