The document provides an overview of the Ukrainian venture capital and private equity market in 2016. Some key points:

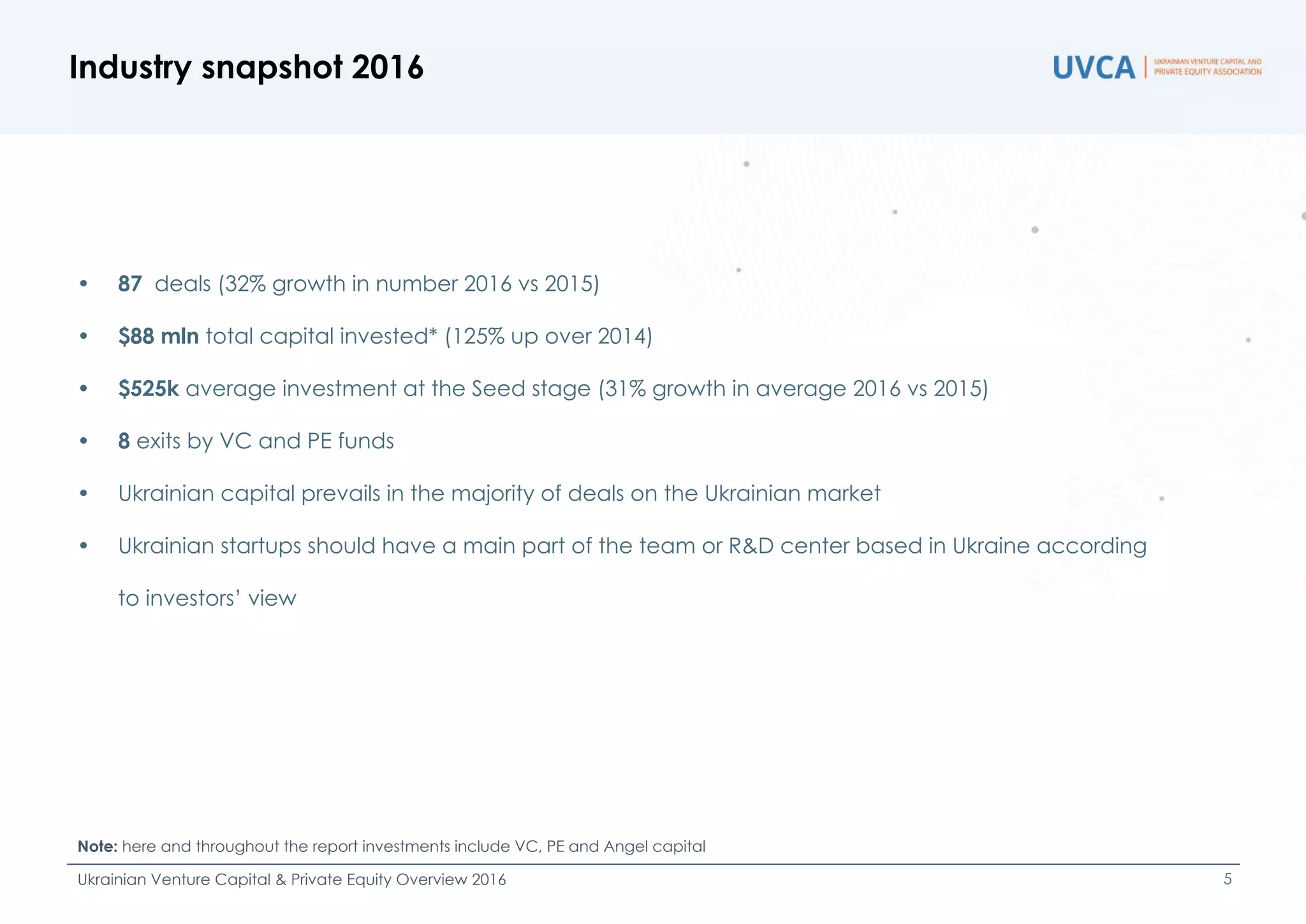

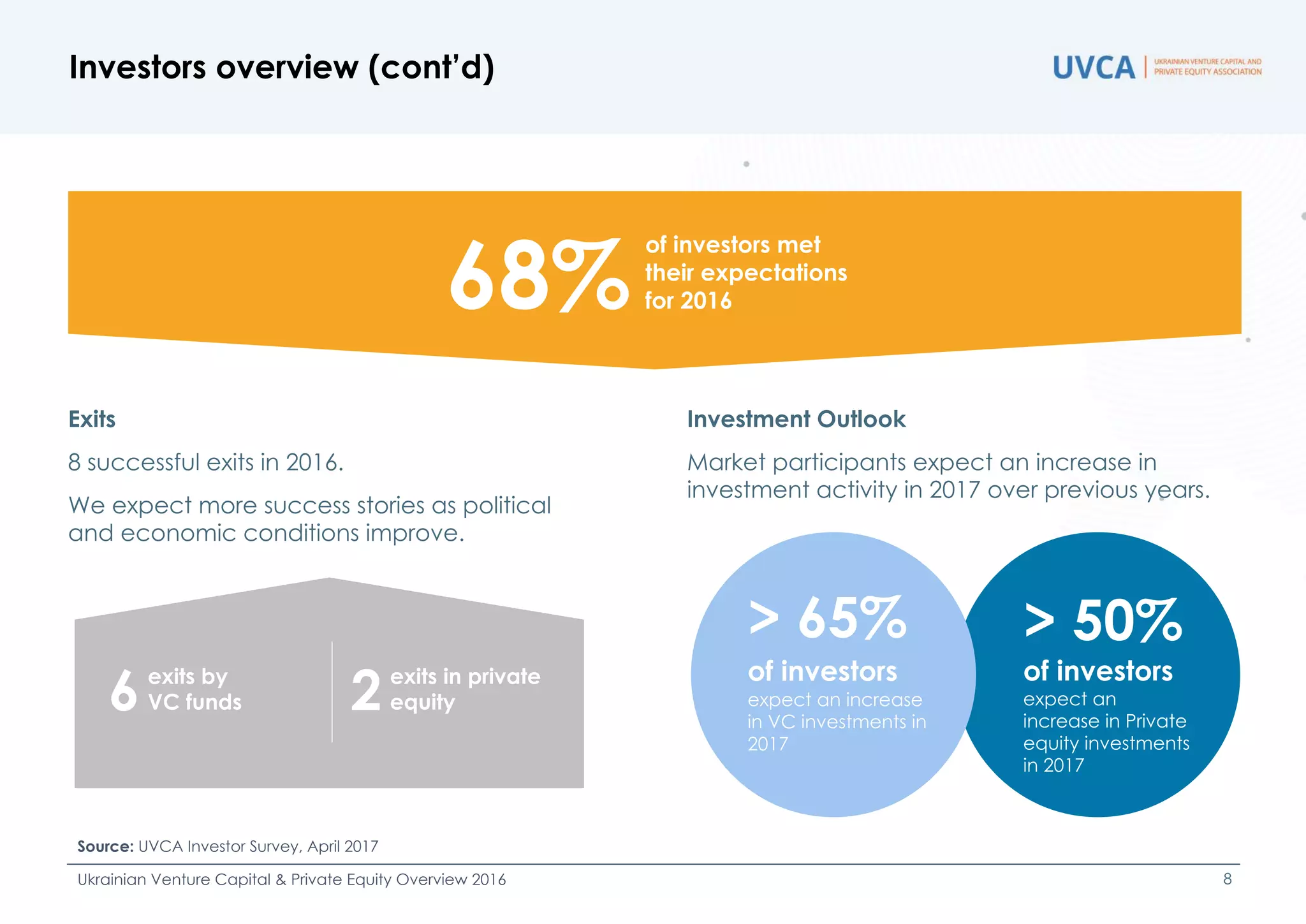

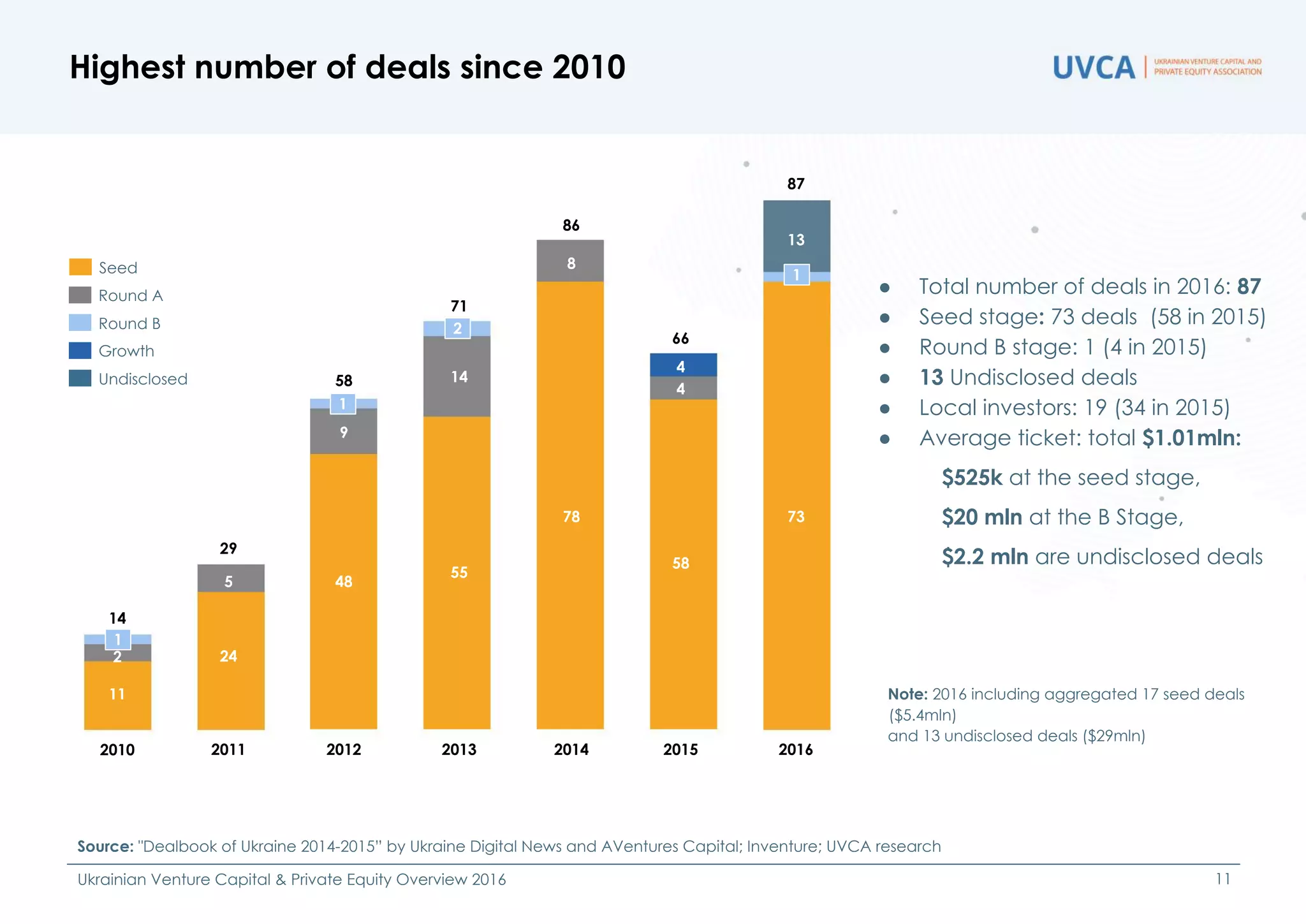

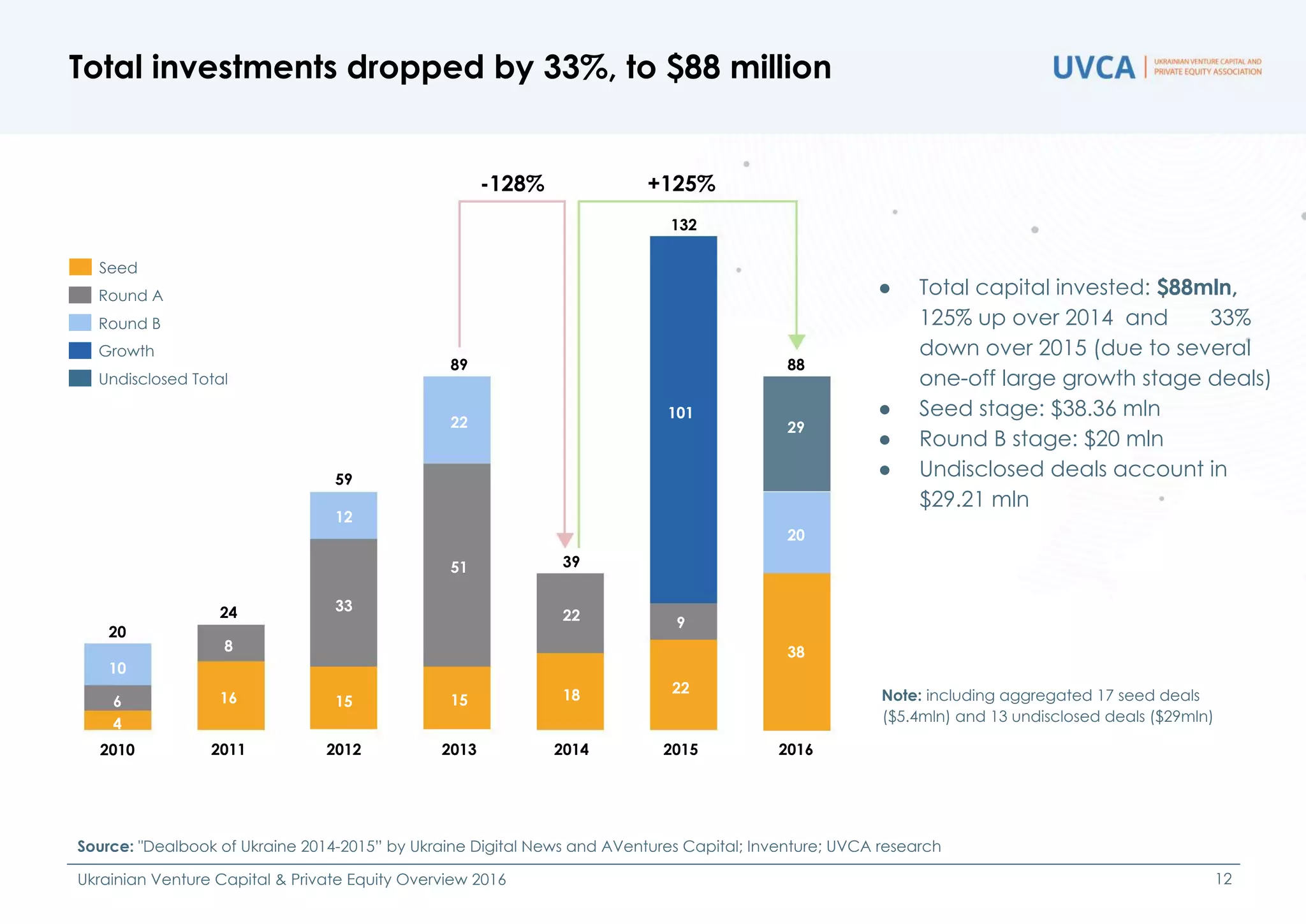

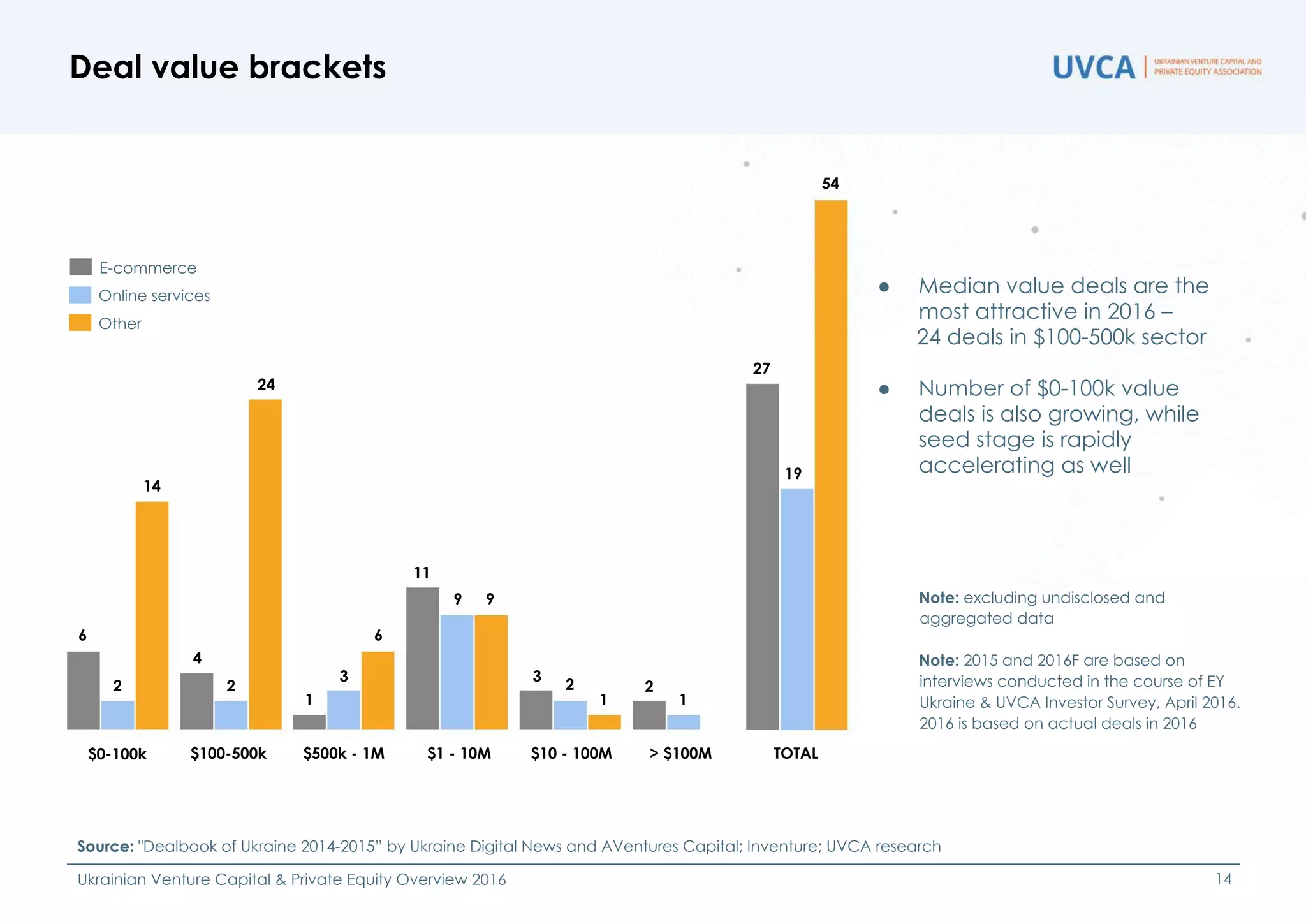

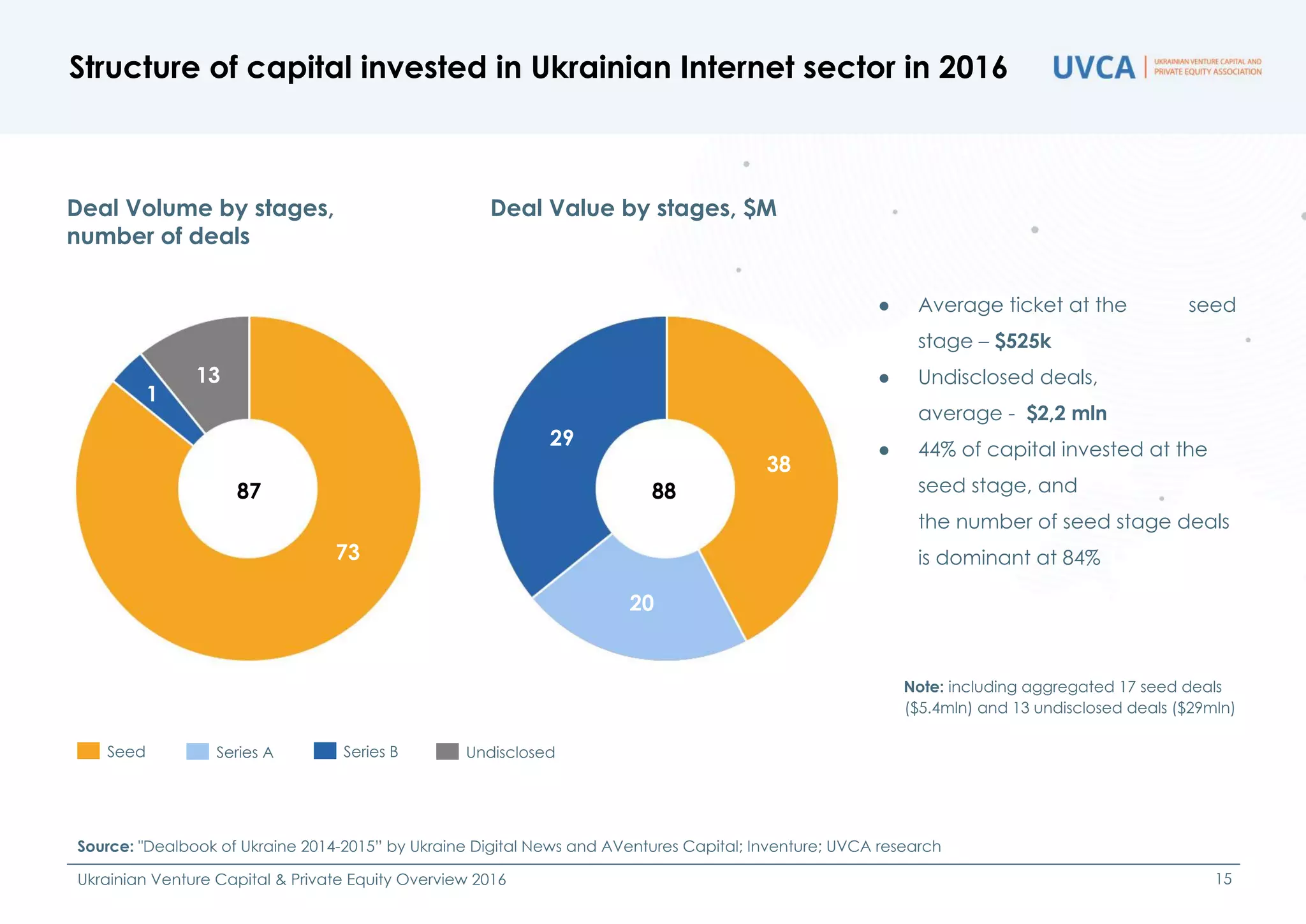

- There were 87 deals in 2016 totaling $88 million invested, a 125% increase over 2014.

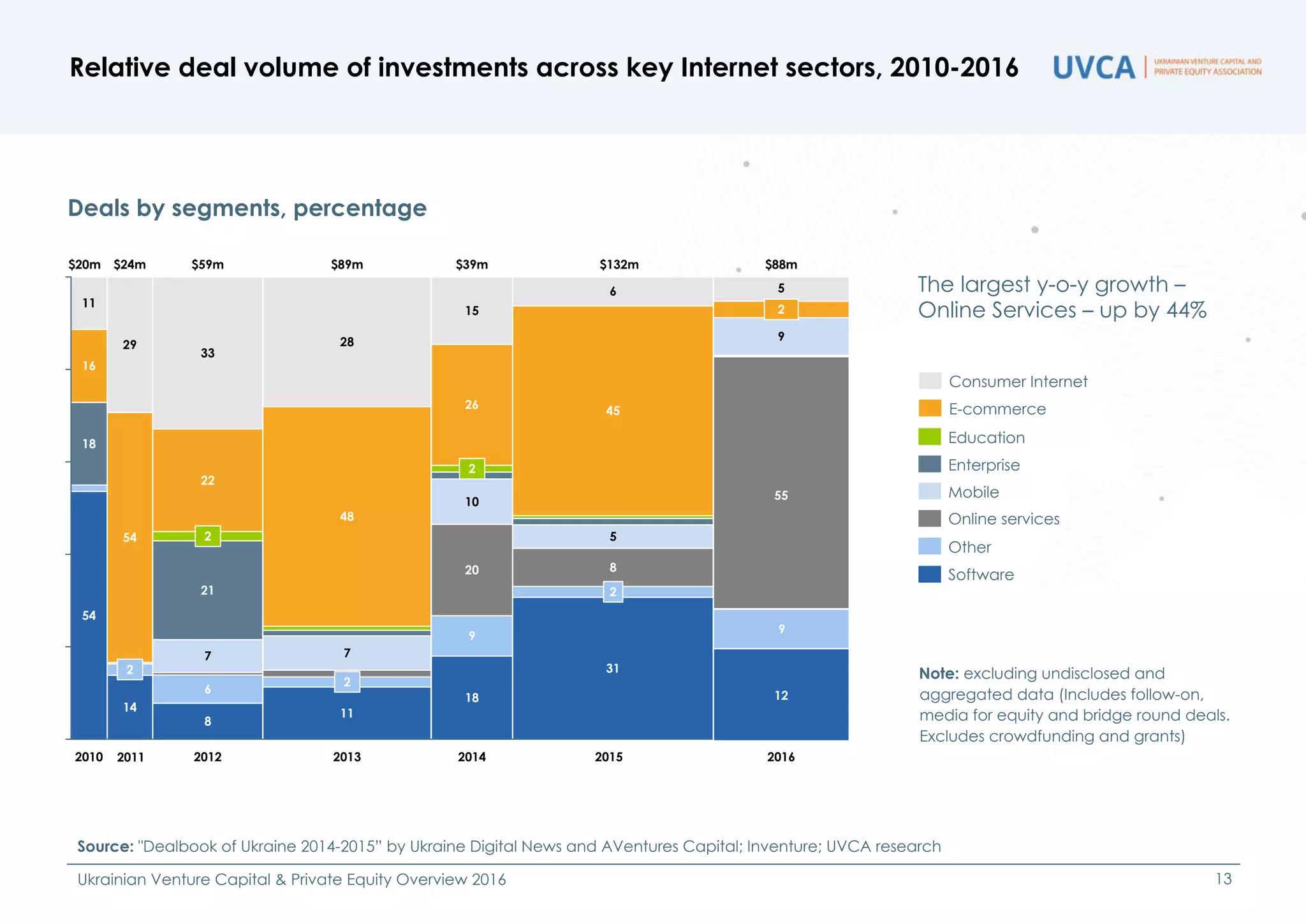

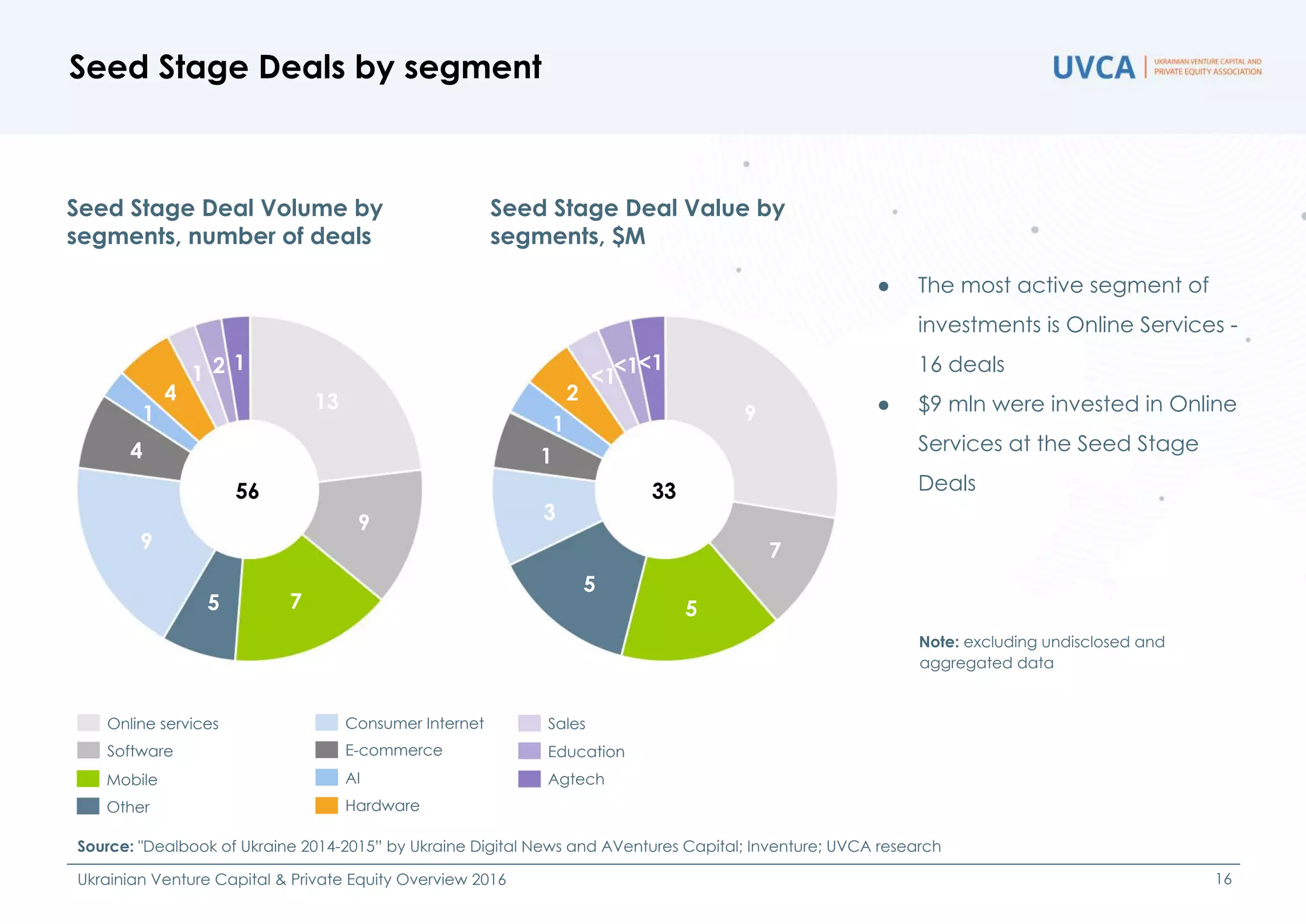

- The majority of deals and capital invested were at the seed stage. Online services saw the largest growth.

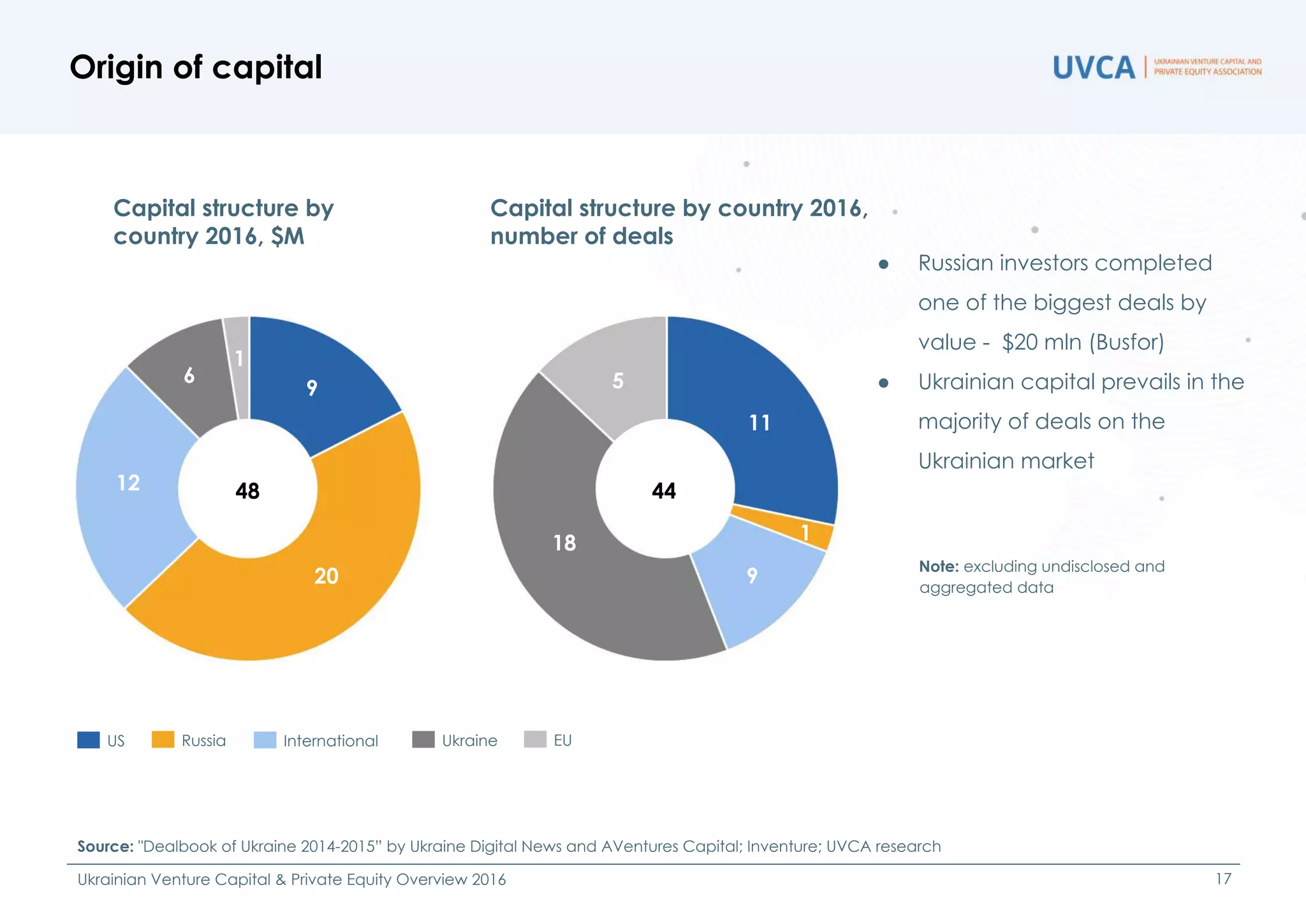

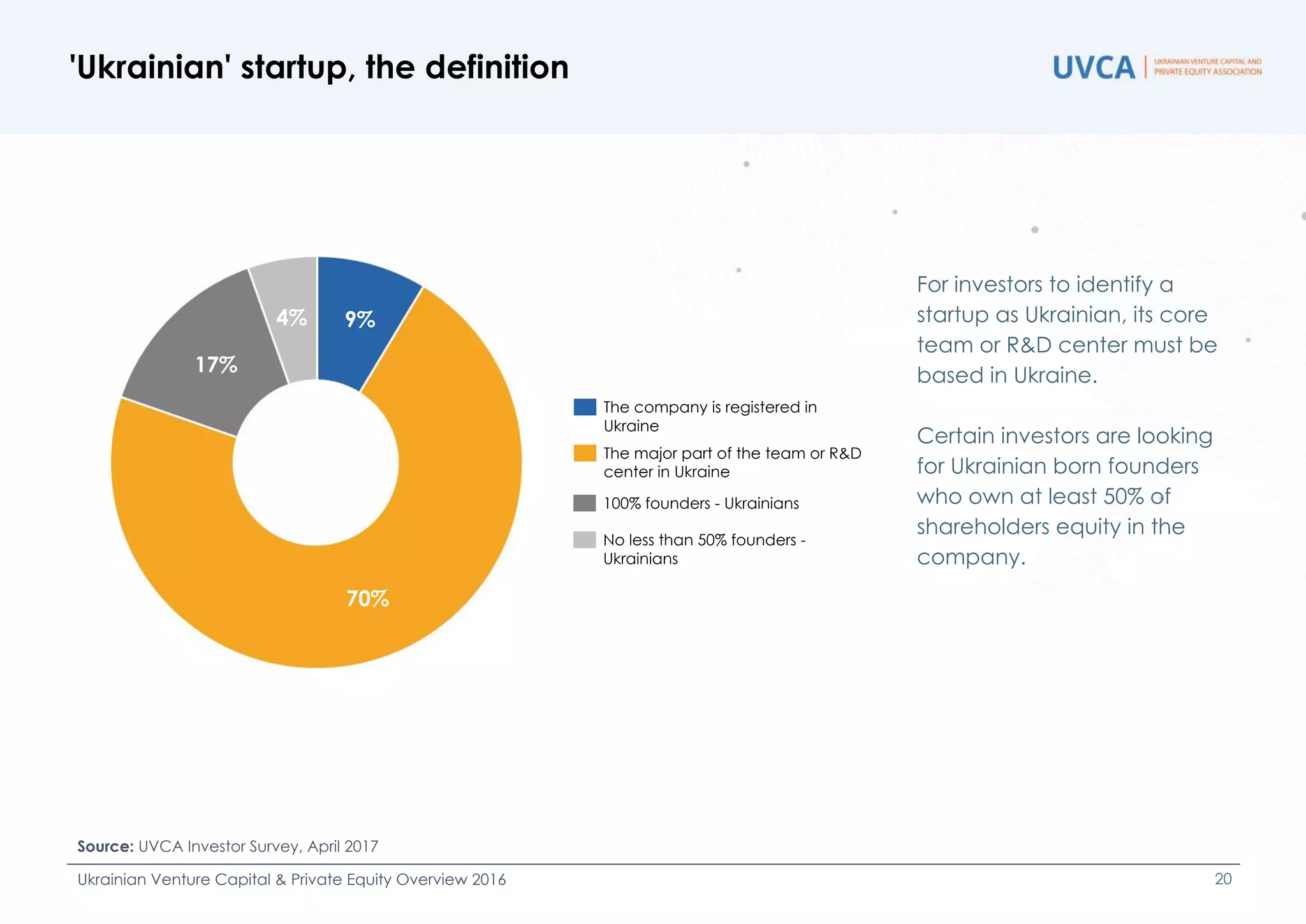

- Ukrainian capital dominated deals though some large deals had Russian and international investors.

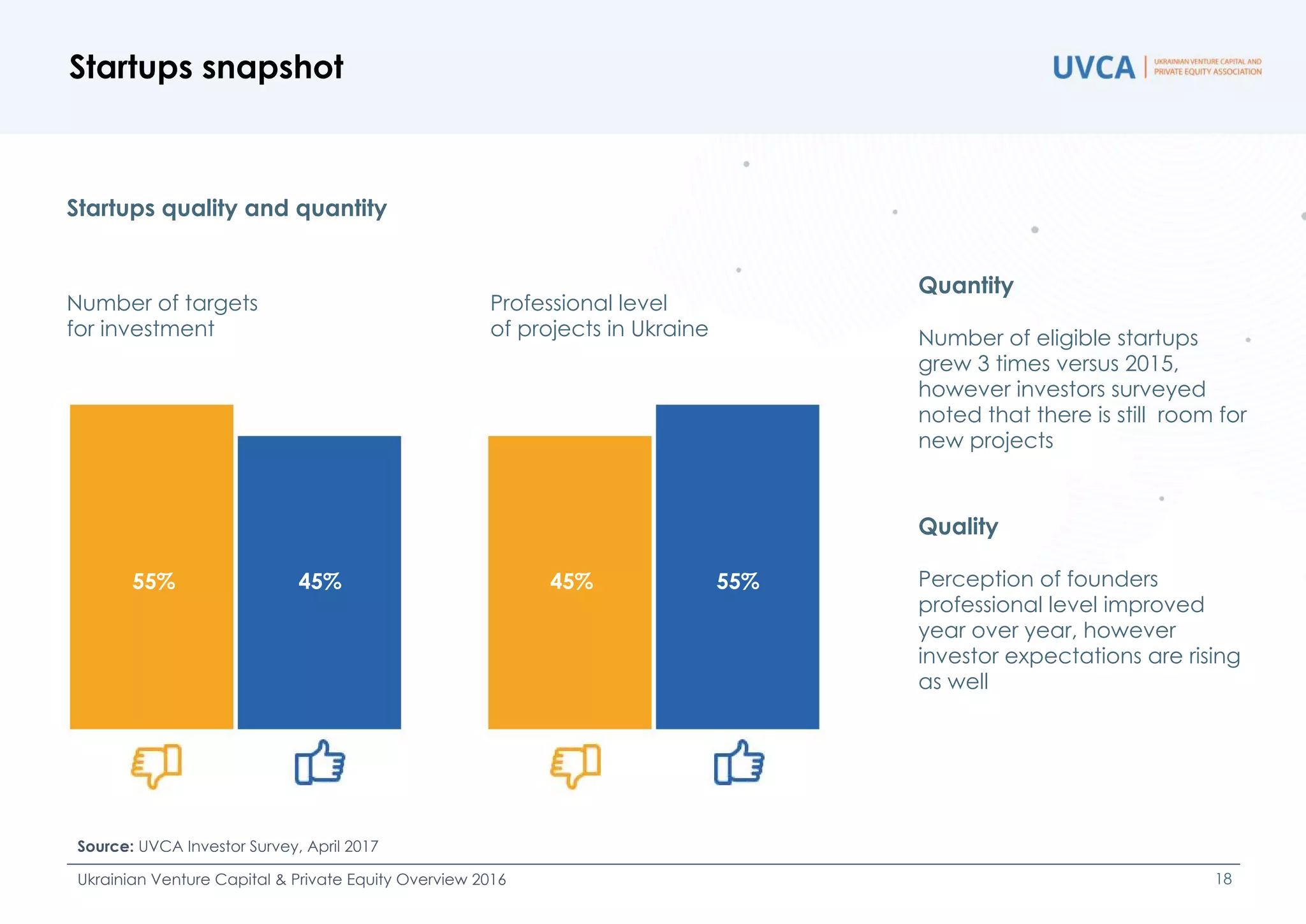

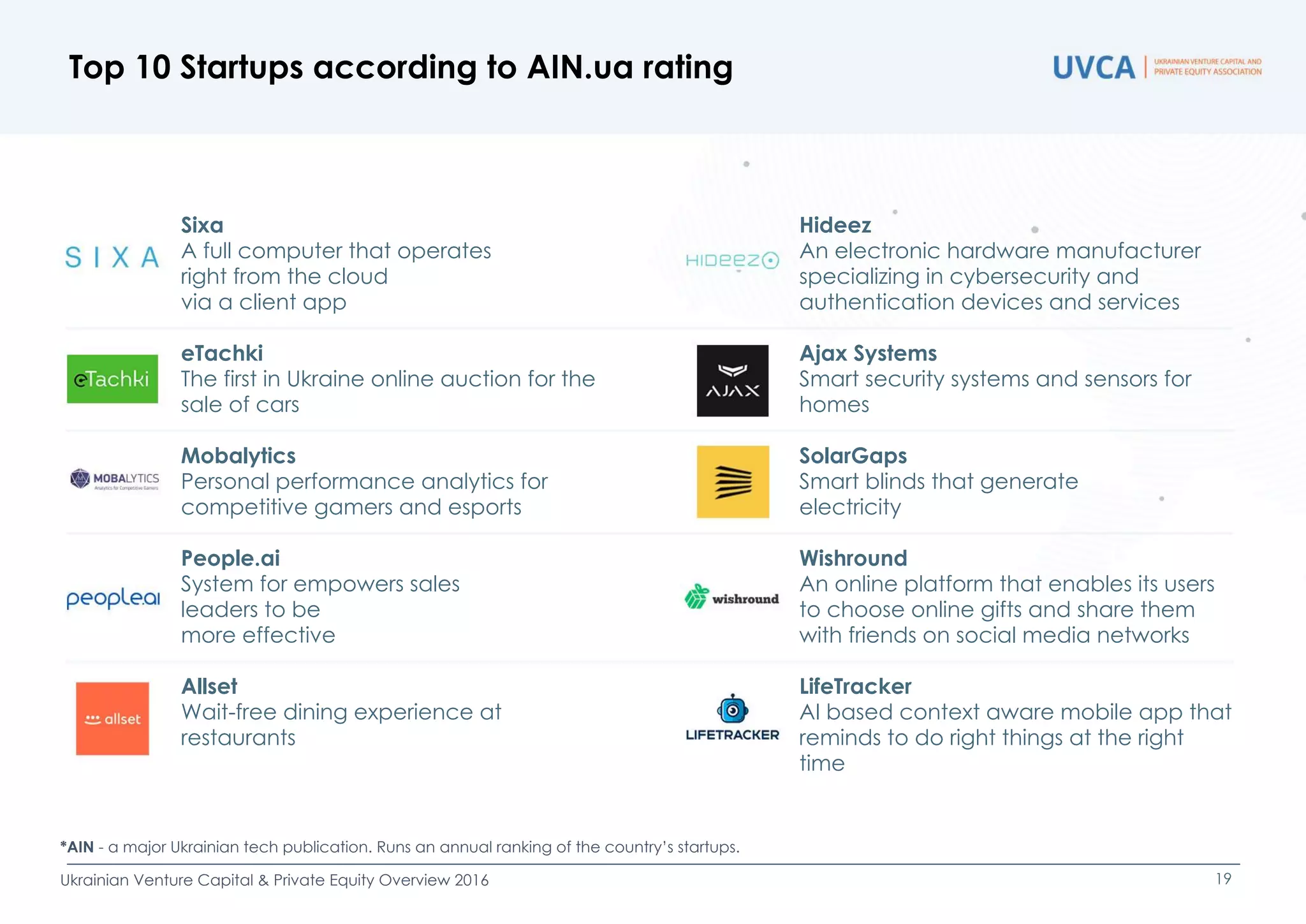

- The number and quality of startups increased but investors said there is still room for growth.

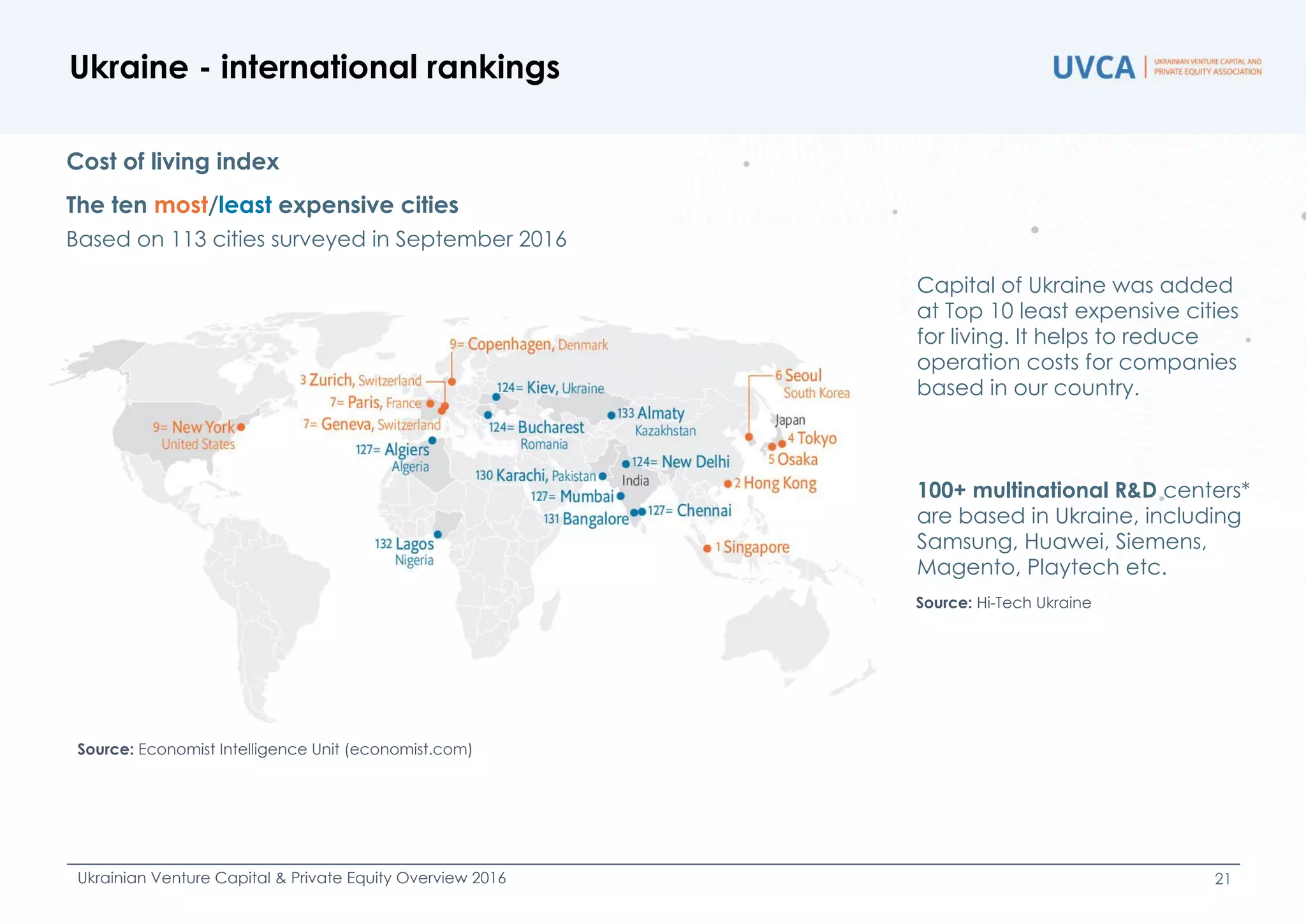

- Factors like tax incentives and a skilled workforce are improving Ukraine's investment climate and competitiveness.