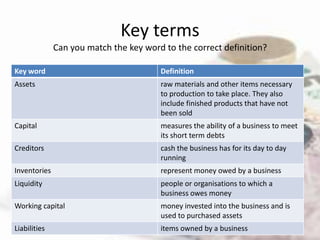

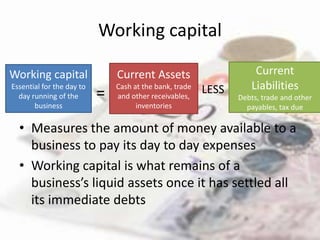

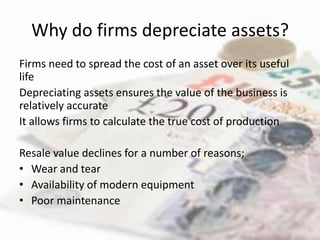

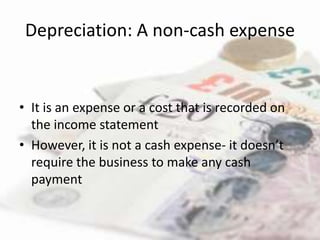

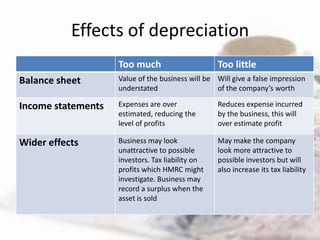

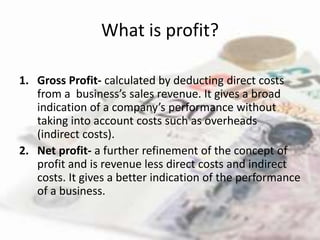

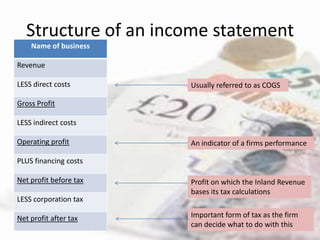

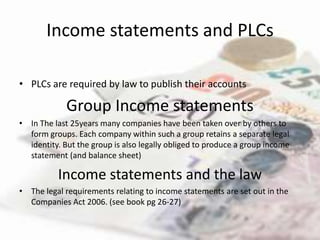

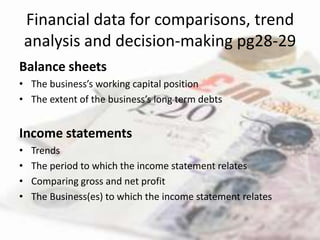

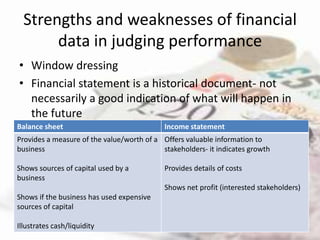

The document discusses key financial concepts such as balance sheets, income statements, assets, liabilities, working capital, and depreciation. It explains that a balance sheet records a business's assets and liabilities on a given date, and must always balance. It also discusses how to interpret balance sheets and income statements to analyze a business's short-term and long-term financial positions. Key metrics like working capital, depreciation, and different types of profit are defined. The document aims to explain how to analyze and use financial data for decision making and performance evaluation.