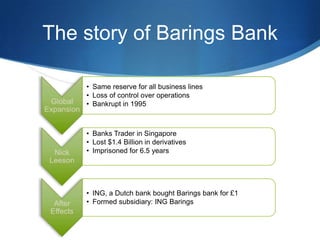

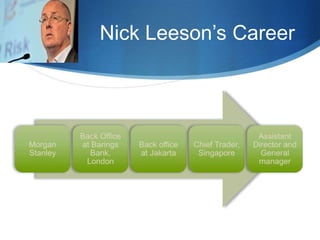

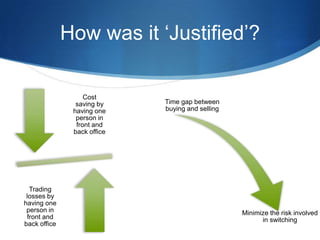

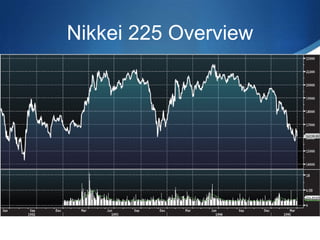

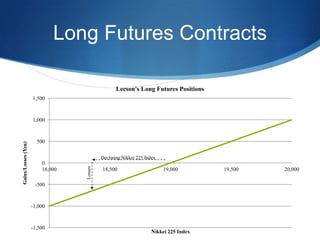

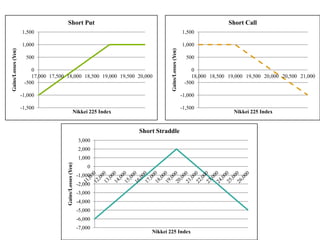

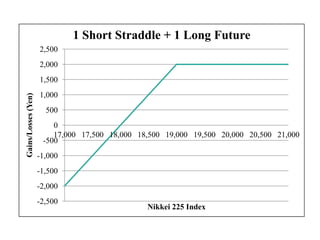

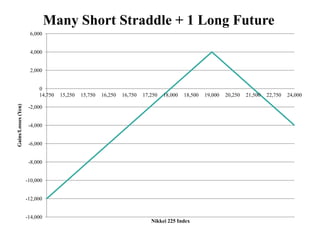

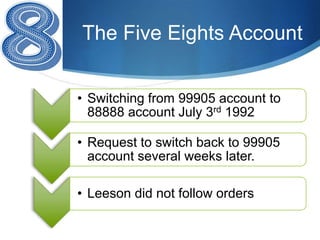

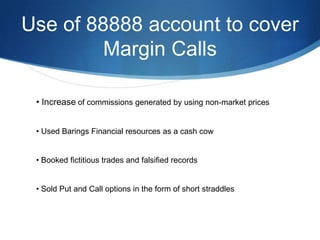

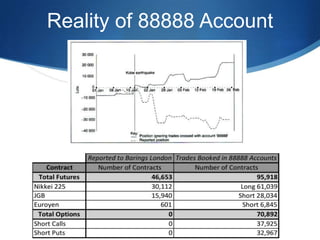

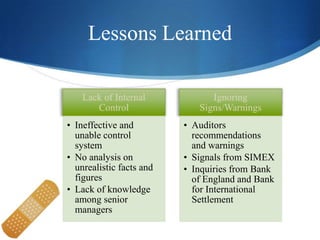

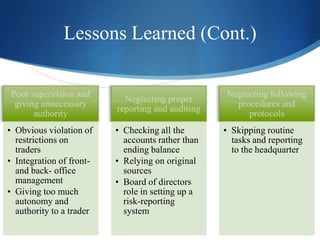

Barings Bank collapsed in 1995 due to massive unauthorized trading losses by Nick Leeson, who worked as a trader in Singapore. [1] Leeson hid his trading losses of over $1.4 billion by moving them to an unauthorized internal account labeled "888888". [2] A lack of controls and oversight by senior management allowed Leeson's deception to continue for years until the bank collapsed and was subsequently purchased for $1. [3] The failure exposed regulatory gaps and had wide-ranging impact on the banking industry.