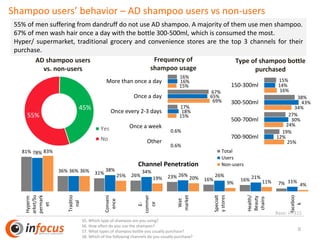

X has an opportunity to become the #1 anti-dandruff brand in HCMC. Currently, 55% of men with dandruff do not use anti-dandruff shampoo. The research found that the top benefits consumers want are effective dandruff removal, relief from itchy scalp, and smooth hair. Younger consumers aged 18-30 are more open to new brands and cited relief from scalp flakiness as important. The study recommends X focus communications on dandruff removal effectiveness and unique benefits. It also suggests targeting younger consumers through social media, point-of-sale displays, and sports sponsorships.