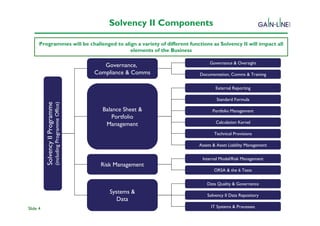

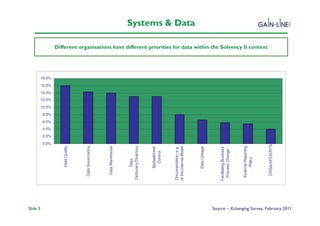

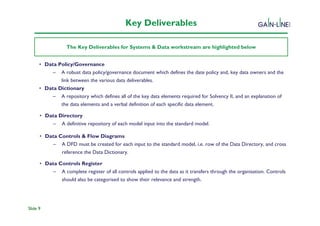

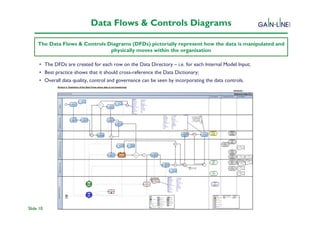

Solvency II is the biggest regulatory change for insurers and reinsurers, bringing the industry under one regime. It will impact all areas of business operations. Early adopters are helping set industry standards. While there is no single solution, companies must have high quality data and robust risk management to meet Solvency II requirements. The regulator emphasizes that firms must improve data management to obtain model approval.