201812-FOMC

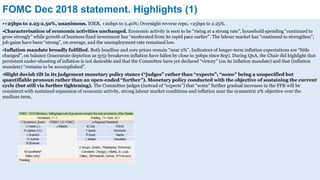

- 1. FOMC Dec 2018 statement. Highlights (1) •+25bps to 2.25-2.50%, unanimous. IOER, +20bps to 2.40%; Overnight reverse repo, +25bps to 2.25%. •Characterisation of economic activities unchanged. Economic activity is seen to be “rising at a strong rate”, household spending “continued to grow strongly” while growth of business fixed investment has “moderated from its rapid pace earlier”. The labour market has “continued to strengthen”; job gains have been “strong”, on average, and the unemployment rate remained low. •Inflation mandate broadly fulfilled. Both headline and core prices remain “near 2%”. Indicators of longer-term inflation expectations are “little changed”, on balance (inaccurate depiction as 5y5y breakeven inflation have fallen by close to 30bps since Sep). During QnA, the Chair did highlight that persistent under-shooting of inflation is not desirable and that the Committee have yet declared “victory” (on its inflation mandate) and that (inflation mandate) “remains to be accomplished”. •Slight dovish tilt in its judgement monetary policy stance (“judges” rather than “expects”; “some” being a unspecified but quantifiable pronoun rather than an open-ended “further”). Monetary policy conducted with the objective of sustaining the current cycle (but still via further tightening). The Committee judges (instead of “expects”) that “some” further gradual increases in the FFR will be consistent with sustained expansion of economic activity, strong labour market conditions and inflation near the symmetric 2% objective over the medium term.

- 2. FOMC Dec 2018 statement. Highlights (2) •Rising risk aversion, though stance of risk remains unchanged. Risks to the economic outlook are “roughly balanced”. However, the statement explicitly highlighted that the Committee will continue to monitor “global economic and financial developments and assess their implications for the economic outlook”. In the Press Conference Statement, the Chair detailed reasons behind rising Committee risk aversion and the slightly lower economic projections. Concerns predominantly arise from weaker than expected global growth (though “still solid levels”) and tightening financial conditions that have become “less supportive” of growth. The gentler path of policy reflects these conditions and the Committee still expect the economy to “perform well” in 2019. The Chair also highlighted policy is “still” accommodative and that considering the state of the economy, policy “does not need to be accommodative” and can move to “neutral”. The Committee is cognizant of the differing economic context for 2019 vis-a-via 2018, highlighting a moderating (rather than accelerating) growth trajectory, less accommodative monetary policy amid weaker external growth and tighter financial conditions. Data dependency will be the key determinant in policy-setting, considering that the spot FFR’s position (following prior hikes) vis-à-vis the “true” neutral is highly uncertain. Essentially a high degree of uncertainty to policy-making. •Data dependency. In determining the timing and size of adjustments to the FFR, realized and expected economic conditions will be assessed relative to the i) maximum employment objective and ii) symmetric 2% inflation target. The Committee will take into account a wide range of information including labour market conditions, inflation pressures and expectations, and readings on financial and international developments.

- 3. FOMC Dec 2018 statement. Highlights (3) •Cosmetic changes made to economic projections; tilted slightly lower. Median growth rates was lowered for 2019 by 20bps to 2.3%, unchanged for 2020-2021 at 2.0% and 1.8% respectively; longer run growth estimates higher by 10bps to 1.9%. No secular uplift to potential from fiscal spending were deemed by the Fed. Unemployment rates barely moved, unchanged at 3.5% for 2019; higher by 10bps for both 2020-2021; longer-run seen lower by 10bps at 4.4%. Core inflation projections was lowered by 10bps for 2019-2021, all at 2.0%. •Slight dovish change to Fed path; lower terminal (3.125%) and neutral (2.75%). Dec’s Fed’s median expectations, 2019 = 2.875% (from 3.125%; 6:5:6; 11/17=<Median); 2020 = 3.125% (from 3.375%; 8:4:5; 12/17=<Median); 2021 = 3.125% (from 3.375%; 8:6:3; 14/17=<Median) and longer run = 2.75% (from 3.00%; 4:5:7; 9/16=<Median). This suggests 2-1-0 hikes from 2019-2021, following by 2 rate cuts in the longer-run; monetary policy will be slightly “tight” between 2019-2021. Longer-run projection (neutral) is anchored around 2.75-3.00%. The average FOMC, on the whole, too reflects the median changes. Dec’s Fed’s average expectations, 2019 = 2.9% (-17bps); 2020 = 3.1% (-22bps); 2021 = 3.0% (-23bps); and longer run = 2.8% (-4bps). •Balance sheet policy on auto-pilot. High hurdle to changes being made to balance sheet policy with the Chair highlighting the primacy of interest rate policy. •On financial conditions. The Committee will take “on-board” “sustained” tightening in financial conditions insofar as such changes impact upon its economic forecasts (as per Dec’s forecasts) and hence moved to a gentler path for policy hikes.

- 4. FFRs and money markets 0.00 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 % Eff FFR IOER 1Mth T-Bills ON RRP Target FFR 0.00 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 % IOER 90d CP 90d Libor 90d T-bills 90d OIS Effective FFR 8 9 10 11 12 13 14 15 16 17 2 4 6 8 10 12 Mar-00 Mar-02 Mar-04 Mar-06 Mar-08 Mar-10 Mar-12 Mar-14 Mar-16 Mar-18 Consumer, Interest, % New Car 5/1Yr ARM CC (RHS) Personal Loans (RHS) 2,000 2,500 3,000 3,500 4,000 4,500 5,000 -20 -10 0 10 20 30 40 Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17 Jan-18 Federal Reserve, %yoy Thousands US$ BilAssets, B/S (RHS) %yoy 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 Jan-00 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10 Jan-12 Jan-14 Jan-16 Jan-18 US$ Bil Fed Total Assets Banks' Reserves Balance

- 5. Thoughts (1) Model-driven policy-making. Monetary policy, as expected, followed Fed guidance with a hike in Dec. The Fed now anticipates a shallower upward rate path, reflecting tighter financial conditions and weaker external growth. However, there were no sign of any intention to re-introduce uncertainty into the trajectory of the Fed path, despite a sharp downturn in financial conditions (close to -1.75 stdev move peak-to-trough). This likely reflects a mix of model-based policy-making and policy stance inertia, considering current levels of employment/inflation (with both mandates deemed broadly met) coupled with prior belief that policy, going forward, should be conducted with the objective of sustaining the cycle via further tightening. Hence, based on economic trajectory and policy inertia, the Fed may continue to tighten policy in 1H19 (+50bps to 2.50-3.00%). Based on Fed’s projections, the risk-neutral fair value of the US5T and US10T is at 2.95% and 2.85%. Our internal models based on Fed’s 2019 nominal GDP (4.2%) points to US5T and US10T FV at 1.97% and 2.30%. Marking-to-market the better growth/inflation outlook and rolling prior rate hikes, YTD, the UST curve shifted higher with the curve up by 30-116bps with a flattening bias. Too blunt? Just-in-time policy-making may not be in time? We think that will be a mistake, with a Fed relent at this juncture key in extending the cycle, considering the prior goal of tightening financial conditions have been met via the turn in markets (which reflects the impossibility for central bankers to manage/time the impact of monetary policy adjustments on financial conditions reflecting inherent complexities of markets). Instead of having to hike till the economic cycle breaks before stroking a turn in the financial cycle, the sharp tightening in financial markets sets up an unique opportunity for the Fed pause to extend the economic cycle. Data dependency, at this juncture, may be too late and blunt, forcing a sharper tightening of global financial conditions amid an environment of heightened concerns over risks in China, global growth, and domestic and global political uncertainties. The median Fed is projecting a further +50bps increase in 2019 (2.75-3.00%), +25bps increase in 2020 (3.00-3.25%) and then a pause in 2021.

- 6. Thoughts (2) Fed must relent. Our expectations now is for a state dependent (global financial conditions to stabilise, cushion rising debt repayment burden and allowing domestic leverage to level off, coupled with still moderate economic growth/inflation, policy options to widen positively globally, especially in China) Fed relent with scope for a final 25-50bps, if any (pause otherwise), in late 2019/2020, should the cycle extents, with the FFR hitting cycle terminal at 2.75-3.00%. The Fed needs to stabilise and lower real risk neutral to a level that market perceived as being adequate to avoid risks of a policy error – essentially flattening risk-neutral while inducing breakevens and term premiums to rise – a curve steepener. As argued, we expect both domestic consumption (higher debt service, slower pace of asset price appreciation, low real income gains) and capital expenditure (higher debt service, elevated current spending vis-à-vis GDP, weakening domestic demand, external uncertainties) to ease off, with the fiscal impulse peaking, financial conditions tightening, and impact of dollar strength. This should taper labour market gains and keep inflation pressures benign. The extent of slowdown will be dependent upon the resiliency of private sector balance sheet and the subsequent impact on demand. It is imperative that the Fed stays ahead in managing overall debt servicing costs (short-run implications on demand; longer-run may short-circuit the feedback from demand to capital spending and future productivity), and limit the negative impact of policy on overall growth. -0.5 0.0 0.5 1.0 1.5 2.0 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18 % 5Yr Implied Real Rate 10Yr Implied Real Rate -12 -9 -33 -15 91 5946 34 -60 -40 -20 0 20 40 60 80 100 5Y 10Y 2018, bps chng TP Breakevens Implied Real Rate Nominal 0 1 2 3 4 5 6 1Q62 1Q68 1Q74 1Q80 1Q86 1Q92 1Q98 1Q04 1Q10 1Q16 % Laubach-Williams Real Neutral Interest Rate

- 7. USTs, Scenarios (1) 1. All is well. As per guidance, the Committee will continue hiking insofar as the labour market remains robust (unemployment stable/falling), inflation near/above target, growth stable, coupled with stabilising financial markets and a balanced risk profile. This will enable the Fed to sustain the expansion, by getting ahead of the labour market under-shoot, sustaining/containing inflation, before moving back towards neutral with growth at target. End of cycle is likely to be caused by a build-up of fundamental fragility with time, leading to a break in the economic equilibrium. This scenario assumes certain degree of macro-economic resiliency, provide scope for productivity improvements, and anchored inflation expectations. This is probably the Fed’s dream scenario (balancing the need to be reactive vis-à-vis pre-emptive). Rates should predominantly be driven by stable risk neutral (no policy error, ex-post), rising break-evens and higher (but anchored) term premiums; 5T and 10T near Fed’s risk-neutral of 2.95% and 2.85%. Scope for transition into curve steepening with higher long rates on realisation of higher productivity, pushing real potential growth and real neutral rate higher (front end pushing long end higher, subsequently, long end dragging short end higher; economic cycle extended). 2. Fed behind the curve. The Fed lose control of the labour market, unable to rein in the under-shoot, leading to higher wages with no productivity offset, margin compression and partial pass through to higher inflation. Term premium rises on a Fed that is deemed behind the curve. Fed guide for even higher rates, pushing risk neutral higher, in order to anchor term premiums, inverting the curve on a higher perceived terminal but still low neutral; curve steepener to curve flattener with low real neutral – long rates can trade substantially wider, >3.50% - depending on magnitude of imbalance, Fed’s subsequent reaction and perceived loss and recovery in policy credibility - but should remain bounded; short end can rise substantially. The combination of high terminal and low neutral will have a significant adverse impact on risk markets. 3. Fed policy error. The Fed continues to hike without due consideration to domestic/global financial conditions, triggering feed-back loops which break the cycle. Debt sustainability issues reach critical/breaking points, weakening demand and triggering re-financing uncertainties, ending with a global recession. A world deprived of US demand and facing dire domestic policy options leads to a sharp global downturn, financial market turmoil, and likely adverse political instability repercussions. Curve will collapse with rates, with time, trading near zero, in a likely deflationary bust.

- 8. USTs, Scenarios (2) 4. Structural changes starts to bind; no escape velocity. Growth and inflation starts to taper off as i) boost from the fiscal stimulus fades; ii) prior monetary tightening starts to bite; and iii) the downward pull from unresolved US (credit, wealth-driven economy; skewed labour/capital share) and global imbalances (Euro-zone fragmentation, internal balance; China de-leveraging, re-structuring; EM stresses). This should be reflected in a peak in growth and inflation soon, coupled with a slowdown in labour gains as demand weakens. The Fed should pause/reverse the tightening cycle, in order to lower short rates to anchor longer-run risk neutral and term premiums. 5T and 10T should ease and re-anchor at a new perceived neutral and terminal (<2.50%). High valuations of markets will ensure that risk markets perform poorly on the turn in the cycle; narrative of omnipotent central banks will be tested, considering that monetary policy will have limited traction on growth outcomes, going forward (wealth/debt-driven consumption/investment via credit/portfolio re-balancing/signalling limited by debt-servicing/asset valuations – defaults/sell-off required first; broken monetary models); fiscal, FX, reforms will be required as policy tools (no global equilibrium).

- 9. USTs, Views (1) Markets have switched to trading on an less grim variant of scenario 3; having priced scenario 1 for most of 2018. Rates markets are priced for a Fed that is on hold for 2019 and then a cut and hold for 2020 and 2021 with a neutral around 2.5%; a dovish outcome vis-à-vis the Fed. YTD higher 10T (+34bps) is wholly driven by higher implied real growth with markets re-pricing real risk neutral higher to 1.6-1.7% (Fed forward estimate approx. 0.75-1.00%; nominal GDP assumption around 3.9%; PCE at 2.0%) while break-evens and term premiums fall; suggesting market perceptions of Fed over-tightening. Key drivers will revolve around, i) global growth trajectory (especially over China’s growth uncertainties; political event risks), ii) extent of US growth/inflation momentum moderation via-a-vis Fed’s outlook, and iii) markets’ perception of i) and ii), its subsequent impact on financial conditions, and the feed-back to Fed policy and rates. Our base case remains 4, with 3 a clear downside risk. We like rates structurally and as a hedge for risk assets. Based on our risk-neutral model, we see 1.80-2.50% and 2.10-2.30% on the UST 5 and 10. We are, however, positioned for a Fed relent, likely soon in 1Q19, and am neutral duration with a preference for steepeners. Our view is to stay long on the UST 5-10y, still prefer 7y; tactical view suggests likely further flattening until a relent with a flat curve, 10T anchored around 2.75%, into 1H19. Risk neutral need to re-price lower with real risk-neutral 5y5y at close to 1.6-1.7%. We maintain that private sector debt loads remain too high to withstand sustained higher interest rates. We believe that current growth drivers are cyclical (fiscal policy will have a transitory impact on the economy via demand channels with spending targeted at wrong segments of the economy), not structural, and that latent secular dis-inflation impulses remains. To repeat, certain factors underlying the US (and global) economy seems highly persistent, a structural reflection of the current global growth model/political paradigm/broken models everywhere; Phillips curve (lower cost labour driven growth; no productivity); r* on consumption and investment and thus not transient (non-linear, easing have limited impact/tightening massive); a lack of substance in global re-balancing; rise in oligarchy); continued dependence on orthodox global central bank policy put – continues to suggest that one can ultimately position for the scenario of a shortened rate hiking cycle as limits are reached once cyclical strength fades. We maintain our view of a neutral no >2.5%.

- 10. USTs, Views (2) 2.875 3.125 3.125 2.875 2.54 2.35 2.49 3.09 2.47 2.31 2.36 2.58 2.46 2.36 2.36 2.402.47 2.27 2.23 0.00 0.50 1.00 1.50 2.00 2.50 3.00 3.50 2019 2020 2021 Longer-run % FOMC 1M Swaps OIS 1-Mth SOFR FFF As of Dec 27th 2.00 2.25 2.50 2.75 3.00 3.25 Jan-19 Apr-19 Jul-19 Oct-19 Jan-20 Apr-20 Jul-20 Oct-20 Jan-21 Apr-21 Jul-21 Oct-21 % Fed Fund Futures Fed Guidance, Mid 2.40 2.65 2.68 2.71 2.66 2.59 2.67 2.67 2.93 3.22 2.00 2.25 2.50 2.75 3.00 3.25 3.50 1M 3M1M 6M1M 9M1M 1Y1M 2Y1M 3Y1M 4Y1M 5Y1M 10Y1M 1-Mth Foward Curve, % Current 2.30 2.35 2.40 2.45 2.50 SOFR 1Q19 3Q19 1Q20 3Q20 1Q21 3Q21 1Q22 3Q22 1Q23 % SOFR Year Fed Path Current Fed Path, Risk Neutral Breakeven Chng, bps 2018 2.875 5y 2.65 2.95 64 2019 3.125 10y 2.78 2.85 35 2020 3.125 as of Dec 27th 2021 2.875 2022 2.750 2023 2.750 2024 2.750 2025 2.750 2026 2.750 2027 2.750

- 11. USTs, Views (3) -1.5 -1.0 -0.5 0.0 0.5 1.0 1.5 Jan-94 Jan-97 Jan-00 Jan-03 Jan-06 Jan-09 Jan-12 Jan-15 Jan-18 Impulse, z-score, yoy chng FCI -0.1 -1.1 -0.5 0.2 0.0 0.1 0.6 -1.5 -1.0 -0.5 0.0 0.5 1.0 2017 2018 2019 2020 2021 2022 2023 %potential GDP -ve implies +ve impulse Fiscal Impulse, Cyclically-adjusted % GDP BBB Corps 5Y Interest Cost, UST + Spreads Non-fin Private interest expense Excess spread over GDP 5Y 4.08 6.02 -1.99 1Y5Y 4.14 6.12 -2.09 2Y5Y 4.21 6.22 -2.19 3Y5Y 4.28 6.32 -2.29 4Y5Y 4.33 6.39 -2.36 5Y5Y 4.38 6.47 -2.45 GDP Growth 4.03 0.00 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 % 90d CP 90d Libor 90d T-bills Effective FFR

- 12. USTs, Curves 0 1 2 3 4 5 6 7 8 -150 -100 -50 0 50 100 150 200 250 Jan-97 Jan-00 Jan-03 Jan-06 Jan-09 Jan-12 Jan-15 Jan-18 %bps 18M3M - 3M (LHS) 18M3M 3M 0 1 2 3 4 5 6 7 8 9-150 -100 -50 0 50 100 150 200 Jan-90 Jan-96 Jan-02 Jan-08 Jan-14 % reverse scale Risk Neutral bps 10y2y 5y2y 10y5y FFR (RHS) 0 1 2 3 4 5 6 7 8 9-50 0 50 100 150 200 250 300 Jan-90 Jan-96 Jan-02 Jan-08 Jan-14 % reverse scale TP, bps 10y2y 5y2y 10y5y FFR (RHS) 0 20 40 60 80 100 120 140 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18 bps 10y2y 10y2y, 1yfwd 10y2y, 2yfwd 10y2y, 3yfwd

- 13. USTs, Technicals 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 3.25 3.50 Jan-16 Jul-16 Jan-17 Jul-17 Jan-18 Jul-18 % 10-Yr Treasury 50 WMA +2stdev -2stdev -12 -10 -8 -6 -4 -2 0 Jan-98 Jan-01 Jan-04 Jan-07 Jan-10 Jan-13 Jan-16 Maximum drawdown, 1Yr, % Barclays UST 7-10Yrs Max Drawdown -4 -3 -2 -1 0 1 2 3 4 5 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18 52wk z-score Copper/Gold Oil/Gold Ratio Metals/Gold Lumber/Gold Risk off 1.2 1.4 1.6 1.8 2.0 2.2 2.4 2.6 2.8 3.0 3.2 3.4 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18 % US10T 20dMA 50dMA 200dMA