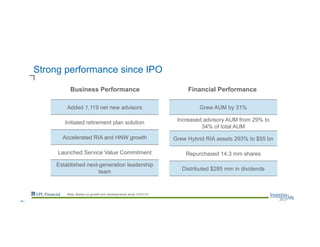

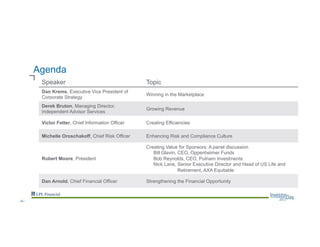

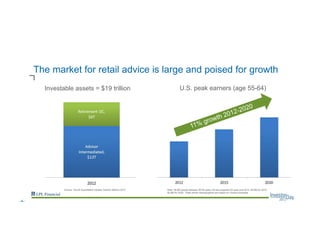

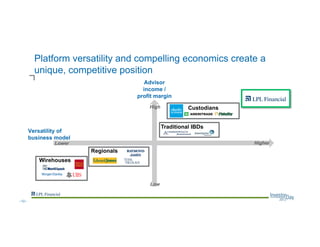

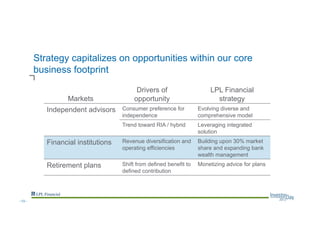

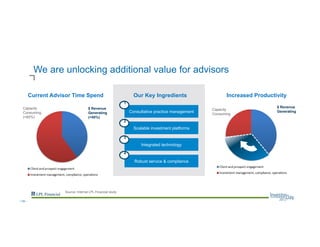

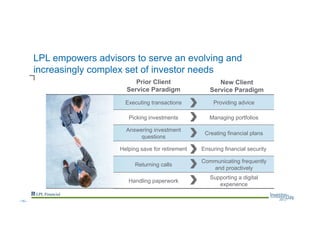

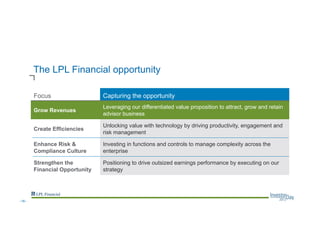

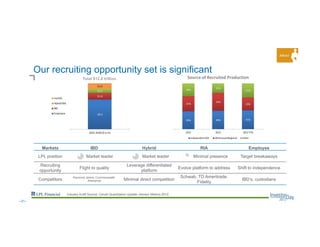

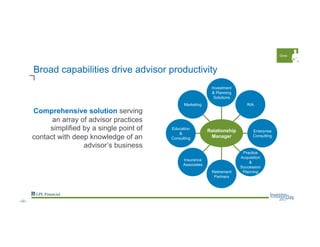

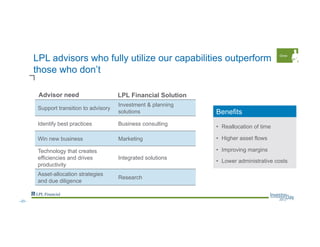

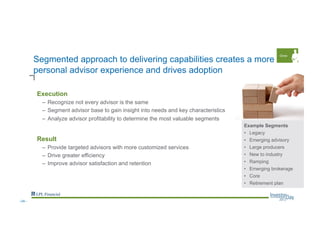

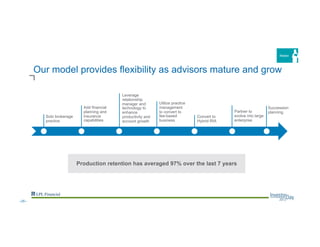

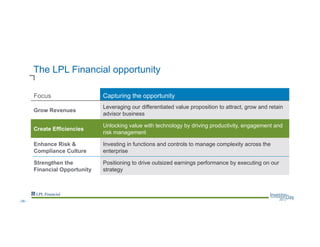

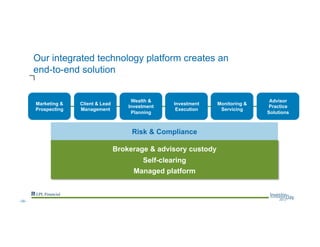

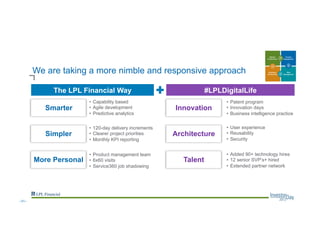

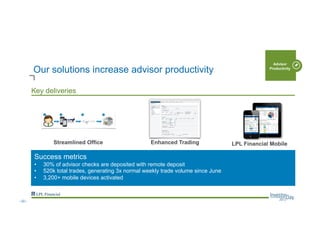

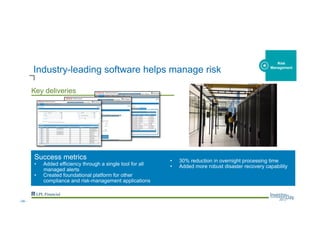

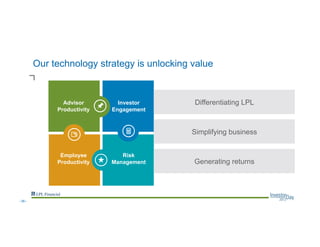

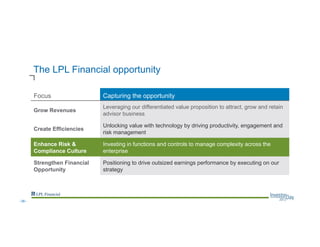

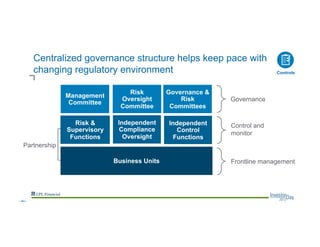

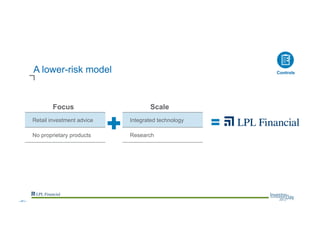

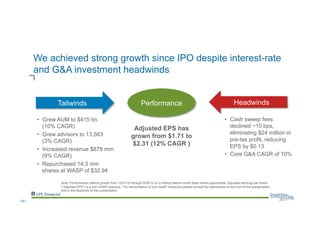

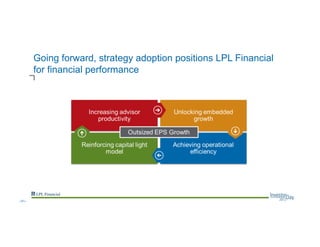

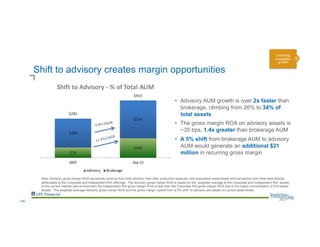

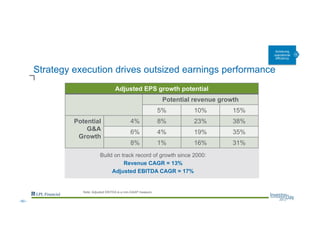

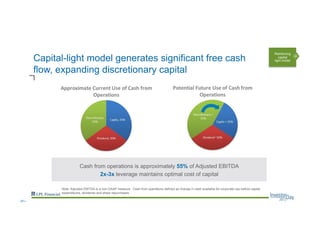

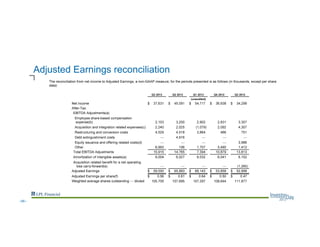

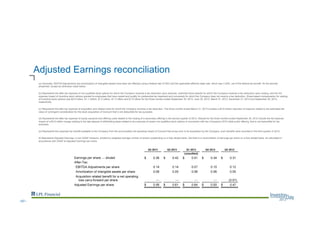

The document provides an overview of a presentation given by LPL Financial Holdings Inc. It includes statements regarding LPL's future plans and financial performance, as well as required disclosures around forward-looking statements and non-GAAP financial measures. The presentation focuses on LPL's strategy to capture opportunities by growing revenues, creating efficiencies through technology investments, enhancing its risk and compliance culture, and strengthening its financial performance.