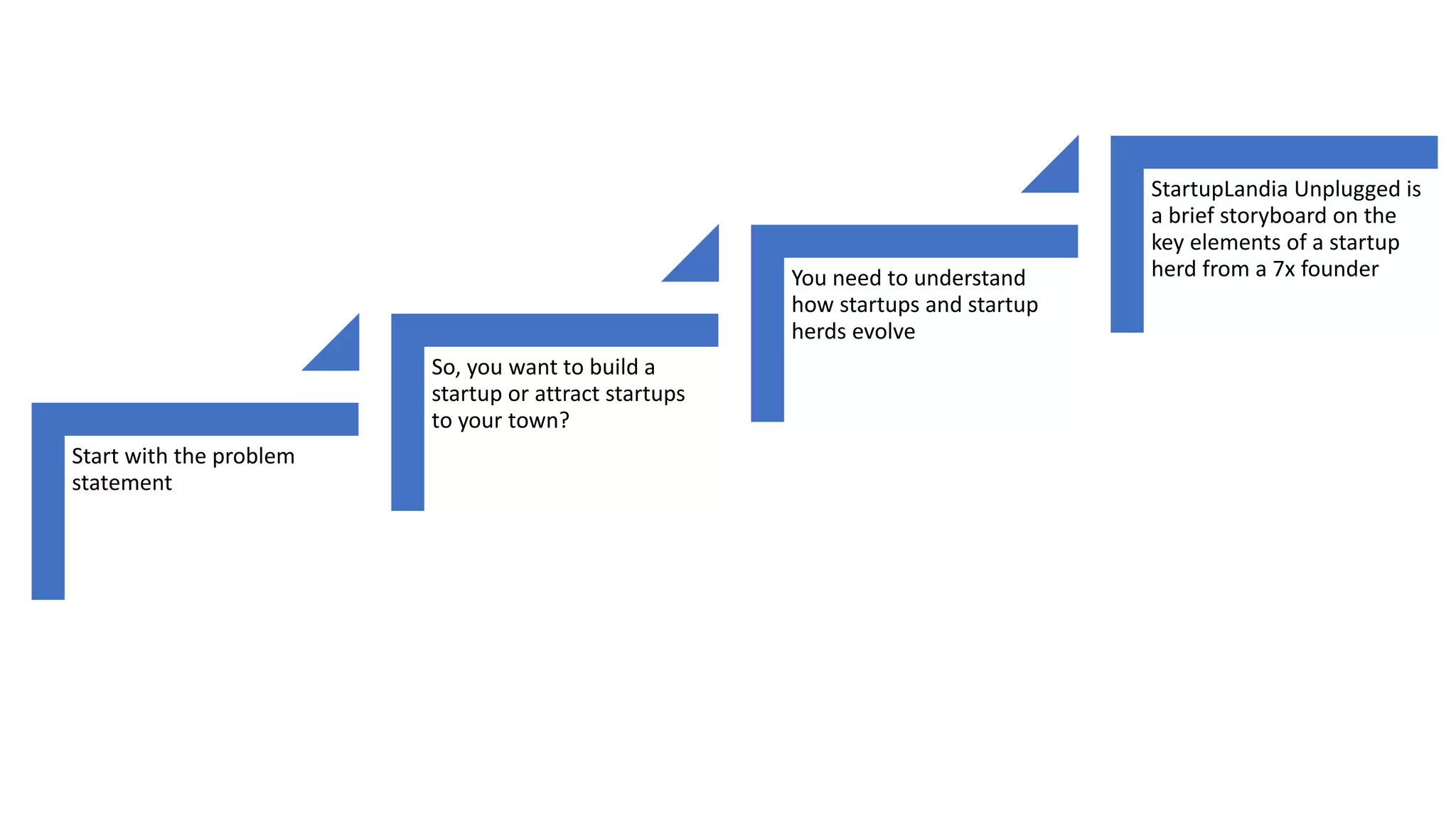

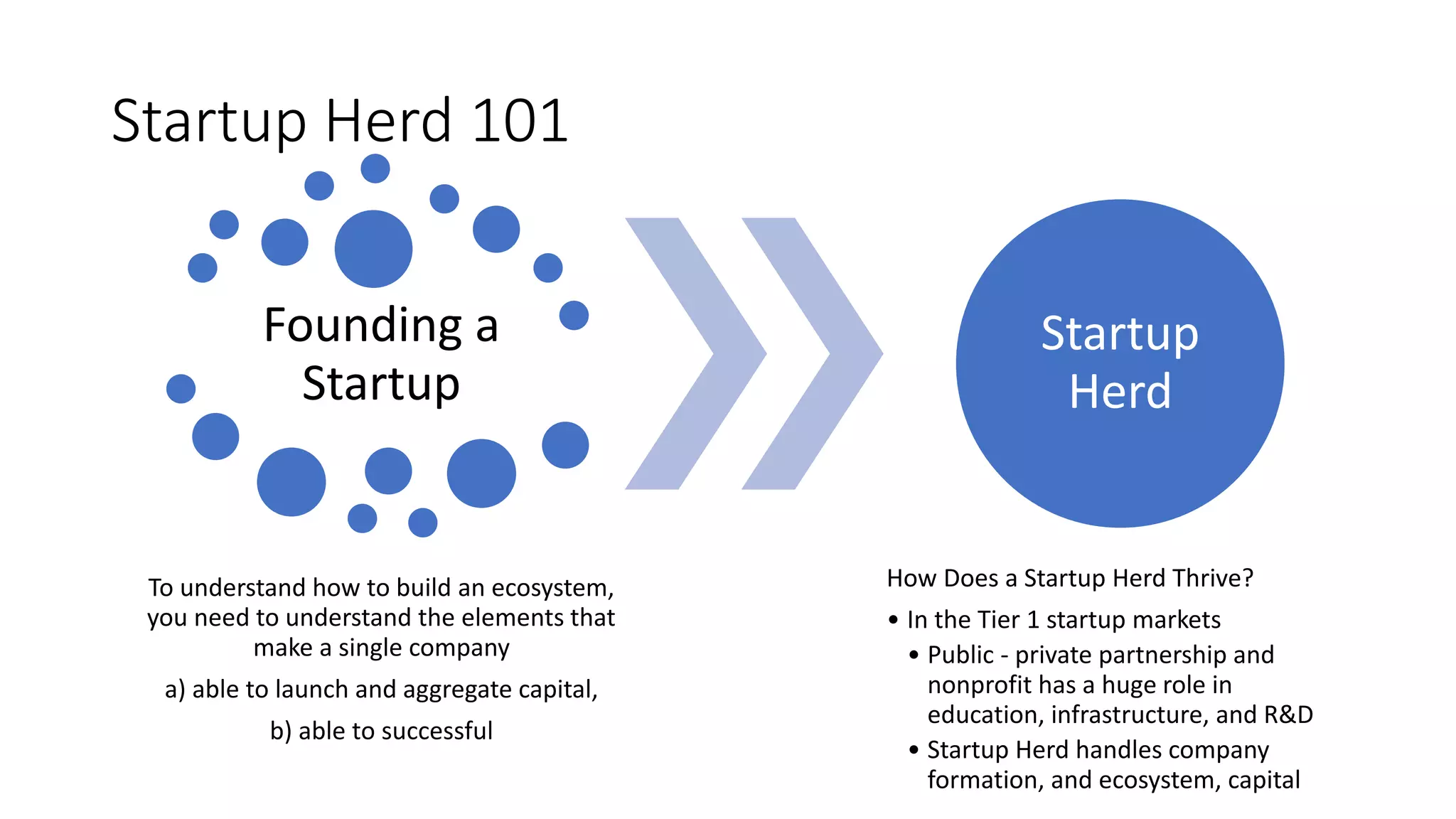

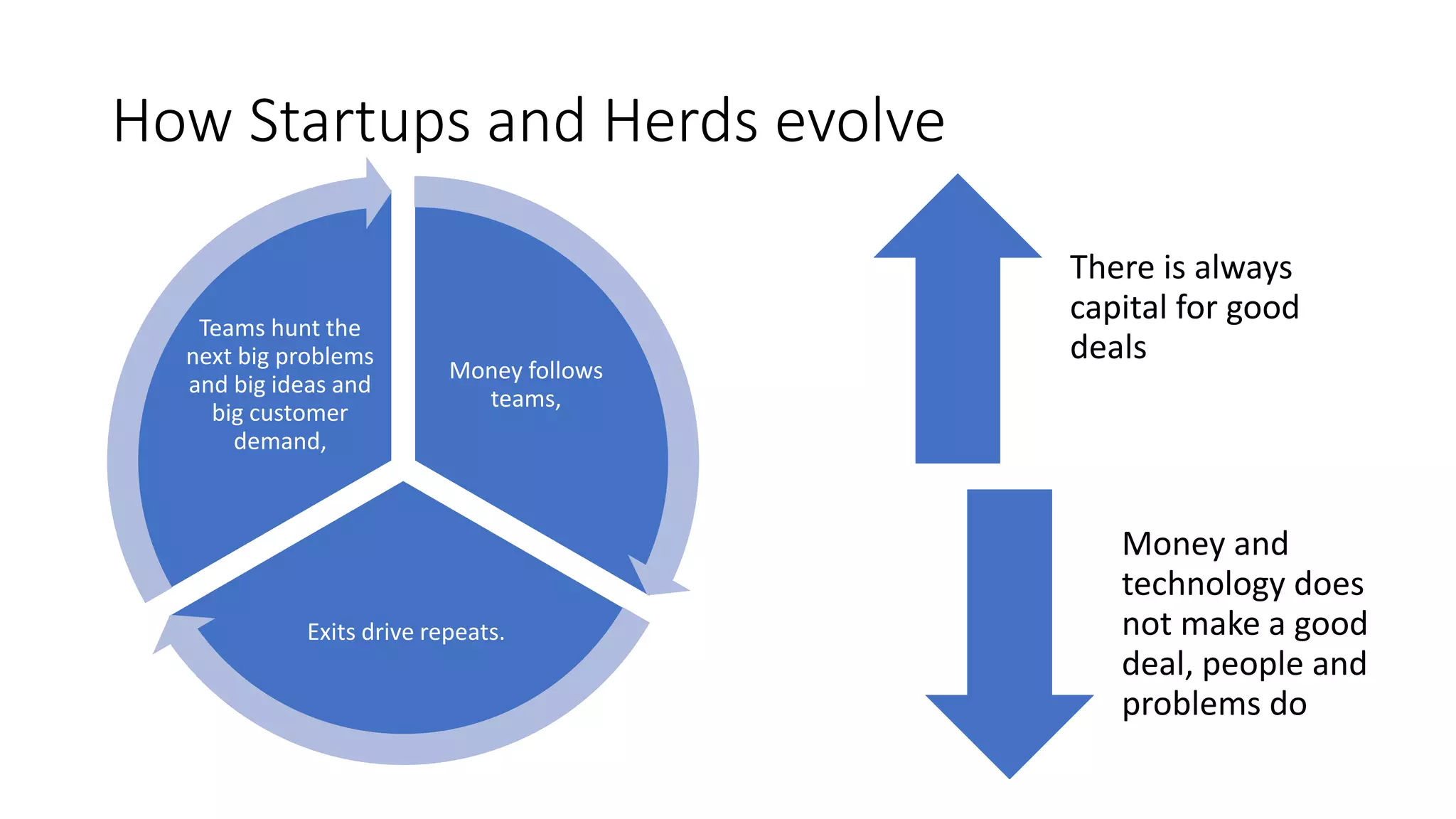

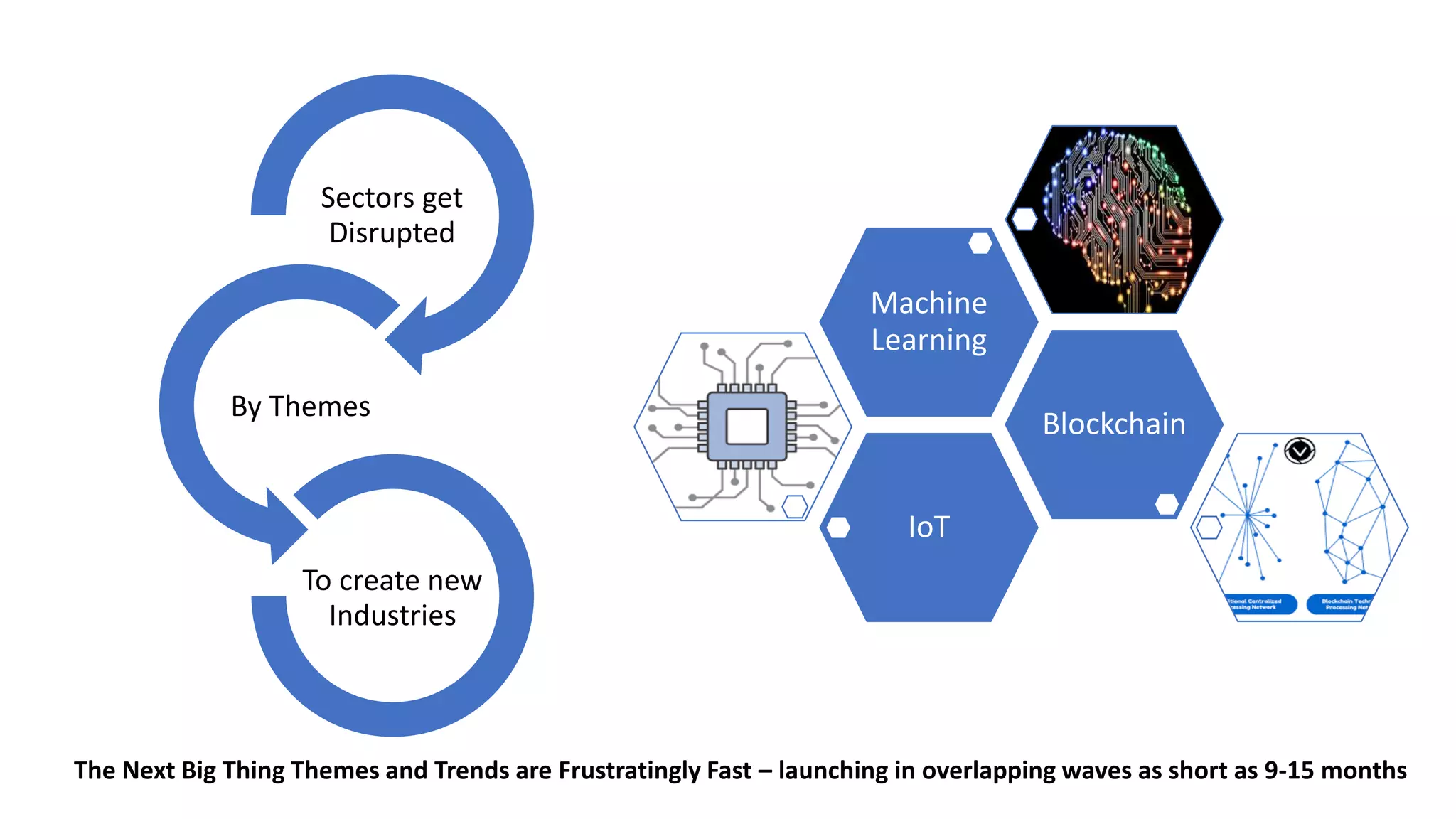

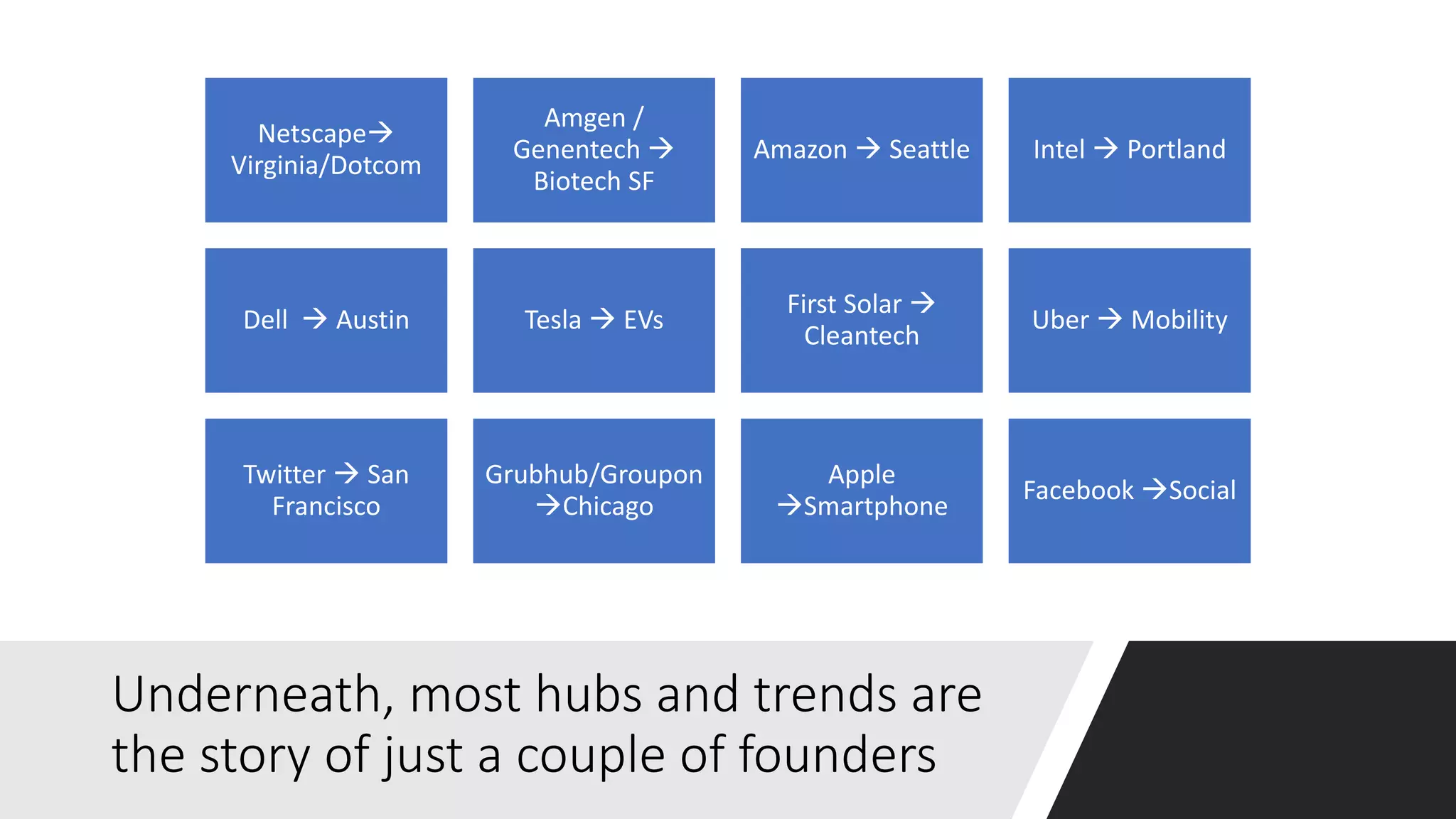

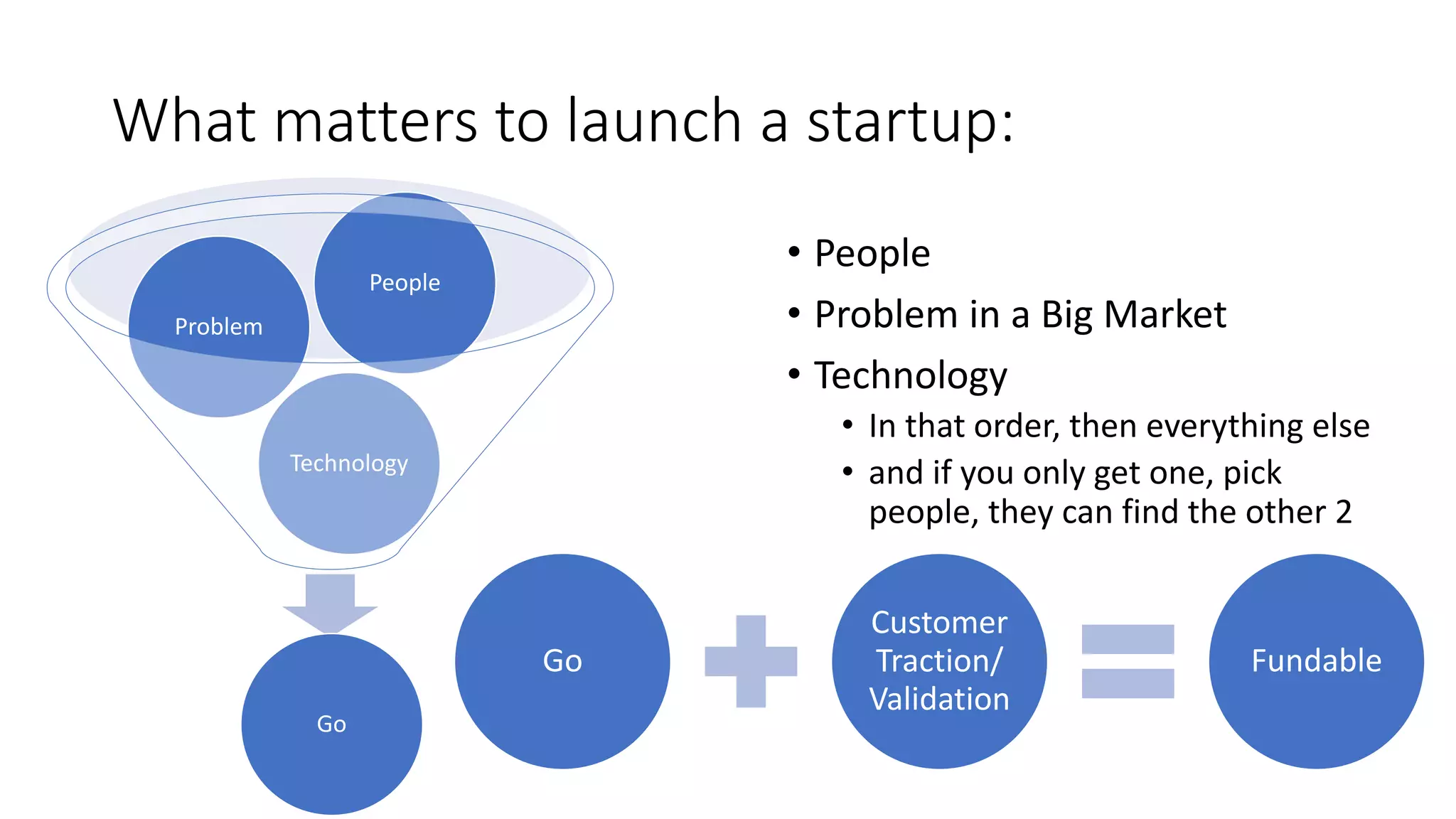

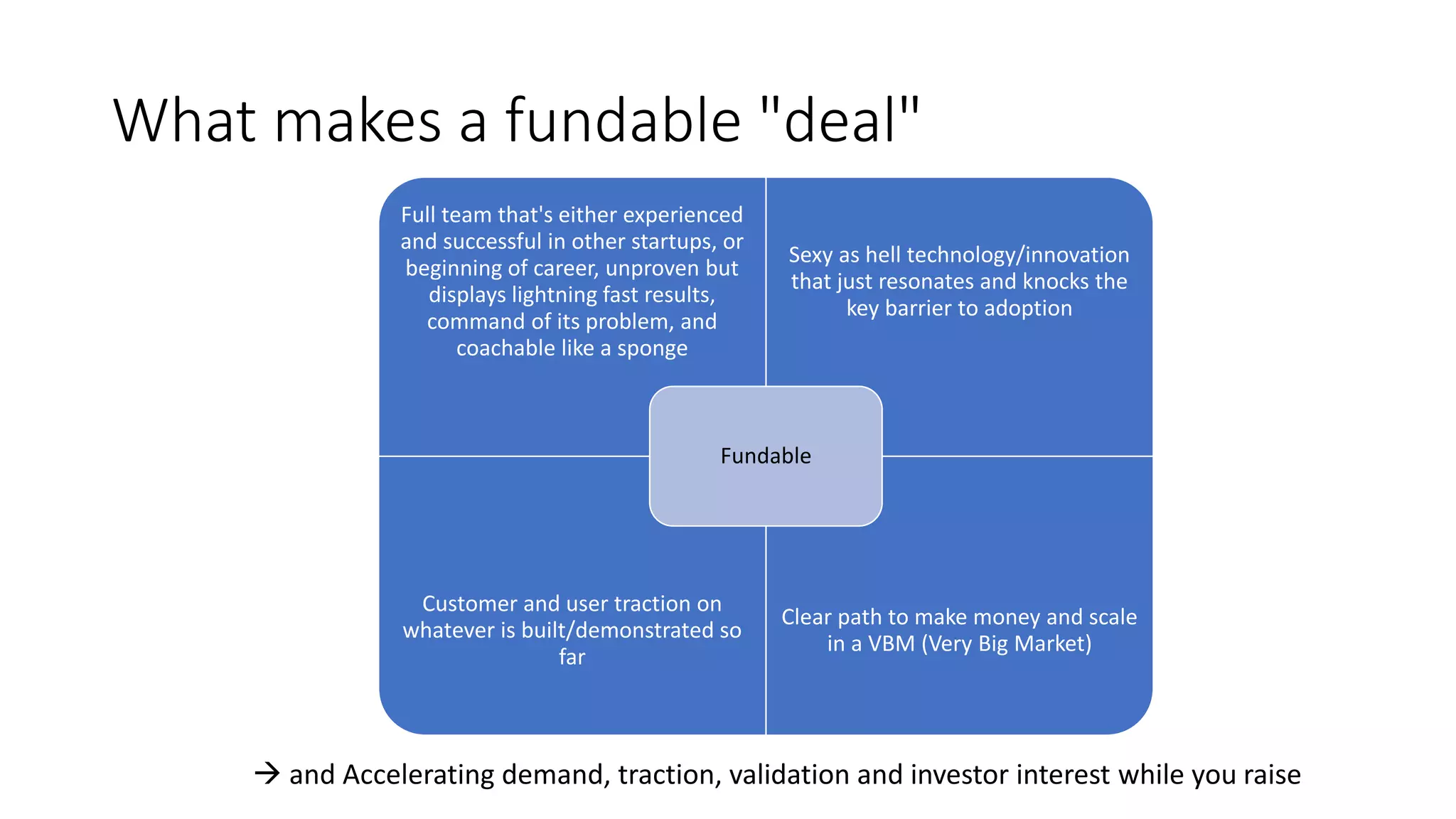

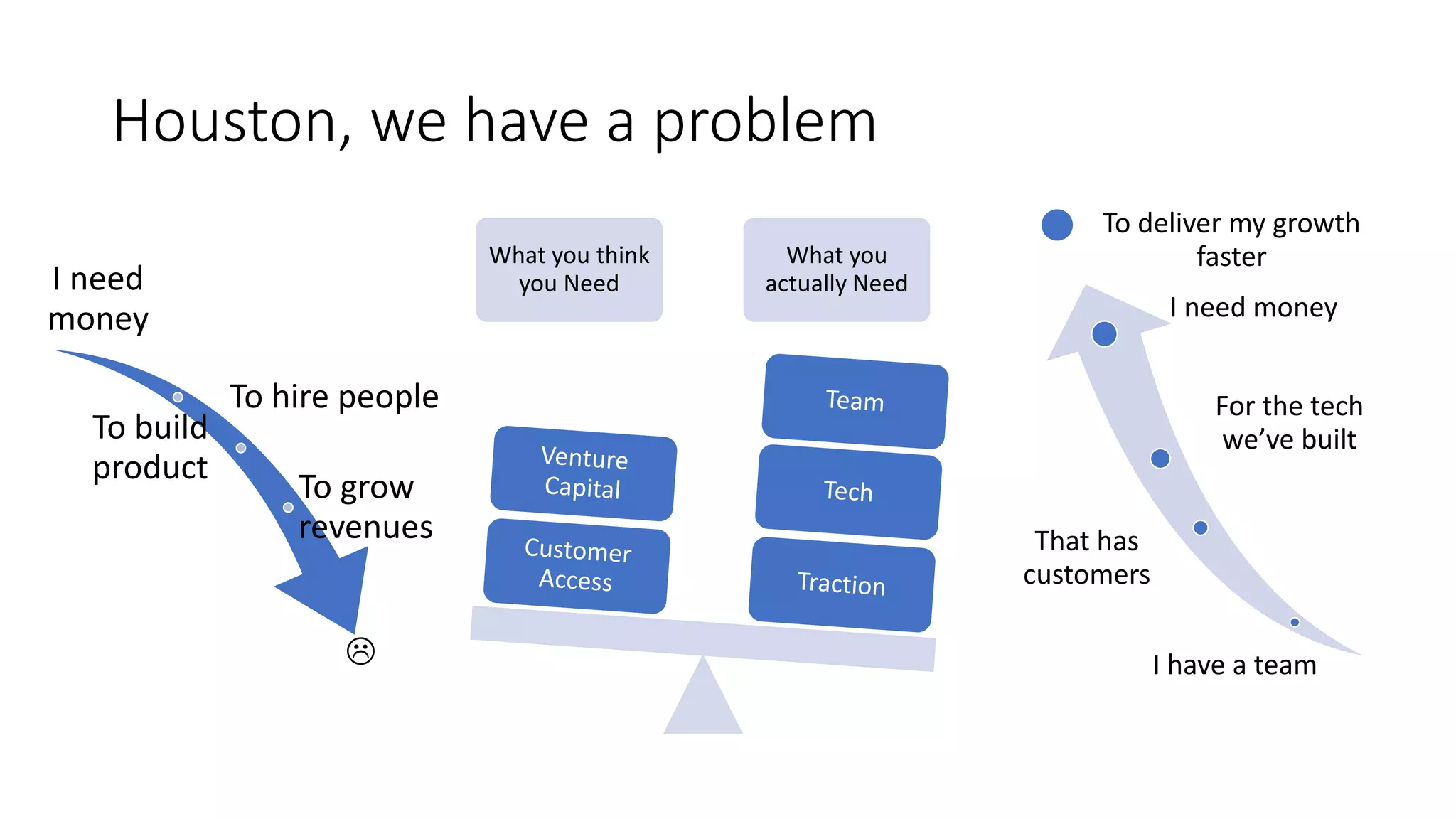

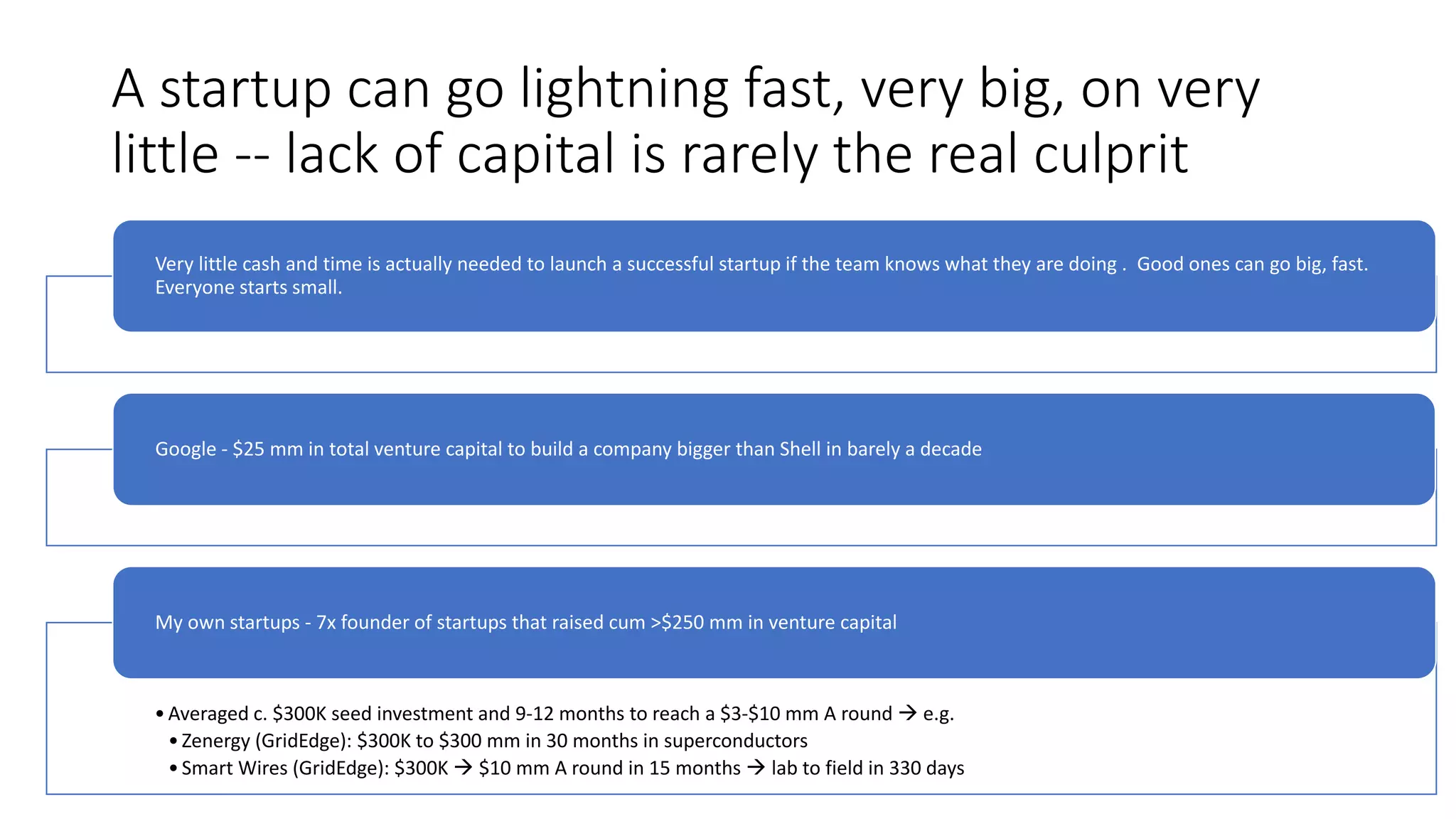

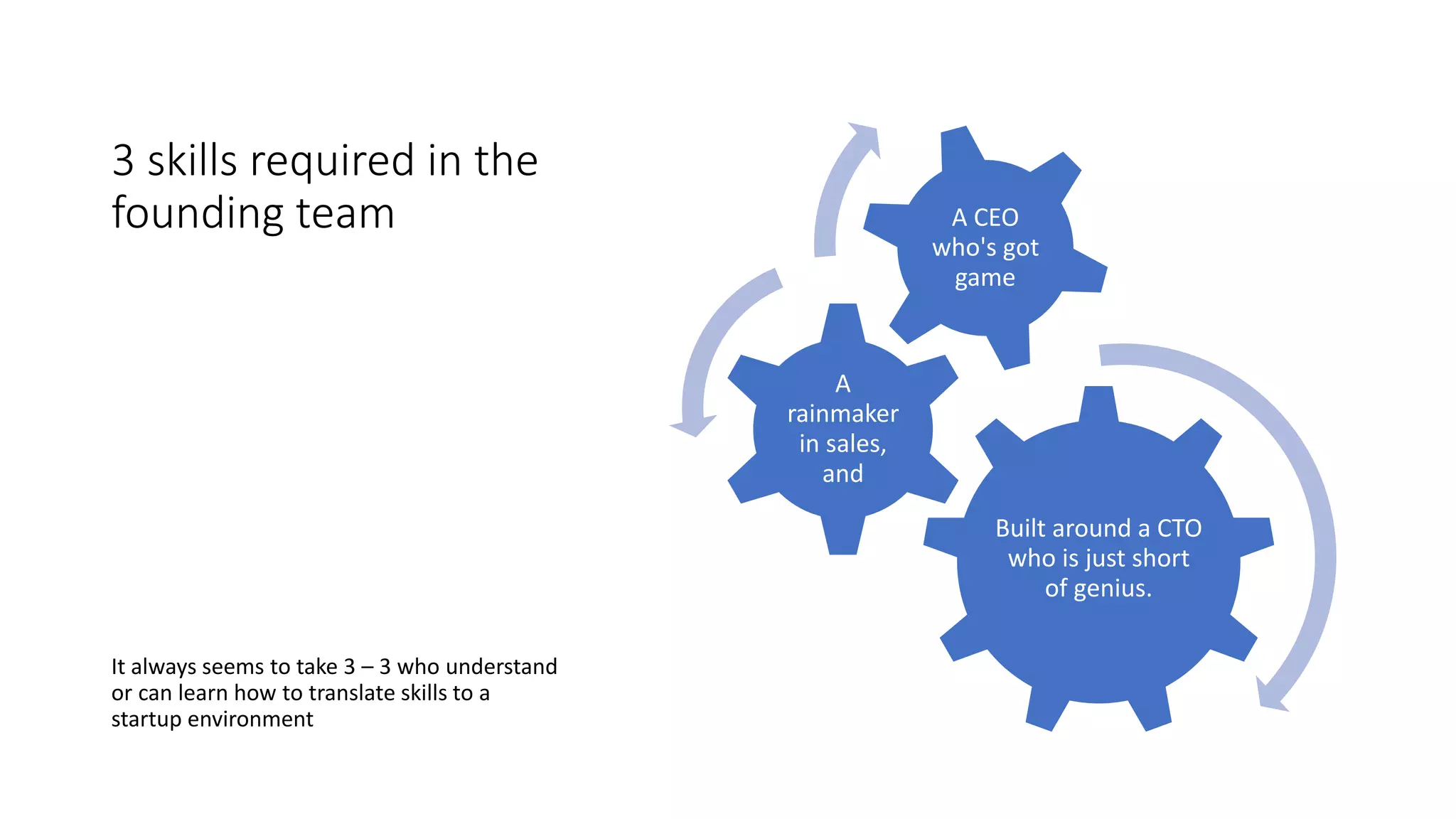

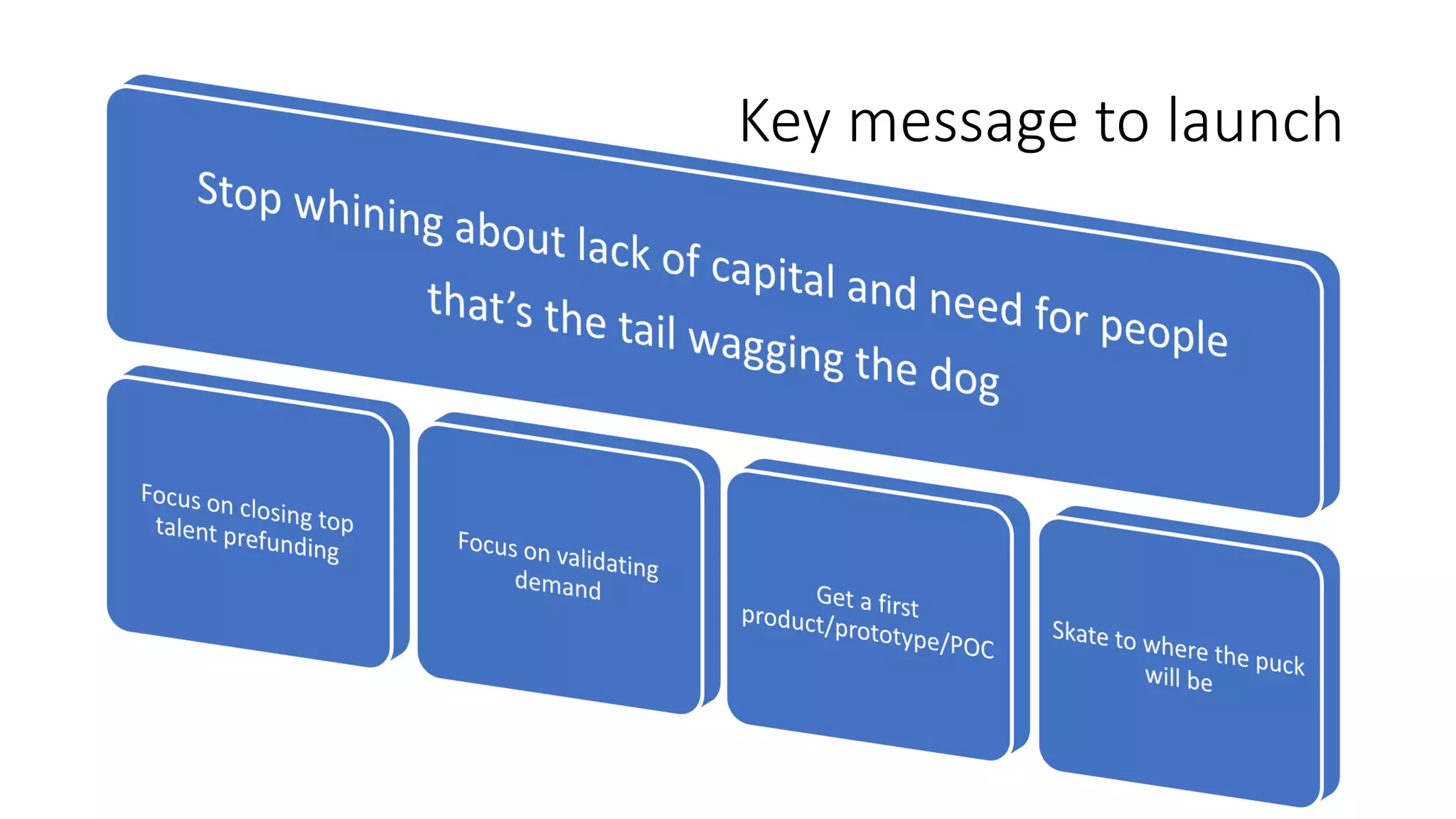

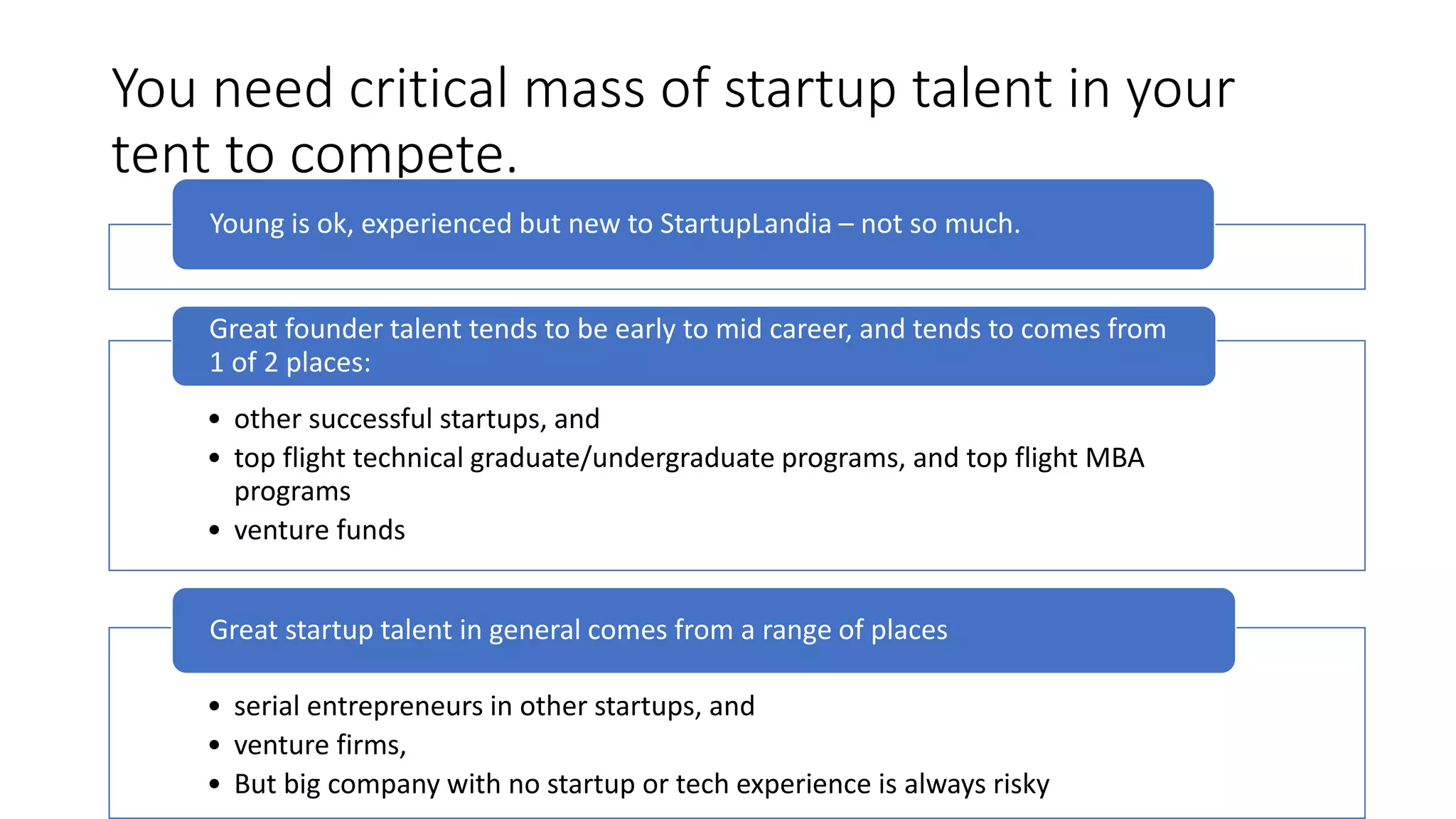

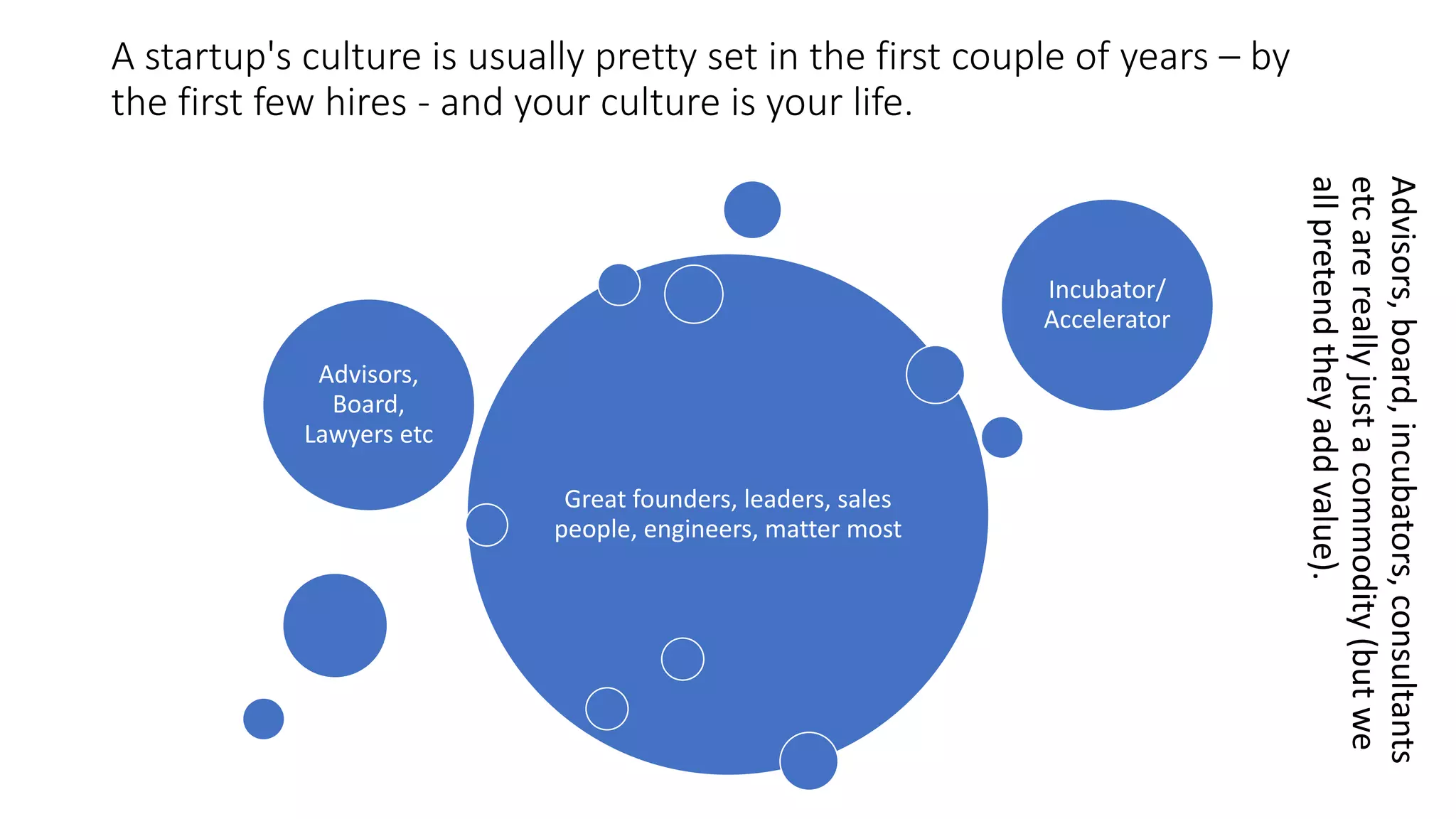

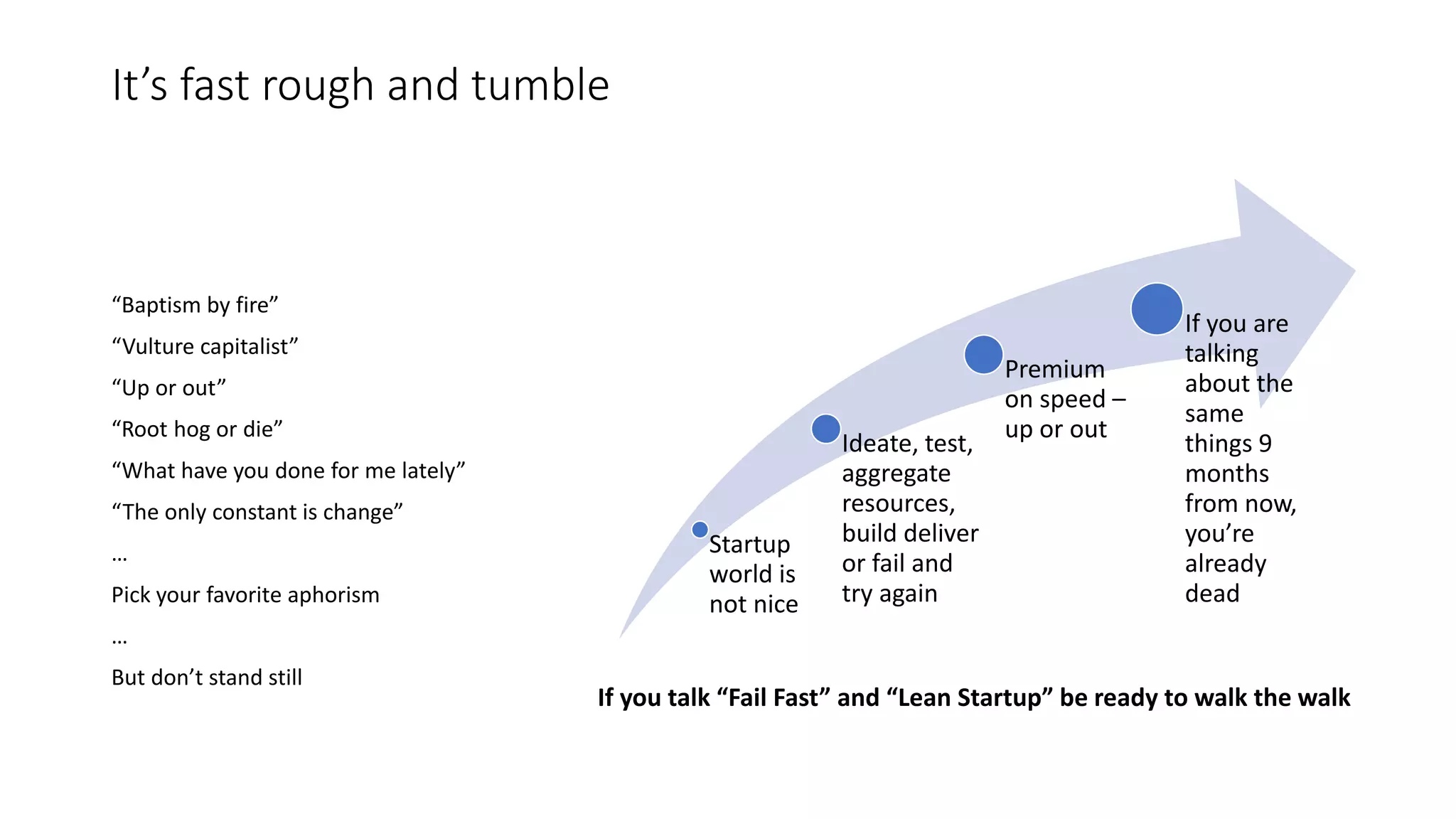

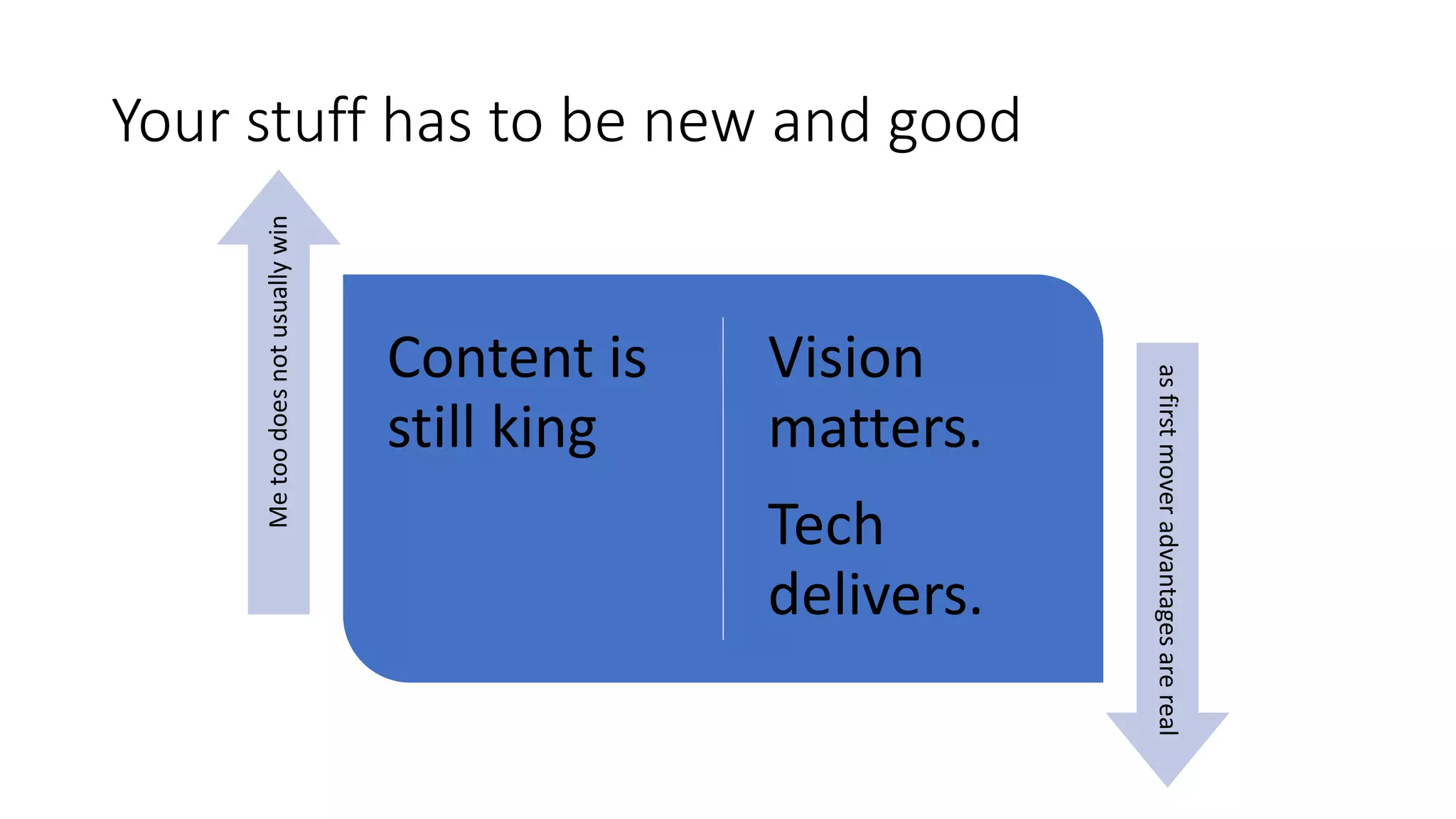

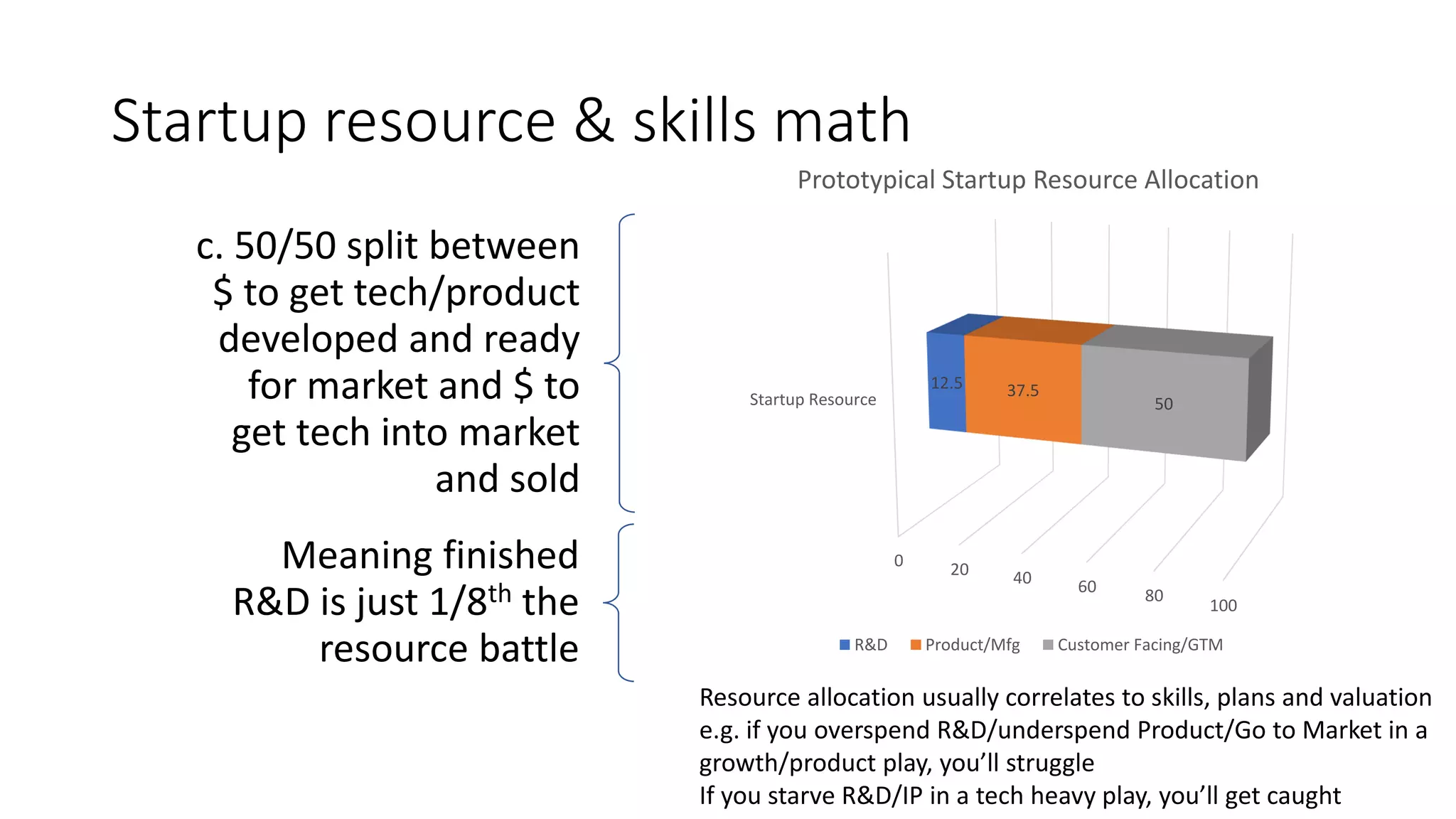

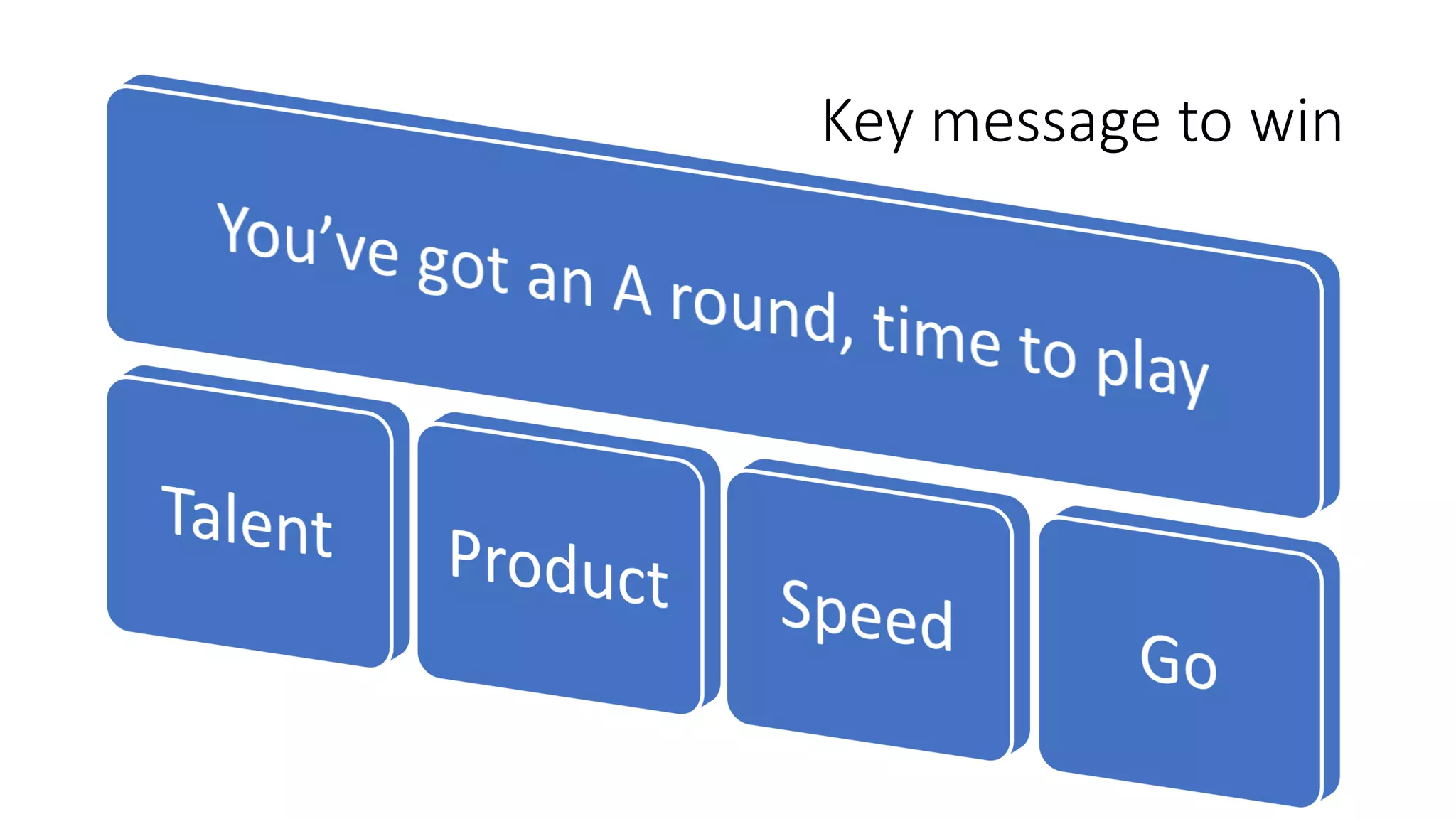

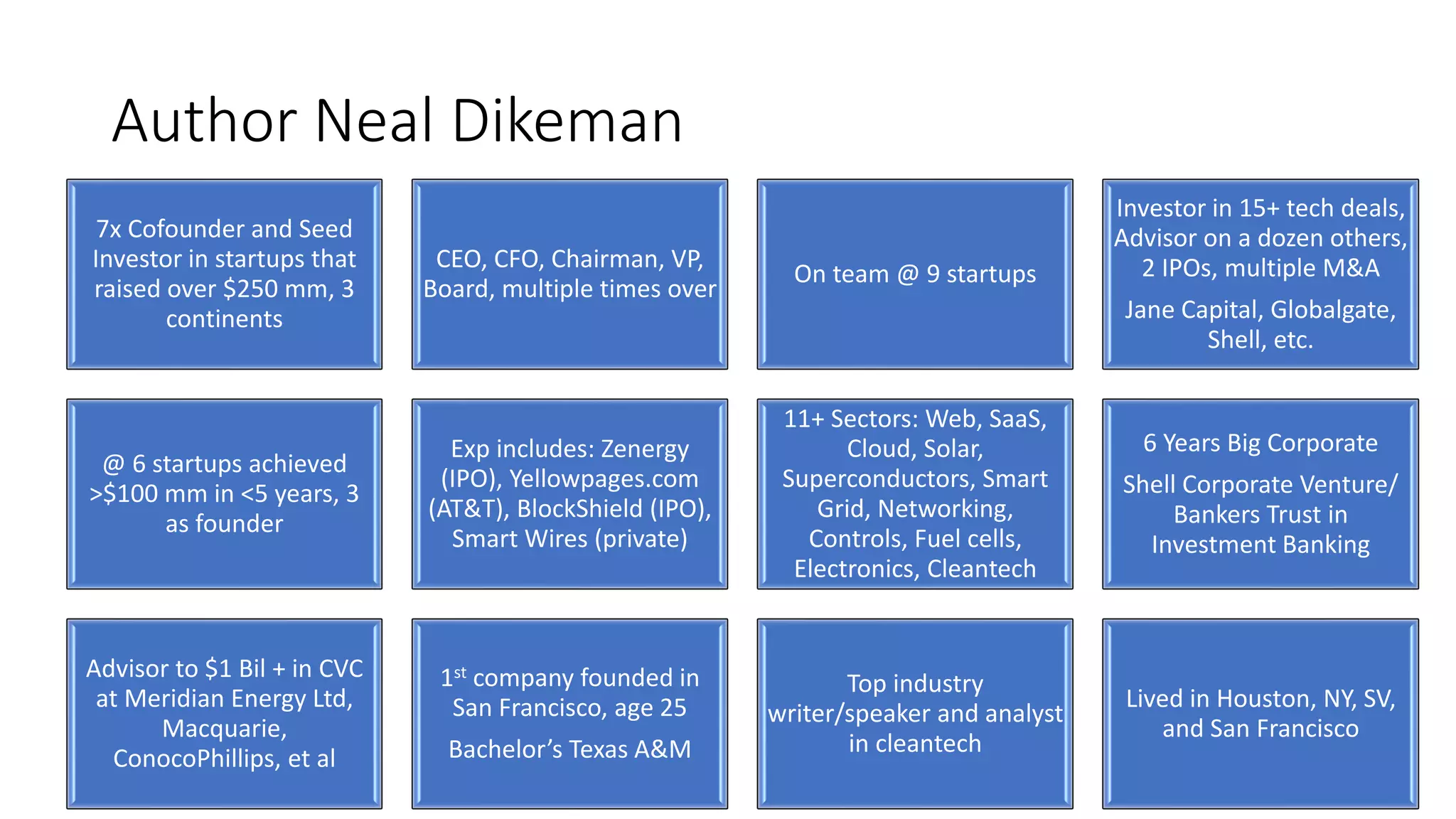

The document discusses key elements of establishing a successful startup and the dynamics of startup ecosystems, highlighting the importance of speed, talent, and capital. It emphasizes that attracting and launching startups requires a deep understanding of market needs, team capabilities, and a fundable business model. The narrative also underscores the necessity of adapting to rapid changes in technology and market trends to thrive in competitive environments.