ACCA_F7_Course_Notes.pdf-130-253.pdf

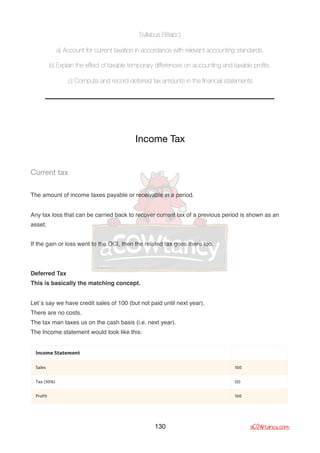

- 1. Syllabus B8abc) a) Account for current taxation in accordance with relevant accounting standards. b) Explain the effect of taxable temporary differences on accounting and taxable profits. c) Compute and record deferred tax amounts in the financial statements. Income Tax Current tax The amount of income taxes payable or receivable in a period. Any tax loss that can be carried back to recover current tax of a previous period is shown as an asset. If the gain or loss went to the OCI, then the related tax goes there too. Deferred Tax This is basically the matching concept. Let´s say we have credit sales of 100 (but not paid until next year). There are no costs. The tax man taxes us on the cash basis (i.e. next year). The Income statement would look like this: 130 aCOWtancy.com

- 2. This is how it should look. The tax is brought in this year even though it´s not payable until next year, it´s just a temporary timing difference. Illustration • Tax Base Let’s presume in one country’s tax law, royalties receivable are only taxed when they are received • IFRS IFRS, on the other hand, recognises them when they are receivable Now let’s say in year 1, there are 1,000 royalties receivable but not received until year 2. The Income statement would show: Royalties Receivable 1000 Tax (0) (They are taxed when received in yr 2) This does not give a faithful representation as we have shown the income but not the related tax expense. Therefore, IFRS actually states that matching should occur so the tax needs to be brought into year 1. Dr Tax (I/S) Cr Deferred Tax (SFP provision) 131 aCOWtancy.com

- 3. Deferred tax on a revaluation Deferred tax is caused by a temporary difference between accounts rules and tax rules. One of those is a revaluation: Accounting rules bring it in now. Tax rules ignore the gain until it is sold. So the accounting rules will be showing more assets and more gain so we need to match with the temporarily missing tax. Illustration A company revalues its assets upwards making a 100 gain as follows: This is how it should look. The tax is brought in this year even though it´s not payable until sold, it´s just a temporary timing difference. Notice the tax matches where the gain has gone to. 132 aCOWtancy.com

- 4. Syllabus B9. Reporting financial performance Syllabus B9a) Discuss the importance of identifying and reporting the results of discontinued operations. Discontinued Operation An analysis between continuing and discontinuing operations improves the usefulness of financial statements. When forecasting ONLY the results of continuing operations should be used. Because discontinued operations profits or losses will not be repeated. What is a discontinued operation? 1 A separate major line of business or geographical area or.. 2 is part of a single co-ordinated plan to dispose of a separate major line of business or geographical area or.. 3 is a subsidiary acquired exclusively with a view to resale How is it shown on the Income Statement? The PAT and any gain/loss on disposal • A single line in I/S How is it shown on the SFP? If not already disposed of yet? • Held for sale disposal group 133 aCOWtancy.com

- 5. How is it shown on the cash-flow statement? • Separately presented • in all 3 areas - operating; investing and financing No Retroactive Classification IFRS 5 prohibits the retroactive classification as a discontinued operation, when the discontinued criteria are met after the end of the reporting period 134 aCOWtancy.com

- 6. Syllabus B9b) Define and account for non-current assets held for sale and discontinued operations. Assets Held for Sale How do we deal with items in our accounts which we are no longer going to use, instead we are going to sell them So, think about this for a moment.. Why does this matter to users? Well, the accounts show the business performance and position, and you expect to see assets in there that they actually are looking to continue using. Therefore their values do not have to be shown at their market value necessarily (as your intention is not to sell them) Here, though, everything changes… we are going to sell them. So maybe market value is a better value to use, but they haven’t been sold yet, so showing them at MV might still not be appropriate as this value has not yet been achieved So these are the issues that IFRS 5 tried, in part, to deal with and came up with the following solution.. Accounting Treatment 1 Step 1 - Calculate the Carrying Amount... Bring everything up to date when we decide to sell This means: - charge the depreciation as we would normally up to that date or - revalue it at that date (if following the revaluation policy) 135 aCOWtancy.com

- 7. 2 Step 2 - Calculate FV - CTS Now we can get on with putting the new value on the asset to be sold.. Measure it at Fair Value less costs to sell (FV-cts). This is because, if you think about it, this is the what the company will receive. HOWEVER, the company hasn’t actually made this sale yet and so to revalue it now to this amount would be showing a profit that has not yet happened 3 Step 3 - Value the Assets held for sale IFRS 5 says the new value should actually be… ...The lower of carrying amount (step 1) and FV-CTS (step 2) 4 Step 4 - Check for an Impairment Revaluing to this amount might mean an impairment (revaluation downwards) is needed. This must be recognised in profit or loss, even for assets previously carried at revalued amounts. Also, any assets under the revaluation policy will have been revalued to FV under step 1 Then in step 2, it will be revalued downwards to FV-cts. Therefore, revalued assets will need to deduct costs to sell from their fair value and this will result in an immediate charge to profit or loss. Subsequent increase in Fair Value? • This basically happens at the year-end if the asset still has not been sold A gain is recognised in the p&l up to the amount of all previous impairment losses. Non-depreciation Non-current assets or disposal groups that are classified as held for sale shall not be depreciated. 136 aCOWtancy.com

- 8. When is an asset recognised as held for sale? • Management is committed to a plan to sell • The asset is available for immediate sale • An active programme to locate a buyer is initiated • The sale is highly probable, within 12 months of classification as held for sale • The asset is being actively marketed for sale at a sales price reasonable in relation to its fair value Abandoned Assets The assets need to be disposed of through sale. Therefore, operations that are expected to be wound down or abandoned would not meet the definition. Therefore assets to be abandoned would still be depreciated. Balance sheet presentation Presented separately on the face of the balance sheet in current assets • Subsidiaries Held for Disposal IFRS 5 applies to accounting for an investment in a subsidiary held only with a view to its subsequent disposal in the near future. • Subsidiaries already consolidated now held for sale The parent must continue to consolidate such a subsidiary until it is actually disposed of. It is not excluded from consolidation and is reported as an asset held for sale under IFRS 5. So subsidiaries held for sale are accounted for initially and subsequently at FV-CTS of all the net assets not just the amount to be disposed of. 137 aCOWtancy.com

- 9. Syllabus B9c) Indicate the circumstances where separate disclosure of material items of income and expense is required. Separate disclosure of material items Exceptional items get disclosed separately This is where disclosure is necessary in order to explain the performance of the entity better The NORMAL accounting treatment is to: • Show in the standard line in the I/S • Disclose the nature and amount in notes EXCEPTIONS such as these can have their own I/S line: • Write down of inventories to net realisable value (NRV) • Write down of property, plant and equipment to recoverable amount • Restructuring costs • Gains/losses on disposal of non-current assets • Discontinued operations profits / losses • Litigation settlements • Reversals of provisions 138 aCOWtancy.com

- 10. Syllabus A1g/B9d g) Discuss the principle of comparability in accounting for changes in accounting policies. d) Account for changes in accounting estimates, changes in accounting policy and correction of prior period errors. IAS 8 Changes in accounting policies and accounting estimates Comparatives are changed for accounting POLICY changes only Changes in accounting estimates have no effect on the comparative Changes in accounting policy means we must change the comparative too to ensure we keep the accounts comparable for trend analysis Accounting Policy Definition “the specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting the financial statements” An entity should follow accounting standards when deciding its accounting policies If there is no guidance in the standards, management should use the most relevant and reliable policy 139 aCOWtancy.com

- 11. Changes to Accounting Policy These are only made if: - It is required by a Standard or Interpretation; or - It would give more relevant and reliable information 1 Adjust the comparative amounts for the affected item (as if the policy had always been applied) 2 Adjust Opening retained earnings (Show this in statement of changes in Equity too) Accounting Estimates Definition “an adjustment of the carrying amount of an asset or liability, or related expense, resulting from reassessing the expected future benefits and obligations associated with that asset or liability” Examples Allowances for doubtful debts; Inventory obsolescence; A change in the estimate of the useful economic life of property, plant and equipment Changes in Accounting Estimate 1 Simply change the current year 2 No change to comparatives Prior Period Errors These are accounted for in the same way as changes in accounting policy Accounting treatment 1 Adjust the comparative amounts for the affected item 2 Adjust Opening retained earnings (Show this in statement of changes in Equity too) 140 aCOWtancy.com

- 12. Syllabus B9e) Earnings per share (eps) i) calculate the eps in accordance with relevant accounting standards (dealing with bonus issues, full market value issues and rights issues) ii) explain the relevance of the diluted eps and calculate the diluted eps involving convertible debt and share options (warrants) IAS 33 EPS Introduction EPS is a much used PERFORMANCE appraisal measure It is calculated as: PAT - Preference dividends / Number of shares It is not only an important measure in its own right but also as a component in the price earnings (P/E) ratio (see below) Diluted EPS This is saying that the basic EPS might get worse due to things that are ALREADY in issue such as: • Convertible Loan This will mean more shares when converted 141 aCOWtancy.com

- 13. • Share options This will mean more shares when exercised Who has to report an EPS? • PLCs • Group accounts where the parent has shares similarly traded/being issued EPS to be presented in the income statement. 142 aCOWtancy.com

- 14. Syllabus B9e) Earnings per share (eps) i) calculate the eps in accordance with relevant accounting standards (dealing with bonus issues, full market value issues and rights issues) ii) explain the relevance of the diluted eps and calculate the diluted eps involving convertible debt and share options (warrants) IAS 33 EPS - earnings figure This is basically Profit after Tax less preference dividends *Be careful of the type of preference share though… Redeemable preference shares These are actually liabilities and their finance charge isn’t a dividend in the accounts but interest. • Do not adjust for these dividends. Irredeemable preference shares These are equity and the finance charge is dividends • Do adjust for these dividends 143 aCOWtancy.com

- 15. Syllabus B9e) Earnings per share (eps) i) calculate the eps in accordance with relevant accounting standards (dealing with bonus issues, full market value issues and rights issues) ii) explain the relevance of the diluted eps and calculate the diluted eps involving convertible debt and share options (warrants) IAS 33 EPS - Number of shares Calculating the weighted average number of ordinary shares The number of shares given in the SFP at the year-end - may not be the number of shares in issue ALL year. So we need to know how many we had in issue on AVERAGE instead of at the end. Well if there were no additional shares in the year then obviously the weighted average is the same as the year end - so no problem! However, if additional shares have been issued we’ve got some work to do as follows (depending on how those shares were issued): Full Market Price issue of shares No problem here as the new shares came with the right amount of new resources so the company should be able to use those new resources to maintain the EPS • No adjustment needed (apart from time) 144 aCOWtancy.com

- 16. Bonus & Rights Issue of shares More problematic, as the share were issued for cheaper (rights) than usual or for free (bonus). In both cases the company has not been given enough new resource to expect the EPS to be maintained. This causes comparison to last year problems. • Adjust for these (Bonus fraction) • Pretend they were in issue ALL year • Change comparative (Pretend they were in last year too) So, how to calculate it is best explained by example: 1st January 100 shares in issue 1st May Full market price issue of 400 shares 1st July 1 for 5 bonus issue Solution Draw up a table like this: Now fill in the first 2 columns: 145 aCOWtancy.com

- 17. Notice how this shows the TOTAL shares. Now fill in the timing of how long these TOTALS lasted for in the year. Finally look for any bonus issues and pretend that they happened at the start of the year. We do this by applying the bonus fraction to all entries BEFORE the actual bonus or rights issue. In this case the bonus fraction would be 6/5 - so apply this to everything before the actual bonus issue: Finally, multiply through and calculate the weighted average: 146 aCOWtancy.com

- 18. Syllabus B9e) Earnings per share (eps) i) calculate the eps in accordance with relevant accounting standards (dealing with bonus issues, full market value issues and rights issues) ii) explain the relevance of the diluted eps and calculate the diluted eps involving convertible debt and share options (warrants) IAS 33 Bonus issue Additional shares are issued to the ordinary equity holders in proportion to their current shareholding, for example 1 new share for every 2 shares already owned. No cash is received for these shares. Double Entry • Dr Reserves or Share premium • Cr Share Capital IAS 33 pretends that the bonus issue has been in place all year - regardless of when it was actually made. We do this by multiplying the totals before the issue by a “bonus fraction”. Bonus Fraction Calculation - Bonus issue 1 for 2 bonus issue - means we’ve now got 3 where we used to have 2 = 3/2 2 for 5 - now got 7 used to have 5 = 7/5 3 for 4 - now got 7 used to have 4 = 7/4 147 aCOWtancy.com

- 19. Example 1st Jan 100 shares in issue 1st July 1 for 2 bonus issue (i.e. 50 more shares) • Weighted Average number of shares 100 x 6/12 (we had a total of 100 for 6 months) = 50 x 3/2 (bonus fraction) = 75 150 x 6/12 (we had a total of 150 for 6 months) = 75 Total = 150 148 aCOWtancy.com

- 20. Syllabus B9e) Earnings per share (eps) i) calculate the eps in accordance with relevant accounting standards (dealing with bonus issues, full market value issues and rights issues) ii) explain the relevance of the diluted eps and calculate the diluted eps involving convertible debt and share options (warrants) IAS 33 Rights Issue Rights issue A rights issue is: • An issue of shares for cash to the existing ordinary equity holders in proportion to their current shareholdings. • At a discount to the current market price. It is, in fact, a mixture of a full price and bonus issue. So again we do the same as in the bonus issue - we pretend it happened all year and to do this we multiply the previous totals by the bonus fraction. The problem is - calculating the bonus fraction for a rights issue is slightly different: Example 2 for 5 offered at £4 when the market value is £10 So we are being offered 2 @ £4 = £8 For every 5 which cost us £10 each = £50 So we now have 7 at a cost of £58 = 8.29 This is what we call the TERP (theoretical ex-rights price). The bonus fraction is the current MV / TERP = 10 / 8.29 149 aCOWtancy.com

- 21. Syllabus B9e) Earnings per share (eps) i) calculate the eps in accordance with relevant accounting standards (dealing with bonus issues, full market value issues and rights issues) ii) explain the relevance of the diluted eps and calculate the diluted eps involving convertible debt and share options (warrants) IAS 33 Basic EPS putting it all together IAS 33 Basic EPS putting it all together 1 Step 1: Calculate the EARNINGS (PAT - irredeemable pref. shares) 2 Step 2: Calculate Weighted average NUMBER OF SHARES 3 Divide one by the other! 150 aCOWtancy.com

- 22. Syllabus B9e) Earnings per share (eps) ii) explain the relevance of the diluted eps and calculate the diluted eps involving convertible debt and share options (warrants) IAS 33 Diluted EPS This is the basic EPS adjusted for the potential effects of a convertible loan (currently in the SFP) being converted and options (currently in issue) being exercised. This is because these things will possibly increase the number of shares in the future and thus dilute EPS. This is how these items affect the Basic Earnings and Shares. Earnings The convertible loan will (once converted) increase earnings as interest will no longer have to be paid. So increase the basic earnings with a tax adjusted interest savings. Shares • Simply add the shares which will result from the convertible loan • Also add the “free” shares from a share option Convertible loan • Add the interest saved (after tax) to the EARNINGS from basic EPS • Add the extra shares convertible to the SHARES from basic EPS 151 aCOWtancy.com

- 23. Options Step 1 : Calculate the money the options will bring in Step 2 : Calculate how many shares this would normally buy Step 3 : Look at the number of shares given away in the option, compare it to those in step 2 and these are the “free shares” We add the free shares to the SHARES figure from basic EPS. Illustration 5% 800 convertible loan - each 100 can be converted into 20 shares (tax 30%) 100 share options @ $2 (MV $5) How to calculate Interest Saved 5% x 800 = 40 x 70% (tax adjusted) = 28 How to calculate the extra convertible shares 800/100 x 20 = 160 How to calculate the free shares in share options Cash in from option $200, this would normally mean the company issuing (200/5) 40 shares instead of the 100, so there has effectively been 60 shares issued for ‘free’. We use this figure in the diluted eps calculation. An alternative calculation is: 100 x (5-2) / 5 = 60 Solution Basic EPS Convertible Loan Share options E 100 + 28 S 50 + 160 + 60 Diluted EPS = 128 / 270 = 0.47 152 aCOWtancy.com

- 24. Syllabus B9e) Earnings per share (eps) i) calculate the eps in accordance with relevant accounting standards (dealing with bonus issues, full market value issues and rights issues) ii) explain the relevance of the diluted eps and calculate the diluted eps involving convertible debt and share options (warrants) EPS as a performance measure EPS is better than PAT as an earnings performance indicator Profit after tax gives an absolute figure An increase in PAT does not show the whole picture about a company's profitability Some profit growth may come from acquiring other companies If the acquisition was funded by new shares then profit will grow but not necessarily EPS So EPS trends show a better picture of profitability than PAT Simply looking at PAT growth ignores any increases in the resources used to earn them The diluted EPS is useful as it alerts existing shareholders to the fact that future EPS may be reduced as a result of share capital changes Where the finance cost per potential new share is less than the basic EPS, there will be a dilution 153 aCOWtancy.com

- 25. Syllabus B10. Revenue Syllabus B10a) Explain and apply the principles of recognition of revenue: (i) Identification of contracts (ii) Identification of performance obligations (iii) Determination of transaction price (iv) Allocation of the price to performance obligations (v) Recognition of revenue when/as performance obligations are satisfied. Revenue Recognition - IFRS 15 - introduction Revenue Recognition - IFRS 15 When & how much to Recognise Revenue? Here you need to go through the 5 step process… 1 Identify the contract(s) with a customer 2 Identify the performance obligations in the contract 3 Determine the transaction price 4 Allocate the transaction price to the performance obligations in the contract 5 Recognise revenue when (or as) the entity satisfies a performance obligation Before we do that though, let’s get some key definitions out of the way.. Key definitions • Contract An agreement between two or more parties that creates enforceable rights and obligations. 154 aCOWtancy.com

- 26. • Income Increases in economic benefits during the accounting period in the form of increasing assets or decreasing liabilities • Performance obligation A promise in a contract to transfer to the customer either: - a good or service that is distinct; or - a series of distinct goods or services that are substantially the same and that have the same pattern of transfer to the customer. • Revenue Income arising in the course of an entity’s ordinary activities. • Transaction price The amount of consideration to which an entity expects to be entitled in exchange for transferring promised goods or services to a customer. 155 aCOWtancy.com

- 27. Syllabus B10abcd) a) Explain and apply the principles of recognition of revenue: (i) Identification of contracts (ii) Identification of performance obligations (iii) Determination of transaction price (iv) Allocation of the price to performance obligations (v) Recognition of revenue when/as performance obligations are satisfied. b) Explain and apply the criteria for recognising revenue generated from contracts where performance obligations are satisfied over time or at a point in time. c) Describe the acceptable methods for measuring progress towards complete satisfaction of a performance obligation. d) Explain and apply the criteria for the recognition of contract costs. Revenue Recognition - IFRS 15 - 5 steps Revenue Recognition - IFRS 15 - 5 steps Ok let’s now get into a bit more detail… Step 1: Identify the contract(s) with a customer • The contract must be approved by all involved • Everyone’s rights can be identified • It must have commercial substance • The consideration will probably be paid 156 aCOWtancy.com

- 28. Step 2: Identify the separate performance obligations in the contract This will be goods or services promised to the customer These goods / services need to be distinct and create a separately identifiable obligation • Distinct means: The customer can benefit from the goods/service on its own AND The promise to give the goods/services is separately identifiable (from other promises) • Separately identifiable means: No significant integrating of the goods/service with others promised in the contract The goods/service doesn’t significantly modify another good or service promised in the contract. The goods/service is not highly related/dependent on other goods or services promised in the contract. Step 3: Determine the transaction price How much the entity expects, considering past customary business practices • Variable Consideration If the price may vary (eg. possible refunds, rebates, discounts, bonuses, contingent consideration etc) - then estimate the amount expected • However variable consideration is only included if it’s highly probable there won’t need to be a significant revenue reversal in the future (when the uncertainty has been subsequently resolved) • However, for royalties from licensing intellectual property - recognise only when the usage occurs Step 4: Allocate the transaction price to the separate performance obligations If there’s multiple performance obligations, split the transaction price by using their standalone selling prices. (Estimate if not readily available) • How to estimate a selling Price - Adjusted market assessment approach - Expected cost plus a margin approach - Residual approach (only permissible in limited circumstances). 157 aCOWtancy.com

- 29. • If paid in advance, discount down if it’s significant (>12m) Step 5: Recognise revenue when (or as) the entity satisfies a performance obligation Revenue is recognised as control is passed, over time or at a point in time. • What is Control It’s the ability to direct the use of and get almost all of the benefits from the asset. This includes the ability to prevent others from directing the use of and obtaining the benefits from the asset. • Benefits could be: - Direct or indirect cash flows that may be obtained directly or indirectly - Using the asset to enhance the value of other assets; - Pledging the asset to secure a loan - Holding the asset. • So remember we recognise revenue as asset control is passed (obligations satisfied) to the customer This could be over time or at a specific point in time. Examples (of factors to consider) of a specific point in time: 1 The entity now has a present right to receive payment for the asset; 2 The customer has legal title to the asset; 3 The entity has transferred physical possession of the asset; 4 The customer has the significant risks and rewards related to the ownership of the asset; and 5 The customer has accepted the asset. Contract costs - that the entity can get back from the customer These must be recognised as an asset (unless the subsequent amortisation would be less 12m), but must be directly related to the contract (e.g. ‘success fees’ paid to agents). Examples would be direct labour, materials, and the allocation of overheads - this asset is then amortised 158 aCOWtancy.com

- 30. Syllabus B10e) Apply the principles of recognition of revenue, and specifically account for the following types of transaction: (i) principal versus agent (ii) repurchase agreements (iii) bill and hold arrangements (iv) consignments Exam Standard Illustrations Illustration 1 - Agent or not? An entity negotiates with major airlines to purchase tickets at reduced rates It agrees to buy a specific number of tickets and must pay even if unable to resell them. The entity then sets the price for these ticket for its own customers and receives cash immediately on purchase The entity also assists the customers in resolving complaints with the service provided by airlines. However, each airline is responsible for fulfilling obligations associated with the ticket, including remedies to a customer for dissatisfaction with the service. How would this be dealt with under IFRS 15? 1 Step 1: Identify the contract(s) with a customer This is clear here when the ticket is purchased 159 aCOWtancy.com

- 31. 2 Step 2: Identify the performance obligations in the contract This is tricky - is it to arrange for another party provide a flight ticket - or is it - to provide the flight ticket themselves? Well - look at the risks involved. If the flight is cancelled the airline pays to reimburse If the ticket doesn't get sold - the entity loses out Look at the rewards - the entity can set its own price and thus rewards On balance therefore the entity takes most of the risks and rewards here and thus controls the ticket - thus they have the obligation to provide the right to fly ticket 3 Step 3: Determine the transaction price This is set by the entity 4 Step 4: Allocate the transaction price to the performance obligations in the contract The price here is the GROSS amount of the ticket price (they sell it for) 5 Step 5: Recognise revenue when (or as) the entity satisfies a performance obligation Recognise the revenue once the flight has occurred 160 aCOWtancy.com

- 32. Illustration 2 - Loyalty discounts An entity has a customer loyalty programme that rewards a customer with one customer loyalty point for every $10 of purchases. Each point is redeemable for a $1 discount on any future purchases Customers purchase products for $100,000 and earn 10,000 points The entity expects 9,500 points to be redeemed, so they have a stand-alone selling price $9,500 How would this be dealt with under IFRS 15? 1 Step 1: Identify the contract(s) with a customer This is when goods are purchased 2 Step 2: Identify the performance obligations in the contract The promise to provide points to the customer is a performance obligation along with, of course, the obligation to provide the goods initially purchased 3 Step 3: Determine the transaction price $100,000 4 Step 4: Allocate the transaction price to the performance obligations in the contract The entity allocates the $100,000 to the product and the points on a relative stand- alone selling price basis as follows: So the standalone selling price total is 100,000 + 9,500 = 109,500 Now we split this according to their own standalone prices pro-rata Product $91,324 [100,000 x (100,000 / 109,500] Points $8,676 [100,000 x 9,500 /109,500] 5 Step 5: Recognise revenue when (or as) the entity satisfies a performance obligation Of course the products get recognised immediately on purchase but now lets look at the points.. Let’s say at the end of the first reporting period, 4,500 points (out of the 9,500) have been redeemed The entity recognises revenue of $4,110 [(4,500 points ÷ 9,500 points) × $8,676] and recognises a contract liability of $4,566 (8,676 – 4,110) for the unredeemed points 161 aCOWtancy.com

- 33. Syllabus B10f) Prepare financial statement extracts for contracts where performance obligations are satisfied over time. Revenues - Presentation in financial statements Presentation in financial statements Show in the SFP as a contract liability, asset, or a receivable, depending on when paid and performed i.e.. Paid upfront but not yet performed would be a contract liability Performed but not paid would be a contract receivable or asset 1 A contract asset if the payment is conditional (on something other than time) 2 A receivable if the payment is unconditional Contract assets and receivables shall be accounted for in accordance with IFRS 9. Disclosures All qualitative and quantitative information about: • its contracts with customers; • the significant judgments in applying the guidance to those contracts; and • any assets recognised from the costs to fulfil a contract with a customer. 162 aCOWtancy.com

- 34. Syllabus B10b) Explain and apply the criteria for recognising revenue generated from contracts where performance obligations are satisfied over time or at a point in time. Accrued and deferred Income An entity will accrue income when it has earned the income during the period but it has not yet been invoiced or received. This will increase income in the statement of profit or loss and be shown as a receivable in the statement of financial position at year end. Accounting Treatment: Accrued Income Dr Accrued income (SOFP) Cr Income Account (I/S) When an entity has received income in advance of it being earned, it should be deferred to the following period. This will reduce income in the statement of profit or loss and be shown as a payable in the statement of financial position at the year end. Accounting Treatment: Deferred Income Dr Income Account (I/S) Cr Deferred Income (SOFP) 163 aCOWtancy.com

- 35. Syllabus B11a) Apply the provisions of relevant accounting standards in relation to accounting for government grants. Government Grants Part 1 Government grants are a form of government assistance. When can you recognise a government grant? When there is reasonable assurance that: • The entity will comply with any conditions attached to the grant and • the grant will be received However, IAS 20 does not apply to the following situations: 1 Tax breaks from the government 2 Government acting as part-owner of the entity 3 Free technical or marketing advice Accounting treatment of government grants Dr Cash The debit is always cash so we only have to know where we put the credit.. 164 aCOWtancy.com

- 36. There are 2 approaches - depending on what the grant is given for: • Capital Grant approach: (Given for Assets - For NCA such as machines and buildings) Recognise the grant outside profit or loss initially: Dr Cash Cr Cost of asset or Cr Deferred Income • Income Grant approach: (Given for expenses - For I/S items such as wages etc) Recognise the grant in profit or loss Dr Cash Cr Other income (or expense) Capital Grant approach - accounting for as "Cr Cost of asset” • Dr Cash Cr Cost of asset This will have the effect of reducing depreciation on the income statement and the asset on the SFP • An Example Asset $100 with 10yrs estimated useful life Received grant of $50 Accounting for a grant received: DR Cash $50 CR Asset $50 At the Y/E Depreciation charge: DR Depreciation expense (I/S) (100-50)/10yrs = $5 CR Accumulate depreciation $5 Capital Grant approach - accounting for as "Cr Deferred Income” • Dr Cash Cr Deferred Income This will have the effect of keeping full depreciation on the income statement and the full asset and liability on the SFP Then... Dr Deferred Income 165 aCOWtancy.com

- 37. Cr Income statement (over life of asset) This will have the effect of reducing the liability and the expense on the income statement • An Example Asset $100 with 10yrs estimated useful life Received grant of $50 Accounting for a grant received: DR Cash $50 CR Deferred income $50 At the Y/E Depreciation charge: DR Depreciation expense (I/S) 100/10yrs = $10 CR Accumulate depreciation $10 Release of deferred income: DR Deferred income 50/10yrs =$5 CR I/S $5 That's all I'll say here as it is best seen visually and practically in the video :) 166 aCOWtancy.com

- 38. Syllabus B11. Government grants Syllabus B11a) Apply the provisions of relevant accounting standards in relation to accounting for government grants. Government Grants Part 2 Government grants Part 2 Conditions These may help the company decide the periods over which the grant will be earned. It may be that the grant needs to be split up and taken to the income statement on different bases. Compensation The grant may be for compensation on expenses already spent. Or it might be just for financial support with no actual related future costs. Whatever the situation, the grant should be recognised in profit or loss when it becomes receivable. NB If a condition might not be met then a contingent liability should be disclosed in the notes. Similarly if it has already not been met then a provision is required. Non-monetary government grants Think here, for example, of the government giving you some land (ie not cash). To put a value on it - we use the Fair Value. Alternatively, both may be valued at a nominal amount. 167 aCOWtancy.com

- 39. Repayment of government grants This means when we are not allowed the grant anymore and so have to repay it back. This would be a change in accounting estimate (IAS 8) and so you do not change past periods just the current one. • Accounting treatment (capital grant repayment): • Dr Any deferred Income Balance or Dr Cost of asset • Dr Income statement with any balance and CR cash with the amount repaid The extra depreciation to date that would have been recognised had the grant not been netted off against cost should be recognised immediately as an expense. • Accounting treatment - Income Grant Repayment Dr Income statement Cr Cash 168 aCOWtancy.com

- 40. Syllabus B12. Foreign currency transactions Syllabus B12a) Explain the difference between functional and presentation currency and explain why adjustments for foreign currency transactions are necessary. Foreign currency - extras Foreign Currency - Examinable Narrative & Miscellaneous points Functional Currency Every entity has its own functional currency and measures its results in that currency Functional currency is the one that influences sales price the one used in the country where most competitors are and where regulations are made and the one that influences labour and material costs If functional currency changes then all items are translated at the exchange rate at the date of change Presentation Currency An entity can present in any currency it chooses. The foreign sub (with a foreign functional currency) will present normally in the parents presentation currency and hence the need for foreign sub translation rules! Foreign currency dealings between H and S There is often a loan between H and a foreign sub. If the loan is in a foreign currency don’t forget that this will need retranslating in H’s or S’s (depending on who has the ‘foreign’ loan) own accounts with the difference going to its income statement. If H sells foreign S, any exchange differences (from translating that sub) in equity are taken to the income statement (and out of the OCI). 169 aCOWtancy.com

- 41. Deferred tax There are deferred tax consequences of foreign exchange gains (see tax chapter). This is because the gains and losses are recognised by H now but will not be dealt with by the taxman until S is eventually sold. 170 aCOWtancy.com

- 42. Syllabus B12b) Account for the translation of foreign currency transactions and monetary/non-monetary foreign currency items at the reporting date. Foreign Exchange Single company Foreign Exchange Single company Transactions in a single company This is where a company simples deals with companies abroad (who have a different currency). The key thing to remember is that… ALL EXCHANGE DIFFERENCES TO INCOME STATEMENT So - a company will buy on credit (or sell) and then pay or receive later. The problem is that the exchange rate will have moved and caused an exchange difference. Step 1: Translate at spot rate Step 2: If there is a creditor/debtor @ y/e - retranslate it (exch gain/loss to I/S) Step 3: Pay off creditor - exchange gain/loss to I/S Illustration 1 On 1 July an entity purchased goods from a foreign country for Y$10,000. On 1 September the goods were paid in full. The exchange rates were: 1 July $1 = Y$10 1 September $1 = Y$9 171 aCOWtancy.com

- 43. Calculate the exchange difference to be included in profit or loss according to IAS 21 The Effects of Changes in Foreign Exchange Rates. Solution Account for Payables on 1 July: Y$10,000/10 = 1,000 Payment performed on 1 September: Y$10,000 / 9 = 1,111 The Exchange difference: 1,000 - 1,111 = 111 loss Illustration 2 Maltese Co. buys £100 goods on 1st June (£1:€1.2) Year End (31/12) payable still outstanding (£1:€1.1) 5th January £100 paid (£1:€1.05) Solution Initial Transaction Dr Purchases 120 Cr Payables 120 Year End Dr Payables 10 Cr I/S Ex gain 10 On payment Dr Payables 110 Cr I/S Ex gain 5 Cr Cash 105 Also items revalued to Fair Value will be retranslated at the date of revaluation and the exchange gain/loss to Income statement. All foreign monetary balances are also translated at the year end and the differences taken to the income statement. This would include receivables, payables, loans etc. 172 aCOWtancy.com

- 44. Syllabus C: ANALYSING AND INTERPRETING THE FINANCIAL STATEMENTS Syllabus C1. Limitations of financial statements Syllabus C1a) Indicate the problems of using historic information to predict future performance and trends. Problems Using Historic Information To Predict Future Historic info gets out of date especially in times of rising prices Effect on Predicting Future 1 Cost of replacing asset (in the future) MUCH higher than NBV of asset currently 2 This means higher future depreciation (and interest if a loan is needed) 3 Cost of Sales are understated (if using FIFO) - yet sales revenue keeps up to date - thus overstating profit trends Also, the low depreciation and interest etc could have led to too many profits being distributed thus meaning more loans needed in the future potentially So profits are overstated and assets understated - making ROCE seem higher compared to those in the future The ‘overstated’ profit means more tax payable and maybe even employees want more wages The understatement of assets can depress a company’s share price and may make it vulnerable to a takeover bid. 173 aCOWtancy.com

- 45. These problems can be overcome by introducing current values by following a policy of revaluations. Also IFRS's are now using Fair (current) Values more eg. Investment Properties and FVTPL items 174 aCOWtancy.com

- 46. Syllabus C1b) Discuss how financial statements may be manipulated to produce a desired effect (creative accounting, window dressing). Manipulating Financial Statements Creative Accounting Example 1 - Using Provisions • Create an unnecessary provision in good times (this reduces profits) • Release this provision in bad times (this increases profits) The effect of this is a smoother profitability rather than big up and down swings (which investors don't like) Window Dressing Cash Postpone paying suppliers, so Y/E cashbooks good Receivables Record an unusually low bad debt provision Revenue Offer early shipment discounts to get revenues in current year Expenses Withhold supplier payments, so that they are recorded in a later period. 175 aCOWtancy.com

- 47. Syllabus C1c) Explain why figures in a statement of financial position may not be representative of average values throughout the period for example, due to: i) seasonal trading ii) major asset acquisitions near the end of the accounting period. When The Financial Position May Not Be Representative Seasonal Trading This is best explained by an example: Imagine a company who has highly seasonal trading. Their year end may be immediately after this high trading period Therefore, they will probably have higher than normal levels of cash and receivables and lower than normal levels of payables Major Asset Acquisitions Near The Year-End This has the effect of: Higher Assets (and maybe loans) but... No related Income (as it was just before the year end) This makes ROCE look worse 176 aCOWtancy.com

- 48. Syllabus C1d) Explain how the use of consolidated financial statements might limit interpretation techniques. Consolidated Financial Statements Might Limit Interpretation The main problem comes from mid year acquisitions / disposals Problems include: 1 Income statement includes only half the returns (if mid-year acq) But the SFP includes all the assets (capital employed) Thus distorting ROCE 2 Synergies can take a while to come in and so return is artificially low 3 Subs are acquired at FV This generally increases asset values Meaning a deterioration in ROCE and Asset Turnover 4 Goodwill is now recognised whereas before it wasn't 177 aCOWtancy.com

- 49. Syllabus C1) Ratio limitations Ratio limitations Ratios aren't always comparable Factors affecting comparability 1 Different accounting policies Eg One company may revalue its property; this will increase its capital employed and (probably) lower its ROCE Others may carry their property at historical cost 2 Different accounting dates Eg One company has a year ended 30 June, whereas another has 30 September If the sector is exposed to seasonal trading, this could have a significant impact on many ratios. 3 Different ratio definitions Eg This may be a particular problem with ratios like ROCE as there is no universally accepted definition 4 Comparing to averages Sector averages are just that: averages Many of the companies included in the sector may not be a good match to the type of business being compared Some companies go for high mark-ups, but usually lower inventory turnover, whereas others go for selling more with lower margins 5 Possible deliberate manipulation (creative accounting) 6 Different managerial policies e.g. different companies offer customers different payment terms Compare ratios with 1 Industry averages 2 Other businesses in the same business 3 With prior year information 178 aCOWtancy.com

- 50. Syllabus C2. Interpretation of accounting ratios Syllabus C2abcd) a) Define and compute relevant financial ratios b) Explain what aspects of performance specific ratios are intended to assess. c) Analyse and interpret ratios to give an assessment of an entity’s/group’s performance and financial position in comparison with: i) previous period’s financial statements ii) another similar entity/group for the same reporting period iii) industry average ratios. d) Interpret financial statements to give advice from the perspectives of different stakeholders. Profitability Return on Capital Employed ROCE This is a measure of management’s overall efficiency in using the finance/assets • is affected by the carrying amount of PPE • So old plant will give a higher than usual ROCE • Revaluations upwards will give a lower than usual ROCE ROCE can be broken down (explained by) 2 more ratios: Operating Margin Asset Turnover 179 aCOWtancy.com

- 51. So if operating margin goes up and ROCE goes down - you know that ROCE is going down due to a poor Net asset turnover. The assets aren't producing the amount of sales they used to Operating Margin = Operating profit (PBIT) / Sales Asset Turnover = Sales / Capital Employed Gross Margin This is affected by.. An increase in gross profit doesn't necessarily mean an increase in the margin This is because Gross profit is also affected by the volume of sales (not just the margin made on each one) • Opening and closing inventory measured at different costs • Inventory write downs due to damage/obsolescence • A change in the sales mix eg. from higher to lower margin sales • New (different margin) products • New suppliers with different costs • Selling prices change eg. discounts offered 180 aCOWtancy.com

- 52. • More or less Import duties • Exchange rate fluctuations • Change in cost classification: eg. Some costs included as operating expenses now in cost of sales 181 aCOWtancy.com

- 53. Syllabus C2abcd) a) Define and compute relevant financial ratios b) Explain what aspects of performance specific ratios are intended to assess. c) Analyse and interpret ratios to give an assessment of an entity’s/group’s performance and financial position in comparison with: i) previous period’s financial statements ii) another similar entity/group for the same reporting period iii) industry average ratios. d) Interpret financial statements to give advice from the perspectives of different stakeholders. Gearing Financial Gearing This could also be calculated as: 182 aCOWtancy.com

- 54. Interest Cover Points to notice about LOW interest cover Low interest cover is a direct consequence of high gearing and . For example, • It makes profits vulnerable to relatively small changes in operating activity • So small reductions in sales / margins or small increases in expenses may mean interest can't be paid 183 aCOWtancy.com

- 55. Syllabus C2abcd) a) Define and compute relevant financial ratios b) Explain what aspects of performance specific ratios are intended to assess. c) Analyse and interpret ratios to give an assessment of an entity’s/group’s performance and financial position in comparison with: i) previous period’s financial statements ii) another similar entity/group for the same reporting period iii) industry average ratios. d) Interpret financial statements to give advice from the perspectives of different stakeholders. Liquidity Current ratio Quick Ratio 184 aCOWtancy.com

- 56. Bank Account / Overdraft Don't forget the obvious and look at the movement on this • Look for why it has increased or decreased • If money is spent on assets thats normally a good thing • If money is spent on high dividends (with little cash) thats a bad thing • If a loan is paid off - that's normally a bad idea (as the company should be able to make a better return) Working Capital Cycle This is made up of The difference between being paid needs to be funded (often by an overdraft) 1 Inventory Days + (ideally these are low) 2 Receivable days - (ideally these are low) 3 Payable days (ideally these are high) 185 aCOWtancy.com

- 57. Indicators of deteriorating liquidity • Cash balances falling • New share / loan issues with no respective increase in assets • Sale and leaseback of assets • Payables days getting longer 186 aCOWtancy.com

- 58. Syllabus C2e) Discuss how the interpretation of current value based financial statements would differ from those using historical cost based accounts. Interpretation Of Current V Historic Value Based Financial Statements ROCE is affected because • HC Capital Employed is understated compared to using CV • HC profits are overstated in comparison to CV • Both of the above have the effect of overstating ROCE 187 aCOWtancy.com

- 59. Syllabus C3. Limitations of interpretation techniques Syllabus C3abcdef) a) Discuss the limitations in the use of ratio analysis for assessing corporate performance. b) Discuss the effect that changes in accounting policies or the use of different accounting polices between entities can have on the ability to interpret performance. c) Indicate other information, including non- financial information, that may be of relevance to the assessment of an entity’s performance. d) Compare the usefulness of cash flow information with that of a statement of profit or loss or a statement of profit or loss and other comprehensive income. e) Interpret a statement of cash flows (together with other financial information) to assess the performance and financial position of an entity. f) i) explain why the trend of eps may be a more accurate indicator of performance than a company’s profit trend and the importance of eps as a stock market indicator ii) discuss the limitations of using eps as a performance measure. Other relevant information When buying a company • Audited financial statements • Forward looking information Eg. Profit and financial position forecasts Capital expenditure budgets and Cash budgets and Order levels • Current (fair) values of assets being acquired • Level of business risk Highly profitable companies may also be highly risky, whereas a less profitable company may have more stable ‘quality’ earnings 188 aCOWtancy.com

- 60. • Expected price to acquire a company It may be that a poorer performing business may be a more attractive purchase because it has higher potential for growth 189 aCOWtancy.com

- 61. Syllabus C3c) Indicate other information, including non- financial information, that may be of relevance to the assessment of an entity’s performance. Other Helpful Information Other helpful Information includes.. 1 Order Books 2 Loan Repayment Dates 3 Age of Company 4 Asset Replacement Dates 5 Management Skills 6 Potential Synergies 7 FV of Assets 190 aCOWtancy.com

- 62. Syllabus C4. Specialised, not-for-profit and public sector entities Syllabus C4a) Explain how the interpretation of the financial statement of a specialised, not-for-profit or public sector organisations might differ from that of a profit making entity by reference to the different aims, objectives and reporting requirements. Not for Profit sector Getting a Loan Similar criteria as would be used for profit-orientated entities • How secure is the loan? Here use the capital gearing ratio: Long-term loans to net assets Clearly if this ratio is high, further borrowing would be at an increased risk • Ability to repay the interest & capital Interest cover should be calculated PBIT / Interest The higher this ratio the less risk of interest default Look for trends indicating a deterioration in this ratio • Nature and trend of income Are the sources of income increasing or decreasing Does the reported income contain ‘one-off’ donations (which may not be recurring) etc? • Other matters Market value of, and prior charges against, any assets used as loan security Any (perhaps the trustees) personal guarantees for the loan 191 aCOWtancy.com

- 63. Syllabus D: PREPARATION OF FINANCIAL STATEMENTS Syllabus D1. CF - Approach to the Question Syllabus D1c) Prepare a statement of cash flows for a single entity (not a group) in accordance with relevant accounting standards using the indirect method. Cashflow statements - Step 1 Cash flow statements - Step 1 Indirect method The idea here is simply to get to the profit from operating activities as a starting point - nothing more! So IAS tells us that although we need to get to the operating profit figure we must start with Profit before tax (PBT) and reconcile this to the operating profit figure. Operating Profit Before we do this let’s remind ourselves what “Operating profit” is. Operating Profit is: 192 aCOWtancy.com

- 64. Illustration tart with the profit before tax figure and then reconcile to the operating profit figure. Operating profit would be: o, let’s start reconciling… Then fill in the reconciling figures between them (income is a negative and expense a positive here). This is because we are going upwards on the income statement, rather than the normal downwards. 193 aCOWtancy.com

- 65. So this is the final answer to step 1: You place this in the “Cashflow from Operating Activities” part of the cash-flow statement. 194 aCOWtancy.com

- 66. Syllabus D1c) Prepare a statement of cash flows for a single entity (not a group) in accordance with relevant accounting standards using the indirect method. Cashflow statements - Step 2 Cash flow statements - Step 2 Now we have the operating profit figure we need to get to the cash. We do this by taking the profit figure (calculated and reconciled to in step 1) and adding back all the non-cash items (we get to the cash therefore indirectly). Key point to remember here The non-cash items we add back are ONLY those in operating profit (Sales, COS, admin and distr. costs). For example: Depreciation, amortisation, impairments, profit on sale, receivables, payables and inventory There could be more - it depends on the question - but dealing with these will ensure you pass. 195 aCOWtancy.com

- 67. So the operating activities part of the cash flow will now look like this: Ensure you get the signs the right way around! For example an increase in stock means less cash so (x). Notice we added back receivables / payables & Inventory. This is because credit sales, stock and credit payables are not cash and are in the operating profit figure. You just need to be careful that you get the signs the right way around as with these we just account for the movement in them. Think of it like this: • Increase in Inventory - means less cash - so show as a negative • Increase in receivables - means less cash now - so show as a negative • Increase in payables - means don’t have to pay people just yet so an increase in cash - so show as a positive We have now dealt with the first part of the income statement - Sales, COS, administration expenses and distribution costs. We have indirectly got the cash from these figures by adding back all the non-cash items that may have been in there (as above). All of this happens in the “Cashflow from Operating Activities” part of the cash-flow statement. 196 aCOWtancy.com

- 68. Syllabus D1c) Prepare a statement of cash flows for a single entity (not a group) in accordance with relevant accounting standards using the indirect method. Cashflow statements - Step 3 Cash flow statements - Step 3 So far we have got the cash (indirectly) from operating profit. This means we have the cash from Sales, COS, admin and distribution costs. What we now do is look at what’s left in the income statement and try to find the cash. (In our example in step 1, we would have to deal with IP income, finance costs and tax). So we are looking at the other parts of the income statement (after operating profit) and finding the cash and putting this directly into the cash-flow statement. Direct method We do this by using a different method to the one in step 2 as we are now looking to put the cash in directly to the cash-flow statement (rather than taking a profit figure and adding back the non- cash items to indirectly arrive at cash). So how do we do this? Let’s say you owed somebody 100, then bought 20 more in the year - you should therefore owe them 120 right? However you look at your books at the year end and you see you only owe them 70 Therefore, you must have paid cash to them of 50 - this is the figure we then put in our cash-flow statement. 197 aCOWtancy.com

- 69. To show this differently (and how the examiner often shows it): We use this format for the rest of the cashflow question - though it may need adjusting slightly (PPE is calculated differently). We will now go on to look at the different items that you may find in the income statement and how we deal with them in the cash-flow statement using this method. 198 aCOWtancy.com

- 70. Syllabus D1c) Prepare a statement of cash flows for a single entity (not a group) in accordance with relevant accounting standards using the indirect method. Cashflow statement - finance costs Finance Costs - Illustration of Step 3 Solution Finance costs of 120 paid go to the operating activities section of the cashflow statement. 199 aCOWtancy.com

- 71. Syllabus D1c) Prepare a statement of cash flows for a single entity (not a group) in accordance with relevant accounting standards using the indirect method. Cashflow statement - taxation Taxation - Illustration of Step 3 Solution Taxation costs of 150 paid go to the operating activities section of the cashflow statement. 200 aCOWtancy.com

- 72. Syllabus D1c) Prepare a statement of cash flows for a single entity (not a group) in accordance with relevant accounting standards using the indirect method. Cashflow statement - Investment property Investment Property Income - Illustration of Step 3 There were no purchases of IP in the year. Solution Investment property income of 20 (rent received probably) goes to the investing activities section of the cashflow statement. 201 aCOWtancy.com

- 73. Syllabus D1c) Prepare a statement of cash flows for a single entity (not a group) in accordance with relevant accounting standards using the indirect method. Cashflow statements - Step 4 Cash flow statements - Step 4 So in the first 3 steps, we have turned the Income statement into cash and placed it into the cash- flow statement. We now need to do the same with the S - remember much of it we have already dealt with (e.g. receivables, inventory, payables, investment Property, interest and tax payable So let’s begin with… PPE We deal with this slightly differently to the income statement items in step 3: Process to follow Here’s the process to follow: Write down the PPE figures per the accounts Work out the cash element of each item (if any) Illustration Notes: Depreciation in year = 50 Revaluation = 100 Disposal = Asset sold for 100 making 20 profit 202 aCOWtancy.com

- 74. Solution The key here is to try and find the balancing figure (per the accounts) which will be additions in the year. Note: we are dealing with NBVs. Write down the PPE figures per the accounts. The balancing figure is 90 and this is additions. Work out the cash element of each item (if any): All PPE items go the investing activities section of the cashflow statement. 203 aCOWtancy.com

- 75. Syllabus D1c) Prepare a statement of cash flows for a single entity (not a group) in accordance with relevant accounting standards using the indirect method. Cashflow statements - Step 5 - Loans Cashflow statements - Step 5 - Loans Let’s now look at another one of the items that would still be left on the SFP, that we need to find the cash and take to the cash-flow statement - Loans Illustration Follow same techniques as before.. Solution Loan repayments of 40 go to the financing activities section of the cashflow statement. 204 aCOWtancy.com

- 76. Syllabus D1c) Prepare a statement of cash flows for a single entity (not a group) in accordance with relevant accounting standards using the indirect method. Cashflow statements - Step 5 - Shares Cashflow statements - Step 5 - Shares So in steps 1-3 we looked at how we got the cash from the income statement and into the statement of cash flows. In step 4 we looked at getting the cash flows from PPE. So now in our final step we look at getting cash from what’s left in the SFP… starting with shares. Share issues Again let’s look at this by illustration and we are using virtually the same technique as step 3 as you will see.. Solution 205 aCOWtancy.com

- 77. Share Proceeds goes to the financing activities section of the cashflow statement. Effect of Bonus Issue If there’s been a bonus issue, you need to be careful. You need to look at where the debit went - share premium or retained earnings: If share premium - ignore the bonus issue and the answer calculated above is still correct If Retained earnings - reduce the cash by the amount of the bonus issue See the quizzes for examples of this. 206 aCOWtancy.com

- 78. Syllabus D2. Preparing group SFP Syllabus D2a) Prepare a consolidated statement of financial position for a simple group (parent and one subsidiary and associate) dealing with pre and post acquisition profits, non-controlling interests and consolidated goodwill. Business Combinations - Basics The purpose of consolidated accounts is to show the group as a single economic entity. So first of all - what is a business combination? • Well my little calf, it’s an event where the acquirer obtains control of another business. • Let me explain, let’s say we are the Parent acquiring the subsidiary. We must prepare our own accounts AND those of us and the sub put together (called “consolidated accounts”) This is to show our shareholders what we CONTROL. Basic principles The accounts show all that is controlled by the parent, this means: 1 All assets and liabilities of a subsidiary are included 2 All income and expenses of the subsidiary are included Non controlling Interest (NCI) However the parent does not always own all of the above. So the % that is not owned by the parent is called the “non-controlling interest”. • A line is included in equity called non-controlling interests. This accounts for their share of the assets and liabilities on the SFP. 207 aCOWtancy.com

- 79. • A line is also included on the income statement which accounts for the NCI’s share of the income and expenses. One Thing you must understand before we go on Forgive me if this is basic, but hey, sometimes it’s good to be sure. Notice if you add the assets together and take away the liabilities for H - it comes to 400 (500+200+100-100-300) There are 2 things to understand about this figure: 1 It is NOT the true/fair value of the company 2 It is equal to the equity section of the SFP Equity • This shows you how the net assets figure has come about. The share capital is the capital introduced from the owners (as is share premium). 208 aCOWtancy.com

- 80. • The reserves are all the accumulated profits/losses/gains less dividends since the business started. Here the figure is 400 for H. Notice it is equal to the net assets Acquisition costs • Where there’s an acquisition there’s probably some of the costs eg legal fees etc Costs directly attributable to the acquisition are expensed to the income statement. • Be careful though, any costs which are just for the parent (acquirer) issuing its own debt or shares are deducted from the debt or equity itself (often share premium). 209 aCOWtancy.com

- 81. Syllabus D2a) Prepare a consolidated statement of financial position for a simple group (parent and one subsidiary and associate) dealing with pre and post acquisition profits, non-controlling interests and consolidated goodwill. Simple Goodwill Simple Goodwill Goodwill • When a company buys another - it is not often that it does so at the fair value of the net assets only. This is because most businesses are more than just the sum total of their ‘net assets’ on the SFP. Customer base, reputation, workforce etc. are all part of the value of the company that is not reflected in the accounts. This is called “goodwill” • Goodwill only occurs on a business combination. Individual companies cannot show their individual goodwill on their SFPs. This is because they cannot get a reliable measure, This is because nobody has purchased the company to value the goodwill appropriately. On a business combination the acquirer (Parent) purchases the subsidiary - normally at an amount higher than the FV of the net assets on the SFP, they buy it at a figure that effectively includes goodwill. Therefore the goodwill can now be measured and so does show in the group accounts. 210 aCOWtancy.com

- 82. How is goodwill calculated? On a basic level - I hope you can see - that it is the amount paid by the parent less the FV of the subs assets on their SFP. Let me explain.. In this example S’s Net assets are 900 (same as their equity remember). This is just the ‘book value’ of the net assets. The Fair Value of the net assets may be, say, 1,000. However a company may buy the company for 1.200. So, Goodwill would be 200. The goodwill represents the reputation etc. of a company and can only be reliably measured when the company is bought out. Here it was bought for 1,200. Therefore, as the FV of the net assets of S was only 1,000 - the extra 200 is deemed to be for goodwill. The increase from book value 900 to FV 1,000 is what we call a Fair Value adjustment. 211 aCOWtancy.com

- 83. Bargain Purchase This is where the parent and NCI paid less at acquisition than the FV of S’s net assets. This is obviously very rare and means a bargain was acquired So rare in fact that the standard suggests you look closely again at your calculation of S’s net assets value because it is strange that you got such a bargain and perhaps your original calculations of their FV were wrong However, if the calculations are all correct and you have indeed got a bargain then this is NOT shown on the SFP rather it is shown as: • Income on the income statement in the year of acquisition 212 aCOWtancy.com

- 84. Syllabus D2a) Prepare a consolidated statement of financial position for a simple group (parent and one subsidiary and associate) dealing with pre and post acquisition profits, non-controlling interests and consolidated goodwill. NCI in the Goodwill calculation NCI in the Goodwill calculation So far we have presumed that the company has been 100% purchased when calculating goodwill. Our calculation has been this: Non-controlling Interests Let’s now take into account what happens when we do not buy all of S. (eg. 80%) This means we now have some non-controlling interests (NCI) at 20% The formula changes to this: 213 aCOWtancy.com

- 85. This NCI can be calculated in 2 ways: 1 Proportion of FV of S’s Net Assets 2 FV of NCI itself Proportion of FV of S’s Net Assets method This is very straight forward. All we do is give the NCI their share of FV of S’s Net Assets..Consider this: P buys 80% S for 1,000. The FV of S’s Net assets were 1,100. How much is goodwill? The NCI is calculated as 20% of FV of S’s NA of 1,100 = 220 “Fair Value Method” of Calculating NCI in Goodwill • So in the previous example NCI was just given their share of S’s Net assets. They were not given any of their reputation etc. In other words, NCI were not given any goodwill. • I repeat, under the proportionate method, NCI is NOT given any goodwill. Under the FV method, they are given some goodwill. • This is because NCI is not just given their share of S’s NA but actually the FV of their 20% as a whole (ie NA + Goodwill). This FV figure is either given in the exam or can be calculated by looking at the share price. 214 aCOWtancy.com

- 86. P buys 80% S for 1,000. The FV of S’s Net assets were 1,100. The FV of NCI at this date was 250. How much is goodwill? Notice how goodwill is now 30 more than in the proportionate example. This is the goodwill attributable to NCI. NCI goodwill = FV of NCI - their share of FV of S’s NA Remember Under the proportionate method NCI does not get any of S’s Goodwill (only their share of S’s NA). Under the FV method, NCI gets given their share of S’s NA AND their share of S’s goodwill. 215 aCOWtancy.com

- 87. Syllabus D2a) Prepare a consolidated statement of financial position for a simple group (parent and one subsidiary and associate) dealing with pre and post acquisition profits, non-controlling interests and consolidated goodwill. Equity Table Equity Table S’s Equity Table As you will see when we get on to doing bigger questions, this is always our first working. This is because it helps all the other workings. Remember that Equity = Net assets Equity is made up of: 1 Share Capital 2 Share Premium 3 Retained Earnings 4 Revaluation Reserve 5 Any other ‘reserve’! If any of the above is mentioned in the question for S, then they must go into this equity table working. 216 aCOWtancy.com

- 88. What does the table look like? Remember that any other reserve would also go in here. So how do we fill in this table? 1 Enter the "Year end" figures straight from the SFP 2 Enter the "At acquisition" figures from looking at the information given normally in note 1 of the question. Please note you can presume the share capital and share premium is the same as the year-end figures, so you're only looking for the at acquisition reserves figures 3 Enter "Post Acquisition" figures simply by taking away the "At acquisition" figures away from the "Year end" figures (ie. Y/E - Acquisition = Post acquisition) So let's try a simple example.. (although this is given in a different format to the actual exam let's do it this way to start with). A company has share capital of 200, share premium of 100 and total reserves at acquisition of 100 at acquisition and have made profits since of 400. There have been no issues of shares since acquisition and no dividends paid out. Show the Equity table to calculate the net assets now at the year end, at acquisition and post-acquisition 217 aCOWtancy.com

- 89. Solution Fair Value Adjustments Ok the next step is to also place into the Equity table any Fair Value adjustments When a subsidiary is purchased - it is purchased at FAIR VALUE at acquisition. Using the figures above, if I were to tell you that the FV of the sub at acquisition was 480. Hopefully you can see we would need to make an adjustment of 80 (let’s say that this was because Land had a FV 80 higher than in the books): 218 aCOWtancy.com

- 90. Now as land doesn’t depreciate - it would still now be at 80 - so the table changes to this: If instead the FV adjustment was due to PPE with a 10 year useful economic life left - and lets say acquisition was 2 years ago, the table would look like this: The -16 in the post acquisition column is the depreciation on the FV adjustment. (80 / 10 years x 2 years). This makes the now column 64 (80 at acquisition - 16 depreciation post acquisition). 219 aCOWtancy.com

- 91. Syllabus D2a) Prepare a consolidated statement of financial position for a simple group (parent and one subsidiary and associate) dealing with pre and post acquisition profits, non-controlling interests and consolidated goodwill. NCI on the SFP Non-Controlling Interests So far we have looked at goodwill and the effect of NCI on this.. Now let’s look at NCI in a bit more detail (don’t worry we will pull all this together into a bigger question later). If you remember there are 2 methods of measuring NCI at acquisition: 1 Proportionate method This is the NCI % of FV of S’s Net assets at acquisition. 2 FV Method This is the FV of the NCI shares at acquisition (given mostly in the question). This choice is made at the beginning. Obviously, S will make profits/losses after acquisition and the NCI deserve their share of these. Therefore the formula to calculate NCI on the SFP is as follows: * This figure depends on the option chosen at acquisition (Proportionate or FV method). 220 aCOWtancy.com

- 92. Impairment S may become impaired over time. If it does, it is S’s goodwill which will be reduced in value first. If this happens it only affects NCI if you are using the FV method. This is because the proportionate method only gives NCI their share of S’s Net assets and none of the goodwill. Whereas, when using the FV method, NCI at acquisition is given a share of S’s NA and a share of the goodwill. NCI on the SFP Formula revised 221 aCOWtancy.com

- 93. Syllabus D2a) Prepare a consolidated statement of financial position for a simple group (parent and one subsidiary and associate) dealing with pre and post acquisition profits, non-controlling interests and consolidated goodwill. Basic groups - Simple Question 1 Basic groups - Simple Question 1 Have a look at this question and solution below and see if you can work out where all the figures in the solution have come from. Make sure to check out the videos too as these explain numbers questions such as these far better than words can.. P acquired 80% S when S’s reserves were 80. Prepare the Consolidated SFP, assuming P uses the proportionate method for measuring NCI at acquisition. 222 aCOWtancy.com

- 95. Group SFP Notice 1) Share Capital (and share premium) is always just the holding company 2) All P + S assets are just added together 3) “Investment in S”..becomes “Goodwill” in the consolidated SFP 4) NCI is an extra line in the equity section of consolidated SFP 224 aCOWtancy.com

- 96. Syllabus D2a) Prepare a consolidated statement of financial position for a simple group (parent and one subsidiary and associate) dealing with pre and post acquisition profits, non-controlling interests and consolidated goodwill. Basic groups - Simple Question 2 Basic groups - Simple Question 2 P acquired 80% S when S’s Reserves were 40. At that date the FV of S’s NA was 150. Difference is due to Land. There have been no issues of shares since acquisition. P uses the FV of NCI method at acquisition, and at acquisition the FV of NCI was 35. No impairment of goodwill. Prepare the consolidated set of accounts. 225 aCOWtancy.com

- 97. Step 1: Prepare S’s Equity Table Now the extra 10 FV adjustment now must be added to the PPE when we come to do the SFP at the end. Step 2: Goodwill Step 3: Do any adjustments in the question : NONE Step 4: NCI 226 aCOWtancy.com

- 98. Step 5: Reserves Step 6: Prepare the final SFP (with all adjustments included) 227 aCOWtancy.com

- 99. Syllabus D2a) Prepare a consolidated statement of financial position for a simple group (parent and one subsidiary and associate) dealing with pre and post acquisition profits, non-controlling interests and consolidated goodwill. Associates An associate is an entity over which the group has significant influence, but not control. Significant influence Significant influence is normally said to occur when you own between 20-50% of the shares in a company but is usually evidenced in one or more of the following ways: • representation on the board of directors • participation in the policy-making process • material transactions between the investor and the investee • interchange of managerial personnel; or • provision of essential technical information Accounting treatment An associate is not a group company and so is not consolidated. Instead it is accounted for using the equity method. Inter-company balances are not cancelled. Statement of Financial Position There is just one line only “investment in Associate” that goes into the consolidated SFP (under the Non-current Assets section). 228 aCOWtancy.com

- 100. It is calculated as follows: Consolidated income statement Again just one line in the consolidated income statement: Include share of PAT less any impairment for that year in associate. Do not include dividend received from A. What’s important to notice is that you do NOT add across the associate’s Assets and Liabilities or Income and expenses into the group totals of the consolidated accounts. Just simply place one line in the SFP and one line in the Income Statement. Unrealised profits for an associate 1 Only account for the parent’s share (eg 40%). This is because we only ever place in the consolidated accounts P’s share of A’s profits so any adjustment also has to be only P’s share. 2 Adjust earnings of the seller Adjustments required on Income Statement • If A is the seller - reduce the line “share of A’s PAT” • If P is the seller - increase P’s COS 229 aCOWtancy.com

- 101. Adjustments required on SFP • If A is the seller - reduce A’s Retained earnings and P’s Inventory • If P is the seller - reduce P’s Retained Earnings and the “Investment in Associate” line Illustration P sells goods to A (a 30% associate) for 1,000; making a 400 profit. 3/4 of the goods have been sold to 3rd parties by A. What entries are required in the group accounts? Profit = 400; Unrealised (still in stock) 1/4 - so unrealised profit = 400 x 1/4 = 100. As this is an associate we take the parents share of this (30%). So an adjustment of 100 x 30% = 30 is needed. Adjustment required on the Income statement P is the seller - so increase their COS by 30. Adjustment required on the group SFP P is the seller - so reduce their retained earnings and the line “Investment in Associate” by 30. The retained earnings of S and A were £70,000 and £30,000 respectively when they were acquired 8 years ago. There have been no issues of shares since then, and no FV adjustments required. The group use the proportionate method for valuing NCI at acquisition. Prepare the consolidated SFP 230 aCOWtancy.com

- 102. Solution Step 1: Equity Table Step 2: Goodwill H owns 18,000 of S’s share capital of 30,000 so 60%. Step 3: NCI 231 aCOWtancy.com

- 103. Step 4: Retained Earnings Step 5: Investment in Associate Final answer - Goodwill 232 aCOWtancy.com

- 104. Syllabus D2b) Prepare a consolidated statement of profit or loss and consolidated statement of profit or loss and other comprehensive income for a simple group dealing with an acquisition in the period and non- controlling interest. Group Income Statement Group Income Statement Rule 1 - Add Across 100% Like with the SFP, P and S are both added together. All the items from revenue down to Profit after tax; except for: 1) Dividends from Subsidiaries 2) Dividends from Associates Rule 2 - NCI This is an extra line added into the consolidated income statement at the end. It is calculated as NCI% x S’s PAT. The reason for this is because we add across all of S (see rule 1) even if we only own 80% of S. We therefore owe NCI 20% of this which we show at the bottom of the income statement. Rule 3 - Associates Simply show one line (so never add across an associate). The line is called “Share in Associates’ Profit after tax”. 233 aCOWtancy.com