The Great Arabian Bubble (2005)

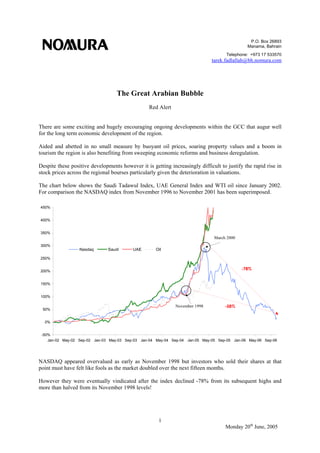

- 1. P.O. Box 26893 Manama, Bahrain Telephone: +973 17 533570 tarek.fadlallah@bh.nomura.com 1 Monday 20th June, 2005 -50% 0% 50% 100% 150% 200% 250% 300% 350% 400% 450% Jan-02 May-02 Sep-02 Jan-03 May-03 Sep-03 Jan-04 May-04 Sep-04 Jan-05 May-05 Sep-05 Jan-06 May-06 Sep-06 Nasdaq Saudi UAE Oil November 1998 March 2000 -58% -78% The Great Arabian Bubble Red Alert There are some exciting and hugely encouraging ongoing developments within the GCC that augur well for the long term economic development of the region. Aided and abetted in no small measure by buoyant oil prices, soaring property values and a boom in tourism the region is also benefiting from sweeping economic reforms and business deregulation. Despite these positive developments however it is getting increasingly difficult to justify the rapid rise in stock prices across the regional bourses particularly given the deterioration in valuations. The chart below shows the Saudi Tadawul Index, UAE General Index and WTI oil since January 2002. For comparison the NASDAQ index from November 1996 to November 2001 has been superimposed. NASDAQ appeared overvalued as early as November 1998 but investors who sold their shares at that point must have felt like fools as the market doubled over the next fifteen months. However they were eventually vindicated after the index declined -78% from its subsequent highs and more than halved from its November 1998 levels!

- 2. P.O. Box 26893 Manama, Bahrain Telephone: +973 17 533570 tarek.fadlallah@bh.nomura.com 2 Monday 20th June, 2005 Sign of the Times The sight of university students flaunting shimmering new sports cars at the local shopping mall may not be unusual but the fact that these are being self-financed by stock market profits ought to be raising alarm. Such images are reminiscent of New York taxi drivers throwing away their keys to become NASDAQ day traders or Japanese housewives funding luxury lifestyles through real estate speculation in the 1980s. Stock Market Performance: (as at 19th June) Saudi Arabia UAE Kuwait Qatar Oman MSCI-World 2005 (YTD) 69.8% 111.8% 33.7% 56.4% 63.1% 0.1% 2004 84.9% 88.4% 33.8% 64.5% 23.8% 13.4% 2003 76.2% 32.1% 101.7% 69.9% 42.1% 32.1% Source: Bloomberg While no two bubbles are identical they tend to share common characteristics some of which are becoming evident across the GCC markets particularly in Saudi Arabia and the UAE. One principle characteristic is that participants and vested interests discard universal valuation benchmarks to validate the higher prices on the basis of some new paradigm. Stock market gains today are said to be durable because they rest on a sound economic basis revolving upon economic reform, a structural rise in oil prices, a boom in real estate and increased regional liquidity. But it is instructive to note that every bubble in history including the one preceding the Great Crash has been rooted in sound fundamentals only to spiral out of proportion through excessive speculation. • In the 1980s the bubble in Japan was sustained by rising asset prices, low interest rates, soaring exports and an appreciating currency – but prices ran too far and valuations deteriorated. • In the 1990s the bubble in internet stocks was based on a genuine revolution in technology that has radically changed our world – but prices ran too far and valuations deteriorated. Another characteristic evident across the GCC is that corporate profits become highly leveraged into the rising trend in asset prices – property and stocks – that develops into a virtuous circle feeding upon itself. A third major characteristic is that retail investors (often borrowing heavily) embrace risk without concern and plunge wholeheartedly into stocks for fear of being excluded from the enriching party. Although investors would like to believe that their markets are unique and that this particular situation is different the likelihood is that the GCC markets are destined to play by the universal rules that govern markets from Toronto to Tokyo and Timbuktu. A case can made for a correction in all GCC markets but this note will focus on the Saudi Arabian market due to its scale, extraordinary valuations and its potential impact on neighbouring states.

- 3. P.O. Box 26893 Manama, Bahrain Telephone: +973 17 533570 tarek.fadlallah@bh.nomura.com 3 Monday 20th June, 2005 The Valuations The following list of thirty large stocks in Saudi Arabia offers the clearest indication of the regional overvaluation with an unweighted Price Earnings Ratio (PER) of 50.4x profits for 2004. COMPANY PRICE PER PBR YIELD MARKET CAP MARKET CAP (data as at 18th June, 2005) (SAR) (x) (x) (%) (SAR mn) ($ mn) SAUDI BASIC INDUSTRIES CORP 1124.0 31.6 11.2 0.80% 449,602 119,894 SAUDI TELECOM CO 940.0 30.3 9.1 2.77% 282,000 75,200 AL-RAJHI BANKING & INVST CRP 1627.0 49.9 20.2 1.11% 146,430 39,048 SAMBA FINANCIAL GROUP 914.0 43.8 11.6 1.53% 109,680 29,248 SAUDI ELECTRICITY CO 128.5 72.9 2.4 2.72% 107,081 28,555 RIYAD BANK 840.0 41.9 9.3 1.71% 84,000 22,400 ETIHAD ETISALAT CO 690.0 - - - 69,000 18,400 SAUDI BRITISH BANK 1306.8 39.9 12.1 1.45% 65,338 17,423 BANQUE SAUDI FRANSI 1275.8 37.4 10.4 1.57% 57,409 15,309 ARAB NATIONAL BANK 938.0 40.2 9.8 0.83% 46,900 12,507 SAVOLA 1575.0 78.4 21.3 0.57% 39,375 10,500 SAFCO 859.0 52.1 8.8 0.93% 34,360 9,163 SAUDI INVESTMENT BANK 889.0 52.1 8.7 0.27% 30,559 8,149 SAUDI HOLLANDI BANK 928.0 31.5 8.1 1.62% 23,386 6,236 MAKKAH CONS 781.0 - - - 22,620 6,032 SOUTHERN PROVINCE CEMENT 857.0 33.0 9.5 2.92% 17,997 4,799 YANBU CEMENT 791.0 38.8 8.2 2.53% 16,611 4,430 SAUDI CEMENT 784.0 36.6 8.2 2.17% 15,994 4,265 NATIONAL SHIPPING/SAUDI 330.5 30.9 6.2 1.51% 13,220 3,525 BANK AL-JAZIRA 827.0 62.5 8.3 0.41% 12,405 3,308 YAMAMAH SAUDI CEMENT 1318.0 21.9 8.8 2.28% 11,862 3,163 ARABIAN CEMENT 878.3 34.4 7.4 1.82% 10,539 2,810 EASTERN CEMENT 807.0 38.6 7.1 2.48% 10,410 2,776 TABUK CEMENT 595.0 64.8 9.1 1.26% 8,330 2,221 MEDICAL APPLIANCES 671.8 123.1 5.2 0.74% 8,061 2,150 AMIANTIT 517.0 98.0 9.7 - 7,962 2,123 THE QASSIM CEMENT 814.0 29.7 6.6 2.70% 7,326 1,954 NATIONAL GAS & INDUSTRIAL 487.0 60.6 6.5 1.23% 7,305 1,948 REAL ESTATE / SAUDI ARABIA 463.8 - - - 5,565 1,484 TAIBAH 359.5 85.7 4.7 1.11% 5,393 1,438 Source: Bloomberg Average 50.4 9.2 1.52% 1,726,719 460,458 In fairness the weighted PER (excluding loss-making firms) is 39.2x due to the influence of heavyweights SABIC (31x) and Saudi Telecom (30x) which are themselves expensive compared to their global peers. The earnings yield of 1.98% (1/50.4) and dividend yield of 1.52% are low by international standards and compared to the SAR discount rate of 3.95% while the Price to Book Ratio (PBR) of 9.2x is outrageous!

- 4. P.O. Box 26893 Manama, Bahrain Telephone: +973 17 533570 tarek.fadlallah@bh.nomura.com 4 Monday 20th June, 2005 The Search for Value Building precise valuation models for the GCC markets in the midst of an evolutionary period is very complicated as it requires a clear understanding and an accurate evaluation of the ongoing changes. The aggregated impact of reform, deregulation, growing inward investment, rising domestic consumption, relaxed property rights for foreigners and the repatriation of regional wealth is difficult to assess. Nonetheless the GCC is not the first region to undergo economic transformation and there are some intuitive measures that can be used to evaluate whether markets are fairly valued in broad terms. Market capitalisation is one measure that – while dependent on the number and size of listed firms – offers some clues to guesstimate relative valuations although PERs and Yields are comparatively more objective. Saudi Arabia China Korea Brazil Mexico Russia S. Africa (TADAWUL) ('A' SHARES) (KOSPI) (BOVESPA) (BOLSA) (RTS INDEX) (ALL SHARE) GDP ($bn) 310.0 7,262.0 925.0 1,492.0 1,006.0 1,408.0 491.0 Market Cap ($bn) 480.0 375.8 448.2 213.4 153.6 153.0 343.9 Ratio (%) 155% 5% 48% 14% 15% 11% 70% PER(weighted) (x) 39.2 17.4 10.5 9.01 12.9 14.9 12.3 Div Yield (%) 1.5 2.1 2.5 24.7 1.7 2.3 2.8 Source: CIA Factbook, Bloomberg The Saudi Arabian market capitalisation (which excludes the publicly owned oil sector and many of the leading family firms that dominate the local economy) is now larger that the country’s GDP and implausibly greater than the Korean KOSPI, Brazilian BOVESPA, Mexican BOLSA, Russian RTS, South African ALL SHARE and the combined Shanghai and Shenzhen ‘A’ share indices. The comparative valuation of Saudi Telecom offers a further insight into the disparity that exists at the corporate level between Saudi stocks and global equities. Country Company PER PBR DIV YIELD China China Telecom 7.9 1.45 2.43 Korea SK Telecom 9.5 1.98 2.66 Brazil Tele Norte 11.5 1.87 6.78 Mexico Telefonos de Mexico 8.6 2.49 3.72 Russia Rostelecom 12.2 0.86 2.61 South Africa Telekom SA 9.1 2.84 4.51 Average 9.8 1.92 3.79 Saudi Arabia Saudi Telecom 30.3 9.12 2.77 (data as at 18th June, 2005) Source: Bloomberg Taking into account the average valuation of the six emerging market telecom companies it seems highly unlikely that Saudi Telecom is appropriately valued at current prices. Given current global valuations investors should consider PERs of 10x-15x as appropriate benchmark market multiples although certain high growth stocks would obviously justify premium multiples.

- 5. P.O. Box 26893 Manama, Bahrain Telephone: +973 17 533570 tarek.fadlallah@bh.nomura.com 5 Monday 20th June, 2005 PER Fair Value? 0 5 10 15 20 25 30 35 40 45 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 10% Growth 20% Growth 30% Growth Profits in Saudi Arabia have increased substantially in the past two years from a modest base but recent history may not provide an accurate guide as to how fast profits will grow in the future. Year 10% 20% 30% 2004 39.2 39.2 39.2 2005 35.6 32.7 30.2 2006 32.4 27.2 23.2 2007 29.5 22.7 17.8 2008 26.8 18.9 13.7 2009 24.3 15.8 10.6 2010 22.1 13.1 8.1 2011 20.1 10.9 6.2 2012 18.3 9.1 4.8 2013 16.6 7.6 3.7 2014 15.1 6.3 2.8 2015 13.7 5.3 2.2 2016 12.5 4.4 1.7 2017 11.4 3.7 1.3 2018 10.3 3.1 1.0 Annual Profit Growth Rates Naturally the timetable for suggested normalisation not only requires profits to rise as expected but also that stock prices remain unchanged for the duration of the adjustment phase. If stock prices were to rise or profits fail to grow as expected the adjustment process would take longer. Current valuations leave no margin for error. Nonetheless assuming a positive and bullish stance the table (left) and chart (below) offer a guide as to how valuations could develop and normalise assuming three base scenarios for profit growth. Under an aggressive scenario of 30% profit growth the market will achieve sensible PER valuations of between 15x-10x by 2007-09 whereas lower growth of 20% will require a further two years. Under the conservative and perhaps sensible assumption of 10% profit growth it will take until 2014-18 (up to thirteen years!) for PERs to correct toward historically sustainable levels.

- 6. P.O. Box 26893 Manama, Bahrain Telephone: +973 17 533570 tarek.fadlallah@bh.nomura.com 6 Monday 20th June, 2005 The China Model The performance of the Chinese stock market offers an illuminating illustration of how highly valued markets can adjust even in a healthy macro-economic environment when profits are rising. In July 1994 the Shanghai A index that consists of Renminbi denominated local shares began a sharp rally propelled by the breathtaking pace of economic growth in China. By June 2001 the index had risen 700% from 330 points to a record 2,337 points as local investors celebrated China’s unprecedented period of double digit economic growth. Valuations also soared with the market earnings multiple reaching a flabbergasting 62x in August 2000 after which they began a downward adjustment which has taken five years and cut PERs to around 17x. 800 1000 1200 1400 1600 1800 2000 2200 2400 Dec-99 May-00 Oct-00 Mar-01 Aug-01 Jan-02 Jun-02 Nov-02 Apr-03 Sep-03 Feb-04 Jul-04 Dec-04 May-05 Shanghai A Share Index 10 20 30 40 50 60 70 P/E Ratio Economic Growth The adjustment was partly due to an increase in earnings but owed much to the fact that the stock market recorded a -55% decline during this period. China has shown that it is possible for stocks to decline in spite of a buoyant economy and rising profits if the starting point is high valuations. This multiple contraction phenomenon is typical in emerging markets and follows a period of rapid share price appreciation after investors have rushed to discount positive news well into the distant future.

- 7. P.O. Box 26893 Manama, Bahrain Telephone: +973 17 533570 tarek.fadlallah@bh.nomura.com 7 Monday 20th June, 2005 Scope for Correction Excessive valuations can be adjusted either gradually through a drawn out period of sideways trading with a downside bias or by a sharp correction with a messy aftermath. And while it is possible that some of the GCC markets could correct gradually the nature of the rally and the frenzied retail activity suggests that the correction will be both sharp and painful. The use of leverage (either directly or indirectly) which has boosted the gains on the upside is likely to amplify the risks to the downside with the upside overshoot being matched by a downside overshoot. Since there are no technical signs that the GCC markets have peaked yet some investors may be tempted to take advantage of the rising price trend to hunt some eleventh-hour profits. Further gains among the GCC markets are certainly possible but an important lesson from the NASDAQ debacle is that timing the market peak is very difficult even in efficient markets. Unfortunately the trigger for a correction is rarely apparent except in hindsight and psychological factors often play a crucial role – sometimes stocks fall because they fell yesterday and might fall tomorrow. Furthermore once a post-bubble bear market is underway it can be both severe in depth and lengthy in duration depending on the nature of the excesses and the market mechanisms in place to deflate them. The Nikkei index fell -80% between December 1989 and April 2003 (one hundred and sixty months) while the more efficient NASDAQ index declined an equally dramatic -78% in just thirty one months! Strategy and Action Plan Exposure to the most blatantly overvalued markets in Saudi Arabia, the UAE and possibly Qatar should be aggressively reduced at current levels. Saudi Arabia UAE Kuwait Qatar Oman Bahrain TASI NBAD KSEI DSM MSM All Share 13,933 17,961 8,569 10,158 5,505 2,163 SELL SELL REDUCE REDUCE REDUCE REDUCE Source: Bloomberg Valuations in Kuwait, Bahrain and Oman appear reasonable if not cheap but these markets are unlikely to be excluded from any regional price adjustments even if they might avoid the worst. Notwithstanding the dire nature of this warning it may be prudent for investors to maintain some selective exposure to attractively priced stocks for long term investment purposes (or in case we are wrong)! Going forward local investors should consider a dollar averaging investment strategy in order to avoid buying the highs or missing the lows.

- 8. P.O. Box 26893 Manama, Bahrain Telephone: +973 17 533570 tarek.fadlallah@bh.nomura.com 8 Monday 20th June, 2005 Conclusion The bearish call on GCC stocks is no reflection on the long term prospects for regional economic growth or the capabilities of local managers. Instead it is a statement about the disconnect that now exists between the real economy and the financial instruments that purport to represent them. The GCC markets had been undervalued prior to the invasion of Iraq but have now become overvalued as the initial euphoria and subsequent boom developed into what some might term “irrational exuberance”. It is possible that the GCC markets provide an exception to the rule but if history is to be repeated then the highs in the local markets may be imminent and may be followed by a period of severe declines. Beware. Red Alert. Regards Tarek Fadlallah, CFA IMPORTANT WARNING: PLEASE NOTE THAT THE PERSONAL OPINIONS EXPRESSED IN THIS NOTE ARE SOLEY THOSE OF THE AUTHOR AND DO NOT REFLECT ANY RECOMMENDATIONS OR ATTEMPT TO SOLICIT BUSINESS. THIS PUBLICATION HAS BEEN ISSUED BY THE SALES/TRADING DEPARTMENT OF NOMURA INVESTMENT BANKING (MIDDLE EAST) BSC AND IS PROVIDED WITHOUT COMPENSATION. THIS DOCUMENT IS NOT INTENDED FOR PRIVATE CUSTOMERS WITHIN THE RULES OF THE UK FINANCIAL SERVICES AUTHRORITY (FSA) OR THE BAHRAIN MONETARY AGENCY (BMA) AND IS NOT TO BE DISTRIUBTED WITHOUT PRIOR AUTHORISATION AND IS NOT INTENDED FOR PRIVATE INDIVIDUALS AND SHOULD NOT BE DISTRIBUTED AS SUCH NOR SHOULD IT BE COPIED TO ANY OTHER PERSON WITHOUT OUT EXPRESS CONSENT. THIS DOCUMENT SHOULD NOT BE CONSIDERED AN OFFER TO BUY OR SELL INVESTMENTS. WE ARE NOT YOUR INVESTMENT ADVISER AND THIS INFORMATION IS PROVIDED ON THE BASIS THAT YOU HAVE SUCH KNOWLEDGE AND EXPERIENCE TO EVALUATE ITS MERITS AMD RISKS AND ARE CAPABLE OF UNDERTAKING YOUR OWN OBJECTIVE ANALYSIS OF THE INVESTMENT AND ITS SUITABILITY TO MEET YOUR REQUIREMENTS. THE INFORMATION IS BASED ON SOURCES WE BELIEVE TO BE RELIABLE BUT WE DO NOT REPRESENT THAT IT IS ACCURATE OR COMPLETE. ANY VALUATIONS CONTAINED HEREIN ARE SUBJECT TO CHANGE WITHOUT NOTICE. NOMURA INVESTMENT BANKING (MIDDLE EAST) BSC AND/OR CONNECTED PERSONS DO NOT ACCEPT ANY LIABILITY WHATSOEVER FOR ANY DIRECT, INDIRECT, INCORRECT OR INCONSEQUENTIAL LOSS ARISING FOM ANY USE OF THE INFORMATION OR ITS CONTENT. NOMURA INVESTMENT BANKING (MIDDLE EAST) BSC IS AUTHORISED AND REGULATED BY THE BMA.