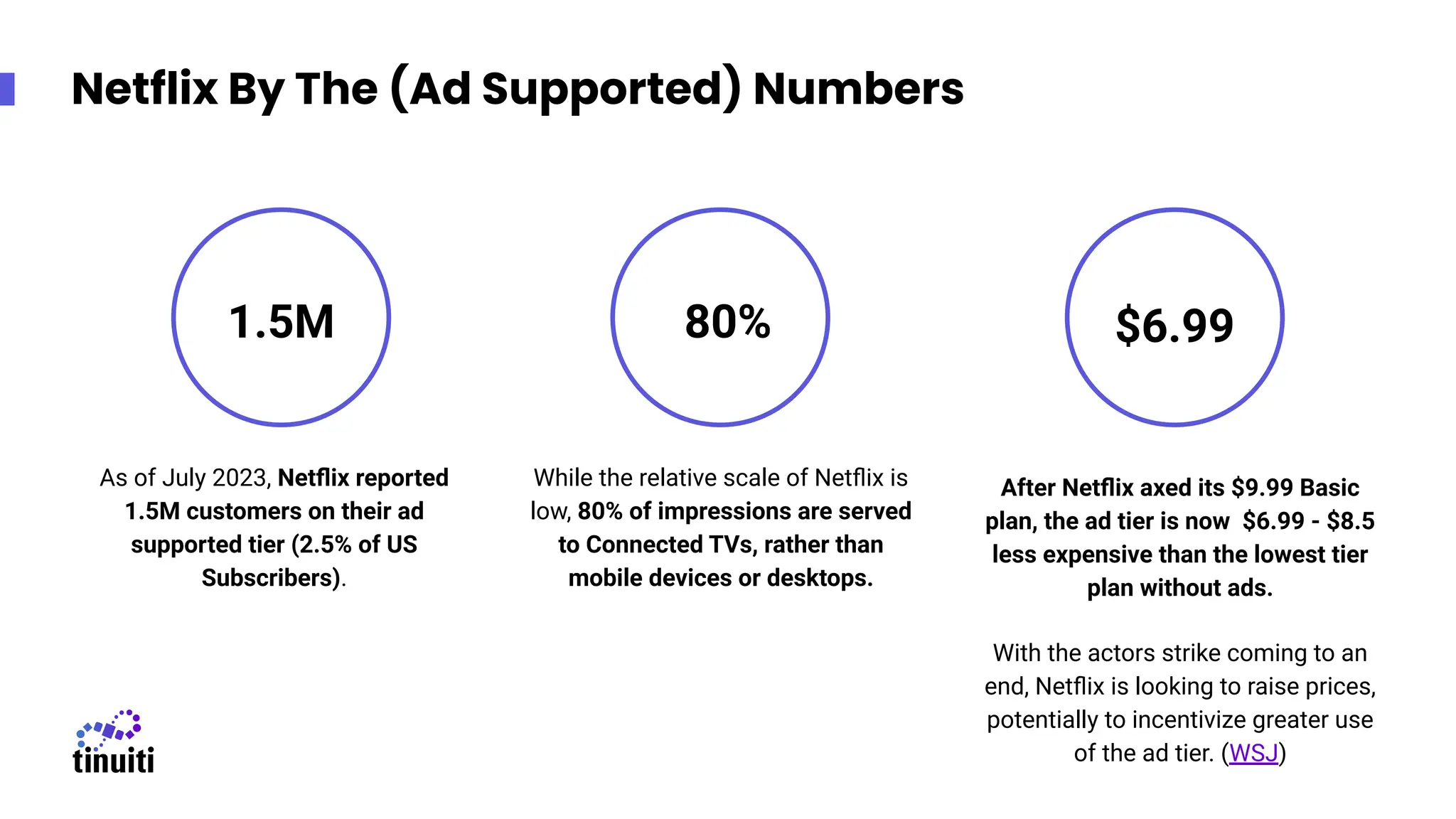

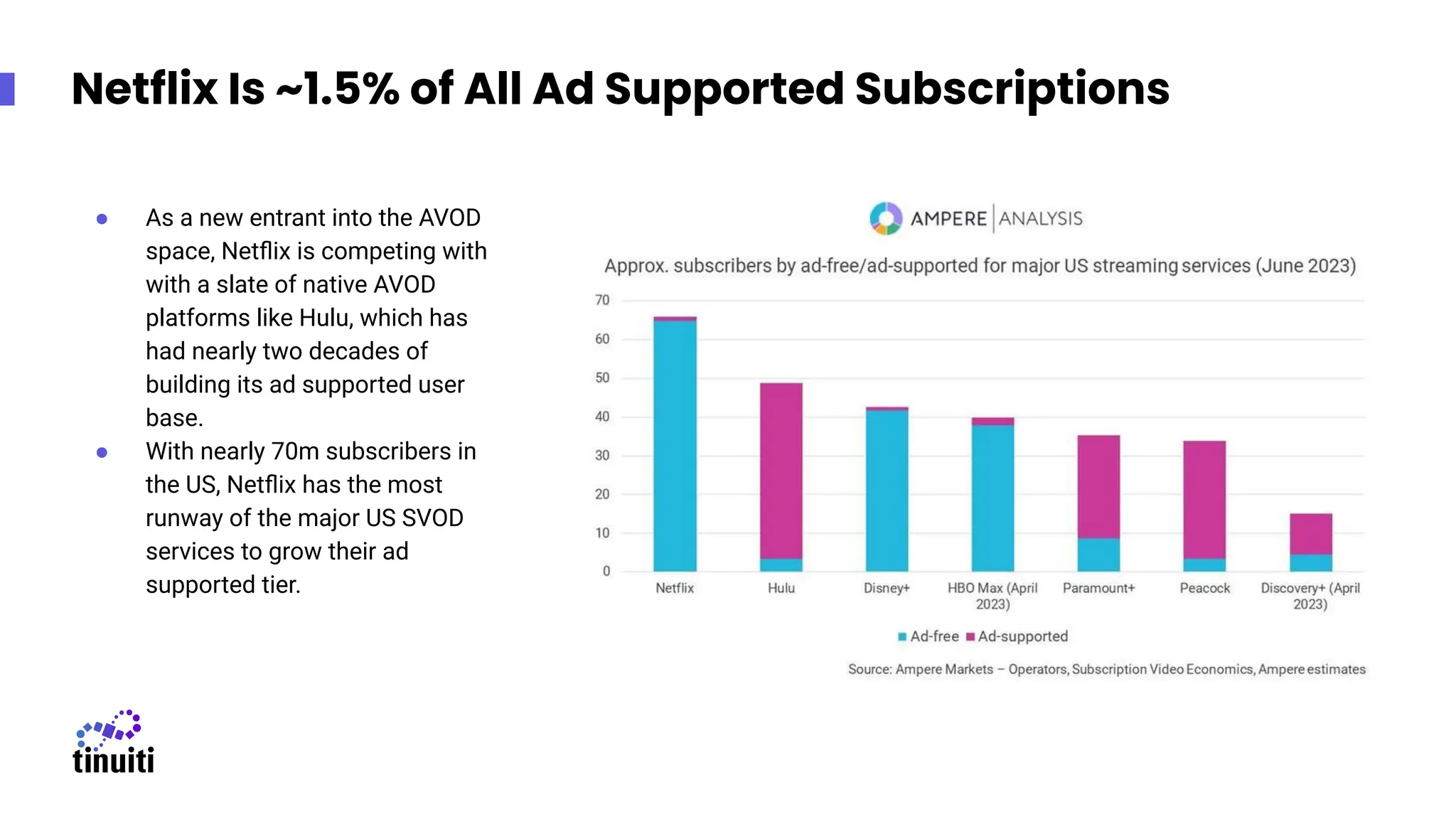

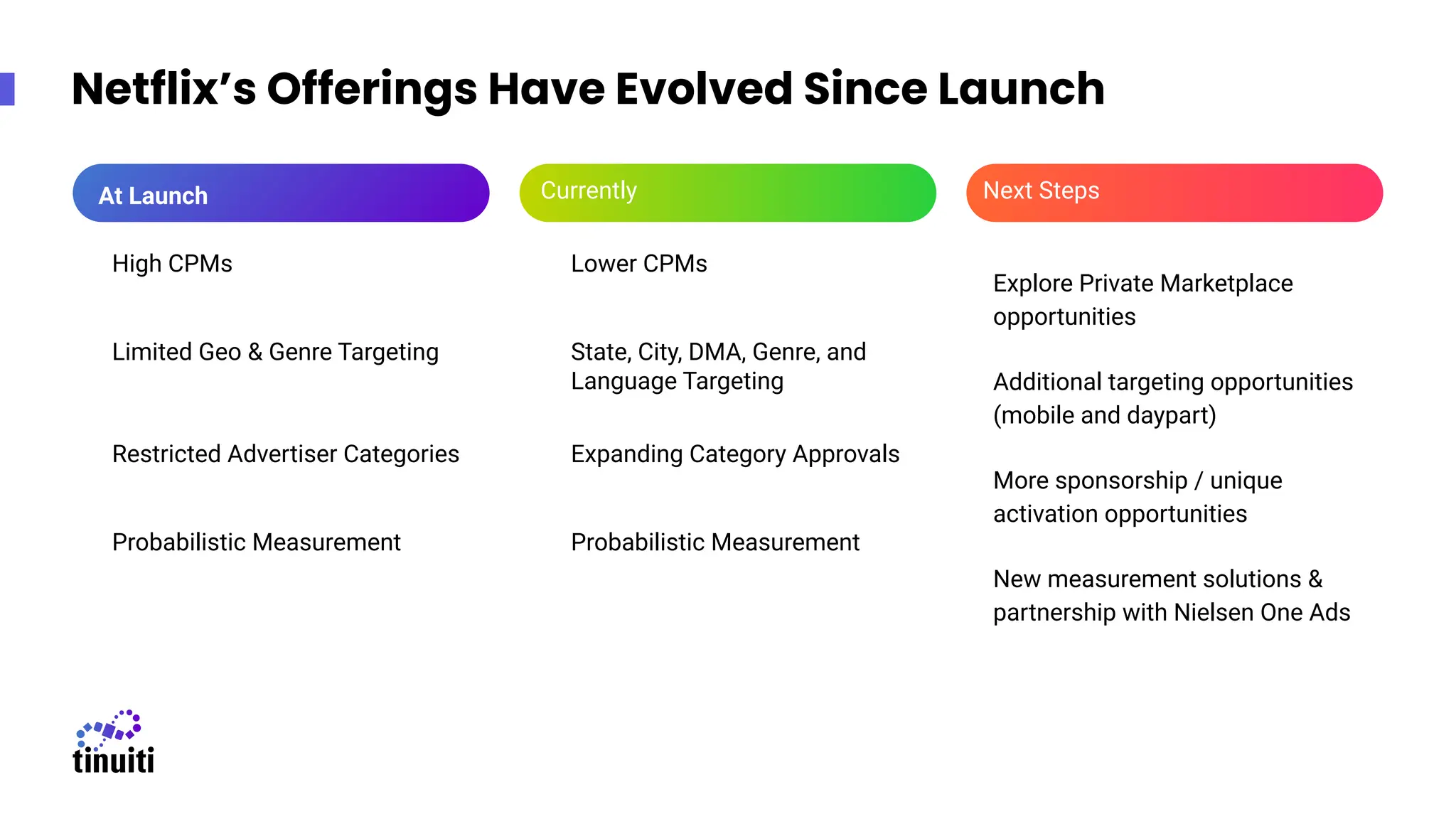

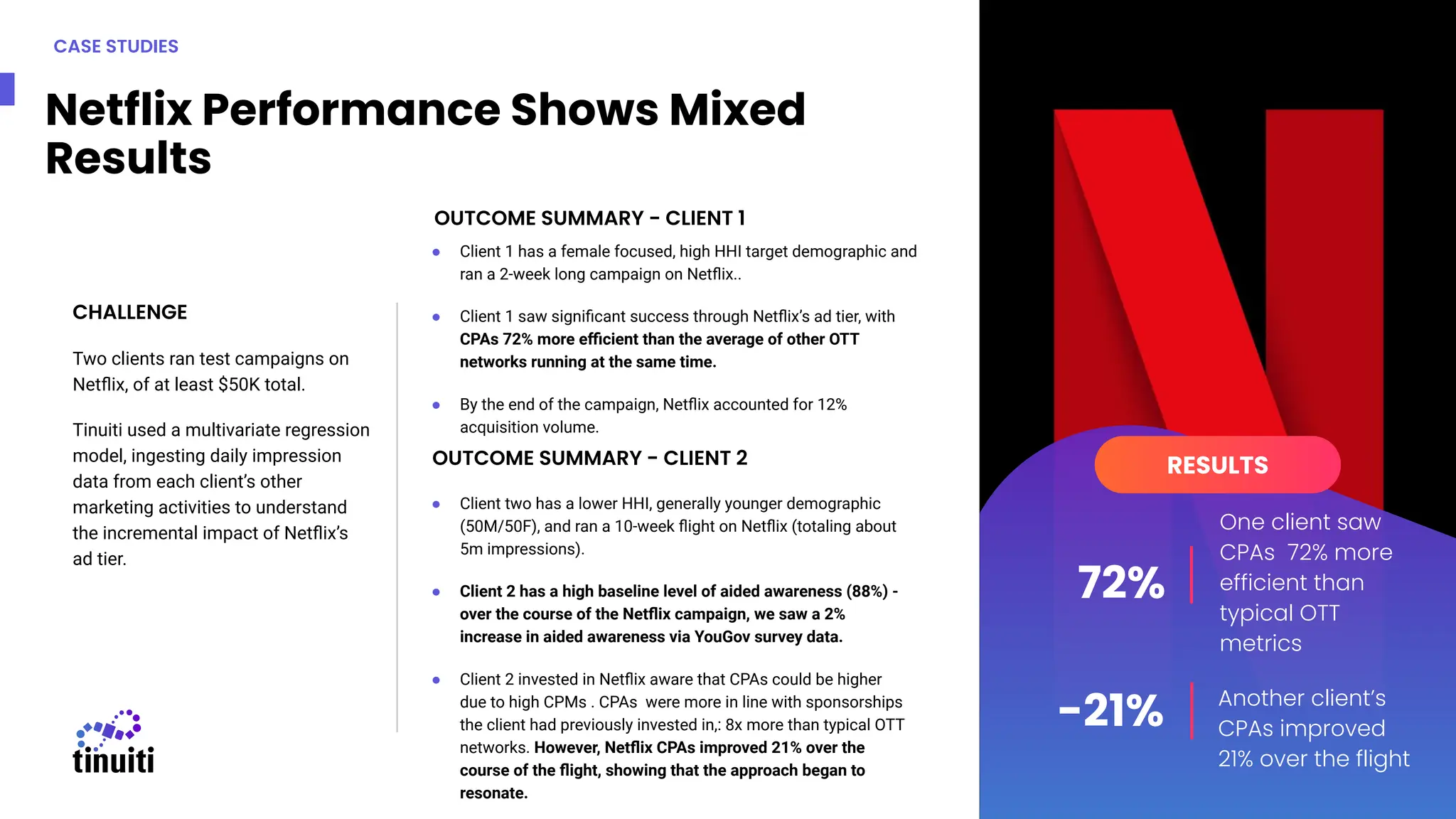

A year after Netflix launched its ad-supported tier, it has attracted 1.5 million customers, representing 2.5% of U.S. subscribers, but faces challenges competing with established AVOD platforms like Hulu. Despite successful test campaigns indicating mixed results for advertisers, Netflix is looking to enhance its offerings and may raise prices to boost the ad tier's profitability. Key considerations for advertisers include assessing campaign goals given Netflix's relatively small scale and evolving measurement capabilities.