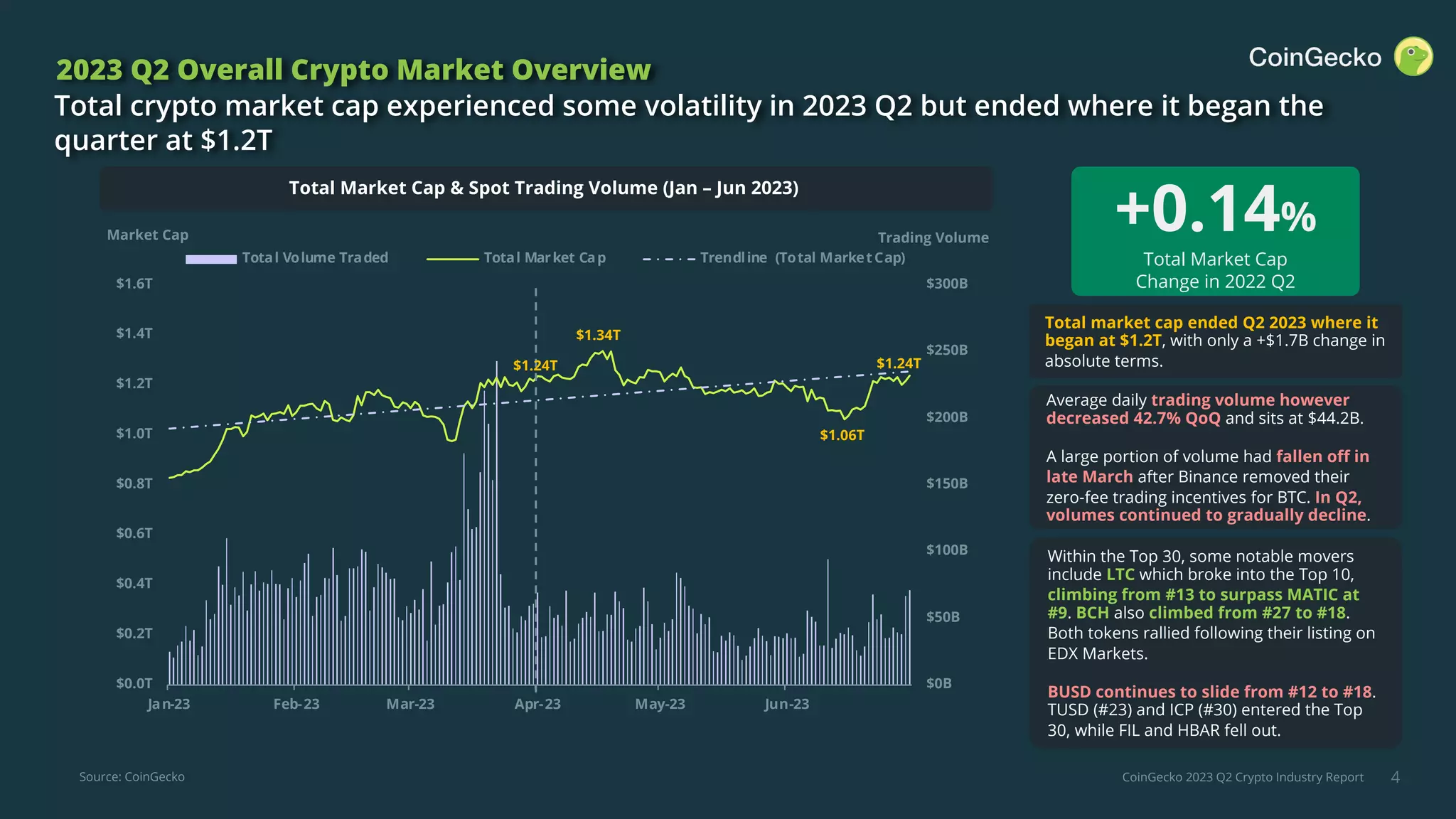

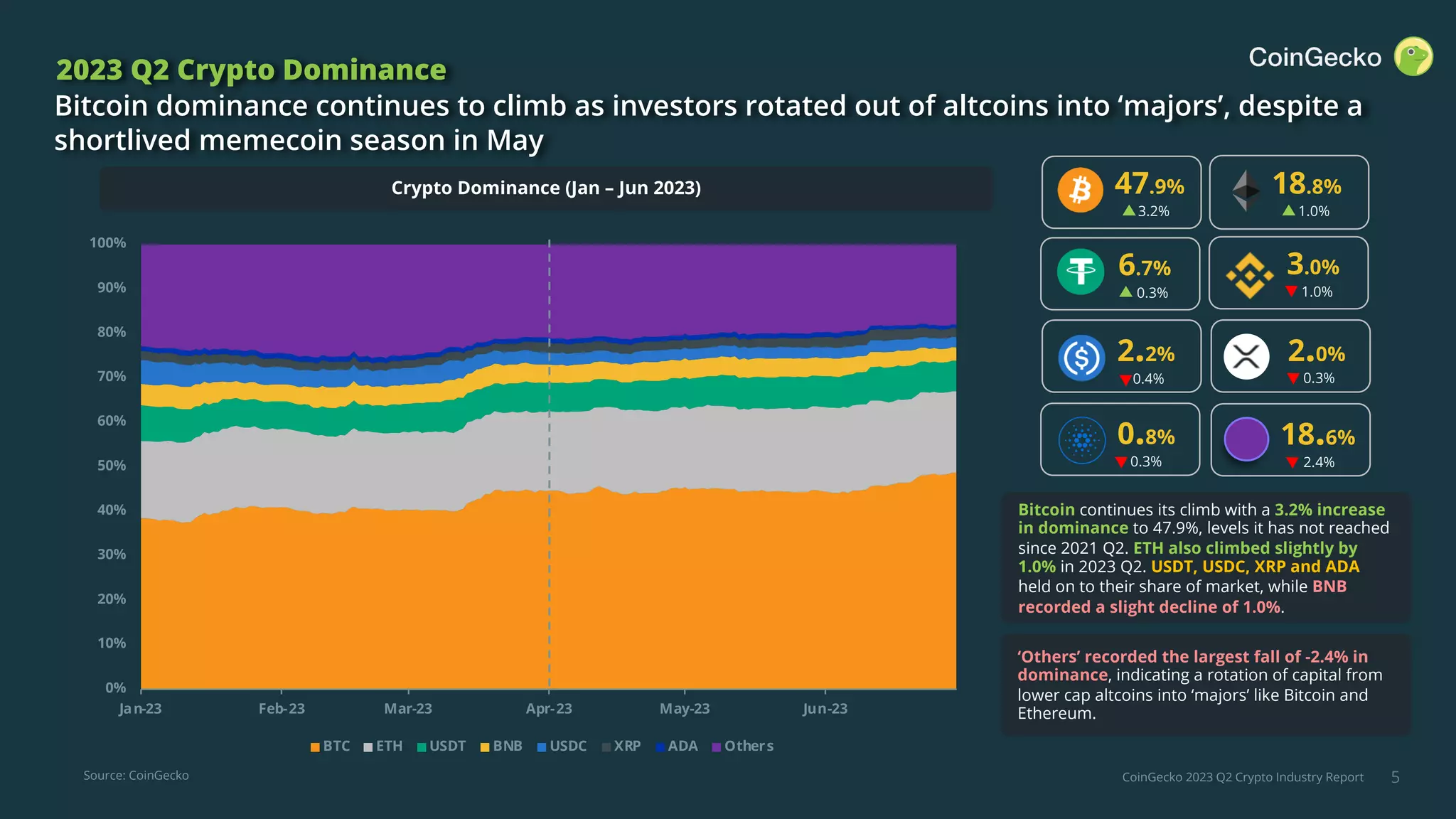

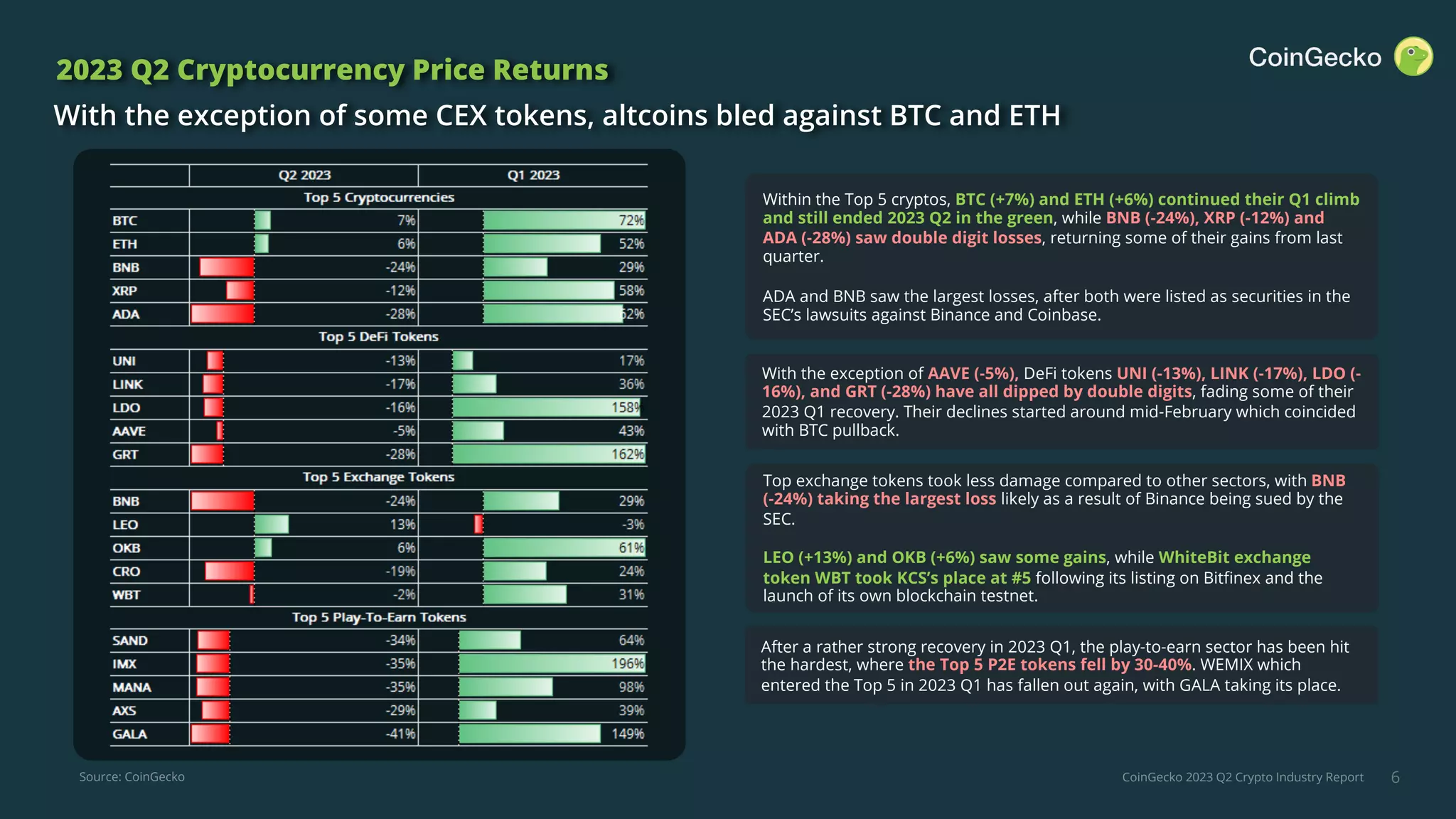

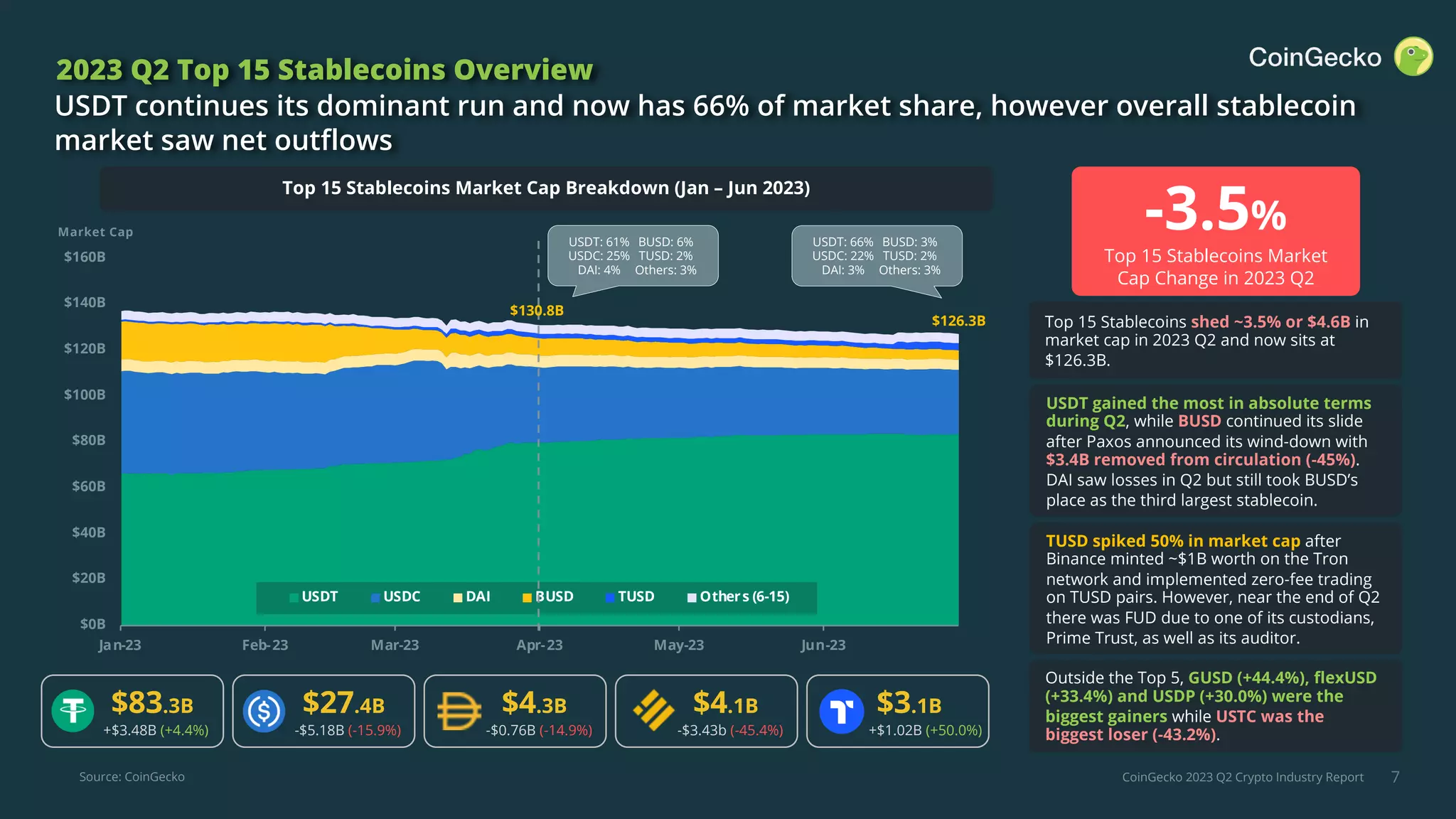

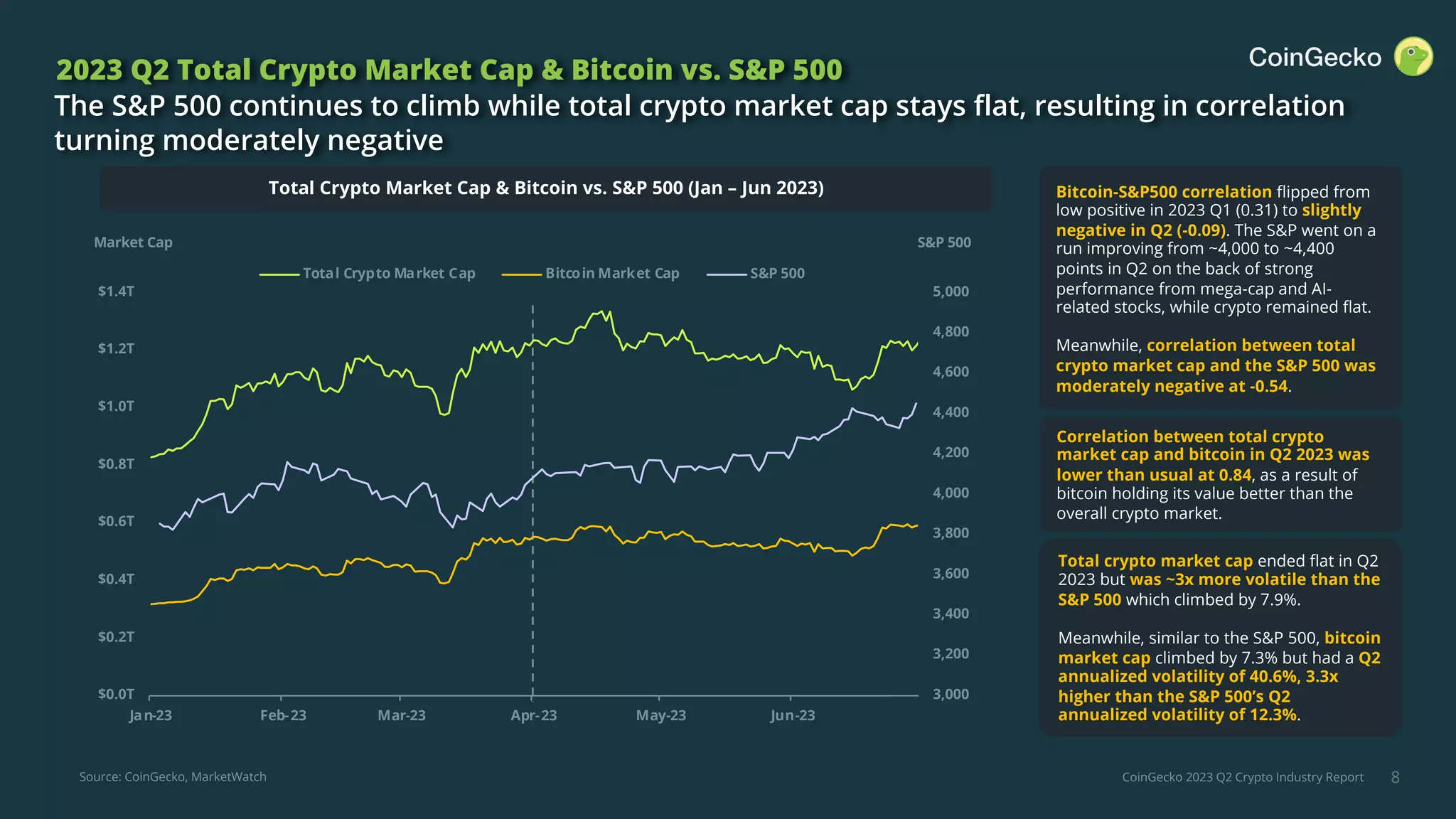

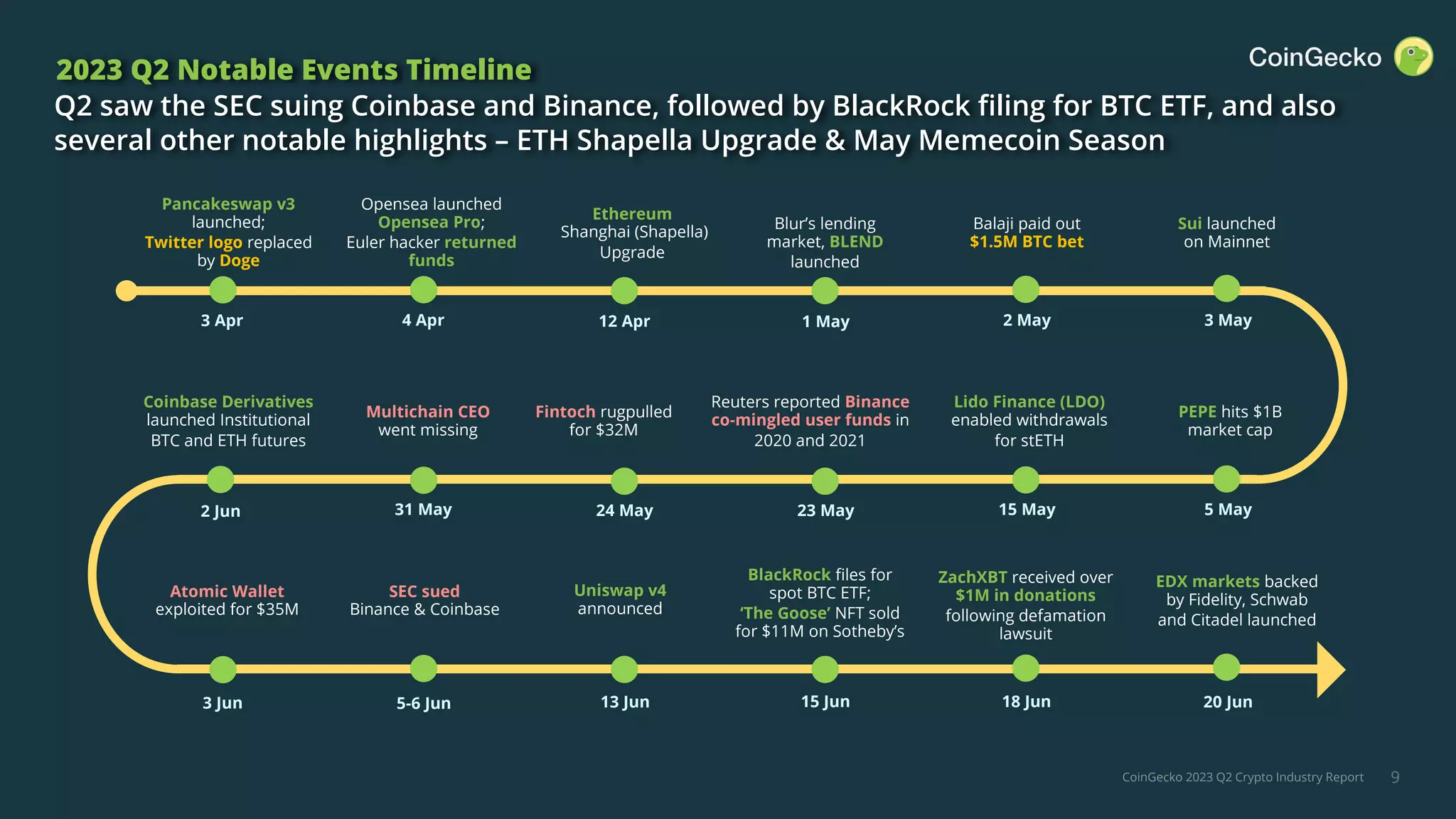

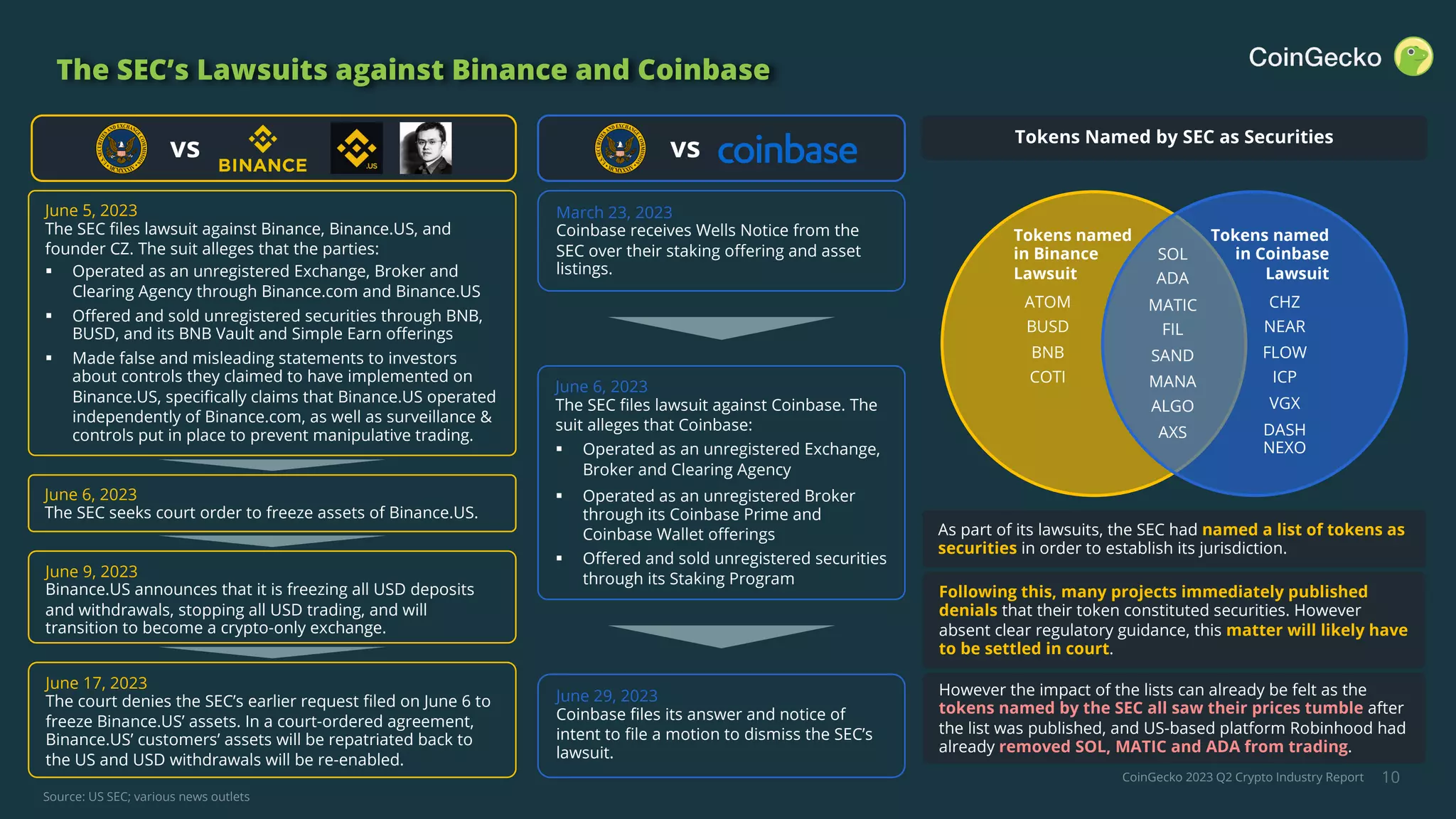

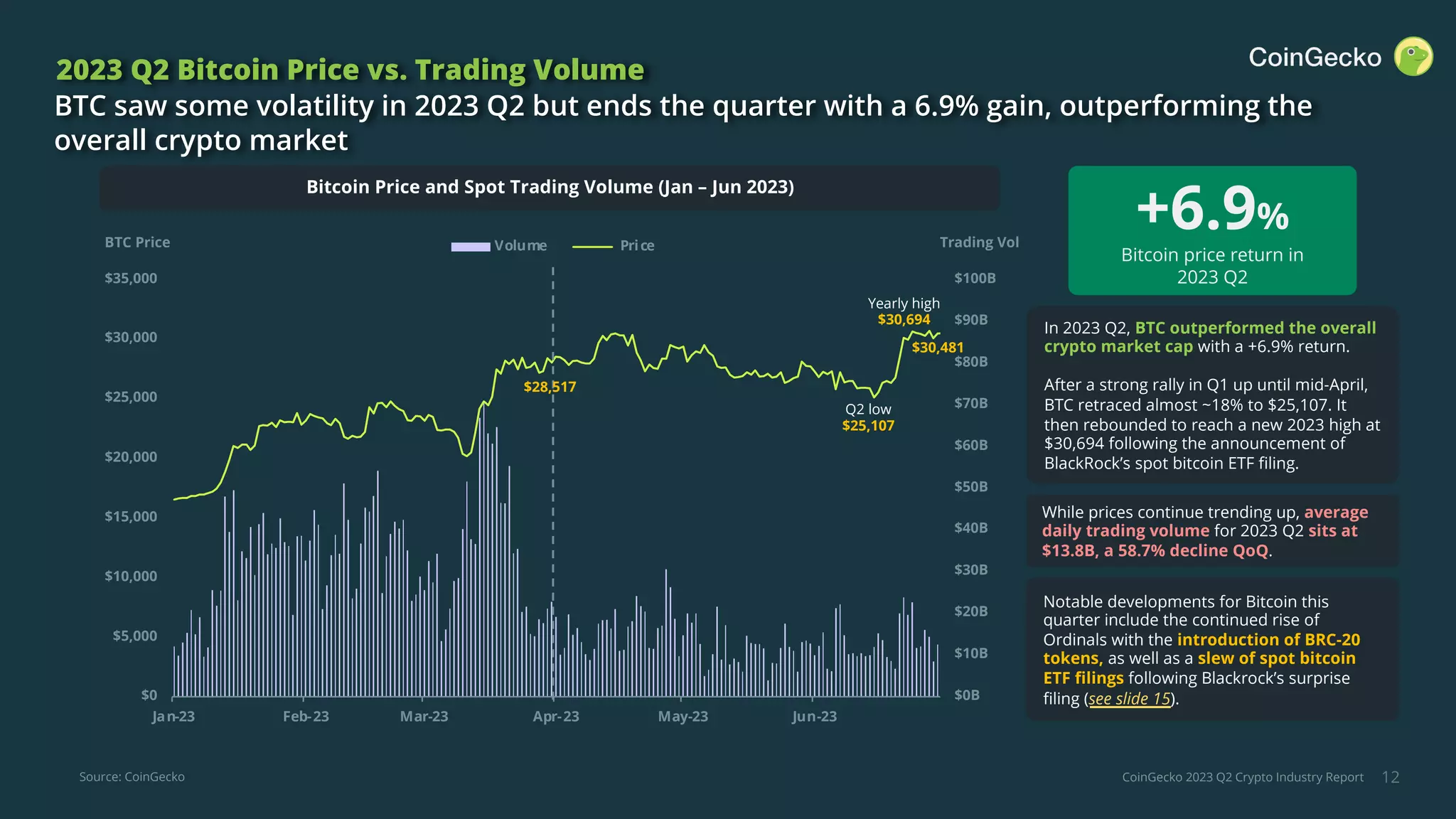

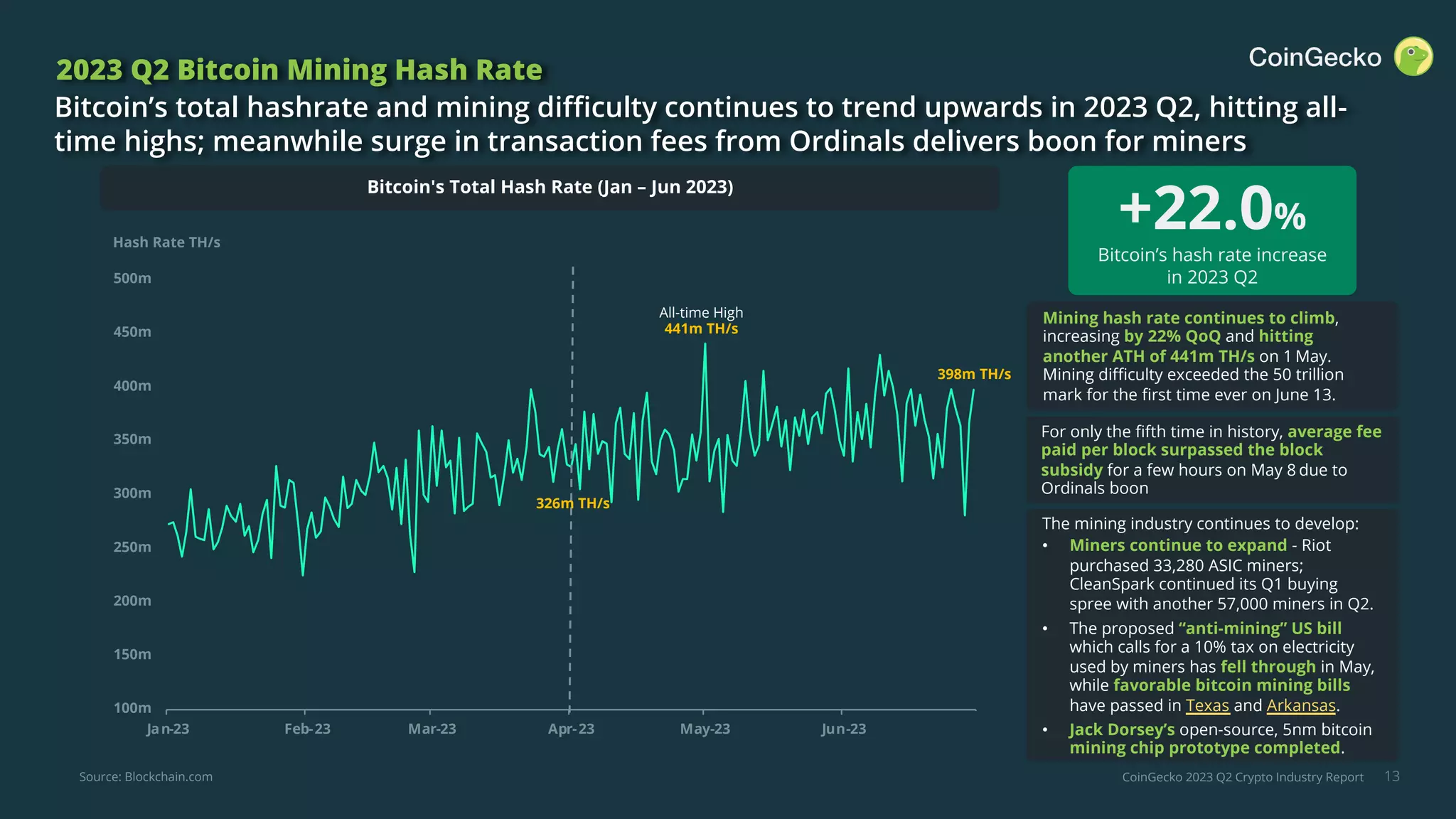

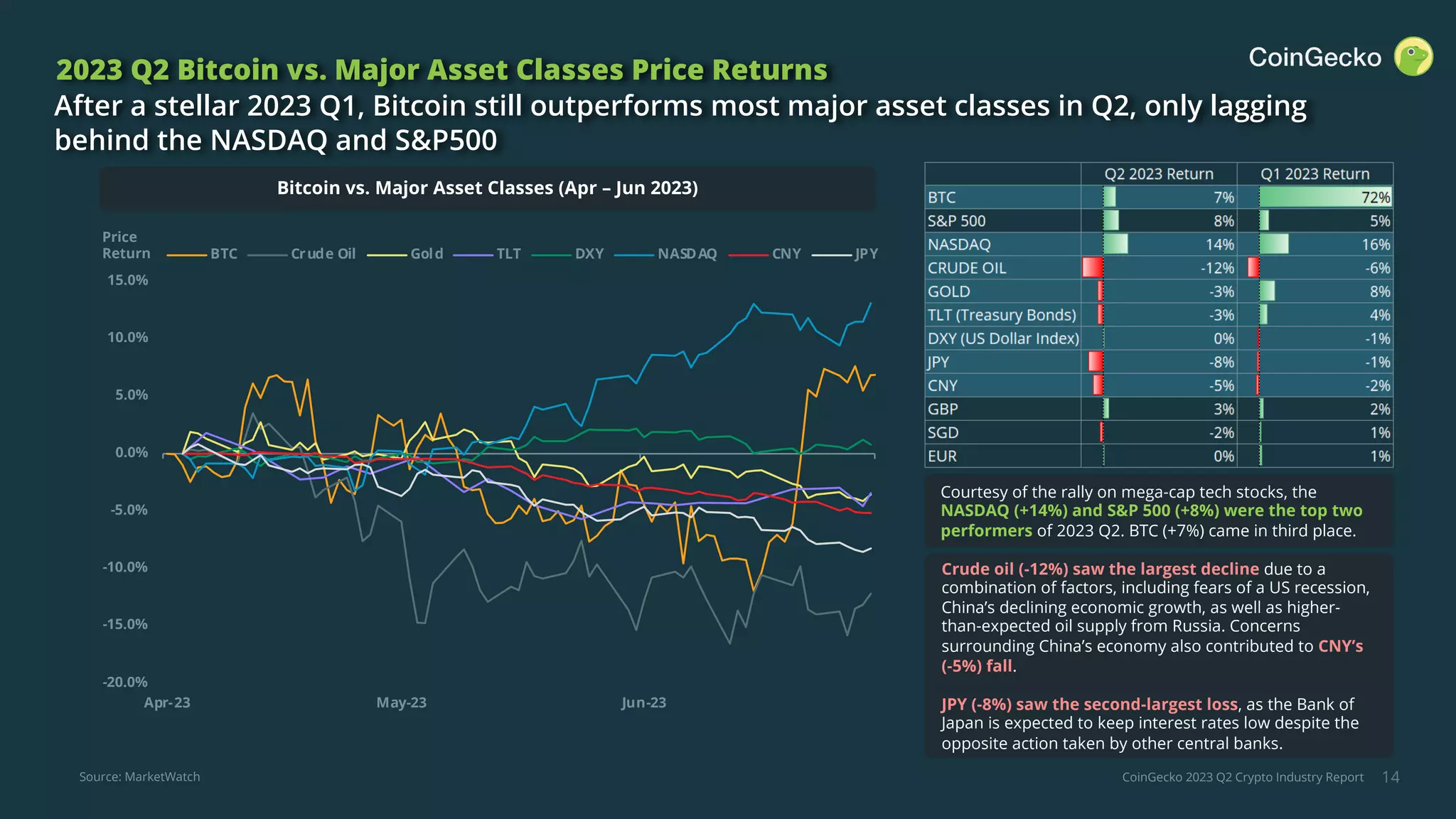

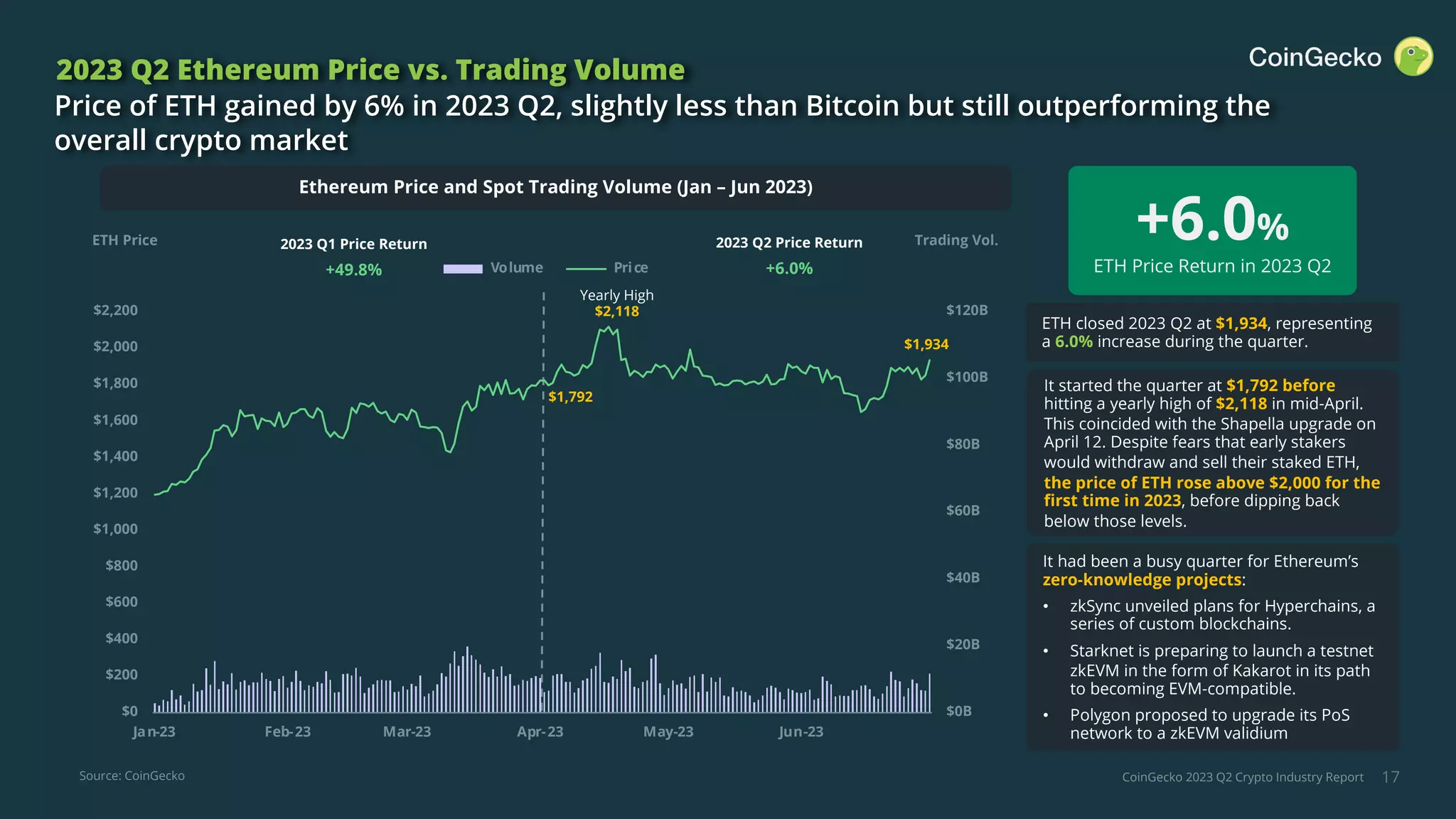

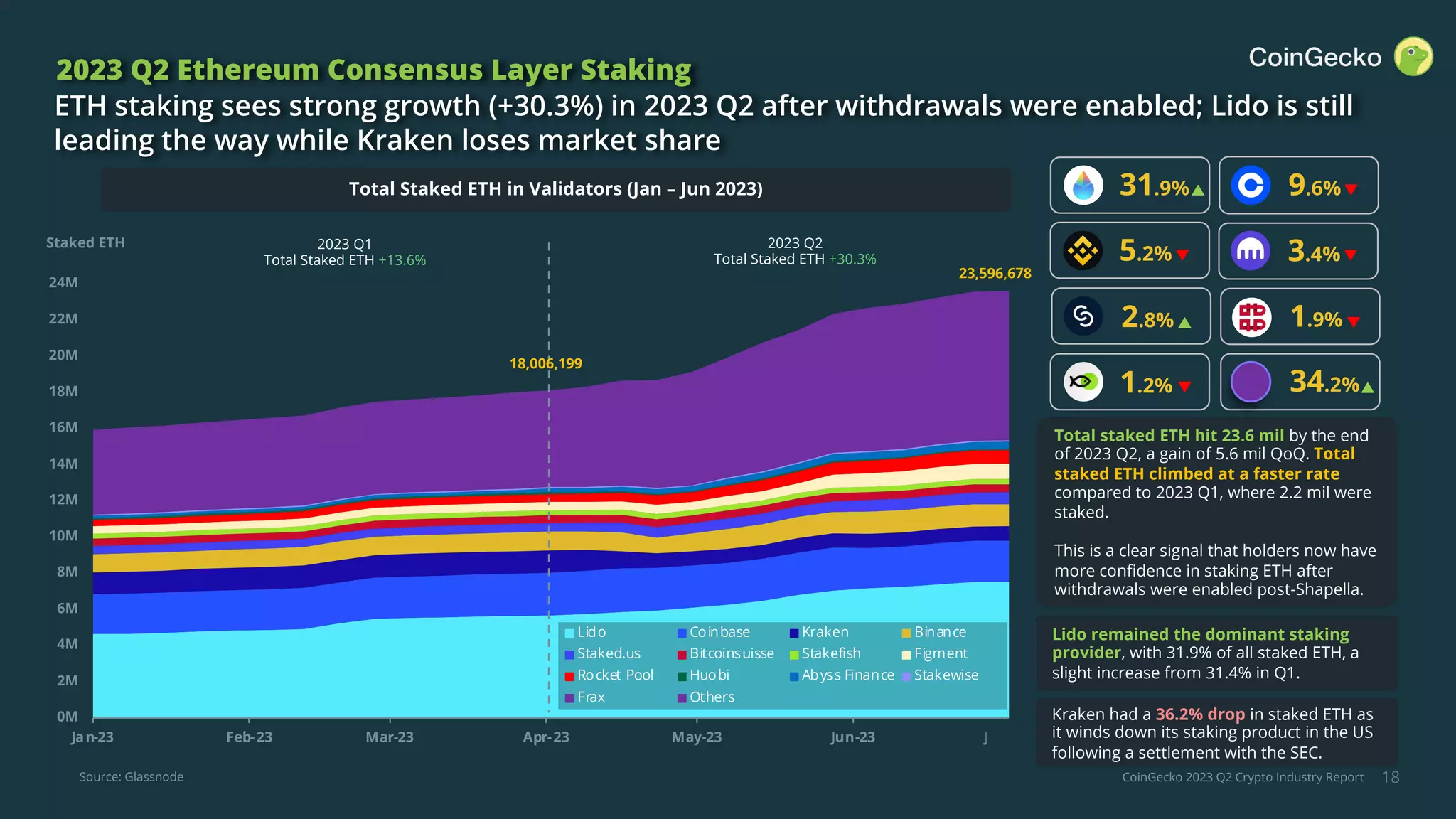

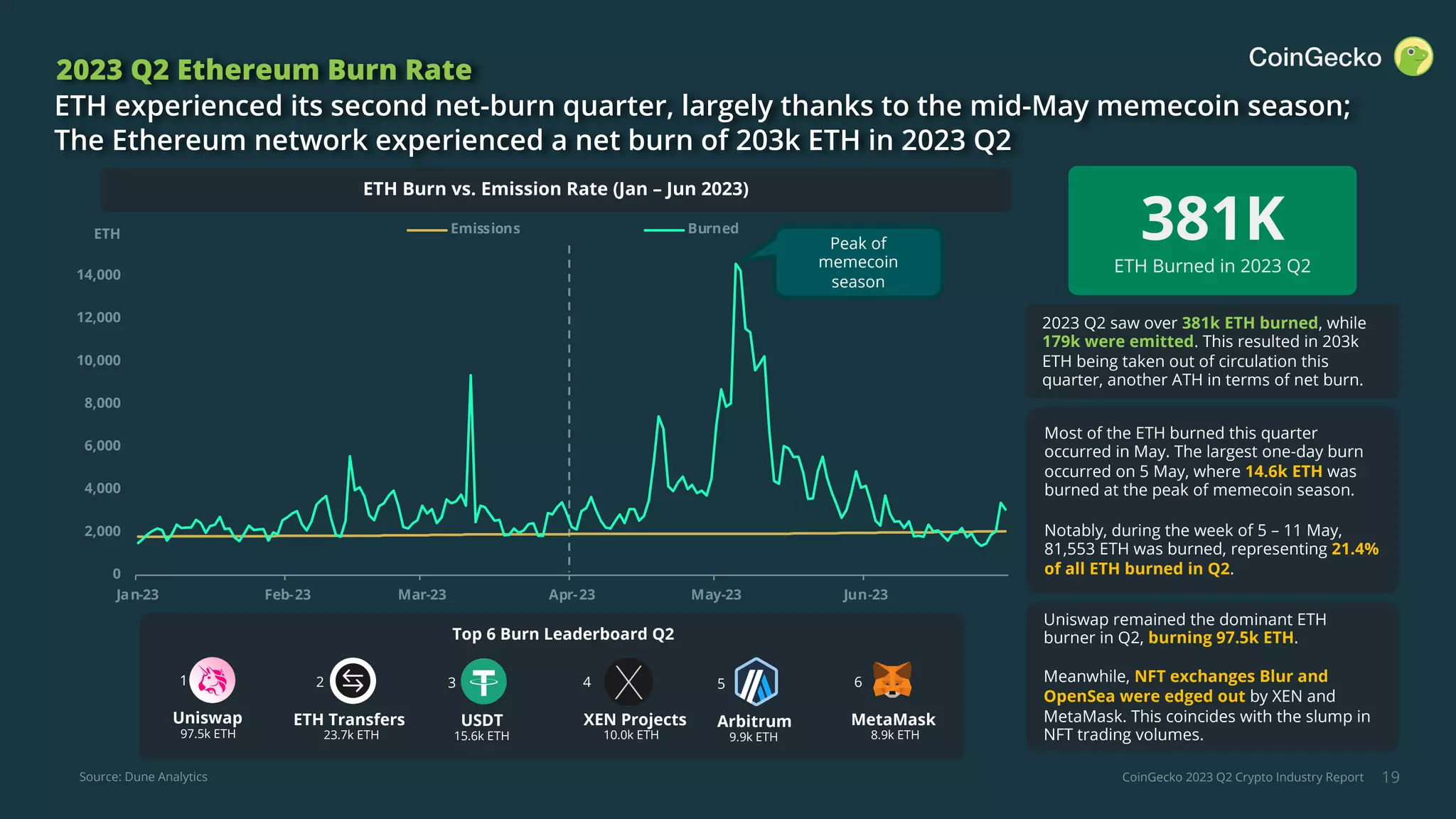

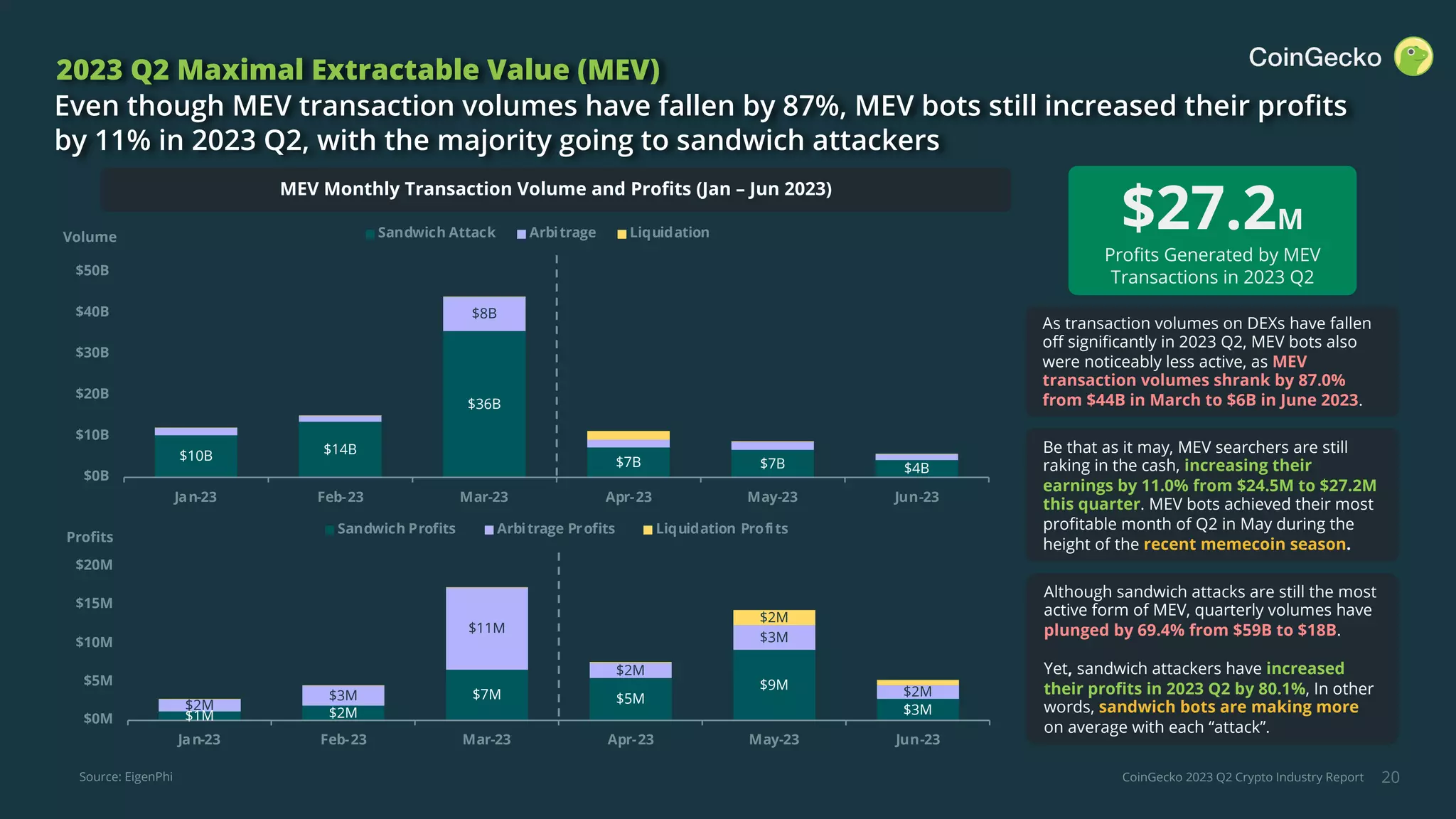

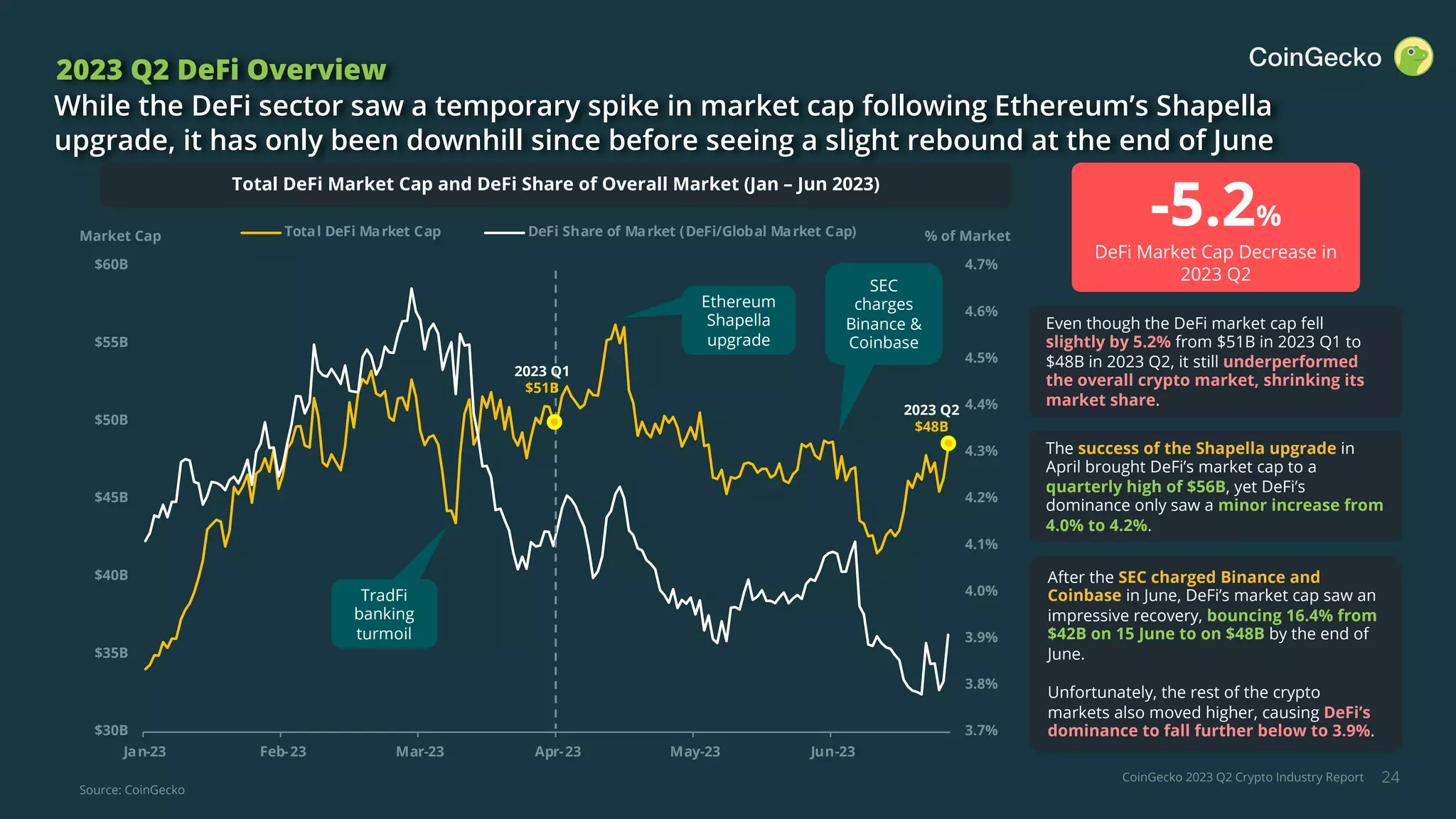

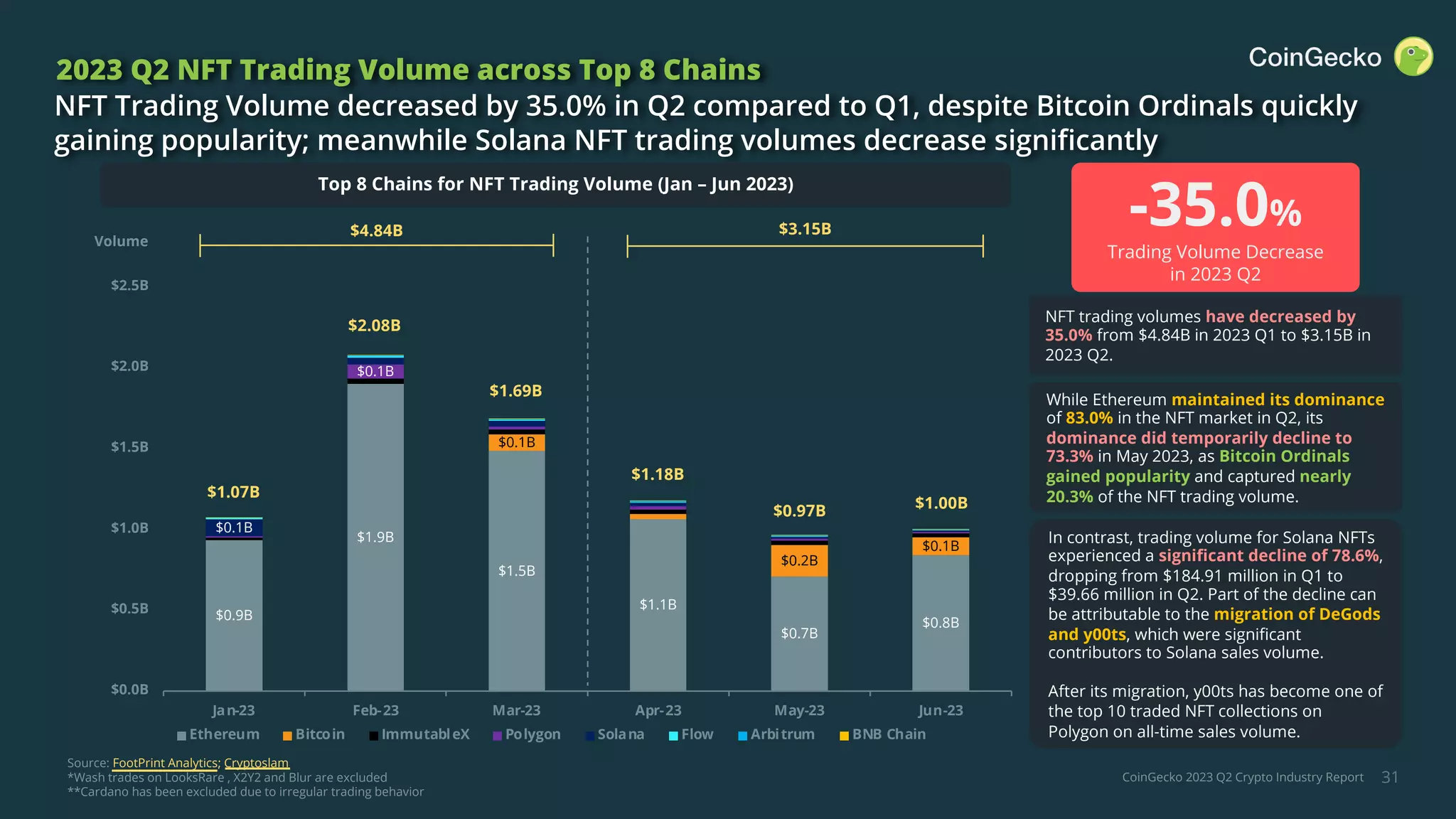

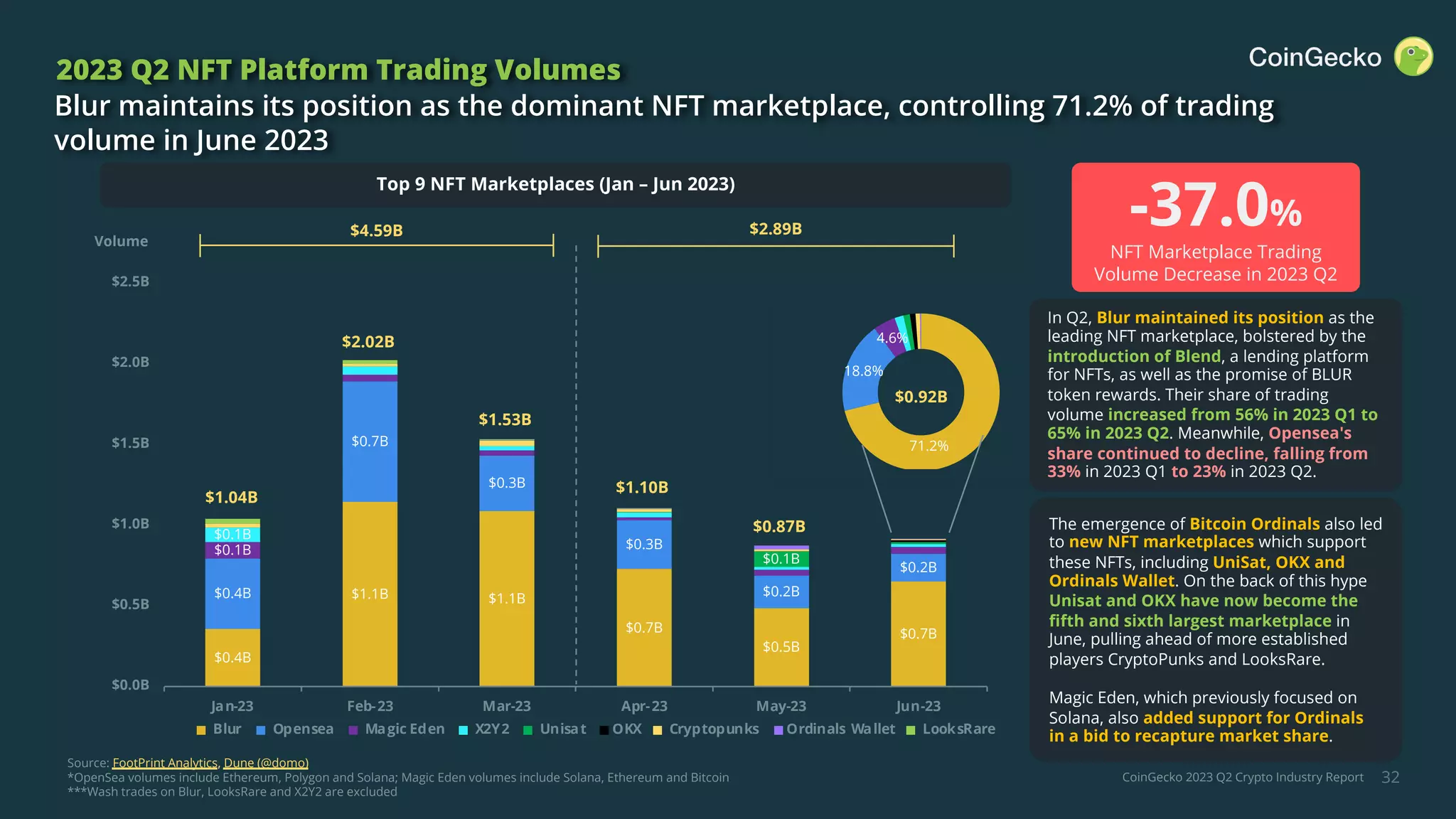

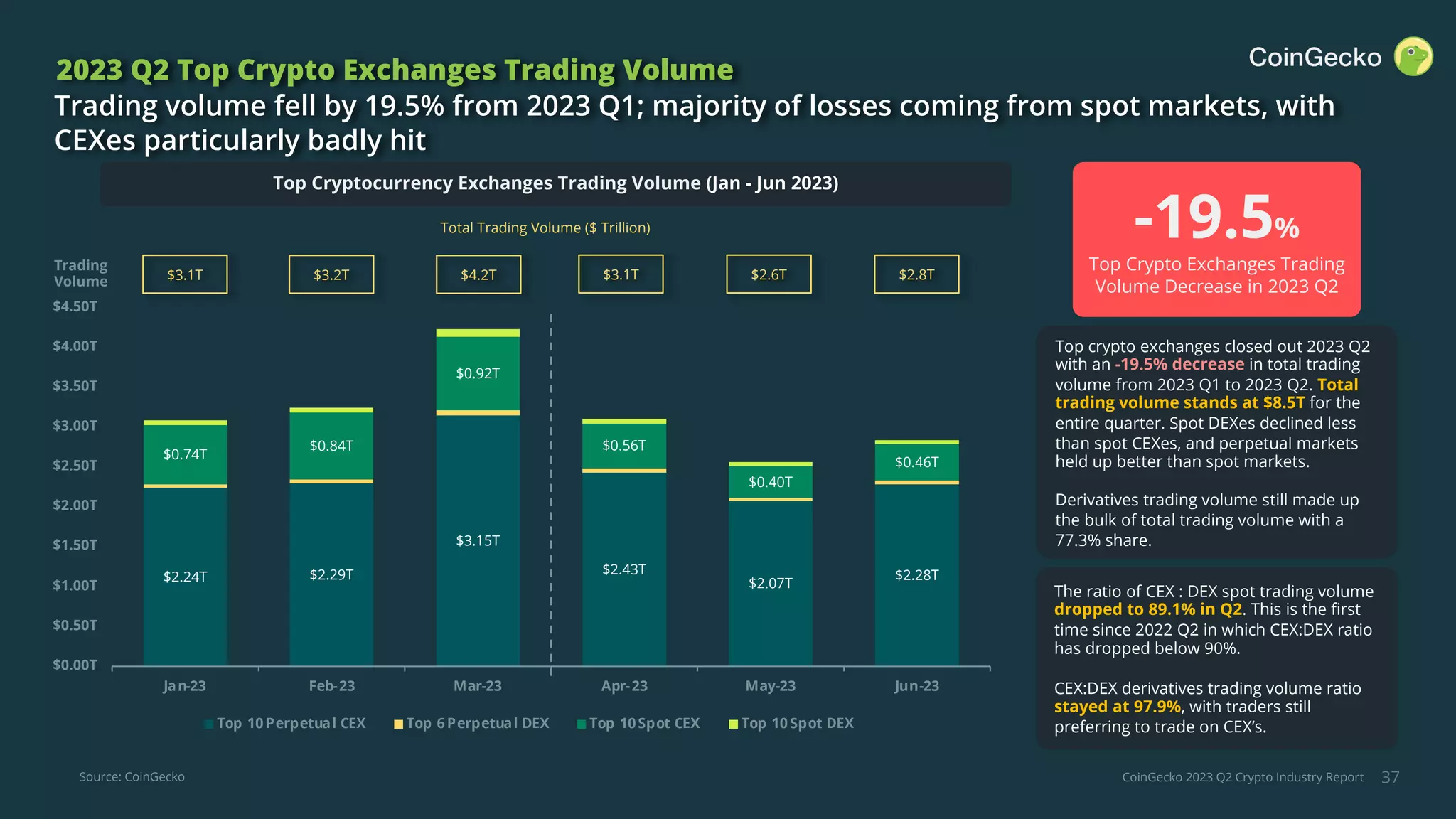

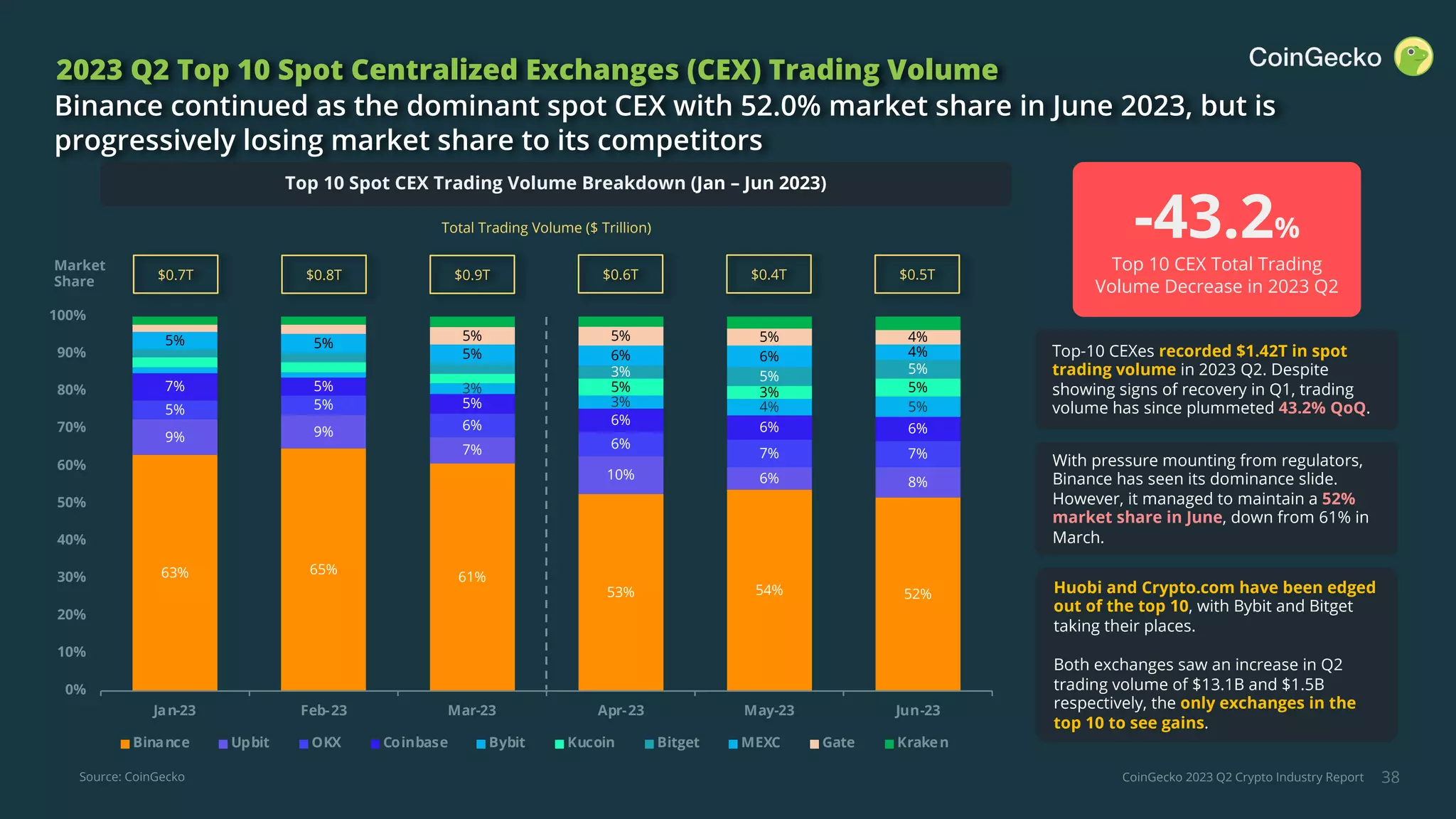

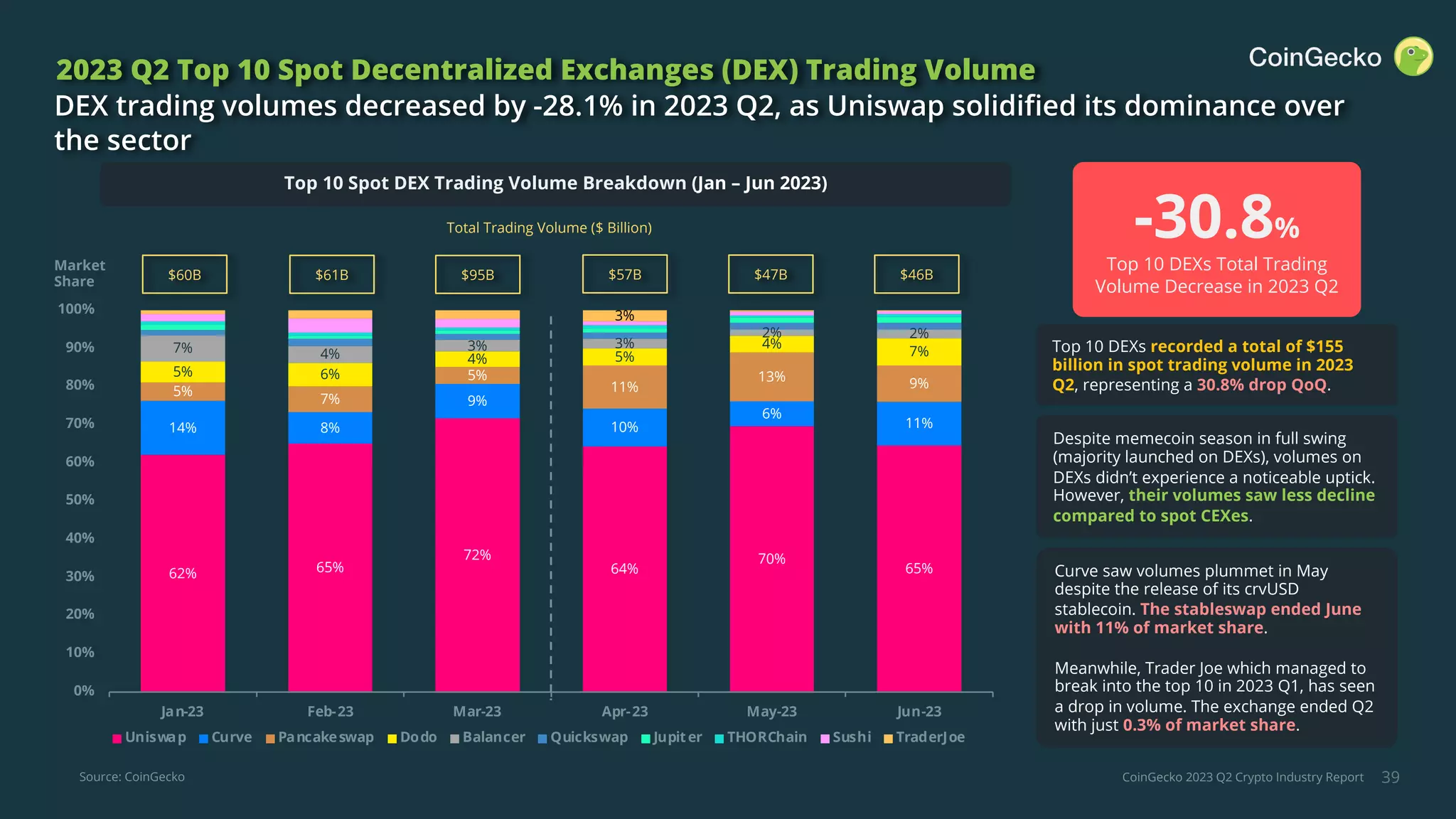

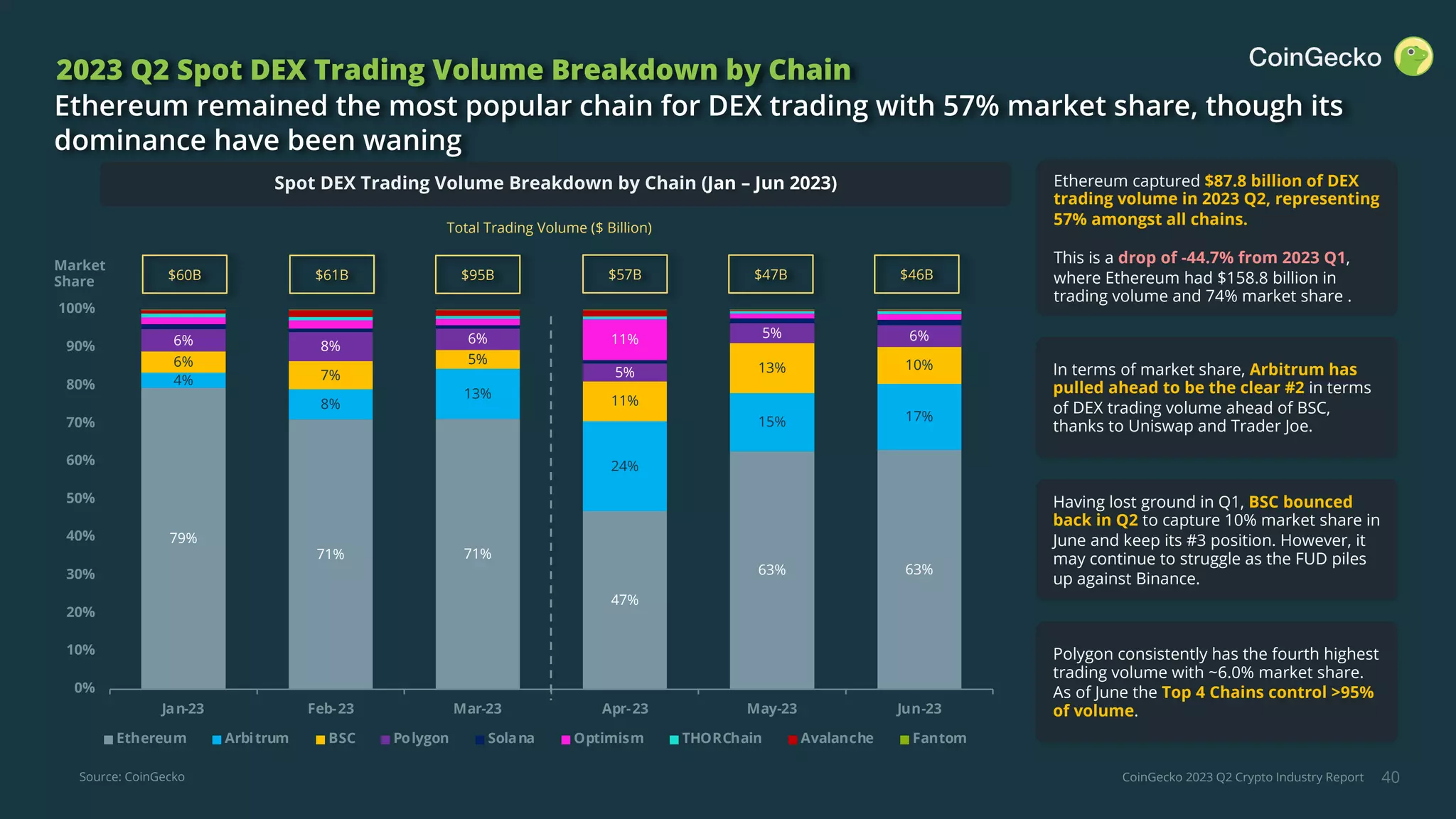

The CoinGecko Q2 2023 Crypto Industry Report indicates a volatile quarter with the total crypto market cap stabilizing at $1.24 trillion, significantly impacted by the SEC's lawsuits against Binance and Coinbase. Notable developments included Ethereum's major Shapella upgrade, which boosted staked ETH's adoption, and BlackRock's push for a Bitcoin ETF, reigniting market optimism. Overall, while the US regulatory atmosphere remains challenging, other regions like Europe and Hong Kong are advancing with clearer regulations.