3.Quantitative Problem Bellinger Industries is considering two .docx

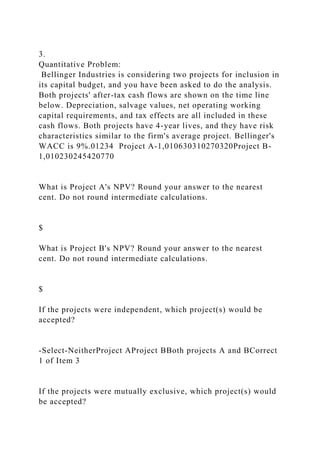

- 1. 3. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 9%.01234 Project A-1,010630310270320Project B- 1,010230245420770 What is Project A's NPV? Round your answer to the nearest cent. Do not round intermediate calculations. $ What is Project B's NPV? Round your answer to the nearest cent. Do not round intermediate calculations. $ If the projects were independent, which project(s) would be accepted? -Select-NeitherProject AProject BBoth projects A and BCorrect 1 of Item 3 If the projects were mutually exclusive, which project(s) would be accepted?

- 2. 4. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 10%.01234 Project A-1,200630330290350Project B- 1,200230265440800 What is Project A’s IRR? Do not round intermediate calculations. Round your answer to two decimal places. % What is Project B's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % If the projects were independent, which project(s) would be accepted according to the IRR method? -Select-NeitherProject AProject BBoth projects A and BCorrect 1 of Item 3 If the projects were mutually exclusive, which project(s) would

- 3. be accepted according to the IRR method? -Select-Neither Project AProject BBoth projects A and BCorrect 2 of Item 3 Could there be a conflict with project acceptance between the NPV and IRR approaches when projects are mutually exclusive? -Select-YesNoCorrect 3 of Item 3 The reason is -Select-the NPV and IRR approaches use the same reinvestment rate assumption so both approaches reach the same project acceptance when mutually projects are considered.the NPV and IRR approaches use different reinvestment rate assumptions so there can be a conflict in project acceptance when mutually exclusive projects are considered.Correct 4 of Item 3 Reinvestment at the -Select-IRRWACCCorrect 5 of Item 3 is the superior assumption, so when mutually exclusive projects are evaluated the -Select-NPVIRRCorrect 6 of Item 3 approach should be used for the capital budgeting decision. 5. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis.

- 4. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 10%.01234 Project A-1,250700370200310Project B- 1,250280315395750 What is Project Delta's IRR? Do not round intermediate calculations. Round your answer to two decimal places. % What is the significance of this IRR? It is the -Select-equity returncrossover rateinterest yieldCorrect 1 of Item 2 , after this point when mutually exclusive projects are considered there is no conflict in project acceptance between the NPV and IRR approaches. Review the graphs below. Select the graph that correctly represents the correct NPV profile for Projects A and B by using the following drop-down menu. -Select-ABCDCorrect 2 of Item 2 6.

- 5. Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after-tax cash flows are shown on the time line below. Depreciation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC is 9%.01234 Project A-950700395250300Project B- 950300330400750 What is Project A's MIRR? Round your answer to two decimal places. Do not round intermediate calculations. % What is Project B's MIRR? Round your answer to two decimal places. Do not round intermediate calculations. % 7. Payback A project has an initial cost of $54,800, expected net cash inflows of $13,000 per year for 7 years, and a cost of capital of 12%. What is the project's payback period? Round your answer to two decimal places. years

- 6. 8. Capital Budgeting Methods Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,500 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $8,000 per year for 5 years. Calculate the two projects' NPVs, assuming a cost of capital of 14%. Round your answers to the nearest cent. Project S$ Project L$ Which project would be selected, assuming they are mutually exclusive? -Select-Project SProject LItem 3 Calculate the two projects' IRRs. Round your answers to two decimal places.Project S %Project L %Which project would be selected, assuming they are mutually exclusive? -Select-Project SProject LItem 6 Calculate the two projects' MIRRs, assuming a cost of capital of 14%. Round your answers to two decimal places. Project S %Project L %Which project would be selected, assuming they are mutually exclusive? -Select-Project SProject LItem 9 Calculate the two projects' PIs, assuming a cost of capital of 14%. Round your answers to two decimal places.Project S

- 7. Project L Which project would be selected, assuming they are mutually exclusive? -Select-Project SProject LItem 12 Which project should actually be selected? -Select-Project SProject L 9. Problem 10-13 NPV and IRR Analysis Cummings Products Company is considering two mutually exclusive investments whose expected net cash flows are as follows: EXPECTED NET CASH FLOWSYearProject AProject B 0-$290-$4001-3871342-1931343- 1001344600134560013468501347-180134 Construct NPV profiles for Projects A and B. Select the correct graph. The correct graph is

- 8. -Select-ABCDItem 1 . What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A % Project B % Calculate the two projects' NPVs, if you were told that each project's cost of capital was 14%. Do not round intermediate calculations. Round your answers to the nearest cent. Project A $ Project B $ Which project, if either, should be selected? -Select-Project AProject BItem 6 Calculate the two projects' NPVs, if the cost of capital was 17%. Do not round intermediate calculations. Round your answers to the nearest cent.

- 9. Project A $ Project B $ What would be the proper choice? -Select-Project AProject BItem 9 What is each project's MIRR at a cost of capital of 14%? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations. Round your answers to two decimal places. Project A % Project B % What is each project's MIRR at a cost of capital of 17%? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations. Round your answer to two decimal places. Project A % Project B %

- 10. What is the crossover rate? Do not round intermediate calculations. Round your answer to two decimal places. % What is its significance? I. If the cost of capital is greater than the crossover rate, both the NPV and IRR methods will lead to the same project selection. II. If the cost of capital is less than the crossover rate, both the NPV and IRR methods lead to the same project selections. III. The crossover rate has no significance in capital budgeting analysis. -Select-IIIIIIItem 15 10 Problem 10-16 Unequal Lives Shao Airlines is considering the purchase of two alternative planes. Plane A has an expected life of 5 years, will cost $100 million, and will produce net cash flows of $30 million per year. Plane B has a life of 10 years, will cost $132 million and

- 11. will produce net cash flows of $25 million per year. Shao plans to serve the route for only 10 years. Inflation in operating costs, airplane costs, and fares is expected to be zero, and the company's cost of capital is 12%. By how much would the value of the company increase if it accepted the better project (plane)? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answer to two decimal places. $ million What is the equivalent annual annuity for each plane? Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Round your answers to two decimal places. Plane A$ millionPlane B$ million 11 Problem 10-19 Multiple Rates of Return The Ulmer Uranium Company is deciding whether or not to open a strip mine whose net cost is $4.4 million. Net cash inflows are expected to be $27.7 million, all coming at the end of Year 1. The land must be returned to its natural state at a cost of $25 million, payable at the end of Year 2.

- 12. Plot the project's NPV profile. Select the correct graph. The correct graph is -Select-ABCDItem 1 . Should the project be accepted if r = 6%? -Select-YesNoItem 2 Should the project be accepted if r = 16%? -Select-YesNoItem 3 What is the project's MIRR at r = 6%? Do not round intermediate calculations. Round your answer to two decimal places. % What is the project's MIRR at r = 16%? Do not round intermediate calculations. Round your answer to two decimal places.

- 13. % Calculate the two NPVs. Do not round intermediate calculations. Round your answers to the nearest cent. 1 $ 2 $ Does the MIRR method lead to the same accept-reject decision as the NPV method? -Select-YesNoItem 8 14. Replacement Analysis Although the Chen Company's milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $38,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $9,300 per year. It would have zero salvage value at the end of its life. The Project cost of capital is 9%, and its marginal tax rate is 35%. Should Chen buy the new machine?

- 14. 15 Problem 11-06 New-Project Analysis The Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,130,000, and it would cost another $24,000 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after 3 years for $650,000. The machine would require an increase in net working capital (inventory) of $16,000. The sprayer would not change revenues, but it is expected to save the firm $354,000 per year in before- tax operating costs, mainly labor. Campbell's marginal tax rate is 40%. What is the Year 0 net cash flow? $ What are the net operating cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar. Year 1$Year 2$Year 3$ What is the additional Year 3 cash flow (i.e, the after-tax salvage and the return of working capital)? Do not round intermediate calculations. Round your answer to the nearest dollar.

- 15. $ If the project's cost of capital is 12 %, what is the NPV of the project? Do not round intermediate calculations. Round your answer to the nearest dollar. $ Should the machine be purchased? -Select-YesNo 16 Problem 11-07 New-Project Analysis The president of the company you work for has asked you to evaluate the proposed acquisition of a new chromatograph for the firm’s R&D department. The equipment's basic price is $100,000, and it would cost another $15,000 to modify it for special use by your firm. The chromatograph, which falls into the MACRS 3-year class, would be sold after 3 years for $25,000. The MACRS rates for the first 3 years are 0.3333, 0.4445 and 0.1481. Use of the equipment would require an increase in net working capital (spare parts inventory) of $5,000. The machine would have no effect on revenues, but it is expected to save the firm $40,000 per year in before-tax operating costs, mainly labor. The firm's marginal federal-plus- state tax rate is 30%.

- 16. What is the Year 0 net cash flow? If the answer is negative, use parentheses. $ What are the net operating cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar. Year 1$Year 2$Year 3$ What is the additional (nonoperating) cash flow in Year 3? Do not round intermediate calculations. Round your answer to the nearest dollar. $ If the project's cost of capital is 11%, should the chromatograph be purchased? -Select-YesNo 17 Problem 11-13 Replacement Analysis The Everly Equipment Company's flange-lipping machine was purchased 5 years ago for $80,000. It had an expected life of 10 years when it was bought and its remaining depreciation is $8,000 per year for each year of its remaining life. As older flange-lippers are robust and useful machines, this one can be

- 17. sold for $20,000 at the end of its useful life. A new high-efficiency digital-controlled flange-lipper can be purchased for $130,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $55,000 per year, although it will not affect sales. At the end of its useful life, the high-efficiency machine is estimated to be worthless. MACRS depreciation will be used, and the machine will be depreciated over its 3-year class life rather than its 5- year economic life, so the applicable depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%. The old machine can be sold today for $50,000. The firm's tax rate is 35%, and the appropriate cost of capital is 13%. If the new flange-lipper is purchased, what is the amount of the initial cash flow at Year 0? Round your answer to the nearest whole dollar. $ What are the incremental net cash flows that will occur at the end of Years 1 through 5? Do not round intermediate calculations. Round your answers to the nearest whole dollar. CF1$CF2$CF3$CF4$CF5$ What is the NPV of this project? Do not round intermediate calculations. Round your answer to the nearest whole dollar. $ Should Everly replace the flange-lipper?

- 18. -Select-YesNoItem 8 18. Replacement Analysis DeYoung Entertainment Enterprises is considering replacing the latex molding machine it uses to fabricate rubber chickens with a newer, more efficient model. The old machine has a book value of $800,000 and a remaining useful life of 5 years. The current machine would be worn out and worthless in 5 years, but DeYoung can sell it now to a Halloween mask manufacturer for $270,000. The old machine is being depreciated by $160,000 per year for each year of its remaining life. The new machine has a purchase price of $1,185,000, an estimated useful life and MACRS class life of 5 years, and an estimated salvage value of $105,000. The applicable depreciation rates are 20.00%, 32.00%, 19.20%, 11.52%, 11.52%, and 5.76%. Being highly efficient, it is expected to economize on electric power usage, labor, and repair costs, and, most importantly, to reduce the number of defective chickens. In total, an annual savings of $250,000 will be realized if the new machine is installed. The company's marginal tax rate is 35% and the project cost of capital is 14%. What is the initial net cash flow if the new machine is purchased and the old one is replaced? Round your answer to the nearest dollar. $ Calculate the annual depreciation allowances for both machines,

- 19. and compute the change in the annual depreciation expense if the replacement is made. Do not round intermediate calculations. Round your answers to the nearest dollar. YearDepreciation Allowance, NewDepreciation Allowance, OldChange in Depreciation1$$$2$$$3$$$4$$$5$$$ What are the incremental net cash flows in Years 1 through 5? Do not round intermediate calculations. Round your answers to the nearest dollar. CF1$CF2$CF3$CF4$CF5$ Should the firm purchase the new machine? -Select-YesNoItem 22 Support your answer. Do not round intermediate calculations. Round your answer to the nearest dollar. NPV: $