09 05 19 Web 2.0 Weekly

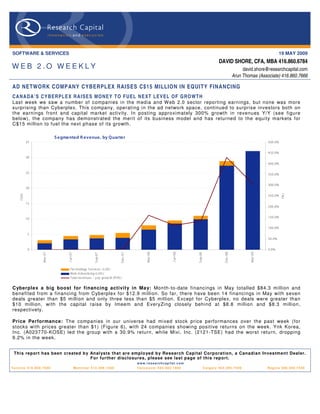

- 1. SOFTWARE & SERVICES 19 MAY 2009 DAVID SHORE, CFA, MBA 416.860.6784 WEB 2.O WEEKLY david.shore@researchcapital.com Arun Thomas (Associate) 416.860.7666 AD NETWORK COMPANY CYBERPLEX RAISES C$15 MILLIO N IN EQ UITY FINANCING CA N AD A’ S C Y B ER PL E X RA I SE S MO N E Y T O F U EL N E XT L E V EL OF G RO WT H Last week we saw a number of companies in the media and W eb 2.0 sector reporting earnings, but none was more surprising than Cyberplex. This company, operating in the ad network space, continued to surprise investors both on the earnings front and capital market activity. In posting approximately 300% growth in revenues Y/Y (see figure below), the company has demonstrated the merit of its business model and has returned to the equity markets for C$15 million to fuel the next phase of its growth. S egmented R evenue, by Quarter 35 500. 0% 450. 0% 30 400. 0% 25 350. 0% 300. 0% 20 (% ) ( $m) 250. 0% 15 200. 0% 10 150. 0% 100. 0% 5 50. 0% 0 0.0% Mar-07 J un-07 Dec-07 Mar-08 J un-08 Dec-08 Mar-09 S ep-07 S ep-08 Technology S ervices (L HS ) Web A dvertis ing ( LHS ) Total revenues - y oy grow th (R HS ) C yberplex a big boost for financing activity in May: Month-to-date financings in May totalled $84.3 million and benefited from a financing from Cyberplex for $12.9 million. So far, there have been 14 financings in May with seven deals greater than $5 million and only three less than $5 million. Except for Cyberplex, no deals were greater than $10 million, with the capital raise by Imeem and EveryZing closely behind at $8.8 million and $8.3 million, respectively. Price Performance: The companies in our universe had mixed stock price performances over the past week (for stocks with prices greater than $1) (Figure 6), with 24 companies showing positive returns on the week. Ynk Korea, Inc. (A023770-KOSE) led the group with a 30.9% return, while Mixi, Inc. (2121-TSE) had the worst return, dropping 9.2% in the week. This report has been created b y Anal ysts that are emplo yed b y Research Capital Corporation, a Canadian Investment Dealer. For further disclosures, please see last page of this report. w w w . r e s e a rc h c a p i t a l . c o m T o ro n t o 4 1 6 . 8 6 0 . 7 6 0 0 Montreal 514.399.1500 Vancouver 604.662.1800 Calgary 403.265.7400 Regina 306.566.7550

- 2. Page 2 THE WEB 2.0 UNIVERSE Ninety-three public Web 2.0 companies identified: Our W eb 2.0 universe contains 93 companies, with a combined market cap of ~ $46 billion (Figure 1). The average market cap for the group is ~$500 million (but a median of only $50.6 million), with average trailing revenue of $148.5 million (median $55.6 million). The companies are also generally profitable, with a median EBITDA margin of 16.0%. On a valuation basis, the overall average is 5.2x trailing revenue (median 1.6x) and 9.3x trailing EBITDA (median 8.7x). Fourteen of the companies have more than 500 employees. C omparable C ompan y A nalys is > W eb 2.0 Trading Cu rr ent U S D Market U S D LT M To tal US D L TM T otal E BITD A TE V/LT M T E V/LT M C om pany Nam e L TM as o f T ic ker E xc hange Currenc y H Q P ric e C ap ($m) R ev ($m) E B ITDA ($m) % R evenu e E B IT DA E mployees Acce le riz e N ew Me dia, Inc. 3 /31 /200 9 AC LZ OT C B B USD U nited S ta tes 0 .50 1 3.8 4.1 (4 .4) NM 4.6 x - 11 Actoz S of t C o., L td. 1 2/31 /200 8 A0 527 90 K OS E KR W S outh K orea 14, 400 9 9.4 75. 7 1 5.1 20 .0% 0.9 x 4.7x NA AQ Inte ractive , Inc. 1 2/31 /200 8 38 38 TSE J PY J apan 48 ,000 .00 2 6.8 61. 8 4 .9 8 .0% - - NA As s ocia ted Media Holdings Inc. 6 /30 /200 7 AS MH OT C P K USD U nited S ta tes 0 0 .1 0.1 (2 .3) NM 8.1 x - 3 B igstring Co rp. 1 2/31 /200 8 BS GC OT C B B USD U nited S ta tes 0 .02 1 .2 0.1 (2 .1) NM 30.6 x - 4 B e tawave Corpora tion 1 2/31 /200 8 B W AV OT C B B USD U nited S ta tes 0 3 .2 7.7 (1 1.8) NM - - 45 B e yond Commerce, Inc. 1 2/31 /200 8 B Y OC OT C B B USD U nited S ta tes 1 .04 4 3.0 1.8 (8 .6) NM 25.4 x - 43 B right T hings plc 9 /30 /200 8 AIM :B G T AIM GBP U nited K ingdom 0 5 .6 0.2 (1 .7) NM 22.1 x - 9 B roa dW ebAs ia Inc. 9 /30 /200 8 BW BA OT C P K USD U nited S ta tes 0 .30 2 5.3 0.0 (4 .6) NM - - 46 C DC C orp. 3 /31 /200 9 C HIN .A Nas da qG S USD H ong K ong 1 15 7.3 389 .9 3 0.8 7 .9% 0.4 x 5.5x NA C ha ngyou. com Limite d 3 /31 /200 9 C Y OU Nas da qG S USD C hina 29 .80 1,5 27.3 222 .5 13 5.1 60 .7% 6.0 x 9.9x 628 C hina G ate wa y C orpora tion 9 /30 /200 8 C GW Y OT C P K USD U nited S ta tes 0 0 .0 6.7 (6 .6) -9 8.9% 0.0 x - 37 C hine s e G amer In ternational 3 /31 /200 9 G T S M:308 3 GT S M TWD T aiwan 225 .00 57 5.6 56. 2 3 1.5 56 .0% 9.1 x 1 6.2 x NA C ornerW orld C orporation 1 /31 /200 9 C WR L OT C B B USD U nited S ta tes 0 6 .4 1.3 NM NM 6.0 x - NA C yberplex Inc. 3 /31 /200 9 T S X:C X TSX C AD C ana da 1 .87 8 6.5 70. 3 7 .3 10 .4% 1.2 x 1 1.3 x NA D ADA S pA 9 /30 /200 8 C M:D A CM EUR Ita ly 6 13 9.4 231 .1 3 6.9 16 .0% 0.8 x 5.0x 574 D XN Holdings B hd 2 /28 /200 9 D XN KL SE MY R Ma la ys ia 0 .44 2 9.1 78. 7 1 0.8 13 .7% 0.6 x 4.2x NA D ibz Inte rnational, Inc. NA D IB Z OT C P K USD U nited S ta tes 0 0 .0 NA NM NM - - NA D igitalP ost Inte ra ctive , Inc. 1 2/31 /200 8 D G LP OT C B B USD U nited S ta tes 0 .02 1 .1 0.5 (3 .2) NM 5.1 x - 7 D igitalT own, Inc. 2 /28 /200 9 DGT W OT C B B USD U nited S ta tes 3 6 7.7 NM (3 .0) NM - - 3 D olphin D igital Me dia, Inc. 1 2/31 /200 8 D P DM OT C B B USD U nited S ta tes 0 .68 3 3.5 0.9 (3 .0) NM 37.2 x - NA E olith C o. L td. 1 2/31 /200 7 A0 410 60 K OS E KR W S outh K orea 900 5 2.4 20. 2 (0 .1) -0 .3% 2.7 x - NA E xte ns ions , Inc. 1 2/31 /200 8 E XT I OT C P K USD U nited S ta tes 0 .15 1 4.2 NM NM NM - - NA F inancia l Media G roup, Inc. 2 /28 /200 9 F NG P OT C B B USD U nited S ta tes 0 0 .4 7.2 2 .4 NM - - 22 F luid M us ic Ca nada, In c. 1 2/31 /200 8 T S X:F MN TSX C AD U nited S ta tes 0 .45 2 0.4 4.6 (9 .3) -6 0.6% 1.9 x - NA F rogs te r Interactive P icture s AG 6 /30 /200 8 F RG XT R A EUR G ermany 8 2 4.6 5.5 (3 .3) 16 .6% 4.4 x - NA G a ma nia D igital E ntertainment C o., L td. 3 /31 /200 9 61 80 GT S M TWD T aiwan 38 .60 17 8.2 126 .0 2 0.9 25 .9% 1.2 x 7.4x NA G a me On C o L td. 1 2/31 /200 8 38 12 TSE J PY J apan 91, 800 9 1.0 76. 5 1 9.8 NM 0.4 x 1.7x NA G e oS e ntric O yj 1 2/31 /200 8 G E O1 V HLS E EUR F inland 0 .04 4 8.8 6.0 (1 3.4) 61 .9% 6.9 x - 94 G iant Intera ctive G roup, Inc. 1 2/31 /200 8 GA NY S E USD C hina 8 1,8 62.2 233 .6 14 4.6 24 .2% - - NA G iga Media Ltd. 1 2/31 /200 8 G IG M Nas da qG S USD T aiwan 6 .38 34 4.7 190 .4 4 6.0 19 .2% 1.4 x 5.8x NA G ravity C o., L td 9 /30 /200 8 GR VY Nas da qG M USD S outh K orea 1 2 7.0 39. 7 7 .6 36 .0% - - 636 G ree, Inc. 6 /30 /200 8 T S E : 363 2 TSE J PY J apan 5 ,260 .00 1,2 03.8 30. 1 1 0.8 17 .8% 37.3 x - NA G ungH o O nline E ntertainment, Inc. 1 2/31 /200 8 37 65 OS E J PY J apan 1 42, 600 16 7.5 115 .3 2 0.6 -2 8.2% 1.3 x 7.1x NA H anbitS of t, Inc. 1 2/31 /200 8 A0 470 80 K OS E KR W S outh K orea 4 ,855 .00 8 6.3 56. 4 (1 5.9) 3 .0% 1.2 x - NA IAC /InterActiveC orp. 3 /31 /200 9 IAC I Nas da qG S USD U nited S ta tes 16 2,3 92.0 1 ,40 6.4 4 2.6 NM 0.4 x 1 1.9 x 3 ,20 0 IAS E nergy, Inc. 1 /31 /200 9 IAS C.A OT C B B USD C ana da 0 .28 1 9.6 0.0 (0 .8) NM - - NA IdeaE dge, Inc. 1 2/31 /200 8 OT C B B :ID AE OT C B B USD U nited S ta tes 1 2 4.3 0.0 (4 .6) NM - - NA is ee media Inc. 1 2/31 /200 8 IE E T S XV C AD C ana da 0 .09 4 .0 1.3 (5 .1) 37 .2% 1.8 x - NA J umbuck E ntertainment P ty Ltd. 1 2/31 /200 8 AS X:J MB AS X AU D Aus tra lia 0 1 5.3 13. 7 5 .1 -6 2.6% 0.8 x 2.1x 72 J umpT V Inc. 1 2/31 /200 8 T S X:J T V TSX C AD C ana da 0 .71 6 9.7 13. 4 (8 .4) 10 .0% 4.0 x - 237 K a boos e Inc. 1 2/31 /200 8 T S X:K AB TSX C AD C ana da 1 7 2.5 70. 7 7 .0 38 .7% 1.1 x 1 1.2 x NA K ings oft Co. Ltd. 1 2/31 /200 8 38 88 S E HK HKD C hina 4 .14 57 6.9 120 .2 4 6.6 NM 4.2 x 1 0.9 x 2 ,27 1 Lingo Media Corporation 1 2/31 /200 8 T S XV : LM T S XV C AD C ana da 1 1 1.1 0.8 (1 .5) -4 .3% 10.9 x - NA Live Wo rld Inc. 1 2/31 /200 8 LV WD OT C P K USD U nited S ta tes 0 .07 2 .2 11. 8 (0 .5) -6 .3% 0.1 x - NA LookS mart, Ltd. 3 /31 /200 9 LOOK Nas da qG M USD U nited S ta tes 1 2 4.6 60. 7 (3 .8) NM - - 90 Magnitude Information S ys tems Inc. 1 2/31 /200 8 MA G Y OT C B B USD U nited S ta tes 0 .01 4 .4 0.1 (3 .0) 38 .0% - - 14 Mixi, Inc. 1 2/31 /200 8 21 21 TSE J PY J apan 4 50, 000 70 8.4 120 .3 4 5.8 15 .3% 5.0 x 1 3.2 x NA Mode rn Times G roup Mtg AB 3 /31 /200 9 MT G B OM S EK S weden 237 .50 2,0 20.2 1 ,73 7.6 26 6.2 NM 1.5 x 9.7x 2 ,96 9 Moggle , Inc 1 2/31 /200 8 MMOG OT C B B USD U nited S ta tes 2 8 3.5 NM (1 .1) NM - - 3 MOK O.mobi L imited 1 2/31 /200 8 MK B AS X AU D Aus tra lia 0 .08 5 .0 1.1 (2 .3) 1 .9% 3.5 x - NA Myriad G rou p AG 1 2/31 /200 8 MY R N SWX C HF S witzerla nd 5 9 8.2 40. 0 0 .8 26 .8% 2.8 x - 405 N E OW IZ G ames C orpora tion 1 2/31 /200 8 A0 956 60 K OS E KR W S outh K orea 62 ,400 .00 48 7.1 200 .8 5 3.9 45 .7% 2.4 x 8.9x NA N etD ragon W ebS oft, Inc. 1 2/31 /200 8 77 7 S E HK HKD C hina 6 37 7.2 87. 3 3 9.9 65 .0% 2.8 x 6.1x 2 ,42 6 N ete as e.com I nc. 1 2/31 /200 8 NT E S Nas da qG S USD C hina 30 .96 3,8 09.7 451 .8 29 3.7 NM - - NA N eXplore Corpora tion 9 /30 /200 7 N XP C OT C P K USD U nited S ta tes 1 3 9.0 NM (4 .9) 30 .8% - - 19 N gi G roup Inc. 1 2/31 /200 8 24 97 TSE J PY J apan 31 ,700 .00 4 0.2 100 .8 3 1.0 17 .6% - - NA N orthgate Te chnologies L imited 1 2/31 /200 8 59 005 7 BS E INR India 39 2 7.6 136 .2 2 4.0 25 .5% 0.2 x 1.2x 286 Open T e xt Corp. 3 /31 /200 9 OT E X Nas da qG S USD C ana da 31 .73 1,6 69.7 782 .6 19 9.2 -1 .0% 2.2 x 8.7x 3 ,40 0 Openwave S ys tems Inc. 3 /31 /200 9 OP W V Nas da qG S USD U nited S ta tes 1 10 5.8 197 .2 (2 .1) 54 .1% 0.0 x - 630 P e rf ect W orld C o., Ltd. 1 2/31 /200 8 PW R D Nas da qG S USD C hina 18 .90 99 7.1 210 .5 11 3.9 -4 .9% - - NA P hotoChannel N etwork s Inc. 1 2/31 /200 8 T S XV : P N T S XV C AD C ana da 2 4 7.0 17. 2 (0 .8) NM 2.7 x - NA Quepa s a C orp. 1 2/31 /200 8 QP S A Nas da qC M USD U nited S ta tes 0 .97 1 2.3 0.1 (1 1.4) 13 .1% - - 74 OA O R B C Information S ys tems 1 2/31 /200 7 R BC I R TS USD R us s ia 1 17 3.4 146 .9 1 9.2 46 .0% 0.0 x 0.3x NA S handa Interactive E ntertainme nt L td. 1 2/31 /200 8 S N DA Nas da qG S USD C hina 49 .38 3,4 26.1 522 .7 24 0.2 13 .2% 0.2 x 0.4x NA S hutte rf ly, Inc. 3 /31 /200 9 S F LY Nas da qG S USD U nited S ta tes 13 32 3.5 215 .2 2 8.3 6 .5% 1.2 x 9.1x 514 S K C ommunications Co., Ltd. 1 2/31 /200 8 A0 662 70 K OS E KR W S outh K orea 9 ,390 .00 31 3.1 186 .7 1 2.1 31 .4% 1.7 x 2 5.8 x NA S N AP Inte ra ctive , Inc. 1 2/31 /200 8 S T VI OT C B B USD U nited S ta tes 1 8 .1 3.0 0 .9 -3 4.8% 2.2 x 7.0x 11 S N M G lobal H oldings 9 /30 /200 8 S N MN OT C P K USD U nited S ta tes 0 .00 0 .0 2.0 (0 .7) -6 0.5% 1.1 x - 33 S ocia l Media V e nures , Inc. 1 2/31 /200 8 S MV I OT C P K USD U nited S ta tes 0 0 .0 0.1 (0 .1) 43 .6% 0.0 x - NA S ohu. com Inc. 3 /31 /200 9 S OHU Nas da qG S USD C hina 55 .32 2,1 16.8 460 .0 20 0.5 NM 3.8 x 8.7x 3 ,19 7 S ite s earch C orporation 1 /31 /200 9 S T PC OT C B B USD U nited S ta tes 3 2 8.2 NM (1 .1) 21 .5% - - 15 S park N etworks , Inc. 1 2/31 /200 8 LOV AME X USD U nited S ta tes 2 .75 5 6.5 57. 3 1 2.3 NM 1.0 x 4.6x 183 S pectrumDN A, Inc. 1 2/31 /200 8 S P XA OT C B B USD U nited S ta tes 0 2 0.5 0.1 (2 .5) 48 .9% - - 7 T encent Holdings L td. 1 2/31 /200 8 70 0 S E HK HKD C hina 71 .30 16,5 68. 2 1 ,04 7.8 51 2.5 -1 2.0% 17.2 x 3 5.3 x 6 ,19 4 T he P arent C ompany 8/2/2008 K ID S .Q OT C P K USD U nited S ta tes 0 0 .3 112 .0 (1 3.5) 33 .7% 0.2 x - 347 T he 9 L imited 1 2/31 /200 8 N CT Y Nas da qG S USD C hina 9 .46 25 3.7 250 .2 8 4.3 2 .9% - - NA T he S treet.com, Inc. 3 /31 /200 9 TSCM Nas da qG M USD U nited S ta tes 2 6 2.8 67. 0 1 .9 -5 0.6% - - 310 T otal S port Online A S 3 /31 /200 6 T OS O OT C NO NOK N orwa y 0 .03 0 .1 2.1 (1 .1) -6 .2% 4.6 x - 16 T ree.C om, Inc. 3 /31 /200 9 TR EE Nas da qG M USD U nited S ta tes 12 13 0.5 215 .6 (1 3.3) 0 .4% 0.6 x - 700 U nis erve C ommunications Corp. 1 1/30 /200 8 T S XV : US S T S XV C AD C ana da 0 .04 0 .8 25. 8 0 .1 21 .9% 0.1 x 2 9.5 x NA U nited Online Inc. 3 /31 /200 9 U NT D Nas da qG S USD U nited S ta tes 7 60 5.1 811 .2 17 7.3 -7 8.2% 1.1 x 5.0x 1 ,46 9 U OMO Media , Inc 1 /31 /200 9 U OMO OT C B B USD C ana da 0 .25 2 1.0 0.6 (0 .5) 17 .8% 33.6 x - NA V a lueC lick Inc. 3 /31 /200 9 V C LK Nas da qG S USD U nited S ta tes 10 89 9.2 591 .7 10 5.5 NM 1.3 x 7.5x 1 ,18 9 V O IS , Inc. 1 2/31 /200 8 V OIS OT C B B USD U nited S ta tes 0 .32 2 .7 0.0 (1 .3) -1 9.8% - - 4 W ebze n Inc. 1 2/31 /200 8 W ZE N Nas da qG M USD S outh K orea 3 3 8.9 23. 1 (4 .6) -9 8.2% - - NA W izza rd S of twa re Corpora tion 1 2/31 /200 8 W ZE AME X USD U nited S ta tes 0 .62 2 9.2 6.1 (6 .0) NM 4.8 x - 110 W orlds .com Inc. 1 2/31 /200 8 W DD D OT C B B USD U nited S ta tes 0 8 .9 0.1 (0 .7) NM - - 1 W ynds torm C orporation NA W YND OT C B B USD U nited S ta tes 0 .03 0 .5 NA NM 32 .0% - - NA XIN G AG 1 2/31 /200 8 O1B C XT R A EUR G ermany 29 20 8.1 47. 6 1 5.2 22 .4% 3.1 x 9.8x 174 Y e dangOnline Corp. 1 2/31 /200 7 A0 527 70 K OS E KR W S outh K orea 8 ,900 .00 11 3.3 55. 6 1 2.4 -7 .6% 2.0 x 9.0x NA Y nk K orea Inc. 1 2/31 /200 7 A0 237 70 K OS E KR W S outh K orea 6, 850 1 3.6 15. 8 (1 .2) NM 0.9 x - NA ZipLocal Inc. 1 2/31 /200 8 T S XV : ZIP T S XV C AD C ana da 0 .01 0 .3 2.8 (3 .0) 0 .0% 0.6 x - NA H igh 16,5 68. 2 1 ,737 .6 51 2.5 65 .0% 37.3 x 3 5.3 x 6 ,194 Low 0 .0 0.0 -15.9 -9 8.9% 0.0 x 0.3x 1 A vera ge 496.0 148.5 33.1 8.3% 5.2x 9.3x 682 Median 5 0.6 55. 6 0 .9 16 .0% 1.6 x 8.7x 210 Figure 1. Web 2.0 Universe Summary Source. Capital IQ

- 3. Page 3 C A P I T A L M A R K E T S A C T I V I T Y (M & A A N D F I N A N C I N G ) C yberplex a big boost for financing activity in May: Month-to-date financings in May totalled $84.3 million and benefited from a financing from Cyberplex for $12.9 million. So far, there have been 14 financings in May with seven deals greater than $5 million and only three less than $5 million. Except for Cyberplex, no deals were greater than $10 million, with the capital raise by Imeem and EveryZing closely behind at $8.8 million and $8.3 million, respectively. The average value for April was $6.5 million on 21 financings. The March average was $6.6 million on 24 financings. Except for two deals (Kaixin001.com and Collective Media), all were below $20 million for the last three months and a total of four deals were greater than or equal to $15 million. Financing Activity Last Three Months 180.0 6.7 6.6 160.0 6.5 140.0 6.4 120.0 6.3 100.0 (US$m) (US$m) 6.2 80.0 6.1 60.0 6.0 40.0 5.9 20.0 5.8 0.0 5.7 Mar-09 Apr-09 May-09 Total Average Figure 2. Financings, Last Three Months Source. Company reports C yberplex largest deal in May: After two weeks into May, Cyberplex tapped the equity markets for $12.9 million. Imeem, a company from the social networks sector, follows with an $8.8 million raise, followed very closely by EveryZing at $8.3 million. Eleven of the 14 deals in the month are equal to or greater than $5 million. For additional details, see Figures 23 and 24 (at end of note). Further, the month of May also witnessed the spin-off of StumbleUpon from E-bay on a $29 million valuation. E-bay had bought StumbleUpon for $75 million.

- 4. (US$m) 0.0 5.0 10.0 15.0 20.0 25.0 30.0 35.0 StumbleUpon Kaixin001.com Collective Media Source. Company reports GOOM Radio Vidyo Marin Software The Rubicon Project Cyberplex Buzznet FreeWheel SendMe Inc. Figure 3. Capital Market Activity, Last Three Months LendingClub Miva Auditude Conductor Inc. Cellufun Glam Media SuperSecret Visible Measures Imeem GoViral EveryZing ScanScout Batanga BlogHer Inc. Gist Fuhu Inc. Azuki Systems I Love Rewards Greystripe Viximo OLX DoubleTwist TimeBridge DocuSign OMGPOP the last few months: Ad Network, Media, Video, and Social Networks. IMShopping Socialtext Apture Mixercast Simulmedia Medialets Tynt SoundCloud AnySource Media Financing & M/A Summary - Last Three Months Pixazza TubeMogul Tribal Nova Tripbase Hunch Resonate Networks Sports Composite Bit.ly Mo'Minis Socialcast Brandtology Scan & Target AdultSpace Myngle Jodange 33Across Three Melons Foodista Apr-09 Mar-09 May-09 Page 4 companies raising over $78.7 million (Figure 4). The Media sector has the next highest totals, with eight companies Ad Network is the most active sector: Activity over the last three months was busiest in the Ad Network sector, with 10 raising $63.4 million. It is important to note that the following sectors continue to generate the most capital activity over

- 5. Page 5 Capital Market Activity by Sector - Last Three Months 90.0 80.0 70.0 60.0 50.0 (US$m) 40.0 78.7 63.4 30.0 49.5 48.5 20.0 30.2 29.1 10.0 18.3 14.4 12.0 12.0 10.4 8.9 7.5 7.0 6.8 5.5 5.0 4.7 4.1 3.1 2.0 2.0 2.0 1.3 1.3 0.0 Comment/Reputation Social Commerce Gaming Visual Commerce Travel Media Mobile Collaboration Publishing Microblog Online Learning Widget Search Lending Infrastructure Blog Mobile Ad SAS Social Networks Video Virtual World Aggregation Crowdsourced Ad Network Analytics Content # companies 10 8 5 6 2 6 2 3 1 1 2 2 2 1 1 1 1 1 1 1 1 1 1 1 1 Figure 4. Capital Market Activity, by Sector, Last Three Months Source. Company reports C A P I T A L M A R K E T S A C T I V I T Y (P R I C E P E R F O R M A N C E ) Web 2.0 Index outperforms: Our W eb 2.0 index (market-cap weighted) essentially mirrored the performance of the NASDAQ composite index from mid-2008 until recently when it has moved higher than the NASDAQ index (Figure 5).

- 6. Page 6 Web 2.0 Index Price Performance 120.0 100.0 80.0 60.0 40.0 20.0 - Index: Web 2.0 X (Market Cap Weights) NASDAQ Composite Index - Share Pricing Figure 5. Web 2.0 Price Performance Source. Capital IQ A positive week: The companies in our universe had mixed stock price performances over the past week (for stocks with prices greater than $1) (Figure 6), with 24 companies showing positive returns on the week. Ynk Korea, Inc. (A023770- KOSE) led the group with a 30.9% return, while Mixi, Inc. (2121-TSE) had the worst return, dropping 9.2% in the week.

- 7. Page 7 1 Week P rice P erformance Y nk K orea Inc. 30.9% Chines e G amer International 30.4% G ungHo Online Entertainment, Inc. 21.5% A Q Interactive, Inc. 18.9% Northgate Technologies Limited 16.9% L ingo Media Corporation 15.0% HanbitS oft, Inc. 13.3% Quepas a Corp. 11.1% S hutterf ly , Inc. 10.7% NetDragon WebS oft, Inc. 9.8% PhotoChannel Netw orks Inc. 9.7% Tencent Holdings Ltd. 8.2% Eolith Co. Ltd. 7.3% X ING A G 5.2% K ings oft Co. Ltd. 4.0% Tree.Com, Inc. 3.8% G ree, Inc. 3.8% S handa Interactive Entertainment Ltd. 2.7% B ey ond Commerce, Inc. 2.5% S K Communica tions Co., Ltd. 1.7% G amania Digital Entertainment Co., Ltd. 1.3% G iant Interactive G roup, Inc. 1.1% Y edangOnline Corp. 0.8% The9 Limited 0.5% G ameOn Co Ltd. 0.0% Open Tex t Corp. -0.4% Changy ou.com Limited -1.1% Neteas e.com Inc. -1.6% V alueClick Inc. -1.9% NEOWIZ G ames Corporation -2.6% My riad G roup A G -2.9% Openw ave S y s tems Inc. -3.2% Webz en Inc. -3.4% Modern Times G roup Mtg A B -3.8% S ohu.com Inc. -4.7% A ctoz S oft Co., Ltd. -5.1% IA C/InterA ctiveCorp. -5.3% Frogs ter Interactive Pictures A G -7.4% Cy berplex Inc. -7.4% G igaMedia Ltd. -7.6% Ngi G roup Inc. -8.0% Perf ect World Co., Ltd. -8.2% TheS treet.c om, Inc. -8.4% S park Netw orks , Inc. -8.7% Mix i, Inc. -9.2% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% Figure 6. 1-Week Price Performance Source. Capital IQ

- 8. Page 8 INDUSTRY NEWS (PARTNERSHIPS, FINANCIAL RESULTS, NEW PRODUCTS) K ey Developments C ompany Headline Notes Open T ext C orp. (Nas daqG S : OT E X) O pen T ext C orp. to S how E C M S uite for U se with S AP (R ) O pen T ext C orp. announced tha t it will be work ing with S AP cus tomers to demons trate the O pen T ext E C M S uite for us e with S AP (R ) S olutions At S AP P H IR E (R ) 2009 O rlando C onference solutions during the S AP P H IR E (R ) 2009 O rla nd o and the 2009 A S UG Annual c onferences . During S AP P H I R E 2009, cus tomers will ha ve the opportunity to lea rn firs thand how the O pen T ex t E C M S uite for use with S AP s oluti ons provides trans parent acces s to enterpris e content of a ll k inds - whether c ustomer c orrespondence, s ca nned ima ges of inv oices , c ontra cts , or word proc es sing documents and sprea ds heets - from within us ers' fa milia r S AP a pplic ations. T his s ignific antly boosts produc tiv ity beca us e the c ontent they need is automa tic ally a va ila ble in the context of their work . O pen T ext de livers E C M extensions that integrate with a nd c ompl ement S A P s olutions , helping orga niza tions reduce risk , inc rease opera tiona l effic ienc y a nd driv e I T c onsolidation. Among the sav ings being highlighted at the O pen Tex t booth (No. 336) this week inc lude: L owered AP proces sing cos ts as well as cost of goods, with the S AP I nvoic e M a na gement a pplication by O pen T ext; E limin a tion of legac y sy stem c ost (maintena nce, servers, c ons ulting, etc) with Lega cy D ecommiss ioning; R eduction of 50% or more in cons ult Modern Times G ro up Mtg AB (OM: MTG Modern Times M ulls Acquisitions Modern Times G roup Mtg AB pla ns to ma k e ac quis itions . Modern T imes G roup a nnounc ed that the 2009 Annual G enera l M eeting of MT G B) sha reholders voted to s upport all of the resol utions propos ed to the Meeting. T he firm s a id, “T he Meeting also approved the B oa rd of Direc tors ' propos a l tha t the B oard be able to pa s s a resolution on one or more occa sions during the period up until the next Annua l G eneral Meeting to trans fer the Compa ny 's own C las s A a nd/or C las s B shares within the quoted s hare pric e spread on the N AS D AQ O M X S tockhol m in connection with potential a cquisitions . This authoriz a tion incl udes the right to res olve on the disapplica tion of the preferentia l rights of shareholders and tha t payment s ha ll be able to be made in forms other tha n cas h. T he purpos e of thes e authoriz a tions is to provide the B oa rd of Direc tors with inc reased freedom to adapt the C ompa ny 's ca pital structure a nd thereby increas e s ha reholder value, a nd/or to fina nc e potential a cquisitions .” Modern Times G ro up Mtg AB (OM: MTG Modern Times G roup Mtg A B announces an E quity Modern Times G roup Mtg AB (O M : MT G B ) wa s gra nted shareholder approval to repurchase own shares at its A nnua l G eneral Meeting held B) B uybac k on M ay 11, 2009m. Under the progra m, the c ompany will repurc ha s e M TG C la s s A and/or Cla s s B shares , provided that the G roup's holding does not a t a ny time exceed 10% of the tota l number of iss ued a nd outsta nding sha res . T he repurchase of s ha res sha ll take pla ce on the O MX N ordic E x change S toc k holm and ma y only occ ur at a price wi thin the sha re price interva l regis tered at tha t time, where s hare pric e interv al means the differe nce between the highes t buy ing pric e a n d lowes t s elling pri ce. T he c ompany wa s a ls o a uthoriz ed to repurchas e its own Cla s s C s hares. T he repurc ha s e may only be effected through a public offer direc ted to a ll holders of C lass C sha res a nd sha l l c ompris e a ll outstanding Clas s C s ha res. T he pu rchas e ma y be affected a t a purc ha se pric e c orresponding to not les s than S E K 5. 00 a nd not more tha n S E K 5.10. T he total price will not exc eed S E K 1. 89 million and pay ment for the C las s C s hares s hall be ma de in ca s h. T he purpos e of the repurcha s e is to ensu re the delivery of Clas s B s ha re s under the P lan. T he share buyba ck a uthority i s va lid until the conclus ion of the next A nnua l Northgate Tec hno logies Limited Northga te T echnologies Limited R eports Una udited Northga te Technologies Limited reported una udited cons olida ted a nd standa lone ea rnings results for the third quarter and nine months (B S E :590057) Cons olida ted a nd S tanda lone E a rnings R esults for the ended D ecember 31, 2008. O n cons olidated ba s is, the compa ny reported a net profit and E B I T of I NR 124. 3 million or I N R 3.44 per diluted T hird Q ua rter a nd Nine Months E nded December 31, sha re on rev enues of I NR 1, 484.0 million for the qua rter compared to net profit of I NR 140. 6 million or I NR 3. 94 per diluted s hare on 2008 revenues of I NR 1,404. 8 million and E B I T of I NR 140. 0 million in the sa me period a year ago. C onsolidated E B IT DA for the qua rter rais ed to IN R 310.8 million, a y ear-on-yea r increa se of 60% . F or the nine months ended December 31, 2008 on c ons olidated ba sis , the c ompany reported a net profit of I N R 572.7 mi llion or IN R 16.12 per diluted s hare on revenues of I NR 5, 112.7 million a nd E B I T of IN R 572. 3 million compared to net profit of IN R 526.6 million or I NR 15. 26 per diluted s hare on revenues of I NR 3, 885.8 million a nd E B I T of IN R 525. 6 million in the s ame period a y ea r a g o. Cons olidated E B I TD A for the period ra is ed to IN R 1,148. 7 million, a y ear-on-yea r increa s e of 83% . Magnitude Information S ys tems Inc. Ma gnitude I nformation S ys tems I nc. announced delayed O n 05/12/2009, Magnitude I nforma tion S y stems Inc . a nnounc ed that they will be unable to file their next 10-Q by the dea dline required by the (OT CB B: MAG Y) 10-Q filing S E C. S hanghai Telecom mun ic ation Co., T he9 Limited a nd T he9 L imited J ointly P romote 3G S hanghai T elec ommunic ation Co. Ltd. a nd T he9 Limited jointly promote a 3G service. U s er c an pa y for the service while la mbing down their L td.; The9 L im ited (N as daqG S :N CTY ) S ervice tolls generated by mobile phone ca lls . B oth s ides wil l c oopera te in the publiciz ing and ma rketing of the service. In the future, they will sh a re sales network s . S ha ngha i T elec om will s oon promote other va lue-a dded s ervic es lik e mobile pa yment, location-base d information serv ice, mobile c ommunity, a nd mobile games . Hurray! Holding Co. L td. S handa S peculated T o B e Ac quiring Hurra y! T here was widespread spec ulation that H urra y ! Holding Co. may be a cquired by S handa Interactive E ntertainment Ltd. Hurra y ’s American (Nas daqG M:HR AY ); S han da Interactive deposita ry receipts ros e by 30% to $2. 87 in N AS DAQ s tock market trading. “C aijing magazine reported that S handa is looki ng a trans a ction E ntertain ment Ltd. (Nas daqG S : S N DA) a nd a dea l is likely to be finalized in the next two week s. is eemedia Inc . (T S XV: IE E ); R emoba iseemedia Inc. 's is eedoc s(T M) T ec hnology G oes Liv e in iseemedia Inc. and R emoba I nc. a nnounced that the new la unch of R emoM a il(TM ) and R emoS y nc(T M) solutions by R emoba utilizing Inc. R emoba 's La test M obile E ma il S olution iseemedia 's is eedocs (TM ) rich ema il attac hment viewing ca pa bilities , is now av ailable on the V eriz on wireless network . T hese new mobile email s ervices, integra ting is eedocs (T M) tec hnology, ena bles Microsoft E xchange ema ils with rich document a tta chments to be viewed on B R E W (T M) enabled mobile phones tha t V erizon sell s. T hey turn every B R E W (T M) enabled mobile phone into a S martphone. T hes e new email attac hment solutions ha ve now begun to provide both c ompa nies with a recurring royalty-bas ed revenue strea m per email a ccount monthly. S ocialwis e, Inc. (OT CB B: IDA E ) IdeaE dge I nc. will C ha nge its T ick er to S C LW from ID AE E ffectiv e M a y 13, 2009, IdeaE dge I nc. will change its O T C B B s tock ticker sy mbol to S C L W from I DAE . C DC C orp. (Nas daqG S : CHIN.A) CD C Corp. A nnounces E arni ngs R es ults for the F irs t CD C Corp. a nnounc ed earnings results for the firs t quarter ended M a rch 31, 2009. F or the quarter, the company's rev enue totaled $79. 0 Q uarter E nded Marc h 31, 2009 million a 20% dec line over revenues of $98. 2 million in the firs t qua rter of 2008. T he compa ny's net income wa s $7. 9 million or $0. 07 per sha re, a n improvement over a net loss of $11.9 million or $0.11 per sha re in the corres ponding qua rter of the prior y ea r. B etawave Corporatio n (OT CB B: B WA V) B etawa ve Corporation R eports Una udited Cons olida ted B etawa ve Corporation reported un audited cons olida ted earnings res ults for the first quarter en ded M arch 31, 2009. F or the quarter, the E a rnings R esults for the F irst Q uarter E nded M arch 31, company reported net los s of $4, 413,667 or $0.15 net los s per s ha re ba s ic a nd dilute d a nd net cas h used in operating a ctivities of 2009 $4,647, 942 on revenues of $1,388, 420 against net l oss of $4, 179, 398 or $0.17 net los s per s hare ba sic and diluted and net c ash used in opera ting activi ties of $641, 002 on revenues of $657, 150 aga ins t a year. T otal revenue increa sed 111% to $1,388, 420 for the three months ended M a rch 31, 2009 from $657, 150 for the firs t quarter of 2 008. C yberplex Inc . (TS X: C X) Cy berplex Mulls Acquis itions Cy berplex Inc. announced tha t it ha s entered into an a greement with a s yndica te of underwriters led by G MP S ec urities L .P . , whic h hav e a greed to purchas e, on a bought dea l basis , 9, 375,000 common s hares of the Compa ny at a purchas e price of $1.60 per c ommon s ha re, for a ggrega te gross proceeds of $15, 000, 000. T he Compa ny intends to us e the net proceeds of the prospectus for general c orpora te purpos es a nd potential acquisitions . C yberplex Inc . (TS X: C X) Cy berplex Inc. ha s filed a F ollow-on E quity O ffering in the Cy berplex Inc. ha s filed a F ollow-on E quity O ffering in the a mount of CAD 15. 00 million. a mount of CAD 15 .00 millio n. C DC C orp. (Nas daqG S : CHIN.A) CD C Corp. R eports E a rnings R esults for the F irst Q ua rter CD C Corp. reported ea rnings results for the first qua rter of 2009. F or the period, the compa ny reported Adjus ted E B I T D A from c ontinuing of 2009 opera tions of $6.7 mill ion c ompa red to $0. 9 million, for the firs t qua rter of 2008. I n the firs t quarter of 2009, the compa ny als o recorded opera ting cas h flows of $2.1 million c ompa red to $5.3 milli on in opera ting ca sh flows in the firs t quarter of 2008.

- 9. Page 9 Neteas e. com Inc. (Nas daqG S : NT E S ); Netea se. c om I nc. E nters into A S trategic P a rtners hip Netea se. com Inc. ha s entered into a s trategic partnership a greement with On2 T echnologies I nc . NetE ase will deploy On2's V P 6 enc oding On 2 Tech nolo gies In c. (AME X:ONT ) Agreement with O n2 T ec hnologies I nc forma t a nd F lix E ngine trans c oding s oftwa re in a number of its v ideo channels . On2 V P 6(R ) is a proprieta ry video format developed by On2 a nd licensed by Adobe(R ) for F la s h(R ) P la yer a nd S un for J avaF X , a ss uring ha ss le-free pla ybac k . On2 V P 6 offers s uperior compres sion performance to S orens on S pa rk and H .264 B as eline profile. O n2 F lix E ngine is a leading s erver-s ide tra ns coding s olution for crea ting a nd publishing web video. Flix E ngine ena bles s upport for a broad ra nge of input formats including M P E G -2, MP E G -4, H. 263, H .264, Q uick Time, W indows M edia a nd more. Flix E ngine outputs On2 V P 6, H .264, a nd S orens on S pa rk ba sed video for Adobe F la s h P l ayer as well as H. 264 video for Apple(R ) iP od(R ) and iP hone(TM ), 3G P video for mobile devices a nd video S un J avaF X. K aboo s e Inc. (T S X:K AB) K a boos e I nc. A nnounces U na udited C onsolida ted K a boose Inc . a nnounc ed unaudi ted cons olidated ea rnings res ults for the first qua rter ended M a rch 31, 2009. F or the period, the compa ny E a rnings R esults for the F irst Quarter E nded M arch 31, reported loss before income ta x es of CAD 4,062, 000 a ga ins t C AD 4,706, 000 a y ear ago. Los s from c ontinuing operations wa s C AD 2009 4,652, 000 or CA D 0.03 per ba s ic a nd diluted s hare agains t CA D 3,934, 000 or CAD 0.03 per bas ic and diluted s hare a year ago. Net loss wa s C AD 4,912, 000 or C AD 0.03 per b a sic a nd diluted s ha re on revenues of C AD 16, 751, 000 a ga ins t CA D 3,787, 000 or C AD 0.03 per ba s ic a nd diluted s ha re on revenues of C A D 16,297, 000 a year a go. N et ca s h provided by operating a ctivities was CA D 2,760, 000 agains t net cas h us ed in operating activities of C AD 3,084, 000 a yea r a go. P urchas es of property , plant a nd equipment, net of tax credits were a mounted to CAD 334, 000 ag ainst C AD 537, 000 a yea r ago. T enc en t Ho ldings Ltd. (S E H K: 700) T enc ent H oldings Ltd. Announces E a rnings R es ults for T enc ent Holdin gs Ltd. announced ea rnings results for the firs t qua rter ended March 2009. F or the quarter, the company reported net income the F irst Q ua rter E nded M a rch 2009 of HK D 1. 05 billion ($135. 5 million), or 57 cents a s hare, compa red to H K D 534 million, or 30 cents, in the y ear-earlier period. R ev enue through Ja nuary to Ma rch tota led HK D 2.5 billion, up from H K D 1. 4 billion. T enc en t Ho ldings Ltd. (S E H K: 700) T enc ent H oldings Ltd. announces a n E quity B uybac k T enc ent Holdin gs Ltd. (S E HK : 700) was granted s ha reholder a pprova l for a n E quity B uybac k a t the Ann ua l G eneral Meeting held on Ma y 13, 2009. Under the progra m, the compa ny will repurchas e 180, 093,334 s hares, repres enting 10% of the is sued s ha re ca pital of the C ompany . Any repurcha s e will be made out of funds which a re lega lly available for the purpos e in a ccordance with the memorandum of as socia tion and bye-la ws of the Compa ny a nd the Companies A ct. T he repurc ha ses will be in a cc orda nce with l aws a nd requirements and regulations of the S tock E xc ha nge of Hong K ong L imited or on any other stoc k exc ha nge on whic h the sha res of the Compa ny may be lis ted and recogniz ed by the S ec uri ties and F utures C ommis sion a nd the S tock E x cha nge of Hong K ong L imited for this purpose, s ubject to and in ac corda nc e with a ll applicabl e la ws a nd requirements of the S ec urities and F utures C ommis s ion, T he S tock E x change of H ong K ong L imited or a ny other stock exch ange a s a mended from time to time. T he s hare buy ba ck progra m shall be valid until the ea rlies t of the conclus ion of the next Annual G enera l Meeting, or the expiration of the period within whic h the next Annua l G eneral Meeting of the C ompa ny is required by the B ye-l J u mpTV Inc . (TS X : J TV) J umpT V I nc. Announces E arnings R es ults for the F irst J umpTV I nc. annou nced ea rnings resu lts for the firs t qua rter ended March 31, 2009. F or the qua rter, the company reported revenue of $6. 6 Quarter E nded Marc h 31, 2009 million c ompared to $1. 9 million in the s ame period in 2008, mark ing a y ear ov er y ear inc reas e of 247% . T he net loss wa s $5. 8 million (including $1.7 million of non-cas h charges (1)) or $0.05 per s hare ba sic and diluted for the firs t qua rter of 2009 compa red to $1.5 million (including $0.7 million of non-cas h charges (1)) or $0.03 per s hare ba sic and diluted for the sa me period in 2008. The revenue a nd net loss for the three months ended M arch 31, 2008 reflec t the res ults of o pera tions of N euL ion Inc. the ac counting a cquirer, prior to the merger between N euLion I nc. and J umpTV Inc. on O ctober 20, 2008. S ocialwis e, Inc. (OT CB B: IDA E ) S oci a lwis e, Inc . has C ha nged its T ick er to S CL W from E ffectiv e M a y 13, 2009, S ocia lwis e, Inc . c ha nged its O T C B B s tock ti ck er s ymbol to S C LW from ID AE . ID AE S ocialwis e, Inc. (OT CB B: IDA E ) IdeaE dge , Inc. ha s C hanged its N a me to S ocia lwis e, Inc . On M ay 13, 2009, I dea E dge, Inc . c ha nged its name to S ocialwise, Inc. T enc en t Ho ldings Ltd. (S E H K: 700) T enc ent H oldings Ltd. R eports Una udited Cons olida ted T enc ent Holdin gs Ltd. reported una udited cons olida ted earnings res ults for the first quarter ended M a rch 31, 2009. F or the quarter, the E a rnings R esults for the F irst Quarter E nded M arch 31, company reported profit before inc ome tax of R M B 1. 2 billion compared to R MB 0.64 billion in the s a me period a y ear ago. 2009 P hotoC han nel N etworks Inc. P hotochannel Network s Inc . R eports U naudited E arnings P hotoC ha nnel N etworks Inc . reported una udited earnings res ults for the s econd qua rter and six months ended M arch 31, 2009. F or the (T S XV: PN) R es ults for the S econd Q ua rter a nd S ix Months E nded quarter, the c ompany has pos ted tota l revenue of CAD 5, 015, 041 c ompared to C AD 3,259, 499 for the s econd quarter of 2008. G AAP net Ma rc h 31, 2009 loss for the qua rter of CA D 1,475, 124 c ompa red to C AD 2, 622,228 for the s a me period of fis c al 2008. N on-G AAP net profi t for the quarter wa s C AD 543,278, compared to a non-G AAP net los s of C AD 1,285, 808 in the s econd qua rter of 2008. B asic and diluted net l oss per sha re wa s C AD 0.04 compared to bas ic a nd diluted net loss per s ha re of CAD 0. 08 for the compa ra ble period in F is c al 2008. N on-G AAP a djusted E a rnings per s hare, defined a s net profit, exc luding amortization and s hare-based c ompens ation expen se, of C AD 0. 02 c ompared to a Non- G AAP a dj usted net los s per sha re of C AD 0.04 for the compa ra ble period for F is c al 2008. F or the six month, the company ha s posted tota l rev enue of C AD 12, 191,374 compared to CAD 7, 558, 093 for the s ame period of 2008. G AAP net loss for the quarter of C AD 534,480 compared to C AD 3,704, 828 for the sa me peri od of fisca l 2008. Non-G AA P net profit for the quarter wa s C AD 3, 336,333, c ompared to a non-G AAP net los s of CAD 1,403, 291 for the same pe ri od of 2008. B asic and diluted net los s per T heS treet.c om, Inc . (Nas daqG M: T S CM) T heS treet.com, Inc. Announc es E xec utive C ha nges T heS treet. com, I nc. announced tha t E ric As hman res igned as the company's C hief F ina ncial Offic er, effectiv e M a y 8, 2009. E ffective the same day, R ichard B roitma n, the company's V ice P resident of F ina nc e, was app ointed to the interim pos ition of the compa ny 's Acting Chief Accounti ng O fficer. Mr. B roitman, who is 56, joi ned the c ompa ny a s its Controller in J uly 2000 a nd wa s appointed V ice P res ident of F inance in Oc tober 2007. B efore joinin g the compa ny, M r. B roitman was C ontroller of I ndividua l Investor G roup. X ING AG (XTR A: O1B C) X IN G AG R ep orts E arnings R es ults for the F irs t Quarter XI NG AG reported earnings res ults for the firs t quarter of 2009. For the year, the company reported profit of E U R 1.68 million, a n inc rea s e of of 2009 3.7% from E UR 1. 62 million for the s ame period a y ea r a go. R eve nues for the quarter were E U R 10.76 million compa red to E U R 7. 51 million for the same period a yea r ago. S park Networks , Inc . (AME X: L OV) S park N etwork s , Inc . R eports U naudited C onsolidated S park Network s, Inc . reported unaudited c ons olidated ea rnings res ults for the firs t qua rter ended March 31, 2009. F or the qua rter, the E a rnings R esults for the F irst Quarter E nded M arch 31, company reported net inc ome of $311, 000 a nd operating income of $1, 208, 000 or $0.02 ba s ic a nd diluted earnings per s ha re on net revenue 2009 ; Announces I mpairment C ha rges of $12,032, 000 compa red to net income of $1,566, 000 a nd operating income of $2, 477, 000 or $0.06 ba s ic a nd diluted earnings per s ha re on net revenue of $15, 022,000 for the s a me period a y ea r a go. I ncome before inc ome tax es for the period wa s $716, 000 compa red to $2,811, 000 for the same period a yea r a go. E B I TD A for the period wa s $1,174, 000 and a djus ted E B I TD A wa s $2, 801,000 compared to E B IT DA of $3, 335,000 and adjusted E B IT DA of $4, 042,000 for the s a me period a y ea r a go. F irst qua rter 2009 net earnings were reduced by a n $880, 000 as s et impai rment c ha rge prima rily rela ted to Hurry Da te ac quis ition. T he company a ls o a nnounc ed that first quarter 2009 net ea rn ings were reduced by an $880, 000 a ss et impa irme nt cha rge prima rily rela ted to Hurry Da te ac quisition. Figure 7. Key Developments Source. Capital IQ