Report

Share

Download to read offline

Recommended

More Related Content

Similar to By Hand Valuation

Similar to By Hand Valuation (20)

Des notions de comptabilité essentielles pour les starters

Des notions de comptabilité essentielles pour les starters

Assessing the sales margins in new business models (SAAS, e-commerce) Bryo Le...

Assessing the sales margins in new business models (SAAS, e-commerce) Bryo Le...

IntroductionACC305Cost AccountingFall 2019AWR Step 1 Financial S.docx

IntroductionACC305Cost AccountingFall 2019AWR Step 1 Financial S.docx

Assessing the Sales Margins in New business models

Assessing the Sales Margins in New business models

April 5, 2019fINAL eXAMaSSIGNMENT REPORTIt is expected to b.docx

April 5, 2019fINAL eXAMaSSIGNMENT REPORTIt is expected to b.docx

ECON 2302 Project· What is a negative externality Construct a g

ECON 2302 Project· What is a negative externality Construct a g

Construction Training Program LFUCG, Bluegrass Airport January 25 2011

Construction Training Program LFUCG, Bluegrass Airport January 25 2011

More from Timothy Conrad

More from Timothy Conrad (19)

By Hand Valuation

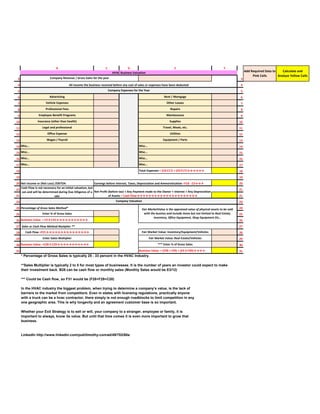

- 1. B C D E F 3 3 4 4 5 5 6 Advertising Rent / Mortgage 6 7 Vehicle Expenses Other Leases 7 8 Professional Fees Repairs 8 9 Employee Benefit Programs Maintenance 9 10 Insurance (other than health) Supplies 10 11 Legal and professional Travel, Meals, etc. 11 12 Office Expense Utilities 12 13 Wages / Payroll Equipment / Parts 13 14 Misc… Misc… 14 15 Misc… Misc… 15 16 Misc… Misc… 16 17 Misc… Misc… 17 18 Total Expenses = (C6:C17) + (F6:F17)→→→→→→ 18 19 19 20 Net Income or (Net Loss) /EBITDA 20 21 21 21 21 23 23 24 Percentage of Gross Sales Method* 24 25 Enter % of Gross Sales 25 26 Business Value = E3 X C25→→→→→→→→→→→ 26 27 Sales or Cash Flow Method Mutiplier ** 27 28 Cash Flow =F21→→→→→→→→→→→→→→→ Fair Market Value: Inventory/Equipment/Vehicles 28 29 Enter Sales Multiplier Fair Market Value: Real Estate/Vehicles 29 30 Business Value =C28 X C29→→→→→→→→→→→ *** Enter % of Gross Sales 30 31 Business Value = (F28 + F29) + (E3 X F30)→→→→ 31 *** Could be Cash flow, so F31 would be (F28+F29+C28) In the HVAC industry the biggest problem, when trying to determine a company’s value, is the lack of barriers to the market from competitors. Even in states with licensing regulations, practically anyone with a truck can be a hvac contractor, there simply is not enough roadblocks to limit competition in any one geographic area. This is why longevity and an agreement customer base is so important. Whether your Exit Strategy is to sell or will, your company to a stranger, employee or family, it is important to always, know its value. But until that time comes it is even more important to grow that business. Add Required Data to Pink Cells Calculate and Analyze Yellow Cells HVAC Business Valuation Company Valuation * Percentage of Gross Sales is typically 25 - 33 percent in the HVAC Industry. **Sales Multiplier is typically 2 to 5 for most types of businesses. It is the number of years an investor could expect to make LinkedIn http://www.linkedin.com/pub/timothy-conrad/49/702/60a their investment back. B28 can be cash flow or monthly sales (Monthly Sales would be E3/12) Fair MarketValue is the appraised value of physical assets to be sold with the busines and include items but not limited to Real Estate, Inventory, Ofiice Equipment, Shop Equipment Etc… Company Revenue / Gross Sales for the year All income the business received before any cost of sales or expenses have been deducted Company Expenses for the Year Earnings before Interest, Taxes, Depreciation and Ammorotization =F18 - E3→→→ Cash Flow Is not necessary for an initial valuation, but can and will be determined during Due Diligence of a sale Net Profit (before tax) + Any Payment made to the Owner + Interest + Any Depreciation of Assets = Cash Flow→→→→→→→→→→→→→→→→→→→→→