Income From Other Sources

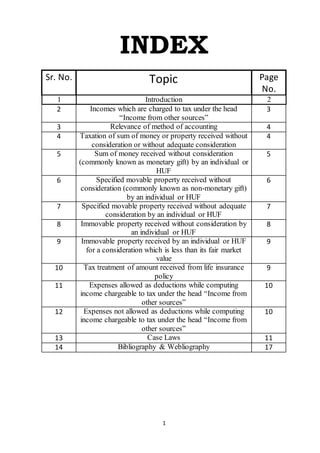

- 1. 1 INDEX Sr. No. Topic Page No. 1 Introduction 2 2 Incomes which are charged to tax under the head “Income from other sources” 3 3 Relevance of method of accounting 4 4 Taxation of sum of money or property received without consideration or without adequate consideration 4 5 Sum of money received without consideration (commonly known as monetary gift) by an individual or HUF 5 6 Specified movable property received without consideration (commonly known as non-monetary gift) by an individual or HUF 6 7 Specified movable property received without adequate consideration by an individual or HUF 7 8 Immovable property received without consideration by an individual or HUF 8 9 Immovable property received by an individual or HUF for a consideration which is less than its fair market value 9 10 Tax treatment of amount received from life insurance policy 9 11 Expenses allowed as deductions while computing income chargeable to tax under the head “Income from other sources” 10 12 Expenses not allowed as deductions while computing income chargeable to tax under the head “Income from other sources” 10 13 Case Laws 11 14 Bibliography & Webliography 17

- 2. 2 Introduction 1. BASIS FOR CHARGE:-The Following conditions must be satisfied for charging income to tax under income under the head income from other sources:- a) There must be an income. b) It should not be an exempt income. c) Such income should not be charged to tax under any other head of income. Therefore this head of income is also called as “residuary head of income”. 2. INCOMES TAXABLEUNDER THIS HEAD: - The various types of incomes taxable under this head can be classified into two parts. These are explained as follows:- SPECIFIC INCOMES: - Dividends Lotteries, crosswords, puzzles Races including horse races Card game or any other game Betting or gambling activity of any other nature Any other income which is not taxable under any other head of income.

- 3. 3 Incomes which are charged to tax under the head “Income from other sources” “Income from other sources”is the residual head of income. Hence, any income which is not specifically taxed under any other head of income will be taxed under this head. Further, there are certain incomes which are always taxed under this head. These incomes are as follows: As per section 56(2)(i), dividends are always taxed under this head. However, dividends from domestic company other than those covered by section2 (22)(e) are exempt from tax under section 10(34). Winnings from lotteries, crossword puzzles, races including horse races, card game and other game of any sort, gambling or betting of any form whatsoever, are always taxed under this head. Income by way of interest received on compensation or on enhanced compensation shall be chargeable to tax under the head “Income from other sources”, and such income shall be deemed to be the income of the year in which it is received, irrespective of the method of accounting followed by the assessee. However, a deduction of a sum equal to 50% of such income shall be allowed from such income. Apart from this, no other deduction shall be allowed from such an income. Gifts received by an individual or HUF (which are chargeable to tax) are also taxed under this head. In addition to above, following incomes are charged to tax under this head, if not taxed under the head “Profits and gains of business or profession”. a) Any contribution to a fund for welfare of employees received by the employer. [Section 56(2) (ic)]. b) Income by way of interest on securities. [Section 56(2) (id)]. c) Income from letting out or hiring of plant, machinery or furniture. [Section 56(2) (ii)]. d) Income from letting out of plant, machinery or furniture along withbuilding; both the lettings are inseparable. [Section 56(2)(iii)]. e) Any sum received under a Keyman Insurance Policy including bonus. [Section 56(2)(iv)].

- 4. 4 Relevance of method of accounting Income chargeable to tax under the head “Income from other sources”is to be computed in accordancewith the method of accounting regularly employed by the assessee. Hence, if the assesseefollows mercantile system, then income will be computed on accrual basis. If assesseefollows cashsystem, then income will be computed on cash basis. However, method of accounting does not affect the basis of charge in caseof dividend income and income by way of interest received on compensation or on enhanced compensation. Taxation of sum of money or property received without consideration or without adequate consideration From the taxation angle, sum of money or property received by an individual or HUF without consideration or without adequate consideration can be classified in following different categories: Sum of money received without consideration (commonly known as monetary gift). Specified movable property received without consideration (commonly known as non-monetary gift). Specified movable property received without adequate consideration. Immovable property received without consideration. Immovable property received without adequate consideration.

- 5. 5 Sum of money received without consideration (commonly known as monetary gift) by an individual or HUF The provisions relating to taxability of monetary gift received by an individual or HUF are as follows: On satisfaction of following conditions any sum of money (i.e., generally known as monetary gift) received by an individual/HUF without consideration will be charged to tax: a) The sum of money is received by an individual or HUF on or after 1-10-2009. b) Such sum of money is received without consideration. c) The aggregate value of such sum received during the previous year exceeds Rs. 50,000. The aforesaid provisions will not apply in the following cases: Money received from relatives (see note 1 below). Money received by a HUF from its members. Money received on occasion of the marriage of the individual. Money received under Will/ by way of inheritance. Money received in contemplation of death of the payer or donor. Money received from a local authority. Money received from any fund, foundation, university, other educational institution, hospital or other medical institution, any trust or institution referredto in section 10(23C). Money received from a trust or institution registered under section12AA. Note 1 : Relative for this purpose means: a) Spouse of the individual; b) Brother or sister of the individual; c) Brother or sister of the spouse of the individual; d) Brother or sister of either of the parents of the individual; e) Any lineal ascendant or descendent of the individual; f) Any lineal ascendant or descendent of the spouse of the individual; g) Spouse of the person referred to in (b) to (f)above

- 6. 6 Specified movable property received without consideration (commonly known as non-monetary gift) by an individual or HUF Any specified movable property received without consideration (i.e., received by way of a gift) by an individual/HUF is charged to tax, if the following conditions are satisfied: i. Any specified movable property is received by an individual or HUF on or after 1-10-2009. ii. Such property is received without consideration. iii. The aggregate fair market value of such properties received by the assessee during the previous year exceeds Rs. 50,000. Specified movable property means shares/securities, jewellery, archaeological collections, drawings, paintings, sculptures or any work of art and with effect from 1- 6-2010 bullion, being capital asset of the assessee. In above case, the fair market value of the specified movable property will be treated as income of the receiver. The aforesaid provisions will not apply in the following cases: Property received from relatives (see note 1). Property received by a HUF from its members. Property received on occasionof the marriage of the individual. Property received under Will/ by way of inheritance. Property received in contemplation of death of the payer or donor. Property received from a local authority. Property received from any fund, foundation, university, other educational institution, hospital or other medical institution, any trust or institution referred to in section 10(23C). Property received from a trust or institution registered under section 12AA.

- 7. 7 Specified movable property received without adequate consideration by an individual or HUF Any specified movable property acquired for less than its fair market value by an individual/HUF is charged to tax if the following conditions are satisfied: i. Any specified movable property is received by an individual or HUF on or after 1-10-2009. ii. Such property is received for a consideration, but aggregate fair market value of such properties received by the assesseeduring the previous year exceeds the consideration of these properties by Rs. 50,000. In other words, the aggregate fair market value of all such properties is higher than the consideration and the aggregate gap is more than Rs. 50,000. Specified movable property means shares/securities, jewellery, archaeological collections, drawings, paintings, sculptures or any work of art and with effect from 1-6-2010 bullion, being capital asset of the assessee. In above case, aggregate fair market value in excess of aggregate consideration of such properties will be charged to tax. The aforesaid provisions will not apply in the following cases : Property received from relatives (see note 1). Property received by a HUF from its members. Property received on occasionof the marriage of the individual. Property received under Will/ by way of inheritance. Property received in contemplation of death of the payer or donor. Property received from a local authority. Property received from any fund, foundation, university, other educational institution, hospital or other medical institution, any trust or institution referred to in section 10(23C). Property received from a trust or institution registered under section 12AA.

- 8. 8 Immovable property received without consideration by an individual or HUF Any immovable propertyreceived without consideration (i.e., received by way of a gift) by an individual/HUF is charged to tax, if the following conditions are satisfied: 1) Any immovable propertyis received by an individual or HUF on or after 1-10- 2009. 2) Such property is received without consideration. 3) The stamp duty value of such property exceeds Rs. 50,000. In above case, the stamp duty value of the property adopted by the Stamp Valuation Authority for charging stamp duty will be treated as income of the receiver. Nothing contained in aforesaid provisions will apply in the following cases: Property received from relatives (see note 1). Property received by a HUF from its members. Property received on occasionof the marriage of the individual. Property received under Will/ by way of inheritance. Property received in contemplation of death of the payer or donor. Property received from a local authority. Property received from any fund, foundation, university, other educational institution, hospital or other medical institution, any trust or institution referred to in section 10(23C). Property received from a trust or institution registered under section 12AA.

- 9. 9 Immovable property received by an individual or HUF for a consideration which is less than its fair market value Where in case of an individual or HUF, if any immovable property is received without adequate consideration (i.e. a case where the property is received for a consideration which is less than the stamp duty value of the property by an amount exceeding Rs. 50,000), then, the stamp duty value of the property as exceeds such consideration will be treated as income of such individual or HUF. Nothing contained in aforesaid provisions will apply in the following cases: Property received from relatives (see note 1). Property received by a HUF from its members. Property received on occasion of the marriage of the individual. Property received under Will/ by way of inheritance. Property received in contemplation of death of the payer or donor. Property received from a local authority. Property received from any fund, foundation, university, other educational institution, hospital or other medical institution, any trust or institution referredto in section10(23C). Property received from a trust or institution registered under section 12AA. Tax treatment of amount received from life insurance policy Any amount received under a life insurance policy, including bonus is exempt from tax under section10(10D). However, following points should be noted in this regard: Exemption is available only in respect of amount received from life insurance policy. Exemption under section 10(10D) is unconditionally available in respect of sum received for a policy which is issued on or before March 31st, 2003, however, in respect of policies issued on or after April 1st, 2003, the exemption is available only if the amount of premium paid on such policy in any financial year does not exceed 20% (10% in respect of policy taken on or after April 1st, 2012) of the actual capital sum assured. It should be noted that amount received on death of the person will continue to be exempt without any condition. Value of premium agreed to be returned or of any benefit by way of bonus (or otherwise), over and above the sum actually assured, which is received under the policy by any person, shall not be taken into account while calculating the actual capital sum assured.

- 10. 10 Expenses allowed as deductions while computing income chargeable to tax under the head “Income from other sources” Following major deductions are available from income chargeable to tax under the head “Income from other sources”: a) Commission or remuneration for realising dividends (if not covered under section 115-O which is exempt) or interest on securities [Section57 (i)]. b) Any sum received by an employer from employees as contribution towards any welfare fund of such employees is first included as income of the employee, and if the employer credits such sum to the employee’s account under the relevant fund on or before the due date (of such fund), then such amount (i.e., employee’s contribution) is deductible from the income of the employer [Section 57(ia)]. c) Current (not capital) repairs, insurance premium and depreciation in respect of plant, machinery, furniture and buildings are deductible from rent income earned by letting out of plant, machinery, furniture and building, which are chargeable to tax under section 56(2)(ii)/(iii). d) A deduction of lower of Rs. 15,000 or 33 1/3% of such income is available in case of income in the nature of family pension (i.e., regular monthly amount payable by the employer to the family members of the deceased employee) [Section 57(iia)]. e) Under section 57(iii), deduction is available in respect of any other expenditure (not being in the nature of capital expenditure) laid out or expended wholly and exclusively for the purpose of making or earning such income during the relevant previous year. Expenses not allowed as deductions while computing income chargeable to tax under the head “Income from other sources” Under section 58, following expenditures are not deductible while computing income chargeable to tax under the head “Income from other sources”: Personal expenditure [Section 58(1)(a)(i)]. Any interest chargeable under the Act which is payable outside India on which tax has not been paid or deducted at source [Section 58(1)(a)(ii)]. Any amount paid which is taxable under the head “Salaries” and payable outside India on which tax has not been paid or deducted at source [Section 58(1)(a)(iii)]. Sum paid on account of wealth-tax is not deductible under section 58(1A). Amount specified under section 40A is not deductible [Section 58(2)].

- 11. 11 Case Laws 1 CIT v. Ambassador Travels (P) Ltd. (2009) 318 ITR 376 (Del.) Would the provisions of deemed dividend under section2(22)(e)be attracted in respectof financialtransactionsenteredinto in the normal courseof business? Under section 2(22)(e), loans and advances made out of accumulated profits of a company in which public are not substantially interested to a beneficial owner of shares holding not less than 10% of the voting power or to a concern in which such shareholder has substantial interest is deemed as dividend. However, this provision would not apply in the case of advance made in the course of the assessee’s business as a trading transaction. The assessee, a travel agency, has regular business dealings with two concerns in the tourism industry dealing with holiday resorts. High Court’s Observations & Decision: The High Court observed that the assessee was involved in booking of resorts for the customers of these companies and entered into normal business transactions as a part of its day-to-day business activities. The High Court, therefore, held that such financial transactions cannot under any circumstances be treated as loans or advances received by the assessee from these concerns for the purpose of application of section 2(22)(e).

- 12. 12 2 Raj Kumari Agarwal vs. DCIT (ITAT Agra), I.T.A. No.: 176/Agra/2013, Date of pronouncing the order : July 18th, 2014 Interest Expense incurred to earn Interest Income is allowable – Section 57(iii) During the course of the assessment proceedings, the Assessing Officer noticed that the assessee had made a fixed deposit of Rs 1,00,00,000 with ICICI Bank and earned interest of Rs 11,77,574 on these deposits. However, while computing the income from other sources, the assessee claimed a deduction of Rs 4,36,705 on account of interest paid on loan of Rs 75,00,000 taken, on the security of deposits. When asked to justify this deduction, the assessee submitted that the assessee needed her funds, as she had to give money to her son and with a view to avoid premature encashment of the fixed deposits, for that purpose, which would have resulted in net loss to her, she took a loan against fixed deposit so as to keep the fixed deposit intact and earn the interest income thereon. It was contended that the interest of Rs 4,36,705 thus paid on the borrowings from ICICI Bank, against security of fixed deposit, was thus made for the purpose of earning FDR interest income of Rs 11,77,574. The Assessing Officer was, however, not impressed with this plea. He rejected the claim of deduction for Rs 4,36,705 with rather cryptic observations that, “since the expenditure of Rs 4,36,705 being accrued interest on loan has not been laid out or expended wholly and exclusively for the purpose of making or earning income from FDRs, claim of the assessee isnot correct and not admissible in view of the provisions of Section 57 (iii) of the Act”. Aggrieved by the stand so taken by the Assessing Officer, assessee carried the matter in appeal before the CIT(A) but without any success. There is no dispute that interest income in this case is to be taxed as an ‘income from other sources’. Section 57(iii) of the Act clearly provides that “the income chargeable under the head ‘ income from other sources’ is to be computer making the deduction, namely.. (inter alia)… any…expenditure (not being in the nature of capital expenditure) laid out or expended wholly and exclusively for the purpose of making or earning such income”. It is thus clear that as long as an expenditure is incurred wholly or exclusively for the purpose earning an income, such an expenditure constitutes an admissible deduction in computation of the income. The question that we really need to adjudicate on is, therefore, whether or not income paid on interest against the fixed deposits can be said to have been incurred “wholly and exclusively” for the purpose of earning interest income from fixed deposits.

- 13. 13 As long as the expense is incurred wholly and exclusively for the purpose of earning an income, even if it is not necessarily for earning that income, it will still be deductible in computation of income. What thus logically follows is that even in a situation in which proximate or immediate cause of an expenditure was an event unconnected to earning of the income, in the sense that the expenditure was not triggered by the objective to earn that income, but the expenditure was, nonetheless, wholly and exclusively to earn or protect that income, it will not cease to be deductible in nature. It is also important to bear in mind the fact that a borrowing against fixed deposit cannot be considered in isolation of a fixed deposit itself inasmuch as, going by the admitted facts of this case, the interest chargeable on the fixed deposit itself is linked to the interest accruing and arising from the fixed deposit. On these facts, in order to protect the interest earnings from fixed deposits and to meet her financial needs, when an assessee raises a loan against the fixed deposits, so as to keep the source of earning intact, the expenditure so incurred in wholly and exclusively to earn the fixed deposit interest income. The authorities below were apparently swayed by the fact that the borrowings were triggered by assessee’s financial needs for personal purposes and, by that logic, the borrowing cannot be said to be wholly and exclusively for the purposes of earning interest income, but what this approach overlooks is whether the expenditure is incurred for directly contributing to the beginning of or triggering the source of income or whether the expenditure is for protecting, and thus keeping alive, that source of income, in either case it is expenditure incurred wholly and exclusively for the purpose of earning that income. The assessee indeed required that money, so raised by borrowing against the fixed deposits, for her personal purposes but thats not relevant for the present purposes. The assessee could have gone for premature encashment of bank deposits, and thus ended the source of income itself, as well, but instead of doing so, she resorted to borrowings against the fixed deposit and thus preserved the source of earning. The expenditure so incurred, in our considered view, is an expenditure incurred wholly and exclusively for earning from interest on fixed deposits. We are alive to the fact that in the case of a business assessee, and in a situation in which the borrowings against fixed deposits were resorted to for use in business, consideration for end use of funds so borrowed would be relevant because the interest deduction is claimed as a business deduction under section 36(1)(iii). That aspect of the matter, however, is academic in the present context as the limited issue for our consideration is whether or not, on the facts before us, the interest on borrowings against the fixed deposits could be said to protect the interest income from fixed deposit interest and thus, incurred wholly and exclusively for the purposes of earning such income.

- 14. 14 3 CIT v. Parle Plastics Ltd. (2011) 332 ITR63 (Bom.) What are the tests for determining “substantial part of business” of lending company for the purpose of application of exclusion provision under section 2(22)? High Court’s Observations: Under section 2(22), “dividend” does not include, inter alia, any advance or loan made to a shareholder by a company in the ordinary course of its business, where the lending of money is a substantial part of the business of the company. The expression used in the exclusion provision of section 2(22) is "substantial part of the business". Sometimes a portion which contributes a substantial part of the turnover, though it contributes a relatively small portion of the profit would be termed as a substantial part of the business. Similarly, a portion which is relatively small as compared to the total turnover, but generates a large portion, say, more than 50% of the total profit of the company would also be a substantial part of its business. Percentage of turnover in relation to the whole as also the percentage of the profit in relation to the whole and sometimes even percentage of manpower used for a particular part of the business in relation to the total manpower or work force of the company would be required to be taken into consideration for determining the substantial part of business. The capital employed for a specific division of a company in comparison to total capital employed would also be relevant to determine whether the part of the business constitutes a substantial part. In this case, 42% of the total assets of the lending company were deployed by it by way of loans and advances. Further, if the income earned by way of interest is excluded, the other business had resulted in a net loss. These factors were considered in concluding that lending of money was a substantial part of the business of the company. High Court’s Decision: Since lending of money was a substantial part of the business of the lending company, the money given by it by way of advance or loan to the assessee could not be regarded as a dividend, as it had to be excluded from the definition of "dividend" by virtue of the specific exclusion in section 2(22).

- 15. 15 4 Pradip Kumar Malhotra v. CIT (2011) 338 ITR 538 (Cal.) Can the loan or advance given to a shareholder bythe company,in return of an advantage conferred on the companyby the shareholder,be deemed as dividend undersection 2(22)(e)in the hands of the shareholder? Facts of the case: In the present case, the assessee, a shareholder holding substantial voting power in the company, permitted his property to be mortgaged to the bank for enabling the company to take the benefit of loan. The shareholder requested the company to release the property from the mortgage. On failing to do so and for retaining the benefit of loan availed from bank, the company gave advance to the assessee, which was authorized by a resolution passed by its Board of Directors. Issue: The issue under consideration is whether the advance given by the company to the assessee-shareholder by way of security deposit for keeping his property as mortgage on behalf of company to reap the benefit of loan, can be treated as deemed dividend within the meaning of section 2(22)(e). High Court’s Observations: In the above case, the Calcutta High Court observed that, the phrase "by way of advance or loan" appearing in section 2(22)(e) must be construed to mean those advances or loans which a share holder enjoys simply on account of being a person who is the beneficial owner of shares (not being shares entitled to a fixed rate of dividend whether with or without a right to participate in profits) holding not less than 10% of the voting power. In case such loan or advance is given to such shareholder as a consequence of any further consideration which is beneficial to the company received from such a shareholder, such advance or loan cannot be said to a deemed dividend within the meaning of the Act. Thus, gratuitous loan or advance given by a company to a share holder, who is the beneficial owner of shares holding not less than 10% of the voting power, would come within the purview of section 2(22)(e) but not to the cases where the loan or advance is given in return to an advantage conferred upon the company by such shareholder. High Court’s Decision: In the present case, the advance given to the assessee by the company was not in the nature of a gratuitous advance; instead it was given to protect the interest of the company. Therefore, the said advance cannot be treated as deemed dividend in the hands of the shareholder under section 2(22)(e).

- 16. 16 5 CIT v. Manjoo and Co. (2011) 335 ITR 527 (Kerala) Can winnings of prize money on unsold lottery tickets held by the distributor oflottery tickets be assessedas businessincome and be subjectto normalrates of tax instead of the rates prescribed under section 115BB? High Court’s Observations: On the above issue, the Kerala High Court observed that winnings from lottery is included in the definition of income by virtue of section 2(24)(ix). Further, in practice, all prizes from unsold tickets of the lotteries shall be the property of the organising agent. Similarly, all unclaimed prizes shall also be the property of the organising agent and shall be refunded to the organising agent. The High Court contended that the receipt of winnings from lottery by the distributor was not on account of any physical or intellectual effort made by him and therefore cannot be said to be "income earned" by him in business. The said view was taken on the basis that the unsold lottery tickets cease to be stock-in-trade of the distributor because, after the draw, those tickets are unsaleable and have no value except waste paper value and the distributor will get nothing on sale of the same except any prize winning ticket if held by him, which, if produced will entitle him for the prize money. Hence, the receipt of the prize money is not in his capacity as a lottery distributor but as a holder of the lottery ticket which won the prize. The Lottery Department also does not treat it as business income received by the distributor but instead treats it as prize money paid on which tax is deducted at source. Further, winnings from lotteries are assessable under the special provisions of section 115BB, irrespective of the head under which such income falls. Therefore, even if the argument of the assessee is accepted and the winnings from lottery is taken to be received by him in the course of his business and as such assessable as business income, the specific provision contained in section 115BB, namely, the special rate of tax i.e. 30% would apply. High Court’s Decision: The High Court, therefore, held that the rate of 30% prescribed under section 115BB is applicable in respect of winnings from lottery received by the distributor.

- 17. 17 Bibliography & Webliography Books: Student’s handbook on Taxation by TN Manoharan. Publisher: Snowwhite-2014. Taxation IPC Study Material by ICAI. Websites: http://taxguru.in/income-tax-case-laws/interest-expense-incurred-earn-interest-income- allowable-section-57iii.html http://www.incometaxindia.gov.in/Tutorials/Income-from-other-sources-Theoritical.pdf http://www.lawzonline.com/bareacts/income-tax-act/section57-income-tax-act.htm http://resource.cdn.icai.org/26941bos16384DTL.pdf