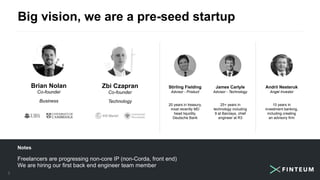

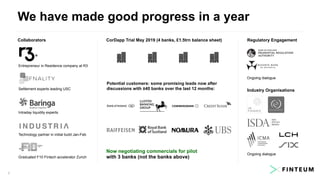

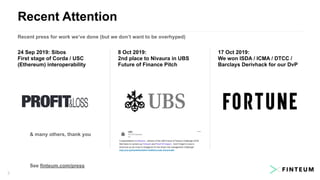

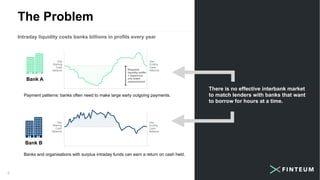

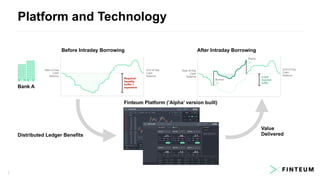

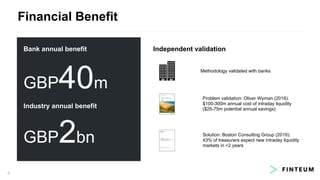

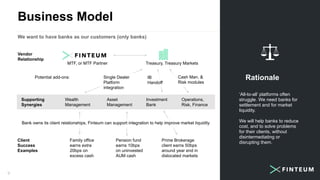

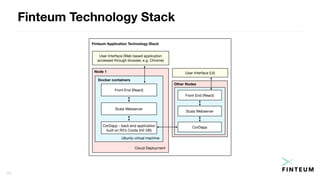

Finteum is creating a global intraday borrowing market for banks using distributed ledger technology. They have made progress in their first year, including building an alpha version of their platform and running a successful trial with four large banks. Their goal is to facilitate more robust intraday lending markets to reduce banks' liquidity costs. They plan to generate revenue by charging banks fees for usage of the platform. Finteum is currently seeking partners, additional funding, and banks to participate in a larger pilot of their system.