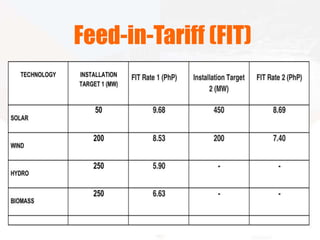

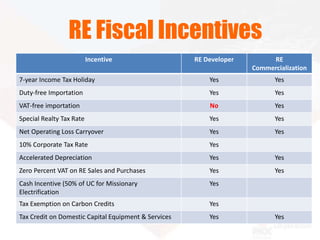

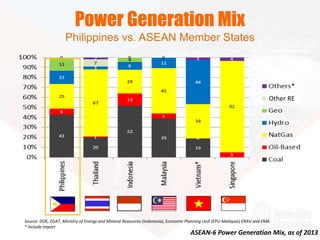

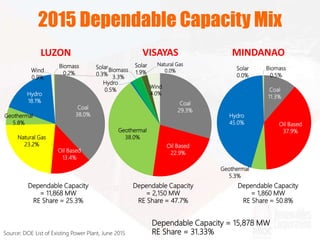

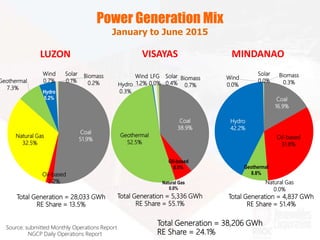

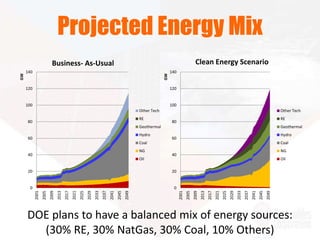

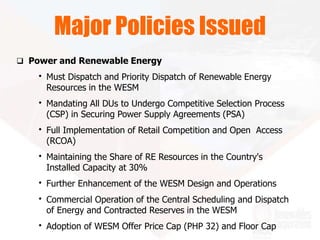

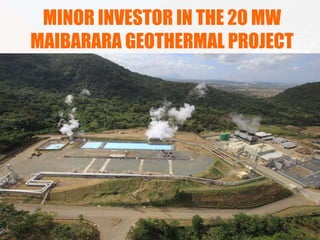

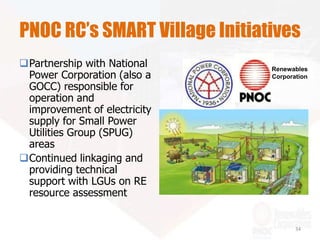

The document summarizes the renewable energy situation in the Philippines. It outlines key policies and incentives to promote renewable energy development established under the Renewable Energy Act of 2008. These include a renewable portfolio standard, feed-in-tariff, and green energy option. It also provides data on the current and projected energy generation mix in the Philippines, which aims to achieve 30% renewable energy by 2030. The document further introduces PNOC Renewables Corporation, a government corporation that develops renewable energy projects and partners with private entities and local communities to expand access to renewable sources.