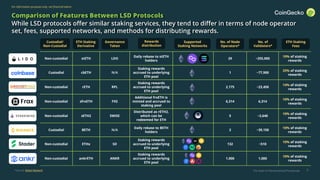

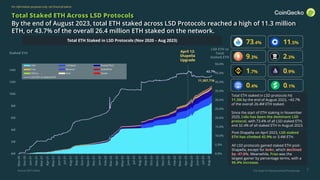

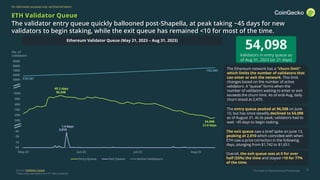

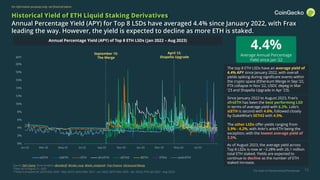

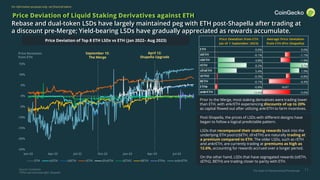

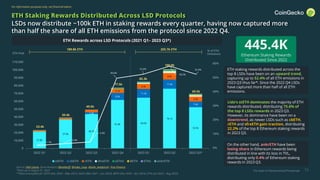

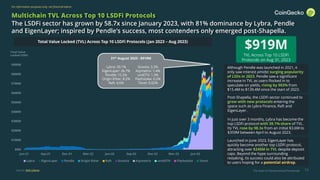

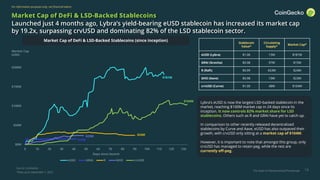

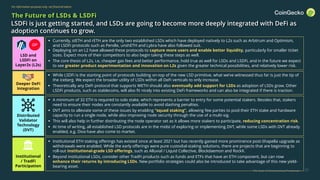

The document provides an overview of decentralized liquid staking derivatives (LSDs), detailing their evolution and significance in the Ethereum ecosystem since the Beacon Chain's launch in 2020. It compares custodial and non-custodial LSDs, explores reward distribution mechanisms, and highlights total staked ETH growth across various protocols post-shapella upgrade in April 2023. The report also discusses yield trends, market implications, and concludes with key takeaways regarding the future of LSDs and related decentralized finance (DeFi) innovations.