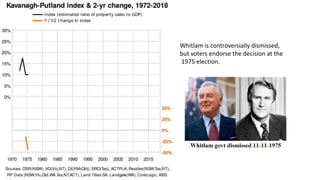

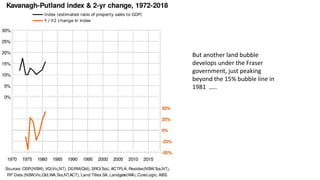

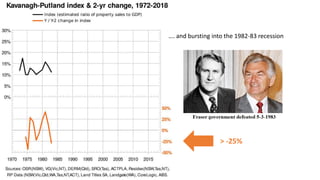

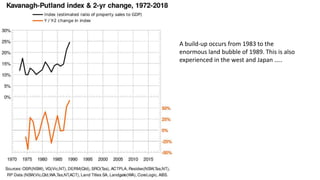

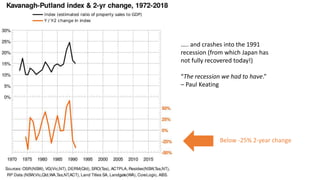

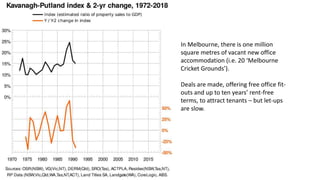

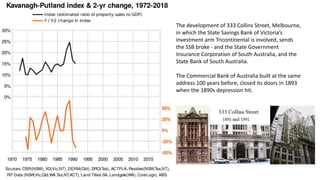

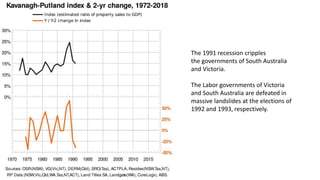

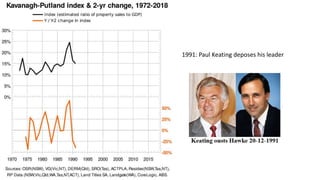

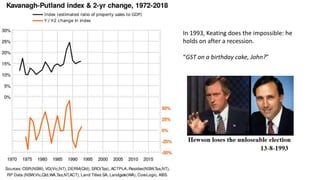

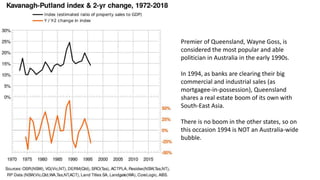

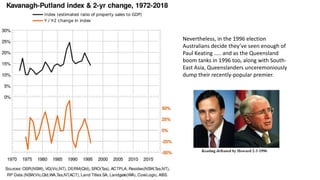

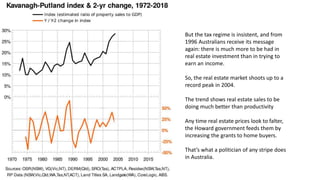

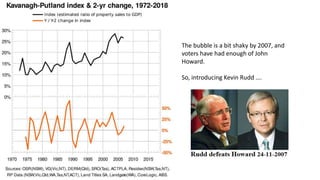

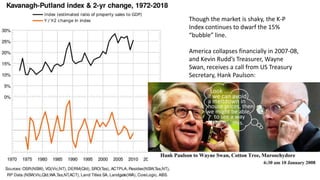

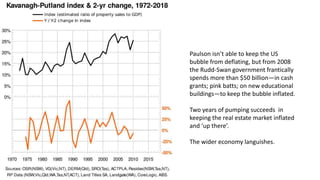

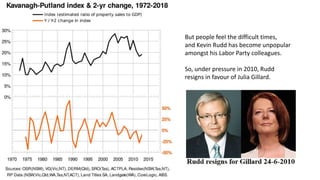

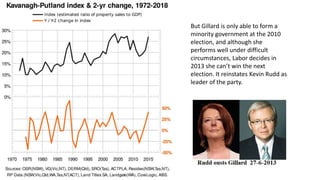

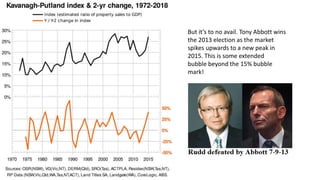

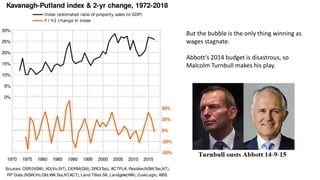

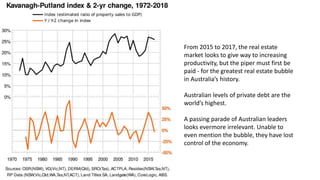

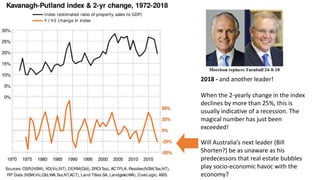

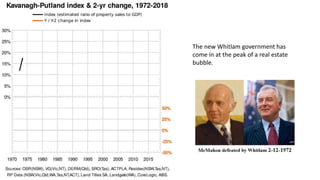

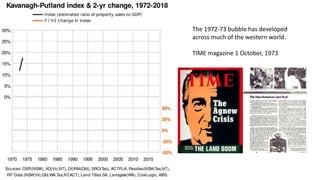

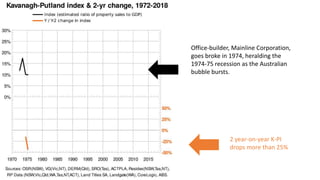

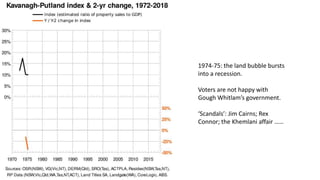

The document reviews the history of real estate bubbles in Australia from 1972 to 2018, highlighting significant events including the economic impacts of various political administrations. It details cycles of real estate growth and subsequent recessions, illustrating how government policy has often exacerbated these trends. The Kavanagh-Putland Index is used to track total real estate sales against GDP, indicating patterns of economic instability driven by these bubbles.

![But could it be that swinging voters are

carrying excessive debt, and need a

scapegoat when the 1974-5 recession

hits?

[The bubble has been all but written out

of economic history.]

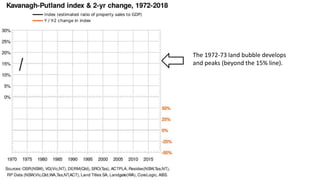

The 1972-73 land bubble develops and

peaks, beyond the 15% line](https://image.slidesharecdn.com/kpiprosperaustralia-190117003129/85/The-Economy-Made-Easy-7-320.jpg)