Energy & Commodities

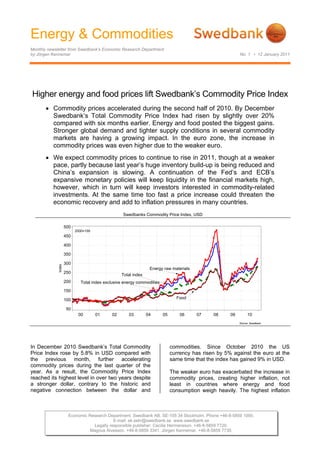

- 1. Energy & Commodities Monthly newsletter from Swedbank’s Economic Research Department by Jörgen Kennemar No. 1 • 12 January 2011 Higher energy and food prices lift Swedbank’s Commodity Price Index • Commodity prices accelerated during the second half of 2010. By December Swedbank’s Total Commodity Price Index had risen by slightly over 20% compared with six months earlier. Energy and food posted the biggest gains. Stronger global demand and tighter supply conditions in several commodity markets are having a growing impact. In the euro zone, the increase in commodity prices was even higher due to the weaker euro. • We expect commodity prices to continue to rise in 2011, though at a weaker pace, partly because last year’s huge inventory build-up is being reduced and China’s expansion is slowing. A continuation of the Fed’s and ECB’s expansive monetary policies will keep liquidity in the financial markets high, however, which in turn will keep investors interested in commodity-related investments. At the same time too fast a price increase could threaten the economic recovery and add to inflation pressures in many countries. Swedbanks Commodity Price Index, USD 500 2000=100 450 400 350 300 Index Energy raw materials 250 Total index 200 Total index exclusive energy commodities 150 100 Food 50 00 01 02 03 04 05 06 07 08 09 10 Source: Swedbank In December 2010 Swedbank’s Total Commodity commodities. Since October 2010 the US Price Index rose by 5.8% in USD compared with currency has risen by 5% against the euro at the the previous month, further accelerating same time that the index has gained 9% in USD. commodity prices during the last quarter of the year. As a result, the Commodity Price Index The weaker euro has exacerbated the increase in reached its highest level in over two years despite commodity prices, creating higher inflation, not a stronger dollar, contrary to the historic and least in countries where energy and food negative connection between the dollar and consumption weigh heavily. The highest inflation Economic Research Department. Swedbank AB. SE-105 34 Stockholm. Phone +46-8-5859 1000. E-mail: ek.sekr@swedbank.se www.swedbank.se Legally responsible publisher: Cecilia Hermansson. +46-8-5859 7720. Magnus Alvesson. +46-8-5859 3341. Jörgen Kennemar. +46-8-5859 7730.

- 2. Energy & Commodities Monthly newsletter from Swedbank’s Economic Research Department, continued No. 1 • 12 January 2011 in the EU in November was in Romania (7.7%), 100 dollar, which could jeopardise the global Estonia (5.0%) and Greece (4.8%). recovery. Swedbanks Commodity Price Index in different currencies Oil price and average forecast for 2011-2012 in USD 150 150 140 130 140 120 EUR 110 100 USD/Barrel 130 90 80 120 70 60 SEK 110 50 40 100 USD 30 05 06 07 08 09 10 11 12 Källa: Swedbank, Reuters EcoWin 90 12 10 11 12 1 2 3 4 5 6 7 8 9 m m m m m m m m m The major increase in food prices, which began m m m m 10 10 10 10 10 10 10 10 10 09 10 10 10 20 20 20 20 20 20 20 20 20 20 20 20 20 last summer, continued in December, when the food price index rose by 6.0% compared with Prices of energy commodities again began to November. This means that food prices have accelerate in November and December. On risen by 26% in 12 months. Grain prices, which average, oil rose by 6.5% in December, while the rose significantly in September and October, price of coal climbed by no less than 11.8%. The stabilised temporarily in November before big increase is partly due to the cold winter and accelerating again in December. Other food historic floods in Australia. A substantial drop in products such as coffee, oilseeds and beverages coal production in Australia, which accounts for have become more expensive, which taken around 40% of the world's total coke production, together are putting pressure on household could lead to a coal shortage, which would consumption. Lower food production owing to especially hurt the steel industry – and the energy unfavourable weather conditions is a main reason sector as well. Coal plays a vital role in global why inventories are lower than expected. Political energy production, particularly for emerging Asian decisions such as the export caps in Russia and economies. The fact that global oil consumption Ukraine to ensure domestic food supplies have will rise faster in 2011 not only in emerging further tightened supply conditions, which also economies but also in OECD countries, which tends to lead to increased speculation. We expect account for around 60% of global consumption, is the increase in food commodity prices to slow in also driving prices higher. We expect the average 2011, when global production rises and the price of oil to rise from USD 80 a barrel last year temporary impact of weather conditions fades. to USD 87 in 2011, even though the momentum in The price increase in the latter part of 2010 global GDP growth will be lower than last year. If means, however, that the average increase will be the dollar continues to appreciate, as expected, greater this year than last. Global food supplies the price increase will be higher in euro terms, are proving highly vulnerable to production with the risk of rising inflation, especially in disruptions at the same time that global demand is countries where energy consumption weighs trending higher as the purchasing power of heavily in the consumption basket. population-dense economies strengthens and economic prospects brighten. This probably means that today’s high oil price of just over USD 95 is temporary and that it will fall Price development for different food commodities, in USD when this unusually cold season ends and warmer weather returns. At the same time the oil 180 2008-12-31=100 market is still facing excess supply, even though 170 inventories have dropped in recent months, which 160 150 Sugar, beverages indicates that the price gains have also been the 140 result of increased expectations and speculation. Food prices, total Index 130 Global pressure on OPEC countries, which 120 provide over 35% of global production, to raise 110 production levels is likely to mount if oil prices 100 Cereals should stabilise at current levels or reach USD 90 jan mar maj jul sep nov jan mar maj jul sep nov jan mar maj jul sep nov 08 09 10 Source: Reuters EcoWin 2 (4)

- 3. Energy & Commodities Monthly newsletter from Swedbank’s Economic Research Department, continued No. 1 • 12 January 2011 Other than foods, metals posted the strongest the debt crisis’s impact on the macro economy price gains in 2010, although there are relatively isn’t over yet. Gold’s status as a safe haven big differences between product groups. Among among financial investors is likely to continue as metals, nickel and copper rose the most (by long as global imbalances remain. Silver’s use in 41.6% and 31.1%, respectively) between an increasing number of commercial applications, December 2009 and December 2010. Zinc and thanks in no small part to its favourable physical lead, on the other hand, have been the weakest in properties, has led to higher price levels. There is the group. Although the price of iron ore has fallen still a long way to go to reach the 1980 level, for two consecutive months in USD, it is still over however, when the price of silver reached USD 48 70% higher than in 2009. We expect metal prices per troy ounce for a short period of time. to continue to rise in 2011, though at a slower Geologists are warning of a future silver shortage pace as global inventories shrink. Ferrous metals if the current increase in consumption continues. rose by 35% in USD last year and are expected to We feel that today’s price increase rests more on increase by an average of 8-12% this year. fundamentals. Metals, where supply conditions are limited, have the biggest potential for further price increases. In addition to changes in supply and demand, Copper and tin inventories have fallen to the commodity prices are increasingly affected by lowest levels since 2008. The expected rise in financial flows. Low nominal interest rates have metal prices is based, however, on the continued led to rapidly expanding liquidity in global financial strong expansion of the Chinese economy, which markets, where an increasing share of investment accounts for slightly over 40% of global metal capital is turning to commodity markets. This consumption. Government concerns about the tends to drive up prices even further, especially high inflation rate (5.1% in November) and rapidly when there are fundamental imbalances. Our rising asset prices have led to several austerity expectation of unchanged benchmark interest packages, and more are likely in the year ahead. rates in the US and in EMU countries in 2011 and The effect of austerity policies on the Chinese further unconventional measures in the form of economy and commodity demand could lead to central banks’ bond purchases would mean increased volatility in global commodity markets. continued high liquidity in the global financial market, which should also drive up commodity Among precious metals, silver continues to rise in prices unless the global economy proves weaker price, while gold has stabilised at a high level of than expected. just under USD 1 400 per troy ounce. Although gold is under pressure from the stronger dollar, Jörgen Kennemar there is still an underlying demand, not least due to growing inflation concerns, the same time that 3 (4)

- 4. Energy & Commodities Monthly newsletter from Swedbank’s Economic Research Department, continued No. 1 • 12 January 2011 Swedbank Commodity Index - US$ - Swedbank Commodity Index - SKr - Basis 2000 = 1oo 12/01/11 Basis 2000 = 1oo 12/01/11 10.2010 11.2010 12.2010 10.2010 11.2010 12.2010 Total index 288.2 297.1 314.2 Total index 209.0 220.3 233.6 Per cent change month ago 5.5 3.1 5.8 Per cent change month ago -0.2 5.4 6.1 Per cent change year ago 17.8 16.5 25.0 Per cent change year ago 13.1 14.8 19.7 Total index exclusive energy 279.4 283.8 292.7 Total index exclusive energy 202.6 210.4 217.6 Per cent change month ago 2.1 1.6 3.1 Per cent change month ago -3.4 3.9 3.4 Per cent change year ago 35.6 34.3 33.2 Per cent change year ago 30.2 32.3 27.6 Food, tropical beverages 256.7 270.1 286.2 Food, tropical beverages 186.1 200.2 212.8 Per cent change month ago 4.4 5.2 6.0 Per cent change month ago -1.2 7.6 6.3 Per cent change year ago 19.3 23.4 26.1 Per cent change year ago 14.5 21.6 20.8 Cereals 252.5 257.1 278.9 Cereals 183.1 190.6 207.4 Per cent change month ago 5.2 1.8 8.5 Per cent change month ago -0.5 4.1 8.8 Per cent change year ago 34.9 29.7 36.2 Per cent change year ago 29.4 27.8 30.5 Tropical beverages and tobacco 270.9 285.2 301.5 Tropical beverages and tobacco 196.4 211.4 224.2 Per cent change month ago 2.5 5.3 5.7 Per cent change month ago -3.1 7.6 6.0 Per cent change year ago 14.4 21.1 22.5 Per cent change year ago 9.8 19.4 17.4 Coffee 161.6 173.9 183.8 Coffee 117.2 128.9 136.7 Per cent change month ago -1.2 7.6 5.7 Per cent change month ago -6.5 10.0 6.0 Per cent change year ago 33.4 45.3 47.0 Per cent change year ago 28.1 43.2 40.9 Oilseeds and oil 228.7 246.1 258.0 Oilseeds and oil 165.8 182.4 191.8 Per cent change month ago 9.1 7.6 4.8 Per cent change month ago 3.2 10.0 5.1 Per cent change year ago 22.4 25.2 28.7 Per cent change year ago 17.4 23.4 23.3 Industrial raw materials 286.0 287.8 294.6 Industrial raw materials 207.4 213.3 219.0 Per cent change month ago 1.5 0.6 2.3 Per cent change month ago -4.0 2.9 2.6 Per cent change year ago 40.6 37.6 35.4 Per cent change year ago 35.0 35.6 29.7 Agricultural raw materials 185.7 190.7 193.2 Agricultural raw materials 134.6 141.4 143.6 Per cent change month ago 6.1 2.7 1.3 Per cent change month ago 0.4 5.0 1.6 Per cent change year ago 27.4 24.8 23.1 Per cent change year ago 22.2 23.0 18.0 Cotton 112.5 132.0 140.8 Cotton 81.6 97.9 104.7 Per cent change month ago 16.2 17.3 6.7 Per cent change month ago 10.0 20.0 7.0 Per cent change year ago 71.5 92.1 88.5 Per cent change year ago 64.6 89.4 80.6 Softwood 153.5 149.3 144.6 Softwood 111.3 110.7 107.5 Per cent change month ago 2.9 -2.7 -3.1 Per cent change month ago -2.7 -0.5 -2.9 Per cent change year ago 13.5 6.5 3.4 Per cent change year ago 8.9 5.0 -0.9 Woodpulp 966.4 956.9 949.8 Woodpulp 700.6 709.4 706.2 Per cent change month ago -0.6 -1.0 -0.7 Per cent change month ago -6.0 1.2 -0.5 Per cent change year ago 30.4 23.9 19.3 Per cent change year ago 25.1 22.1 14.3 Non-ferrous metals 263.7 264.0 275.6 Non-ferrous metals 191.2 195.7 204.9 Per cent change month ago 8.1 0.1 4.4 Per cent change month ago 2.3 2.4 4.7 Per cent change year ago 28.6 24.4 22.2 Per cent change year ago 23.4 22.6 17.0 Copper 8291.8 8469.1 9130.1 Copper 6011.6 6278.2 6788.0 Per cent change month ago 7.6 2.1 7.8 Per cent change month ago 1.8 4.4 8.1 Per cent change year ago 31.9 26.9 31.1 Per cent change year ago 26.6 25.0 25.6 Aluminium 2346.1 2332.6 2347.4 Aluminium 1700.9 1729.2 1745.2 Per cent change month ago 8.5 -0.6 0.6 Per cent change month ago 2.7 1.7 0.9 Per cent change year ago 24.9 19.7 7.8 Per cent change year ago 19.9 18.0 3.2 Lead 2379.0 2376.1 2404.9 Lead 1724.8 1761.4 1788.0 Per cent change month ago 8.9 -0.1 1.2 Per cent change month ago 3.1 2.1 1.5 Per cent change year ago 6.2 2.9 3.5 Per cent change year ago 1.9 1.5 -0.9 Zinc 2371.8 2291.1 2272.7 Zinc 1719.6 1698.4 1689.7 Per cent change month ago 10.3 -3.4 -0.8 Per cent change month ago 4.3 -1.2 -0.5 Per cent change year ago 14.5 4.5 -3.9 Per cent change year ago 9.9 3.0 -8.0 Nickel 23802.0 22905.5 24055.5 Nickel 17256.5 16979.9 17884.7 Per cent change month ago 5.1 -3.8 5.0 Per cent change month ago -0.5 -1.6 5.3 Per cent change year ago 28.5 34.8 41.6 Per cent change year ago 23.3 32.9 35.6 Iron ore, steel scrap 605.3 603.0 607.0 Iron ore, steel scrap 438.8 447.0 451.3 Per cent change month ago -8.6 -0.4 0.7 Per cent change month ago -13.5 1.9 1.0 Per cent change year ago 75.0 75.0 73.4 Per cent change year ago 68.0 72.5 66.1 Energy raw materials 292.1 303.0 323.8 Energy raw materials 211.8 224.6 240.7 Per cent change month ago 7.1 3.7 6.8 Per cent change month ago 1.3 6.1 7.2 Per cent change year ago 11.6 10.4 21.9 Per cent change year ago 7.1 8.8 16.8 Coking coal 369.2 406.7 454.7 Coking coal 267.7 301.5 338.1 Per cent change month ago 4.1 10.2 11.8 Per cent change month ago -1.6 12.6 12.1 Per cent change year ago 36.8 38.6 48.5 Per cent change year ago 31.3 36.6 42.3 Crude oil 288.6 298.3 317.8 Crude oil 209.2 221.1 236.3 Per cent change month ago 7.2 3.4 6.5 Per cent change month ago 1.5 5.7 6.8 Per cent change year ago 10.4 9.0 20.5 Per cent change year ago 6.0 7.4 15.5 Source : SWEDBANK and HWWA-Institute for Economic Research Hamburg Source : SWEDBANK and HWWA-Institute for Economic Research Hamburg Swedbank Economic Research Department Swedbank’s monthly Energy & Commodities newsletter is published as a service to our customers. We believe that we have used reliable sources and methods in the preparation SE-105 34 Stockholm, Sweden of the analyses reported in this publication. However, we cannot guarantee the accuracy or Phone +46-8-5859 7740 completeness of the report and cannot be held responsible for any error or omission in the ek.sekr@swedbank.se underlying material or its use. Readers are encouraged to base any (investment) decisions www.swedbank.se on other material as well. Neither Swedbank nor its employees may be held responsible for Legally responsible publisher losses or damages, direct or indirect, owing to any errors or omissions in Swedbank’s Cecilia Hermansson, +46-88-5859 7720 monthly Energy & Commodities newsletter. Magnus Alvesson, +46-8-5859 3341 Jörgen Kennemar, +46-8-5859 7730 4 (4)