QNBFS Daily Market Report May 31, 2017

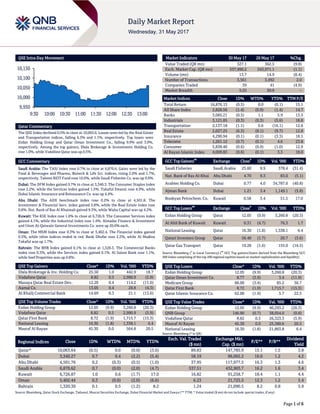

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.5% to close at 10,063.6. Losses were led by the Real Estate and Transportation indices, falling 6.3% and 1.1%, respectively. Top losers were Ezdan Holding Group and Qatar Oman Investment Co., falling 9.9% and 3.9%, respectively. Among the top gainers, Dlala Brokerage & Investments Holding Co. rose 1.0%, while Vodafone Qatar was up 0.5%. GCC Commentary Saudi Arabia: The TASI Index rose 0.7% to close at 6,870.6. Gains were led by the Food & Beverages and Pharma, Biotech & Life Sci. indices, rising 2.0% and 1.7%, respectively. Taleem REIT Fund rose 10.0%, while Saudi Fisheries Co. was up 9.9%. Dubai: The DFM Index gained 0.7% to close at 3,340.3. The Consumer Staples index rose 2.2%, while the Services index gained 1.5%. Takaful Emarat rose 4.9%, while Dubai Islamic Insurance and Reinsurance Co. was up 4.4%. Abu Dhabi: The ADX benchmark index rose 0.2% to close at 4,501.8. The Investment & Financial Serv. index gained 3.8%, while the Real Estate index rose 0.8%. Nat. Bank of Ras Al Khaimah gained 9.3%, while Waha Capital was up 4.2%. Kuwait: The KSE Index rose 1.0% to close at 6,726.9. The Consumer Services index gained 4.1%, while the Industrial index rose 1.4%. Almadar Finance & Investment and Umm Al-Qaiwain General Investments Co. were up 20.0% each. Oman: The MSM Index rose 0.3% to close at 5,402.4. The Financial index gained 0.5%, while other indices ended in red. Bank Dhofar rose 2.2%, while Al Madina Takaful was up 1.7%. Bahrain: The BHB Index gained 0.1% to close at 1,320.3. The Commercial Banks index rose 0.3%, while the Services index gained 0.1%. Al Salam Bank rose 1.1%, while Seef Properties was up 0.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv. Holding Co. 25.50 1.0 442.9 18.7 Vodafone Qatar 8.82 0.5 2,990.9 (5.9) Mazaya Qatar Real Estate Dev. 12.20 0.4 114.2 (11.0) Aamal Co. 13.05 0.4 28.8 (4.3) Al Khalij Commercial Bank 14.69 0.3 21.1 (13.6) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 12.05 (9.9) 3,260.8 (20.3) Vodafone Qatar 8.82 0.5 2,990.9 (5.9) Qatar First Bank 8.72 (1.9) 1,715.7 (15.3) National Leasing 16.30 (1.8) 1,338.1 6.4 Masraf Al Rayan 45.30 0.0 564.8 20.5 Market Indicators 30 May 17 29 May 17 %Chg. Value Traded (QR mn) 327.1 362.5 (9.8) Exch. Market Cap. (QR mn) 537,990.2 543,971.1 (1.1) Volume (mn) 13.7 14.9 (8.4) Number of Transactions 3,561 3,492 2.0 Companies Traded 39 41 (4.9) Market Breadth 5:25 30:9 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 16,876.13 (0.5) 0.0 (0.1) 15.1 All Share Index 2,828.56 (1.4) (0.9) (1.4) 14.7 Banks 3,085.21 (0.5) 1.1 5.9 13.5 Industrials 3,121.85 (0.3) (0.3) (5.6) 18.8 Transportation 2,137.18 (1.1) 0.6 (16.1) 12.6 Real Estate 2,027.25 (6.3) (8.1) (9.7) 12.8 Insurance 4,290.94 (0.1) (0.1) (3.3) 18.1 Telecoms 1,261.12 (0.7) (0.1) 4.6 23.8 Consumer 5,838.40 (0.6) (0.9) (1.0) 12.9 Al Rayan Islamic Index 4,009.83 (0.6) (0.1) 3.3 18.0 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Saudi Fisheries Saudi Arabia 25.60 9.9 378.4 (31.4) Nat. Bank of Ras Al-Khai Abu Dhabi 4.70 9.3 83.0 (5.1) Arabtec Holding Co. Dubai 0.77 4.0 34,787.0 (40.8) Ajman Bank Dubai 1.21 3.4 1,149.1 (5.8) Boubyan Petrochem. Co. Kuwait 0.58 3.4 51.5 17.0 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Ezdan Holding Group Qatar 12.05 (9.9) 3,260.8 (20.3) Al Ahli Bank of Kuwait Kuwait 0.31 (4.7) 76.3 1.7 National Leasing Qatar 16.30 (1.8) 1,338.1 6.4 Qatari Investors Group Qatar 56.40 (1.7) 20.7 (3.6) Qatar Gas Transport Qatar 19.28 (1.6) 155.0 (16.5) Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 12.05 (9.9) 3,260.8 (20.3) Qatar Oman Investment Co. 8.77 (3.9) 3.4 (11.9) Medicare Group 86.00 (3.4) 85.2 36.7 Qatar First Bank 8.72 (1.9) 1,715.7 (15.3) Qatar Islamic Insurance Co. 62.00 (1.9) 5.7 22.5 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Ezdan Holding Group 12.05 (9.9) 40,293.2 (20.3) QNB Group 146.90 (0.7) 38,054.0 (0.8) Vodafone Qatar 8.82 0.5 26,323.3 (5.9) Masraf Al Rayan 45.30 0.0 25,380.6 20.5 National Leasing 16.30 (1.8) 21,863.8 6.4 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,063.64 (0.5) 0.0 (0.0) (3.6) 89.83 147,785.9 15.1 1.5 3.8 Dubai 3,340.27 0.7 0.4 (2.2) (5.4) 58.19 96,092.2 16.0 1.2 4.2 Abu Dhabi 4,501.76 0.2 (0.3) (0.5) (1.0) 37.95 117,977.5 16.3 1.3 4.6 Saudi Arabia 6,870.62 0.7 (0.0) (2.0) (4.7) 537.51 432,903.7 16.2 1.6 3.4 Kuwait 6,726.87 1.0 0.6 (1.7) 17.0 16.82 91,258.7 18.4 1.1 4.4 Oman 5,402.44 0.3 (0.0) (2.0) (6.6) 6.23 21,725.5 12.3 1.2 5.4 Bahrain 1,320.30 0.1 0.5 (1.2) 8.2 1.24 21,090.5 8.2 0.8 5.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,950 10,000 10,050 10,100 10,150 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 0.5% to close at 10,063.6. The Real Estate and Transportation indices led the losses. The index fell on the back of selling pressure from GCC and non-Qatari shareholders despite buying support from Qatari shareholders. Ezdan Holding Group and Qatar Oman Investment Co. were the top losers, falling 9.9% and 3.9%, respectively. Among the top gainers, Dlala Brokerage & Investments Holding Co. rose 1.0%, while Vodafone Qatar was up 0.5%. Volume of shares traded on Tuesday fell by 8.4% to 13.7mn from 14.9mn on Monday. However, as compared to the 30-day moving average of 9.7mn, volume for the day was 41.6% higher. Ezdan Holding Group and Vodafone Qatar were the most active stocks, contributing 23.8% and 21.9% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change QNB Group Moody's Qatar LT-DR/LT-CRA Aa3/ Aa2(cr) Aa3/ Aa3(cr) – Stable National Bank of Kuwait Moody's Kuwait LT-DR Aa3 Aa3 – Stable Kuwait Finance House Moody's Kuwait LT-DR A1 A1 – Stable Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, DR – Deposit Ratings, CRA – Counterparty Risk Assessment) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 05/30 EU European Commission Economic Confidence May 109.2 110.0 109.7 05/30 EU European Commission Industrial Confidence May 2.8 3.1 2.6 05/30 EU European Commission Services Confidence May 13.0 14.2 14.2 05/30 EU European Commission Consumer Confidence May -3.3 -3.3 -3.3 05/30 France INSEE Consumer Confidence May 102 101 100 05/30 France INSEE Consumer Spending MoM April 0.5% 0.8% -0.1% 05/30 France INSEE Consumer Spending YoY April -0.5% 0.6% -0.8% 05/30 France INSEE GDP QoQ 1Q2017 0.4% 0.3% 0.3% 05/30 France INSEE GDP YoY 1Q2017 1.0% 0.8% 0.8% 05/30 Germany German Federal Statistical Office CPI MoM May -0.2% -0.1% 0.0% 05/30 Germany German Federal Statistical Office CPI YoY May 1.5% 1.6% 2.0% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) News Qatar Moody’s affirms QNB Group rating, upgrades outlook to ‘stable’ – Global credit rating agency Moody’s has affirmed the ‘Aa3’ long term deposit rating on QNB Group and changed the outlook to ‘stable’ from ‘negative’. The ratings and rating inputs that are unaffected by yesterday’s action are QNB Group ‘baa1’ baseline credit assessment (BCA), ‘baa1’ adjusted BCA, ‘Prime- 1’ short-term deposit ratings and QNB Group Finance’s ‘(P)A2’ backed subordinate MTN (medium term note) rating. The key driver for the affirmation of the ‘Aa3’ deposit rating is based on Moody’s view of a continued very high likelihood of Qatari government support. This continues to translate into four notches of uplift for the bank’s long-term deposit ratings, from its ‘baa1’ BCA. Moody’s support assumptions take into account the capacity and willingness of a government to provide support to the bank in case of need, it said, highlighting the Qatari authorities’ strong track record of supporting the country’s banks. (Gulf-Times.com) Moody's downgrades Qatari project finance ratings; changes outlook to ‘stable’ – Moody's Investors Service, (Moody's) downgraded the guaranteed senior secured debt ratings of Ras Laffan Liquefied Natural Gas Co.Ltd (II) (RasGas II) and Ras Laffan Liquefied Natural Gas Co. Ltd (3) (RasGas 3) to ‘A1’, from ‘Aa3’. Moody's has also downgraded the senior secured debt Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 47.24% 42.73% 14,756,623.17 Qatari Institutions 33.23% 24.48% 28,617,382.20 Qatari 80.47% 67.21% 43,374,005.37 GCC Individuals 0.50% 0.79% (950,526.43) GCC Institutions 2.34% 8.70% (20,827,701.18) GCC 2.84% 9.49% (21,778,227.61) Non-Qatari Individuals 8.59% 10.30% (5,610,310.51) Non-Qatari Institutions 8.12% 13.00% (15,985,467.25) Non-Qatari 16.71% 23.30% (21,595,777.76)

- 3. Page 3 of 6 ratings of Nakilat Inc. (Nakilat) to ‘A1’, from ‘Aa3’ and downgraded the senior subordinated debt rating of Nakilat to ‘A2’, from ‘A1’. The outlook on all three issuers has been changed to ‘stable’, from ‘negative’. (Bloomberg) Moody's downgrades Qatar Petroleum to ‘Aa3’, Industries Qatar to ‘A1’; outlook stable – Moody's Investors Service (Moody’s) downgraded the long-term issuer ratings of Qatar's national oil & gas company Qatar Petroleum (QP) to ‘Aa3’ from ‘Aa2’ and subsidiary Industries Qatar to ‘A1’ from ‘Aa3’. The outlook on the ratings has been changed to ‘stable’ from ‘negative’. Concurrently, Moody's has downgraded the long-term issuer rating and senior unsecured bond ratings of special purpose vehicle Qatari Diar Finance (QDF) to ‘Aa3’ from ‘Aa2’. The outlook on the ratings has been changed to ‘stable’ from ‘negative’. (Bloomberg) ORDS announces its intent to delist Ooredoo GDR from the London Stock Exchange – Ooredoo (ORDS) announced it has requested the UK Listing authority to cancel the listing and admission to trading of Ooredoo GDR (ISIN number: US6834202029) on the London Stock Exchange, with effect from the opening of the market on August 31, 2017. The decision is primarily due to the ease with which international investors are now able to purchase Ooredoo securities on the Qatar Stock Exchange. Ooredoo GDR was admitted to trading on the London Stock Exchange on July 19, 1999. The shares of ORDS will remain listed on the Qatar Stock Exchange and the Abu Dhabi Securities Exchange. (QSE) QIIK-led JV starts Morocco operations – Qatar International Islamic Bank (QIIK) has announced the launch of the operations of Umnia Bank in Morocco. The bank is the result of a partnership between QIIK, Crédit immobilier et hotelier (CIH) and Moroccan Deposit and Management Fund. The bank’s operations began through its branches in Casablanca and Rabat, where Umnia Bank is considered the first bank of its kind to obtain the necessary approval of the Central Bank of Morocco to promote its products in the Kingdom. The joint venture in Morocco is among those pioneering Shari’ah- compliant banking in the Kingdom. Umnia Bank has formulated an operational strategy that focuses on expanding in various cities in the Kingdom of Morocco and offers innovative products, including everyday banking solutions, finance and investments as well as deposits and savings. (Gulf-Times.com) QDB, Dubai Exports sign deal to promote trade, support SMEs – Qatar Development Bank (QDB), through its export arm, Tasdeer, signed a Memorandum of Understanding (MoU) for cooperation with Dubai Exports to facilitate business transactions, promote trade, and foster opportunities for greater commerce between the two countries. QDB said the signing ceremony was held on the sidelines of the recently-held Index Design Series 2017 held in Dubai. This year, QDB participated at Index Design Series 2017 along with nine Qatari companies involved across various fields of designing. The MoU was signed by QDB’s executive director of export development and promotion Hassan Khalifa al-Mansoori and Dubai Exports CEO Saed al-Awadi in the presence of officials from both organizations and participating exhibitors. (Gulf-Times.com) Norwood Qatar Steel Solutions opens new factory – Norwood Qatar Steel Solutions, the leading turnkey steel solutions provider in Qatar, officially opened the doors to its innovative new steel solutions factory in the Industrial Area, in a grand ceremony attended by a host of VIPs and distinguished guests. Since arriving in Qatar in 2011, as a member of the multifaceted Tadmur Holding, Norwood Qatar Steel Solutions has quickly established itself as an industry leader by offering tailored solutions in planning, design, manufacturing and the installation of bespoke steel solutions. The new, state-of-the- art manufacturing facility, covering an area of 5,000 square meters, will further strengthen the position of Norwood as the market leader in providing bespoke steel solutions covering an array of industries, including the education sector, transportation infrastructure, medical facilities, large corporate work spaces and controlled environments, such as clean rooms and laboratories. (Peninsula Qatar) International Consumer spending, inflation data support Fed rate hike case – US consumer spending recorded its biggest increase in four months in April and monthly inflation rebounded, pointing to firming domestic demand that could allow the Federal Reserve to raise interest rates next month. Consumer spending, which accounts for more than two-thirds of US economic activity, is likely to remain on solid ground in the wake of other reports that showed confidence among households still at lofty levels despite some slippage this month and strong gains in house prices in March. MUFG Union Bank’s Chief Economist, Chris Rupkey said, "Fed officials can continue with their gradual pace of rate hikes in June as the economy remains on course for stronger growth this quarter and throughout the rest of the year." The Commerce Department reported that consumer spending increased 0.4% last month after an upwardly revised 0.3% gain in March, as households spent more on both goods and services. Consumer spending grew at its slowest pace in more than seven years in 1Q2017, helping to restrict the increase in GDP to an annual rate of 1.2% in 1Q2017. (Reuters) Eurozone’s economic confidence unexpectedly slips from decade high – Eurozone’s economic confidence fell for the first time this year and consumers’ outlook for inflation weakened, pointing to subdued price pressures. The European Commission’s index of executive and consumer sentiment fell to 109.2 in May from a revised 109.7 in April. While that fell short of economists’ expectations, the gauge remains close to the highest level in a decade. Another measure showed 12- month price expectations declined for a second month. The report may reinforce European Central Bank’s President, Mario Draghi’s view that the region still needs an extraordinary amount of monetary policy support. Draghi has urged patience in outlining an exit strategy from negative rates and a $2.6tn bond-buying program even as he has acknowledged that that the upswing is becoming increasingly solid and broad-based. The decline in the confidence gauge marks the first modest stumble by Eurozone’s economy, which has shown continued signs of strength this year. (Bloomberg) German inflation slows more than expected in May, state data suggest – German consumer inflation probably slowed more than expected in May, falling below the European Central Bank's (ECB) target of just under 2%, taking some pressure off the ECB to wind down its monetary stimulus soon. The

- 4. Page 4 of 6 surprisingly weak figures from several German states hinted that price pressures in Europe's biggest economy remain relatively modest despite its continued upswing, booming labor market and the ECB's loose monetary policy. In Germany's most populous state, North Rhine-Westphalia, annual inflation slowed to 1.6% (from 2.1% in April). Inflation also fell back to 1.6% in Saxony. In Bavaria and Brandenburg, it dropped to 1.4%, while it slowed to 1.5% in Baden-Wuerttemberg and to 1.7% in Hesse. The German data follows Spanish price figures that showed inflation in the Eurozone's fourth biggest economy also eased in May. According to the National Statistics Institute (INE), Spanish consumer prices rose by 2.0% on the year, the slowest rate since December. (Reuters) Japan's factory output races in April to hit its highest level since 2008 – Japan's factory output rebounded in April from March and grew at the fastest pace in almost six years, taking production to its highest level since 2008. Japan's industrial output rose 4.0% in April from the previous month, the strongest growth since posting a 4.2% gain in June 2011, although slightly shy of the median estimate in a Reuters poll for a 4.3% rise. Norio Miyagawa, Senior Economist at Mizuho Securities said, "Output grew at a very high level in April. I think production will continue to grow as a trend. The result kicked off a start to the second quarter that gives us hope for positive growth." Overall inventories increased 1.5% in April from March, the fifth straight rising month, as stocks of cars and trucks rose. (Reuters) China’s factory PMI growth holds up in May, steel sector activity speeds up – China’s manufacturing sector grew faster than expected in May as activity in the steel industry rebounded sharply, allaying concerns of slowing economic momentum as Beijing cracks down on financial risks. The National Bureau of Statistics' official Purchasing Managers' Index (PMI) held up at 51.2 in May, in line with April's number, which was the lowest in six months. Analysts polled by Reuters had predicted a reading of 51.0, the tenth straight month above the 50-point mark that separates growth from contraction on a monthly basis. New orders kept pace with April at 52.3, with export orders firming a touch by 0.1% to 50.7, suggesting external demand held up. Production in the month stayed within the expansionary territory, though growth eased to 53.4 compared to last month's 53.8. Activity in China's steel industry expanded at the fastest pace in a year in May, supported by an increase in new orders, a separate survey showed, suggesting still-solid demand in the construction sector. (Reuters) Regional A M Best: Introduction of VAT in GCC to hit cash flow in insurance sector – According to insurance rating agency, A M Best, the introduction of value added tax (VAT) in the GCC countries from next year is expected to hit the insurance sector, impacting the cash flow and expense ratio. An Associate Financial Analyst at A M Best, Aneela Mather-Khan said, “The implementation of the VAT rules will increase the cost of doing business for insurers in the GCC as VAT will be applied to almost all goods and services in the value chain, including outsourced services.” The degree of the impact on individual insurers would depend on the classification of the product and whether they are able to reclaim input tax. (Gulf-Times.com) Mixed results for MENA hospitality industry – The MENA hospitality industry experienced mixed results in April 2017 as higher occupancies yet lower average room rates affected the overall revenue per average room (RevPAR). Dubai experienced an increase across all KPIs, including the highest RevPAR of $273, an increase of 18.7% when compared to last year. Dubai also saw the highest occupancy in April at 88% and the highest average room rate of $310. (GulfBase.com) Alpen Capital: Internet drives GCC’s retail e-commerce market to top $41bn by 2020 – Driven by internet and the social media, GCC’s retail e-commerce market is expanding fast and expected to touch $41.5bn by 2020. Currently, Qatar accounts for 10% of the region’s online market, according to Alpen Capital. It said the retail e-commerce market in the GCC is expanding, given the increasing use of Internet and social media, better access to secure payment gateways and gradual improvement in the delivery system. Another key factor boosting popularity of the online channel and garnering consumer attention is the availability of wide product choices at competitive rates. (Gulf- Times.com) Consumer spending picks up in Saudi Arabia – According to a report issued by Al-Rajhi Capital, Saudi Arabia’s consumer spending is beginning to recover, as indicated by the 11.4% YoY increase in the value of point-of-sale (POS) transactions to SR16.5bn in April 2017. The report stated that the strong POS data was likely supported by the reinstatement of allowances for government employees announced in the last week of April. The report noted that the Kingdom’s cost of living index continued in the deflation territory in April 2017 for the fourth consecutive month. (GulfBase.com) MedGulf denies it is considering sale of business – Saudi Arabia- based Mediterranean and Gulf Insurance & Reinsurance Co (MedGulf) denied it’s considering putting itself up for sale. MedGulf isn’t exploring strategic options that could include a potential sale of the company and hasn’t appointed Saudi Fransi Capital to advise on the process, according to a company spokeperson. (GulfBase.com) UAE ministry managing 12 projects worth $390mn – UAE’s Ministry of Infrastructure Development is currently managing 12 vital projects, as part of its investment program, which is distributed around several of the country’s Emirates at a total cost of $390mn. UAE’s Minister of Infrastructure Development, Dr Abdullah bin Mohammed Belhaif Al Nuaimi said that the projects include five road projects that connect the country’s various regions, as well as four projects for the Ministry of Interior, two projects for the Ministry of Justice, and one project for the Ministry of Culture and Knowledge Development, reported WAM, the Emirates official news agency. (GulfBase.com) Abu Dhabi Department of Finance processes tenders worth AED5bn – Abu Dhabi’s Department of Finance said that in 1Q2017, it processed 26 tenders for seven government entities in the Emirate worth AED5bn under the system managed by Al Maqta’a bidding hall that ensures greater transparency. The tenders that were managed by Al Maqta’a included service and infrastructure projects in Al Wathba North and various regions of the Emirate and roadworks in the Al Dhafra region. It also included the construction of buildings for Abu Dhabi

- 5. Page 5 of 6 Distribution Company, Abu Dhabi Central Morgue, General Directorate of Penal and Correctional Institutions, Al Ghuwaifat Border and Strategic Feed Stores. That is in addition to establishing electricity, water and sanitation infrastructure. (GulfBase.com) Around 900 jobs cut in Abu Dhabi’s banking sector – Nearly 900 jobs were cut across the banking sector in Abu Dhabi over the past year, with the number of employees in the sector dropping to 12,500 in 1Q2017. According to the Statistics Centre Abu Dhabi (SCAD), the sector saw a 6.9% YoY decline in the number of employees compared to the 13,400 employees working in it in 1Q2016. SCAD said the figures were for all commercial and Islamic banks it studied in Abu Dhabi. The bank did not say that every bank in Abu Dhabi was included in the study. The decline comes amid a slowdown in the banking sector, especially during 2016, with many publicly-listed banks reporting lower YoY profit growth and some reporting a decline in profitability. The banks’ financial statements showed the decline was supported by higher impairment charges and slower loan growth. This is amid slower economic growth in the UAE, with data from the International Monetary Fund (IMF) forecasting a 1.3% growth rate in the country’s gross domestic product in 2017 compared to 2.7% in 2016. (GulfBase.com) Dana Gas venture seeks $26.5bn in damages from Iraqi Kurds – Dana Gas and its partners are seeking damages of at least $26.5bn from Iraq’s self-governing Kurdish region for delays in oil and natural gas projects, a US court filing shows. UAE-based Dana Gas and its partners in the venture, called Pearl Petroleum, filed a petition on May 12, 2017 in a federal court in Washington, D.C., seeking recognition and enforcement of awards in a London arbitration case, according to the US court documents. The petition is part of a legal process that may allow Pearl Petroleum to seize Kurdish assets if the Kurds don’t pay awards decided in arbitration. (GulfBase.com) Moody's affirms ratings of five UAE banks and changes outlook to ‘stable’ from ‘negative’ on four – Moody's Investors Service (Moody's) affirmed the long-term ratings of five banks based in the UAE, namely, First Abu Dhabi Bank at ‘Aa3’, Abu Dhabi Commercial Bank at ‘A1’, Al Hilal Bank at ‘A1’, Union National Bank at ‘A1’ and Abu Dhabi Islamic Bank at ‘A2’. The outlook on First Abu Dhabi Bank, Abu Dhabi Commercial Bank, Union National Bank’s long-term deposit and Abu Dhabi Islamic Bank's long-term issuer ratings has been changed to ‘stable’ from ‘negative’. In addition, the ‘ba2’ baseline credit assessment (BCA) and adjusted BCA and ‘Prime-1’ short-term issuer ratings of Al Hilal Bank were also affirmed. The outlook on Al Hilal Bank's long term ratings remains ‘negative’. The action follows Moody's decision to affirm the UAE's government issuer rating at ‘Aa2’, and change the outlook to ‘stable’ from ‘negative’. (Bloomberg) Oman's central bank raises OMR47mn from treasury bills – Oman’s central bank has raised OMR47.27mn by way of issuing government treasury bills. The total value of the allotted treasury bills amounted to OMR47.27mn, for a maturity period of 91 days, from May 31 to August 30, 2017. The average accepted price reached OMR99.729 for every OMR100 while the minimum accepted price arrived at OMR99.725 per OMR100. The average discount rate and the average yield reached 1.08654% and 1.08950%, respectively. (GulfBase.com) PDO: Exploration focus on low unit technical cost opportunities – Majority government-owned oil and gas producer in Oman, Petroleum Development Oman (PDO) is harnessing cutting- edge seismic data acquisition technology to explore and build a portfolio of oil and gas assets designed to help sustain production over the long-term. In its sights are low unit technical cost opportunities that will help the company meet its production targets over the coming 10 years, PDO stated in its 2016 Sustainability Report. (GulfBase.com) Oman’s first large-scale wind farm to start operations in 2020 – Oman’s first large-scale commercial wind-based renewable energy project is getting delayed and will start operations in 2020. “The project has been tendered, but is currently on hold and awaiting approval. The wind farm, which is expected to be comprised of around 25 wind turbines will be located near Harweel,” according to the seven-year outlook for the power and water sector released by the Oman Power and Water Procurement Company. (GulfBase.com) Oman Oil mandates banks for revolving credit facility – According to sources, Oman Oil Co. mandated a group of regional and international banks to arrange a $1.2bn revolving credit facility. The loan would refinance a $1bn revolving facility which the company obtained in 2014 and which is due for redemption this year. That loan was the shorter-dated tranche of a $1.85bn revolving credit facility, which also included a five-year, $850mn tranche. The new revolver would have a five-year maturity and be provided by banks including Barclays, Bank of Tokyo-Mitsubishi UFJ, Credit Agricole, Deutsche Bank, First Abu Dhabi Bank, HSBC, Natixis, Societe Generale, Standard Chartered and Sumitomo Mitsui Banking Corp. (Reuters) Moody's withdraws ratings of Bahrain Development Bank – Moody's Investors Service (Moody's) has withdrawn Bahrain Development Bank’s ‘Ba2/Not Prime’ Issuer Ratings and its ‘Ba2(cr)/NP(cr)’ Counterparty Risk Assessment. At the time of the withdrawals, the long-term ratings had a negative outlook. (Bloomberg)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mohamed Abo Daff QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mohd.abodaff@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market closed on May 30, 2017) Source: Bloomberg (*$ adjusted returns, # Market closed on May 30, 2017) 70.0 90.0 110.0 130.0 150.0 170.0 Apr-13 Apr-14 Apr-15 Apr-16 Apr-17 QSEIndex S&P Pan Arab S&P GCC 0.7% (0.5%) 1.0% 0.1% 0.3% 0.2% 0.7% (0.6%) 0.0% 0.6% 1.2% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,263.15 (0.5) (0.3) 9.6 MSCI World Index 1,909.90 (0.1) (0.1) 9.1 Silver/Ounce 17.40 0.0 0.3 9.3 DJ Industrial 21,029.47 (0.2) (0.2) 6.4 Crude Oil (Brent)/Barrel (FM Future) 51.84 (0.9) (0.6) (8.8) S&P 500 2,412.91 (0.1) (0.1) 7.8 Crude Oil (WTI)/Barrel (FM Future) 49.66 (0.3) (0.3) (7.6) NASDAQ 100 6,203.19 (0.1) (0.1) 15.2 Natural Gas (Henry Hub)/MMBtu 3.05 (1.6) (1.6) (17.1) STOXX 600 390.50 (0.2) (0.2) 14.5 LPG Propane (Arab Gulf)/Ton 65.75 (0.6) (0.6) (8.4) DAX 12,598.68 (0.2) (0.0) 16.3 LPG Butane (Arab Gulf)/Ton 67.50 (3.2) (3.2) (30.4) FTSE 100 7,526.51 0.1 0.1 9.6 Euro 1.12 0.2 0.0 6.4 CAC 40 5,305.94 (0.5) (0.6) 15.6 Yen 110.85 (0.4) (0.4) (5.2) Nikkei 19,677.85 0.4 0.5 8.4 GBP 1.29 0.1 0.4 4.2 MSCI EM 1,011.77 (0.3) (0.5) 17.3 CHF 1.03 0.3 (0.0) 4.5 SHANGHAI SE Composite# 3,110.06 0.0 0.0 1.4 AUD 0.75 0.3 0.2 3.6 HANG SENG# 25,701.63 0.0 0.2 16.2 USD Index 97.28 (0.2) (0.2) (4.8) BSE SENSEX 31,159.40 0.1 0.4 23.2 RUB 56.57 0.1 0.1 (8.1) Bovespa 63,962.27 0.3 (0.2) 5.6 BRL# 0.31 0.0 0.1 (0.1) RTS 1,074.81 (1.0) 0.2 (6.7) 118.4 99.8 98.0