QNBFS Daily Market Report May 09, 2016

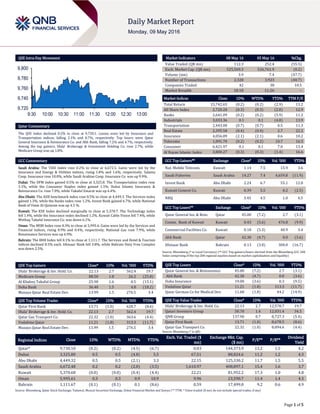

- 1. Page 1 of 5 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.2% to close at 9,730.1. Losses were led by Insurance and Transportation indices, falling 2.1% and 0.7%, respectively. Top losers were Qatar General Insurance & Reinsurance Co. and Ahli Bank, falling 7.2% and 4.7%, respectively. Among the top gainers, Dlala' Brokerage & Investment Holding Co. rose 2.7%, while Medicare Group was up 1.8%. GCC Commentary Saudi Arabia: The TASI Index rose 0.2% to close at 6,672.5. Gains were led by the Insurance and Energy & Utilities indices, rising 1.8% and 1.6%, respectively. Salama Coop. Insurance rose 10.0%, while Saudi Arabian Coop. Insurance Co. was up 9.9%. Dubai: The DFM Index gained 0.5% to close at 3,325.8. The Transportation index rose 3.1%, while the Consumer Staples index gained 1.5%. Dubai Islamic Insurance & Reinsurance Co. rose 7.0%, while Takaful Emarat was up 6.4%. Abu Dhabi: The ADX benchmark index rose 0.5% to close at 4,449.3. The Services index gained 1.3%, while the Banks index rose 1.2%. Invest Bank gained 6.7%, while National Bank of Umm Al-Qaiwain was up 4.5 %. Kuwait: The KSE Index declined marginally to close at 5,370.7. The Technology index fell 1.4%, while the Insurance index declined 1.2%. Kuwait Cable Vision fell 7.4%, while Wethaq Takaful Insurance Co. was down 6.1%. Oman: The MSM Index rose 0.3% to close at 5,995.6. Gains were led by the Services and Financial indices, rising 0.9% and 0.4%, respectively. National Gas rose 7.9%, while Renaissance Services was up 6.9%. Bahrain: The BHB Index fell 0.1% to close at 1,111.7. The Services and Hotel & Tourism indices declined 0.5% each. Ithmaar Bank fell 3.8%, while Bahrain Duty Free Complex was down 2.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Dlala' Brokerage & Inv. Hold. Co. 22.13 2.7 562.4 19.7 Medicare Group 88.50 1.8 26.2 (25.8) Al Khaleej Takaful Group 25.90 1.6 0.5 (15.1) Doha Bank 36.40 1.5 4.8 (18.2) Mazaya Qatar Real Estate Dev. 13.99 1.5 276.5 3.4 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 13.71 (1.0) 628.7 (8.6) Dlala' Brokerage & Inv. Hold. Co. 22.13 2.7 562.4 19.7 Qatar Gas Transport Co. 22.32 (1.0) 363.6 (4.4) Vodafone Qatar 11.21 (1.8) 313.3 (11.7) Mazaya Qatar Real Estate Dev. 13.99 1.5 276.5 3.4 Market Indicators 08 May 16 05 May 16 %Chg. Value Traded (QR mn) 112.3 252.4 (55.5) Exch. Market Cap. (QR mn) 525,569.3 526,761.9 (0.2) Volume (mn) 3.9 7.4 (47.7) Number of Transactions 2,328 3,923 (40.7) Companies Traded 42 38 10.5 Market Breadth 18:18 11:26 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,742.65 (0.2) (0.2) (2.9) 13.2 All Share Index 2,720.20 (0.3) (0.3) (2.0) 12.9 Banks 2,641.09 (0.2) (0.2) (5.9) 11.2 Industrials 3,033.36 0.1 0.1 (4.8) 13.9 Transportation 2,443.00 (0.7) (0.7) 0.5 11.3 Real Estate 2,395.58 (0.4) (0.4) 2.7 22.2 Insurance 4,056.89 (2.1) (2.1) 0.6 10.2 Telecoms 1,091.70 (0.2) (0.2) 10.7 16.5 Consumer 6,421.97 0.1 0.1 7.0 13.4 Al Rayan Islamic Index 3,800.27 (0.3) (0.3) (1.4) 16.6 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Mobile Telecom. Kuwait 1.14 7.5 15.9 3.6 Saudi Fisheries Saudi Arabia 14.27 7.4 4,659.8 (11.9) Invest Bank Abu Dhabi 2.24 6.7 55.1 12.0 Kuwait Cement Co. Kuwait 0.39 5.5 0.2 (2.5) NBQ Abu Dhabi 3.45 4.5 1.0 4.5 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Qatar General Ins. & Rein. Qatar 45.00 (7.2) 2.7 (3.1) Comm. Bank of Kuwait Kuwait 0.43 (5.6) 476.8 (9.9) Commercial Facilities Co. Kuwait 0.18 (5.3) 40.9 3.4 Ahli Bank Qatar 42.30 (4.7) 0.0 (3.6) Ithmaar Bank Bahrain 0.13 (3.8) 300.0 (16.7) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar General Ins. & Reinsurance 45.00 (7.2) 2.7 (3.1) Ahli Bank 42.30 (4.7) 0.0 (3.6) Doha Insurance 19.00 (3.6) 0.3 (9.5) Vodafone Qatar 11.21 (1.8) 313.3 (11.7) Qatar German Co for Medical Dev. 11.68 (1.8) 44.2 (14.9) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Dlala' Brokerage & Inv. Hold. Co. 22.13 2.7 12,578.7 19.7 Qatari Investors Group 50.70 1.4 12,031.4 34.5 QNB Group 137.90 0.7 8,727.3 (5.4) Qatar First Bank 13.71 (1.0) 8,678.5 (8.6) Qatar Gas Transport Co. 22.32 (1.0) 8,094.6 (4.4) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,730.10 (0.2) (0.2) (4.5) (6.7) 0.03 144,373.9 13.2 1.5 4.2 Dubai 3,325.80 0.5 0.5 (4.8) 5.5 67.51 88,824.6 11.2 1.2 4.3 Abu Dhabi 4,449.32 0.5 0.5 (2.1) 3.3 22.15 125,330.2 11.7 1.5 5.5 Saudi Arabia 6,672.48 0.2 0.2 (2.0) (3.5) 1,610.97 408,897.1 15.4 1.6 3.7 Kuwait 5,370.68 (0.0) (0.0) (0.4) (4.4) 22.21 81,952.2 17.3 1.0 4.8 Oman 5,995.61 0.3 0.3 0.9 10.9 9.96 23,590.7 11.4 1.4 4.3 Bahrain 1,111.67 (0.1) (0.1) 0.1 (8.6) 0.59 17,499.0 9.2 0.6 4.9 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,720 9,740 9,760 9,780 9,800 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 5 Qatar Market Commentary The QSE Index declined 0.2% to close at 9,730.1. The Insurance and Transportation indices led the losses. The index fell on the back of selling pressure from GCC shareholders despite buying support from Qatari and non-Qatari shareholders. Qatar General Insurance & Reinsurance Co. and Ahli Bank were the top losers, falling 7.2% and 4.7%, respectively. Among the top gainers, Dlala' Brokerage & Investment Holding Co. rose 2.7%, while Medicare Group was up 1.8%. Volume of shares traded on Sunday fell by 47.7% to 3.9mn from 7.4mn on Thursday. Further, as compared to the 30-day moving average of 9.5mn, volume for the day was 59.1% lower. Qatar First Bank and Dlala' Brokerage & Investment Holding Co. were the most active stocks, contributing 16.3% and 14.5% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 1Q2016 % Change YoY Operating Profit (mn) 1Q2016 % Change YoY Net Profit (mn) 1Q2016 % Change YoY Amanat Holdings Dubai AED – – – – 9.5 533.3% Oman Insurance Co. Dubai AED 335.6 -6.7% 15.0 -54.5% 24.3 -45.4% Union Cement Co. Abu Dhabi AED 127.8 -15.0% 10.3 -59.7% 9.4 -62.0% Methaq Takaful Insurance Co. Abu Dhabi AED – – – – 1.8 NA Source: Company data, DFM, ADX, MSM Earnings Calendar Tickers Company Name Date of reporting results No. of days remaining Status VFQS Vodafone Qatar 17-May-16 8 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 50.24% 51.92% (1,884,687.81) Qatari Institutions 16.20% 12.67% 3,970,140.96 Qatari 66.44% 64.59% 2,085,453.15 GCC Individuals 0.51% 0.65% (156,101.82) GCC Institutions 6.32% 9.82% (3,935,520.33) GCC 6.83% 10.47% (4,091,622.15) Non-Qatari Individuals 18.29% 16.11% 2,445,235.36 Non-Qatari Institutions 8.44% 8.83% (439,066.36) Non-Qatari 26.73% 24.94% 2,006,169.00

- 3. Page 3 of 5 News Qatar QTA: Agreement set to boost cruise tourism in Qatar – Qatar Tourism Authority (QTA), while announcing an agreement, has said that seven cruise ships with up to 17,500 visitors will berth in Qatar during the 2017-18 season, giving a boost to the country’s plans to become an emerging cruise destination. German cruise liner TUI Cruises will be including Qatar in its itineraries. The new accord comes as a result of discussions started at the Sea trade Europe Forum in Hamburg, Germany in 2015 and continued until March 2016 in Fort Lauderdale, US. The pact puts Qatar on track to achieve its target of 250,000 visitors on board cruise ships in 2019. The Qatar Ports Management Company, Mwani Qatar, has confirmed the berthing schedule for the cruise ships. The Qatar National Tourism Sector Strategy 2030 identifies the cruise industry as a focus area in coming years. QTA is working closely with Mwani Qatar to expand various elements of the country’s cruise industry, in particular, Doha Port, which will be undergoing redevelopment in the coming months to transform it into a full- time cruise terminal and tourist attraction. (Gulf-Times.com) BMI: Qatar SWF, access to global debt markets cushion energy demand drop – BMI has said in a report that Qatar’s $256bn sovereign wealth fund (SWF) as well as the country’s continuing ability to tap international debt markets provide the economy with “significant bulwarks against a sustained drop-off in demand” for oil & gas, while lower hydrocarbons prices do not present a significant threat to Qatar’s fiscal sustainability. Nevertheless, it said, “The government will seek to tighten control over public spending and rationalize Qatar’s vast pipeline of infrastructure projects – a trend that will be positive for the economy over the longer run.” The performance of the Qatari economy will be more mixed than in recent years, amidst the intertwined pressures of the global energy slump and tightening domestic liquidity. BMI said, “We forecast real economic growth of 5% this year and 4.8% in 2017, driven mainly by strong growth in the primary and secondary sectors.” (Gulf-Times.com) ERES set to open two hotels – Ezdan Holding Group (ERES) will soon open two hotels - Ezdan Palace and The Curve Hotel, a move that will strengthen the group’s leadership in the hospitality and tourism sector. The Curve, a four-star hotel, is expected to open in July while Ezdan Palace will be a luxury five-star hotel and will open in January 2017. (Peninsula Qatar) Qatar-UAE ties reviewed – HE the Head of the Court of Cassation and President of the Judicial Supreme Council Masoud Mohamed al-Amiri met with UAE ambassador Saleh Mohamed bin Nasra al- Ameri in Doha. Talks during the meeting dealt with cooperation between the two countries in the judicial field and means of enhancing them. (Gulf-Times.com) GI Survey: ‘Produced water’ is an asset, not liability – According to Gulf Intelligence (GI) industry survey, a vast majority of energy professionals in Qatar view that produced water – a byproduct of oil & gas production – is more of an asset than a liability. Globally, around four barrels of water are produced along with every barrel of crude oil. It said finding economic and environmental ways to use produced water is important for all energy producers, including Qatar, which is the world’s largest liquefied natural gas (LNG) exporter and produces 680,000 bpd of oil. Qatar’s industry usually treats and then re-inject produced water from oil & gas production into the reservoir as a means to sustain the pressure, or ultimately inject it into a disposal well. (Gulf-Times.com) QA to fly A380 on Doha-Guangzhou route from July 1 – Qatar Airways (QA) will upgrade its Doha-Guangzhou service with the introduction of its flagship Airbus A380 on the route. Guangzhou will be QA’s fourth A380 destination after London, Paris, and Bangkok. Daily flights on board the world’s largest commercial aircraft will begin on July 1 from the Hamad International Airport in Doha, Qatar, to the Guangzhou Baiyun International Airport. Passengers travelling to and from Guangzhou on QA QR874 and QR875 will enjoy a unique and enhanced travel experience on the airline’s bespoke A380 super-jumbo aircraft. Meanwhile, an airline spokesperson said QA is reducing the frequency of more than a dozen regular routes from Doha because of hold-ups in the delivery of new planes from European manufacturer Airbus. The 15 affected routes include the carrier's recently launched service to Adelaide in Australia, flights to Boston, Houston, and Miami in the US and services to Copenhagen, Jakarta, and Manchester. (Peninsula Qatar, Reuters) Doha top-ranked in achieving smart city goals – A latest survey revealed that Doha ranked number one in terms of smart building capabilities, across all three categories of ‘Green’, ‘Safe’, and ‘Productive’, among all major cities in the Middle East. The Qatari capital scored 70 points out of 100 in the study, which evaluated 620 buildings across seven major Middle Eastern cities, which included Abu Dhabi, Dammam, Doha, Dubai, Jeddah, Kuwait City, and Riyadh. The average score across the Middle East was 48 out of 100, with Doha scoring 22 points above the regional average, closely followed by Dubai scoring 65 points. (Peninsula Qatar) Interior Ministry services office opens at SC headquarters – A variety of services offered by the Ministry of Interior (MoI) will be available in a newly-opened facility at the Supreme Committee for Delivery and Legacy (SC) headquarters in Doha. The MoI, represented by the Unified Services Department (USD) at the General Directorate of Nationality, Ports and Expatriate Affairs, inaugurated the new services office at the SC headquarters in Al Bidda Tower, Dafna, recently. (Gulf-Times.com) International Moscovici: EU Commission likely to raise France growth forecast – The European Economic and Monetary Affairs Commissioner Pierre Moscovici said the European Union (EU) Commission will probably raise its growth forecast for France from 1.3% it predicted recently. According to the figures published by INSEE, the Eurozone as a whole is expected to grow 1.6% in 2016 and 1.8% in 2017, after 1.7% in 2015. The French economy grew a faster-than-expected at 0.5% in 1Q2016. The French economy grew a faster-than-expected 0.5% in 1Q2016. (Reuters) Greeks strike to protest against tax and pension reforms – Greeks went on a 48-hour nationwide strike on Friday to protest against tax and pension reforms, as Prime Minister Alexis Tsipras appealed to fractious lawmakers to approve the overhaul as part of a multi-billion euro bailout. Lowering its annual pension bill, one of the most expensive in the Eurozone, is a condition for Athens to qualify for a fresh installment of the latest international bailout, worth up to €86bn, which it agreed a year ago with its EU partners. The strike left ships docked at port, disrupted public transport and kept civil servants and journalists off the job. Thousands of protesters with the Communist-affiliated group PAME marched before parliament holding banners that read: "Rise up now!" and "Resist". (Reuters) Aso: Japan ready to intervene if volatile yen hurts country’s economy – Japanese Finance Minister Taro Aso said that Tokyo is ready to intervene in the currency market if yen moves are volatile enough to hurt the country's trade and economy. Aso also said he did not think the US considered Japan's currency policy to be inappropriate. (Reuters) China April exports, imports decline more than expected – China's exports and imports fell more than expected in April, underlining weak demand at home and abroad and cooling hopes of a recovery

- 4. Page 4 of 5 in the world's second-largest economy. The General Administration of Customs said exports fell 1.8% YoY reversing the previous month's brief recovery and supporting the government's concerns that the foreign trade environment will be challenging in 2016. April imports dropped 10.9% YoY falling for the 18th consecutive month, suggesting domestic demand remains weak despite a pick up in infrastructure spending and record credit growth in 1Q2016. (Reuters) China to curb land supply for cities with property glut – The People's Daily, citing the Ministry of Land and Resources, reported that China will reduce or stop land supply for cities where there is a property glut while boosting supply in areas that face stronger housing demand. The government aims to keep arable land of more than 124.33mn hectares under a five-year plan (2016-2020) by limiting construction land or land for industrial or property development. (Reuters) Regional Musanada: Saudi highway project on track – Abu Dhabi General Services Company (Musanada) said work was progressing well on the AED5.3bn Mafraq-Ghuwaifat International Highway project, linking western region cities and facilitating commercial transport on the international road. The project, which is being implemented by Musanada in collaboration with the Department of Municipal Affairs and Transport (DMAT), extends from Mafraq to the international borders with Saudi Arabia at Ghuwaifat, passing through the Al Ruwais industrial center. (GulfBase.com) KSA committed to meeting hydrocarbon demand – Saudi Arabia's new Energy Minister Khalid al-Falih said that the Kingdom was committed to meeting hydrocarbon demand from its customers and would maintain its petroleum policies. Meanwhile, Falih who is already chairman of Saudi Aramco, will handle oil & gas extraction, power generation & distribution, mining & industrial development. (Reuters) Saudi Arabia reviews plans to break up SEC into four parts – According to sources, Saudi Arabia is reviewing its plan to break up Saudi Electricity Company (SEC) into four parts as part of a drive to further privatize the utility. The review, which is being conducted by consultants and advisors to the government, could result in the original plan being retained or a new restructuring scheme put in place. (Reuters) Saudi Catering to provide security services at King Khalid Airport – Saudi Airlines Catering has signed a SR12mn two-year agreement with Saudi Cargo Limited. The deal, which begins in June 2016, entails that Saudi Catering will provide security services for the cargo firm at King Khalid Airport in Riyadh and the agreement concludes in May 2018. Saudi Catering said in a filing to the Saudi Stock Exchange (Tadawul) that it expects a positive financial impact from the deal in 3Q2016. Meanwhile, Saudi Catering’s AGM has approved dividend distribution for FY2015 with a total amount of SR571mn, which represents 69.63% of the share capital after Zakat and before income tax. (Tadawul) SACO distributes dividend for 1Q2016 – Saudi Company for Hardware (SACO) announces that SABB Bank will distribute dividends to all eligible shareholders registered in the SACO share registry at the end of trading day on May 5, 2016. The dividend payment process will start from May 19. The due dividends will be deposited directly into the current accounts of the investment portfolios. (Tadawul) Saudi Arabia forges ahead with projects worth $500bn – Saudi Arabia’s projects market in 2016 boasts of schemes worth $500bn in the pre-execution phase spanning the power & water, transport, hydrocarbons and construction sectors. Under the ambitious reform agenda being driven by Deputy Crown Prince Mohammed bin Salman, within its recently announced Vision 2030 framework, Saudi Arabia is seeking to drive the non-oil economy and stimulate private investment in state activities. Further, Riyadh has set itself a target of increasing the private sector’s contribution to GDP from 40% today to 65% by 2030, and growing non-oil government revenues from SR163bn to SR1tn by the end of the next decade. (GulfBase.com) KSA retail market offers plenty of opportunities – Colliers International Managing Director Imad Damrah said the retail market in Saudi Arabia is witnessing strong growth driven by a growing, young population with a high disposable income, thus painting a positive picture of an expected surge in shopping mall construction and renewed interest from international retail brands. (GulfBase.com) UAE-Japan trade stands at $15bn – The UAE Assistant Under- Secretary of the Ministry for Foreign Trade Affairs Juma Mohammed Al Kait said the volume of the UAE foreign trade with Japan stood at around $15bn in 2015, accounting for one third of non-oil trade with Japan. He said the volume of trade exchange between the Arab countries and Japan exceeded $80bn in 2015, accounting for 7% of Japan’s total foreign trade. The UAE official noted that these figures could increase in light of potential opportunities to build more partnerships in vital sectors of mutual interest. He said Japan comes first in the list of the most important investors in the UAE, as its investments exceeded three percent of the total volume of foreign investments in the country at the end of 2014. Meanwhile, the total UAE investments in Japan amounted to about $271mn at the end of 2014, accounting for 38% of the total investments of the Middle East countries, and the first at the Arab level. (GulfBase.com) Etihad Airline appoints new CEO – Etihad Airways has appointed Peter Baumgartner as its new CEO – he will oversee the day-to-day operations of the business. Baumgartner joined Etihad Airways in 2005 from Swiss International Air Lines. (Bloomberg) Emirates Insurance appoints Chairman – Emirates Insurance Company has appointed Mr. Abdullah Mohamed Mazrouei as Chairman and Mr. Fadel Saeed Al Darmaki as Deputy Chairman. (ADX) CEO: Aabar committed to Abu Dhabi amid focus on expansion in Dubai – Aabar Properties Chief Executive Officer Khalifa Al Mheiri said Aabar Properties is committed to Abu Dhabi, even as it focuses on expansion in Dubai and other parts of the world, especially Morocco and Jordan. He said the company is planning to deliver 1,000 units in 2016 in Abu Dhabi and another 1,000 in 2017. Aabar aims to construct around 6,000 units in Abu Dhabi in the coming years. (GulfBase.com) Burgan Bank net profit declines in 1Q2016 – Burgan Bank’s net profit in 1Q2016 hit KD14.3mn, down 18.5% owing to less income from foreign exchange. The earnings were hit by a 77.9% reduction in non-interest income, which fell to KD1.7mn. The fall offset a 7.4% increase in net interest income, which rose to KD40.6mn. The asset quality continued to improve, non- performing assets (net of collateral) stood at 1.4% while the coverage ratio (net of collateral) reached 328%. (GulfBase.com) Construction Materials Ind. production stops – Construction Materials Ind. announced that the kiln 200 ton capacity located in Sohar has stopped production due to non availability of LPG gas from the refinery to operate the kiln. The kiln will restart working when the gas is available. (MSM)

- 5. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa ` QNB Financial Services Co. WLL One Person Company Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. WLL One Person Company (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg (#Market closed on May 06, 2016) Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Apr-12 Apr-13 Apr-14 Apr-15 Apr-16 QSE Index S&P Pan Arab S&P GCC 0.2% (0.2%) (0.0%) (0.1%) 0.3% 0.5% 0.5% (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,287.90 0.8 (0.4) 21.3 MSCI World Index 1,643.19 0.1 (1.7) (1.2) Silver/Ounce 17.47 0.7 (2.1) 26.1 DJ Industrial 17,740.63 0.5 (0.2) 1.8 Crude Oil (Brent)/Barrel(FM Future) 45.37 0.8 (5.7) 21.7 S&P 500 2,057.14 0.3 (0.4) 0.6 Crude Oil (WTI)/Barre (FM Future) 44.66 0.8 (2.7) 20.6 NASDAQ 100 4,736.16 0.4 (0.8) (5.4) Natural Gas (Henry Hub)/MMBtu 1.84 (10.1) (3.5) (20.4) STOXX 600 331.67 (0.2) (3.0) (4.7) LPG Propane (Arab Gulf)/Ton# 48.50 0.0 (2.5) 26.4 DAX 9,869.95 0.3 (1.8) (3.8) LPG Butane (Arab Gulf)/Ton# 57.38 0.0 (1.1) 4.1 FTSE 100 6,125.70 (0.0) (3.0) (3.7) Euro 1.14 (0.0) (0.4) 5.0 CAC 40 4,301.24 (0.3) (3.0) (2.5) Yen 107.12 (0.1) 0.6 (10.9) Nikkei 16,106.72 (0.4) (1.8) (4.3) GBP 1.44 (0.4) (1.3) (2.1) MSCI EM 805.34 (0.5) (4.1) 1.4 CHF 1.03 (0.5) (1.4) 3.1 SHANGHAI SE Composite 2,913.25 (2.8) (1.3) (17.9) AUD 0.74 (1.3) (3.1) 1.1 HANG SENG 20,109.87 (1.6) (4.6) (8.4) USD Index 93.89 0.1 0.9 (4.8) BSE SENSEX 25,228.50 (0.1) (1.7) (3.9) RUB 66.17 0.4 2.2 (8.8) Bovespa 51,717.82 0.7 (5.6) 34.5 BRL 0.29 1.0 (2.0) 13.0 RTS 912.02 (0.5) (4.1) 20.5 110.0 88.5 88.2