Series A OnlyVC Method Practice Problem SolutionVC Method - Proble.docx

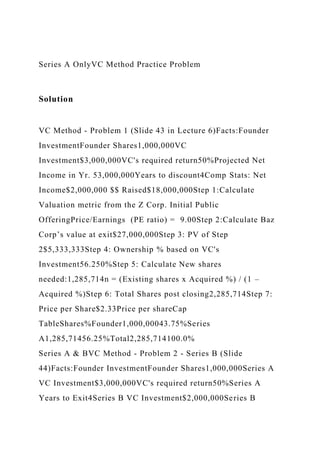

Series A OnlyVC Method Practice Problem Solution VC Method - Problem 1 (Slide 43 in Lecture 6)Facts:Founder InvestmentFounder Shares1,000,000VC Investment$3,000,000VC's required return50%Projected Net Income in Yr. 53,000,000Years to discount4Comp Stats: Net Income$2,000,000 $$ Raised$18,000,000Step 1:Calculate Valuation metric from the Z Corp. Initial Public OfferingPrice/Earnings (PE ratio) = 9.00Step 2:Calculate Baz Corp’s value at exit$27,000,000Step 3: PV of Step 2$5,333,333Step 4: Ownership % based on VC's Investment56.250%Step 5: Calculate New shares needed:1,285,714n = (Existing shares x Acquired %) / (1 – Acquired %)Step 6: Total Shares post closing2,285,714Step 7: Price per Share$2.33Price per shareCap TableShares%Founder1,000,00043.75%Series A1,285,71456.25%Total2,285,714100.0% Series A & BVC Method - Problem 2 - Series B (Slide 44)Facts:Founder InvestmentFounder Shares1,000,000Series A VC Investment$3,000,000VC's required return50%Series A Years to Exit4Series B VC Investment$2,000,000Series B Required Return25%Series B Years to Exit2Projected Net Income in Yr. 53,000,000Comp Stats: Net Income$2,000,000 $$ Raised$18,000,000Step 1:Calculate the required Future Value of Series B VC’s investment using the 25% required rate of return: 2,000,000 x (1.25)2 3,125,000.00Step 2: Calculate Series B Required Ownership % Series B FV / Exit Valuaion from Problem 111.5741%0.562567.8241%Step 3: Calculate Required Shares to be issued to Series A VC to ensure that it owns 56.25% at exit n = (Existing shares x Acquired %) / (1 – Acquired %)2,107,914Step 4: Total Shares3,107,914Step 5: Series A Required Ownership % based on VC's Investment67.824%Step 6: Price per Share$1.42Cap TableShares%Founder1,000,00032.2%Series A2,107,91467.8%Total3,107,914100.0% Name ; - SECOND EXAM SPRING 2020 1. Mark Price the marketing manager for Speakers needs to find which variable most affects the demand for a line of speakers. He is uncertain whether the price of speakers of the advertising expenditures drive the sale of speakers. He plans to use the regression analysis to determine the relative impact price an advertising. He used 12 years of data which is given below. The output from his regression analysis also give: Sales (000) Price Per Unit Advertising ($000) 400 280 600 700 215 835 900 211 1100 1300 210 1400 1150 215 1200 1200 200 1300 900 225 900 1100 207 1100 980 220 700 1234 211 900 925 227 700 800 245 690 Regression Statistics Multiple R 0.8550 R Square 0.7310 Adjusted R Square 0.6712 Standard Error 146.6234 Observations 12 ANOVA df SS MS F Significance F Regression 2 525718.3339 262859.1669 12.2269 0.0027 Residual 9 193485.9161 21498.4351 Total 11 719204.2500 Coefficients Standard Error t Stat P-value Lower 95% Intercept 2191.34 826.08 2.65 0.03 322.61 Price -6.91 2.92 -2.37 0.04 -13.51 Advertising 0.33 0.24 1.36 0.21 -0.21 a. Interpret the output from the regression analysis given above.

Recommended

Recommended

More Related Content

Similar to Series A OnlyVC Method Practice Problem SolutionVC Method - Proble.docx

Similar to Series A OnlyVC Method Practice Problem SolutionVC Method - Proble.docx (20)

More from klinda1

More from klinda1 (20)

Recently uploaded

Recently uploaded (20)

Series A OnlyVC Method Practice Problem SolutionVC Method - Proble.docx

- 1. Series A OnlyVC Method Practice Problem Solution VC Method - Problem 1 (Slide 43 in Lecture 6)Facts:Founder InvestmentFounder Shares1,000,000VC Investment$3,000,000VC's required return50%Projected Net Income in Yr. 53,000,000Years to discount4Comp Stats: Net Income$2,000,000 $$ Raised$18,000,000Step 1:Calculate Valuation metric from the Z Corp. Initial Public OfferingPrice/Earnings (PE ratio) = 9.00Step 2:Calculate Baz Corp’s value at exit$27,000,000Step 3: PV of Step 2$5,333,333Step 4: Ownership % based on VC's Investment56.250%Step 5: Calculate New shares needed:1,285,714n = (Existing shares x Acquired %) / (1 – Acquired %)Step 6: Total Shares post closing2,285,714Step 7: Price per Share$2.33Price per shareCap TableShares%Founder1,000,00043.75%Series A1,285,71456.25%Total2,285,714100.0% Series A & BVC Method - Problem 2 - Series B (Slide 44)Facts:Founder InvestmentFounder Shares1,000,000Series A VC Investment$3,000,000VC's required return50%Series A Years to Exit4Series B VC Investment$2,000,000Series B

- 2. Required Return25%Series B Years to Exit2Projected Net Income in Yr. 53,000,000Comp Stats: Net Income$2,000,000 $$ Raised$18,000,000Step 1:Calculate the required Future Value of Series B VC’s investment using the 25% required rate of return: 2,000,000 x (1.25)2 3,125,000.00Step 2: Calculate Series B Required Ownership % Series B FV / Exit Valuaion from Problem 111.5741%0.562567.8241%Step 3: Calculate Required Shares to be issued to Series A VC to ensure that it owns 56.25% at exit n = (Existing shares x Acquired %) / (1 – Acquired %)2,107,914Step 4: Total Shares3,107,914Step 5: Series A Required Ownership % based on VC's Investment67.824%Step 6: Price per Share$1.42Cap TableShares%Founder1,000,00032.2%Series A2,107,91467.8%Total3,107,914100.0% Name ; - SECOND EXAM SPRING 2020 1. Mark Price the marketing manager for Speakers needs to find which variable most affects the demand for a line of speakers. He is uncertain whether the price of speakers of the advertising expenditures drive the sale of speakers. He plans to use the regression analysis to determine the relative impact price an

- 3. advertising. He used 12 years of data which is given below. The output from his regression analysis also give: Sales (000) Price Per Unit Advertising ($000) 400 280 600 700 215 835 900 211 1100 1300 210 1400 1150 215 1200 1200 200 1300

- 5. Regression Statistics Multiple R 0.8550 R Square 0.7310 Adjusted R Square 0.6712

- 8. 11 719204.2500 Coefficients Standard Error t Stat P-value Lower 95% Intercept 2191.34 826.08 2.65 0.03 322.61 Price -6.91

- 9. 2.92 -2.37 0.04 -13.51 Advertising 0.33 0.24 1.36 0.21 -0.21 a. Interpret the output from the regression analysis given above – is this a good regression model to forecast sales b. Evaluate the regression model. Also, comment on the sample size (observations) c. Write the regression equation showing the relationship between Sales versus Advertising and Price d. Determine whether Price or Advertising has more impact on the forecast of Sales e. Predict average yearly speaker sales the price was $300 per unit and Mark is planning to spend $900 thousand in Advertising. 2. Assume the network and data as follows:

- 10. a. Construct the network diagram b. Indicate the critical path when normal activity times are used c. Explain the procedure you would use to crash this project if you had a penalty cost per week above 15 weeks as well you had indirect costs per week 3. Ace Steel Mill estimates the Demand for steel in millions of tons per year as follows Millions of t tons Probability 10 10 12 25 14 30 16 20 18 15

- 11. a. If capacity is set at 18 Million tons what is the capacity cushion b. What is the probability of Idle capacity c. What is the average utilization of the plant at 18 million ton capacity d. If it costs $8 million per ton of lost business and $80 million to build a million ton of capacity how much capacity should be built to minimize the total cost 4. Explain the reasons for a. Carrying large levels of inventories b. Carrying Small Levels of Inventories 5. We discussed in class how MRP (Materials Planning System) works we examined an example of the a Table with four legs and a leg assembly. We discussed the following charts. Please explain how the Bill of Materials Explosion takes place

- 12. in these charts 6. 7. Explain the following as discussed in class Thompson manufacturing produces industrial scales for the

- 13. electronics industry. Management is considering outsourcing the shipping operation to a logistics provider experienced in the electronics industry. a. Thompson’s annual fixed costs of the shipping operation are $1,650,000, which includes costs of the equipment and infrastructure for the operation. The estimated variable cost of shipping the scales with the in-house operation is $4.70 per ton- mile. b. If Thompson outsourced the operation to Carter Trucking, the annual fixed costs of the infrastructure and management time needed to manage the contract would be $560,000. Carter would charge $8.50 per ton-mile. c. Currently Thompson shipped 255,000 ton-miles this year and his shipments in the last five years have increased at the rate of 18,000 ton-miles a year. What would you recommend Thompson to do and why? 2 Entrepreneurial Finance Lecture 6

- 14. Valuing Entrepreneurial Ventures 2 Housekeeping: This Tuesday we have an In-class exercise where you will apply the valuation techniques that you are currently learning. To complete this you will need to purchase the case. I have put together a Course Pack at Harvard Business Publishing that has the case you will need, and two other cases for later in the course. The cases will cost $12.75. I have also added some suggested reading that is optional and won't be directly tested on. These cost an additional $32.90. The link for theses purchases was sent by email and is posted on BlackBoard. Cash, Build, Burn & Runway and Cash Conversion Cycle Homework - Still waiting for one more student to submit the assignment so I can't post the answer yet. Most of you did very well. Here are two common errors that you should fix so that you get it right for the test. For Cash Build, Burn and Runway, be careful with the Cash Burn from Balance Sheet. You are looking at the change in balances from one year to the next. Also, review the slides on whether in increase or decrease in a balance item is a cash inflow or outflow. For Cash Conversion Cycle, there is no such thing a negative

- 15. days. Use absolute values. Also, your answer is in days, not dollars. You are trying to understand how long it takes from the time that you first invest in Raw Materials to make your product to the date when you receive the cash from a completed sale. 1 2 Adjusted Present Value Example 3 APV formula steps Estimate the value of the firm in three steps: Calculate the value of the unlevered firm Discount equity CF’s at unlevered re Calculate interest tax savings generated from debt (tax shield), if any Tax rate x Debt Sum up steps 1 and 2 and add back starting cash Step 1: Calculate the value of the unlevered firm

- 16. Calculate free-cash flows from operations: FCF = EBIT (1 – t) + Depreciation – CAPEX – Δ NWC Calculate the Terminal Value (future value of all steady state firm cash flows): Terminal Value = FCF (1 + g) / (re – g) where g is the steady state (stable) growth rate of the firm, and re is the unlevered cost of equity Discount FCF and terminal value to present time using re 4 5 APV Method Example – Crunch Co.Facts:Crunch Co. is a start- up fitness equipment company founded by Bob “Crunch” Borkowski. Crunch Co. received a $300,000 investment from Golden Venture Partners (GVP). After 3 years, Crunch Co. has finally begun to generate positive earnings and free cash flow.GVP is now considering its exit options and asks you to help value Crunch Co. They have provided financial projections and other information below. Value the company using the Adjusted Present Value Method.Unlevered Cost of Equity14%Perpetual Growth Rate4.50%Debt (US$ 000’s)$200Cost of Debt10%Tax Rate22%

- 17. APV Method Example – Crunch Co. Crunch Co. Selected Financial Projections (US$ 000’s) 6YearActual 1 2 3 4 5Sales$220.0 $231.0 $242.6 $254.7 $267.4 $280.8 Cost of Goods Sold132.0 138.6 145.5 152.8 160.4 168.5 General & Administrative Expenses20.0 20.0 20.0 20.0 20.0 20.0 Depreciation15.0 15.0 16.0 17.0 18.0 19.0 EBIT53.0 57.4 61.0 64.9 69.0 73.3 Interest Expense20.0 20.0 20.0 20.0 20.0 20.0 Pre-tax Income33.0 37.4 41.0 44.9 49.0 53.3 Taxes7.3 8.2 9.0 9.9 10.8 11.7 Net Income$25.7 $29.2 $32.0 $35.0 $38.2 $41.6 Selected Balance Sheet Information:Cash & Marketable Securities24.0 33.8 37.6 45.6 47.8 53.2 Gross Property Plant and Equipment10.0 15.0 19.0 22.0 25.0 27.0 Net Working Capital 6.0 7.0 9.0 8.0 9.0 10.0 Time 0 YearUnlevered Free Cash Flow Calculation: 1 2 3 4 5NOPLAT (EBIT x (1 - tax rate))44.8 47.6 50.6 53.8 57.2 + Depreciation15.0 16.0 17.0 18.0 19.0 - Capital Expenditures5.0 4.0 3.0 3.0 2.0 - Change in New Working Capital1.0 2.0 (1.0)1.0 1.0 Unlevered Free Cash Flow$53.8 $57.6 $65.6 $67.8 $73.2 Present Value @re of 14%47.2 44.3 44.3 40.1 38.0 Cumulative PV of Forecast Period$213.9 Terminal Value Calculation$805.0 Present Value of Terminal

- 18. Value418.1 Crunch Co. Unlevered Value $632.0 Crunch Co. APV – Calculate Unlevered Value 7 Step 1: Calculate Unlevered Value of Crunch Co. YearUnlevered Free Cash Flow Calculation: 1 2 3 4 5NOPLAT (EBIT x (1 - tax rate))44.8 47.6 50.6 53.8 57.2 + Depreciation15.0 16.0 17.0 18.0 19.0 - Capital Expenditures5.0 4.0 3.0 3.0 2.0 - Change in Net Working Capital1.0 2.0 (1.0)1.0 1.0 Unlevered Free Cash Flow$53.8 $57.6 $65.6 $67.8 $73.2 Present Value @re of 14%47.2 44.3 44.3 40.1 38.0 Cumulative PV of Forecast Period$213.9 Terminal Value Calculation$805.0 Present Value of Terminal Value418.1 Crunch Co. Unlevered Value $632.0 Crunch Co. APV – Calculate Unlevered Value 8 Step 1: Calculate Unlevered Value of Crunch Co. NOPLAT = EBIT x (1 – tax rate $57.4 x (1 – .22) = $44.8 CAPEX = Gross PPE Yr. 1 – Gross PPE Yr. 0 $15 – $10 = $5

- 19. Change in NWC = NWC Year 2 – NWC Year 1 $9.0 – $7 = $2 Present Value = CF4 / (1 + re)4 $67.8 / (1 + .14)4 = $40.1 Terminal Value = CF5 x (1 + g) / (r – g) $73.2 x (1 + .045) / (.14 - .045) = $805.0 Present Value = TV / (1 + re)5 $805.0 / (1 + .14)5 = $418.1 Keep this slide handy for the exam. 8 Crunch Co. APV – Interest Tax Shield 9 Interest Tax Shield Formula:Tax Rate x Debt

- 20. Tax Rate: 22% Debt = $200 Interest Tax Shield = .22 x $200 = $44 Step 2: Calculate Interest Tax Shield Crunch Co. APV