Report

Share

Download to read offline

Recommended

Recommended

More Related Content

What's hot

What's hot (20)

DVAT Input Credit Cant be Carried Forward to Next Financial Year

DVAT Input Credit Cant be Carried Forward to Next Financial Year

Analysis of ca ipcc taxation- nov 2014 question paper

Analysis of ca ipcc taxation- nov 2014 question paper

Contract for consultancy services time based - b6 payments to the consultant

Contract for consultancy services time based - b6 payments to the consultant

Reconciliation with other laws and information to be retrieved from Assessee

Reconciliation with other laws and information to be retrieved from Assessee

Motor Registration Authority - Excise & Taxation Solution

Motor Registration Authority - Excise & Taxation Solution

Viewers also liked

To Get any Project for CSE, IT ECE, EEE Contact Me @ 09849539085, 09966235788 or mail us - ieeefinalsemprojects@gmail.com-Visit Our Website: www.finalyearprojects.orgJAVA 2013 IEEE CLOUDCOMPUTING PROJECT Cam cloud assisted privacy preserving m...

JAVA 2013 IEEE CLOUDCOMPUTING PROJECT Cam cloud assisted privacy preserving m...IEEEGLOBALSOFTTECHNOLOGIES

To Get any Project for CSE, IT ECE, EEE Contact Me @ 09849539085, 09966235788 or mail us - ieeefinalsemprojects@gmail.com-Visit Our Website: www.finalyearprojects.orgJAVA 2013 IEEE CLOUDCOMPUTING PROJECT Collaboration in multicloud computing e...

JAVA 2013 IEEE CLOUDCOMPUTING PROJECT Collaboration in multicloud computing e...IEEEGLOBALSOFTTECHNOLOGIES

To Get any Project for CSE, IT ECE, EEE Contact Me @ 09849539085, 09966235788 or mail us - ieeefinalsemprojects@gmail.com-Visit Our Website: www.finalyearprojects.orgJAVA 2013 IEEE CLOUDCOMPUTING PROJECT Cloud mov: cloud based mobile social tv

JAVA 2013 IEEE CLOUDCOMPUTING PROJECT Cloud mov: cloud based mobile social tvIEEEGLOBALSOFTTECHNOLOGIES

Viewers also liked (15)

MANAGING AND ANALYSING SOFTWARE PRODUCT LINE REQUIREMENTS

MANAGING AND ANALYSING SOFTWARE PRODUCT LINE REQUIREMENTS

JAVA 2013 IEEE CLOUDCOMPUTING PROJECT Cam cloud assisted privacy preserving m...

JAVA 2013 IEEE CLOUDCOMPUTING PROJECT Cam cloud assisted privacy preserving m...

JAVA 2013 IEEE CLOUDCOMPUTING PROJECT Collaboration in multicloud computing e...

JAVA 2013 IEEE CLOUDCOMPUTING PROJECT Collaboration in multicloud computing e...

JAVA 2013 IEEE CLOUDCOMPUTING PROJECT Cloud mov: cloud based mobile social tv

JAVA 2013 IEEE CLOUDCOMPUTING PROJECT Cloud mov: cloud based mobile social tv

О науке ярко и увлекательно. Методы популяризации науки

О науке ярко и увлекательно. Методы популяризации науки

Similar to Ifc contract 0002

Similar to Ifc contract 0002 (20)

3. IMI Financial workshop 18 November 2014_Reporting requirements

3. IMI Financial workshop 18 November 2014_Reporting requirements

Discuss the Self Assessment Scheme in detail under the income tax audience of...

Discuss the Self Assessment Scheme in detail under the income tax audience of...

GST Goods and Service Tax India - Refund E-commerce Job Work Accounts Audit

GST Goods and Service Tax India - Refund E-commerce Job Work Accounts Audit

Litigation - Faceless Assessment Appeals - Procedure.pptx

Litigation - Faceless Assessment Appeals - Procedure.pptx

Litigation - Faceless Assessment Appeals - Procedure.pdf

Litigation - Faceless Assessment Appeals - Procedure.pdf

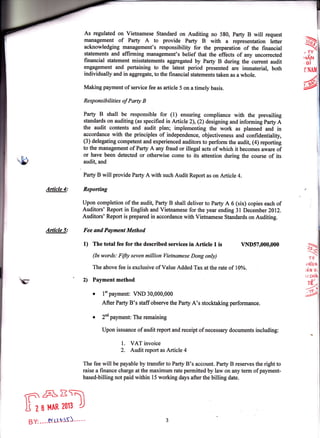

Ifc contract 0002

- 1. I v rn Z*8 [ 2 I MAR 2ol3 )) Article 4: Article 5: As regulated on vietnamese standard on Auditing no 580, party B will request management of Pa(y A to provide Paffy B with a representation letter acknowledging management's responsibility for the preparation of the financial statements and affirming management's belief that the effects of any uncorrected financial statement misstatements aggregated by Party B during the current audit engagement and pertaining to the latest period presented are immaterial, both individually and in aggregate, to the financial statements taken as a whole. Making payment of service fee as article 5 on a timely basis. Responsibilities of Party B Palty B shall be responsible for (1) ensuring compliance with the prevailing standards on auditing (as specified in Article 2), (z) designing and informing party A the audit contents and audit plan; implementing the work as planned and in accordance with the principles of independence, objectiveness and confidentiality, (3) delegating competent and experienced auditors to perform the audit, (4) reporting to the management of Party A any fraud or illegal acts of which it becomes aware of or have been detected or otherwise come to its attention during the course of its audit, and Party B will provide Party A with such Audit Report as on Article 4. Reporting Upon completion of the audit, Party B shall deliver to Party A 6 (six) copies each of Auditors' Report in English and Vietnamese for the year ending 3l December 2012. Auditors' Report is prepared in accordance with Vietnamese Standards on Auditing. Fee and Payment Method 1) The total fee for the described services in Article 1 is vID57,000,000 (In words: Fifty seven million Vietnamese Dong only) The above fee is exclusive of Value Added Tax at the rate of l0%. 2) Payment method o l't payment: VNID 30,000,000 After Party B's staff observe the Party A's stocktaking performance. ? zon payment: The remaining Upon issuance of audit report and receipt of necessary documents including: l. VAT invoice 2. Audit report as Article 4 The fee will be payable by transfer to Party B's account. Party B reserves the right to raise a finance charge at the maximum rate permitted by law on any term of payment- based-billing not paid within 15 working days after the billing date. BY: ----Wr3-e55)-----