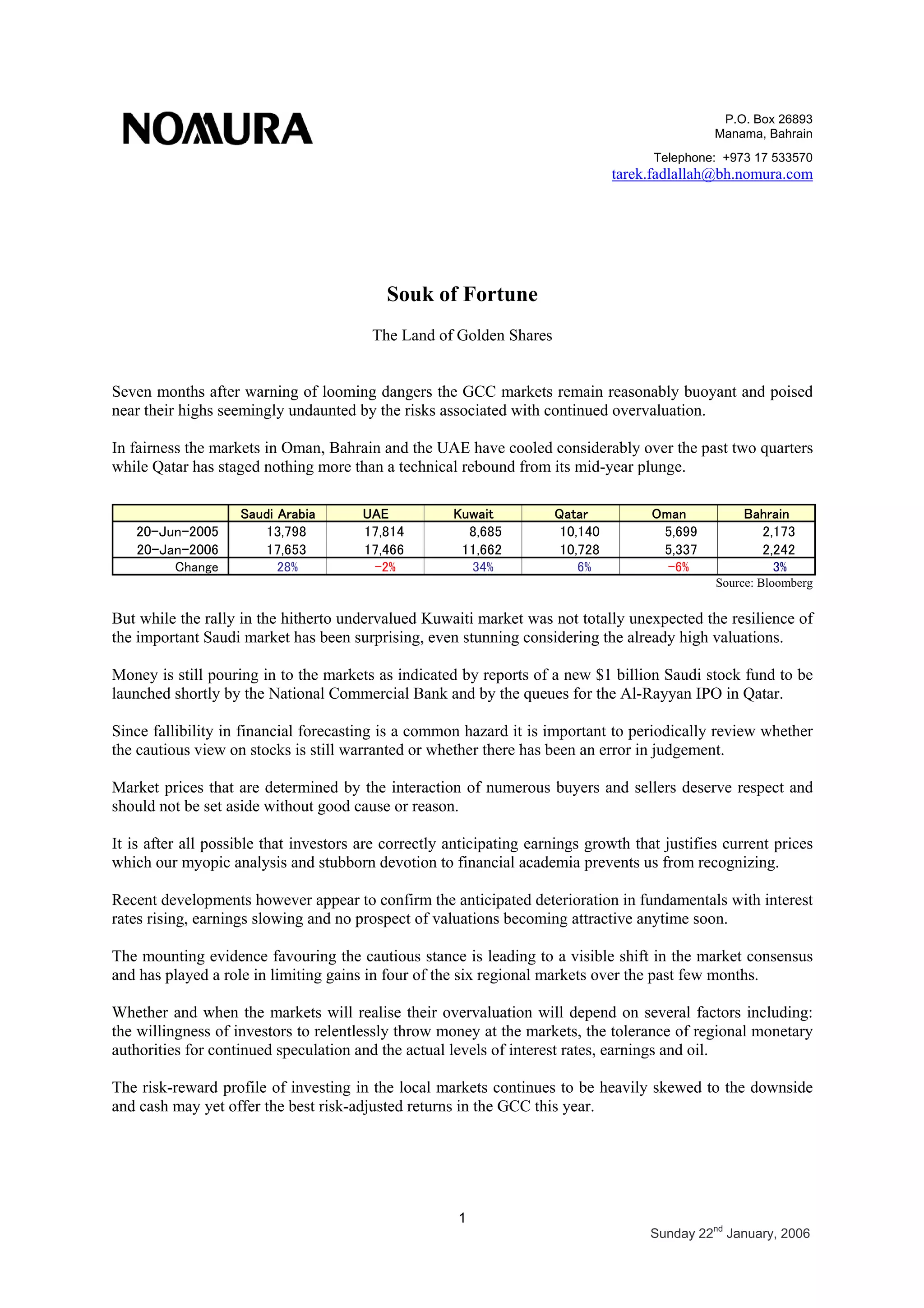

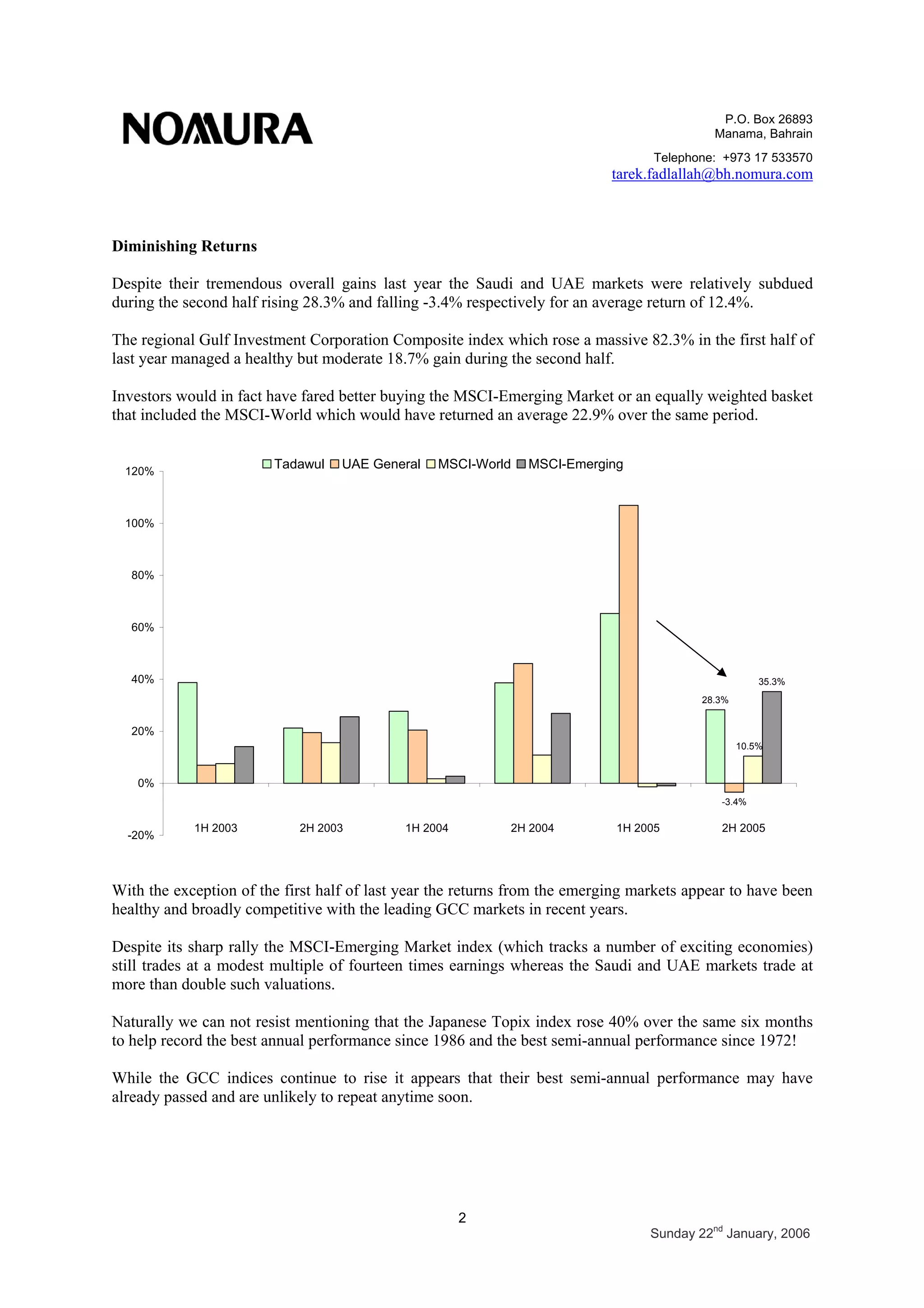

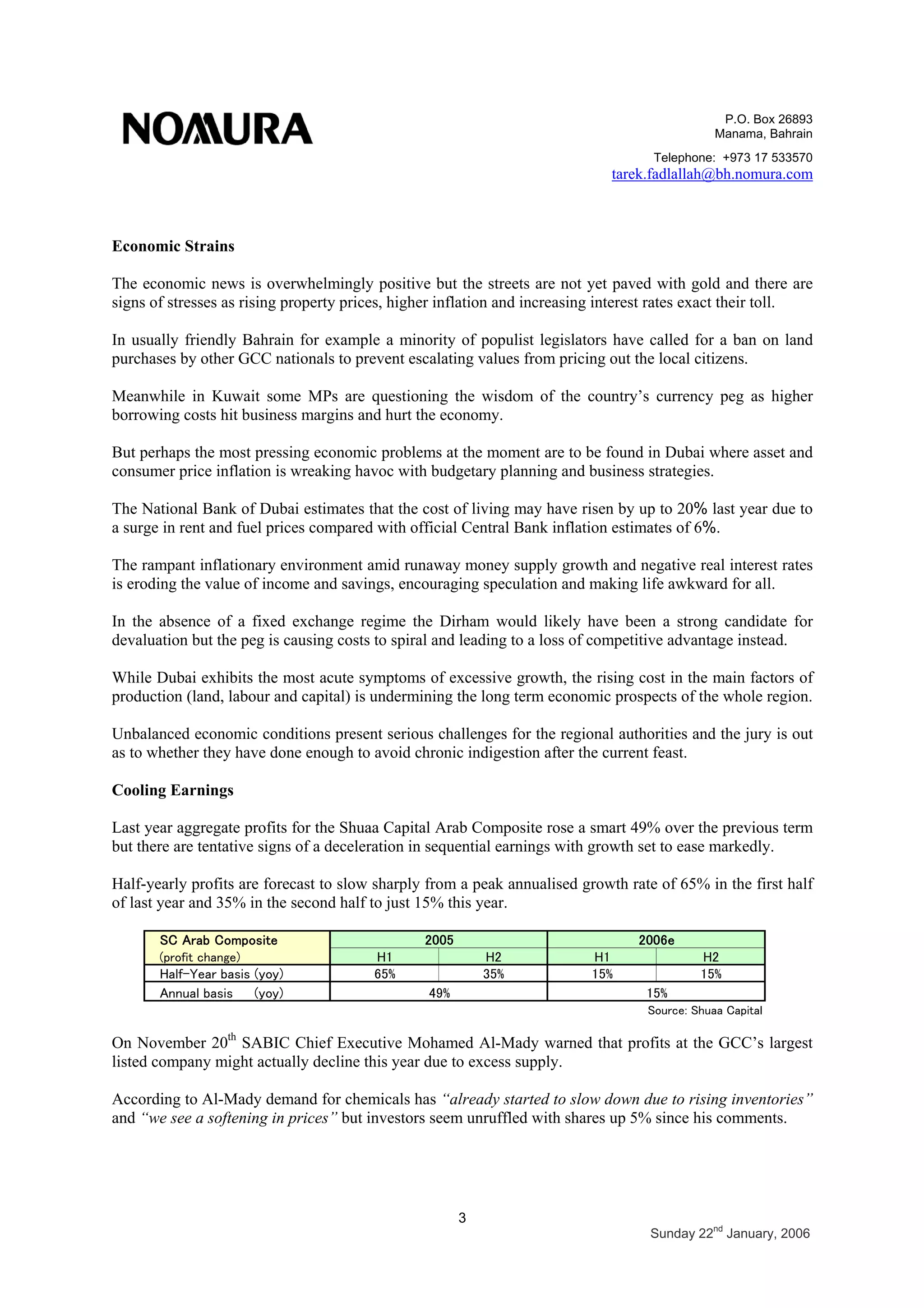

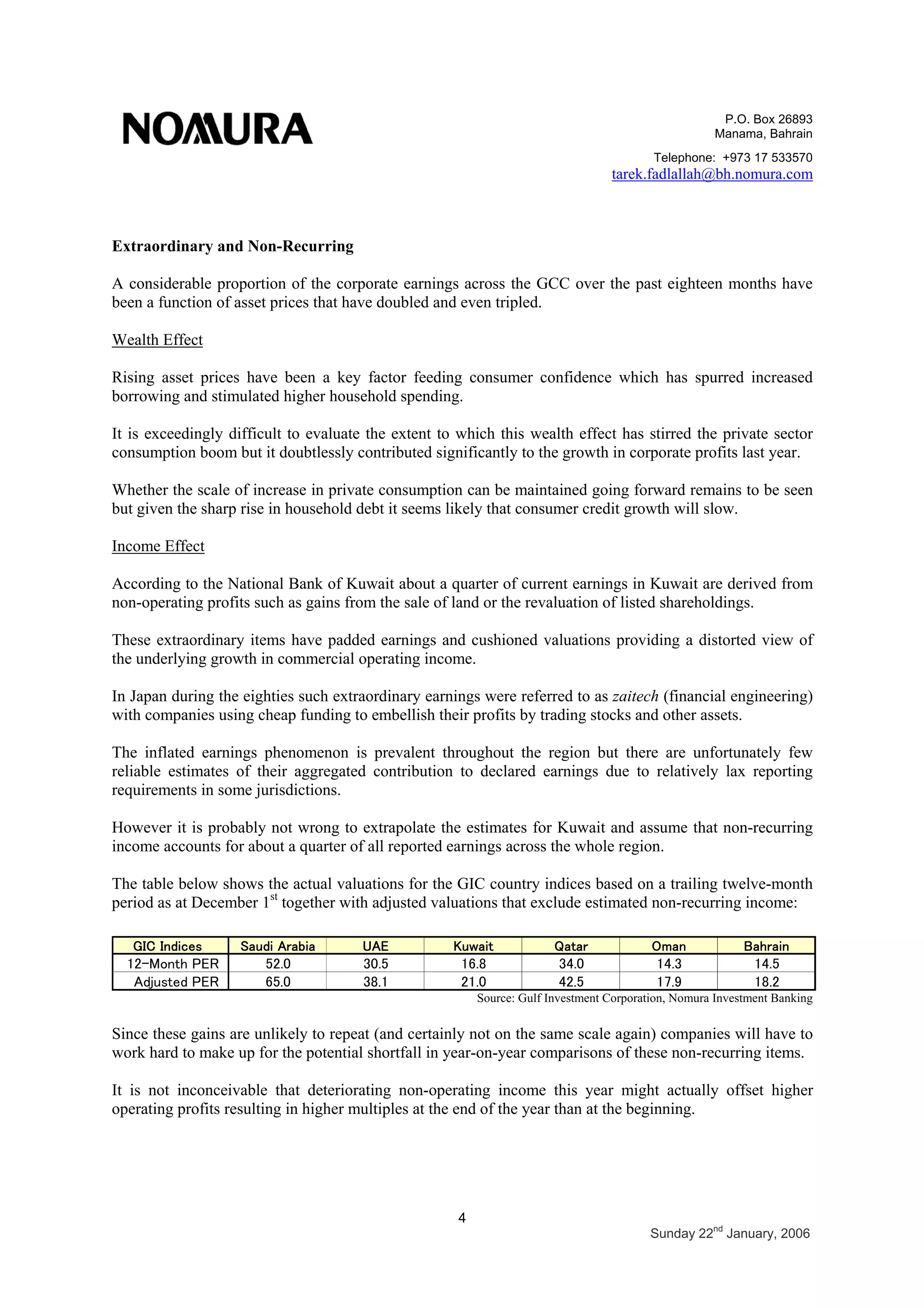

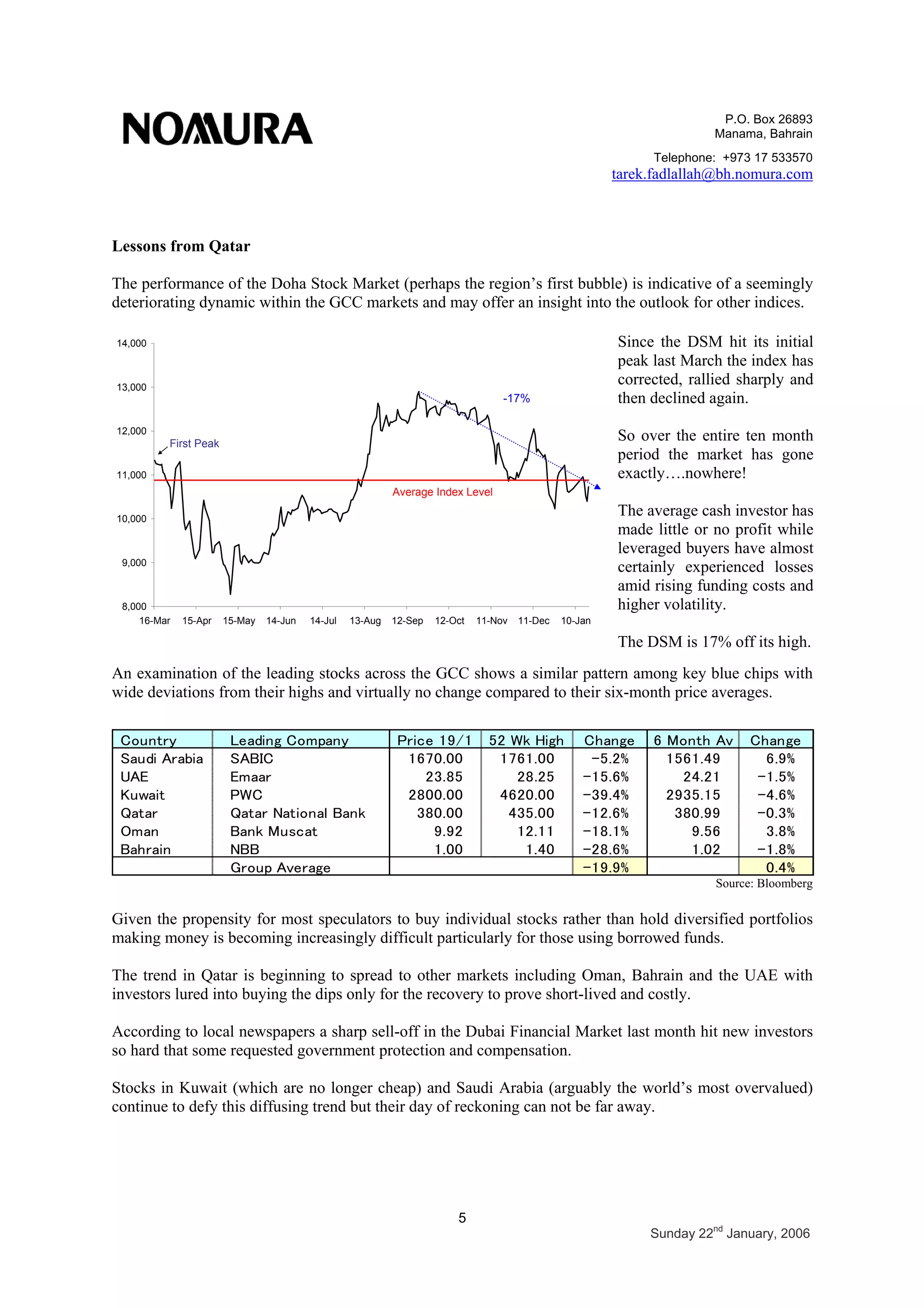

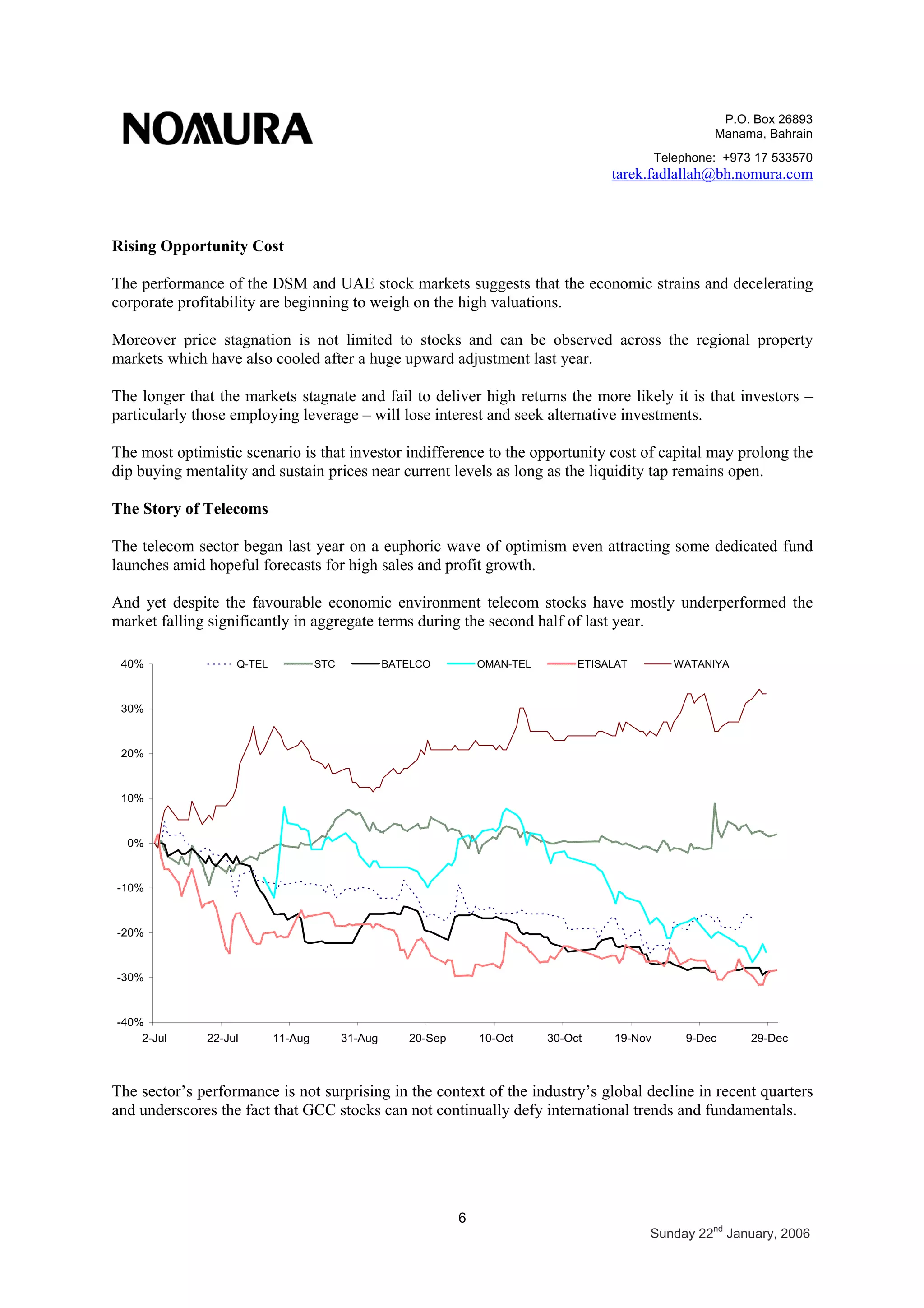

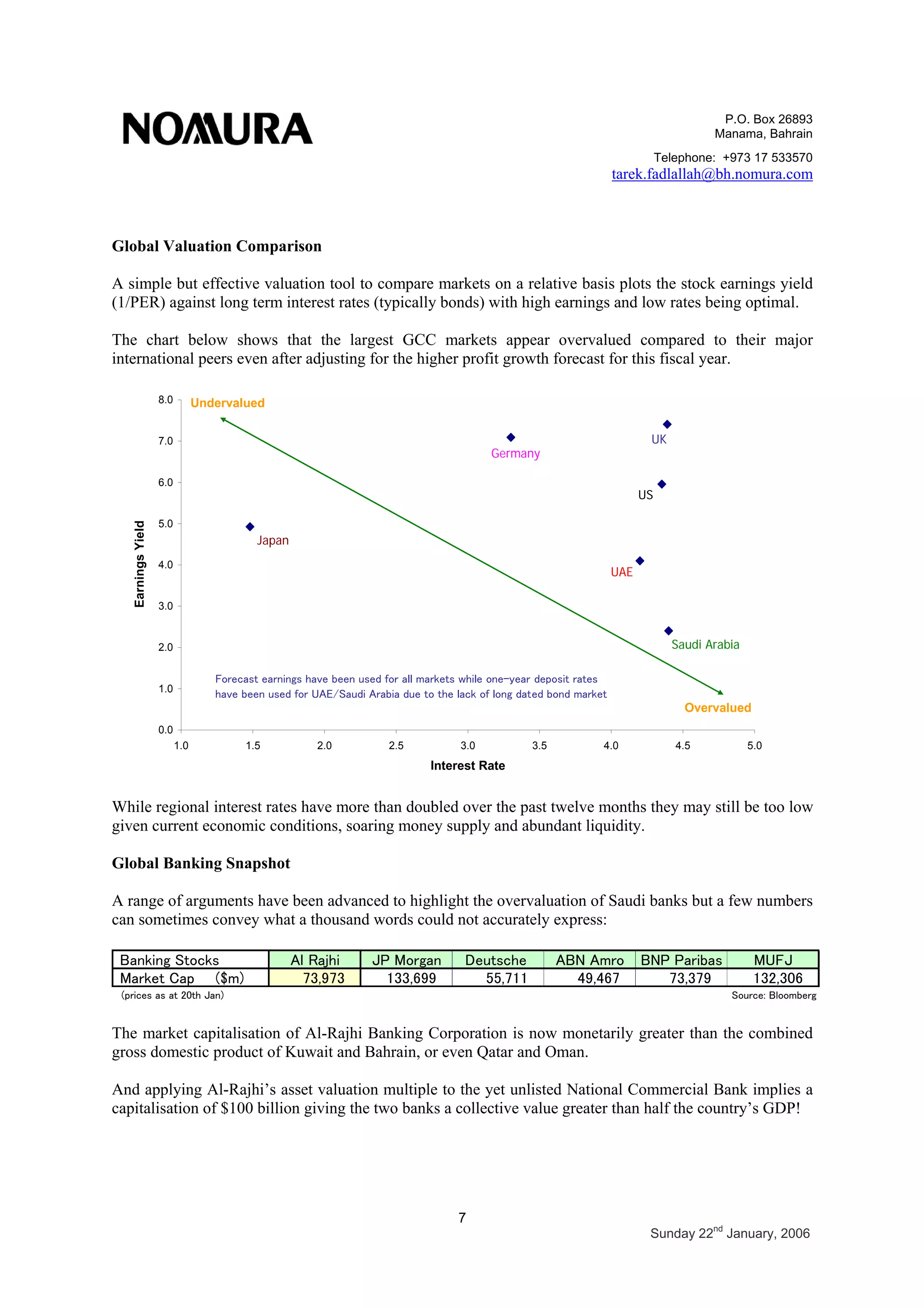

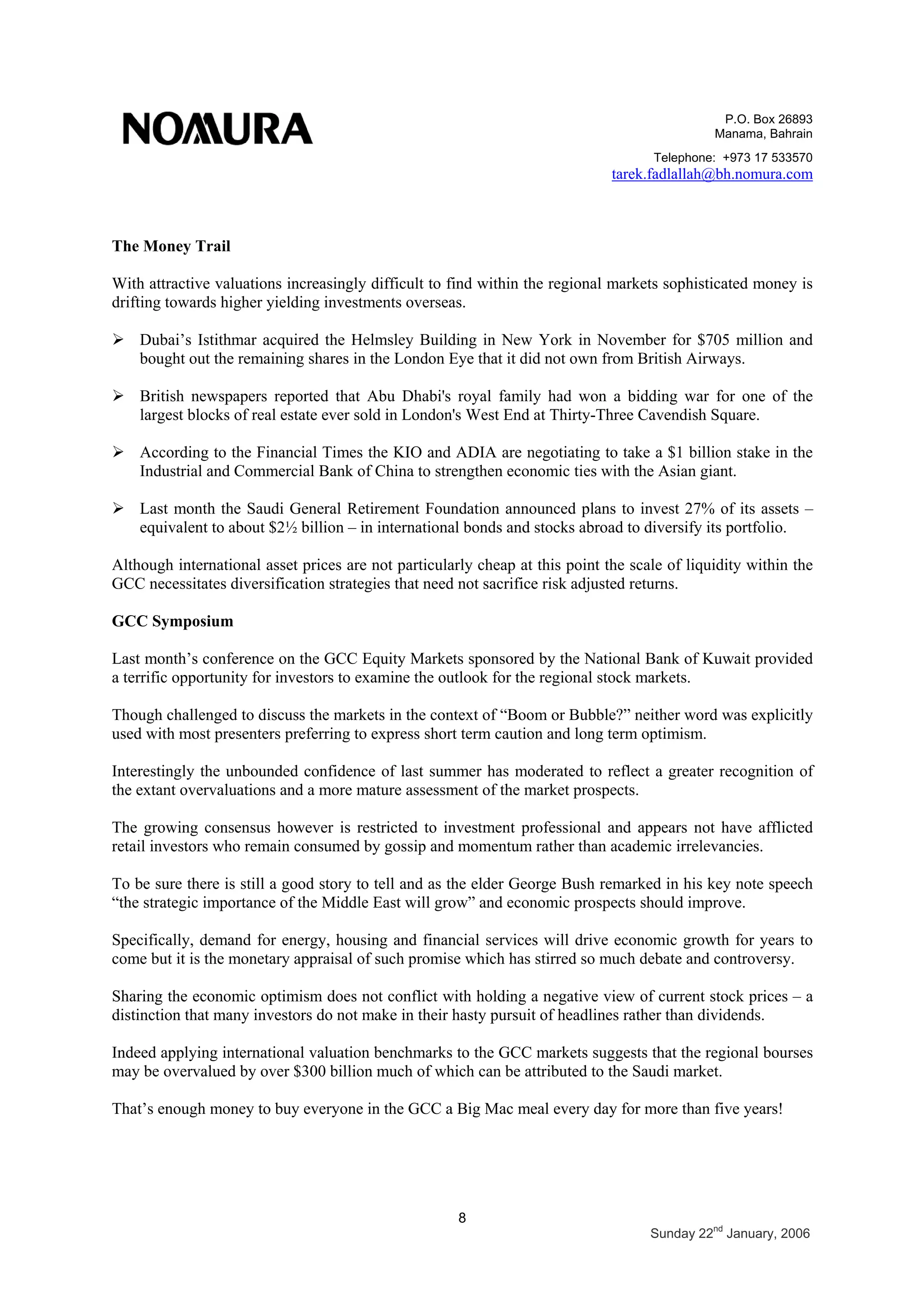

The document discusses the state of stock markets in GCC countries. While some markets have cooled, stock prices in Saudi Arabia have remained resilient despite high valuations. Money continues flowing into the markets but underlying fundamentals are showing signs of deterioration. Earnings growth is expected to slow sharply this year. There are also signs of economic stresses in countries like Dubai from high inflation and rising interest rates. A significant portion of earnings over the past year have come from non-recurring sources like property revaluations, which are unlikely to be repeated at the same scale. Overall the risk-reward profile remains skewed to the downside for investing in local markets.