Aranca Views | US Fed Rate Hike Potential Impact - A Report

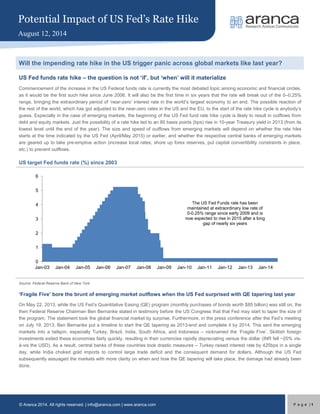

- 1. suPoet Potential Impact of US Fed’s Rate Hike August 12, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com P a g e | 1 Will the impending rate hike in the US trigger panic across global markets like last year? US Fed funds rate hike – the question is not ‘if’, but ‘when’ will it materialize Commencement of the increase in the US Federal funds rate is currently the most debated topic among economic and financial circles, as it would be the first such hike since June 2006. It will also be the first time in six years that the rate will break out of the 0–0.25% range, bringing the extraordinary period of ‘near-zero’ interest rate in the world’s largest economy to an end. The possible reaction of the rest of the world, which has got adjusted to the near-zero rates in the US and the EU, to the start of the rate hike cycle is anybody’s guess. Especially in the case of emerging markets, the beginning of the US Fed fund rate hike cycle is likely to result in outflows from debt and equity markets. Just the possibility of a rate hike led to an 80 basis points (bps) rise in 10-year Treasury yield in 2013 (from its lowest level until the end of the year). The size and speed of outflows from emerging markets will depend on whether the rate hike starts at the time indicated by the US Fed (April/May 2015) or earlier, and whether the respective central banks of emerging markets are geared up to take pre-emptive action (increase local rates, shore up forex reserves, put capital convertibility constraints in place, etc.) to prevent outflows. US target Fed funds rate (%) since 2003 Source: Federal Reserve Bank of New York ‘Fragile Five’ bore the brunt of emerging market outflows when the US Fed surprised with QE tapering last year On May 22, 2013, while the US Fed’s Quantitative Easing (QE) program (monthly purchases of bonds worth $85 billion) was still on, the then Federal Reserve Chairman Ben Bernanke stated in testimony before the US Congress that that Fed may start to taper the size of the program. The statement took the global financial market by surprise. Furthermore, in the press conference after the Fed’s meeting on July 19, 2013, Ben Bernanke put a timeline to start the QE tapering as 2013-end and complete it by 2014. This sent the emerging markets into a tailspin, especially Turkey, Brazil, India, South Africa, and Indonesia – nicknamed the ‘Fragile Five’. Skittish foreign investments exited these economies fairly quickly, resulting in their currencies rapidly depreciating versus the dollar (INR fell ~20% vis- à-vis the USD). As a result, central banks of these countries took drastic measures – Turkey raised interest rate by 425bps in a single day, while India choked gold imports to control large trade deficit and the consequent demand for dollars. Although the US Fed subsequently assuaged the markets with more clarity on when and how the QE tapering will take place, the damage had already been done. 0 1 2 3 4 5 6 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 The US Fed Funds rate has been maintained at extraordinary low rate of 0-0.25% range since early 2009 and is now expected to rise in 2015 after a long gap of nearly six years

- 2. suPoet Potential Impact of US Fed’s Rate Hike August 12, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com P a g e | 2 This time, the Fed resorts to dropping hints on rate hike to avoid repeating last year’s fiasco Global markets eventually adjusted to the idea of the QE tapering, which started in December 2013. Since then, QE has been on auto-pilot ($10 billion reduction every month) and is expected to end by October/November 2014. With the overall Fed policy expected to return to normalcy, the current Fed Chairman Janet Yellen has been letting on the expectations of next action, i.e., rate hike, fairly ahead of time. The official stance is that the rates would likely remain close to zero for considerable time after the end of the central bank’s bond-buying program (October 2014). However, the Fed Chairman has clarified the period (“considerable time”) to be approximately six months, indicating the rate hike would start in April/May 2015. The US Fed’s stance is best summarized by this comment: "We do want to give markets as much of an indication of how we expect to conduct policy as we can" – Ms. Yellen Rate hikes – how much and how fast will they happen? In the past, the US Fed increased rates by varying amounts and at varying paces. The last rate hike cycle lasted two years (June 2004 to June 2006), during which the Fed increased rates 17 times and in increments of 25 bps. However, at the time, US GDP growth was healthy (between 2.7% and 3.8%) and inflation was relatively higher (2.7–3.4%), warranting regular rate hike. Currently, GDP growth has just started recovering (1.9% in 2013 and an estimated 2% in 2014) and consumer price inflation (at 1.5%) is below the Fed’s target rate of 2%. Consequently, even if the US Fed starts hiking rates, we expect gradual increments, so as not to adversely impact the economic recovery and progress to achieve the Fed’s non-accelerating inflation rate of unemployment (NAIRU) target of 5.5% from the current 6.2%. Historical US Fed rate hikes between 1998 and 2006 Period No. of rate hikes Size/range of rate hike (bp) Quantum (bp) June 2004–June 2006 17 25 425 June 1999–May 2000 6 25–50 175 February 1994–February 1995 7 25–75 300 March 1998–February 1999 9 12.5–50 325 Source: Federal Reserve of New York Ten-yr US Treasury yield moves in anticipation of rate hikes Since the surprise announcement by Ben Bernanke in May 2013, the 10-year US Treasury yield has increased 80bps to 2.43%. The yield breached the 3% mark (+140 bps) in January 2014 and has since retreated as weak Q1 (abnormal winter slowing down US economic growth, possibly delaying rate hike) and rising geopolitical tensions (Russia/Ukraine, the Middle East) resulted in a flight to safer US debt. Despite the retreat, the yield movement indicates the bond market is anticipating a rate hike earlier than the Fed formally mentioned. Furthermore, the yield curve has started shifting downward since the start of 2014. On the other hand, CME futures contracts used by traders to bet on the path of the fed funds rate, imply a 58% chance of the first rate hike to be in June 2015.

- 3. suPoet Potential Impact of US Fed’s Rate Hike August 12, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com P a g e | 3 10-yr US Treasury yield (%) Source: www.investing.com; www.treasury.gov Potential impact on debt markets We analyze the potential impact of the US Fed rate hike in two parts: (i) impact on US debt markets; and (ii) impact on global debt markets. The US debt markets have enjoyed a dream run since the Fed lowered rates to near zero and bought bonds worth trillions of dollars for a record six years to support economic recovery. With an anticipated increase in rates, bond prices are projected to start declining and consequently yields are likely to start rising just as they have for 10-year US treasuries. However, the pace of decline in bond prices (or rise in yields) would depend on the pace of rate hikes. Globally, the US government debt is considered the most ‘risk-free’, with the US dollar being the dominant reserve currency. Consequently, despite record low rates for a prolonged time, demand for the US debt remained intact throughout the financial crisis of 2008 and afterwards. Since the 2008 crisis, the US economy has improved on multiple fronts: steady economic growth, reducing unemployment rate, downtrend in weekly jobless claims, lower trade deficit partly due to the shale gas boom, and lower fiscal deficit. Therefore, confidence in the US economy has increased. Furthermore, with the increase in US rates, interest rate differential between emerging market debt and US debt will narrow, leading to movement of funds from emerging and riskier markets to the US debt markets. Consequently, with a rate hike on the cards sooner or later, demand for US longer term debt may grow further, leading to downward pressure on the yield curve, as witnessed in the shifting of the curve between the start of 2014 until now in the graph below. US debt yield curve (%) Source: www.treasury.gov 1.5 1.7 1.9 2.1 2.3 2.5 2.7 2.9 3.1 Jan-13 Mar-13 May-13 Jul-13 Sep-13 Nov-13 Jan-14 Mar-14 May-14 Jul-14 143 bps 80 bps 0 0.8 1.6 2.4 3.2 4 1 mon 3 mon 6 mon 1 yr 2 yr 3 yr 5 yr 7 yr 10 yr 20 yr 30 yr January 2, 2014 August 6, 2014 The US debt yield curve has shifted lower, especially at the longer end of the curve, as anticipated rise in interest rate, coupled with current geopolitical uncertainties led to demand for safer havens like US govt debt

- 4. suPoet Potential Impact of US Fed’s Rate Hike August 12, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com P a g e | 4 Potential impact on money markets – ‘break-the-buck’ regulation change creating demand? A hike in rates will increase the cost of debt to the US government, which funds fiscal deficit by issuing treasuries. However, a recent change in the regulation for money market funds may create significant potential demand for short-term treasuries, thereby lowering short-term yields. On July 23, the Securities and Exchange Commission (SEC) adopted a rule requiring money market funds investing in riskier assets (e.g., two-day maturity commercial paper) to abandon the traditional $1-share price floor, and disclose daily changes in value. This change, for the first time since 1983, will mean companies like Boeing and individual states like Maryland, which used money market investments like bank accounts (for daily cash transactions), may face a situation where every $1 of their investments will be subject to daily price changes and may fall to less than $1 at the time of redemption (popularly termed ‘breaking-the-buck’). Consequently, the alternative is to shift their very-short-term money market investments into shorter term treasuries. Analysts forecast creation of demand for short-term US treasuries ranging from $100bn (Credit Suisse) to $500bn (Bank of America). Irrespective of the size, creation of demand will lower borrowing costs for the US government. Although the SEC rule would come into effect in 2016, the timing of the announcement can be construed as a prelude to the rate hike and a measure to create demand for government debt. Probable impact on equity markets We analyze the potential impact of the US Fed rate hike on equity markets in two parts: (i) impact on the US equity markets; and (ii) impact on global equity markets, especially emerging and frontier markets. The US equity market has performed phenomenally well since the 2008 crisis (S&P 500 is up 3x), initially led by ample liquidity created by the US Fed and more recently by the strength of the economic recovery. Although the rate hike will increase borrowing costs across the board (industry, consumers, government), we believe the pace of the hikes will be adjusted so as to not hurt economic growth. As such, we expect rake hikes to not have a major impact on the US equity markets, which will be driven by corporate profitability in the longer term. On the other hand, emerging and frontier equity markets may witness outflows due to rate hikes and greater strength of the US equity markets. Potential impact on commodity markets As far as the liquidity-driven speculative investments in commodity markets are concerned, with the tapering of the QE coming to an end, the rally appears to be over and normal demand supply dynamics are expected to drive commodity markets to a greater extent. The fall in crude oil prices from the recent peak of $110 per barrel to $105 on surplus supply concerns reaffirms the ‘return-to- fundamentals’. Since the 2008 crisis, global energy demand supply dynamics have changed due to the shale gas boom in the US. As such, we do not expect the US Fed rate hikes to have a major and direct impact on commodity markets. Likely impact on forex markets Demand for the US dollar has strengthened on economic recovery in the US. Furthermore, it is expected to remain strong due to several issues in other geographies such as a fragile recovery in Europe, and slower growth in China and India. The US dollar carry trade (to take advantage of near-zero borrowing costs) continues as concerns over China’s growth and escalation of the Russia- Ukraine conflict have been resulting in a shift to safer havens like the US dollar. Also, considering the European Central Bank (ECB)’s measure of further easing policy and continuation of Japan’s monetary easing, the US Fed’s rate hike would further increase attractiveness of the US dollar. Consequently, currencies in emerging markets may be at risk of depreciation unless their respective central banks take measures to arrest the outflow.

- 5. suPoet Potential Impact of US Fed’s Rate Hike August 12, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com P a g e | 5 Potential impact of US Fed funds rate hike on various markets Market Scale Direction of flows / likely impact Debt Markets US Bond prices to start declining (consequently yields will start rising) Global Outflows from emerging debt markets and into the US debt markets Equity Markets US No major impact as rate hikes expected to be calibrated Global Outflows from emerging and frontier markets due to rate hike and greater strength of US equity markets Money Markets US Corporates to shift their very-short-term money market investments into shorter term treasuries due to change in regulation related to $1 share price floor Commodity Markets Global No major and direct impact on commodity markets Forex Markets Global Further increase attractiveness of the US dollar and exert pressure on emerging market currencies Source: Aranca Research Impact of the US rate hike on developed economies Among developed economies, the UK appears the best placed currently to return to normalcy in terms of macroeconomic policies. In fact, the consensus among the investment community is that the Bank of England may start increasing rates earlier than the US Fed. On the other hand, the European Central Bank continues to pursue quantitative easing and recently implemented a historical negative interest rate. European economies continue to remain vulnerable to threats, such as Portugal being under pressure after bailout of its largest bank Espirito Santo and a fall in Germany’s industrial orders for June (sharpest drop since 2011) on escalation of the crisis between Russia and Ukraine. Japan is facing unique problems, as the recent sales tax rate hike is yet to have the desired impact of increasing inflation and wages, thereby putting consumption growth at risk. However, Japanese exports may benefit with the strengthening of the US dollar and weakening of the yen; this would provide some solace to Japan’s economic growth. Among other major world economies, China has ring-fenced itself from external factors by pegging the Chinese yuan to the US dollar. However, it is yet to be seen if the country will adjust to the growth slowdown and whether its large shadow banking sector remains unscathed. Furthermore, unlike in the past, a resurgent US economy does not necessarily translate into growth for Chinese exports, thereby putting the onus on the Chinese government to implement a local consumption driven economic model. Emerging economies once again cause of concern due to possible US rate hike As indicated earlier, the last time the US Fed Chairman hinted at QE tapering, global financial markets went into panic mode. The emerging markets, especially the Fragile Five, bore the brunt of exodus of funds, resulting in sharp depreciation of their currencies. The key question on everyone’s mind is: ‘What will happen to these economies if the US Fed hikes rates?’ On one hand, the Fed appears to be more cautious while anchoring expectations about the possible timing of rate hikes. On the other hand, having learned their lessons the hard way, emerging and frontier economies are taking measures to reduce vulnerability to such externalities. Taking the example of India, the Reserve Bank of India and the central government acted in tandem to narrow trade deficit by strangulating gold imports last year. While the central government sharply raised import duty for gold, the Reserve Bank imposed strict, prohibitive conditions on gold imports, effectively reducing monthly imports to 1/6th of the average volume. The consequent contraction in gold imports and hence in trade deficit helped reduce demand for US dollars and enabled the Indian rupee to appreciate to prior levels. Since then, measures such as opening up the forex refinancing window for bank borrowing, increasing foreign investment limits in government bonds and continued fiscal deficit reduction path have helped put India on a stronger footing than last year. This should augur well in case the US Fed rate hikes prompted outflows. At the same time, the central bank may be constrained in terms of raising rates to maintain the interest rate differential with US Fed rate, as the benchmark Repo rate is already at a high of 8% to ease inflation; any further increase would dampen the much needed recovery in economic growth.

- 6. suPoet Potential Impact of US Fed’s Rate Hike August 12, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com P a g e | 6 Overall, emerging economies remain vulnerable to outflows in the event of the US Fed fund rate hike due to lack of any drastic improvement in macroeconomic indicators over the last year. Some of these economies have been critical of the US Fed’s stance. The Reserve Bank of India’s governor Raghuram Rajan criticized that the US Fed policies are framed in the context of the US economy alone without consideration for global (read ‘emerging’) economies. However, the US Fed is expected to continue prioritizing its domestic economy. Hence, the rest of the world will have to fend for itself in any eventuality. The only solace this time around is that the US Fed would intimate of any interest rate action in advance.

- 7. suPoet Potential Impact of US Fed’s Rate Hike August 12, 2014 © Aranca 2014. All rights reserved. | info@aranca.com | www.aranca.com P a g e | 7 ARANCA DISCLAIMER This report is published by Aranca, Inc. Aranca is a customized research and analytics services provider to global clients. The information contained in this document is confidential and is solely for use of those persons to whom it is addressed and may not be reproduced, further distributed to any other person or published, in whole or in part, for any purpose. This document is based on data sources that are publicly available and are thought to be reliable. Aranca may not have verified all of this information with third parties. Neither Aranca nor its advisors, directors or employees can guarantee the accuracy, reasonableness or completeness of the information received from any sources consulted for this publication, and neither Aranca nor its advisors, directors or employees accepts any liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with this document. Further, this document is not an offer to buy or sell any security, commodity or currency. This document does not provide individually tailored investment advice. It has been prepared without regard to the individual financial circumstances and objectives of persons who receive it. The appropriateness of a particular investment or currency will depend on an investor’s individual circumstances and objectives. The investments referred to in this document may not be suitable for all investors. This document is not to be relied upon and should not be used in substitution for the exercise of independent judgment. This document may contain certain statements, estimates, and projections with respect to the anticipated future performance of securities, commodities or currencies suggested. Such statements, estimates, and projections are based on information that we consider reliable and may reflect various assumptions made concerning anticipated economic developments, which have not been independently verified and may or may not prove correct. No representation or warranty is made as to the accuracy of such statements, estimates, and projections or as to its fitness for the purpose intended and it should not be relied upon as such. Opinions expressed are our current opinions as of the date appearing on this material only and may change without notice. © 2014, Aranca. All rights reserved.