QSE declines 0.1% as Ahli Bank and Qatar Gas Transport fall sharply

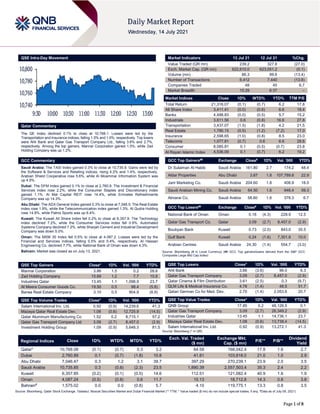

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QE Index declined 0.1% to close at 10,768.1. Losses were led by the Transportation and Insurance indices, falling 1.5% and 1.0%, respectively. Top losers were Ahli Bank and Qatar Gas Transport Company Ltd., falling 3.6% and 2.7%, respectively. Among the top gainers, Mannai Corporation gained 1.5%, while Zad Holding Company was up 1.2%. GCC Commentary Saudi Arabia: The TASI Index gained 0.3% to close at 10,735.9. Gains were led by the Software & Services and Retailing indices, rising 4.2% and 1.4%, respectively. Arabian Shield Cooperative rose 5.6%, while Al Moammar Information System was up 4.9%. Dubai: The DFM Index gained 0.1% to close at 2,760.9. The Investment & Financial Services index rose 2.2%, while the Consumer Staples and Discretionary index gained 1.1%. Al Mal Capital REIT rose 14.4%, while Emirates Refreshments Company was up 14.3%. Abu Dhabi: The ADX General Index gained 0.3% to close at 7,046.5. The Real Estate index rose 1.9%, while the Telecommunication index gained 1.3%. Al Qudra Holding rose 14.9%, while Palms Sports was up 6.4%. Kuwait: The Kuwait All Share Index fell 0.2% to close at 6,357.9. The Technology index declined 7.2%, while the Consumer Services index fell 0.9%. Automated Systems Company declined 7.2%, while Sharjah Cement and Industrial Development Company was down 5.0%. Oman: The MSM 30 Index fell 0.5% to close at 4,087.2. Losses were led by the Financial and Services indices, falling 0.5% and 0.4%, respectively. Al Hassan Engineering Co. declined 7.7%, while National Bank of Oman was down 4.3%. Bahrain: Market was closed as on July 13, 2021. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Mannai Corporation 3.86 1.5 0.2 28.6 Zad Holding Company 15.69 1.2 7.7 15.8 Industries Qatar 13.45 1.1 1,098.9 23.7 Al Meera Consumer Goods Co. 19.50 0.5 98.4 (5.8) Barwa Real Estate Company 3.10 0.5 904.9 (8.9) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Salam International Inv. Ltd. 0.92 (0.9) 14,239.6 41.3 Mazaya Qatar Real Estate Dev. 1.08 (0.6) 12,725.9 (14.5) Qatar Aluminum Manufacturing Co 1.52 0.2 8,715.1 57.2 Qatar Gas Transport Company Ltd 3.09 (2.7) 8,457.0 (2.9) Investment Holding Group 1.09 (0.9) 5,648.3 81.5 Market Indicators 13 Jul 21 12 Jul 21 %Chg. Value Traded (QR mn) 239.2 327.8 (27.0) Exch. Market Cap. (QR mn) 622,610.0 623,051.2 (0.1) Volume (mn) 86.3 99.6 (13.4) Number of Transactions 6,412 7,440 (13.8) Companies Traded 48 45 6.7 Market Breadth 15:29 6:37 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 21,316.07 (0.1) (0.7) 6.2 17.8 All Share Index 3,411.41 (0.0) (0.6) 6.6 18.4 Banks 4,488.83 (0.0) (0.5) 5.7 15.2 Industrials 3,611.56 0.6 (0.8) 16.6 27.8 Transportation 3,437.07 (1.5) (1.8) 4.2 21.5 Real Estate 1,790.15 (0.5) (1.2) (7.2) 17.0 Insurance 2,598.65 (1.0) (0.8) 8.5 23.0 Telecoms 1,077.81 (0.7) 0.6 6.6 28.6 Consumer 8,085.81 0.1 (0.5) (0.7) 23.8 Al Rayan Islamic Index 4,536.09 0.1 (0.7) 6.2 19.2 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Dr Sulaiman Al Habib Saudi Arabia 161.80 2.7 174.2 48.4 Aldar Properties Abu Dhabi 3.87 1.8 107,789.8 22.9 Jarir Marketing Co. Saudi Arabia 204.60 1.8 408.9 18.0 Saudi Arabian Mining Co. Saudi Arabia 64.50 1.6 946.4 59.3 Almarai Co. Saudi Arabia 58.60 1.6 378.3 6.7 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% National Bank of Oman Oman 0.18 (4.3) 228.9 12.5 Qatar Gas Transport Co. Qatar 3.09 (2.7) 8,457.0 (2.9) Boubyan Bank Kuwait 0.73 (2.0) 843.0 35.5 Gulf Bank Kuwait 0.24 (1.6) 7,301.8 10.0 Arabian Centres Saudi Arabia 24.30 (1.4) 554.7 (3.0) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ahli Bank 3.66 (3.6) 96.0 6.3 Qatar Gas Transport Company 3.09 (2.7) 8,457.0 (2.9) Qatar Cinema & Film Distribution 3.61 (2.5) 0.3 (9.7) QLM Life & Medical Insurance Co. 4.78 (1.4) 48.5 51.7 Qatari German Co for Med. Dev. 2.70 (1.4) 2,053.6 20.7 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 17.85 0.2 48,126.5 0.1 Qatar Gas Transport Company 3.09 (2.7) 26,349.2 (2.9) Industries Qatar 13.45 1.1 14,736.1 23.7 Mazaya Qatar Real Estate Dev. 1.08 (0.6) 13,738.4 (14.5) Salam International Inv. Ltd. 0.92 (0.9) 13,272.1 41.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,768.08 (0.1) (0.7) 0.3 3.2 64.58 168,042.4 17.8 1.6 2.7 Dubai 2,760.89 0.1 (0.7) (1.8) 10.8 41.81 103,818.0 21.0 1.0 2.9 Abu Dhabi 7,046.47 0.3 1.2 3.1 39.7 397.29 270,239.1 23.9 2.0 3.5 Saudi Arabia 10,735.85 0.3 (0.8) (2.3) 23.5 1,890.39 2,557,503.4 35.3 2.4 2.2 Kuwait 6,357.85 (0.2) (0.1) (0.5) 14.6 112.51 121,082.4 40.9 1.6 1.9 Oman 4,087.24 (0.5) (0.8) 0.6 11.7 15.13 18,712.8 14.3 0.8 3.8 Bahrain# 1,575.02 0.0 0.0 (0.8) 5.7 4.10 119,775.1 13.3 0.8 3.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any, #Data as of July 08, 2021) 10,740 10,760 10,780 10,800 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QE Index declined 0.1% to close at 10,768.1. The Transportation and Insurance indices led the losses. The index fell on the back of selling pressure from Arab and foreign shareholders despite buying support from Qatari and GCC shareholders. Ahli Bank and Qatar Gas Transport Company Ltd. were the top losers, falling 3.6% and 2.7%, respectively. Among the top gainers, Mannai Corporation gained 1.5%, while Zad Holding Company was up 1.2%. Volume of shares traded on Tuesday fell by 13.4% to 86.3mn from 99.6mn on Monday. Further, as compared to the 30-day moving average of 146.2mn, volume for the day was 41.0% lower. Salam International Inv. Ltd. and Mazaya Qatar Real Estate Dev. were the most active stocks, contributing 16.5% and 14.7% to the total volume, respectively. Source: Qatar Stock Exchange (*as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Kuwait Projects Holding S&P Kuwait LT-LIC/LT-FIC BB/BB BB-/BB- Negative – Source: News reports, Bloomberg (* LT – Long Term, LIC – Local Issuer Credit, FIC – Foreign Issuer Credit) Earnings Releases Company Market Currency Revenue (mn) 2Q2021 % Change YoY Operating Profit (mn) 2Q2021 % Change YoY Net Profit (mn) 2Q2021 % Change YoY Jarir Marketing Co.* Saudi Arabia SR 2,015.3 -20.4% 205.6 -28.0% 189.2 -29.3% The National Detergent Co.* Oman OMR 9.0 -17.0% – – 0.1 -80.2% Sharqiyah Desalination Co.* Oman OMR 6.8 2.7% – – 0.6 -26.3% Ubar Hotels & Resorts* Oman OMR 1.1 -12.7% (0.4) N/A (0.5) N/A Al Jazeera Services* Oman OMR 3.7 -12.5% 0.2 -46.0% 1.7 149.8% Gulf Hotels Co. Ltd* Oman OMR 1.3 -33.7% – – (0.6) N/A Al Omaniya Financial Services* Oman OMR 7.4 -12.7% – – 1.2 93.8% Dhofar Poultry Co.* Oman OMR 4.6 -3.0% – – (0.2) N/A Sembcorp Salalah Power & Water* Oman OMR 37.8 4.0% – – 9.6 -8.8% Oman Chlorine* Oman OMR 4.5 28.7% 0.9 29.1% 0.9 22.9% Source: Company data, DFM, ADX, MSM, TASI, BHB. (#Values in Thousands, *Financial for 6M2021) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 07/13 US Bureau of Labor Statistics CPI MoM Jun 0.9% 0.5% 0.6% 07/13 US Bureau of Labor Statistics CPI YoY Jun 5.4% 4.9% 5.0% 07/13 Germany German Federal Statistical Office CPI MoM Jun 0.4% 0.4% 0.4% 07/13 Germany German Federal Statistical Office CPI YoY Jun 2.3% 2.3% 2.3% 07/13 France INSEE National Statistics Office CPI MoM Jun 0.1% 0.2% 0.2% 07/13 France INSEE National Statistics Office CPI YoY Jun 1.5% 1.5% 1.5% 07/13 China National Bureau of Statistics Exports YoY Jun 32.2% 23.0% 27.9% 07/13 China National Bureau of Statistics Imports YoY Jun 36.7% 29.5% 51.1% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 40.80% 41.25% (1,075,315.7) Qatari Institutions 21.02% 13.34% 18,362,927.3 Qatari 61.82% 54.59% 17,287,611.6 GCC Individuals 1.01% 0.24% 1,834,173.3 GCC Institutions 2.38% 0.47% 4,557,961.5 GCC 3.39% 0.72% 6,392,134.7 Arab Individuals 9.58% 10.10% (1,238,624.7) Arab Institutions 0.00% 0.00% (10,425.9) Arab 9.58% 10.11% (1,249,050.6) Foreigners Individuals 3.25% 3.54% (712,917.2) Foreigners Institutions 21.96% 31.04% (21,717,778.5) Foreigners 25.21% 34.59% (22,430,695.7)

- 3. Page 3 of 8 Earnings Calendar Tickers Company Name Date of reporting 2Q2021 results No. of days remaining Status WDAM Widam Food Company 14-Jul-21 0 Due VFQS Vodafone Qatar 14-Jul-21 0 Due QIBK Qatar Islamic Bank 14-Jul-21 0 Due QEWS Qatar Electricity & Water Company 14-Jul-21 0 Due QNNS Qatar Navigation (Milaha) 15-Jul-21 1 Due MCGS Medicare Group 15-Jul-21 1 Due KCBK Al Khalij Commercial Bank 15-Jul-21 1 Due NLCS Alijarah Holding 15-Jul-21 1 Due ABQK Ahli Bank 15-Jul-21 1 Due QIIK Qatar International Islamic Bank 26-Jul-21 12 Due CBQK The Commercial Bank 27-Jul-21 13 Due BRES Barwa Real Estate Company 27-Jul-21 13 Due GWCS Gulf Warehousing Company 27-Jul-21 13 Due DHBK Doha Bank 27-Jul-21 13 Due UDCD United Development Company 28-Jul-21 14 Due QNCD Qatar National Cement Company 28-Jul-21 14 Due ORDS Ooredoo 28-Jul-21 14 Due QIMD Qatar Industrial Manufacturing Company 28-Jul-21 14 Due QIGD Qatari Investors Group 01-Aug-21 18 Due DOHI Doha Insurance Group 04-Aug-21 21 Due IHGS INMA Holding Group 08-Aug-21 25 Due QISI Qatar Islamic Insurance Group 09-Aug-21 26 Due IGRD Investment Holding Group 10-Aug-21 27 Due Source: QSE News Qatar MARK posts 6.0% YoY increase but 1.1% QoQ decline in net profit in 2Q2021, bang in-line with our estimate – Masraf Al Rayan's (MARK) net profit rose 6.0% YoY (but declined 1.1% on QoQ basis) to QR568.6mn in 2Q2021, bang in-line with our estimate of QR564.3mn (variation of +0.8%). Total net income from financing and investing activities decreased 1.3% YoY and 2.7% QoQ in 2Q2021 to QR1,128.4mn. The company's Total Income came in at QR1,263.5mn in 2Q2021, which represents an increase of 1.3% YoY. However, on QoQ basis Total Income fell 1.0%. The bank's total assets stood at QR125.1bn at the end of June 30, 2021, up 14.4% YoY. However, on QoQ basis the bank's total assets decreased 0.4%. Financing Assets were QR91.2bn, registering a rise of 16.8% YoY at the end of June 30, 2021. However, on QoQ basis Financing Assets decreased 0.1%. Customer Current Accounts declined 0.2% YoY and 5.9% QoQ to reach QR8.4bn at the end of June 30, 2021. EPS amounted to QR0.076 in 2Q2021 as compared to QR0.072 in 2Q2020. MARK, Chairman and Managing Director, HE Ali bin Ahmed Al-Kuwari said the good results (of the bank) came particularly amidst the challenging conditions that “negatively affected” the financial markets. He attributed the strengthened bottom-line in part to the support extended by Qatar to private sectors in overcoming the adverse conditions from the global spread of the Covid-19 pandemic. Total shareholders' equity stood at QR14.25bn, showing a yearly increase of 7.2% at the end of June 30, 2021. The return on average assets continues to be one of the highest in the market at 1.86%, a bank spokesman said, adding return on average shareholders’ equity is 15.98%. The capital adequacy ratio, using Basel III standards and the Qatar Central Bank regulations, reached 20.29% compared to 19.70% as on June 30, 2020. The operating efficiency (cost-to-income) ratio is 18.97%, which continues to be one of the best in the region. Non- performing financing (NPF) ratio is 1.07% and is the lowest in the banking sector, reflecting strong and prudent credit risk management policies and procedures. The bank's book value per share reached QR1.90 in 1H2021 compared to QR1.77 a year- ago period. Earnings-per-share amounted to QR0.152 at the end of June 30, 2021. The spokesman said the merger between MARK and Al Khaliji has been approved by the Qatar Financial Markets Authority. Both the institutions are in the process of holding their respective extraordinary general assemblies to get the shareholders’ approval. The integration adviser is continuously working with MARK and Al Khaliji in implementing the merger that will create a larger and stronger financial institution with a strong financial position and significant liquidity. (QNB FS Research, QSE, Gulf-Times.com) CBQK to disclose its semi-annual financial results on July 27 – The Commercial Bank (CBQK) will disclose its financial statement for the period ending June 30, 2021 on July 27. (QSE) BRES to disclose its semi-annual financial results on July 27 – Barwa Real Estate Company (BRES) will disclose its financial statement for the period ending June 30, 2021 on July 27. (QSE) QIIK to hold its investors relation conference call on 28/07/2021 to discuss the financial results – Qatar International Islamic Bank announces that the conference call with the Investors to discuss the financial results for the Semi- Annual 2021 will be held on 28/07/2021 at 01:30 PM, Doha Time. (QSE) MARK to hold its investors relation conference call today – Masraf Al-Rayan (MARK) will hold the conference call with the Investors to discuss the financial results for the Semi-Annual 2021 on July 14, 2021 at 01:30pm, Doha Time. (QSE)

- 4. Page 4 of 8 Atos, Ooredoo to partner on cybersecurity for Qatar's smart- city program – Atos SE said that it is partnering with Qatari telecommunications firm Ooredoo (ORDS) to deliver cybersecurity services for the country's smart-city program. The French IT company will provide its managed detection and response service for the TASMU program, run by Qatar's transportation and communication ministry. "Atos and Ooredoo's solution integrates cloud-native intelligent security analytics and next-generation artificial-intelligence capability from the Atos Alsaac platform to secure TASMU's infrastructure and applications," the company said. (Bloomberg, Zawya) Aamali mobile allows small businesses to build bespoke communication plans – Ooredoo Qatar (ORDS) has launched a new service to help small businesses devise bespoke communications plans in line with their specific needs. Customers working from a small office or home office, with 20 employees or fewer, can now subscribe to and set up a personalized Aamali Small Business plan. This new service enables customers to build their own plans using My Ooredoo Business Portal, including the structuring and management of various allowances – data, local calls, international calls – in the way most beneficial to their business needs. Once each tailored Aamali plan is set up, Ooredoo will ensure that SIMs are delivered safely and for free to the customer’s premises. (Gulf-Times.com) Real estate deals worth more than QR2bn signed in June – Qatar’s real estate sector witnessed signing of deals worth over QR2.03bn in June this year, according to the Real Estate Bulletin released by the Ministry of Justice. The real sector was abuzz with deal making last month as 520 transactions were completed in June, compared to 321 transactions in May this year, reflecting a rise of 62%. The number of deals taking place in real estate sector demonstrates the growing trust of global and domestic investors on country’s robust economy. In terms of value to deals, municipalities of Al Rayyan, Doha and Al Daayen came at the top during June. Al Rayyan municipality witnessed deals worth over QR662mn, Doha Municipality recorded deals worth over QR532mn while Al Daayen municipality registered deals worth over QR446mn during last month. With regard to the volume of mortgage transactions during June 2021, the number of mortgage transactions that took place during the month reached 137, with a total value of QR5.35bn. Al Rayyan Municipality recorded the highest number of mortgage transactions with 46 transactions, constituting 33.6% of the total number of mortgaged real estate, followed by Doha Municipality with 41 transactions. Al Daayen municipality came at the top in terms of number of deals as it accounted for 28% of total deals, while Al Rayyan came second having share of 23% in total number of deals. (Peninsula Qatar) Qatari Deputy Emir, Saudi ambassador explore ways to boost bilateral ties – Qatar’s Deputy Emir Sheikh Abdullah Bin Hamad met here on Tuesday with Saudi Arabia’s Ambassador to Qatar Prince Mansour Bin Khalid Bin Farhan, the Saudi Press Agency reported. The Saudi ambassador conveyed the greetings of Crown Prince Muhammad Bin Salman to Sheikh Abdullah Bin Hamad who reciprocated the kind gesture. During the meeting, they discussed relations between the two countries and ways to support and enhance them in all fields. (Bloomberg) International US June budget deficit falls to $174bn – The US government posted a June deficit of $174bn, about a fifth of the June 2020 deficit of $864bn, as a rebound in the labor market and an earlier tax deadline this year raised revenues, the US Treasury said. Receipts for June jumped 87% to $449bn, in part a reflection of this year’s Internal Revenue Service income tax filing deadline being brought forward to May 17 compared to last year’s pandemic-induced delay to July 15. The Treasury also said taxes withheld from wages increased by 33%, on an adjusted basis, to $240bn during June compared to a year ago, while June corporate taxes rose to $79bn from $11bn last year. Outlays for June dropped 44% from a year earlier to $623bn, largely due to the outsized impact on the deficit a year earlier from the implementation of the Paycheck Protection Program, a subsidy to keep businesses afloat during the COVID-19 pandemic. This reduction in costs helped lower the fiscal year-to-date deficit to $2.238tn from $2.744tn for the first nine months of the prior fiscal year, Treasury officials said. YTD receipts rose 35% from a year earlier to $3.056tn, while outlays grew 6% to $5.294tn. (Reuters) US consumer prices post largest gain in 13 years – US consumer prices increased by the most in 13 years in June amid supply constraints and a continued rebound in the costs of travel- related services from pandemic-depressed levels as the economic recovery gathered momentum. With used cars and trucks accounting for more than one-third of the surge in prices reported by the Labor Department on Tuesday, economists continued to believe that higher inflation was transitory. Federal Reserve Chair Jerome Powell has repeatedly stated similar views, noting that he expected supply chains to normalize and adapt. The consumer price index increased 0.9% last month, the largest gain since June 2008, after advancing 0.6% in May. Used cars and trucks prices accelerated 10.5%. That was the biggest increase since January 1953 when the government started tracking the series. A global semiconductor shortage has undercut motor vehicle production. Used cars and trucks have been the major driver of inflation in recent months. But prices are rising across the economy. COVID-19 vaccinations, low interest rates and nearly $6tn in government relief since the pandemic started in the US in March 2020 are fueling demand, straining the supply chain and raising prices across the economy. Consumers also paid more for food, gasoline, rents and apparel last month. In the 12 months through June, the CPI jumped 5.4%. That was the largest gain since August 2008 and followed a 5.0% increase in May. Excluding the volatile food and energy components, the CPI accelerated 0.9% after increasing 0.7% in May. The so-called core CPI surged 4.5% on a YoY basis, the largest increase since November 1991, after rising 3.8% in May. (Reuters) BOJ to offer cautiously upbeat view on economy as COVID curbs weigh – The Bank of Japan (BOJ) will offer a cautiously optimistic view of the economy in fresh quarterly projections due on Friday, as renewed state of emergency curbs to combat the COVID-19 pandemic hurt consumption and keep growth heavily reliant on overseas demand. The central bank will also unveil details of a new scheme to boost funding for activities aimed at battling climate change, putting it in line with its global counterparts stepping up efforts to deal with the economic fallout from climate risks. At the two-day policy meeting ending on Friday, the BOJ is set to maintain its yield curve control (YCC) targets at -0.1% for short-term interest rates and 0% for 10-year bond yields. In new quarterly projections also due on Friday, the board is seen slashing its economic growth forecast for the fiscal year ending in March 2022 from the current 4.0% estimate made three months ago, some sources have previously told Reuters. The cut will likely reflect weakness in consumption and the impact of new curbs imposed in Olympic host city Tokyo from Monday through August 22, which have dashed policymakers’ hopes for a solid rebound in July-September growth. But the BOJ will stick to its view the economy is headed for a moderate recovery, and may slightly upgrade next fiscal year’s growth forecast on expectations that steady vaccinations will spur pent-up demand, said separate sources familiar with its thinking. (Reuters) Reuters Tankan: Japan's factory mood in July hits highest since late 2018 – Japanese manufacturers’ business confidence rose in July to hit a more than two-and-a-half-year high, as the

- 5. Page 5 of 8 country’s export-driven recovery remained intact thanks to solid global demand, the Reuters Tankan poll showed. But in a worrying sign, service-sector sentiment turned pessimistic, as firms struggled with the fallout from the coronavirus crisis, according to the poll, which tracks the Bank of Japan’s (BOJ) closely watched tankan quarterly survey. The Reuters Tankan sentiment index for manufacturers rose to 25 from 22 in June, its highest since November 2018, the poll conducted June 30-July 9 showed. The service index fell to minus 3 from a flat reading the prior month. The Reuters Tankan index readings are calculated by subtracting the percentage of respondents who say conditions are poor from those who say they are good. A positive reading means optimists outnumber pessimists. Manufacturers’ sentiment got a boost from strong confidence at car, chemical and metal products makers, which offset negative conditions in the textiles and paper sector. The poll, which surveyed 503 large- and mid-sized companies of which 257 firms responded on condition of anonymity, comes ahead of the BOJ’s July 15-16 policy meeting. The BOJ’s own “tankan” business survey out this month also showed business confidence improved to a two-and-half- year high, while service-sector sentiment turned positive for the first time in five quarters. (Reuters) China central bank says macro policy will depend on domestic conditions – China will base the pace and intensity of monetary policy on the domestic economy and inflation trends in the second half of the year, a central bank official said, following a surprise cut in bank reserves to bolster the economic recovery. Sun Guofeng, head of the monetary policy department at the People’s Bank of China (PBOC), said China’s policy will prioritize stability and focus on domestic conditions, adding that possible tightening by the US Federal Reserve would have a limited impact on China’s monetary policy. The PBOC announced on Friday it would cut the amount of cash banks must hold as reserves, releasing around 1tn Yuan ($154.67bn) in long-term liquidity to underpin its post-COVID economic recovery that is starting to lose momentum. The PBOC last cut the RRR in April last year, when the Chinese economy was still badly affected by the coronavirus crisis. Small firms are bearing the brunt of a recent surge in raw material prices as they are unable to pass on the higher costs to consumers. The producer price index (PPI), which is already near its highest in more than a decade, is likely to continue to hover at an elevated level in the third quarter, before falling back in the fourth quarter and next year, Sun said. (Reuters) China's export growth quickens as global vaccinations, easing lockdowns lift demand – China’s exports grew much faster than expected in June, as solid global demand led by easing lockdown measures and vaccination drives worldwide eclipsed virus outbreaks and port delays. But overall trade growth in the world’s second-biggest economy may slow in the second half of 2021, a customs official warned on Tuesday, partly reflecting the COVID-19 pandemic uncertainties as the Delta virus variant wreaks havoc in some countries. Overall imports also beat expectations, though the pace of gains eased from May, with the values boosted by high raw material prices, customs data showed. Thanks to Beijing’s efforts in largely containing the pandemic earlier than its trading partners, the world’s biggest exporter has managed a solid economic revival from the coronavirus-induced slump in the first few months of 2020. Exports in dollar terms rose 32.2% in June from a year earlier, compared with 27.9% growth in May. The analysts polled by Reuters had forecasted a 23.1% increase. China’s trade performance has seen some pressure in recent months, mainly due to a global semiconductor shortage, logistics bottlenecks, and higher raw material and freight costs. All the same, the global easings in COVID-19 lockdown measures and vaccination drives appeared to underpin a strong uptick in worldwide demand for Chinese goods. Germany, for example, which was at first sluggish in its vaccination drive, said this month it had caught up with the United States in terms of the proportion of the population having had one shot of COVID-19 vaccine. Close to half of Americans are now fully vaccinated, while elsewhere in Europe the rate has also increased recently. China’s strong shipment numbers last month underlined some solid factory surveys overseas. A measure of US factory activity climbed to a record high in June, while Euro zone business growth accelerated at its fastest pace in 15 years. (Reuters) Brazil services activity grows in May, exceeds pre-pandemic levels – Brazil’s services sector continued its upward trajectory in May, showing record growth that was 0.2% higher than pre- pandemic levels, according to data released on Tuesday. The sector grew 23.0% from May 2020, statistics agency IBGE said. Economists had forecast a median rise of 22.6% in a Reuters poll. Services activity rose 1.2% from April after seasonal adjustments. Still, the sector remains below the levels seen in February of this year, just before a second wave of the COVID-19 pandemic led to new economic restrictions in March. Growth, however, did not reach all corners of the services sector in May. The IBGE survey tracks five service activities and registered growth in three of them: transportation, tourism and family services. Growth was highest in the tourism sector, up 18% in May compared with April. But tourism also remains 53% below pre-pandemic levels, according to the survey. Negative rates were registered in IT services and communications. (Reuters) Regional IEA: OPEC+ impasse means tight oil market now, volatility ahead – The oil market will see tighter supply for now amid a dispute inside OPEC+ about how to ease production curbs but it still faces the risk of a dash for market share if disagreement persists, the International Energy Agency (IEA) said on Tuesday. The Paris-based agency said oil prices would be volatile until differences were resolved among members of OPEC+, which groups the OPEC, Russia and other oil producers. "The OPEC+ stalemate means that until a compromise can be reached, production quotas will remain at July's levels. In that case, oil markets will tighten significantly as demand rebounds from last year's COVID-induced plunge," an IEA report said. (Reuters) IEA: Saudi oil-supply boost drove up OPEC output in June – OPEC’s June crude production rose 450k bpd from May to 25.93mn bpd as Saudi Arabia led the return of barrels to the market, the IEA said in its monthly report. Saudi Arabia pumped 8.92mn bpd, up 380k bpd from a month earlier, as it continued to unwind its voluntary cuts. Riyadh could raise July output by 580k bpd as per the OPEC+ agreement and as it phases out its remaining voluntary curbs. Kuwaiti crude supply inched up to 2.38mn bpd, while UAE production climbed 40k bpd to 2.68m bpd, just below its higher OPEC+ target. Iraq was the only Mideast producer to reduce output, pumping 3.9mn bpd, down 40k bpd from May and 50k bpd below its OPEC+ cap. Supply from Iran exempt from quotas advanced 50k bpd to 2.45m bpd. Among African countries, Nigeria’s production slipped 30k bpd to 1.31mn bpd, with operational issues, sabotage and pipeline leaks keeping output below its quota. Angolan supply dropped to 1.08mn bpd, 220k bpd below its target. OPEC’s compliance with quotas was 123% over the month. (Bloomberg) IMF: Higher oil income will boost Saudi saving not spending – Saudi Arabia is likely to use surplus oil revenue to rebuild reserves, breaking with its historical practice of boosting spending when crude prices rise, according to the International Monetary Fund (IMF). “The message that we very strongly got was that the expenditure path set out in the budget will be stuck to, regardless of where oil prices go to, which I think is the right thing to do,” the

- 6. Page 6 of 8 IMF Mission Chief to the Kingdom, Tim Callen said. Sticking to targeted spending “allows you then to really build the financial assets that have been run down in recent years.” Crude prices around $75 a barrel are only slightly lower than what Saudi Arabia needs to balance the budget, according to IMF estimates. They may rise further as the global economy rebounds from the impact of the pandemic and the International Energy Agency (IEA) warned on Tuesday that the oil market would remain tight unless Saudi Arabia and its OPEC+ allies boost production. (Bloomberg) Saudi Ma'aden signs deal for calcined petroleum coke for aluminium plant – A subsidiary of state-run Saudi Arabian Mining Co (Ma’aden) signed a five-year contract on Tuesday to buy calcined petroleum coke from a Saudi company for its aluminium smelter facility in Ras Al Khair, the Saudi state news agency (SPA) reported. Ma’aden Aluminium Company will receive 100,000 tons a year of the material, used in the manufacture of aluminium, once commercial production starts at the end of 2024 from a facility owned by Saudi Calcined Petroleum Coke Company (SCPCC). The contract, worth $40mn a year, is part of a plan by Ma’aden, the Gulf’s largest miner, to secure 320,000 tons a year of calcined petroleum coke from domestic sources. (Reuters) Arabian Centres looks to top up Islamic bonds deal – Saudi mall operator Arabian Centres is expected to issue $150mn in Islamic bonds in a reopening of a transaction that raised $650mn in April, according to a bank document seen by Reuters on Tuesday. The company said in a stock exchange filing it intends to issue US Dollar-denominated Sukuk that "shall be consolidated and will form part of the same series as the currently outstanding $650mn Sukuk due 2026," without disclosing the size. Arabian Centres hired Goldman Sachs International and HSBC as joint global coordinators and bookrunners, the bourse filing and the document from one of the banks on the deal showed. (Zawya) Saudi Arabia's insurance firms eye M&A to expand market share – Saudi Arabia’s insurance sector is expected to consolidate with 62% of companies looking at mergers and acquisition (M&A) as a path to increase market share, KPMG said in a new report. The report also said that heads of insurance companies feel more confident over the next three-year horizon, with investments in digital technology set to improve the customer experience and disruptive technologies that will transform operating models. “Through our discussions with industry leaders, we concluded that insurers need to maintain sufficient liquidity and solvency to continue managing cost pressures. Those who would be able to pull the right levers across liquidity, capital and cost will gain market share,” Head of Financial Services at KPMG in Saudi Arabia, Ovais Shahab said. (Zawya) Emaar Economic reschedules SR538mn Saudi Fransi facility – Emaar Economic has rescheduled SR538mn Saudi Fransi facility. It has amended terms of 2015 facility includes grace period of three years and a repayment over seven years, 2023- 2029, in semi-annual installments. (Bloomberg) UAE’s May M3 money supply rises 0.1% YoY – The UAE's M3 money supply rose 0.1% YoY in May versus +0.8% in April, according to The Central Bank of the UAE (CBUAE). (Bloomberg) One of Dubai’s oldest lenders prepares for a digital-only future – One of the oldest banks in the UAE is preparing for a digital-only future as it fends off competition from non-traditional financial services startups. Dubai-based Mashreqbank now operates just 10 branches in the UAE, down from 34 two years ago. That’s set to fall further, with CEO, Ahmed Abdelaal predicting traditional branches will “cease to exist very soon.” “There’s a complete shift in our strategy to focus on digital channels,” which now account for the majority of new business at the lender, Abdelaal said in an interview. “We still have some clients who rely on brick and mortar but our numbers show these are diminishing by the minute.” Mashreq traces its origins back to 1967, four years before the UAE was founded as an independent country. The lender, like others in the Middle East, is pivoting to digital banking to cater to a young population that prefers to bank online. For some countries like Egypt, digital platforms are often the only way to access banking services. (Bloomberg) Abu Dhabi hotel occupancy rises to highest since pandemic began – Hotel occupancy in the oil-rich capital of the UAE surged in June to the highest level since the start of the coronavirus pandemic. Abu Dhabi hotels were 68.5% full last month, according to preliminary data from research firm STR. Revenue per available room, a key measure of profitability, was AED219.81, the highest since February. Room rates have also risen in neighboring Dubai, STR said earlier this year. The Emirate is hosting the Expo 2020 international exhibition in October and is aiming for 25mn unique visits in what it hopes will be a significant boost to the key tourism sector. The year-over- year percentage increases are “substantial” because of the comparison with the months most affected by the pandemic in 2020, STR said. The UAE has largely shunned lockdowns since emerging from one last year. While Abu Dhabi has announced some curbs and plans to restrict public spaces to vaccinated people from August, Dubai remains largely open. (Bloomberg) Kuwait sells KD240mn 91-day bills; bid-cover at 10.42x – Kuwait sold KD240mn of 91-day bills due on October 12. Investors offered to buy 10.42 times the amount of securities sold. The bills have a yield of 1.125% and settled on July 13. (Bloomberg) Kuwait looks to gas imports as gulf states aim to burn less oil – Kuwait has opened its first permanent facility to import liquefied natural gas, as oil-rich Persian Gulf states accelerate efforts to wean their power plants off crude and use cleaner forms of energy. The Al Zour LNG terminal received its first cargo of gas, from Qatar, on Monday, according to state news agency Kuna. The plant, roughly 10 miles from Kuwait’s border with Saudi Arabia, is designed to import as much as 22mn tons of the super- chilled gas each year, making it easily the largest of its kind in the Middle East. “Gas demand in Kuwait is set to rise in the power sector due to the planned phase-out of oil plants worth 10 gigawatts,” an LNG analyst at BloombergNEF, Abhishek Rohatgi said in a note. “Gas-demand growth is likely to outpace domestic production growth from the Jurassic fields, raising LNG imports.” BloombergNEF expects LNG use in the Middle East to increase almost 50% by 2025, with most of the increase coming from Kuwait. Several of its neighbors are also trying to phase out oil from domestic use. Saudi Arabia aims to stop burning as much as 1mn bpd of crude in its power plants by 2030, instead using solar, wind and natural gas. Iraq is spending billions of dollars to ramp up gas output. The Gulf Arab economies are among the world’s biggest oil consumers on a per capita basis, in part because of their heavy use of crude in their electricity grids. Kuwait, one of OPEC’s biggest oil producers, needs to buy LNG from abroad since it pumps little gas of its own. The oil diverted from power plants will probably be exported. The country has a 15-year contract with state-owned Qatar Petroleum (QP) to buy 3mn tons of LNG a year for Al Zour. It plans to buy another 3.5mn tons a year from other suppliers. Until now, Kuwait has mostly imported LNG via floating storage and re-gasification units. (Bloomberg) S&P downgrades KIPCO to BB-; with a Negative outlook – S&P downgrades KIPCO to BB-; with a Negative outlook. S&P stated that Kuwait Projects’ Company (KIPCO) “leverage continued to increase markedly, while its investment performance remained weak”. Company to face large maturities in 2023, and

- 7. Page 7 of 8 its cash flow from investments is likely to remain muted over this time. (Bloomberg)

- 8. Contacts QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 info@qnbfs.com.qa Doha, Qatar Saugata Sarkar, CFA, CAIA Shahan Keushgerian Mehmet Aksoy, PhD Head of Research Senior Research Analyst Senior Research Analyst saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa mehmet.aksoy@qnbfs.com.qa Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 160.0 Jun-17 Jun-18 Jun-19 Jun-20 Jun-21 QSE Index S&PPan Arab S&PGCC 0.3% (0.1%) (0.2%) 0.0% (0.5%) 0.3% 0.1% (1.0%) (0.5%) 0.0% 0.5% 1.0% Saudi Arabia Qatar Kuwait Bahrain Oman Abu Dhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,807.76 0.1 (0.0) (4.8) MSCI World Index 3,059.28 (0.3) 0.2 13.7 Silver/Ounce 25.99 (0.8) (0.4) (1.6) DJ Industrial 34,888.79 (0.3) 0.1 14.0 Crude Oil (Brent)/Barrel (FM Future) 76.49 1.8 1.2 47.7 S&P 500 4,369.21 (0.4) (0.0) 16.3 Crude Oil (WTI)/Barrel (FM Future) 75.25 1.6 0.9 55.1 NASDAQ 100 14,677.65 (0.4) (0.2) 13.9 Natural Gas (Henry Hub)/MMBtu 3.72 0.5 0.3 55.6 STOXX 600 460.96 (0.4) 0.2 11.5 LPG Propane (Arab Gulf)/Ton 109.75 0.5 (0.8) 45.8 DAX 15,789.64 (0.5) 0.1 10.6 LPG Butane (Arab Gulf)/Ton 124.63 2.2 1.3 79.3 FTSE 100 7,124.72 (0.3) (0.1) 11.8 Euro 1.18 (0.7) (0.8) (3.6) CAC 40 6,558.47 (0.5) (0.1) 14.1 Yen 110.63 0.2 0.4 7.1 Nikkei 28,718.24 0.5 2.6 (2.2) GBP 1.38 (0.5) (0.6) 1.1 MSCI EM 1,339.51 1.0 1.6 3.7 CHF 1.09 (0.4) (0.5) (3.7) SHANGHAI SE Composite 3,566.52 0.6 1.4 3.6 AUD 0.74 (0.4) (0.5) (3.2) HANG SENG 27,963.41 1.6 2.3 2.5 USD Index 92.75 0.5 0.7 3.1 BSE SENSEX 52,769.73 0.7 0.7 8.3 RUB 74.32 (0.2) (0.0) (0.1) Bovespa 128,167.70 0.9 3.7 7.9 BRL 0.19 0.2 1.9 0.6 RTS 1,648.84 0.5 0.8 18.8 142.3 136.0 108.3