Creative Real Estate for a Bad Market

- 4. TABLE OF CONTENTS Introduction SECTION I – Real Estate Trade Secrets Legacy Real Estate First Time Buyers Holdover Subdivisions Execotel Condo-plex Upside Down Commercial Real Estate Business Cycles Apartments Office Buildings Shopping Centers Industrial and Manufacturing Properties Bad Farm Years Situational Enhancements REIT of REITS Condo Quarters Leftover Timeshares Homeless Solutions Buffer Building Sweat Equity Trades Real Estate Games

- 5. Converting Digital Credits (Barter Dollars) into Cash Community Apartments Undivided Interest in Recreational Developments Space Condos Flow Charts Classified Advertising Forms SECTION II – Barter Techniques Introduction to Barter Choosing a Business Make a List of Marketable Talents Make a List of Things You Would like to Accomplish in your Life Wish List Digital Credits and Barter Strategy Links to Barter and Digital Credit Organizations BBC – 3000 Restaurant Delivery Service Plus Barter Book Contact Management Opening Day Cash Conversion Other Case Histories Forms

- 6. SECTION III – Book of Solutions Universal Problems International Problems National Problems Local Problems Bibliography Internet Links ABOUT THE AUTHOR

- 7. INTRODUCTION Problem solving for a down market in the real estate world involves both the practical and the esoteric. This ranges from simple tenant problems to space condo development. Creative solutions, outside the norm, sometimes have incredible results. An attempt to illustrate some of the ways used to deal with any real or perceived problems in this arena will be addressed within the pages of this book. An additional section is included on how to start and run a business using digital credits and bartering techniques. All of the sections in this book will be continually updated. Real estate professionals will be encouraged to contact the author with suggestions and practical solutions that could contribute to the subject at hand. The question and answer section will initially contain questions considered important to the author but other questions will be added. The readers are encouraged to submit requested answers to valid inquiries. The author will attempt to give you possible solutions. The best questions will be used in updated versions of this book and posted on our website. (Web address) The questions answers may also be used on the author’s Pod cast. Each example will include a flow chart unless the solution is too simple to bother with this type of information. Some of these deals have been done before by the author and some are in the process of being tested to see how well they work. As each solution in progress develops, the author will update this book for the readers enjoyment. Included will be some background techniques in the art of barter using digital credits and barter dollars. This tutorial will be more than just the basics. It will include tried and true methods of starting and running a business with barter as a major tool for success. A separate bibliography on this subject will be placed at the end of the chapter. Political problems will also be addressed as a backdrop to both causing problems and providing solutions. This subject will be the major thrust of our Pod cast. Each obstacle will be clearly defined including some political commentary from the author. All political commentary will come from the point of view of a positive capitalist. The socialist/ communist influences perpetrated on private property owners will be exposed from every angle to help the reader understand the hidden motives of “The American Power Triangle”. SEE: The Evolution of the International Capitalist Party. This ICON will be placed somewhere during any political discussion with a link to the subject on the Internet. This ICON will be placed on all the other links. Forms will be included with links to their usage in each of the example transactions.

- 8. SECTION I REAL ESTATE TRADE SECRETS

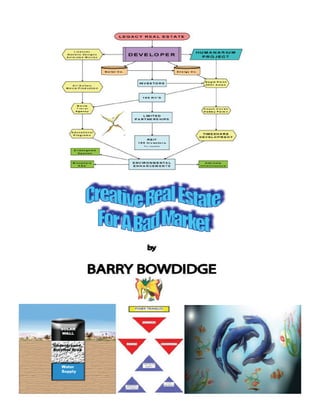

- 9. LEGACY REAL ESTATE The ride will start with a legacy deal that’s already in progress. My legacy deal should show how everything in real estate isn’t set in stone. The solution is provided by combining existing methods of doing business with some unusual goals and concepts. Conventional Items • Land with extreme beauty and access • Non profit organization (Humanarium Project) • A series of Limited Partnerships • Form a Real Estate Investment Trust (REIT) • Real Estate Brokers License • Recreation Vehicles • Solar and Wind Energy Company • Web Portal and Pod cast Non-conventional Items • Approximately two thousand five hundred genetic designs g • An international political party (www.plizzel.com) • A personal legacy concept • Animation and movie making skills • “Internet Only” incorporation process (Cyber-corporations web site) • Coach condo timeshares Land with extreme beauty and access There are currently two properties under consideration. Two hundred acres at Eagles Peak in San Diego County in California is at the top of the list. It is next to large parcels currently owned by an environmental group on one side and the Cleveland National Forest on another side. The view is spectacular of an area known as “The Gorge”, with one waterfall in full view and another within close walking distance. The initial purchase price will be a little over one million dollars. There are currently four parcels. A large estate home can be built on each of the parcels. The largest parcel should qualify for another lot split. Personal Legacy Concept As avid environmentalist and a positive capitalist, a plan that reconciles the current political factions will be developed using problem solving efforts that satisfy both disciplines. I know exactly what I want to do with my assets and future earnings. If you are interested in a legacy situation, this factor will enhance your chances of success. The nature of my plan allows me to use all of my training in a variety of fields plus several established real estate methods to optimize the project. 8 C r e a t i v e Re a l E state for a B ad Mar ke t

- 10. Non-profit Structure At the core of this solution is the proper establishment of the Humanarium Project. The initial paperwork with state is fairly simple. (SEE: FORMS – Non- profits) To fully qualify as a non-profit with the IRS, it is much more complicated. (SEE: FORMS – IRS) From the beginning, as a director, I’ll be the main donator of assets. After the paperwork is approved, other individuals and groups can participate, if they so choose. Limited Partnerships and REITS To qualify as a real estate investment trust (REIT), there must be one hundred or more investors to start the REIT. There are clear rules the originating Broker must follow that are outlined by State and Federal laws. (SEE: FORMS – REITS) One way to do that is to have enough investors in limited partnerships to convert to a REIT. There are many advantages for the investors to convert. Real estate equities are converted to shares. g This method increases the liquidity of the investor’s real estate holding and allows for partial withdrawal of funds by selling shares on the open securities markets. www.nareit.org Recreation Vehicles Two markets are slow right now. (2007) The housing market and the recreation vehicle market are both down for different reasons. Over a reasonable period of time, most personal property goes down in value while most real estate increases in value. By using RV’s at their full appraisal value as all or part of a down payment on real estate, the owner of the recreation vehicle is able to reverse his losses and possibly get a better value in the process. Buying in a down real estate market is usually where the best bargains are found. In this case the broker agrees to take the RV’s as commissions on the various transactions. This effectively cash converts the recreation vehicles for both the buyers and sellers and increases the choices for the RV owners. It is best for the broker to present properties to the RV owners that want to purchase another property larger than the one they have. This creates a three-way trade. This type of transaction traditionally has a better chance of closing than a two-way trade. Larger more expensive RV’s can be traded using three way trades instead of direct two-way transactions. This way of doing business is a way of discounting a real estate commission and the broker takes on all the problems of recreation vehicle ownership. (SEE: DOM the movie) To be able to absorb a large contingent of recreation vehicles, I’ve started a special business to handle as many RV’s as I can manage to earn doing trades. (SEE: DOM the movie) Each of these real estate deals has the potential of being set up as a limited partnership and then later converted to a REIT for liquidity. The recreation vehicles come into play at the Eagle Peak Development. (SEE: Legacy Flow Chart) The primary mission of the Humanarium Project is environmental enhancement. The local zoning ordinances allow up to five homes built on the acreage. Our plan is to build only one structure above ground. The other structures will be built Cr e a tive Re a l Esta te f or a Ba d M a r k e t 9

- 11. underground to minimize the visual disturbance of the landscape. Enhancement features include the following: • Underground coach condos leave the land above in its natural state. These coach condos are just large rectangular steel rooms with huge doors that give the recreation vehicles drive through capabilities. The building acts as a huge living room. There is a full bathroom and RV dump system. • The coach condos will be timeshared and the profits will be kept within the Humanarium Project to enhance the property. • Timeshare association fees will also be used to enhance the entire project with more indigenous plants and animals. • The fees and profits will also be used to improve the walking trails and educational programs made available to the public. • The association will have rules to prohibit above ground parking except at the entrance next to the main public building. • There will be deed restrictions that only allow small electric vehicles on the trails. • Endangered species will be introduced and cared for, if it is determined possible and good for the species. (Gnatcatchers, Kangaroo Rat, etc.) • Water systems developed and maintained to increase the vegetation and create ponds for the local animal population. Solar Company – Blackwind Energy, Inc The one above ground building will be a multi-use structure. The placement of the building will be right on Eagle Peak road with the best possible views to the northwest featuring spectacular views of “The Gorge”. The building will be open to the public. The structure of the building will be rectangular steel, two-story design with solar walls scientifically oriented to capture maximum solar exposure. Small windmills will be strategically placed for cogeneration for the common use of the entire development. Back-up generators will be installed to insure continuous power. The founder of the Humanarium Project owns a solar and wind energy company (SEE: www.plizzel.com) Genetic Art and Animated Art Movies www.iucn.org The co-generation public building will be a combination Art Gallery, Movie Studio and Educational complex. The founder of the Humanarium Project is an artist that has already produced over two thousand five hundred genetic designs. They will all be available for viewing by the general public. Each image has both a first and last name and a tax ID number. Each creature is also assigned an endangered species. All income from the licensing of any image will be used to help save these species. Animated movies will be produced using these characters on site by BWB Films, Inc. All of these movies and any pre-released versions will be available for viewing and purchasing by visitors. An educational program will be developed for the public use of the facility. The subject matter will include the following: 10 Cr e a t i v e Real E state for a B ad Ma r ke t

- 12. • • Drawing programs • Genetics • Animation • Movie making • Endangered species awareness • Alternate future housing • International political awareness (ICP) Some of the other tools available to help develop or promote the Humanarium Project includes a barter organization that can make barter credits available for any number or reasons. Another tool will be our websites and pod casts for promotional purposes. We even have a new Internet incorporation site to generate income. To help the reader understand this legacy structure, a flow chart is included. A typical script synopsis and budget for the movie travel packages follow. The second property is a 50,000-acre parcel in Kern County, California with basically the same legacy plan. The advantage of going with this property would be the almost endless supple of available land. The combination of the Coach Condo concept and the Bad Farm solution could make this a very valuable property for both the present owners and the developer. As a mountainous area the underground Coach Condos could be designed with interesting views without disturbing the eco-system or the general look of the property. A new group of underground designers could be called into play. Some of these professional already exist and will be documented with links to their presence on the Web. The possible disadvantage would be the access and possible infrastructure costs of such a large remote development. A joint venture between the current owners and the developer may be the best solution. The other possibility would be bringing in outside investors using a limited partnership, corporate or LLC legal structure. My personal preference would be selling off small parcels with plans to raise the funds for the rest of the development. This can be done with a series of options and release clauses based on performance by the developer. All funds would be in a performance trust fund to assure the security of the funds raised for the current land owners and any investors brought into the project. Each section must first be preplanned with the appropriate drawings and engineering reports. The whole project should have a professional futuristic computer generated concept vision using the latest design software to show anyone interested in the development the direction this land will be heading toward. The finished images should be posted on the Web. Cr e a tive Re a l Esta te f or a Ba d M a r k e t 11

- 13. 12 Cr e a t i v e Real E state for a B ad Ma r ke t

- 14. DOM SYNOPSYS The story is only an example of a script designed to be used as one of many that can be performed by tourists while on a theme vacation package. Demographically, the baby boomers are the best market to target for travel. Approximately fifty percent of the boomers are currently single. This movie script is a tongue and cheek look at the “dirty old men and dirty old women” situation that many of these boomers will find themselves in at this junction in time. (2007) This is a motor home trip but most of the time the participants will be staying in hotels or motels. The recreation vehicle is mostly for travel comfort and social interplay. Some of the RV’s will be converted to all electric vehicles. All of them will have Internet and office capabilities. This will help travelers keep in touch with their work while on a long vacation. Most vacation packages will be thirty days or more. Each caravan will consist of four or more recreation vehicles. One RV will be for the crew, the movie and sound equipment and the director. Each tourist will be instructed on how to become a storyboarder. A storyboarder is an amateur actor used to storyboard a script for the possible use by professionals. The movie made during the trip will have three uses. Each storyboarder will have a copy of the uncut version for their home movie collection. One edited version will be submitted for possible use on a reality TV show. Another final cut will be marketed for full production using professionals that use our version as a guideline; hence the name “storyboarders”. The groups will have new scripts custom designed for the individuals involved. This script will be archived for possible re-use if the theme becomes popular. There will always be room for improvisation by the storyboarders. Having fun will be more important than trying to go strictly by the script The plot is fairly simple but has many twists and turns with a lot of surprises. Because the owner is both one of the writers and animators, additional scenes will be edited beyond the raw footage. This technology will allow for story and visual enhancement beyond the storyboarders performance. Each older male will be traveling with two younger females. This is designed to set up the audience for their negative prejudicial attitudes. It will be made to appear that these men are financing the trip and taking advantage of gullible younger women anxious to be rich and famous. To break this negative spell, an older female storyboarder will be revealed to be the moneybags behind the whole trip. She will be traveling with two young men perceived to be her gigolos. The underlying soap opera will consist of all the younger all the younger storyboarders sneaking off to be with each other. Several crew members will balance off this equation. Gangsters, politicians and strange new species will be added to the mix. Even a few ET’s will be included just to jazz up the story. All versions will include the added features. Cr e a tive Re a l Esta te f or a Ba d M a r k e t 13

- 15. DOM BUDGET DISCRIPTION: Four motor homes traveling across the country and north to Baltimore and returning in a thirty-day period. The trip starts in San Diego. Major stops include Phoenix, Houston, Atlanta and the Baltimore area. There are twelve storyboarders being paid one hundred dollars per day plus basic expenses. At each of the major stops, rooms will be rented and various side trips will be taken by plane, bus, train or boat by everyone on the vacation. ITEMIZED EXPENSES: *Motor home rental: 4 units @ $6,686 per unit $26,744 Motor home insurance: $16 per day per vehicle for 30 days $1,920 Gas: @ 10 miles per gal x 4 x $3 per gal x 3159 miles x 2 $7,582 Salaries: $100 per day x 12 x 30 $36,000 Per Diem: $50 per day x 12 x 30 $18,000 Room rental: $25 per day x 12 x 30 $9,000 Side trips: 2 per major area x 4 x 12 storyboarders Tickets and extras @ $100 per day $9,600 Equipment: Canon Hi Def movie camera @ 24 fpm @ $300 per day $9,000 (Recommend purchase for approximately the same price) Miscellaneous equipment, lights, sound, etc $5,000 Contingency fund: $10,000 TOTAL EXPENSES: $132,845 *Use $26,744 to purchase 2nd motor home; drive Betsy plus 2 autos as an alternate plan. Keep motor homes in DOM Corporation. Note: Main route driving time one way – 52 hours or 104 hours roundtrip 14 Cr e a t i v e Real E state for a B ad Ma r ke t

- 16. FIRST TIME BUYERS PERSONAL PROPERTY TRADES FOR REAL ESTATE The use of motor homes and luxury cars during a down turn in the real estate market offers several great opportunities for buyers, sellers and brokers. The legacy transaction mentioned earlier includes several features that will be outlined below. One of the worst problems that will be facing most first time buyers is the fact that home prices are way out of their budget. A split equity solution can help potential homebuyers if they are sellers of recreation vehicles and expensive automobiles. By structuring a Limited Partnership with the broker being the General Partner and Trustee of the joint purchase solution, a qualified purchase of a home or condo can be arranged. The ownership formula can be adjusted to fit each individual purchase. A good example is a California home with average price and financing as follows: • Purchase price: $500,000 • Commission @ 6%: $30,000 • Cash down payment/first time buyer: $20,000 • First trust deed 80%: $400,000 ARM @ 4% - 5 year • Second trust deed plus PMI: $50,000 @ current rate Breakdown of Ownership • Motor home or luxury vehicle owner - $20,000 value (accepted by broker for part or the commission) 40% equity in the home • New owner/resident - $20,000 cash – 40% equity in the home • Broker equity retained - $10,000 – 20% equity in the home Terms and Conditions The first time buyer has the right of occupancy and a five-year lease option to purchase the twenty percent equity from the broker at appraised value. In the event the option isn’t exercised it is agreed that the property will be sold or converted into a REIT with similar properties for liquidity for all the parties. Lease payments include PITI and PMI if called for by the lender. Another way with the owner of two homes This is an actual account of an ongoing transaction to help a new home buyer get into a home that his family would ordinarily not be able to afford in the pricy Southern California housing market. The owner of the two homes was in a zero equity position on his newer home. There was a very good chance that he would soon be upside down on this property if the San Diego market continued to decline at its present pace. On his older home he needed to refinance because of an existing loan with very unfavorable terms. He does have a very solid equity in this home. His dilemma was how to qualify as an owner occupant on this house to get the best rates available. It currently had tenants paying rent. He was afraid he would have to let the newer home go into foreclosure because the loan on that house was also about to adjust. This would double the payments. He couldn’t afford the new payments and didn’t want to continue throwing good money after bad money. He knew the foreclosure would ruin his credit and make it impossible to refinance his older home. He planned to move his family back into the older home until the real estate market returned to a sellers market again. He told me about his situation while I was ordering a pizza at his restaurant. He is an old member of my barter organization. I suggested the following solution. The personal property in this case is digital credits or barter dollars that the developer uses to option the newer home as follows on this form: Cr e a tive Re a l Esta te f or a Ba d M a r k e t 15

- 17. 16 Cr e a t i v e Real E state for a B ad Ma r ke t

- 18. HOLDOVER SUBDIVISIONS Another good use for recreation vehicles and luxury cars as real estate investments is for the long-term investment in land for future development. One of the first types of real estate that goes into a buyers market is land that was scheduled for development when the home market crashed. Simple supply and demand forces dictate the timing. Many bargains are available from leveraged homebuilders that miss timed the market. These builders are more knowledgeable than most sellers and are more apt to accept and understand a creative solution in a bad market. Every property has a fire sale, wholesale and retail price. For this bad market solution to work the seller of the land must be willing to sell at fire sale prices or the property must be a “one of a kind” property like the example given in the preceding legacy solution. In other words, a large margin must be available to take all the water out of the personal property values but still give the investors a fair deal. While all numbers are adjustable to particular situations, the following example can be used as a general template: • Fire sale value/price - $1,000,000 • Wholesale value/price - $1,250,000 • Retail value/price - $1,750,000 Developer purchases land at wholesale price with a $250,000 down payment in vehicles. The purchase price is $1,250,000 with a 10% commission of $125,000 taken in full in personal property. This is basically a discounted commission structure that creates new buyers. The down payment of $250,000 is in the form of recreation vehicles, cars, etc. The seller carries back $1,000,000 in value. Terms and Conditions A limited partnership or LLC is formed with the following ownership breakdown based on the retail value with the seller having the entire markup and the broker holding five percent as general partner. The initial limited partners will have a 14.28% equity position in the land. The seller carry back value is set initially at $1,410,000 or 80.72% and is a combination of a trust deed and ownership in the limited partnership. The note is for $1,000,000 @ 5% interest payable yearly backed by the 80.72% equity position. Seller agrees to take acceptable personal property to accelerate the payback on the note and deliver percentage of their ownership based on values agreed upon using a release clause based on that percentage. Should the total pay back be less than $1,000,000 plus five percent interest per annum on a prorated basis not be paid, the residual balance after the full percentage is sold, the remaining borrows in the limited partnership agree to borrow enough to complete the contract. The limited partnerships’ goal is to own the land free and clear and then develop of sell when the market has peaked again. Another option the partnership should consider is merging into a real estate investment trust for better liquidity. In the event of a short fall, (residual balance) an interim loan will be placed on the property to pay off the seller. It will then be necessary to dilute the percentage owned by each investor to bring in enough cash to pay off this interim loan. By this time, cash buyers may be interested in the investment. If not, the same process of taking personal property for equity can be used to complete the transaction. Cr e a tive Re a l Esta te f or a Ba d M a r k e t 17

- 19. A monthly fee for taxes, insurance, management, etc will be assessed on a prorated basis to all the partners. Management duties include annual reports, maintenance and bookkeeping. Commissions on the resale of the seller’s equity shall be paid from the net sales of the recreation vehicles and automobiles by the seller as agreed between broker and seller. Broker should be open to taking said commissions in the form of personal property traded in for equity by buyers. While this is a way of discounting the commissions, it also greases the wheels and is a way of showing the investors that you do the same type of business as you have recommended to them. In this way you’ll be walking your talk. Remember, these investors will be your long-term clients if you show them positive results. As the market slows down, builders that didn’t anticipate a bad market are heading toward a financial abyss if they are undercapitalized. In most cases a final map offers the option of selling a completed house or individual lot sales to get rid of the inventory and pay off the underlying debt. It is also good to have a niche market to beat the trend. I’m currently working with a broker/owner on a subdivision that only has a tentative tract map. The city of Perris, California acts like they are trying to be the most politically correct city in the country. Either they think they are a branch office of the Smithsonian museum or an office of the Endangered Species Act. I thought they were weird a few years ago when they tried to charge me five hundred dollars per house for a rat fund. It made me wonder who the rats really were. This new property, in the middle of town, still is subject to the rat fee but they added some almost unbelievable condition. Now they have an assessment for burrowing owls that includes a full inspection by an approved qualified biologist. For some reason this part of the planet has been chosen to retain both a trained paleontologist to check for dinosaurs and certified archeologist to see if they can find the mission link. Another politically correct solution might work better with this local mind set than to choose butting heads with these commucrats. I just happen to be working with one of the major home manufacturers to have an assembly line process for photovoltaic shingles. By including a system that produces the entire electrical needs of the home our carbon footprint should be negligible. To offset the irritation factor that I’ll have to deal with, I’m preparing a special disclosure form that all new buyers will be required to read and sign. The disclosure will be of all the incidental fees and costs the builder has to pass on to the consumer because of government rules. A rebate request from the city will be included in the package for those that want to take action against the city for abusive taxation. If there is any builder’s profit, it will go to the Humanarium Project. This way the bureaucrats can’t pass the buck. Hopefully, we will be successful in irritating them and maybe even causing them some political embarrassment. It’s too bad we can’t affect their pocket books like they do ours. On the more positive side using solar manufactured housing allows a phased delivery system and a unique market. Lots can be sold separately with CC&R’s or just simple deed restrictions requiring conformity with the rest of the homes in the subdivision. Smaller builders would be a good market for lot sales. Pacing the market properly will make all the difference. Using trades and barter organizations can also accelerate the marketing process. 18 Cr e a t i v e Real E state for a B ad Ma r ke t

- 20. Cr e a tive Re a l Esta te f or a Ba d M a r k e t 19

- 21. EXECOTEL CONCEPT: Developer purchases high-end quality estates and quality furnishings. These homes must have at least four areas that are or can be made private and clearly defined. The property must already have a separate guesthouse or one must be built to house an onsite management couple. PURPOSE: Provide luxury housing at hotel prices with a more familiar home setting and individual service. The time can be structured like an extended stay rental; yearly, monthly or weekly. INITIAL STRUCTURE OF EXECOTEL’S FINANCIAL POSITION: Purchase: $1,800,000 Development costs: $200,000 Total: $2,000,000 Developer resells each unit for $1,000,000 based on the income numbers as a hotel situation for a total of $4,000,000. (Prepare a typical hotel Performa) There are several ways to purchase this home in a bad sellers market. If as a developer you can establish a business relationship with a primary lender. Their REO department should be able to keep you supplied with all the inventory you can handle during the current down turn in the market. Expensive homes are generally the first segment of the market to have foreclosures but that trend has been reversed due to technical corrections concerning the sub-prime mortgage problems. There is still a lot of high-end inventory to work with for Execotels. A contract can be made with the lender that gives the lender a floating participation percentage based on the time needed to market the four units at the projected prices. The lender must be covered against the losses that they would have taken under normal foreclosure situations. They will need normal interest paid during the marketing phase of development of the Execotel concept. The participation factor should be negotiated on individual properties. Some properties will be easier to market that others and some lenders will be more motivated to get relief from their REO inventory. In any case, the developer to insure a continued business relationship with the lender should negotiate a win/win contract. Going directly to owners before they loose their homes is another way to help them and create an Execotel property. As a developer and being single; a unique opportunity for the mutual benefit of both the seller and the developer exists. A listing agreement that includes an onsite house sitting arrangement can be initiated during the early stages of the marketing process. Many owners have moved on to another home and would appreciate a responsible house sitter during the development and marketing of this excess home. The broker must be nimble and careful to act in a proper fiduciary manner with his principal. Many lines are crossed with this solution so the broker must keep the owner abreast of his every move and make sure there is full understanding and agreement with the owner. From my experience this is best done with an owner that is also a real estate professional that understands the subtleties of the solution. Otherwise, you might be heading for useless lawsuits that just aggravate the problem instead of solving anything. It could be a monstrous waste of time if attempted with a civilian. (General public) Perhaps after a good enough track record is compiled by the broker/developer, the general public can be brought into the loop. A disclaimer and or a disclosure as to the risk assessment in attempting this solution should be standard practice by the developer. This should require signatures of all parties involved. A strong recommendation that the principles should consult a qualified real estate attorney before proceeding should be in BOLD FACE TYPE on the disclaimer/disclosure statement. 20 Cr e a t i v e Real E state for a B ad Ma r ke t

- 22. Cr e a tive Re a l Esta te f or a Ba d M a r k e t 21

- 23. CONDO-PLEX The condo-plex concept is a rescue mission for distressed apartment complexes and overbuilt or over converted condo developments in a community. El Cajon, California, a suburb of San Diego is known as a renters’ city. In an attempt to change their image, the local government agencies have fast tracked the condo conversion process for developers. Unfortunately, not only did they create a glut in the market but also the real estate market as a whole has gone into a slump. The author owned a company in Houston, Texas that specialized in fixer upper apartment complexes. The condo-plex name comes from the common usage of duplex for two units, triplex for three units, etc. The condo- plex concept allows all of these combinations to be side by side within the same development. There are more investors available to purchase smaller apartment complexes. The price per unit is almost always higher. The management problems quite often discourage new investors before they can purchase or trade up to larger complexes that have enough income to cover professional management. By using the condo-plex concept, all parties benefit. Even the initial objectives of the local government will be served albeit in a more natural market way. The developers are at the greatest risk in this equation. They’ve been tempted by high returns and government encouragement. This is a rare combination in a State that has more obstacles for builders and developers than just about anywhere in the country. While we can’t keep the timetable hoped for to turn renters into buyers, an interim stage can head off some of the probable disastrous consequences of massive foreclosures and failed conversions. By offering the units to small investors with existing tenants and professional management, a holding period for full conversion can happen as a work through solution. This will require lenders, home owners associations and developers cooperation. The condo-plex investors should get a wholesale price per unit. The condos should be deed restricted to call for an owner occupant upon resale by the condo-plex investor. This will give the investor a nice profit in the future and fulfill the aspirations of everyone involved. From a political point of view, this is just another example of good intentions being perverted by governments’ lack of understanding. You can’t dictate real estate markets. Supply and demand decisions should be taken out of government’s control. As an example from the twentieth century, building low income housing by the government should prove forever that they are incompetent. This was just a feel good political boondoggle that didn’t help anyone and cost the taxpayers billions of wasted dollars. The commucrats entrenched establishment was fully responsible for this fiasco and many more projects like it throughout our country. A “Bureaucrats Responsibility Act” should bring these people to task. Of the very least they should loose is pensions and barred from public employment forever. This lack of accountability is at the root of power abuse by the power triangle in this country. (SEE: plizzel.com) The initial step taken by the developer of condo-plex solutions is to examine the numbers and prepare a general plan. Assume a fifty unit complex at an average price of $250,000 per condo or a total retail price for the entire complex of $12,500,000. Assume a duplex in the area sells for approximately $225,000 per unit or a total retail price for the duplex of $450,000. Assume a triplex in the area sells for approximately $215,000 per unit or a total retail price for the triplex of $645,000. Assume a fourplex in the area sells for approximately $205,000 per unit or a total retail price for the fourplex of $820,000. The pricing structure should be as follows: Fire sale price - $175,000 per unit for the developer Wholesale price - $200,000 per unit for the condo-plex investor Retail or resale price - $225,000 to $250,000 per unit 22 Cr e a t i v e Real E state for a B ad Ma r ke t

- 24. Cr e a tive Re a l Esta te f or a Ba d M a r k e t 23

- 25. UPSIDE DOWN Upside down means you owe more than your home or condo is worth. Upside down with an adjustable loan or a low down payment on a recent sale purchase is the area of the market that will see millions of families loosing their American dream home. This is the situation that too many homeowners are finding themselves in because of poor timing. Several options can alleviate some of these nightmarish problems. Often, when a lender workout can’t be completed, the family being foreclosed on is mentally like a deer on the road staring into the headlights. Some people cure the problem by taking in roommates. That is, if there is extra room available and the tenants are willing to put up enough money to pay the arrearage. Either that or the lender will have to settle with a new payment plan that the homeowner can live with while waiting for the market to turn around. A better solution for families is to take in a qualified investor. See the First Time Buyer solution. (page x) A cash investor can be advertised for in all types of media. The safety factor and rate of interest/return should be commensurate with other market investments. A comparison Performa using past performance numbers that compare different types of real estate investments, stocks and bonds and other similar investment should be prepared by the broker to help market each deal for the troubled home owner. A special REIT and a new type of PMI insurance can be designed and implemented by professionals in each of these venues. As soon as a reported product is available the author will include details for the readers in later editions of the book. I’m currently working with a seller that will soon be in this position but they have two houses. (SEE: First Time Buyer section on page __) The older home has a very good equity and can easily save the newer home but the owner doesn’t want to make the payments on a asset that is going down in value. He may sacrifice his good credit by dumping the newer home and moving back to his smaller place. The following links are to foreclosure lists: 24 Cr e a t i v e Real E state for a B ad Ma r ke t

- 26. Cr e a tive Re a l Esta te f or a Ba d M a r k e t 25

- 27. COMMERCIAL REAL ESTATE BUSINESS CYCLES Each type of commercial property has its own business cycle. Sometimes the bad markets run concurrent with general real estate down turns. Other times the run counter to general real estate trends. APARTMENTS Apartment complexes usually reflect the market conditions for homes and condos. This is a regional or local situation. If the local developers anticipate the market drop, the balance between supply and demand will keep vacancies at an acceptable rate. Unfortunately, an overbuilt apartment market usually occurs in a housing slump. Inducements to attract tenants are commonplace at these times. All owners want to want maintain or increase their income stream on their properties. Retaining good tenants and finding good quality residents becomes of utmost importants to maintain the value of the owner’s investment. A good way to keep quality tenants would be to offer “Rent Performance Rebate Vouchers”. These can be redeemed at any time during the tenants’ occupancy. The voucher amounts can be creatively administered to suit the situation. SUGESSTED EXAMPLE (Dollar amounts vary depending upon the Gross Monthly Rental) Gross rent on a two-bedroom apartment - $1,000 per month $25 – rent rebate if rent is paid on or before first of the month $20 – rent rebate if rent is paid no later the 3rd of the month $10 – rent rebate if there are no complaints for the month $50 – rent rebate on the 13th month of continued residency $75 – rent rebate on the 25th month of continued residency $100 – rent rebate on the 37th month of continued residency $100 – rent rebate for each year of continued residency thereafter In the event the complex is a condominium, give double coupons that can be used toward the purchase of the unit by the tenant. (SEE: plizzel.com for coupon examples) OFFICE BUILDINGS As a real estate broker in the seventies working primarily exchanging properties, I ran into this opportunity. Office buildings in many areas of San Diego, California were overbuilt and under rented. A fellow broker was caught in this unfortunate situation with a new office building and an eighty percent vacancy rate. He was willing to give me the property plus boot (cash) to close a sale before the end of the year. We had three business days to record the transaction. We did it in two days with no escrow. We drew up the papers and hand carried everything to expedite the transaction. “Time is of the essence” had a new meaning for both of us. “Necessity is the mother of invention” just to add another cliché to the equation would be applicable here. Why would anyone do this to himself or herself? This is because I had a solution to the problem. An exchange solution that hadn’t been done, to my knowledge, but made perfect sense in my mind was the reason I proceeded with the deal. To start with, a full understanding of the three types of value is imperative. In this case, they are as follows: 26 Cr e a t i v e Real E state for a B ad Ma r ke t

- 28. FIRESALE – A distressed sale for any number of reasons. In this case they were both personal and tax reasons. WHOLESALE – The price the property would probably be expected to obtain on the market without solving any of the market problems affecting this particular office building. RETAIL – The price this property should bring using the numbers generated by comparable office complexes in the area. Note: The loan was assumable and the loan to value was based on the retail value of the building. Due to government impediments during development, the time for new office space had come and gone. The permitting process in California is an abortion and the people that are bureaucrats and politicians in charge of building permits should be held accountable for creating this nightmare for builders and developers. Any idiot could figure a faster and better way to do construction permitting in a timely manner. These arrogant public dictators should be regulated as soon as possible. Everyone looses, except these powerful government officials. The developers that take the risk of trying to predict the future market get hit first. Then the general public gets hit with higher prices. In a worse case scenario, the lender is the last victim in this vicious cycle by having to foreclose on the building. Why does anyone have to put up with this public abuse? The solution to this particular property was a combination of doing a standard “Down and Out” exchange into a smaller property and finding a way to fill the building at projected market rates. “Down and Out” refers to finding an investor trying to trade up into a larger property to taking advantage of the 1031 tax rules. The investors I found were also broker/owners that wanted to leverage their current portfolio. I choose two high equity beach homes that fit the retail value of my office building equity. The trick was getting leases on all the units. At the time there were morning real estate exchange morning meetings for agents that specialized in trades. These meetings were held almost every day in one part of the county or another. I prepared a flyer and presented the property to each group outlining a new exchange product. The name of the product defined its essence. “PRE-PAID LEASES FOR TRADE” was the heading on the handout. An example would be similar to my standard flow charts for this book: Cr e a tive Re a l Esta te f or a Ba d M a r k e t 27

- 29. 28 Cr e a t i v e Real E state for a B ad Ma r ke t

- 30. INCOME EVALUATION Projected total annual income - $57,600 The retail value based on seven times the gross income is - $403,200 The existing loan is based on seventy percent of retail value - $302,400 Trade equity - $100,800 The terms of the exchange agreement between me and the owners of the two beach homes called for a first year guarantee of the projected income on the office building. This was accomplished by raising enough cash on the two homes traded in to prepay the rents for most of the units on the office building. One large unit had an acceptable tenant that counted as part of this requirement. I rented an office on a two-year lease that also counted toward the guarantee. Annual first year guarantee - $57,600 Less accepted leases - $12,000 Cash needed at close of escrow - $45,600 This meant that I had to raise approximately $50,000 to close the deal by either placing loans on the two beach properties traded into the office complex or sell or trade the two beach houses during the escrows for a simultaneous closing. I traded one of the houses for a free and clear boat and the other for an almost new car. The new buyers qualified for the loans needed to raise the cash to close the deal. The buyers of the office building were also concerned about having real tenants. By using my pre-paid lease for trade concept, I was able to trade out almost every unit for vehicles and trust deeds that agents had taken for commissions on other transactions and other types of personal property. This whole process is a very good example of a “Boil Down Deal”. By taking in an assortment of personal property items, I had manageable assets instead of a huge negative cash flow on the office building. Some of these assets I used, some I sold to raise cash and others I used to trade into other situations. This was a true win/win/win/win deal. Everyone involved got what he or she wanted by using an unconventional business technique. Everyone involved was a real estate professional. Some of them went on to duplicate this template transaction to save other distressed properties in the area. Cr e a tive Re a l Esta te f or a Ba d M a r k e t 29

- 31. SHOPPING CENTERS Shopping centers have a lot of creative solutions when they get into trouble. The basic reason they can often be helped is in their very nature. They cater to and serve entrepreneurs, business owners. These folks are naturally creative, industrious, adventurous, risk taking professional sales people. Problem solving challenges are part of their everyday life or they won’t survive the competition to be successful in their business endeavors. Cash flow is almost always the main problem. There are lots of reasons an owner can get into trouble. Like every other type of real property, location can make of break the center’s future. This section will be updated on a regular basis on my web site. (plizzel.com) Just to get it started, a real life solution that has been done successfully in many older and poorly located shopping centers is presented below: Older centers often fall prey of having their major tenant not renewing their lease. These spaces are usually large open spaces. Large spaces with major tenant status generally pay a lot lower cost per square foot for their long-term lease. Assume large space rent at one dollar per square foot and small space rent at one dollar and fifty cents per square foot. Start a flea market with small spaces going at monthly, weekly and even daily rates in the vacant space. If the business can be easily monitored as to the gross income, a percentage rent can be offered. Spaces should also be offered to all the major barter organizations if there are chronic vacancies for cash. The owner of the shopping center can use the barter credits for both personal and business purposes. All barter money is “Found Money” This concept brings out the bargain hunters and should fill the parking lot. A private shuttle bus should be offered for “shoppers only”. Home delivery of both the person and their purchases could prove very cost effective and present an energetic entrepreneur an attractive business opportunity if properly managed and promoted. 30 Cr e a t i v e Real E state for a B ad Ma r ke t

- 32. INDUSTRIAL AND MANUFACTURING PROPERTIES Like all large spaces available to business owners, a league of creative people are aware of the potential profits that can be made if a new use can be successfully developed for older vacant industrial and manufacturing buildings. Sometimes a “Civic Service” can get the local political leaders to bend the rules. A good example is as follows: Search the records in the city that has the large vacant industrial or manufacturing building you want to work with at the time for nuisance complaints for night clubs. Contact the owners of these clubs to see if they would consider a huge site to relocate or even just expand their business. Give them a rental incentive and agree to sub-let their existing location if the numbers work. These locations don’t have a residential neighbor problem and will be easier to police without so many disturbances. Another good use would be for the development of “Coach Condos”. Most industrial and manufacturing buildings are well built out of steel or block or both. This lends itself to the coach condo concept to be able to handle the weight of the motor homes. By designing each unit with drive through capabilities, a private “Dan Tana” like lifestyle from the old TV show “Las Vegas” motor home owners can have a livable indoor environment. Instead of a car in the living room, a recreation vehicle drives into the unit. Each unit can either be leased or sold as a condo or timeshare. These units can be sold bare bones or completely professionally designed. A local home remodeling with the latest computer modeling software can be engaged to service your clients. Unfortunately, good ideas aren’t enough. Your biggest obstacle, once again, is your local government officials. They are the “No Birds” that want to protect the status quo and their jobs. They don’t want to work any harder than they have to for the same amount of money. New large industrial parks that are over built might be a good place to attempt this type of usage. Recreation vehicle storage is already an acceptable use but with the concept of using the space as a residential unit could present zoning problems with the local building departments. Each community is a little different on their approach and may let you do a prototype development to see if it solves an overbuilt situation. After all, this increases their tax base and that is something every community is searching for Cr e a tive Re a l Esta te f or a Ba d M a r k e t 31

- 33. BAD FARM YEARS Farms operate on a totally different business cycle than any other type of real estate. Events on the other side of the world quite often affect farm prices. Weather and planting decisions world-wide dictate the commodities market for the most part. Of course there are a lot of other factors like war or political situations that affect prices. The most important factor is whether or not the individual farmer is up to date using the latest technology. When a mistake is made and the farm has too much debt, the farm itself is often sold at a price lower than expected. Usually the big farm conglomerates are fully aware of distressed farm properties and they swoop down to take advantage of the obvious situation. An alternate solution is needed. The following method can help some of these farms survive by adding a new crop, baby boomers. By using the coach condo concept as mentioned in previous sections, along with a shared equity structure, many of these smaller farms can be saved. By using underground steel living room structures with drive through capabilities, the land above can become hobby farms. The CCR’s need to detail what the individual timeshare owner can do with each unit. Some of the important rules that must be rigorously enforced are as follows: • No above ground parking of any vehicles to maintain the rural atmosphere and ecological perfection of the project. • All hobby farming by the timeshare owners to be supervised by management. • All produce should be allocated in a logical manner depending on the crops chosen and the degree of interest by each timeshare owner. Management should be prepared for the flexible use of the hobby farms. • The produce is considered community property but should be considered a benefit of ownership for the traveling families and friends of the current users of each coach condo unit. • All excess produce sold, less expenses, should be applied on a prorated basis to association fees charged to the owners. The best situation is where the current owner of the farm is retained as resident management. Their lifestyle can be enhanced while doing something they love to do. If the current owners aren’t willing to adapt to the new reality, professional management will have to be retained by the home owners association. When a current owner is willing to stay on, the developer should be more willing to structure the deal with shared ownership benefits. This way the current owner can participate in the profits made by the developer. This should help motivate the seller to stay with the project and maintain some continuity. In these areas, tradition can be very important. The local political environment might be more in favor of new ideas if the old ways are respected by the developer. This is not the place for monetary arrogance. The wrong attitude could very easily backfire with everyone losing instead of the project helping on all levels. One of the best parts of this solution is the fact that the developer is generally dealing with a larger parcel of land to start with using this plan. That means larger parcels can be marketed in the resale process to make a reasonable profit for the developer. That also makes for less disruption of the land and ecological enhancement instead of degradation due to poor planning. 32 Cr e a t i v e Real E state for a B ad Ma r ke t

- 34. SITUATIONAL ENHANCEMENTS The following section concerns itself with problem solving in areas that aren’t particularly related to bad real estate markets. If the reader enjoyed the solutions presented so far, these transaction should be of interest. REIT OF REITS Retirement investment options will soon be available that fully diversify a real estate portfolio with REIT investments. In some cases they include properties formerly owned by the investor. REIT of REITS would be very useful if the Bernie Cornfield mistakes with Fund of Funds were taken out of the concept. This would give the soon to be retired person a very versatile option and a long term plan for the younger investors. Coach condos and condo quarters owned by the REIT investors can be added on a lease back basis if properly structured for added diversity. This way the investor can have usage and liquidity along with a more diversified portfolio. Another interesting possibility would be to add “Save a Home” properties. Both parties to a “Save a Home” property would have to agree to the terms and conditions of the REIT involved. To pull off this kind of solution, a very knowledgeable lender is required. After this type of doing business is more seasoned, lenders will be more willing to get involved. Offshore investors could add another layer of sophistication. This could include structuring, tax benefits and International properties and financing partners. An extensive search for the necessary forms and legal procedures to undertake this project is currently underway. The following links on the Internet are very useful: nareit.org sec.gov/answers/reits.htm reitnet.com wikipedia.org (search reit) investopedia.com/terms/r/reit.asp D u e t o t h e f act that many of the s olutions pr e se nte d in this book e nd with a c o n v e r s io n t o a Re a l E st a t e Investm ent Trust, so me te c hnic a l inf or ma tion is pr e se nte d he r e f o r th e p ro fe ssi o n a l r e al estate readers. SE E : FORMS Cr e a tive Re a l Esta te f or a Ba d M a r k e t 33

- 35. R E IT O F R E IT S P o r tf o l io Manager C a s h Inv e s tors D i g i ta l C r e d i ts C o m m i s s io n s 401 K M anagem ent R o th I R A P e n s io n F u n d s In d u s t r i a l S h o p p in g O ffi c e B l d g M a n u f a c t u r in g C e n ter R E IT R E IT R E IT M o r tg a g e R E IT A p a r tm e n t R E IT O ff S h o r e In v e s t o rs R E IT O R R E IT S C o a c h C o nd o R E IT "S av e a H o me " R E IT C o n d o Q u a r te rs R E IT O ff S ho r e P r o p e r ti e s R E IT 34 Cr e a t i v e Real E state for a B ad Ma r ke t

- 36. CONDO QUARTERS BEACH FRONT AND LAKE FRONT PORTFOLIO EXPANSION My oldest and best client owns a variety of properties but considers his recreational beach front and lake front units his primary portfolio investments. He has reached a point where he still enjoys the real estate game but doesn’t want the stress of management. Some of his units are retained for his personal use during certain seasons. He is particularly good at weekly summer rentals. He’s come to the point where he is seriously thinking of selling his holdings. He would also like to stay in the game. A new paradigm is called for to keep his interest and increase his wealth and retain his lifestyle. Condo quarters to the rescue! The initial plan requires that properties involved are placed in escrow with the proper 1031 starker verbiage. Vesting the retained condo quarters should also be in a limited partnership or LLC structure if the tax consequences are advantages. This strategy will allow for a later REIT absorption for greater liquidity. EXAMPLE OF CONDO QUARTERS ON FOUR UNITS SEASONAL CONDO QUARTER PRICES 1 2 3 4 Winter Penthouse $1.25M/$1.5M $1.25M/$1.5M $1.25M/$1.5M *Spring $1M/$1.25 $1M/$1.25 $1M/$1.25 $1M/$1.25 Summer N/A N/A N/A N/A *Fall $1M/$1.25 $1M/$1.25 $1M/$1.25 $1M/$1.25 RESALE TOTAL 9 units sold at between $9,700,000 to $12,000,000 in cash and seller carry back trust deeds. *Plus two units presold at between $2,000,000 and $2,500,000 (Penthouse) If this plan is carried out at least once a year for the next ten years the minimum profit from sales should be well over $100,000,000 and the summer condo quarters retained from each project should exceed over fifty units. Cr e a tive Re a l Esta te f or a Ba d M a r k e t 35

- 37. C O NDO Q UAR TE R S OW N E R 4 B e ac h G E N E R AL L a k e F ro n t F ro n t U n i ts P A R TN ER H o us e B R O K E R C O M M I S S IO N S M a na g em ent L im i t e d P a r t n e r 2 B e ac h 99 Y ea r L e a s e F ro n t U n i ts or P r e p a id L e a se D EV EL OPE R C on dom i ni um C o n v e r s io n C O N DO Q U A R T E R S P e n th o u s e 1 2 3 4 5 W S p ri ng W i nte r Own er I nv e s to r I nv e s tor In v e s t o r I nv e s tor In v e s t o r F ri e n d O w ner F a m i ly S B ro k e r I nv e s to r I nv e s tor In v e s t o r I nv e s tor In v e s t o r S u m m er O w ner Fall B k r/D e v S Own er O w ne r O w ner O w ner O w ner Own er F F ri e nd F a m i ly I nv e s to r I nv e s tor In v e s t o r I nv e s tor In v e s t o r DE V E L O P E R O w n e rs O w n er s 1 03 1 E x c h an g e 10 3 1 E x c h a n g e R e p ea t C o n d o Q u a r te r s M a r k e t in g L i m i te d L im i t e d P a r tn e r s h i p P a rtn ers h i p C o n d o Q u a r te r s ' R E IT 36 Cr e a t i v e Real E state for a B ad Ma r ke t

- 38. LEFTOVER TIMESHARES One of the most interesting deals I’ve been involved with was helping timeshare companies market the tail end of their timeshare inventories. Each company had over three hundred weeks left without the ability to market them without taking a loss. The cost for them using their normal marketing methods was too high. I purchased an option at fire sale prices for close to nothing. The broker that handled the initial purchase did an outstanding job of explaining my exchange methods. Without his help, it would have been much more difficult for me to set everything in motion. It was possible to use the most creative solution that could be devised. These were just hot potatoes as far as the original developers were concerned. Everyone involved was a real estate professional and most were exchange specialists. The pricing was broken down as fire sale value, wholesale value and retail value as explained earlier. Some of the trades were as follows: • Free and clear Pontiac Firebird exchanged for 2 free and clear timeshares at retail prices plus 2 units with 50% seller carry back loans at retail prices. • Free and clear mobile home exchanged 3 free and clear timeshares at retail prices plus 3 units with 50% seller carry back loans at retail prices. • Precious gems exchanged for 1 free and clear timeshare at retail and 1 unit with 50% seller carry back loan at retail price. • Prepaid lease on office space in downtown San Diego, California exchanged for 250 free and clear timeshares at retail prices. I received 35 free and clear timeshares as the developer’s profit. I used these to trade for a variety of items and other real estate including a hill top mansion in Valley Center, California. • Condo equity exchanged for 2 free and clear timeshares at retail plus 4 units with 50% seller carry back loans at retail prices with 50% seller carry back loans at retail prices. The loans were kept by original timeshare developer and the free and clear units were my developer’s profit. Needless to say, there were many other similar trades to complete the liquidation of over six hundred timeshare weeks. The following links are major p y in the timeshare world: players www.thetimesharebeat.com www.timesharesourcecenter.com Cr e a tive Re a l Esta te f or a Ba d M a r k e t 37

- 39. L E F T O V E R T IM E S H A R E S C O M M IS S I O N S 3 0 0 + T im e s h a r e s 3 00 + T i m e s h a re s L a ke T ah o e B R OKER P a lm S p r in g s AUTO DE VE L OP E R O f f ic e C ond o M o b il e HO USE H ome P r e - p a id GE MS L e as e C la s s ic M o to r D e v e lo p e r C a r H ome P r o f it s KEE P C AS H TR ADE 38 Cr e a t i v e Real E state for a B ad Ma r ke t

- 40. HOMELESS SOLUTIONS This would best be described as a multi-media real estate venture, or maybe bum adventure. Just keep your sense of humor and try not to be too politically correct. If that’s impossible for you, just burn the book, please! The first thing we need to do is ask one of the Indian tribes to give us a large in the middle of nowhere for three new cities; “Hope”, “Training” and “Escape”. The reason this could prove to be the best strategy is political. Both the left and the right wing politicos have agendas that won’t agree with our way of dealing with the homeless. Legal hassles will just take food out of the mouths of the needy and the confused. Indian tribal law could prove to be less cumbersome. After securing the sites for the new Bum towns, three scripts/stories will be released to the participants including the following: • Members of the Humanarium Project – crew and recruits • Low income social security recipients – monitors and storyboarders • Homeless for the town of Hope – storyboarders • Homeless for the town of Training – storyboarders and technicians • Homeless for the town of Escape – storyboarders and games • Indians – storyboarders, inspectors, trainers and referees The scripts will be for the reality show and a possible movie if we can get backing and true professional involved. This is why we can call all the amateur actors and actresses storyboarders. Hopefully some of the storyboarders will go on to become professionals. It could be the same for some of the technicians that are trained in the program. A good editor can frame several versions of the original screen play for possible commercial use. THE TOWNS OF HOPE, TRAINING AND ESCAPE OUTLINE OF THE INITIAL THREE SCRIPTS Opening Scene – A helicopter fly over of the future home of the town of Hope emphasizing the remoteness and natural beauty of the location. Credits and music added. Cut to – Bowery type location showing the hopelessness of street sleeping. Feature each skyline and zoom down to the street level to show the contrast. End in San Diego, California with the Humanarium Project members and tribesmen giving tickets for flight to the town of hope to selected homeless street people. All applicants are screened to make sure they go to the right town. Families or women and children usually have several local options. They are directed to these resources. We are looking for the hardcore cases that litter the streets with their presence. For the town of Hope we look for people where compassion can help the most. For the town of Training we look for candidates for self improvement. For the town of Escape we choose the truly scandalous bums. End shot – Show the same area of the city of Hope after it has been environmentally enhanced with the visible building a huge solar structure. The increase in vegetation and animal population is featured. This is done digitally on the computer using Maya 8 to project the future look of the town when the development is completed Cr e a tive Re a l Esta te f or a Ba d M a r k e t 39

- 41. The stories of how this environmental enhancement came about constitute the core of each script. Some of the themes include: • Collecting new town members • Trip trips • Initial orientation problems • Sponsor tie-ins and embedded ads • Camping to living • Featuring the Internet mentors (social security seniors) • Skills acquired • Games • Hanging around habits • Why bother • New soaps • Developing the infrastructure • Cowboys and Indians (role reversal) • Humanarium technology (Biosphere) • New style electric vehicle races Our first choice of sponsors will be the beer companies. This will help us recruit bums. The flyers will emphasize “FREE BEER” to supply the number one commodity for the bums. This will be a trade out sponsorship for beer and water supplies. The alcohol content will slowly be reduced to wean them back to normalcy, or not. While drinking water will be supplied via helicopters, waste water recycling will be used to enhance the landscape and provide drinking water for additional animals. Solar companies and electric vehicle manufacturing companies will be pursued as sponsors on a trade out basis. Any other company interested in the subject and would like to help will be welcomed as a sponsor. We are currently contacting the following companies for possible sponsorship: 40 Cr e a t i v e Real E state for a B ad Ma r ke t

- 42. H O M E L E S S S O L U T IO N S DEV EL O PE R P R ODUC E R I N D IA N H U M A N A R IU M G OV E R NME NT L AND P R OJ E C T LAND HOP E T R A IN I N G E SCAP E C o m p a s s io n S ic k / B a t t e r e d S e l f Im p r o v e m e n t S c an d al o u s V a g r a n ts Bu ms T r ip T r i p s S p o n s o rs O r ie n ta ti o n B io s p h e r e S pon s or A ds B e er W at e r S to ry b o a rd e rs C a m p in g / L i v in g R e a l it y S c r ip t s M e nto rs S o la r H ope T ra i ni ng W in d S k i l ls E l e c t r ic c a r ra c e s S S G am es E sc a p e E l e c tri c M o n it o r s V e h ic l e s C o ll e c t in g H a b i ts O th e r W hy B othe r I n d ia n s N e w S oa ps H um a na ri um V ol unte e rs In f r a s t r u c t u r e Cr e a tive Re a l Esta te f or a Ba d M a r k e t 41

- 43. BUFFER BUILDING Buffer building refers to those spaces between the edge of the freeway and the nearest private property line. In California, CAL-TRANS is actively seeking private party solutions. We will be testing their rhetoric and resolve. Anything done should include a *soft crash zone and *quick vehicle removal systems to help with traffic management. Because of the nature of the topography in California the suggested uses only apply to certain stretches of road. These are primarily urban solutions, not necessarily urban concepts. Special architects and engineers will be needed to design buffer buildings. For long stretches of urban freeway next to established subdivisions an intricate design could prove useful. Considering the fact that freeways are a concept of the forties and fifties, surely some new thinking is long overdue. To start with, think of this plan as a tubular rectangle inside an outer tubular rectangle. The inside tube is designed and used by combustion engine vehicles that should be isolated, if possible, because of noise and air pollution. INSERT IMAGE HERE Replace the above image with rendering of the Buffer Building concept Some of the possible designs could include: • Overhead toll roads and rail systems • Underground toll roads • Solar voltaic on roof and south and southwest walls • Electric vehicles only zone • *Soft crash zone • *quick vehicle removal systems • Commercial and office space • Special landscaping • Special signage, time, weather, breaking new and emergency information • Speed and reckless driving monitors The following links are posted below and should help develop some of these ideas: p p 42 Cr e a t i v e Real E state for a B ad Ma r ke t

- 44. B U F F E R B U IL D IN G H U M A N A R IU M P R OJ E C T DE V E L O P E R B R OK ER P R O F IT S C O M M I S S IO N S F I N A N C IN G DEV EL O PM ENT P e n s i on F u n d s S Y N D ICA T E In s u r a n c e C o . L L C or A R C H IT E C T O ffs h o r e L e nd e r s L im i te d P a r tn e r s h i p A- 1 C O N T R A C T O R C ondos E m e r g e n cy M in i- S h o pp in g S to r a g e O f f ic e S p a c e C e n te r s RO ADS G ar ag e s P a r kin g C A L-TR A N S Cr e a tive Re a l Esta te f or a Ba d M a r k e t 43

- 45. SWEAT EQUITY TRADES Sweat equity trades usually refer to someone in the trades or an actual contractor. My experience is that the professions are a good candidate for bulk trades of their services. By determining what type of real estate the professional is interested in purchasing, a credit for the amount of your commission or equity can be pre- arranged or a contract can be delivered at close of escrow for the agreed upon amount. This new business and found money for the professional, the broker and the any developer involved in this type of transaction. This technique can replace the need for all but catastrophic health insurance and dental insurance. Pre paid legal fees and accounting fees can also come in handy. Make sure the agreement includes the right to trade the contracted services to third parties. Point out that you can do multiple contracts and bring new clients as fast as you can trade out the current contract. These contracts are good for buying cars, recreation vehicles, boats, even restaurant and advertising scrip (gift certificates). If used properly, these contracts will go right to the bottom line of your business. Here is an example of a simple sweat equity contract: PRE PAID SERVICE CONTRACT FIRST PARTY : __________________________________________________ Name of professional and type of service provided __________________________________________________ Address State Zip __________________________________________________ Business Phone Cell Phone e-Mail address SECOND PARTY: __________________________________________________ Name of Broker or Developer __________________________________________________ Address State Zip __________________________________________________ Business Phone Cell Phone e-Mail address Party of the first part agrees to provide _________________________services for the total amount of _________________________to the party of the second part or their assignees. Party of the second part agrees to credit party of the first part ____________________ dollars toward the purchase of an acceptable property purchased through the second party at close of escrow. __________________________________ Signature of First Party Date __________________________________ Signature of Second Party Date 44 Cr e a t i v e Real E state for a B ad Ma r ke t

- 46. REAL ESTATE GAMES FOR USE ON CELL PHONES, PDA’s, GAME BOXES, COMPUTERS I’m currently designing a series of real life games that can be played by real estate professionals and investors and their children. My partner is a Maya instructor. Maya is the premier animation software used in the industry. Several Adobe products augment the development process. For investment purposes, the game will use micro dollar amounts for even the smallest investments. I use pay pal and digital credits for small amounts and credit cards for larger amounts. All transactions will be over the Internet. For the kids that want to play, the amounts earned by playing can be locked into a product that releases the funds for college or retirement by permission of the parents requiring a digital signature as confirmation of said permission. If this account is used, monthly or quarterly withdrawal amounts can be opted for based on the amount in the account. The account will transfer to a REIT as soon as the investment legally qualifies. The games will have different levels aimed at the players lifestyle rather than a pre set market assumption. Parents will be able to use the game to train their children about the work/play connection. They will also learn some good habits like the importance of saving and investing for their future. They will also learn the power of passive income when they reach a certain level. Each level will require a reality aspect to move on to the next level. These tasks can be done over the phone from a general database or in person with friends and family. Some of the projects include: • Special chores and projects designed by parents. The parents should be verify upon completion before the agreed amount is placed into the game vault for the child. • Fund raising while playing the game will also get the player to the next level and earn an investment credit based on volume. • Participating Internet businesses can tap into this game to increase the sales inventory for the players. Normal sales commissions will automatically be inserted into any players game vault. The following links are companies that develop software for game development: Cr e a tive Re a l Esta te f or a Ba d M a r k e t 45

- 47. R E AL E S TATE G AME S M o b i l e P h o n e s , P D A 's , G a m e B ox e s , C o m p u t er s , K io s ks T yp eo f G AME C o m m is s i o n s G a me P LAY E R S B o n u s es L e v el L ev e l In d e p e n d a n t 1 3 C o n t ra c to rs & L e ve l L ice n s in g 2 A g r e e m e n ts C re d it C ard s Pay Pal C r e d i ts M o b ile P h o n es IN T E R N E T K io s k s P D A 's G am e C o m p u te r s B oxe s H U M A N A R IU M PR OJ E C T In d us t ri a l M a n u f a c tu r i n g M o rtg a g e R E IT R E IT R E IT O F O ffS h o r e A p artm en t P r o p e r ti e s R E IT R E IT S R E IT C ondo K ID ' s S av e a C oa ch Q u a rte rs O ffi c e B l d g S h o p p i n g C en t er R E IT R E IT I R A fo r H ome C on do R E IT S cho ol R E IT R E IT 46 Cr e a t i v e Real E state for a B ad Ma r ke t