Micro equity finance for indian establishments

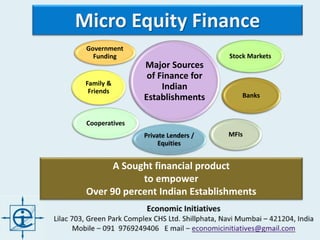

- 1. Micro Equity Finance A Sought financial product to empower Over 90 percent Indian Establishments Major Sources of Finance for Indian Establishments Stock Markets Family & Friends Cooperatives MFIs Banks Private Lenders / Equities Government Funding

- 2. Untapped Micro Equity Market in India 1. Inclusive Finance is not just meant for allowing the poor open bank account; but it should also mean to assure that poor among us are allowed to access the surplus of capital hold by rich among us. 2. For inclusive growth ( Sabka Saath Sabka Vikaas) we need to ensure justice in provisioning supply of capital to the rich and poor. It is not justified that corporate avail capital from stock market at zero cost whereas poor have no choice except availing loans at cost over average rate of interest. 3. Still 98.5% Indian commercial establishments are not registered as company under Ministry of Corporate Affairs. Only equity finance can induce more and more establishments to convert into companies. 4. India has high potential to convert informal sector establishments to convert them into formal sector establishments condition they are induced by suitable products and mechanism. Micro equity can be one sought product. 5. Despite rise in business of private equities, India’s 80% establishments are yet not allowed to get equity finance from any source. Had they been tapped by any source, Indian capital market could become world’s largest with inclusion of as much as 50 million establishments into capital market.

- 3. Major Sources of finance for Indian Establishments 1. According to All India Report on Sixth Economic Census 2016, there are around 58.49 millions establishments providing employment for 131.29 million workers in activities excluding crop production, plantation, public administration, defense, and compulsory social security in India. 2. Major source of finance for 80.1% Indian establishments is Self–finance. Just 2.2% urban establishments are financed through borrowings from financial institutions against 2.4% rural establishments financed by this source. 3. Just 1.36% establishments (7,93,446 out of 5,84,95,359) are registered as companies under Ministry of Corporate Affairs (MCA). It means still 98.64% Indian establishments are unable to access stock market for capital support. 4. The equity support for MSMEs from SME Exchange is negligible because during 2015-16 only 50 companies out of registered 21,33,885 Udhyog Aadhar succeeded raising amount of Rs. 379 crores through SME platform. 5. Indian Banks being constrained for investing less than 30% paid up capital of any company, opted investing major amount on listed companies. But after global financial crisis with fall in international trade, these companies found difficult to grow further. Ultimately these companies kept loosing their stock prices and also burdened Indian banks with as much as 55% of total NPAs.

- 4. Private equity is gaining grounds in Indian Market 1. Generally equity is considered as tradable stocks in the capital market. But recent growth trend in private equities for unlisted companies outside stock market opened gateway for equity business to serve unlisted companies. 2. While Indian stock exchange observed 6.5% decline (Rs. 19,36,844 crores) in market capitalisation during 2015-16 compared to 2014-15, India registered 36% growth in FDI (Rs. 1,44,674 crores) during April to September 2016, mainly due to private equities. 3. The performance of SME Exchange to support only 50 companies raising Rs. 379 crores with no trading during 2015-16 shows that 99% smaller and micro establishments are still looking to access private equity for their growth. 4. According to Report on Fifth Annual Employment – Unemployment Survey 2015-16 average monthly income for 94.7% Workers in India is less than Rs. 20,000. India’s 45% workers with monthly income below Rs. 20,000 through Self-Employed Establishments are deprived of equities from any source. 5. Since private equity players have yet not reached 41.9 million Own Account Establishments in India, banks (with restriction to invest less than 30% paid up capital in any company) can opt strategy to invest in MFIs with intention to use their network for reaching potential establishments with micro equity.

- 5. Micro Equity for Indian Micro Establishments 1. The micro and tiny establishments in the unorganized sector with inability to access the SME exchange are facing shortage of required capital for growth. 2. Notably banks in general don’t prefer targeting customers who seek loan under Rs. five lakhs; and MFIs in rare cases extend loan over Rs. 50,000 and in no case sanction loan above Rs. five lakh. 3. Thus the financial needs of micro and tiny enterprises ( for amount between Rs. 50,000 to Rs. 5 lakhs) in general is not fulfilled through stock market. For banks they are smaller ticket size whereas for MFIs they are too large. 4. 60 millions Self Employed Workers engaged in Micro or Tiny Establishments with financial need between Rs. 50,000 to Rs. 5 lakhs is too big to ignore. There is huge untapped market for MFIs in India who could arrange supply of formal finance under ticket size in range of Rs. 50,000 to 5 Lakh. Still private equity players are not tapping this market, so MFIs could easily tap them. 5. Considering the fact that 27.46% establishments (16 out of 58 millions) are engaged into sales and trade activities in India where rate of profit could be higher; MFIs should prefer using ‘Micro Equity Finance’ so as to earn better returns over investments against interest rate changed over loan under present regulations for MFIs in India.

- 6. Defining the Product of Micro Equity Finance • The Micro Equity Finance may be defined as participative finance product used to support micro enterprises through providing capital on terms of sharing floated risk and reward in the enterprise. • In India the amount of equity finance in range between Rs. 50,000 to Rs. 5,00,000 could be set limit for Diminishing Micro Equity which may be appropriate to serve as much as 90% credit accounts. • The process of Micro Equity starts with collective investment in any enterprise by two or more parties; but ends with complete conversion of ownership for one party who purchases the shares of other/s in that particular enterprise during a time frame. • Whole process needs three different set of contracts defining – • Collective Investment in any project / enterprise by two or more parties • Terms of diminishing share in enterprise / project for different partners • Contracts defining terms of selling out the undivided share of one or more partners in the enterprise / project to the other partner. • After completion of Micro Equity Contract, complete ownership of total enterprise capital / asset is transferred in favour of the customer.

- 7. Different Stages under Micro Equity Finance Initial Stage • Financier makes fractional investment in Customer’s Enterprise • Customer Invites investment from financier on profit / loss sharing basis with option to periodically buy back investor’s share. Middle Stage • Financier receives amount for sell of unit share along with profit / Loss against outstanding investment in customer’s enterprise. Rate of profit keeps decreasing with diminishing share in enterprises. May also need to adjust customer’s account in case the customer do not buy back unit share according to scheduled repayment. • Customer periodically keep buying back investor’s unit shares in the enterprise and shares proportionate profit / loss according to investor’s outstanding share in the enterprise. May buy back more unit share if financial conditions allow the customer do so. Final Stage • After selling out all shares in the enterprise the Financier declares customer as sole owner of the enterprise. • The Customer becomes sole owner of the enterprise after buying back investor’s all share in the enterprise.

- 8. Micro Equity may also help in National Accounting • Under Micro Equity Finance it may be possible for financier to envisage how much value addition is created, how much income is earned and how much capital accumulation is done through equity finance. Under debt financing we may not be able to calculate net value addition, income or capital formation. Lending on interest terms Micro Equity Finance Loan Amount in Rs. 1,20,000 Equity Investment in Rs. 1,20,000 Rate of Interest 24% Profit / Loss Sharing Ratio 24% to 0% Interest charged over Principal Profit / Loss Shared from Profit Total Repayable Amount 1,48,800 Total Receivable by end 1,59,000 Max. Monthly Installment 12,400 Max. Monthly Installment 16,000 Min. Monthly Installment 12,400 Min. Monthly Installment 10,500 Months for Repayment 12 Months for Repayment 12 Gross Income to MFI 28,800 Gross Income to MFI 39,000 Income earned by Customer ? Income earned by Customer 1,41,000 Capital Accumulation ? Capital Accumulation 1,20,000 Gross Value Addition ? Gross Value Addition 3,00,000

- 9. enMonths MFI’s Capital Share Customer’s Capital Share Profit through Enterprise Total Instalment to MFI Equity Buy Back Per month Net Profit to MFI MFI’s Profit Share 1 1,20,000 2,50,000 25,000 16,000 10,000 6,000 24% 2 1,10,000 2,60,000 25,000 15,500 10,000 5,500 22% 3 1,00,000 2,70,000 25,000 15,000 10,000 5,000 20% 4 90,000 2,80,000 25,000 14,500 10,000 4,500 18% 5 80,000 2,90,000 25,000 14,000 10,000 4,000 16% 6 70,000 3,00,000 25,000 13,500 10,000 3,500 14% 7 60,000 3,10,000 25,000 13,000 10,000 3,000 12% 8 50,000 3,20,000 25,000 12,500 10,000 2,500 10% 9 40,000 3,30,000 25,000 12,000 10,000 2,000 8% 10 30,000 3,40,000 25,000 11,500 10,000 1,500 6% 11 20,000 3,50,000 25,000 11,000 10,000 1,000 4% 12 10,000 3,60,000 25,000 10,500 10,000 500 2% Total 3,70,000 3,00,000 1,59,000 1,20,000 39,000 0% Hypothetical cash flow under Micro Equity Finance

- 10. Process involved under Micro Equity Finance 1. Identifying the geography after economic survey of the village / town area. 2. Explaining the model to the target group, identification of potential customer, analyzing constraints and prospects for customer’s livelihood. 3. Prepare the customer realize the significance of equity to increase income through existing livelihood; and eagerness to share returns with the investor. 4. Filling Application, appraisal of applicant, counter party check and explaining the transactional cash flow to the customer, fixing co-obligant and finalizing sought measures to mitigate the financial risk; and approving application and approving amount for finance against collateral. 5. Signing the Micro Equity agreement between the investor and Customer; Transferring sought amount into customer’s account after handing estimated repayment schedule to customer with option to buy back investor’s share. 6. The customer periodically buys back investor’s unit share. After personal verification, the Investor prepares notes on cash flow of customer’s activity. 7. Repayment of amount by customer in accordance to the actual cash flow retrieved in customer’s business activity / livelihood. The investor makes adjustment into Customer’s account after each received repayment. 8. Closing customer’s account after receipt of sought repayment amounts.

- 11. Banks and MFIs can execute Micro Equity 1. With no source of equities between Rs. 50,000 to Rs. 5 Lakhs for 50 millions micro enterprises, Indian banks / MFIs should try exploring this opportunity. 2. Considering the limitation about investment and limited exposure to the micro and tiny enterprises, it would be better for banks to invest in MFIs for reaching the micro and tiny enterprises. This may allow banks get better returns with lesser hassle and lower chances for NPAs. 3. Considering the growth trend in private equities, if banks pass on equities to MFI asking to finance micro equities, it may open avenues for banks to draw private equity investors to subscribe bank’s capital. 4. Equity support from banks to MFI for micro equity finance may open avenues to earn better returns through micro equity at one hand and get additional loans through bank’s equities on other hand. 5. According to Section 19 (2) of Banking Regulation Act, any bank can invest any amount less than 30% of paid up capital in any particular company; bank also needs to assure that total investment in all companies should be less than 30% of its own paid up capital. If Section 19 (2) is edited it may allow banks to invest any suitable amount in any company and banks can also directly execute Diminishing Micro Equity Finance.

- 12. • Since the returns under Micro Equity Finance is linked with actual profit / loss of enterprise, the Weighted Risk for this product could be 100%. • It should not be used as general financial product. It should only be used for customers with potential to yield better returns over investment duly supported with relevant source to prove the transactional account genuine. • There may be customers seeking this product to cheat financier with false / manipulated cash flow to draw attention of financier / investor. Thus it is always required to check and verify the transactional accounts as genuine. • Investor needs to guide the customer transact digitally. In case where digital transaction is not feasible, there should be receipts and vouchers to check and verify the genuineness of submitted transactional account. • Further it is expected that genuine transactional account may vary from the proposed transactional account and accordingly the received amount may keep varying from proposed repayments. In such cases the customer’s ledger should be provisioned with option to edit repayment with modified rate of profit / risk sharing or equity buy back. • The risk can be further mitigated if actual transactions be made digitally and provisioned to share between investor and customer. Weighted Risk under Micro Equity Finance

- 13. • Since the return over investment under Micro Equity Finance may not be fixed, but just predicted according to submitted business plan, there is high probability that on monthly basis the actual repayment may differ from scheduled repayment. In such cases the team has to - 1. Check and verify all related receipts and vouchers to ensure that transactional account submitted by the customer is not fake / scripted. 2. Adjust customer’s ledger to update the entries about equity buy back, retrieved profit / loss share and percentage of profit / loss to share according to outstanding percentage share in the enterprise / project. 3. Field staff need to periodically visit and observe performance of customer’s activity to ensure that business is going smoothly. They need to behave like sleeping but aware partner in customer’s enterprise. 4. Periodically update the customer about investor’s outstanding share in customer’s enterprise and accordingly liable percentage of profit / loss sharing ratio from actual retrieved profit. 5. There should be counter checking system at field level staff so as to ensure that field level staff could not find any chance to take bribe from customer by making undue favour for the customer and ditch the investor. On random basis the filed executive may check their sub ordinates and similarly the manager should check the filed executive. 6. Before signing the agreement, it should be ensured that the customer has no problem in appointing the common arbitrator referred by the investor. Sought Precautions under Micro Equity Finance

- 14. Micro Equity may help building Capital for India Micro Finance Institutions (MFIs) / Livelihood Service Institutions (LSIs) Extend micro Equity support to Micro and Tiny Enterprises Helping Micro enterprises build required capital base Indian Scheduled Commercial banks Invest in Equities of MFIs/LSIs May ask MFIs / LSIs to maintain separate account for Micro Equity Potential Investors for Banks Invest in equities of Indian Banks May buy bank’s shares with condition of equity assets

- 15. Micro Equity may support transactional tax system 1. Micro Equity Finance may be a better product than subsidized loans for micro enterprises as it needs no subsidy; and also helps to develop transparent accounting system where customers may be asked to transact digitally. 2. Since under Micro Equity Finance, the returns are linked with actual cash flow of the customer’s business only, the Banks / MFI’s would be required to obtain record of actual transactions held in customer’s livelihood activity. 3. The transactional records provided by the customer to Banks / MFIs would ultimately help us calculate the volume of transactions, value additions, income generation, capital accumulations and paid taxes. This may help us retrieve better estimates required under national accounting and taxation. 4. India may need to develop technical support system for micro and tiny entrepreneurs to use mobile app to maintain transactional records along with financial entries related to investment, sale purchase and taxation. The cost of the app may be borne by Government through taxes raised under this system. 5. If India resolves promoting product like Micro Equity Finance it would be easier for the Government to implement the system of Transactional tax even among 50 million informal sector enterprises. Such system may also enable banks to collect taxes for the Central and State Governments.

- 16. References for source of data used above 1. http://www.mca.gov.in/MinistryV2/paidupcapitalreports.html 2. Report on Fifth Annual Employment – Unemployment Survey 2015-16 3. All India Report on Sixth Economic Census 2016 (Table 3.9 & 4.12) 4. https://dbie.rbi.org.in/DBIE/dbie.rbi?site=publications 5. https://rbidocs.rbi.org.in/rdocs/Speeches/PDFs/PPT1102166AB61D0F35C54 6539EF4DCD3C83B3668.pdf Thank You! Please feel free to extend your valuable Feedback, Suggestions and Comments at economicinitiatives@gmail.com