More Related Content

Similar to DITMo Investment Process 2015

Similar to DITMo Investment Process 2015 (20)

DITMo Investment Process 2015

- 2. Fundamental

Analysisfor

Stability

Quantitative

AnalysisforOver-

priced

Volatility

REFERENCE

PORTFOLIO ADDS

& DELETES (S&P)

TAKEOVER

TARGETS

BUYERS,JV’s

HIGH SHORT

INTEREST/

PAIREDTRADES

Desired

Portfolio

Attributions

After screening for

Volatility & Stability,

Trade Analysis

is performed to evaluate Buy/Write

Trades that offer a high probability

of exercise due to factors of stability

relative to the volatility premium

price in the option.

Technical Analysis

ofDownside

Potential

Mean Reversion of

Volatility

(Conversion)TARGET RETURN

TARGETED

DELTA,

DOWNSIDE

PROTECTION,

BETA, ETC

TARGETED

TACTICAL INDUSTRY

ALLOCATION

LOW TOTAL

LEVERAGE, LOW

T-RATIO

LOW

DOWNSIDE

EXPOSURE, IND.

RESEARCH,

INLINE COMPS.

ROIC>WACC

=ECONOMIC

VALUE

ADDED

DITMo® Investment Process: Trade Analysis

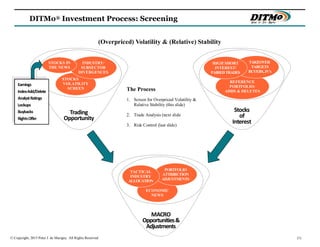

(Overpriced) Volatility & (Relative) Stability

© Copyright, 2015 Peter J. de Marigny. All Rights Reserved. (2)

- 3. Portfolio

Evaluation &

Adjustment

Individual

Trades

Liquidity

DITMo® is a risk-driven strategy.

SCREENING and ANALYSIS proc-

esses attempt to attain the maxi-

mum DOWNSIDE PROTECTION

offered by the volatility priced into

the option covering an underlying

stock believed to exhibit maximum

stability.

HIGH

PROBABILITY

EXERCISE FOR

HIGH MO

TURNOVER

ZEROTARGET

LEVERAGE AT

EXPIRY DATE

POSITION

& CALENDAR

MONTH LIMITS,

MARKET LEVEL

LADDERING

INDUSTRY

DIVERSIFICATION

METRICS BETA,

AVG OPTION

EXPIRATION,

AVG WEIGHTED

DELTA

HIGHVISIBILITY

SHORT HOLDING

PERIOD 2-4 MOS

IFOPTIONNOT

EXERCISED

THENEXECUTE

OVERWRITE

OVERWRITE TRADE

FALLING OUTOF

THE MONEY

CUSHIONOVER

STRIKEAT TIME

OFTRADE &LIVE

DITMo® Investment Process: Risk Control

(Overpriced) Volatility & (Relative) Stability

© Copyright, 2015 Peter J. de Marigny. All Rights Reserved. (3)