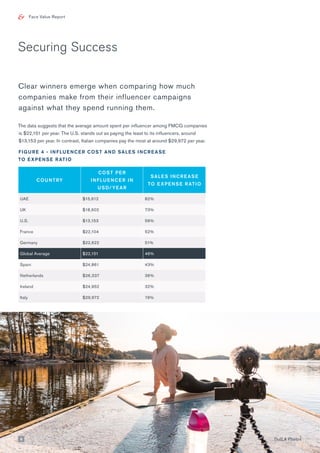

The report analyzes the impact of influencer marketing in the fast-moving consumer goods (FMCG) industry, revealing that nearly a quarter of companies faced significant losses due to negative influencer experiences, while almost half expect to allocate a substantial portion of their marketing budget to influencers. Despite the risks, successful campaigns can yield significant returns, with one in ten companies generating millions in sales; however, credibility concerns persist, as 70% of respondents doubted an influencer's follower count. The study highlights the growing importance of influencers in marketing strategies across various sectors, with mixed results reflecting varying levels of success and risk management.