Kantar BrandZ Top 75 Most Valuable Indian Brands 2023- Report_Under Embargo till Thursday 28th Sept, 7.30 PM, IST..pdf

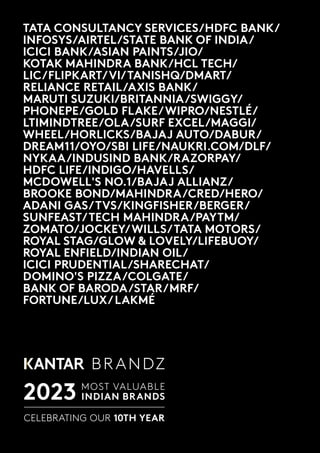

- 1. TATA CONSULTANCY SERVICES/HDFC BANK/ INFOSYS/AIRTEL/STATE BANK OF INDIA/ ICICI BANK/ASIAN PAINTS/JIO/ KOTAK MAHINDRA BANK/HCL TECH/ LIC/FLIPKART/VI/TANISHQ/DMART/ RELIANCE RETAIL/AXIS BANK/ MARUTI SUZUKI/BRITANNIA/SWIGGY/ PHONEPE/GOLD FLAKE/WIPRO/NESTLÉ/ LTIMINDTREE/OLA/SURF EXCEL/MAGGI/ WHEEL/HORLICKS/BAJAJ AUTO/DABUR/ DREAM11/OYO/SBI LIFE/NAUKRI.COM/DLF/ NYKAA/INDUSIND BANK/RAZORPAY/ HDFC LIFE/INDIGO/HAVELLS/ MCDOWELL'S NO.1/BAJAJ ALLIANZ/ BROOKE BOND/MAHINDRA/CRED/HERO/ ADANI GAS/TVS/KINGFISHER/BERGER/ SUNFEAST/TECH MAHINDRA/PAYTM/ ZOMATO/JOCKEY/WILLS/TATA MOTORS/ ROYAL STAG/GLOW & LOVELY/LIFEBUOY/ ROYAL ENFIELD/INDIAN OIL/ ICICI PRUDENTIAL/SHARECHAT/ DOMINO'S PIZZA/COLGATE/ BANK OF BARODA/STAR/MRF/ FORTUNE/LUX/LAKMÉ

- 2. 3 2

- 3. 5 4 THE TOP 75 MOST VALUABLE INDIAN BRANDS IN 2023 HAVE A COMBINED VALUE OF YEAR-ON-YEAR CHANGE TOP 10 MOST VALUABLE INDIAN BRANDS 2023 Brand Value (US$M) $379 BILLION -4% TATACONSULTANCY SERVICES #1 $42,969 BUSINESSTECHNOLOGYAND SERVICES PLATFORMS HDFC BANK #2 $33,612 FINANCIALSERVICES INFOSYS #3 $24,170 BUSINESSTECHNOLOGYAND SERVICES PLATFORMS AIRTEL #4 $22,517 TELECOM PROVIDERS STATE BANK OF INDIA #5 $14,483 FINANCIALSERVICES ICICI BANK #6 $12,976 FINANCIALSERVICES ASIAN PAINTS #7 $12,839 PAINTS JIO #8 $11,773 TELECOM PROVIDERS KOTAK MAHINDRA BANK #9 $10,332 FINANCIALSERVICES HCL TECH #10 $9,361 BUSINESSTECHNOLOGYAND SERVICES PLATFORMS COMPOSITION OF THE TOP 75 BRAND VALUE BY CATEGORY Financial services $379 Bn Telecom providers Retail Food & Beverages Automotive Paints Others* Business/consumer technology and services platforms Personal care - 3% Home care - 2% Tobacco - 2% 29% 26% 11% 8% 5% 5% 4% 7% * Includes Alcohol, Travel Services, Energy, Real Estate Developers, Gambling, Media and Entertainment, Apparel, Home Appliances and Fast Food GDP 2022 (US$M) GDP GROWTH RATE 2022 FORECAST GDP GROWTH 2023 GDP PER CAPITA 2022 (US$M) $3.29 trillion 6.8% 5.9% $8,379 NEW AND RE-ENTERING BRANDS IN THE TOP 75 NEW NEW NEW NEW RE-ENTRY RE-ENTRY $1,297 72 2023 Brand Value Financial Services Consumer Technology and Services Platforms Media and Enterainment Financial Services Financial Services Automotive 2023 Rank $4,473 21 2023 Brand Value 2023 Rank $1,333 67 2023 Brand Value 2023 Rank $1,303 71 2023 Brand Value 2023 Rank $1,997 48 2023 Brand Value 2023 Rank $1,315 70 2023 Brand Value 2023 Rank

- 4. 7 6 1 51 Automotive 1,896 59% 2 47 Automotive 2,008 48% 3 54 Food and Beverages 1,831 40% 4 59 Tobacco 1,748 39% 5 22 Tobacco 4,127 36% 6 4 Telecom Providers 22,517 29% 7 17 Financial Services 5,589 28% 8 60 Automotive 1,712 24% 9 19 Food and Beverages 5,326 24% 10 64 Automotive 1,461 19% LEVELLING UP WOMEN’S OPPORTUNITIES IMPROVING TOP 10 RISERS 6 Column Diploma/Graduates/ Postgraduates 36% 28% Single women (unmarried/separated) 20% 19% Savings account 78% 53% Access to internet 84% 54% Online shopping (functional) 37% 16% Social networking (social) 43% 22% 2015 2022 Social metrics Economic metrics Digital inclusion LOGGING ONTO GREATER EQUITY INTERNET USER PENETRATION IN RURAL POPULATION 41% <24 years 48% 25-44 years 30% 45+ years PURPOSE IS PARAMOUNT INDEX SCORES ACROSS INDIAN BRANDS Convenience 109 101 111 Purpose 113 105 115 Top 30 Top 75 All brands LIVING IN DIGITAL INDIA 2022 2025 Online shoppers added in the last 3 years Active social media users 37% are millennials Combined revenue of 10 D2C Brands in FY20 Online shoppers expected to be added in the next 3 years Active social media users Addressable market size for D2C brands 125 M+ 500 M+ $0.44 Bn 80 M+ 750 M+ $100 Bn+ Brand Value 2023 (US$M) Year-on-Year change 2023 Rank Category Brand Sr.No

- 5. 9 8 WELCOME 1 2 INTRODUCTION MOST VALUABLE INDIAN BRANDS 3 BRAND ANALYSIS CLIENT PERSPECTIVES 4 6 5 THOUGHT LEADERSHIP & BRAND BUILDING RESOURCES 20 – KEY FINDINGS 22 – ECONOMIC OVERVIEW 26 – ECONOMY & DEMOGRAPHICS 04 – INFOGRAPHIC 10 – WELCOME 12 – WHAT IS KANTAR BRANDZ? 30 – CROSS-CATEGORY TRENDS 38 – FAST-MOVING CONSUMER GOODS 42 – DIGITAL INDIA 48 – WOMEN IN INDIA 54 – RURAL INDIA 62 – TOP 75 MOST VALUABLE INDIAN BRANDS 2023 66 – BRAND VALUE 74 – BUILDING RESILIENT BRANDS 80 – FUELLING DEMAND 84 – DEMONSTRATING VALUE 88 – THE BIGGER PICTURE 144 – BRAND VALUATION METHODOLOGY 152 – GOING GLOBAL 158 – KANTAR IN INDIA 164 – OUR BRAND EXPERTS 170 – KANTAR BRANDZ INDIA TEAM 94 – FLUIDITY, SOUMYA MOHANTY 98 – THE REMAINING OPPORTUNITY FOR INDIA’S IT INDUSTRY, PUNEET AVASTHI 104 – THE GREAT INDIAN MONEY MANAGER, K RAMAKRISHNAN 110 – UNSEEN BUT GLARING, POONAM KUMAR 116 – VALUE TO CONSUMER IS KEY TO FACING ECONOMIC HEADWINDS, RANJANA GUPTA 124 – THE TRANSFORMATION OF BRAND STORYTELLING, HARISH BHAT, TATA SONS 128 – MAKING CONNECTIONS, SHASHWAT SHARMA, BHARTI AIRTEL LIMITED 132 – AI-POWERED PROGRESS, SUMIT VIRMANI, INFOSYS 136 – UNIQUENESS AT SCALE, RAVI SANTHANAM, HDFC BANK

- 6. 11 10 Welcome BIG ACHIEVEMENTS, BIGGER ASPIRATIONS In the past few months, India has successfully landed a craft on the surface of the moon – something only three other countries have ever done before. And it’s achieved that not just safely but also efficiently. The project cost less than $75 million, which in space budget terms is tiny. The landing is cause for celebration in many ways, and I’m highlighting it here because it says so much about India today – what has been achieved to date, and where the country’s aspirations lie. As we celebrate the brands that feature in this Kantar BrandZ Top 75 Most Valuable Indian Brands ranking, we are also reflecting on a decade of change and development in India. There has been huge economic progress, of course; GDP has grown by nearly 50%, and the effects of technology have been immense. But we have also seen change at a very human level. People have more choice, more freedom, and greater agency to fulfil their aspirations. Life expectancy in India has risen by close to five years in the past decade. Brands play a key role in people’s changing lives, and not just because many of them supply the products and services that we all use day to day. Beyond the very powerful practical benefits of brands, brands also bring emotional value to people’s lives. They bring trust, excitement, indulgence, convenience and fun. These feelings are part of what helps create the richness of modern life. Progress is not just having more possessions; it’s the way you feel and what you believe is possible. Brands play a key role in these feelings and beliefs. For businesses, there are significant benefits to investing in brands, and as we face yet another set of macro-economic challenges, it’s a good time to remember that strong brands give a business better prospects and heightened resilience. An abundance of research by Kantar and others leaves no doubt: strong brands decline less and recover faster during times of crisis. It’s not often that I begin a discussion of brands by talking about space exploration, but as I welcome you to this ranking and report, which marks 10 years of Kantar BrandZ in India, I feel there’s an important point to be made. Deepender Rana Executive Managing Director, South Asia Insights Division, Kantar deepender.rana@kantar.com In the pages ahead we look at some of the ways this fast- changing consumer market is evolving, with a specific focus on digitisation, Indian women, the rise of rural markets, the after-effects of the pandemic, and global inflation. There is also a collection of excellent thought leadership essays from some of our own Kantar experts in India, as well as special guest interviews and essays from leaders at Tata, HDFC Bank, Airtel and Infosys – just some of the Indian brands that are turning local success into global impact. This is a market of consumers with big aspirations and high expectations. Brands must also think big – and think beyond their home market. The space programme that celebrated a lunar landing in August was launching its next mission – to put an observatory in orbit around the Sun – just one week later. Such is the pace of progress in India today, and a similar pressure to keep on moving exists for brands. Kantar BrandZ is where theory meets real-world experience, and is reflected in the business bottom line. We’re here to help you understand the present and plan for the future. Please reach out to any of the Kantar professionals in the Resources section of this report, or feel free to connect with me directly. All the best, The Kantar BrandZ ranking is proof of that. We began by measuring just the Top 50 most valuable brands in India, and if we look at how the Top 50 has fared over the past 10 years, there is clear evidence that strong brands power strong businesses. They have improved in value at a compound annual growth rate of 19% – a tremendous result that demonstrates the real- world impact of investing in brand building. But it’s not just that Indian brands have grown in value; they have shifted in outlook. Brands young and old feature in this report; many have a rich heritage that predates the internet age by a century or more. Others could not have existed much more than a decade ago. What they have in common is that their success is built on relevance to contemporary consumers. No longer do Indian brands aim to be ‘as good’ as the global market leader. They aim to be that leader. To break new ground, do things better, more efficiently, and often in a distinctly Indian way. Fresh perspective India’s growth on the world stage has been fuelled by its brands, and vice versa. Over the past decade, the rise to prominence of our technology services and automotive brands in particular have, like the lunar landing, broadened international perceptions of what it means to be Indian. They signal quality and expertise, and reflect the country’s growing GDP and its rise up the world’s ranking of economies. A decade ago, India ranked 10th, after Italy, based on the size of its economy. By 2030, it is expected to be #3. Indian brands are also generating what we call ‘soft power’ for India. Just as Coca-Cola, Levi’s and MTV took American culture to the world, Indian exports are doing the same. Think not just of consumer goods and services, but also Bollywood and yoga. The next decade will see further development of both Indian brands and Brand India. How Kantar helps brand builders Strong brands start with a deep understanding of consumers. This report and ranking is based on the Kantar BrandZ model of measuring brand value, linking financial data with the all-important voice of the consumer. Through our unique and validated methodology, we will demonstrate how the different elements of brand equity directly influence financial value. We can identify and examine the attributes shared by valuable brands across all categories, and show how strength in different attributes can drive market share and help brands justify their pricing.

- 7. 13 12 What is Kantar BrandZ? 5.4 BILLION DATA POINTS 4.2 MILLION CONSUMER INTERVIEWS 21,000 BRANDS 540 CATEGORIES 54 MARKETS THE DEFINITIVE GUIDE TO BRAND BUILDING WHAT IS ? Kantar BrandZ ranks the most valuable brands in the world... and shows you how to become one of them. It is the world’s largest, consumer-focused source of brand equity insight, which also powers our proprietary brand valuation methodology. Kantar BrandZ brings you industry-leading brand valuations, along with research from the world’s most extensive brand equity study: Over 4.2 million consumer interviews covering 21,000 brands across 540 categories in 54 markets. This brand valuation series began in 1998 to help researchers, planners, and strategists better understand the brands they worked on. Our reports rank, analyse, and honour the world’s top brands. Kantar BrandZ has become a global standard brand value ecosystem, featuring our flagship Global Most Valuable Brands ranking and report. It also features country and regional rankings across six continents, and world-class thought leadership on building strong brands.

- 8. 15 14 What is Kantar BrandZ? HOW DOES WORK? The proportion of the total $ value of the parent company that can be attributed to the brand in question, considering both current and future performance. STEP 01 FINANCIAL VALUE ($) BRAND CONTRIBUTION (%) The proportion of financial value generated by the brand’s ability to increase purchase volume and charge a premium. STEP 02 The amount that the brand contributes to the overall business value of the parent company. Kantar BrandZ valuations isolate the value generated by the strength of the brand alone in the minds of consumers i.e. with all other elements removed. STEP BRAND VALUE ($) 03 We start by examining relevant corporate financial data and stripping away everything that doesn’t pertain to the branded business. We also conduct ongoing, in-depth quantitative consumer research with more than 170,000 consumers annually, and globally, to assess consumer attitudes about, and relationships with thousands of brands. Then a team of our analysts combine those inputs with a financial model of the business to determine the brand’s ability to generate value. The result is a holistic portrait of brand equity: one that incorporates how the market values a company’s brand assets – and how ordinary people do, too. WHAT CAN DO FOR YOU? STRONG BRANDS: DELIVER SUPERIOR SHAREHOLDER RETURNS ARE MORE RESILIENT IN TIMES OF CRISIS RECOVER MORE QUICKLY Kantar BrandZ research data is uniquely linked to financial outcomes. Our analysis has repeatedly proven that businesses that invest in their brands outperform the market… and that investing in your brand remains the most powerful way to grow. What’s more, we can show you how. Our data and frameworks work to create a forensic portrait of a brand’s strengths, weaknesses and opportunities, within one or many categories and markets. Get essential insight on category trends and macroeconomic shifts – and how brands compare across crucial building blocks of brand value like Trust, Meaning, Innovation, Difference, and Responsibility.

- 9. 17 16 Don’t just take our word for it University of Oxford’s Saïd Business School has studied Kantar BrandZ brand valuations and compared them against the real-world ups and downs of business. They found that Kantar BrandZ equity metrics are an excellent predictor of ‘abnormal’ business returns – those not explained by historical share price performance and company results alone – and that adding Kantar BrandZ measures to their models allowed them to predict business performance with 99.5% accuracy. What they also found was that Difference contributed most to the best business results. What is Kantar BrandZ? THE BUILDING BLOCKS OF BRAND EQUITY The most valuable brands in the world have built powerful connections allowing them to create shareholder value faster, resist market downturns, and recover sooner from recessions. Brands with powerful connections have three essential qualities: they are Meaningful, Different, and Salient. Behavioural science has taught us that our brains store memories using three types of mental connection: knowledge, feelings, and experience. Brands with a balance of each come to mind most easily – quickly activating the brain’s memory-retrieval processes. Effective marketing delivers all three informing us of what a brand is or does; providing an emotional context and tapping into our emotional needs; and ensuring a positive experience of the brand when used. The strongest brands – ones that have built up deeper and broader connections over time – end up with three essential qualities: they are Meaningful, Different, and Salient to consumers. Brands with powerful connections are... Meaningful: The extent to which brands create clear and consistent functional and emotional connections with consumers. Meaningful brands meet people’s needs in a way that demonstrates warmth. Different: The extent to which a brand is seen to offer something that others don’t and lead the way. Different brands are hard to substitute and often offer something new. Salient: The mental availability of the brand - how quickly and easily it comes to mind when choosing between options. A brand’s most fundamental role is as a shortcut for decision-making. KANTAR BRANDZ ANALYSIS PROVES THAT STRONG BRAND EQUITY IS GROWING SHARE PRICES FASTER AND HIGHER OVER THE LONG TERM % growth vs. 2006 To February 2020 and to April 2023 February 2020 April 2023 SP 500 162 231 Kantar BrandZ Strong Brands 228 321 Kantar BrandZ strong brands portfolio grew +228% vs. 2006 share prices by February 2020 In absolute terms, over the next 3 years it added a further Compared to +69% for the SP 500 +93% growth

- 10. 19 18 INTRODUCTION 20 – KEY FINDINGS 22 – ECONOMIC OVERVIEW 26 – ECONOMY DEMOGRAPHICS

- 11. 21 20 MARKET CORRECTION PUTS BRANDS UNDER PRESSURE Key Findings Top 75 Indian brands worth $379 billion The Kantar BrandZ Top 75 Most Valuable Indian Brands this year has a combined value of $379 billion. This is 4% lower than the value of the Top 75 a year earlier and reflects the strain that businesses and consumers have been under in recent times – a perfect storm of supply chain challenges, rising interest rates, and market uncertainty. By comparison, the Top 100 Most Valuable Global Brands declined in value by 20% between 2022 and 2023. In this context, and given that so many of India’s most valuable brands serve a global market, a dip is to be expected. Variation reflects category stresses While the overall value of the Top 75 ranking is down 4% this year, this average perhaps masks some of the much bigger ups and downs that many of the individual brands have seen. The main downward force on the ranking has come from a decline in the value of brands in the Business Technology and Services Platforms and Consumer Technology and Services Platforms categories, which have significant exposure to international markets. Real Estate Developers and Energy brands also saw big falls. Financial Services, Telecom Providers and Automotive brands, meanwhile, have had a good year overall thanks to a boom in digital banking, the end of price wars in mobile phone services, and a fast response on the part of several carmakers to changing market demands. 4 new entrants to largely stable ranking There are 58 brands in the Top 75 that have featured every year since 2019; this year, there are four new entrants and two brands have re-entered the ranking after some time away. PhonePe is the highest of the newcomers, in 21st position, a digital payments brand that has caught a wave of consumer interest in online financial services. Cred (ranked 48th) is another in the same sector, and stands out for taking a break from category norms with its communications around consumer credit. ShareChat, the photo and video sharing app, provides access in 14 local languages and has quickly become a hit. It joins the Top 75 in 67th. Star entertainment services makes its Kantar BrandZ debut this year, and Bank of Baroda and MRF re- enter the ranking after some time away. Top performers highlight value of brand The value to businesses of investing in brand equity is underlined by our analysis of the Top 75 this year. Those names that have worked hard, over many decades in some cases, to stand out in consumers’ minds as being different to their rivals in ways that really matter, are those that have reaped the rewards later. These are the brands that have had resilience baked into them, and when the market correction came, they fell less far and recovered more quickly than the rest. This resilience is evident in the stock market performance of the companies behind the brands. Investing in brand building pays off. Convenience high on consumers’ wishlist The brands with the highest levels of Demand Power – a Kantar BrandZ metric that is closely linked to market share – are those that consumers perceive as offering the greatest convenience and having the strongest sense of purpose. As the world gets ever busier, people are looking for ways to conserve their time and save it for the things that matter most to them. Expectations of convenience have been bolstered by broadening access to technology and all that comes with it – from ecommerce to digital banking. Stand out to justify pricing The Indian brands that do the best job of justifying their pricing – and even justifying a premium – are those that strike consumers as being truly distinctive. They offer something that no other brand can. Often that stand-out factor comes from a brand being seen as a specialist in its field. Brands with what we call Pricing Power are best placed to resist the pressure to discount when consumer budgets are strained; these brands are seen as being ‘worth it'. Sustainability credentials are becoming more important by the day Public concern around sustainability – and this includes the fair treatment of people as well as taking care of the planet – is a much bigger influence on consumer decision- making here in India than it is in much of the rest of the world. Our analysis highlights two important findings: the more sustainable brands tend to drive market share, and perceptions around the sustainability of the Top 75 brands is lower than for all Indian brands. There’s an opportunity here to build brands while doing the right thing.

- 12. 23 22 Economy ECONOMIC OVERVIEW While much of the world is mired in gloom about the state of world economics, politics, and plenty else, there’s a sense of relative buoyancy in India – a cautiously positive outlook regarding economic growth and development, and a feeling among consumers that the challenges they face are manageable. Inflation might be a new phenomenon to generations of consumers in the Western world, but here in India, we know inflation well. Even rates around the 6-7% mark, as we’ve seen over the past year, are not enough to spook a population that knows from experience that these things come and go. What is newly challenging, however, is India having to deal with a global market for exports that is grappling with the effects of inflation, and at the same time managing strained supply chains and geopolitical tensions. India’s economy grew at 6.8% in 2022 – outpacing almost every other major economy – and putting the country in fifth place globally based on size of GDP, taking over from the UK. The International Monetary Fund is predicting growth of 5.9% for India in 2023, putting the country’s growth well ahead of its neighbours but also much of the rest of the world. Growth in the US, for example, is expected to be around 1.6%, global growth is expected to average 2.8%, and China is on track for growth of 5.2% after a 3.0% increase in 2022. If the wind in India’s sails continues to blow, the country will surpass Germany to become the fourth-biggest economy in 2026, and will then have Japan in its sights. Businesses seeking to diversify their manufacturing supply chains by moving beyond China are looking at India afresh; Apple has increased its India-based production and hinted that more is on the way, and the CEO of Taiwan’s Foxconn has expressed keenness to ‘deepen partnerships’ in India. A burgeoning manufacturing sector would help India address one key barrier to future growth: employment opportunities. This is a market with young and growing population – and a fairly high unemployment rate, which in early 2023 was 6.8%, down from 8.2% a year earlier. The number of people comprising India’s workforce is already over 900 million, and could soon be bigger than China’s. Job creation is essential to the health of the national economy. Varied effects The impact of wider economic change on people’s everyday lives in India is not well represented by averages. This is a market in which few people are average; there is a resilient and affluent upper class that, for now, remains largely unaffected by inflation, and a large tier of low-income earners who have been protected from rising prices for essentials by government aid schemes and subsidies. The proportion of households with total monthly income of ₹40,000+ has doubled in the past three years, from 3% to 6%. At the same time, the proportion in the ₹15,001-20,000 bracket has also surged, from 17% to 23%. The effect of this shift on shopping habits has been considerable; 59% of people now say they prefer premium products, up from 42% three years ago, and 52% (up from 41%) say they pay extra to personalise products to suit their style and tastes. Rich getting richer – changing incomes 2019-2022 Population Income Groups (2022 AHI) Base: All India Urban, 15 to 55 yrs: 2019 - 38007, 2022 - 39798 Source: Kantar TGI 2019,2022 Kantar Global Monitor 1.2% (US$9000) 19 3 17 197 3% 0.7% 18% 78% 7% (US$6000-9000) 24% (US$3000-6000) 68% (Upto US$3000) 2019 2022 Population (2022 - in Mn)

- 13. 25 24 The automotive sector tells a compelling story about buoyancy at the top end. In the 150CC+ bike segment, for example, there’s been a surge in sales of premium bikes and, as a result, higher demand for premium fuels and accessories. Even among first-car buyers, there’s a shift from hatchbacks into an emerging compact SUV category as people raise their expectations of product and experience. At the lower end of the income scale, the effects of the pandemic and then post-pandemic inflation have been dampened by ongoing government aid. Grants of free food grains, launched during COVID times, were extended for the whole of 2023. The impact of this is to free up spending for other products and categories such as education – widely viewed as children’s ticket to a better life than their parents have had. The resilience of the top and the bottom of the consumer market is powering what we’re calling ‘K-shaped’ growth. In between the rich and the poor is what we might call the ‘squeezed middle’ – people who have a little money and some job security, but who are definitely feeling the pinch on household budgets and are worried about what lies ahead. What’s clear is that consumer sentiment and behaviour are not tracking back towards their pre-COVID ‘normal’. Overall, there is a sense of cautious optimism. People feel, after three years of being unpleasantly surprised by global events, that the next nasty shock may be just around the corner. This is tempered somewhat by a desire to move on and make the most of the opportunities available now. What’s curious is that how people feel about the future isn’t necessarily commensurate with people’s current situation. Those in the most precarious position now are often those feeling bullish about what’s ahead. In a sense, for them, things can only get better. Others with more security are often more nervous about the future, Kantar research shows. Overall, though, the picture is one of cautious optimism; a considerably more rosy outlook than the global average. Things are going very/fairly well financially in my country Uptick in optimism Percentage of customers who agree Things are going very/fairly well with my personal financial situation Source: Economic Survey - '22-23 Kantar Global Monitor 2018 2019 2020 2021 2022 0 10 90 80 70 60 50 40 30 20 43% 44% 46% 35% 35% 60% 72% 77% 79% 70% India Global 2018 2019 2020 2021 2022 0 10 90 80 70 60 50 40 30 20 54% 57% 58% 55% 53% 68% 82% 82% 82% 74% India Global Shifting from valuations to value creation The heat surrounding Indian start-ups for the past few years has dissipated, with the cost of borrowing and a decreased appetite for risk having a cooling effect on investor sentiment. Rather than plunge into new deals, investors are opting to focus instead on profitability, backing proven businesses in their existing portfolios. This is a global phenomenon, not just an Indian one, although the ‘funding winter’ is hitting Indian start-ups hard. The number of unicorns born in India dropped from 44 in 2021 to 23 in 2022. Globally, there was a 55% drop in the number of start-ups attaining a valuation of $1 billion or more. GlobalData figures show that 459 venture capital (VC) deals worth $3.4 billion were closed in India between January and May 2023, a substantial decline on the 851 deals worth $13.3 billion closed in the same period a year earlier. In April, India’s Business Today reported that the first quarter of 2023 saw no new unicorns created, compared to 14 in the same period a year earlier. Yet there is one irresistible lure for investors, even in the current conditions: artificial intelligence. Among the leading AI deals struck so far in 2023 is the $250 million investment by Qatar Investment Authority, as well as further funds from Microsoft in Builder.ai, an AI-powered software creator, and Mad Street Den, a computer vision and AI company that raised $30 million in a funding round led by Avatar Growth Capital. Economy

- 14. 27 26 26 CENTRES OF POPULATION TOTAL POPULATION 2022: 1.44 BILLION POPULATION GROWTH RATE: 0.8% URBAN POPULATION 2023: 36.4% RATE OF URBANISATION (2020-2025 EST): 2.33% Economy Demographics 27 POPULATION BY AGE GDP 2022: $3.29 TRILLION GDP GROWTH RATE 2022: 6.8% FORECAST GDP GROWTH 2023: 5.9% GDP PER CAPITA 2022: $8,379 GDP 3.3 MILLION KM2 1.2 MILLION MI2 29 STATES AND 7 UNION TERRITORIES LAND AREA NUMBER LIVING ON LESS THAN $2.15 PER DAY: 146 MILLION POPULATION BELOW POVERTY LINE LANGUAGES MEDIAN AGE 38.4 33.2 31.1 28.7 40.6 38.5 FOREIGN DIRECT INVESTMENT US$BILLION 2018 42.2 2019 50.6 2020 64.0 2021 47.4 2022 52.3 24.77% 68.42% 6.8% 0-14 years 15-64 years 65 years and over Hyderabad Bangalore Chennai New Delhi Mumbai Kolkata 10.8 million 13.6 million 11.8 million 32.9 million 21.3 million 15.3 million 22 OFFICIAL LANGUAGES 121 LANGUAGES AROUND 20,000 DIALECTS Sources: International Monetary Fund, Statista, CIA World Factbook, India Briefing, Scroll.in.

- 15. 28 INDIA IN FOCUS 30 – CROSS-CATEGORY TRENDS 38 – FAST-MOVING CONSUMER GOODS 42 – DIGITAL INDIA 48 – WOMEN IN INDIA 54 – RURAL INDIA

- 16. 31 30 CROSS-CATEGORY TRENDS Cross-Category Trends Cross-Category Trends HYGIENE FOCUS SWITCHES TO WELLNESS The importance of prioritising good health was thrown into the spotlight during the COVID-19 pandemic, and consumers responded by doing what they could to improve and maintain their physical health. Now that the crisis has subsided, and sales of soap, sanitiser, and home cleaning agents have subsided to their pre-pandemic levels, Indian consumers are taking a slightly different approach to looking after themselves, shifting their focus from health and cleanliness to health and wellness. Kantar research shows that two-thirds of Indians say they are actively trying to improve their health, and not just their physical health. A higher proportion of Indians than the global average say they are consulting with mental health or traditional healing practitioners, practising meditation or mindfulness, eating natural, organic food, and monitoring their own health on a regular basis. Health now means not just physical strength and fitness, but also feeling good to look good, having confidence, doing what makes you feel good, eating and sleeping well, and having an active lifestyle and a positive outlook. Sport is seen as a serious life pursuit not just for health but as a career; while most Indian boys have grown up with dreams of playing cricket for their country, that aspiration is becoming more common among girls now, and Indian athletes’ success on the global stage is inspiring interest in other sports. Indian men and women are world leaders in sports as varied as javelin, wrestling, archery, and boxing. It is a curious paradox that consumers are turning both to nature and digital technology to pursue their health goals. The positivity around natural and traditional personal care products, catalysed by the rise of Patanjali, continues to have momentum, though with messaging focused less on the importance of longevity or tradition and more on the benefits of products and their ingredients. Kantar Worldpanel’s research shows that sales (by value) of ‘natural’ products have grown at an annualised rate of 7.7% between the pre-pandemic and post-pandemic periods, while sales of products claiming to support immunity have grown by 17%. Our ICUBE research shows that there are more than 31 million Indians buying medicine online, and 53 million accessing healthcare of various kinds online, from fitness coaching to medical consultations. Health technology is on track to be a high-growth category in the coming years, and the big opportunity for brands seems to be in linking the desire for better health and wellbeing with products and tools enabling people to achieve it. More than a quarter of India’s social media users follow health and fitness influencers. The opportunity is in integrating products, guidance, inspiration, and services into a wellness ecosystem that meets a range of consumer health and lifestyle needs. Ananda Spa, for instance, is offering online wellbeing programs as well as in-person spas, while Apollo 24/7 gives people online medical consultations at their convenience and enables them to order medicines or book lab tests online. Healthkart, PharmEasy, and Netmeds are also offering the flexibility and personalisation of healthcare that consumers now seek; 53% of Indians now say they will pay a premium to personalise what they buy, up from 41% in 2019. Lenskart’s augmented reality spectacles try-on tool responds to these converging trends.

- 17. 33 32 Cross-Category Trends Cross-Category Trends IMPACT OF CLIMATE CHANGE DRIVING SUSTAINABILITY PUSH D2C – PROVIDING A SHORTCUT TO SUCCESS India is on the front line of environmental damage, with catastrophic weather events being linked to climate change, as well as changing rainfall patterns and dangerously high levels of air pollution meaning that the environment is on everybody’s mind. But being on their mind and affecting their shopping list have long been two different things, and a wide gap exists between what people say they’re worried about – and what they’re actually prepared to do about it. This gap appears to be closing, however, and Kantar’s research shows that consumers feel businesses have an obligation to create more sustainable products and services – and make it easier for consumers to identify and afford them. Kantar research shows that 84% of Indians say they want to buy environmentally sustainable products, 62% try to avoid using disposable products, even if it’s less convenient, and 54% now say they will pay more for products that are better for the environment. Just under half say they’re buying second-hand items to reduce waste. They are trying to do their ‘bit’ but expect businesses to match their energies; almost two-thirds of Indian consumers say businesses and governments are more responsible for creating sustainable solutions than they are. There is a much stronger feeling in India than the average in the rest of the world that brands should make environmentally sustainable products affordable to them, not exclusive to a wealthy elite. Brands are heeding the call of consumers to move towards sustainable and affordable options. Many of the businesses that have been launched in recent years are making claims about being clean or green, and for those that are linking their stated purpose with what they’re actually producing, there’s been a warm consumer reception. The organic, fair- trade cotton clothing business ‘No Nasties’, which launched in 2011, is very clearly linking its mission with what it describes as an acute climate crisis. In 2022, its earnings rocketed by more than 900%. The cosmetics brand Forest Essentials, based on Ayurvedic principles, has been expanding beyond India, and in late 2022 opened its first London store. Bigger businesses are also promoting their sustainability credentials, as well as snapping up start-ups that began with a sustainability-led mission. Unilever has invested in skincare start-up BeMinimalist and vegan beauty brand Plum Goodness, while WOW Skin Science, which began as a wellness brand, is now a nature-based personal care brand that saw revenue grow 3.4X in 2022. The continued growth of both social networking and ecommerce has fuelled a surge in the number of businesses that are cutting out the retail middleman and going D2C (direct to consumers). The ability to build a business and a brand without having to negotiate listings with retailers and arrange distribution has lowered the barriers to entry for huge numbers of small and micro businesses, which are linking online listings with digital payments to build successful enterprises. Sellers of everything from coffee, traditional foods, treats, and personal care items are now operating online, serving an estimated 400 million ecommerce users in India. About half of Indian businesses and merchants are now either operating online or are gearing up to; this is a huge jump in the past couple of years, given that only 4% were in the same position in 2019. Kantar’s ICUBE research shows that more than one- third of the country’s internet users are buying via social media platforms; a trend that is only expected to gather momentum over time. That’s more than 57 million people buying via social – with many more to come. And they’re not just in urban areas, but also Bharat (rural India). The social commerce business Gobillion, founded with the goal of making ecommerce social and accessible to people in small towns across India, has been growing sales at the rate of more than 70% per month so far in 2023. While the time it takes for a brand to become well-known and achieve strong sales has come down significantly, many of these nascent businesses are focusing almost exclusively on sales and not differentiation or brand building. This is potentially risky; if they are known, but only for offering something that competing businesses already provide, then they are eminently replaceable in consumers’ minds as soon as something less expensive or more exciting comes along.

- 18. 35 34 INFLUENCERS ARE TRULY SHAPING PURCHASE DECISIONS CONSUMERS ARE VOCAL FOR LOCAL – IF IT’S GREAT For anyone who scoffed at the audacity of online content creators calling themselves ‘influencers’, it’s definitely time to eat some humble pie. Kantar research shows that the average internet user in India now follows 7.5 influencers. A quarter of people follow at least one influencer, and 40% follow more than five. That’s an audience of 26 million people following influencers. Facebook, YouTube, and Instagram are the platforms where consumers prefer to connect with influencers; Kantar research shows that 58% of people who follow an influencer do so via Facebook, 56% do it via YouTube and 46% on Instagram, with far smaller proportions (sub-10%) linking with influencers on either LinkedIn or Twitter. Short video is the preferred format, with YouTube Shorts, Snapchat, and Facebook Short videos winning plenty of interaction. Kantar TGI research shows that in urban India, the consumers most likely to follow influencers tend to skew male and young (age 15-24). The influence of influencers is a global phenomenon but it’s one that our data shows is gaining particular traction in India. Here, 42% of consumers in our TGI research said they followed a broad range of social media influencers who were famous, popular, or entertaining, compared to 29% globally. Half of social media users in India say it’s important to them that they seek ideas and advice from social media influencers, compared to a 25% global average. This influence affects not just how internet users spend their time but also how they spend their money. Our Influencer Pulse study found that three in five consumers in India say they’re likely to try products based on influencers’ recommendations. Trust tends to go up according to the number of followers someone has, and the effect on trial and purchase decision-making is highest among people aged 45-55. One curious phenomenon is that people say that, on average, they trust influencers more than they trust celebrities. Scepticism that the superstars endorsing products in TV ads would actually use the product they’re advertising abounds; there’s a sense that influencers are more authentic, even if they are being paid (and that sponsorship must legally be made clear). Brands as varied as Tetley, Colgate, and Amazon have been working with influencers, often deliberately seeking out people who are not super-well-known to build their authenticity. Colgate, for instance, worked with a YouTuber who had less-than-perfect teeth, and Forest Essentials partnered with a woman living in the Mumbai slums for its communications. Authenticity and consumers’ desire to be part of the conversation around brands can be a double-edged sword, as several brands have found. A YouTube influencer who posted criticism of a sugar-rich milk drink-mix product had his criticisms widely shared, before removing his post after being contacted by the brand. That move that led to another large-scale public conversation about the rights and wrongs of the product and the brand’s handling of the controversy. The idea of having one-way conversations between brands and consumers is old hat, and brands are being judged not just on what they say, but how they engage in conversation. No, this is not about flag waving and patriotism, but rather about unprecedented levels of openness to try and trust home-grown brands – as long as they’re good. The days of international brands being seen as bringing with them superior quality and social cachet are gone, with consumers justifiably content – proud, even – of the products and services that have been developed here at home. Look at local ride-sharing service Ola, which has a significant lead in market share over global giant Uber (around 59% compared to 41%), although both also face tough competition from smaller rivals. Ola has more than 100 million registered users, compared to roughly 93 million+ for Uber. Both offer, essentially, the same kind of service. Both have introduced in-app features to help allay concerns around passenger safety, both offer easy payment, and their rates are highly competitive, though Ola perhaps has the edge here. Ola also offers ride- sharing options that help bring down the cost of a fare to individuals. The service is perceived as being a great choice, and it’s this rather than the brand’s local heritage that helps Ola win the race. It's a similar story with Flipkart, which leads in India’s ecommerce market ahead of global rival Amazon. Flipkart, which was launched locally but is now owned by Walmart, is not just the ‘local’ alternative to Amazon but a strong one. Products and services have much in common with Amazon, though Flipkart has always focused on the reliability of quick deliveries. Flipkart has also honed its local-language interfaces to make shopping easier, and has launched Shopsy, offering bargain-priced items designed to appeal to less-affluent rural consumers. This growing affinity with local brands is not about falling out of love with foreign brands. In fact, consumers often don’t know whether brands are local or not, and many global brands have been available in India for so long that they feel local. What this comes down to is that there is no longer an advantage to being foreign; the brands that are seen as being most relevant locally are those that tend to have the edge. Increasingly, being ‘local’ means more than being Indian. Tata Tea Premium, for instance, has been promoting specific products designed to suit taste profiles in different regions of India, and promoting them via region-specific ad campaigns. The tea blends, packaging design and communications all have a distinctly local (regional) flavour. Similarly, Britannia Good Day snacks recently launched a hyper-local TV advertising campaign for its range of products focused on the idea of ‘happy celebrations’. Each ad presents a different perspective on what makes a day a good day, featuring local cultural references and filmed in six local languages, rather than being shot in one and then dubbed. Cross-Category Trends Cross-Category Trends

- 19. 37 36 ASPIRATION PROVIDES INSPIRATION While the government has set its sights on India becoming a 5T (US$5 trillion) economy, and has been investing in physical infrastructure and developing digital, business- friendly policies to work towards that goal, individuals are shaping their behaviour according to their own aspirations. Consumers want to do more, see more, and provide more to their children than they have had, and are ensuring that when they have funds available, they are investing in making their dreams a reality. The government’s investments will help make some of these individual aspirations more achievable. The country is spending 1.7% of its GDP on transport infrastructure in 2023 – around double what the US and most western European countries spend – to improve road and rail networks, as well as create jobs. Investment in new tracks, coaches, electrification, and station facilities is at the heart of railway spending, and there are new roads and road upgrades planned, plus new airports, heliports, and water aerodromes. The government’s huge digitisation programme (more on this on page 42) is also helping people achieve their goals, making it easier to set up and scale up online businesses. People’s appetite for digitising their lives is evident in not just the growing number of online businesses, but also the huge sales achieved at India’s two recently opened Apple stores, in Delhi and Mumbai. There’s a strong desire to live life well and make money to secure a better future; the number of people taking holidays post-COVID is tremendous, despite the fact that air fares have gone up considerably in price. Kantar TGI data shows that while 62% of people enjoy going back to a holiday destination somewhere familiar, there’s a growing hunger for something out of the ordinary; 51% of people now say they prefer to holiday somewhere that’s ‘off the beaten track’, up from 47% in 2019. Aspiration is also evident in the number of Indian students going abroad to study. This is not a new phenomenon, but it’s one that’s gathered momentum in the past two years. In 2023, 68% more Indian students went abroad to study, Ministry of Education figures show, and there was a similar rate of increase the year before. Cross-Category Trends Cross-Category Trends

- 20. 39 38 Growth driven by value, not volume The growth story for fast-moving consumer goods (FMCG) brands in India has for many years been about volume sales. Expanding distribution beyond the biggest towns and cities, appealing to a widening of consumers, and encouraging existing buyers to purchase more frequently. Times have definitely changed, however. Volume sales have been stagnant for some time, and growth for most brands has been the result of higher value sales based on inflationary price rises. Prices have gone up for urban and rural shoppers, and while rural consumption was somewhat insulated as prices started to go up, sustained high inflation means that household budgets nationwide have been put under some strain. The effect of rising prices for essentials is felt across the board; many homes spend 40-50% of their total income on FMCG goods and fresh food items. Whatever is left must cover apparel, entertainment, and all other ‘non-essentials’. When the bill for essentials goes up, what’s left for the rest is squeezed. Smarter shopping Of course, few consumers simply drop entire categories from their shopping lists. They shop smart in order to make their budget stretch as far as possible. Consumers are looking for better value, not necessarily the lowest prices, and they are still open to spending when it comes to categories and brands they feel deliver them something special. This is still a highly aspirational market, and premium brands that demonstrate how they justify their pricing are faring well. Dove haircare, for example, is a premium option that is growing, and products that offer specialised benefits are also faring well. Sensodyne toothpaste for sensitive teeth, for instance, as well as hair products designed to address specific problems, such as ‘hair fall’. And, in a country with such a large population as India, even a small percentage of the total remains a large addressable audience. This means there’s still a fair-sized market (if a small percentage of the total) for super- premium products. In fact, many of the fast-growing D2C brands that are flourishing right now are priced at a premium to supermarket brands, particularly in personal care. Brands that have a portfolio of products and sub-brands are also proving resilient; if people can no longer afford or justify to themselves a higher-priced product, these brands are ready with a more economical replacement to trade down to. Change in approach Brands are responding to the shift in spending habits. Some are launching smaller packs to make purchases more affordable, while others are upping the size of a pack and keeping the price steady, to provide better value. In marketing communications, there’s a focus on the quality or longevity of a product or pack – pointing out that it will last a whole month, for example – and brands are offering special prices for a bundle of goods, but there’s little appetite for buying or becoming the cheap option. Consumers want a good deal, not a cheap deal, and brands thinking long term will want to represent more in people’s minds than just being the cheapest. FAST-MOVING CONSUMER GOODS Fast-Moving Consumer Goods Shopping for bargains Discounts, best prices, and convenience increasingly sought by consumers Top 2 box scores Overall (2022) Index (2022 vs 2019) I look for the lowest possible prices when I go shopping 62% 146 I always look out for special offers/discounts that are given for brands 60% 142 I am prepared to pay more for products that make my life easier 61% 140 I tend to hold out on buying things I want until they go on sale 55% 141 I prefer prmium products 59% 139 I buy new products before most of my friends* 52% 123 * Upper socio-economic classes are early adopters when it comes to product purchases

- 21. 41 40 What to expect Inflation in India has actually come down over the course of 2023, and FMCG sales in the Feb-April quarter were rising – up 8% in urban areas and 4.2% rurally, Kantar Worldpanel data shows. At that rate of growth, average FMCG spending per household is on track to hit ₹20,000 by the end of 2025. There are six categories on which the average household spends more than ₹1,000 annually; before the pandemic, there were only two – edible oils and atta. Now, this level of average spending also applies to toilet soaps, tea, washing powders, and biscuits. Along with biscuits, chocolate and noodles, ready-to-cook mixes have also seen rapid increases in spending. There has been an explosion of brands in the snacking space, particularly among those taking the direct-to-consumer (D2C) route. While these brands may not become overnight successes, this is reflective of a category that has started evolving and has a long way to go. Ecommerce is a rapidly growing part of the FMCG market, accounting for around 6-7% of total sales. Given that in categories like mobile phones the proportion of online sales is about the 35-40% mark, this suggests there remains considerable scope for growth in online grocery. Other shifts include not just the arrival of new D2C competitors in FMCG but also heritage brand Reliance, which has scale and a retail network to help it make a big impact, fast. Reliance bought the 50-year-old Campa Cola brand last year and is now taking on Coke and Pepsi with pricing around 20% lower than the multinationals. Reliance has also launched Scrubz, for dishwashing. In the months ahead, we can expect continued growth in FMCG overall, with rural growth starting to play catch-up with urban rates if forecasts of a good monsoon come to pass. Fast-Moving Consumer Goods

- 22. 43 42 DIGITAL INDIA LEADING THE WAY IN AN ONLINE WORLD Digital India While the rest of the world has been digitising fast, India has been becoming a digital-first nation at a blistering pace. Boosted by the twin catalysts of government investment and COVID-induced necessity, India’s digital landscape has been utterly transformed. The effect has been tremendous, not just for bringing convenience and opportunity to Indians who had previously been excluded from many aspects of the country’s progress, but also for the national economy. Several of India’s digital developments for the domestic market now look poised to become India’s gifts to the world, such is their rapid growth and ease of use. Aadhaar is the world's largest biometric identification system and has been described by World Bank Chief Economist Paul Romer as ‘the most sophisticated ID programme in the world’. It uses facial recognition to authenticate someone’s identity, and can be used for a range of functions, from government workers clocking on and off at the office, to voters using it as ID at polling booths. Its biggest impact has been in providing people with easy access to government benefits such as unemployment payments, food and fuel subsidies, and tax filings. It also provides access to government examinations, some salaries, and some banking facilities. It was set up primarily to streamline delivery of social security benefits and subsidies – reducing fraud and enhancing transparency. DigiYatra (meaning ‘digital journey’) is another government- backed development that uses facial recognition at airports to enable passengers to go paperless when taking domestic flights. The technology was launched in December 2022 and began in Bengaluru, Delhi, and Varanasi, before being extended to Hyderabad, Kolkata, Pune, and Vijayawada. What’s been a bigger game changer, however, is the rollout of India’s United Payments Interface, or UPI, which allows Indians to easily and instantly transfer money between accounts, either from a customer to a business or between consumers. It has more than 260 million users and in March this year was used for a record 8.7 billion transactions. In short, it’s huge. But UPI’s growth story may have only just begun. International expansion has started, enabling Indians living abroad to send remittances back to India without the usual fees. This is a huge market – remittances to India were more than $100 billion in 2022, the highest of any country in the world. UPI is being widely rolled out in Nepal, and is already available to Indian consumers shopping abroad in some markets. Expansion is being helped by participation in UPI by some big global names in fintech, including Google Pay and Paytm. UPI is even being talked about as a potential alternative to SWIFT. And then there’s ONDC, the Open Network for Digital Commerce, the recently launched (2022) non-profit company established by the government to broaden access to ecommerce. We’re in danger of wearing out the term ‘game changer’, but ONDC is definitely another one in India’s digital playbook. An open-source platform enabling even the smallest vendors to sell online, ONDC also provides protection for consumers by centralising data collection and storage, payment, and delivery information. Digital change, real-world impact It is difficult to overstate the effect that all these developments are having on the way people work, shop, and live in India. Around 15 million wholesale and retail establishments are now online, and around 50% of micro and small businesses are digitally active. Kantar’s annual ITOPS study, which seeks to understand SME businesses and their planned investments, found that in 2019, half of the businesses in India were offline only; today, that’s less than one in 10. The digitally engaged segment among SME businesses has more than quadrupled in four years, accelerated by COVID and given a huge boost by the availability of digital payments infrastructure and the ONDC. SMEs ride the digital wave Source: Kantar ITOPS 10 60 50 40 30 20 2018 2020 2022 0 12% 34% 54% Offline: With no internet connectivity Digitally engaged: Using digital technology investing online e.g. buying, sell or communicating 56% 20% 9%

- 23. 45 44 The clicking consumer India’s digital ecosystem has created the conditions in which ecommerce can flourish. Our ICUBE research shows that 125 million Indian shoppers went online for the first time in the three years to 2022. In the three years to 2025, a further 80 million are expected to be shopping online. The proportion buying FMCG goods online shot up from 2.9% in 2019 to 15.6% in 2022. Already, India has more fintech users than the US. Newcomers to ecommerce are not just teenagers getting online independently for the first time. Many of India’s new online shoppers are much older; 33% of those shopping online for the first time in 2022 were aged 35+, our research shows. Among urban Indians, we’re finding that shoppers are combining online and offline formats to suit their changing needs. Both will still be relevant in the coming years. In 2022, Kantar research found that 54% of people said they usually browse the internet to find products they like before buying them in-store, and 52% said they usually visit stores to look at items they later buy online. The sudden upsurge in ecommerce is another example of consumers ‘leapfrogging’ stages in development that in some markets have taken place over decades. Almost all of the people who have gained access to the internet in the past few years have done it via a smartphone, completely bypassing desktop and laptop computers. Similarly, they have gone straight from cash to cashless and digital, without ever having a credit card. This leapfrogging is also symptomatic of India’s pace of economic development, not just digitisation. In the car market, it’s not unusual for a consumer to go straight from a hatchback to an SUV, without spending a decade moving slowly up the range. Jumping stages Emergence of SUVs Mobile first Internet user size (overall level, by PC and mobile device) Making connections Share shift in car body type (%) 2022 2025 Online shoppers added in the last 3 years Active social media users 37% are millennials Combined revenue of 10 D2C Brands in FY20 Online shoppers expected to be added in the next 3 years Active social media users Addressable market size for D2C brands 125 M+ 500 M+ $0.44 Bn 80 M+ 750 M+ $100 Bn+ Living in a digital India Source: Kantar ICUBE 2022 2012 - 2016 • Launch of 4G affordable smartphones • Growth of ecommerce 100 Million 100 Million 2016 - 2019 • Launch of Jio • Demonetisation 50 Million 2020 - 2022 • COVID-19 • Surge in OTT and smart device adoption Active internet users Smartphone internet users PC internet users 2012 2016 2019 2022 SUV NON-SUV 2022 47% 53% 2012 95% 5% Source: Kantar ICUBE, Urban Source: Kantar ICUBE, Urban Digital India

- 24. 47 46 Taking the direct route - the rise of D2C Another manifestation of the digitisation of commerce is the boom in D2C or direct-to-consumer businesses, which are disrupting the traditional wholesale-retail-consumer chain by cutting out the middleman and going straight to the consumer. India’s D2C market was estimated to have been worth $55 billion in 2022 and is forecast to top $100 million by 2025. These businesses occupy a vast range of categories, from food and health/wellness to fashion, beauty, and pet products. Pandemic restrictions on movement helped create the conditions in which D2C brands could flourish; now that they have been lifted, some online-only brands are dipping a toe into the world of physical retail, to broaden their appeal and accessibility. Yet there’s something special for consumers about D2C brands and the way they feel about them. Kantar research shows consumers love the sense that they’ve ‘discovered’ a brand on their own. They also love the idea of buying ‘direct from the source’, and they appreciate the scope for personalisation that D2C brands are often able to provide. By building a relationship directly with consumers, these brands are able to foster a closeness that’s difficult to match if they interact via a retailer; the brand can understand each user’s browsing patterns and buying habits, learn their preferences, and provide relevant and welcome rewards or incentives. ID Fresh Food, for instance, has used livestreaming from its giant kitchen to show exactly, and in real time, how its products are made. Over 50,000 people tuned in over 48 hours. There’s closeness and intimacy, despite the distance. Ad spend follows eyeballs online The popularity of digital media platforms has, not surprisingly, been growing apace. But it’s not just the number of people spending time online that’s been rising; it’s also the amount of time they spend there. Around 86% of people in urban India report having watched TV in the past month (2022 data), which is roughly the same as three years ago. The proportion saying they’ve used the internet in the past month has shot up, though, from 43% to 64% in those same three years. Kantar’s TGI research shows that while time spent watching television has risen, on average, from 2.5 hours in 2019 to 2.6 hours in 2022, the time spent watching online video has grown more radically, from 1.3 to 1.9 hours a day. Overall, digital’s share of time spent across media has grown 21% CAGR since 2019. There’s a growing number of ‘cord cutters’ – people discontinuing their traditional TV usage and shifting entirely to the OTT (over the top) entertainment space. Around 82 million Indians have cut the cord and no longer tune in to traditional TV, our ICUBE 2022 study shows, and the overwhelming majority are watching their OTT video content on a mobile phone rather than a smart TV. This reflects the increasing sense of attachment consumers have to their phones, and the fact that mobiles are now a tool for work, entertainment, shopping, socialising, and all of daily life. In fact, 52% of urban Indians now say they could not live without their phone, compared to 44% three years ago. The most popular genres of content consumed via OTT are comedy, reality shows, action, and drama, while traditional TV still proves to be a magnet for consumers seeking out news, TGI data shows. Levels of advertising spend are rising at world-leading rates in India, fuelled largely by investment in digital media; digital is forecast to account for just over 53% of all ad spend in 2023. Forecast ad market growth in 2023 Share of media 2013 v 2023 (%) SOURCE: GroupM, This Year Next Year, Dec 2022 SOURCE: GroupM, This Year Next Year, Dec 2022 16.8% 6.3% 6.3% 3.4% 2.5% 2.2% 4.4% TV 41.2% 32.0% Audio 4.3% 1.3% Newspapers 36.0% 9.7% Magazines 2.0% 0.1% Outdoor + cinema 6.2% 3.0% Digital 10.3% 53.9% 2023 2013 Digital India

- 25. 49 48 EMPOWERED, ASPIRATIONAL, AND INFLUENTIAL Women In India The challenges facing women in India are many, deep rooted, and well documented. But there are signs that real, meaningful change is afoot, and brands are showing they can be part of supporting that change, as well as reflecting the evolution of women’s roles in society. India now has more women than men for the first time since records began, and the life expectancy of women has improved to now exceed that of men by 2.7 years. Enrolment in higher education is higher for girls than boys (27.3% compared to 26.9%), and there are now 18% more women in higher education than there were even just five years ago. These are all huge changes that will have repercussions on family life and career expectations – not just for women now, but for generations. Women are playing a more prominent role in public life, too. In the 2019 national elections, there were more women voters than men – another first. And the share of seats held by women in local government bodies stands at 44.4%. The country’s athletes are winning medals and accolades; the national women’s football team ranks more highly in FIFA rankings than the men’s team, India’s women wrestlers are Olympic medallists, and Nikhat Zareen is a two-time boxing world champion in the women’s competition. Women are playing a bigger role in the nation’s economy; there are now 350 million women in paid work, a figure that is expected to reach 470 million by 2030. They represent more than 20% of Indians owning micro, small, and medium-sized enterprises, and 39% of senior management roles are held by women (the global average is 31%). A cohort in fast transition Source: TGI Diploma/Graduates/ Postgraduates 36% 28% Single women (unmarried/separated) 20% 19% Savings account 78% 53% Access to internet 84% 54% Online shopping (functional) 37% 16% Social networking (social) 43% 22% 2015 2022 Social metrics Economic metrics Digital inclusion

- 26. 51 50 There is no chance for the welfare of the world unless the condition of women is improved. It is not possible for a bird to fly on only one wing Swami Vivekananda Evolving attitudes and aspirations Women are not just taking on new roles, but also rethinking their outlook on the world and how they feel about themselves. Kantar research shows that when it comes to beauty, for instance, there’s a growing determination to be confident, authentic, and proud of who they are, marking a shift away from a need to measure up to ideals set by Bollywood. Health and wellbeing are now widely seen as being part of what makes a person look and feel great. An extension of that is the growing number of women taking time for themselves, guilt-free, driven by passion and pleasure, not just responsibilities. They’re using their time for their own pursuits; women are the fastest-growing consumer cohort in the travel sector, for example, and spending by women on solo experiences such as dining, travel, and salon and spa visits has doubled in the space of just four years. As India becomes a digital-first economy, the inclusion of women in financial services will have huge significance. As well as accessing bank accounts and government aid, rural women are now also buying insurance products, applying for loans, and making investments. Kantar’s Rural Barometer shows a significant lift in the proportion of rural women who are active in financial planning, and this is particularly strong among rural women from lower socio- economic groups. In just one year, the number of women who say they are part of household financial planning in rural India has soared by 15%. Clearly, the bottom of the income pyramid has been a major beneficiary of digital-led financial inclusion in terms of, firstly, a bank account that enables minimal shrinkage in direct benefit transfers to them. Additionally, they have better access to healthcare through their inclusion in the government’s Ayushman Bharat health insurance programme, and they can access credit for their personal needs and for business development. Advertising change Brands are demonstrating through their communications that they are both supportive of women’s greater freedoms, and reflecting the changes they see in society. It’s been eight years since laundry brand Ariel launched its ‘Share the load’ campaign to encourage couples to divide household chores equally. Other brands positioning themselves as leaders of change include Havells, which urges consumers to ‘Hawa Badlegi’ (‘Be the change’) in its ad showing newlyweds registering their marriage and each taking the other’s name. Genuine change within the home does seem to be afoot. Kantar research among women aged 15-55 in 2022 found that 73% believed the burden of household tasks is shared by men and women in their household – up from around half just three years earlier. This shift in the prevailing view of what’s to be expected from men and women means advertising has also changed. Old stereotypes – incompetent men struggling in the kitchen or laundry, for instance – are no longer seen as funny. And slice-of-life vignettes that might, a decade ago, have shown a mother proudly serving her family at the table have been subtly replaced. Now, it’s not uncommon to see a man serving his wife coffee as part of a bigger story; his act of kindness is not the main event but an incidental detail. Financially included, making decisions A gradual improvement in the proportion of women accessing financial services has been given a huge boost in recent years by the digitisation of banking and identification checks. The effect has been especially marked in rural areas, where government subsidies and aid – delivered as part of pandemic and post-pandemic recovery programmes – have largely been paid directly to women, rather than to families via men. There are now growing conversations between women about financial security and investment, and our research shows more women than men are making investments and planning for tax. Almost half of women across all classes of town are following the stock market, and 82% of women say they discuss their investment plans with their family and friends. Women now account for 39% of digital transactions in urban India, up from 34% in 2019, our ICUBE data shows; among urban women, 39% have a debit card, up from 14% in 2019. Outside the major centres, the gender gap is being bridged largely due to increased access to formal banking, often because of internet connectivity and digital services, and due to government direct benefit transfer schemes. Staking a claim – accessing government benefits Incidence of accessing government benefits % Respondents Base: All Respondents Source: Kantar’s Rural Barometer Men 73 78 Women 78 71 December 2021 December 2022 Women In India

- 27. 53 52 Ads for cosmetics and hair care tend to focus on the way they give women confidence, rather than catching the attention of male admirers. As beauty ideals change, Unilever has changed its Fair Lovely product range to Glow Lovely. In advertising around financial services, women are depicted in non-traditional workplace roles such as engineers, bank managers, and architects. These representations feel subtle and authentic rather than tokenistic. One touching piece of advertising that shows just how much times have changed is by Mondelez for Cadbury Dairy Milk, which, in the 1990s, created a TV ad showing a girl celebrating her cricketer boyfriend hitting a six. In the latest version, a young female cricketer hits a six and her boyfriend celebrates. The original ad is not referenced, but those old enough to remember will instantly connect the two. Kantar research shows that brand equity and short-term sales go up when brands use ‘gender progressive’ depictions of women in their advertising. The impact is greater in India than in other key markets. Breaking with tradition Strongest impact for women and girls in India +43 +28 +47 +33 +41 +28 +51 +32 Brand equity Short-term sales likelihood The bigger picture The broadening of opportunities for women is part of a wider move across India towards greater inclusivity regarding people who are ‘different’, whether that’s regarding age, religion, place of origin, or something else. Difference is now seen as something to be celebrated. To some degree, this embracing of difference extends to gay and trans people, although there are still strong pockets of conservatism. Boundary-pushing of this nature tends to be seen more online and in social media rather than in more mainstream media such as TV. For brands, it can signal positivity, inclusion, and modernity. But in modern India, being progressive does not come without risk. Even people who haven’t seen an ad campaign deemed to be controversial are often willing to protest about it and boycott a brand, generally out of concern that traditional Indian ways are being trampled on in the name of progress. Starbucks, for instance, found itself on the sharp end of criticism from a vocal minority of consumers when it created a TV ad featuring parents subtly showing, over an iced coffee in Starbucks, their acceptance of their son’s decision to identify as a woman. There was a sense that the brand had brought unwelcome ‘Western woke’ views to India. Similarly, Tanishq had to withdraw an ad that proved controversial for showing a Muslim woman organising a baby shower for her Hindu daughter-in-law. With movies featuring LGBT characters performing well at the box office, and discussions about legalising same-sex marriage in India, these conversations are gradually evolving. Women In India Difference in average percentile for ads in the top quartile on UnStereotype Metric

- 28. 55 54 BHARAT RISING THE TRANSFORMATION OF RURAL INDIA Rural India The development of India’s smaller towns and villages is not just a story of social justice – improving living standards and access to employment and education – but also one of economic advancement for the nation as a whole. As Mahatma Gandhi famously said, ‘The future of India lies in its villages’. For businesses in India, this is certainly true. While urban consumers have traditionally been the ones with the most money, best internet access, best infrastructure, and closest proximity to modern-trade retailing, there is considerable value beyond the big cities, much of it untapped. The gradual shifts that were already under way in rural development were supercharged by changes largely brought about by the pandemic – and the government’s measures to alleviate the economic and social stresses that it delivered. The adoption of digital technology – firstly, getting online and then using social networking and ecommerce – alongside the financial inclusion of women, thanks largely to digital banking, have brought about change at a pace previously unknown. Add to this the investment in road and rail infrastructure, and it’s clear that India’s rural consumers are better connected – physically and digitally – than ever. This digital revolution is creating a more level playing field of information access, cutting through previously exclusive brackets of class and gender divide. The rapidly digitising rural India is increasingly accessing media content that is like their urban counterparts, through digital content and influencers, and are striving to buy products that were otherwise perceived to be of low relevance to rural consumers. This march towards a better lifestyle has been enabled by digital, but is principally driven by the changing structure of household decision making, with a greater say for women in decisions about the family and the home. Improving access to higher education and employment among women in rural India is accelerating this change. Women today constitute 38% of the workforce in rural India.

- 29. 57 56 Digital rural landscape It is difficult to overstate the pace of digitisation in rural India. The number of rural internet users now exceeds the number of individuals in rural areas, and eight out of every 10 new users are from rural India. Adoption of digital technology is not limited to the young, or to any other particular rural consumer group; Kantar’s ICUBE research shows that 54% of the non-agricultural workforce in rural India are active users of the internet, while 40% of their farming counterparts are connected. Logging on to greater equity Internet user penetration of rural population 48% 25-44 years 30% 45+ years 41% 24 years The rural digital story is not just about new users coming in; they are also rapidly maturing as digital natives. Rural India today has more social media users than urban India; usage of online services is broad-based and diverse, with online transactions leading the way. Around 60% of rural India’s active internet users are using OTT and social media. User growth across online activities: 2022 vs 2019 Urban FMCG Volume Index Rural FMCG Volume Index Online transactors 150% OTT 109% Social media 105% Online gaming 105% New everything This evolution in the way people discover, research, buy, and share is changing the rural economy – and the homes of rural consumers. As per Kantar’s ICUBE, 8 million connected TV homes are in rural India, 3 million own a car, and 1.6 million own an iPhone, which represents 33% growth since 2019. In FMCG, total volume sales last year amounted to $32 billion across India, 51.1% of which was generated in rural areas. Consumers in rural areas are now buying more of everything; personal care products, home care, tech, cars, phones – you name it. MAT* Sep’ 20’ 100 MAT* Sep’ 21’ 101 MAT* Sep’ 22’ 98 MAT* Sep’ 20’ 100 MAT* Sep’ 21’ 103 MAT* Sep’ 22’ 104 Source: Worldpanel Division, Kantar *MAT = Moving annual total Rural India

- 30. 59 58 Urban – Penetration (%) Growth: MAT* August 2022 vs MAT* August 2021 Rural – Penetration (%) Growth: MAT* August 2022 vs MAT* August 2021 Dishwash liquid 12.6 14.0 15.7 17.4 Washing liquid 12.4 15.3 15.4 18.7 Fabric softener 21.8 25.7 29.1 32.0 Face wash 12.6 16.0 16.0 18.0 Washing liquid 5.3 6.4 6.3 7.4 Fabric softener 8.3 10.4 11.2 11.6 *MAT = Moving annual total Source: Kantar Worldpanel Communications beyond the big cities Any sense that rural consumers are somehow the ‘country cousins’ of city dwellers has evaporated. The emergence of a ‘digital Bharat’, in which people have access to many of the same media messages, shopping opportunities, and online business opportunities of their urban counterparts. Rural Indians strongly identify with the government’s push to create ‘Atma Nirbhar’, or a self-reliant India. They are proud of where they’re from and, when launching digital businesses of their own, are often in no hurry to head to the big smoke. This shift in mindset is important for advertisers to appreciate. No longer is it funny to laugh at ads showing a rural person lost in the city. Similarly, brands should not imagine they can take their urban marketing plans from five years ago and apply them now to an urban audience that’s ‘catching up’. What applies in rural India is the same rule of marketing that applies everywhere: it’s vital to engage with consumers with relevant, resonant messages on the most credible and appropriate platforms. There are regional differences, of course, but brands should steer well clear of tokenistic representations of people who are presented in ways that make it obvious where they’re from. Half-hearted localisation – using the same ad but shot against half a dozen different ‘local’ backdrops – is unlikely to succeed, either. We at Kantar are seeing more clients make the effort to dub advertising into local languages for different regions, and create hyper-local campaigns – with not just different talent or languages, but, in some cases, products tailored to local tastes. Rural India

- 31. 61 60 BRAND ANALYSIS 62 – TOP 75 MOST VALUABLE INDIAN BRANDS 2023 66 – BRAND VALUE 74 – BUILDING RESILIENT BRANDS 80 – FUELLING DEMAND 84 – DEMONSTRATING VALUE 88 – THE BIGGER PICTURE