14 October Daily market report

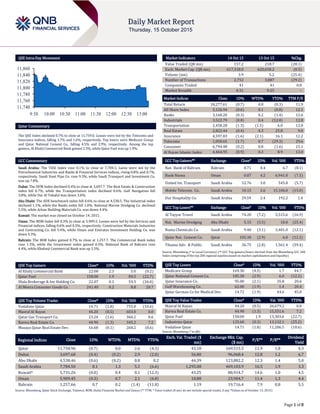

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.7% to close at 11,759.0. Losses were led by the Telecoms and Insurance indices, falling 1.7% and 1.6%, respectively. Top losers were Medicare Group and Qatar National Cement Co., falling 4.5% and 2.9%, respectively. Among the top gainers, Al Khalij Commercial Bank gained 2.3%, while Qatar Fuel was up 1.9%. GCC Commentary Saudi Arabia: The TASI Index rose 0.1% to close at 7,784.5. Gains were led by the Petrochemical Industries and Banks & Financial Services indices, rising 0.8% and 0.7%, respectively. Saudi Steel Pipe Co. rose 9.3%, while Saudi Transport and Investment Co. was up 7.8%. Dubai: The DFM Index declined 0.4% to close at 3,697.7. The Real Estate & Construction index fell 0.7%, while the Transportation index declined 0.6%. Gulf Navigation fell 3.8%, while Dar Al Takaful was down 3.0%. Abu Dhabi: The ADX benchmark index fell 0.6% to close at 4,538.5. The Industrial index declined 1.1%, while the Banks index fell 1.0%. National Marine Dredging Co. declined 5.5%, while Arkan Building Materials Co. was down 4.4%. Kuwait: The market was closed on October 14, 2015. Oman: The MSM Index fell 0.3% to close at 5,909.5. Losses were led by the Services and Financial indices, falling 0.6% and 0.5%, respectively. Construction Materials Industries and Contracting Co. fell 5.4%, while Oman and Emirates Investment Holding Co. was down 4.3%. Bahrain: The BHB Index gained 0.7% to close at 1,257.7. The Commercial Bank index rose 1.3%, while the Investment index gained 0.3%. National Bank of Bahrain rose 4.4%, while Khaleeji Commercial Bank was up 3.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Khalij Commercial Bank 22.00 2.3 5.0 (0.2) Qatar Fuel 158.00 1.9 84.5 (22.7) Dlala Brokerage & Inv Holding Co. 22.07 0.3 59.3 (34.0) Al Meera Consumer Goods Co. 241.40 0.2 8.8 20.7 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 14.71 (1.8) 755.0 (10.6) Masraf Al Rayan 44.20 (0.5) 603.0 0.0 Qatar Gas Transport Co. 23.24 (1.6) 360.2 0.6 Barwa Real Estate Co. 44.90 (1.3) 345.2 7.2 Mazaya Qatar Real Estate Dev. 16.68 (0.1) 268.2 (8.6) Market Indicators 14 Oct 15 13 Oct 15 %Chg. Value Traded (QR mn) 157.2 218.7 (28.1) Exch. Market Cap. (QR mn) 617,318.0 620,658.2 (0.5) Volume (mn) 3.9 5.2 (25.4) Number of Transactions 2,752 3,887 (29.2) Companies Traded 41 41 0.0 Market Breadth 4:31 9:25 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,277.61 (0.7) 0.0 (0.3) 11.9 All Share Index 3,126.94 (0.6) 0.1 (0.8) 12.1 Banks 3,160.20 (0.3) 0.2 (1.4) 12.6 Industrials 3,522.79 (0.8) 0.4 (12.8) 12.8 Transportation 2,458.28 (1.3) (1.5) 6.0 12.0 Real Estate 2,822.44 (0.4) 0.3 25.8 9.0 Insurance 4,597.83 (1.6) (2.1) 16.1 12.2 Telecoms 1,050.65 (1.7) 0.7 (29.3) 29.6 Consumer 6,794.48 (0.2) 0.8 (1.6) 15.1 Al Rayan Islamic Index 4,464.95 (0.9) 0.3 8.9 13.0 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Bank of Bahrain Bahrain 0.71 4.4 6.7 (8.1) Bank Nizwa Oman 0.07 4.2 6,941.0 (7.5) United Int. Transport Saudi Arabia 52.76 3.0 545.8 (5.7) Mobile Telecom. Co. Saudi Arabia 10.15 2.6 15,106.0 (15.0) Dur Hospitality Co. Saudi Arabia 29.59 2.4 192.2 1.4 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Al Tayyar Travel Saudi Arabia 74.20 (7.2) 5,515.6 (16.9) Nat. Marine Dredging Abu Dhabi 5.15 (5.5) 10.0 (25.4) Nama Chemicals Co. Saudi Arabia 9.40 (3.1) 3,401.0 (12.1) Qatar Nat. Cement Co. Qatar 105.30 (2.9) 6.0 (12.2) Tihama Adv. & Public. Saudi Arabia 36.75 (2.8) 1,561.4 (59.4) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Medicare Group 169.30 (4.5) 1.7 44.7 Qatar National Cement Co. 105.30 (2.9) 6.0 (12.2) Qatar Insurance Co. 95.00 (2.1) 35.8 20.6 Gulf Warehousing Co. 62.00 (1.9) 1.4 20.4 Qatar German Co for Medical Dev. 14.72 (1.9) 44.6 45.0 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 44.20 (0.5) 26,679.2 0.0 Barwa Real Estate Co. 44.90 (1.3) 15,551.6 7.2 Qatar Fuel 158.00 1.9 13,303.6 (22.7) Industries Qatar 125.60 (0.3) 13,132.1 (25.2) Vodafone Qatar 14.71 (1.8) 11,206.5 (10.6) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,758.96 (0.7) 0.0 2.6 (4.3) 43.18 169,515.5 11.9 1.8 4.3 Dubai 3,697.68 (0.4) (0.2) 2.9 (2.0) 56.80 96,068.4 12.8 1.2 6.7 Abu Dhabi 4,538.46 (0.6) (0.2) 0.8 0.2 44.39 123,882.2 12.3 1.4 5.0 Saudi Arabia 7,784.50 0.1 1.3 5.1 (6.6) 1,295.08 469,103.9 16.5 1.9 3.3 Kuwait# 5,731.26 (0.0) 0.4 0.1 (12.3) 43.25 88,914.7 14.6 1.0 4.5 Oman 5,909.45 (0.3) 0.7 2.1 (6.8) 18.88 23,904.7 11.4 1.3 4.4 Bahrain 1,257.66 0.7 0.2 (1.4) (11.8) 1.19 19,716.4 7.9 0.8 5.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, MSM, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any #Values as of October 13, 2015) 11,740 11,760 11,780 11,800 11,820 11,840 11,860 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index declined 0.7% to close at 11,759.0. The Telecoms and Insurance indices led the losses. The index fell on the back of selling pressure from non-Qatari and GCC shareholders despite buying support from Qatari shareholders. Medicare Group and Qatar National Cement Co. were the top losers, falling 4.5% and 2.9%, respectively. Among the top gainers, Al Khalij Commercial Bank gained 2.3%, while Qatar Fuel was up 1.9%. Volume of shares traded on Wednesday fell by 25.4% to 3.9mn from 5.2mn on Tuesday. Further, as compared to the 30-day moving average of 8.3mn, volume for the day was 53.3% lower. Vodafone Qatar and Masraf Al Rayan were the most active stocks, contributing 19.6% and 15.6% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 3Q2015 % Change YoY Operating Profit (mn) 3Q2015 % Change YoY Net Profit (mn) 3Q2015 % Change YoY Jazan Development Co. (JAZADCO)* Saudi Arabia SR – – 6.8 1139.0% 7.2 104.0% Takween Advanced Industries Co. * Saudi Arabia SR – – 17.9 0.9% -2.3 NA Saudi Industrial Export Co. (SIEC)* Saudi Arabia SR – – 2.4 445.5% 1.9 603.7% Southern Province Cement Co. (SPCC)* Saudi Arabia SR – – 205.0 17.1% 202.0 -29.1% Al Mazaya Holding Co. Dubai AED 17.1 177.3% – – 2.6 2.8% Oman & Emirates Investment Holding Co. (OEIHC) * Oman OMR 1.5 -73.0% – – -1.1 NA Al Suwadi Power Co. * Oman OMR 55.6 26.3% – – 10.0 22.2% Salalah Mills Co. (SMC)* Oman OMR 51.1 -0.7% – – 3.9 -14.4% Sohar Power Co. * Oman OMR 46.5 29.0% – – 1.7 -52.6% Dhofar Beverages and Foodstuff Co. ** Oman OMR 4.3 10.3% 0.4 24.8% 0.3 -12.2% Takaful Oman Insurance * Oman OMR 0.0 #DIV/0! – – 1.1 NA Al Jazeira Services Co. * Oman OMR 8.4 10.3% 1.6 12.5% 2.9 -20.9% Dhofar Fisheries and Food Industries Co. * Oman OMR 2.9 -16.0% – – -0.6 NA Oman National Engineering & Investment Co. Oman OMR 28.1 -5.7% – – 1.5 -14.6% Al Batinah Development & Investment Holding Co. * Oman OMR 0.3 -86.6% – – 0.1 -89.7% SMN Power Holding * Oman OMR 82.7 36.3% – – 7.4 12.1% Sharqiyah Desalination Co.* Oman OMR 7.6 5.7% – – 1.1 -38.3% Oman Ceramic Co. * Oman OMR 3.3 3.6% – – 0.0 -64.7% Oman Hotels and Tourism Co. (OHTC) * Oman OMR 4.6 -13.0% – – 1.7 6.9% Oman Fiber Optic Co. (OFO)* Oman OMR 14.8 -13.6% – – 0.6 -90.2% Oman International Development and Investment Co. (Ominvest) * Oman OMR 89.1 30.5% – – 17.8 32.7% Voltamp Energy * Oman OMR 25.1 41.7% – – 2.4 40.6% Al Anwar Ceramic Tiles Co. (AACT) Oman OMR 21.5 -1.7% – – 5.3 -21.1% Sembcorp Salalah Power & Water Co. * Oman OMR 55.0 15.5% – – 10.6 1.0% Al Batnah Hotels Co. ** Oman OMR 1.1 48.9% – – 0.1 271.2% Sweets of Oman * Oman OMR 9.1 -6.1% – – 0.5 -20.6% Oman United Insurance Co. (OUIC) * Oman OMR 31.5 -9.3% – – 3.2 -27.9% Oman Oil Marketing Co. (OOMCO) * Oman OMR 278.0 5.0% – – 8.9 6.9% Al Fajar Al Alamia Co. Oman OMR 4.9 16.2% – – 0.5 52.6% Source: Company data, DFM, ADX, MSM (*9M2015 results, **6M2015-16 results) Global Economic Data Overall Activity Buy %* Sell %* Net (QR) Qatari 69.64% 57.50% 19,096,738.92 GCC 4.08% 6.22% (3,356,768.52) Non-Qatari 26.27% 36.29% (15,739,970.40)

- 3. Page 3 of 8 Date Market Source Indicator Period Actual Consensus Previous 10/14 US Mortgage Bankers Association MBA Mortgage Applications 9-October -27.60% – 25.50% 10/14 US Census Bureau Business Inventories August 0.00% 0.10% 0.00% 10/14 US Census Bureau Retail Sales Control Group September -0.10% 0.30% 0.20% 10/14 US Bureau of Labor Statistics PPI Final Demand MoM September -0.50% -0.20% 0.00% 10/14 US Bureau of Labor Statistics PPI Ex Food, Energy, Trade MoM September -0.30% 0.10% 0.10% 10/14 US Bureau of Labor Statistics PPI Final Demand YoY September -1.10% -0.80% -0.80% 10/14 US Bureau of Labor Statistics PPI Ex Food, Energy, Trade YoY September 0.50% 0.80% 0.70% 10/14 EU Eurostat Industrial Production SA MoM August -0.50% -0.50% 0.80% 10/14 EU Eurostat Industrial Production WDA YoY August 0.90% 1.80% 1.70% 10/14 France INSEE National Statistics Offi CPI EU Harmonized MoM September -0.40% -0.40% 0.40% 10/14 France INSEE National Statistics Offi CPI EU Harmonized YoY September 0.10% 0.10% 0.10% 10/14 France INSEE National Statistics Offi CPI MoM September -0.40% -0.40% 0.30% 10/14 France INSEE National Statistics Offi CPI YoY September 0.00% 0.10% 0.00% 10/14 UK ONS ILO Unemployment Rate 3Mths August 5.40% 5.50% 5.50% 10/14 UK ONS Employment Change 3M/3M August 140k 140k 42k 10/14 Spain INE CPI Core MoM September 0.10% – 0.10% 10/14 Spain INE CPI Core YoY September 0.80% 0.80% 0.70% 10/14 Italy Banca D'Italia General Government Debt August 2184.7b – 2200.2b 10/14 China National Bureau of Statistics CPI YoY September 1.60% 1.80% 2.00% 10/14 China National Bureau of Statistics PPI YoY September -5.90% -5.90% -5.90% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earning Calendar Tickers Company Name Date of reporting 3Q2015 results No. of days remaining Status QNBK QNB Group 7-Oct-15 - Reported QIBK Qatar Islamic Bank 13-Oct-15 - Reported ABQK Al Ahli Bank 14-Oct-15 - Reported MRDS Mazaya Qatar 14-Oct-15 - Reported QIGD Qatari investor group 19-Oct-15 4 Due DBIS Dlala Brokerage & Investment Holding Company 19-Oct-15 4 Due KCBK Al khalij Commercial Bank 20-Oct-15 5 Due DOHI Doha Insurance 20-Oct-15 5 Due QEWS Qatar Electricity & Water Company 20-Oct-15 5 Due SIIS Salam International 20-Oct-15 5 Due AKHI Al Khaleej Takaful 20-Oct-15 5 Due IHGS Islamic Holding 20-Oct-15 5 Due QIIK International Islamic Bank 20-Oct-15 5 Due GWCS Gulf Warehousing Company 21-Oct-15 6 Due QGTS Qatar Gas Transport Company (Nakilat) 21-Oct-15 6 Due QIMD Industrial Manufacturing Company 22-Oct-15 7 Due QNNS Qatar Navigation 24-Oct-15 9 Due QATI Qatar Insurance 25-Oct-15 10 Due MARK Masraf Al Rayan 25-Oct-15 10 Due DHBK Doha Bank 25-Oct-15 10 Due QISI Qatar Islamic Insurance 25-Oct-15 10 Due QGRI Qatar General Insurance & Reinsurance 25-Oct-15 10 Due QOIS Qatar Oman 25-Oct-15 10 Due MCGS Medicare Group 25-Oct-15 10 Due UDCD United Development Company 26-Oct-15 11 Due QFLS Qatar Fuel Company 26-Oct-15 11 Due ERES Ezdan Real Estate Company 26-Oct-15 11 Due MERS Al Meera Consumer Goods Company 27-Oct-15 12 Due ORDS Ooredoo 28-Oct-15 13 Due AHCS Aamal Company 29-Oct-15 14 Due NLCS National Leasing (Alijarah) 29-Oct-15 14 Due ZHCD Zad Holding Company 29-Oct-15 14 Due QNCD Qatar National Cement Company - - - CBQK Commercial Bank - - - BRES Barwa Real Estate Company - - -

- 4. Page 4 of 8 GISS Gulf International Services - - - IQCD Industries Qatar - - - MPHC Mesaieed Petrochemical Holding Co - - - MCCS Mannai Corp. - - - QCFS Qatar Cinema & Film Distribution Company - - - WDAM Widam Food Co. - - - QGMD Qatar German Company for Medical Devices - - - VFQS Vodafone Qatar - - - Source: QSE News Qatar MRDS reports a flat bottom-line in 3Q2015 on a sequential basis – Mazaya Qatar Real Estate Development Co. (MRDS) reported a flat net profit of QR33.23mn in 3Q2015 compared to QR33.24mn in 2Q2015. However, the net profit rose marginally by 0.6% YoY. EPS amounted to QR0.32 in 3Q2015 as compared to QR0.31 in 2Q2015. The company’s construction revenue jumped 49.8% QoQ to QR80.2mn (up 4.4% YoY) in 3Q2015. However, the gain in the construction revenue was almost entirely offset by increased construction costs (QR44.1mn in 3Q2015 vs. QR18.5mn in 2Q2015). As a result, income from operations marginally inched up to QR46.3mn in 3Q2015 compared to QR45.6mn in 2Q2015. However, it declined 11.4% on a YoY basis. (QSE, QNBFS Research) MRDS considering possibility of increasing capital –Mazaya Qatar Real Estate Development Co. (MRDS) in its board meeting showed the intention to study the increase in capital of the company and requested the executive management to examine the possibility of increasing the company’s capital and provide the board with the required procedures and available options for further discussion. (QSE) IQCD to disclose financial statements on October 28 – Industries Qatar Company (IQCD) will announce its financial reports for the period ending September 30, 2015 on October 28, 2015. (QSE) MPHC to disclose financial statements on October 27 – Mesaieed Petrochemical Holding Company (MPHC) will announce its financial reports for the period ending September 30, 2015 on October 27, 2015. (QSE) Draft law on equality between Qataris, GCC citizens reviewed – QNA has reported that the Cabinet has reviewed and taken the appropriate decision on a draft law on equality between Qataris and other GCC citizens regarding the practice of different professions & activities and delivery of economic & social services. During the meeting the Cabinet also reviewed a draft law amending some provisions of Law No 7 of 1987 on regulations for the practice of commercial activities by GCC citizens in the country. A draft law on permitting companies from GCC nations to open branches in Qatar was also reviewed at the meeting. Appropriate decisions were taken on these draft laws. (Gulf-Times.com) Procurement law to get tougher – Qatar is contemplating tough actions against price fixing, bid rigging and other forms of possible collusions in public tenders. Qatar’s soon-to-be- issued procurement law stipulates that officials who act against the country’s competition protection and collusion combat policy in public procurement will be prosecuted. A top Ministry of Finance official has said strict action will be taken against bidders found involved in rigging the bid or making attempts to influence the concerned officials, including through bribing. (Peninsula Qatar) DTZ: Qatar residential market occupancy to improve in six months – Global real estate firm DTZ said that with Qatar’s non-hydrocarbon sectors experiencing double-digit growth, occupancy levels in the country’s prime residential market are likely to recover over the next six months. DTZ Qatar, in its market report for 3Q2015, stated that there is an increase in vacancies in the prime residential market due to recent redundancies in the oil & gas sector. Despite these increases, rents in this sector have remained strong in 2Q2015 and 3Q2015 due to population growth. According to DTZ, the steady job growth in non-hydrocarbon sectors such as finance, hotels, restaurants, trade and transport helped push Qatar’s population to 2.37mn in May 2015, representing a 9.2% YoY growth. The commercial sector has witnessed a reduction of new office acquisitions from the public sector, which accounts for 60% of office leasing in Doha’s West Bay area. The report said most of the activity in 2Q2015 and 3Q2015 has been limited to transactions of less than 250 square meters (sqm) and there have been no commercial leases in excess of 3,000 sqm agreed in 3Q2015. (Gulf-Times.com) QPMC signs 5-yr supply deal with Village Trading for 30mn tons of quarry products – Qatar Primary Materials Company (QPMC) has signed a new off-take agreement with Village Trading Group for the supply of 30mn tons of high quality quarry products for the next five years. Under the terms of the agreement, Village Trading has agreed to supply QPMC with 6mn tons of gabbro aggregates annually over the next five years. In planning the import of the required quantity, Village Trading is committed to providing QPMC with gabbro aggregates of grades: 0-5 mm gabbro and 5-32mm grades, all commencing on January 1, 2016. All grades supplied to QPMC match the Qatar construction specifications and Ashghal’s quality standards. (Gulf-Times.com) International Weak US retail sales, inflation data cloud rate hike outlook – US retail sales barely rose in September 2015 and producer prices recorded their biggest decline in eight months, raising further doubts about whether the Federal Reserve will raise interest rates in 2015. The weak reports were the latest suggestion that the economy was losing momentum in the face of slowing global growth, a strong dollar, an inventory correction and lower oil prices that are hampering capital spending in the energy sector. Job growth braked sharply in the past two months. The Commerce Department said retail sales had edged up 0.1% in September largely as cheaper gasoline pushed service station receipts down 3.2%. Giving the report a weak tone, sales in August were revised down to show them unchanged instead of rising 0.2%. Retail sales excluding automobiles, gasoline, building materials and food services slipped 0.1% in September after a downwardly revised 0.2% gain in August. These so-called core retail sales correspond most closely with the consumer spending component of GDP and were previously said to have advanced 0.4% in August. (Reuters) UK jobless rate hits seven-year low, BoE to note cooler pay growth – Britain's jobless rate has fallen to its lowest level in more than seven years but pay growth was a bit slower than expected, suggesting the labor market is not hot enough to speed up a Bank of England (BoE) interest rate hike. The Office for National Statistics said Britain's unemployment rate fell to 5.4% in the

- 5. Page 5 of 8 three months to August 2015, down from 5.5% in the three months to July. It was the lowest jobless rate since the 2Q2008, before the worst of the financial crisis, and below a Reuters median forecast of 5.5%. Investors focused initially on the wage growth figures that were slightly weaker than forecast but sterling recovered from an initial fall as economists highlighted the strong job creation numbers. The number of people in employment jumped by 140,000, pushing the employment rate to 73.6%, the highest since records began in 1971. The number of unemployed people was down by 79,000, the biggest fall since the three months to January. (Reuters) Eurozone August industry output reverses after strong July – Eurozone industrial production had declined in line with expectations in August 2015, as the energy sector reversed gains made in July and only durable consumer goods output showed robust expansion. Eurostat said the industrial output in the 19 countries sharing the euro fell by 0.5% MoM for a 0.9% YoY gain. Reuters had expected a 0.5% monthly decline and a 1.8% annual gain. Eurostat also revised data for July to a 0.8% monthly fall from an increase of 0.6% and to a 1.7% YoY rise from the previously reported 1.9%. Meanwhile, the German industrial output shrank 1.1% in August 2015, while in France, production was 1.6% higher. Furthermore, German Economy Minister Sigmar Gabriel said that he was not concerned about Europe's largest economy slipping into deflation after annual inflation in Germany turned negative in September for the first time in eight months. (Reuters) Reuters Tankan: Japan manufacturers' mood down again amid recession fears – According to a Reuters poll, Japanese manufacturers' confidence worsened for the second straight month and is expected to fade going forward adding to lingering fears of a recession and keeping policy makers under pressure to deploy fresh stimulus. Service-sector sentiment bounced from the September's fall but is seen worsening again over the next three months, a sign of the fragility in private consumption which accounts for roughly 60% of the economy. The Reuters Tankan - which closely tracks the Bank of Japan's (BoJ) tankan survey - came as a recent run of weak data including surprise drops in factory output and machinery orders cast doubt on the strength of business activity. The bleak business outlook could undermine policy makers’ efforts to generate a virtuous cycle of growth and investment led by the private sector, which is crucial for the BoJ's rosy projections that the economy is on track to hit its ambitious 2% price goal in 2016. (Reuters) Chinese Yuan now third most traded currency on EBS platform – China's currency is now the third most traded on the EBS platform, overtaking such pairs as the dollar-Swiss franc and euro-yen on one of the main independent venues where banks trade currencies. Officials at ICAP-owned EBS Brokertec, which competes with Thomson Reuters' Matching platform in bank-to- bank currency trading, said the number of players trading every day in China's yuan, or renminbi, had grown 50% in 2014. That follows the announcement by the banking payment network SWIFT that the yuan is now the fourth most used currency in ordinary day-to-day payments worldwide. (Reuters) Regional Alpen Capital: GCC insurance industry expected to touch $62.1bn by 2020 – According to a report by Alpen Capital, the Gulf Cooperation Council (GCC) insurance industry is expected to touch $62.1bn by 2020, registering a CAGR of 18.7% for the period between 2014 and 2020. Alpen Capital (ME) Managing Director Sameena Ahmad said that the GCC insurance industry continues to grow at a double-digit CAGR despite a challenging 2014, backed by increased awareness and favorable regulatory changes in most of the GCC nations. The industry is thus expected to grow in the upcoming period, driven by government spending on infrastructure and a gradual increase in insurance penetration level in the region. The report’s conservative growth scenario, assuming that the GCC countries would average non-life premium growth in line with their preceding five years, results in the GCC insurance industry reaching a size of $49bn by 2020 at a 14.1% CAGR. The International Monetary Fund’s (IMF) forecasted drop in the GDP of the GCC countries for 2015 and the volatility in oil prices are expected to result in lower growth in premiums for 2015. Between 2014 and 2020, IMF forecasts GDP growth in the region at a CAGR of 2.3%. (GulfBase.com) KSA signs multiple agreements with France – The King Abdulaziz City for Science and Technology (KACST) has signed a cooperation agreement with the French Marine Systems Directorate to build a marine research center. Another agreement for cooperation and training was signed between the King Fahd Medical City and France’s Jostav Institute. Meanwhile, a letter of intent was signed between the King Abdullah City for Atomic and Renewable Energy and the French Nuclear Safety Authority in the field of renewable energy. The two countries also entered into agreement for establishing a blood plasma plant in the Kingdom. The Saudi Public Investment Fund signed with two French firms an agreement worth $2bn for establishing a Saudi fund, which will work jointly with the private funds in France. Jarir Marketing leases out office space to Jarir Real Estate – Jarir Marketing Company has signed a renewable two-year agreement to lease a 217 square meters office to Jarir Real Estate Company at Jarir Plaza Building, Riyadh. The annual rental price is estimated to be SR156,023. The agreement is subject to the final approval of the general assembly. (Tadawul) KSA may amend rules to widen access for foreign investors – The Saudi Capital Markets Authority (CMA) Chairman Mohammed Al- Jadaan has said that Saudi Arabia may soften the rules for foreigners seeking to own stocks in the Kingdom, as the country seeks to boost liquidity on the Saudi Stock Exchange. He said the authority is studying the possibility of allowing institutional foreign money managers with less than SR18.75bn under management to own shares in the country. The regulator is also considering changing rules around initial public offerings to help boost the number of institutional investors in the market. Since opening the market to direct foreign investment in June 2015, in all 11 overseas investors have applied for and received licenses. Al-Jadaan said the CMA is also studying the introduction of other products like real-estate investment funds, and will announce very ambitious strategies in the future. (Bloomberg) UAE Insurance Authority to launch new regulations by 2016 – The UAE Insurance Authority has said that it would launch a new set of regulations regarding insurance policies to govern the banking sector by 2016, with the Authority currently working with the country’s central bank to draft the regulations. The Federal Authority is also set to launch regulations for the insurance of vehicles in 2015. (GulfBase.com) Mediclinic, Al Noor reach accord, NMC Health continues to pursue Al Noor – Mediclinic International Limited has agreed to merge with the Al Noor Hospitals Group to create the biggest private healthcare provider in the UAE, even as rival NMC Health vowed to keep pursuing with Al Noor. The transaction will involve a reverse takeover that gives Mediclinic’s shareholders a majority stake in the combined operations. Al Noor holders can opt to get a special dividend of £3.28 a share or tender their stock for £11.60 a piece, which represents a 39% premium over the October 1, 2015 closing price. The latter values the transaction at £1.5bn. Under the terms of the agreement, Mediclinic shareholders will get 0.625 new Al Noor shares for each held in Mediclinic, as well as an interim

- 6. Page 6 of 8 dividend to be paid in December 2015. The transaction would result in Mediclinic shareholders owning 84% to 93% of the combined business, which is to be renamed Mediclinic International Plc and listed on the London Stock Exchange (LSE). The company will also have a secondary listing in Johannesburg, and may trade on the Namibian Stock Exchange. (Bloomberg) eDirham 9M2015 revenues up 15% at AED6bn – The total automatically collected revenues by the Federal Government via the eDirham system in 9M2015 amounted to over AED6bn, up 15% as compared to AED5.1bn in 9M2014. The total number of electronic services that have been completed through the eDirham system since the beginning of 2015 rose 8% to 27.3mn as compared to around 25.1mn services in 2014. In 9M2015, the total number of transactions conducted through the eDirham system increased 9% to over 12.5mn transactions as compared to 11.4 transactions in 9M2014, while the number of sold eDirham cards had increased to 1.6mn September 2015-end. (GulfBase.com) Amlak, Palma Development sign strategic tie-up – Amlak Finance has entered into a strategic alliance with Palma Development to offer financing for Serenia Residences in the Palm Jumeirah. Under the terms of the agreement, customers wishing to purchase property at Serenia Residences through using the Shari’ah compliant Amlak’s services will make an initial down payment of the unit price with Amlak, financing the balance based on the customer’s portfolio and financial status. Finance is available for up to 25 years with profit rates from 3.75% to 4.9% being fixed for the first three years. (DFM) Dubai to attract AED150bn in FDIs over next five years – Dubai FDI CEO Fahad Al Gergawi has said that Dubai is expected to attract AED150bn in new foreign direct investments (FDIs) over the next five years. He emphasized that authorities seek to further promote Dubai’s status as a springboard for global companies to reach out to markets in the Middle East and North Africa (MENA) region. Fahad said Dubai secured AED28.6bn FDI in 2014, adding that the largest proportion of FDIs (roughly 78% or AED22bn of the total) targeted areas of real estate, financial services, hospitality and tourism, renewable/alternative energy, business services, programming and information technology. (GulfBase.com) UAB operating income declines 9% in 9M2015 – United Arab Bank (UAB) reported a net profit of AED71.82mn in 9M2015 as compared to AED497.6mn in 9M2014. The profit was impacted by a provision of AED466mn taken during the quarter following a significant increase in loan defaults in UAB’s higher risk commercial loan portfolio. UAB’s total income for 9M2015 declined 3% YoY to AED9982.27mn, while operating income for the period was down 9%, impacted by lower non-interest income. The bank’s total assets stood at AED25.83bn as of September 30, 2015 as compared to AED25.71bn on December 31, 2014. Loans & advances reached AED17.6bn, while customers’ deposits reached AED18.28bn. UAB remains well capitalized with its capital adequacy ratio at 14.4%, while its NPL ratio stood at 3.9% as at 30 September 2015. EPS amounted to AED0.05 in 9M2015 versus AED0.36 in 9M2014. (DFM) AIB reports net loss of OMR4.23mn in 3Q2015 – Alizz islamic bank (AIB) reported a net loss of OMR4.228mn in 3Q2015 as compared to OMR4.425mn in 3Q2014. Financing receivables reached OMR169.92mn, while total deposits stood at OMR145.56mn.The bank’s total income stood at OMR4.25mn in 3Q2015 as compared to OMR1.25mn in 3Q2014. AIB’s total assets had stood at OMR236.77mn as of September 30, 2015 as compared to OMR104.23mn on September 30, 2014. (MSM) Ahli Bank 9M2015 net profit surges 14.1% YoY – Ahli Bank reported a net profit of OMR21.8mn in 9M2015 as compared to OMR19.1mn in 9M2014, representing a YoY increase of 14.1%. The bank’s operating income had stood at OMR43mn in 9M2015, up 13.5% YoY as compared to OMR37.9mn in 9M2014. Ahli Bank’s total assets had stood at OMR1.92bn as of September 30, 2015, up 20.8% YoY as compared to OMR1.59bn at the end of September 30, 2014. Net loans & advances and financing grew 12.9% YoY to OMR1.5bn, while customers’ deposits were up 27.4% and had stood at OMR1.32bn. (MSM) Bank Nizwa reports OMR4.23mn net loss in 9M2015 – Bank Nizwa reported a net loss of OMR4.23mn in 9M2015 as compared to OMR5.96mn in 9M2014. The bank’s operating income had grown 55% YoY to OMR8.28mn in 9M2015. The bank’s total assets had stood at OMR316.43mn as of September 30, 2015, up 23% YoY as compared to OMR256.55mn on September 30, 2014. Financing to customers had reached OMR240.76mn, while customers’ deposits had stood at OMR170.58mn. (MSM) CBO foreign assets drop 4.8% YoY in August 2015 – According to Central Bank of Oman (CBO), credit growth at Oman’s conventional banks had accelerated to an annual 10.6% in August 2015 from 9.2% in July 2015. M2 money supply growth had slowed to 10%, the lowest rate since December 2013, from 10.9%. CBO’s foreign assets, including gold, had fallen 4.8% from a year earlier to OMR6.63bn. Low oil prices have hit Oman’s oil revenues and balance of payments. (Reuters) Agthia completes acquisition in Dubai & Oman – Agthia Group has completed the acquisition of a 100% stake in Al Bayan Purification & Potable Water and Shaklan Plastic Manufacturing Company in Dubai, in addition to Oman-based Al Manal Purification & Bottling Mineral Water from Al Bayan Group of Companies. Alpen Capital, Dubai acted as the sole financial adviser to Al Bayan Group for the transaction. (GulfBase.com) CMIC stops 200-ton main oven for repair – Construction Materials Industries & Contracting (CMIC) has announced that the new oven sized 200 ton has stopped production as a result of an emergency technical failure. The company is doing necessary maintenance work and expects to complete it within 15 days. (MSM) Investcorp unit buys eight residential properties for $400mn – Investcorp, through its US-based subsidiary, has bought eight residential properties in the US for about $400mn. The acquired properties are rented out to tenants and have an average occupancy rate of about 96%. These latest purchases take Investcorp’s total real estate investments over the past 12 months to over $1bn. Investcorp acquired properties in the metropolitan areas of Las Vegas, Denver, Chicago, Atlanta and Dallas. (Reuters) Garmco completes major restructuring of international operations – Garmco, a Bahrain-based international aluminium rolling mill, has completed a major restructuring of its international operations. The restructuring has resulted in the closing of unprofitable subsidiaries in the saturated markets of China & Korea and non- operating companies in Hungary & Cyprus, which do not add value to core activities. The reshuffle is in line with the company’s three- year strategy, which involves closing unprofitable subsidiaries & non-operating companies and identifying additional opportunities for growth in high-margin markets, where Garmco has established a strong presence, in particular Southeast Asia, the US and Australia. (GulfBase.com) IIB makes profitable exit from aircraft leasing deal – Bahrain’s International Investment Bank (IIB) has announced a profitable exit from Boeing 777-300 ER aircraft leasing deal. The aircraft, which was purchased by IIB in a sale and leaseback transaction, was on lease to a leading regional airline on a non-cancellable basis for a period of nine years, and has recently been sold to an international buyer. The disposal resulted in an internal rate of return (IRR) of over 30%. (GulfBase.com)

- 7. Page 7 of 8 Gulf Air in final talks to buy 50 aircraft – Gulf Air is in final talks to place an order for up to 50 aircraft to meet the airline’s needs over the next decade. Gulf Air CFO Sahar Ataei said the airline would purchase both narrow and wide-body aircraft to replace its current fleet. She said negotiations with manufacturers were expected to finish by 1Q2016. The airline, with a fleet of 28 Airbus narrow and wide-body aircraft, is going through a lengthy restructuring, which aims to return the loss-making airline to profit. (Reuters)

- 8. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg (#Value as of October 15, 2015) Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Index S&P Pan Arab S&P GCC 0.1% (0.7%) (0.0%) 0.7% (0.3%) (0.6%) (0.4%) (0.8%) (0.4%) 0.0% 0.4% 0.8% SaudiArabia Qatar Kuwait# Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,184.13 1.3 2.3 (0.1) MSCI World Index 1,653.01 (0.5) (1.2) (3.3) Silver/Ounce 16.13 1.4 1.8 2.7 DJ Industrial 16,924.75 (0.9) (0.9) (5.0) Crude Oil (Brent)/Barrel (FM Future) 49.15 (0.2) (6.6) (14.3) S&P 500 1,994.24 (0.5) (1.0) (3.1) Crude Oil (WTI)/Barrel (FM Future) 46.64 (0.0) (6.0) (12.4) NASDAQ 100 4,782.85 (0.3) (1.0) 1.0 Natural Gas (Henry Hub)/MMBtu 2.44 0.1 3.0 (18.6) STOXX 600 355.81 (0.3) (1.4) (1.7) LPG Propane (Arab Gulf)/Ton 44.50 (3.3) (9.4) (9.2) DAX 9,915.85 (0.7) (1.2) (4.8) LPG Butane (Arab Gulf)/Ton 61.00 0.0 (6.2) (2.8) FTSE 100 6,269.61 0.2 (1.5) (5.3) Euro 1.15 0.8 1.0 (5.2) CAC 40 4,609.03 (0.3) (1.4) 2.0 Yen 118.83 (0.8) (1.2) (0.8) Nikkei 17,891.00 (1.4) (2.1) 2.8 GBP 1.55 1.5 1.0 (0.6) MSCI EM 849.40 (0.6) (1.2) (11.2) CHF 1.05 0.9 1.3 4.7 SHANGHAI SE Composite 3,262.44 (1.1) 2.4 (1.4) AUD 0.73 0.8 (0.5) (10.7) HANG SENG 22,439.91 (0.7) (0.1) (4.9) USD Index 93.93 (0.9) (0.9) 4.1 BSE SENSEX 26,779.66 0.0 (1.4) (5.2) RUB 62.64 (0.7) 1.8 3.1 Bovespa 46,710.44 (1.2) (7.4) (35.6) BRL 0.26 2.1 (1.3) (30.5) RTS 863.31 (0.4) (2.6) 9.2 140.8 118.6 114.3