QNBFS Daily Market Report March 5, 2019

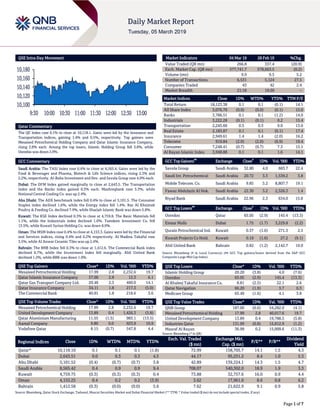

- 1. Page 1 of 7 QSE Intra-Day Movement Qatar Commentary The QE Index rose 0.1% to close at 10,118.1. Gains were led by the Insurance and Transportation indices, gaining 1.4% and 0.5%, respectively. Top gainers were Mesaieed Petrochemical Holding Company and Qatar Islamic Insurance Company, rising 2.8% each. Among the top losers, Islamic Holding Group fell 3.8%, while Ooredoo was down 2.9%. GCC Commentary Saudi Arabia: The TASI Index rose 0.4% to close at 8,565.4. Gains were led by the Food & Beverages and Pharma, Biotech & Life Science indices, rising 2.3% and 2.2%, respectively. Al-Baha Investment and Dev. and Savola Group rose 4.0% each. Dubai: The DFM Index gained marginally to close at 2,643.5. The Transportation index and the Banks index gained 0.3% each. Mashreqbank rose 5.3%, while National Central Cooling Co. was up 2.4%. Abu Dhabi: The ADX benchmark index fell 0.4% to close at 5,101.5. The Consumer Staples index declined 1.6%, while the Energy index fell 1.4%. Ras Al Khaimah Poultry & Feeding Co. declined 7.9%, while Sharjah Islamic Bank was down 5.8%. Kuwait: The KSE Index declined 0.3% to close at 4,759.8. The Basic Materials fell 1.1%, while the Industrials index declined 1.0%. Tamdeen Investment Co. fell 13.5%, while Kuwait Syrian Holding Co. was down 8.9%. Oman: The MSM Index rose 0.4% to close at 4,153.3. Gains were led by the Financial and Services indices, rising 0.4% and 0.2% respectively. Al Madina Takaful rose 3.5%, while Al Anwar Ceramic Tiles was up 2.4%. Bahrain: The BHB Index fell 0.3% to close at 1,412.6. The Commercial Bank index declined 0.7%, while the Investment index fell marginally. Ahli United Bank declined 1.2%, while BBK was down 1.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 17.99 2.8 2,232.6 19.7 Qatar Islamic Insurance Company 57.00 2.8 12.3 6.1 Qatar Gas Transport Company Ltd. 20.46 2.3 460.0 14.1 Qatar Insurance Company 34.11 1.8 217.3 (5.0) The Commercial Bank 40.81 1.8 218.6 3.6 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Mesaieed Petrochemical Holding 17.99 2.8 2,232.6 19.7 United Development Company 13.89 0.4 1,426.3 (5.8) Qatar Aluminium Manufacturing 11.55 (1.5) 983.1 (13.5) Aamal Company 9.80 0.0 923.9 10.9 Vodafone Qatar 8.15 (0.7) 547.8 4.4 Market Indicators 04 Mar 19 28 Feb 19 %Chg. Value Traded (QR mn) 266.8 337.4 (20.9) Exch. Market Cap. (QR mn) 577,741.7 578,663.5 (0.2) Volume (mn) 9.9 9.5 5.2 Number of Transactions 6,531 5,124 27.5 Companies Traded 43 42 2.4 Market Breadth 21:18 19:20 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,123.38 0.1 0.1 (0.1) 14.1 All Share Index 3,076.70 (0.0) (0.0) (0.1) 15.0 Banks 3,786.51 0.1 0.1 (1.2) 14.0 Industrials 3,222.28 (0.1) (0.1) 0.2 15.4 Transportation 2,245.60 0.5 0.5 9.0 13.0 Real Estate 2,183.87 0.1 0.1 (0.1) 17.4 Insurance 2,949.61 1.4 1.4 (2.0) 16.2 Telecoms 919.84 (2.0) (2.0) (6.9) 19.4 Consumer 7,248.41 (0.7) (0.7) 7.3 15.1 Al Rayan Islamic Index 3,948.88 0.1 0.1 1.6 14.1 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% Savola Group Saudi Arabia 32.80 4.0 683.7 22.4 Saudi Int. Petrochemical Saudi Arabia 20.72 3.3 1,539.2 3.8 Mobile Telecom. Co. Saudi Arabia 9.85 3.2 8,807.7 19.1 Fawaz Abdulaziz Al Hok. Saudi Arabia 22.30 3.2 2,326.3 1.4 Riyad Bank Saudi Arabia 22.96 2.3 634.0 15.8 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Ooredoo Qatar 65.05 (2.9) 145.4 (13.3) Emaar Malls Dubai 1.75 (1.7) 3,229.8 (2.2) Qurain Petrochemical Ind. Kuwait 0.37 (1.6) 271.3 2.5 Kuwait Projects Co Hold. Kuwait 0.19 (1.6) 27.2 (9.1) Ahli United Bank Bahrain 0.82 (1.2) 2,142.7 19.0 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Islamic Holding Group 20.20 (3.8) 4.0 (7.6) Ooredoo 65.05 (2.9) 145.4 (13.3) Al Khaleej Takaful Insurance Co. 8.81 (2.5) 22.1 2.6 Qatar Navigation 66.20 (1.9) 3.7 0.3 Medicare Group 65.49 (1.6) 4.1 3.8 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 187.00 (0.6) 54,282.0 (4.1) Mesaieed Petrochemical Holding 17.99 2.8 40,017.6 19.7 United Development Company 13.89 0.4 19,788.5 (5.8) Industries Qatar 131.99 (0.8) 15,812.9 (1.2) Masraf Al Rayan 36.99 0.2 15,009.6 (11.3) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,118.10 0.1 0.1 0.1 (1.8) 72.99 158,705.7 14.1 1.5 4.3 Dubai 2,643.51 0.0 0.3 0.3 4.5 44.17 95,251.2 8.4 1.0 5.3 Abu Dhabi 5,101.52 (0.4) (0.7) (0.7) 3.8 42.89 139,224.1 14.3 1.5 4.7 Saudi Arabia 8,565.42 0.4 0.9 0.9 9.4 708.07 540,302.0 18.9 1.9 3.3 Kuwait 4,759.75 (0.3) (0.3) (0.3) 0.4 73.88 32,757.6 16.0 0.9 4.4 Oman 4,153.25 0.4 0.2 0.2 (3.9) 3.62 17,961.0 8.6 0.8 6.2 Bahrain 1,412.58 (0.3) (0.0) (0.0) 5.6 7.62 21,622.9 9.1 0.9 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,100 10,120 10,140 10,160 10,180 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 7 Qatar Market Commentary The QE Index rose 0.1% to close at 10,118.1. The Insurance and Transportation indices led the gains. The index rose on the back of buying support from Qatari shareholders despite selling pressure from GCC and non-Qatari shareholders. Mesaieed Petrochemical Holding Company and Qatar Islamic Insurance Company were the top gainers, rising 2.8% each. Among the top losers, Islamic Holding Group fell 3.8%, while Ooredoo was down 2.9%. Volume of shares traded on Monday rose by 5.2% to 9.9mn from 9.5mn on Sunday. Further, as compared to the 30-day moving average of 8.7mn, volume for the day was 14.4% higher. Mesaieed Petrochemical Holding Company and United Development Company were the most active stocks, contributing 22.4% and 14.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY National Shipping Company of Saudi Arabia* Saudi Arabia SR 6,129.9 1.4% 1,088.2 -4.0% 481.2 -39.9% United Electronics Company (Extra) * Saudi Arabia SR 4,394.1 4.4% 180.0 15.2% 161.2 15.1% United Gulf Holding Company* Bahrain USD 104.0 302.1% – – 18.6 317.8% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/04 EU Sentix Behavioral Indices Sentix Investor Confidence March -2.2 -3.1 -3.7 03/04 EU Eurostat PPI MoM January 0.4% 0.3% -0.8% 03/04 EU Eurostat PPI YoY January 3.0% 2.9% 3.0% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status SIIS Salam International Investment Limited 6-Mar-19 1 Due ERES Ezdan Holding Group 10-Mar-19 5 Due AKHI Al Khaleej Takaful Insurance Company 12-Mar-19 7 Due IGRD Investment Holding Group 12-Mar-19 7 Due DBIS Dlala Brokerage & Investment Holding Company 13-Mar-19 8 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 28.22% 33.97% (15,356,269.71) Qatari Institutions 28.81% 18.81% 26,696,698.45 Qatari 57.03% 52.78% 11,340,428.74 GCC Individuals 0.51% 1.28% (2,074,585.47) GCC Institutions 2.54% 3.44% (2,416,170.97) GCC 3.05% 4.72% (4,490,756.44) Non-Qatari Individuals 7.53% 10.70% (8,467,060.27) Non-Qatari Institutions 32.39% 31.79% 1,617,387.97 Non-Qatari 39.92% 42.49% (6,849,672.30)

- 3. Page 3 of 7 News Qatar QGRI posts 35.7% YoY decrease but a sharp QoQ increase in net profit in 4Q2018 – Qatar General Insurance & Reinsurance Company's (QGRI) net profit declined 35.7% YoY (but rose 946.2% on QoQ basis) to QR175mn in 4Q2018. EPS amounted to QR2.81 in FY2018 as compared to QR3.51 in FY2017. In FY2018, QGRI recorded net profit of QR245.81mn as compared to net profit of QR307.38mn in FY2017. QGRI’s board of directors proposed cash dividend of 10% of the nominal share value i.e., QR1 per share for the year ended December 31, 2018, provided that the dividends distribution proposal be adopted by the company’s General Assembly. (QSE) CBQK marks syndicated loan closure with banks – The Commercial Bank (CBQK) organized an event to thank ‘relationship banks’ for lending their support in closing a $750mn syndicated senior unsecured term loan facility, a press statement stated. The banks’ group was led by Bank of America Merrill Lynch and Mizuho Bank as joint coordinators and mandated lead arrangers. The syndicated loan closure in December 2018 attracted a high level of interest and was oversubscribed 25%, displaying tremendous support that CBQK enjoys with its relationship banks group. CBQK decided to retain the original amount due to the strong liquidity position. Initially launched with a value of $750mn, the transaction received strong interest from the market and closed significantly oversubscribed at a value of $975mn. The event was attended by coordinating banks and mandated lead arranger banks for the syndicate which included Australia and New Zealand Banking Group Limited, Barclays Bank, Citibank, Commerzbank Aktiengesellschaft, and Standard Chartered Bank. (Qatar Tribune) GWCS announces establishment of new subsidiaries – Gulf Warehousing Company (GWCS) announced the establishment of new subsidiaries, GWC Shipping Services and ION Shipping Services, in Qatar. GWC Shipping Services is a limited liability company, 100% owned by GWCS and its capital is QR3,000,000. ION Shipping Services company is also a limited liability company, fully owned by GWCS and its capital is QR3,000,000. Both subsidiaries are headquartered in Doha, Qatar. (QSE) ERES to hold its EGM on March 18 – Ezdan Holding Group’s (ERES) Extraordinary General Meeting (EGM) will convene on March 18, 2019. In the event of lack of quorum, the assembly will be held on March 31, 2019. In the event of lack of quorum, the second meeting has been scheduled on May 1, 2019. (QSE) QGMD announces list of candidates for board membership – Qatari German Company for Medical Devices (QGMD) announced opening the candidature for membership of the board of directors of the company for the remaining term till 2021. The following candidates have submitted their applications: (i) Saleh Jowhar Saeed Mohammed Al Mohammad, and (ii) Khamis Mubarak Khamis Zamil Al-Kuwari as independent member. (QSE) Milaha to hold its AGM and EGM on March 18 – Qatar Navigation’s (Milaha) board of directors invited its shareholders to attend the Ordinary General Meeting (AGM) and Extraordinary General Assembly Meeting (EGM) which will be held on March 18, 2019. If there is no quorum, the alternate date will be March 24, 2019. (QSE) AKHI postpones its board meeting to March 12 – Al Khaleej Takaful Insurance Company (AKHI) announced that the company will postpone its board meeting to March 12, 2019 instead of March 5, 2019 to discuss and approve the audited financial statements for the financial year ended December 31, 2018 and the recommendation on shareholders’ profits distribution, which will be submitted to the General Assembly of the company. (QSE) QCFS to hold its AGM and EGM on April 3 – Qatar Cinema & Film Distribution Company’s (QCFS) board of directors invited its shareholders to attend the AGM and EGM to be held on April 3, 2019. In case of lack of quorum, the second meeting will be held on April 10, 2019. (QSE) Vodafone Qatar approves cash dividend of QR0.25 per share and announces election of three independent board members – Vodafone Qatar (VFQS) held its AGM and EGM on March 4, 2019. The meetings approved all resolutions on the agenda including the board of directors’ proposal to distribute cash dividend of 5% of the nominal share value equivalent to QR0.25 per share, totaling QR211.4mn, for the financial year ended December 31, 2018. Under the supervision of Ministry of Commerce and Industry representatives, the election of three independent members to the board of directors took place for a term of three years starting in 2019 and ending in 2022. Following nominees were elected by majority votes – Abdulla Nasser Al Misnad, Akbar Al Baker, and Sheikh Hamad bin Faisal Thani Jassim Al Thani. The remaining four board members – Rashid Fahad Al Naimi, Sheikh Saoud Abdul Rahman Hassan Al Thani, Nasser Jaralla al Marri, and Nasser Hassan Al Naimi were appointed previously by Vodafone and Qatar Foundation LLC pursuant to Article 29.1 of Vodafone Qatar’s Articles of Association. The meeting also covered the board’s report detailing the company’s activities and its financial position for the financial year ended December 31, 2018. (Qatar Tribune) Food storage project to boost downstream industries, says Qatar Chamber’s official – The food storage and processing facility being built at Hamad Port will not only help transform Qatar into a regional export hub but it will also open many opportunities to downstream industries, according to Qatar Chamber’s First Vice Chairman, Mohamed bin Towar Al- Kuwari. Al-Kuwari pointed out that the QR1.6bn Strategic Food Security Facilities Project follows the public-private partnership (PPP) model. “The project is a partnership between Qatar’s government and private sectors, and this is a good opportunity for the private sector to show its performance and strength. It also shows how the private sector could cooperate with the government further in more projects. The private sector will run the project, which will offer a lot of opportunities for downstream industries,” Al-Kuwari emphasized, noting that construction of the food storage facility is on track and will be delivered in time. (Gulf-Times.com) QFBQ appoints Ali Al Obaidly as its new CEO – Qatar First Bank (QFBQ) appointed eminent Qatari business and banking figure, Ali al Obaidly as its CEO. QFBQ’s board of directors has

- 4. Page 4 of 7 welcomed the appointment of Obaidly as CEO with a view to realizing the bank’s vision to maximize shareholder rights, according to a press release. Al Obaidly said, “I will be developing an investment and operational strategy covering the bank’s business and investment portfolios, internal processes and organizational structure. This strategy will be presented to the board of directors soon for discussion, approval and implementation. The previous situation was a challenge for the board and shareholders, but we will work together to rectify the process. I’m asking shareholders for support over this transitional and sensitive phase.” (Qatar Tribune) Qatar, European Union sign landmark air transport agreement – Qatar and the European Union initialed a comprehensive air transport agreement at the European Commission’s headquarters in Brussels. The first of its kind agreement between the European Union and a GCC member state, the agreement allows for open airspace between Qatar and all the European Union’s member states with unlimited access to their respective territories, in addition to daily shipment flights between the two sides. (Gulf-Times.com) Qatar Airways to unveil enhanced economy class product at ITB Berlin – Qatar Airways will unveil its enhanced economy class product at ITB Berlin 2019. ITB Berlin is the world’s largest travel and tourism trade show. Conference delegates and visitors to ITB 2019 are invited to the airline’s stand to see for themselves the innovative technology and design that Qatar Airways has brought to its enhanced economy class product. There will be an opportunity for visitors to interact with the airline’s latest products and to experience Qatar Airways’ world-renowned five-star hospitality. The airline will add a number of exciting new destinations to its extensive route network in 2019, including Malta. (Gulf-Times.com) International US construction spending falls, fourth quarter GDP seen revised lower – US construction spending unexpectedly fell in December as investment in both private and public projects dropped, leading economists to expect that the government will trim its economic growth estimate for the fourth quarter. The report from the Commerce Department was further evidence the economy lost momentum at the tail end of 2018. Growth is slowing as the stimulus from a $1.5tn tax cut and increased government spending ebbs. Trade tensions between the US and China as well as slowing global economies are also hurting domestic activity. The construction spending report extended the run of weak December economic data, that has included retail sales, housing starts, trade and home sales. Construction spending declined 0.6% after an unrevised 0.8% increase in November. Economists polled by Reuters had forecast construction spending rising 0.2% in December. Construction spending increased 1.6% on a YoY basis. It rose 4.1% in 2018, the weakest reading since 2011. The release of the December report was delayed by a five-week partial shutdown of the government that ended on January 25. (Reuters) US intends to end preferential trade treatment for Turkey – The US intends to end Turkey’s preferential trade treatment under a program that allowed some exports to enter the US duty free, the US Trade Representative’s Office stated. Turkey is no longer eligible to participate in the Generalized System of Preferences program because it is sufficiently economically developed. Office of the United States Trade Representative (USTR) stated in August it was reviewing Turkey’s eligibility in the program after the NATO ally imposed retaliatory tariffs on US goods in response to American steel and aluminum tariffs. Removing Turkey from the program would not take effect for at least 60 days after notifications to Congress and the Turkish government, and it will be enacted by a presidential proclamation. (Reuters) UK shoppers slow their spending ahead of Brexit, some stockpile – British consumers reined in their spending in February ahead of Brexit and shoppers focused on buying food, including for stock-piling, rather than non-essential items, data released showed. British Retail Consortium (BRC) stated total sales edged up by an annual 0.5%, a sharp slowdown from growth of 2.2% in January. Separately, Barclaycard stated its broader measure of consumer spending rose by 1.2%, the weakest increase since the company began recording spending on its cards in 2015. Sustained spending by Britain’s consumers took the edge off a slowdown in the world’s fifth-biggest economy for much of the period since the 2016 Brexit referendum although consumer confidence levels are close to five-year lows as the scheduled Brexit date of March 29 approaches. (Reuters) Eurozone’s producer prices rise slightly faster than expected in January – Eurozone’s producer prices rose slightly faster than expected in January, pushed up by a jump in energy, intermediate and capital goods, data showed. The European Union’s statistics office Eurostat stated prices at factory gates in the 19 countries sharing the Euro rose 0.4% MoM for a 3.0% YoY increase. Economists polled by Reuters had expected a 0.3% monthly rise and a 2.9% annual gain. Eurostat stated energy prices rebounded in January, rising 0.4% on the month, after a 2.7% fall in December. Intermediate goods prices rose 0.3% after a 0.4% decline in December and capital goods prices rose 0.6% after no change in December. Producer prices are an early indication of trends in consumer prices, because unless their changes are absorbed by intermediaries and retailers, they are passed on to consumers. The European Central Bank wants to keep consumer inflation below but close to 2% over the medium term. Consumer prices rose 1.5% YoY in February accelerating from 1.4% in January because of the still high contribution of energy. (Reuters) Eurozone’s investor morale improves on hopes of Asian tailwind – Investor morale in the Eurozone improved in March, largely due to hopes that an upturn in Asia might help the single currency bloc, a survey showed. Sentix research group said its investor sentiment index for the Eurozone rose to -2.2 from -3.7 in February. Analysts had expected a reading of -3.1. A sub-index on the current situation also weakened for the seventh month running, slumping to its weakest level since September 2016. Expectations improved for the second month in a row, mainly on hopes that a revival of economic activity in Asia, except Japan, would provide impetus for the Eurozone. (Reuters) Japan’s February services PMI shows new business grows at fastest pace in almost six years – Japanese services sector activity expanded in February as new business grew at the

- 5. Page 5 of 7 fastest pace in almost six years, a business survey showed, a sign that domestic demand remains in good health in early 2019. The Markit/Nikkei Japan Services Purchasing Managers’ Index (PMI) rose to a seasonally adjusted 52.3 in February from 51.6 in January. The index stayed above the 50 threshold that separates contraction from expansion for the 29th month. The index measuring new business increased to 54.5 from 52.1 in January, reaching its highest since May 2013 due to stronger sales, new product launches and an increase in demand from overseas, the survey showed. The composite PMI, which includes both manufacturing and services, eased slightly to 50.7 in February from 50.9 in January, because factory activity last month contracted at the fastest pace in two-and-a-half years due to the US-China trade war. (Reuters) China to slash taxes, boost lending to shore up slowing economy – China will cut billions of Dollars in taxes and fees, increase infrastructure investment, and step up lending to small firms, Premier Li Keqiang said, as the government boosts stimulus to shore up an economy growing at its slowest pace in almost 30 years. The government is targeting economic growth of 6.0% to 6.5% in 2019, Li said at opening of the annual meeting of China’s parliament, less than the 6.6% gross domestic product growth reported last year. Sources told Reuters earlier this year that China would cut its 2019 growth target to 6.0% to 6.5% from the 2018 target of around 6.5% as demand at home and abroad ebbed, and a trade war with the United States heightened economic risks. Adopting a target range rather than a single growth figure gives policymakers’ room to maneuver as the world’s second-largest economy slows further. (Reuters) Regional OPEC likely to defer output policy decision until June – OPEC and its partners are unlikely to decide on their output policy in April as it would be too early to get a clear picture of the impact of their supply cuts on the market by then, sources said. The sources said that the production policy by the so-called OPEC+ alliance is expected to be agreed on in June with an extension of the pact the likely scenario so far, but much depends on the extent of US sanctions on both OPEC members Iran and Venezuela. “So far the likely decision is to extend the agreement in June. Nothing much is planned for April, just to discuss the OPEC and non-OPEC (cooperation pact),” sources said. OPEC and its allies meet next in Vienna on April 17-18 and delegates say another gathering is scheduled for June 25-26. Another OPEC source said the most likely outcome of the June meeting was “a rollover” of the current oil supply cuts. (Reuters) EFG Hermes advising on $500mn M&A deal in Saudi Arabia, more in pipeline – Egypt’s EFG Hermes is working on a $500mn merger and acquisition (M&A) in Saudi Arabia and expects more deals to come out of the Kingdom this year, especially from the private sector, its Head of Investment Banking, Mohammed Fahmi said. Saudi Arabia has made attracting greater foreign investment a key part of its economic Vision 2030 plan as it tries to diversify the economy away from its reliance on oil. The Kingdom’s impending inclusion in the FTSE Russell emerging markets index this month is expected to draw billions of Dollars of foreign fund flows. “Saudi I think will be very busy, “I’m seeing a lot of RFPs (request for proposals) coming from Saudi for IPOs... Private sector companies looking to go public, which I think is a valuable thing,” he said. (Reuters) Saudi Arabia's ACWA Power signs financing for $700mn desalination project – Saudi Arabia’s power and water plants developer ACWA Power stated that it has signed financing and hedging agreements for a $700mn desalination project in the Kingdom. The project, Rabigh-3 IWP, will generate 600,000 cubic meters a day, making it one of the largest desalination projects of its type in the world, the company stated. The initial mandated lead arrangers for the project financing are Natixis, MUFG, SAMBA and Riyad Bank. Riyad Bank has already provided an equity bridge loan for the transaction earlier this month, it stated. (Reuters) Jabal Omar starts private placement of up to $533mn Sukuk – Jabal Omar Development Company has started privately placing $533mn of Sukuk with local investors. The offering, with five-year tenure, will take place from March 4 to April 3, 2019, the company stated. HSBC Holdings Plc’s Saudi Arabia’s unit, JPMorgan Chase & Co. and GIB Capital are managing the process. (Bloomberg) Al Yamamah Steel Industries Company announces project sign off with Europea de Construcciones Metalicas SA – Al Yamamah Steel Industries Company has announced signing the contract worth $106.7mn to supply Solar Steel Structure to Dubai Solar Park Project - Phase IV with Europea de Construcciones Metalicas SA on March 3, 2019. The contract duration is four years and delivery will start in September 2019 for 26 months, which can be extended. The financial impact of this contract will appear in the quarter ended September 2019 till the end of the 26 months’ supply period that can be extended. (Tadawul) UAE’s January consumer prices fall 2.4% YoY; falls 0.1% MoM – The Federal Competitiveness and Statistics Authority in Dubai published the UAE’s consumer price indices which showed that in January, the consumer prices fell 2.4% YoY and it fell 0.1% MoM in January as compared to a fall of 0.3% in the previous month. Transportation price index fell 4.4% in January as compared to a fall of 1.7% in the previous month. (Bloomberg) Dubai posts strong real estate sales in February – Dubai Land Department in Dubai published data on real estate transactions which showed that sales increased to AED8,533mn in February from AED5,796mn in January and 118.8% YoY. Land sales increased to AED4,106mn in February from AED2,734mn in January and 53.8% YoY. Unit sales increased to AED3,720mn in February from AED2,427mn in January and 252.5% YoY. Mortgage deals increased to AED16,176mn in February from AED7,653mn in January and 68.8% YoY. Land mortgage deals increased to AED14,303mn in February from AED7,036mn in January and 69.7% YoY. Unit mortgage deals increased to AED1,156mn in February from AED463mn in January and 59.3% YoY. Building mortgage deals increased to AED717mn in February from AED154mn in January and 67.4% YoY. (Bloomberg) Kuwait Petroleum Corp signs MoU with Britain – State-owned Kuwait Petroleum Corp (KPC) has signed a memorandum of understanding (MoU) with the British government for up to

- 6. Page 6 of 7 $3bn in loans and credit facilities, the company stated. The UK’s credit agency, UK Export Finance, will provide loans and credit facilities for exports of British goods and services in projects carried out by KPC and its subsidiaries, KPC stated. (Peninsula Qatar) Bahrain sells BHD70mn 91-day bills; bid-cover at 2.44x – Bahrain sold BHD70mn of bills due on June 5, 2019. Investors offered to buy 2.44 times the amount of securities sold. The bills were sold at a price of 98.987, having a yield of 4.05% and will settle on March 6, 2019. (Bloomberg)

- 7. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 7 of 7 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg ( # Market was closed on March 4, 2019) Source: Bloomberg (*$ adjusted returns, # Market was closed on March 4, 2019) 45.0 70.0 95.0 120.0 Feb-15 Feb-16 Feb-17 Feb-18 Feb-19 QSEIndex S&P Pan Arab S&P GCC 0.4% 0.1% (0.3%) (0.3%) 0.4% (0.4%) 0.0% (0.5%) 0.0% 0.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,286.72 (0.5) (0.5) 0.3 MSCI World Index 2,090.40 (0.3) (0.3) 11.0 Silver/Ounce 15.09 (0.8) (0.8) (2.6) DJ Industrial 25,819.65 (0.8) (0.8) 10.7 Crude Oil (Brent)/Barrel (FM Future) 65.67 0.9 0.9 22.1 S&P 500 2,792.81 (0.4) (0.4) 11.4 Crude Oil (WTI)/Barrel (FM Future) 56.59 1.4 1.4 24.6 NASDAQ 100 7,577.57 (0.2) (0.2) 14.2 Natural Gas (Henry Hub)/MMBtu 4.25 33.2 33.2 30.8 STOXX 600 375.09 (0.1) (0.1) 9.9 LPG Propane (Arab Gulf)/Ton 67.88 1.7 1.7 6.1 DAX 11,592.66 (0.4) (0.4) 8.7 LPG Butane (Arab Gulf)/Ton 71.50 0.7 0.7 2.9 FTSE 100 7,134.39 0.2 0.2 9.7 Euro 1.13 (0.2) (0.2) (1.1) CAC 40 5,286.57 0.1 0.1 10.6 Yen 111.75 (0.1) (0.1) 1.9 Nikkei 21,822.04 1.2 1.2 7.8 GBP 1.32 (0.2) (0.2) 3.3 MSCI EM 1,053.62 0.2 0.2 9.1 CHF 1.00 0.0 0.0 (1.7) SHANGHAI SE Composite 3,027.58 1.1 1.1 24.5 AUD 0.71 0.2 0.2 0.6 HANG SENG 28,959.59 0.5 0.5 11.8 USD Index 96.68 0.2 0.2 0.5 BSE SENSEX# 36,063.81 0.0 0.0 (1.8) RUB 65.75 (0.3) (0.3) (5.7) Bovespa# 94,603.75 0.0 0.0 10.2 BRL# 0.26 0.0 0.0 2.8 RTS 1,185.83 (0.1) (0.1) 11.0 98.6 92.7 83.9