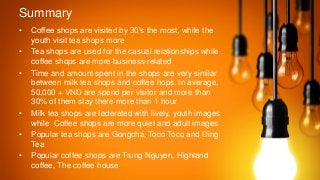

Vietnamese enjoy spending their time in cafe and we have two types of shops - milk tea shops & coffee shops

This survey is conducted to compare images between milk tea shop and coffee shop image towards Vietnamese customer in terms of their usage behavior and perception.

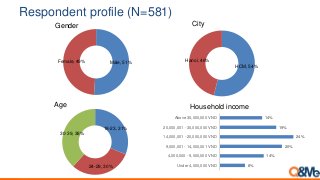

The survey was conducted to 581 respondents in both Ha Noi and Ho Chi Minh City in May 2018.