Embed presentation

Download to read offline

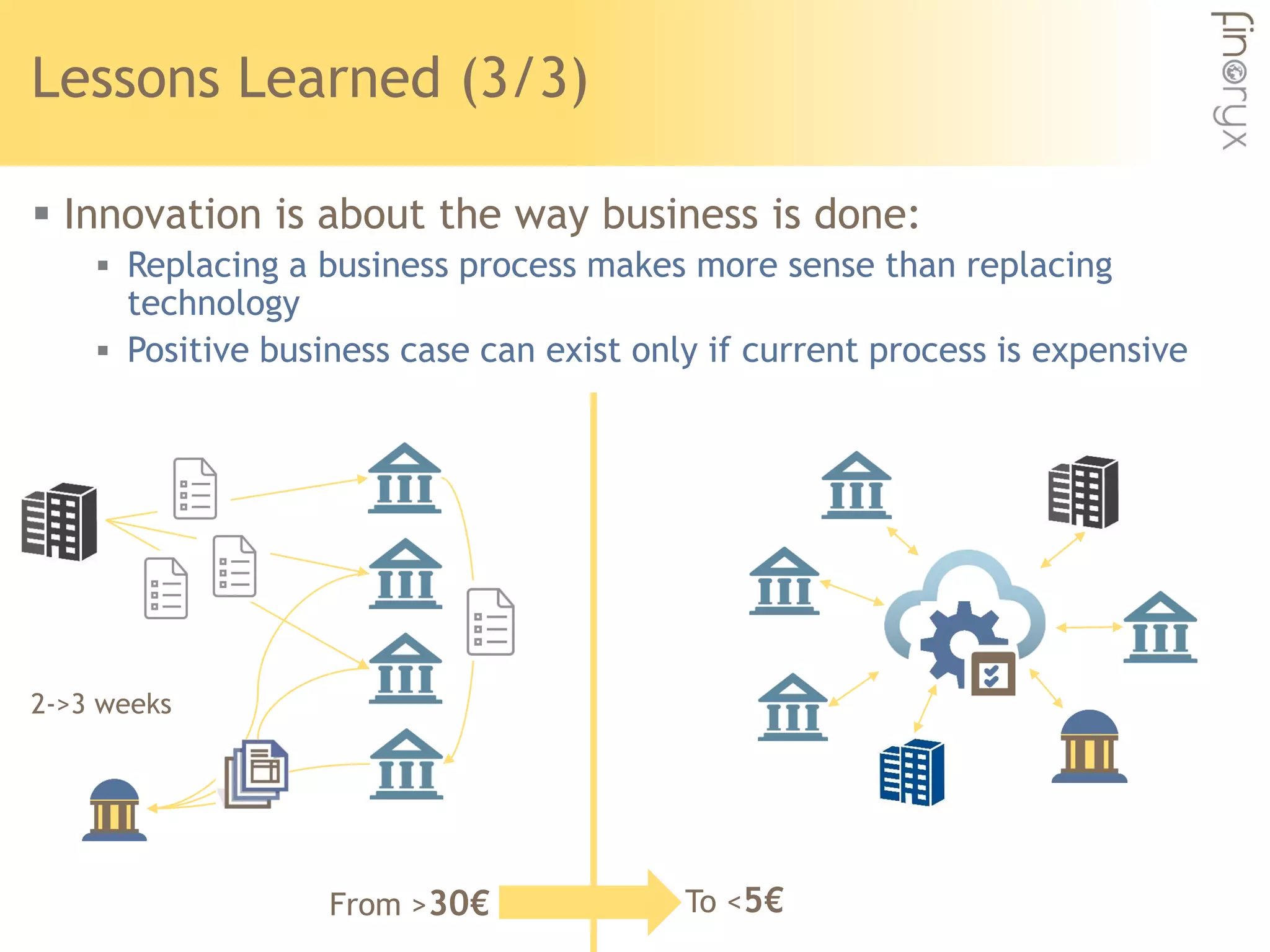

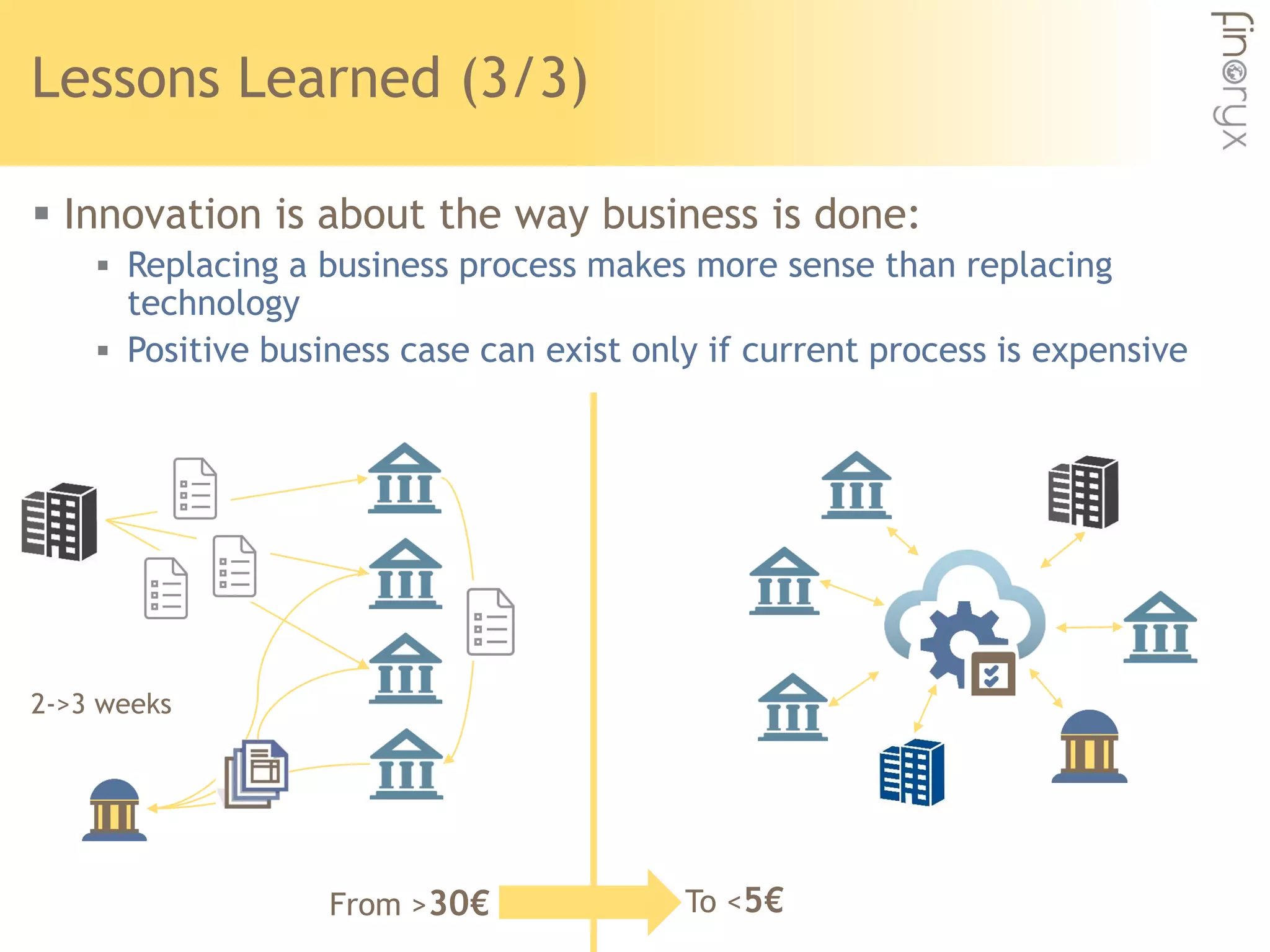

Blockchain does not provide value for all processes and smart contracts are not suitable for all on-premises systems. Blockchain is best for processes involving multiple participants but stored data may need to be outside the blockchain to ensure GDPR compliance. A blockchain business case requires a global view beyond a single institution as benefits often accrue to new market entrants. Changing existing processes to use blockchain may be more viable than replacing technology if current processes are expensive. Blockchain will not solve all problems or be free, so opportunities should be pragmatic and focus on existing inefficiencies or new business models rather than replacing efficient processes.