201901 FOMC

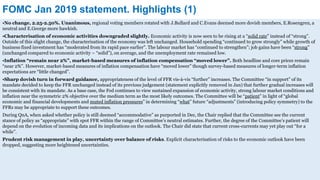

- 1. FOMC Jan 2019 statement. Highlights (1) •No change, 2.25-2.50%. Unanimous, regional voting members rotated with J.Bullard and C.Evans deemed more dovish members, E.Rosengren, a neutral and E.George more hawkish. •Characterisation of economic activities downgraded slightly. Economic activity is now seen to be rising at a “solid rate” instead of “strong”. Outside of this slight change, the characterisation of the economy was left unchanged. Household spending “continued to grow strongly” while growth of business fixed investment has “moderated from its rapid pace earlier”. The labour market has “continued to strengthen”; job gains have been “strong” (unchanged compared to economic activity – “solid”), on average, and the unemployment rate remained low. •Inflation “remain near 2%”, market-based measures of inflation compensation “moved lower”. Both headline and core prices remain “near 2%”. However, market-based measures of inflation compensation have “moved lower” though survey-based measures of longer-term inflation expectations are “little changed”. •Sharp dovish turn in forward guidance, appropriateness of the level of FFR vis-à-vis “further” increases. The Committee “in support” of its mandate decided to keep the FFR unchanged instead of its previous judgement (statement explicitly removed in Jan) that further gradual increases will be consistent with its mandate. As a base case, the Fed continues to view sustained expansion of economic activity, strong labour market conditions and inflation near the symmetric 2% objective over the medium term as the most likely outcomes. The Committee will be “patient” in light of “global economic and financial developments and muted inflation pressures” in determining “what” future “adjustments” (introducing policy symmetry) to the FFRs may be appropriate to support these outcomes. During QnA, when asked whether policy is still deemed “accommodative” as purported in Dec, the Chair replied that the Committee see the current stance of policy as “appropriate” with spot FFR within the range of Committee’s neutral estimates. Further, the degree of the Committee’s patient will depend on the evolution of incoming data and its implications on the outlook. The Chair did state that current cross-currents may yet play out “for a while”. Prudent risk management in play, uncertainty over balance of risks. Explicit characterisation of risks to the economic outlook have been dropped, suggesting more heightened uncertainties.

- 2. FOMC Jan 2019 statement. Highlights (2) •Data dependency still in play. In determining the timing and size of adjustments to the FFR, realized and expected economic conditions will be assessed relative to the i) maximum employment objective and ii) symmetric 2% inflation target. The Committee will take into account a wide range of information including labour market conditions, inflation pressures and expectations, and readings on financial and international developments. •Dovish guidance on balance sheet policy; clearly not on auto-pilot. Despite again highlighting the primacy of interest rate policy, the Committee now sees the balance sheet as an active part of monetary policy consideration. First, on size, the Committee intends to implement monetary policy whereby “an ample supply of reserves” ensures that control over rates is exercised primarily through the setting of administered rates (in which active management of the supply of reserves is not required); and, secondly, on monetary policy, the Committee is prepared to “adjust any of the details” for completing balance sheet normalization in light of economic and financial developments. The Committee stands ready “to use its full range of tools, including altering the size and composition of its balance sheet”, if future economic conditions were to warrant a more accommodative monetary policy than can be achieved solely by reducing the FFR. On 1), the ultimate size of our balance sheet will be driven principally by FIs’ demand for reserves, plus a buffer so that fluctuations in reserve demand do not require frequent sizable market interventions. Based on surveys and market intelligence, current estimates of reserve demand are considerably higher than estimates of a year or so ago. The implication is that the normalization of the size of the portfolio will be completed sooner, and with a larger balance sheet, than in previous estimates. •Rationale behind policy shifts. The Committee decided that the “cumulative” effects of recent developments (global growth slowdown, global and domestic politics and geo-politics, tightening financial conditions, and weakening domestic survey data) and rising risks of a less favourable outlook warrant a “patient, wait and see” approach to future policy-making. This is within a context of muted inflationary pressures (muted realised data, lower oil, stable/lower expectations) and receding risk of financial imbalances. 7 Governors, Board FRBNY (VC FOMC) J.Powell (C) J.Williams J.Bullard St. Louis R.Clarida (VC) C.Evans Chicago L.Brainard E.Rosengren Boston R.Quarles E.George Kansas M.Bowman M.Goodfriend* Nellie Liang* *Pending FOMC, 10/12 Members; 2019 4 Groups: (Boston, Philadelphia, Richmond); (Cleveland, Chicago); (Atlanta, St. Louis, Dallas); (Minneapolis, Kansas, St Francisco) Permanent, 7 + 1 Rotating, 1Yr Term, 4/11 4 Regional Presidents

- 3. FFRs and money markets 0.00 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 Jan-19 % Eff FFR IOER 1Mth T-Bills ON RRP Target FFR 0.00 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 Jan-19 % IOER 90d CP 90d Libor 90d T-bills 90d OIS Effective FFR 8 9 10 11 12 13 14 15 16 17 2 4 6 8 10 12 Mar-00 Mar-02 Mar-04 Mar-06 Mar-08 Mar-10 Mar-12 Mar-14 Mar-16 Mar-18 Consumer, Interest, % New Car 5/1Yr ARM CC (RHS) Personal Loans (RHS) 2,000 2,500 3,000 3,500 4,000 4,500 5,000 -20 -10 0 10 20 30 40 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Federal Reserve, %yoy Thousands US$ BilAssets, B/S (RHS) %yoy 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 Jan-00 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10 Jan-12 Jan-14 Jan-16 Jan-18 US$ Bil Fed Total Assets Banks' Reserves Balance

- 4. Thoughts (1) Fed relented, in a big way. The Fed is seemingly now on hold, being patient in policy-making and awaiting macroeconomic and financial data in determining what its next move (policy symmetry) will most likely be vis-à-vis its expectations of further tightening previously. Further, balance sheet policy is apparently not on auto-pilot with the Fed willing to consider changes to the size and end point of run-off as dictated by developments. This likely reflects a sense of heightened downside risks with the Chair suggesting that changes were made (to forward policy rate and balance sheet guidance) in order to offset such concerns over rising risks, considering broadly unchanged spot levels of employment/inflation (both in line with mandates). The Fed is thus unlikely to shift policy in 1H19. Policy whiplash. Again, we think that the Fed is making a communication error (swinging from being too nonchalant in Dec to too dovish now). The scale of dovish policy guidance, compared with likely trajectory of the economy, considering realised and evolving market movements, will likely place the Fed in a bind should it seeks to raise rates, going forward. The economy is not that weak with financial conditions already starting to ease, on the back of Fed speeches following Dec’s FOMC (which have help contained financial distress risks). External demand may yet be challenged but following an improvement in financial conditions, coupled with more dovish domestic policy-making (globally, especially in China and Europe) should start to see a cyclical improvement, going forward. Instead of seeking to dampen volatility via essentially a form of statement based guidance (patient, balance of risk, appropriate), it would have been better to allow global markets to find its own levels (via two way volatility) in accordance to a new evolving market perceived neutral (which markets are trying to do prior to this new perceived policy “put”) rather than anchoring at current levels (in accordance with the “appropriate” language). -18 -10 -39 -26 86 59 29 24 -80 -60 -40 -20 0 20 40 60 80 100 5Y 10Y 2018, bps chng TP Breakevens Implied Real Rate Nominal -1 -6 12 6 -6 -1 5 -1 -10 -5 0 5 10 15 5Y 10Y 2019, bps chng TP Breakevens Implied Real Rate Nominal -1.5 -1.0 -0.5 0.0 0.5 1.0 1.5 Jan-94 Jan-97 Jan-00 Jan-03 Jan-06 Jan-09 Jan-12 Jan-15 Jan-18 Impulse, z-score, yoy chng FCI

- 5. Thoughts (2) Policy “collar” not “put”. Prior expectations for a Fed relent has been (overly) met, hence our state dependent (global financial conditions to stabilise, cushion rising debt repayment burden and allowing domestic leverage to level off, coupled with still moderate economic growth/inflation, policy options to widen positively globally, especially in China) expectations for a final 25-50bps will likely be met in 2H19, should the cycle extents, with the FFR hitting cycle terminal at 2.75-3.00%. Fed relent, we believe, is a policy collar, not a put. Global financial conditions are now easing pretty rapidly (on Fed anchoring), pushing up asset valuations on uncertain fundamentals with aggressively dovish pricing limiting future policy room to support markets, if needed. More importantly, a hike (to anchor financial conditions, asset pricing, term out leverage) will now be a communication nightmare with a likely more dramatic negative impact on volatility and markets. The Fed has seemingly yet to learn the lesson on the impossibility for central bankers to manage/time the impact of monetary policy adjustments on financial conditions (reflects inherent complexities of markets). Rates commentary Markets have pricing dovishly. Rates markets are priced for a Fed that is on hold for 2019 and then a cut and hold for 2020 and 2021 with a neutral around 2.25-2.50%. Key drivers will revolve around, i) extent of the easing of financial conditions easing; ii) global growth trajectory, and iii) extent of US growth/inflation momentum moderation via-a-vis Fed’s outlook. Tactically, we think duration is rich, expecting a bear steepening, preferring the 2-5yr. -0.5 0.0 0.5 1.0 1.5 2.0 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18 Jan-19 % 5Yr Implied Real Rate 10Yr Implied Real Rate 0 1 2 3 4 5 6 1Q62 1Q68 1Q74 1Q80 1Q86 1Q92 1Q98 1Q04 1Q10 1Q16 % Laubach-Williams Real Neutral Interest Rate -4 -2 0 2 4 6 8 10 12 14 16 Jan-87 Jan-91 Jan-95 Jan-99 Jan-03 Jan-07 Jan-11 Jan-15 Jan-19 Policy-rule Models, % Williams, Orphanides Robust 1st Diff FFR

- 6. USTs, Appendix (1) As of Jan 31st 2.875 3.125 3.125 2.875 2.54 2.35 2.49 3.09 2.44 2.21 2.20 2.65 2.44 2.30 2.31 2.342.41 2.24 2.19 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 2019 2020 2021 Longer-run % FOMC, Dec 18 1M Swaps OIS 1-Mth SOFR FFF 2.00 2.25 2.50 2.75 3.00 3.25 Jan-19 Apr-19 Jul-19 Oct-19 Jan-20 Apr-20 Jul-20 Oct-20 Jan-21 Apr-21 Jul-21 Oct-21 % Fed Fund Futures Fed Guidance, Mid Year Fed Path Current Fed Path, Risk Neutral Breakeven Chng, bps 2018 2.875 5y 2.45 2.95 59 2019 3.125 10y 2.64 2.85 34 2020 3.125 as of Jan 31st 2021 2.875 2022 2.750 2023 2.750 2024 2.750 2025 2.750 2026 2.750 2027 2.750 2.33 2.59 2.65 2.70 2.59 2.54 2.61 2.61 2.86 2.00 2.25 2.50 2.75 3.00 1M 3M1M 6M1M 9M1M 1Y1M 2Y1M 3Y1M 4Y1M 5Y1M 1-Mth Foward Curve, % Current 2.25 2.30 2.35 2.40 2.45 2.50 SOFR 2Q19 4Q19 2Q20 4Q20 2Q21 4Q21 2Q22 4Q22 % SOFR

- 7. USTs, Appendix (2) - Inflation 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 3.25 3.50 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 Breakeven Inflation, % 5y5y 5y 10y 30y -1.5 -1.0 -0.5 0.0 0.5 1.0 1.5 2.0 Jan-88 Jan-91 Jan-94 Jan-97 Jan-00 Jan-03 Jan-06 Jan-09 Jan-12 Jan-15 Jan-18 z-score Composite 1yr ahead Inflation expectations U.Mich, Conf Board, FRBNY, Cleveland Fed -2.0 -1.5 -1.0 -0.5 0.0 0.5 1.0 1.5 Jan-95 Jan-98 Jan-01 Jan-04 Jan-07 Jan-10 Jan-13 Jan-16 z-score Agglomerated z-score of inflation measures *Core PCE, CPI, Atlanta Fed, Trimmed Mean Indices (Dallas & Cleveland Fed), FRBNY -20 -15 -10 -5 0 5 10 15 20 25 -8 -6 -4 -2 0 2 4 6 8 10 12 Jan-95 Jan-98 Jan-01 Jan-04 Jan-07 Jan-10 Jan-13 Jan-16 Jan-19 %yoy%yoy PPI Import Price Index (RHS)

- 8. USTs, Appendix (3) - Curves 0 1 2 3 4 5 6 7 8 -150 -100 -50 0 50 100 150 200 250 Jan-97 Jan-00 Jan-03 Jan-06 Jan-09 Jan-12 Jan-15 Jan-18 %bps 18M3M - 3M (LHS) 18M3M 3M 0 1 2 3 4 5 6 7 8 9-150 -100 -50 0 50 100 150 200 Jan-90 Jan-96 Jan-02 Jan-08 Jan-14 % reverse scale Risk Neutral bps 10y2y 5y2y 10y5y FFR (RHS) 0 1 2 3 4 5 6 7 8 9-50 0 50 100 150 200 250 300 Jan-90 Jan-96 Jan-02 Jan-08 Jan-14 % reverse scale TP, bps 10y2y 5y2y 10y5y FFR (RHS) 0 20 40 60 80 100 120 140 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18 Jan-19 bps 10y2y 10y2y, 1yfwd 10y2y, 2yfwd 10y2y, 3yfwd

- 9. USTs, Appendix (4) - Technicals 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 3.25 3.50 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 Jan-19 % 10-Yr Treasury 50 WMA +2stdev -2stdev -12 -10 -8 -6 -4 -2 0 Jan-98 Jan-01 Jan-04 Jan-07 Jan-10 Jan-13 Jan-16 Jan-19 Maximum drawdown, 1Yr, % Barclays UST 7-10Yrs Max Drawdown 1.2 1.4 1.6 1.8 2.0 2.2 2.4 2.6 2.8 3.0 3.2 3.4 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18 Jan-19 % US10T 20dMA 50dMA 200dMA -5 -4 -3 -2 -1 0 1 2 3 4 5 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18 Jan-19 52wk z-score Copper/Gold Oil/Gold Ratio Metals/Gold Lumber/Gold Risk off